Coterra Energy Inc. (NYSE: CTRA) (“Coterra” or the

“Company”) today reported fourth-quarter and full-year 2024

results, provided first-quarter and full-year 2025 guidance, and

released a new three-year outlook for 2025 through 2027.

Key Takeaways & Updates

- For the fourth quarter of 2024, total barrels of oil equivalent

(BOE), oil production and natural gas production beat the high-end

of guidance by 3% or more and capital expenditures (non-GAAP) came

in near the low-end of guidance. Relative to our full-year 2024

guidance, total BOE, oil production and natural gas production

exceeded the high-end of guidance and capital expenditures

(non-GAAP) came in near the low-end of guidance. Dividends and

share repurchases totaled $218 million, or 61% of Free Cash Flow

(non-GAAP), in the fourth quarter of 2024 and $1,086 million, or

89% of full-year 2024 Free Cash Flow (non-GAAP).

- 2025 capital expenditures are expected to be between $2.1 and

$2.4 billion, in line with the 2025 pro forma framework announced

with our acquisitions in November 2024. Relative to last November,

Permian drilling and completion capital expenditures are estimated

to be approximately $70 million lower, driven by improved services

costs and acquisition synergies. Marcellus drilling and completion

capital expenditures are estimated to be approximately $50 million

higher than expected in November as we restart activity in the

basin early in the second quarter. Anadarko capital expenditures

are expected to be relatively consistent. At the mid-point of

capital, and based on current commodity price outlook, the

Company’s 2025 reinvestment rate (non-GAAP) is estimated to be

slightly below 50%.

- Our 2025 production guidance is unchanged at the midpoint from

the 2025 pro forma framework announced last November. 2025 total

BOE production is expected to be up approximately 9% year-over-year

at the mid-point, with oil volumes up approximately 47%, and

natural gas volumes relatively flat to 2024 levels. Our 2025

guidance includes the impact of the recent acquisitions from the

closings in late January. Organic 2025 annual oil and BOE growth

for Coterra’s legacy assets, excluding the recently closed

acquisitions, is estimated to be greater than 5% for oil and 0 to

5% for BOE.

- Updated three-year outlook (2025 through 2027) includes annual

average oil growth of 5% or greater, annual average BOE growth of 0

to 5% and an average annual capital range of $2.1 to $2.4 billion,

which includes legacy organic Coterra growth in 2025 and pro forma

combined growth in 2026 and 2027. This outlook reflects an average

reinvestment rate below 50% at the recent strip, pairing strong

capital efficiency with consistent production growth.

- The Company is announcing a 5% dividend increase to $0.22 per

share for the fourth quarter of 2024. The new annualized dividend

of $0.88 per share equates to a 3.1% yield, based on the Company's

$28.14 closing share price as of February 21, 2025.

- In late January 2025, the Company completed the previously

announced Permian acquisitions for aggregate consideration of

approximately $3.2 billion of cash and 28.2 million shares of

Coterra common stock, subject to post-closing purchase price

adjustments. These acquisitions, combined with previously owned

leaseholds, create a new focus area in the Northern Delaware basin

consisting of approximately 83,000 acres.

Tom Jorden, Chairman, CEO and President of Coterra, noted, “I am

proud to report that Coterra continued its trend of excellent

operational execution throughout 2024. Capital expenditures came in

near the low end and production was above the high end of guidance,

delivering improved capital efficiency. The team continues to

engineer better solutions across our operating regions through

decreased cycle times, increased productivity and lower costs.

Additionally, I am pleased to report that we closed on our

accretive Delaware Basin acquisitions on schedule, as well as

finished bringing online our large 57 well Culberson row

development. We enter 2025 with strong momentum in the Permian

Basin and we exited the year at a three-year production high in the

Marcellus. We are pleased to announce that we expect to restart our

Marcellus development program in the coming months, which will

provide incremental natural gas volumes next winter. We remain

committed to value creation through operational excellence,

disciplined capital allocation driven by full-cycle returns, and

returning value to shareholders.”

Fourth-Quarter 2024 Highlights

- Net Income (GAAP) totaled $297 million, or $0.40 per share.

Adjusted Net Income (non-GAAP) was $358 million, or $0.49 per

share.

- Cash Flow From Operating Activities (GAAP) totaled $626

million. Discretionary Cash Flow (non-GAAP) totaled $776

million.

- Cash paid for capital expenditures for drilling, completion and

other fixed asset additions (GAAP) totaled $425 million. Capital

expenditures for drilling, completion and other fixed asset

additions (non-GAAP) totaled $417 million, near the low end of our

guidance range of $410 to $500 million.

- Free Cash Flow (non-GAAP) totaled $351 million.

- Unit operating cost (reflecting costs from direct operations,

transportation, production taxes, and G&A) totaled $8.89 per

BOE (barrel of oil equivalent), near the mid-point of our annual

guidance range of $7.45 to $9.55 per BOE.

- Total equivalent production of 682 MBoepd (thousand barrels of

oil equivalent per day), exceeded the high end of guidance (630 to

660 MBoepd), driven by improved cycle times and strong well

performance.

- Oil production averaged 113.0 MBopd (thousand barrels of oil

per day), exceeding the high end of guidance (106 to 110

MBopd).

- Natural gas production averaged 2,779 MMcfpd (million cubic

feet per day), exceeding the high end of guidance (2,530 to 2,660

MMcfpd).

- Natural Gas Liquids (NGLs) production averaged 105.4

MBoepd.

- Oil was $68.57 per barrel (Bbl), excluding the effect of

commodity derivatives, and $68.70 per Bbl, including the effect of

commodity derivatives.

- Natural Gas was $2.02 per Mcf (thousand cubic feet), excluding

the effect of commodity derivatives, and $2.04 per Mcf, including

the effect of commodity derivatives.

- NGLs were $20.94 per BOE.

2025 Outlook (including the impact of acquisitions from their

closing dates in January)

- Estimate Discretionary Cash Flow (non-GAAP) of approximately

$5.0 billion and Free Cash Flow (non-GAAP) of approximately $2.7

billion, at recent strip prices.

- Expect 2025 capital expenditures of $2.1 to $2.4 billion, up

28% year-over-year at the mid-point, driven by incremental spend

associated with our recently completed Delaware Basin acquisitions.

The 2025 reinvestment rate (non-GAAP) is slightly below 50%, at the

recent strip. In 2025, the Company expects to average approximately

11 drilling rigs and 3 completion crews in the Permian Basin, 1 rig

and 0.5 completion crews in the Marcellus, and 1.5 drilling rigs

and 0.5 completion crews in the Anadarko Basin.

- Expect 2025 total equivalent production of 710 to 770 MBoepd,

up approximately 9% year-over-year at the mid-point; oil production

of 152 to 168 MBopd, up approximately 47% year-over-year at the

mid-point; and natural gas production of 2,675 to 2,875 MMcfpd,

relatively flat year-over-year at the mid-point.

- Expect 1Q25 total equivalent production of 710 to 750 MBoepd,

oil production of 134 to 144 MBopd, natural gas production of 2,850

to 3,000 MMcfpd, and capital expenditures of $525 to $625

million.

Three Year Outlook: 2025 to 2027

- Reflecting legacy Coterra growth in 2025 and pro forma growth

in 2026 and 2027, our new three-year outlook (2025 through 2027),

includes annual average oil growth of 5% or greater, annual average

BOE growth of 0 to 5%, which includes legacy organic Coterra growth

in 2025 and pro forma combined growth in 2026 and 2027, and an

average annual capital range of $2.1 to $2.4 billion. At the recent

strip, this would imply an average reinvestment rate (non-GAAP)

below 50% over the three-year period.

- The Company maintains significant flexibility to adjust its

total capital investment level and allocation of capital across its

three basins, supported by limited long-term service contracts and

minimal lease obligations. The Company maintains flexibility and

optionality in each of its three operating regions, allowing a

flexible allocation of capital to its highest return projects.

- We expect this three year outlook to deliver significant Free

Cash Flow (non-GAAP) to support our healthy base dividend, rapid

debt reduction, and an impactful share repurchase program.

Fourth Quarter and Full-Year 2024 Shareholder Return

Highlights

- Common Dividend: On February 24, 2025, Coterra's Board

of Directors (the "Board") approved a quarterly base dividend of

$0.22 per share, a 5% increase. The dividend will be paid on March

27, 2025 to holders of record on March 13, 2025.

- Share Repurchases: During the quarter, the Company

repurchased 2.1 million shares for $50 million (excluding 1% excise

tax) at a weighted-average price of $24.29 per share. During 2024,

the Company repurchased 17.1 million shares for $451 million at a

weighted-average price of $26.41 per share. $1.1 billion remains on

the Company's $2.0 billion share repurchase authorization as of

December 31, 2024.

- Total Shareholder Return: During the quarter, total

shareholder returns amounted to $218 million, composed of $168

million of declared dividends and $50 million of share repurchases

(excluding 1% excise tax). In 2024, total shareholder returns

amounted to $1,086 million, composed of $635 million of declared

dividends and $451 million of share repurchases (excluding 1%

excise tax), representing 89% of 2024 Free Cash Flow

(non-GAAP).

- Shareholder Return Strategy: Based on our current

outlook, Coterra expects to return 50% or more of its annual Free

Cash Flow (non-GAAP). In 2025, the Company intends to utilize a

significant portion of its Free Cash Flow (non-GAAP) for its base

dividend, the retirement of its term loans and share repurchases.

Coterra also expects to continue to review increasing its base

dividend on an annual cadence.

Full-Year 2024 Highlights

- Net Income (GAAP) totaled $1,121 million, or $1.51 per share.

Adjusted Net Income (non-GAAP) was $1,245 million, or $1.68 per

share.

- Cash Flow From Operating Activities (GAAP) totaled $2,795

million. Discretionary Cash Flow (non-GAAP) totaled $2,968

million.

- Cash paid for capital expenditures for drilling, completion and

other fixed asset additions (GAAP) totaled $1,754 million. Capital

expenditures for drilling, completion and other fixed asset

additions (non-GAAP) totaled $1,762 million, at the low end of our

original guidance range of $1.75 to $1.95 billion.

- Free Cash Flow (non-GAAP) totaled $1,214 million. Unit

operating costs (reflecting costs from direct operations,

transportation, production taxes, and G&A) totaled $8.66 per

BOE, within our annual guidance range of $7.45 to $9.55 per

BOE.

- Total equivalent production of 677 MBoepd, exceeded the high

end of our original guidance (635 to 675 MBoepd), driven by

improved cycle times and strong well performance.

- Oil production averaged 108.8 MBopd, exceeding the high end of

original guidance (99 to 105 MBopd).

- Natural gas production averaged 2,800 MMcfpd, exceeding the

high end of original guidance (2,650 to 2,800 MMcfpd).

- NGLs production averaged 101.1 MBoepd.

- Oil: $74.18 per Bbl, excluding the effect of commodity

derivatives, and $74.22 per Bbl, including the effect of commodity

derivatives

- Natural Gas: $1.65 per Mcf, excluding the effect of commodity

derivatives, and $1.75 per Mcf, including the effect of commodity

derivatives

Strong Financial Position

The Company ended the year with a cash balance of $2.0 billion,

two undrawn $500 million term loans totaling $1.0 billion, and no

debt outstanding under its $2.0 billion revolving credit facility,

resulting in total liquidity of approximately $5.0 billion.

Coterra's net debt to trailing twelve-month EBITDAX ratio

(non-GAAP) at December 31, 2024 was 0.4x.

In January 2025, we closed on our Delaware Basin acquisitions,

which, after purchase price adjustments, included total cash

consideration of approximately $3.2 billion and stock consideration

to the sellers totaling 28.2 million Coterra common shares. Due to

purchase price adjustments, which were calculated based on

Coterra's share price at the time the acquisitions were announced,

of $24.24 per share, 28.2 million shares were issued, down from

40.9 million shares anticipated to be issued at announcement of the

transactions. Based on our current outlook, Coterra expects to

retire its term loans totaling $1.0 billion in 2025 and expects to

maintain a Net Debt to Adjusted EBITDAX leverage ratio (non-GAAP)

below 1.0x, through commodity price cycles.

See “Supplemental Non-GAAP Financial Measures” below for

descriptions of the above non-GAAP measures as well as

reconciliations of these measures to the associated GAAP

measures.

2024 Proved Reserves

At December 31, 2024, Coterra's proved reserves totaled 2,271

million barrels of oil equivalent (MMBoe), down approximately 2%

year-over-year. This was primarily driven by lower trailing 12

months natural gas prices and the decision to book fewer proved

undeveloped reserves. At year-end 2024 proved undeveloped reserves

were 18% of total proved reserves, down from 21% at year-end 2023.

The proved undeveloped percentage reduction allows management to

maintain future budgeting flexibility and the ability to allocate

future capital to its most productive use between its business

units.

Proved developed producing reserves were up 1% year over

year.

SEC realized commodity prices used to calculate our proved

reserves in 2024 for oil, natural gas liquids and natural gas,

adjusted for basis and quality differentials, are $72.84 per Bbl,

$18.16 per Bbl and $1.23 per Mcf, respectively, down from 2023

prices of $75.05 per Bbl, $18.39 per Bbl and $2.04 per Mcf.

The Company had net positive revisions of prior estimates of 9

MMBoe. This revision included a 59 MMBoe negative revision due to

price, offset by a positive 64 MMBoe performance revision and a 4

MMBoe positive revision for improved operating expenses.

For a summary of Coterra's estimated proved reserves at December

31, 2024, see the "Year-End Proved Reserves" table below and in our

annual report on Form 10-K for the fiscal year ended December 31,

2024.

Committed to Sustainability and ESG Leadership

Coterra is committed to environmental stewardship, sustainable

practices, and strong corporate governance. The Company's

sustainability report can be found under "ESG" on

www.coterra.com.

Conference Call

Coterra will host a conference call tomorrow, Tuesday, February

25, 2025, at 9:00 AM CT (10:00 AM ET), to discuss fourth-quarter

and full-year 2024 financial and operating results and its 2025

outlook.

Conference Call Information

Date: Tuesday, February 25, 2025

Time: 9:00 AM CT / 10:00 AM ET

Dial-in (for callers in the U.S. and Canada): (800) 715-9871

International dial-in: (646) 307-1963

Conference ID: 4460734

The live audio webcast and related earnings presentation can be

accessed on the "Events & Presentations" page under the

"Investors" section of the Company's website at www.coterra.com.

The webcast will be archived and available at the same location

after the conclusion of the live event.

About Coterra Energy

Coterra is a premier exploration and production company based in

Houston, Texas with focused operations in the Permian Basin,

Marcellus Shale, and Anadarko Basin. We strive to be a leading

energy producer, delivering sustainable returns through the

efficient and responsible development of our diversified asset

base. Learn more about us at www.coterra.com.

Cautionary Statement Regarding Forward-Looking

Information

This press release contains certain forward-looking statements

within the meaning of federal securities laws. Forward-looking

statements are not statements of historical fact and reflect

Coterra's current views about future events. Such forward-looking

statements include, but are not limited to, statements about

returns to shareholders (including anticipated future dividend

increases), enhanced shareholder value, reserves estimates, future

financial and operating performance, and goals and commitment to

sustainability and ESG leadership, strategic pursuits and goals,

including with respect to the publication of Coterra’s

Sustainability Report, and other statements that are not historical

facts contained in this press release. The words "expect,"

"project," "estimate," "believe," "anticipate," "intend," "budget,"

"plan," "predict," "potential," "possible," "may," "should,"

"could," "would," "will," "strategy," "outlook", "guide" and

similar expressions are also intended to identify forward-looking

statements. We can provide no assurance that the forward-looking

statements contained in this press release will occur as projected

and actual results may differ materially from those projected.

Forward-looking statements are based on current expectations,

estimates and assumptions that involve a number of risks and

uncertainties that could cause actual results to differ materially

from those projected. These risks and uncertainties include,

without limitation, the volatility in commodity prices for crude

oil and natural gas; cost increases; the effect of future

regulatory or legislative actions; the impact of public health

crises, including pandemics (such as the coronavirus pandemic) and

epidemics and any related governmental policies or actions on

Coterra’s business, financial condition and results of operations;

actions by, or disputes among or between, the Organization of

Petroleum Exporting Countries and other producer countries; market

factors; market prices (including geographic basis differentials)

of oil and natural gas; impacts of inflation; labor shortages and

economic disruption (including as a result of geopolitical

disruptions such as the war in Ukraine or conflict in the Middle

East); determination of reserves estimates, adjustments or

revisions, including factors impacting such determination such as

commodity prices, well performance, operating expenses and

completion of Coterra’s annual PUD reserves process, as well as the

impact on our financial statements resulting therefrom; the

presence or recoverability of estimated reserves; the ability to

replace reserves; environmental risks; drilling and operating

risks; exploration and development risks; competition; the ability

of management to execute its plans to meet its goals (including

successful integration of the Delaware Basin acquisitions into

Coterra's operations); and other risks inherent in Coterra's

businesses. In addition, the declaration and payment of any future

dividends (or any increases thereto), whether regular base

quarterly dividends, variable dividends or special dividends, as

well as any share repurchases or pay downs of existing debt, will

depend on Coterra's financial results, cash requirements, future

prospects and other factors deemed relevant by Coterra's Board.

While the list of factors presented here is considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Should one or

more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual outcomes may vary

materially from those indicated. For additional information about

other factors that could cause actual results to differ materially

from those described in the forward-looking statements, please

refer to Coterra's annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and other filings with

the SEC, which are available on Coterra's website at

www.coterra.com.

Forward-looking statements are based on the estimates and

opinions of management at the time the statements are made. Except

to the extent required by applicable law, Coterra does not

undertake any obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. Readers are cautioned not to place

undue reliance on these forward-looking statements that speak only

as of the date hereof.

Operational Data

The tables below provide a summary of production volumes, price

realizations and operational activity by region and units costs for

the Company for the periods indicated:

Quarter Ended December

31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

PRODUCTION VOLUMES

Marcellus Shale

Natural gas (Mmcf/day)

2,042.8

2,304.9

2,098.5

2,262.7

Daily equivalent production (MBoepd)

340.5

384.2

349.7

377.1

Permian Basin

Natural gas (Mmcf/day)

517.5

482.0

505.1

440.8

Oil (MBbl/day)

103.8

97.3

100.8

89.5

NGL (MBbl/day)

78.3

76.9

77.3

70.5

Daily equivalent production (MBoepd)

268.3

254.5

262.2

233.4

Anadarko Basin

Natural gas (Mmcf/day)

217.2

179.4

194.3

178.9

Oil (MBbl/day)

9.1

6.7

7.9

6.5

NGL (MBbl/day)

27.1

20.7

23.7

19.7

Daily equivalent production (MBoepd)

72.4

57.3

64.0

56.0

Total Company

Natural gas (Mmcf/day)

2,778.9

2,970.0

2,799.8

2,884.2

Oil (MBbl/day)

113.0

104.7

108.8

96.2

NGL (MBbl/day)

105.4

97.8

101.1

90.2

Daily equivalent production (MBoepd)

681.5

697.4

676.5

667.1

AVERAGE SALES PRICE (excluding

hedges)

Marcellus Shale

Natural gas ($/Mcf)

$

2.27

$

2.17

$

1.98

$

2.33

Permian Basin

Natural gas ($/Mcf)

$

0.79

$

1.19

$

0.16

$

1.28

Oil ($/Bbl)

$

68.55

$

77.26

$

74.18

$

75.98

NGL ($/Bbl)

$

20.00

$

17.65

$

19.13

$

18.44

Anadarko Basin

Natural gas ($/Mcf)

$

2.51

$

2.30

$

1.92

$

2.37

Oil ($/Bbl)

$

68.80

$

79.12

$

74.16

$

76.92

NGL ($/Bbl)

$

23.66

$

22.40

$

22.62

$

23.54

Total Company

Natural gas ($/Mcf)

$

2.02

$

2.03

$

1.65

$

2.18

Oil ($/Bbl)

$

68.57

$

77.10

$

74.18

$

75.97

NGL ($/Bbl)

$

20.94

$

18.66

$

19.95

$

19.56

Quarter Ended December

31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

AVERAGE SALES PRICE (including

hedges)

Total Company

Natural gas ($/Mcf)

$

2.04

$

2.19

$

1.75

$

2.44

Oil ($/Bbl)

$

68.70

$

77.21

$

74.22

$

76.07

NGL ($/Bbl)

$

20.94

$

18.66

$

19.95

$

19.56

Quarter Ended December

31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

WELLS DRILLED(1)

Gross wells

Marcellus Shale

—

20

26

73

Permian Basin

56

44

230

159

Anadarko Basin

18

2

57

32

74

66

313

264

Net wells

Marcellus Shale

—

16.2

25.0

69.2

Permian Basin

35.3

18.6

111.3

82.1

Anadarko Basin

3.2

1.8

23.1

18.1

38.5

36.6

159.4

169.4

TURN IN LINES

Gross wells

Marcellus Shale

11

12

41

71

Permian Basin

36

61

195

183

Anadarko Basin

17

3

58

19

64

76

294

273

Net wells

Marcellus Shale

11.0

12.0

41.0

71.0

Permian Basin

18.1

28.0

86.5

94.9

Anadarko Basin

5.6

—

25.5

7.1

34.7

40.0

153.0

173.0

AVERAGE RIG COUNTS

Marcellus Shale

—

2.0

0.9

2.6

Permian Basin

8.7

7.0

8.2

6.5

Anadarko Basin

1.0

1.0

1.3

1.3

Quarter Ended December

31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

AVERAGE UNIT COSTS ($/Boe)(2)

Direct operations

$

2.83

$

2.51

$

2.66

$

2.31

Gathering, processing and

transportation

3.82

3.83

3.94

4.00

Taxes other than income

1.22

1.12

1.09

1.16

General and administrative (excluding

stock-based compensation and severance expense)

1.02

0.95

0.97

0.90

Unit Operating Cost

$

8.89

$

8.41

$

8.66

$

8.37

Depreciation, depletion and

amortization

7.75

7.11

7.43

6.74

Exploration

0.09

0.08

0.10

0.08

Stock-based compensation

0.29

0.23

0.25

0.24

Severance expense

—

0.03

—

0.05

Interest expense

0.29

0.13

0.18

0.11

$

17.31

$

16.00

$

16.62

$

15.60

_______________________________________________________________________________

(1)

Wells drilled represents wells drilled to total depth during the

period. Wells completed includes wells completed during the period,

regardless of when they were drilled.

(2)

Total unit costs may differ from the sum of the individual costs

due to rounding.

Derivatives Information

As of December 31, 2024, the Company had the following

outstanding financial commodity derivatives:

2025

Oil

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

WTI oil collars

Volume (MBbl)

5,040

5,096

4,232

4,232

Weighted average floor ($/Bbl)

$

61.79

$

61.79

$

61.63

$

61.63

Weighted average ceiling ($/Bbl)

$

79.36

$

79.36

$

78.64

$

78.64

WTI Midland oil basis swaps

Volume (MBbl)

6,300

6,370

5,520

5,520

Weighted average differential ($/Bbl)

$

1.07

$

1.07

$

1.02

$

1.02

WTI oil swaps

Volume (MBbl)

1,710

1,729

1,748

1,748

Weighted average price ($/Bbl)

69.18

69.18

69.18

69.18

2026

Oil

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

WTI oil collars

Volume (MBbl)

900

910

920

920

Weighted average floor ($/Bbl)

$

62.50

$

62.50

$

62.50

$

62.50

Weighted average ceiling ($/Bbl)

$

69.40

$

69.40

$

69.40

$

69.40

WTI Midland oil basis swaps

Volume (MBbl)

1,800

1,820

1,840

1,840

Weighted average differential ($/Bbl)

$

0.95

$

0.95

$

0.95

$

0.95

WTI oil swaps

Volume (MBbl)

900

910

920

920

Weighted average price ($/Bbl)

$

66.14

$

66.14

$

66.14

$

66.14

2025

Natural Gas

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

NYMEX Collars

Volume (MMBtu)

45,000,000

45,500,000

46,000,000

46,000,000

Weighted average floor ($/MMBtu)

$

2.85

$

2.85

$

2.85

$

2.85

Weighted average ceiling ($/MMBtu)

$

4.51

$

4.07

$

4.07

$

5.55

Transco Leidy gas basis swaps

Volume (MMBtu)

18,000,000

18,200,000

18,400,000

18,400,000

Weighted average price ($/MMBtu)

$

(0.70

)

$

(0.70

)

$

(0.70

)

$

(0.70

)

Transco Zone 6 Non-NY gas basis swaps

Volume (MMBtu)

9,000,000

9,100,000

9,200,000

9,200,000

Weighted average price ($/MMBtu)

$

(0.29

)

$

(0.29

)

$

(0.29

)

$

(0.29

)

2026

Natural Gas

First Quarter

NYMEX Collars

Volume (MMBtu)

27,000,000

Weighted average floor ($/MMBtu)

$

2.75

Weighted average ceiling ($/MMBtu)

$

7.66

In January 2025, the Company entered into

the following financial commodity derivatives:

2025

Natural Gas

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

NYMEX collars

Volume (MMBtu)

5,900,000

9,100,000

9,200,000

9,200,000

Weighted average floor ($/MMBtu)

$

3.00

$

3.00

$

3.00

$

3.00

Weighted average ceiling ($/MMBtu)

$

4.46

$

4.46

$

4.46

$

4.46

2026

Natural Gas

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

NYMEX collars

Volume (MMBtu)

22,500,000

22,750,000

23,000,000

23,000,000

Weighted average floor ($/MMBtu)

$

3.00

$

3.00

$

3.00

$

3.00

Weighted average ceiling ($/MMBtu)

$

5.79

$

5.79

$

5.79

$

5.79

Year-End Proved Reserves

The tables below provide a summary of changes in proved reserves

for the year ended December 31, 2024.

Oil (MBbl)

Natural Gas

(Bcf)

NGL (MBbl)

Total (MBOE)

PROVED RESERVES

December 31, 2023

249,213

10,525

317,456

2,320,757

Revision of previous estimates

11,636

(181

)

27,686

9,039

Extensions and discoveries

48,956

516

53,628

188,516

Production

(39,808

)

(1,025

)

(36,993

)

(247,589

)

Sales of reserves

(2

)

(1

)

—

(2

)

December 31, 2024

269,995

9,834

361,777

2,270,721

PROVED DEVELOPED RESERVES

December 31, 2023

173,392

8,590

234,306

1,839,219

December 31, 2024

189,275

8,420

271,030

1,863,583

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS (Unaudited)

Quarter Ended December

31,

Twelve Months Ended

December 31,

(In millions,

except per share amounts)

2024

2023

2024

2023

OPERATING REVENUES

Oil

$

713

$

742

$

2,953

$

2,667

Natural gas

516

553

1,693

2,292

NGL

203

168

738

644

Gain (loss) on derivative instruments

(51

)

101

(3

)

230

Other

14

32

77

81

1,395

1,596

5,458

5,914

OPERATING EXPENSES

Direct operations

177

161

658

562

Gathering, processing and

transportation

239

246

976

975

Taxes other than income

77

72

271

283

Exploration

6

6

25

20

Depreciation, depletion and

amortization

486

456

1,840

1,641

General and administrative (excluding

stock-based compensation and severance expense)

65

61

240

220

Stock-based compensation(1)

19

15

62

59

Severance expense

—

2

—

12

1,069

1,019

4,072

3,772

Gain (loss) on sale of assets

—

—

3

12

INCOME FROM OPERATIONS

326

577

1,389

2,154

Interest expense

29

23

106

73

Interest income

(11

)

(15

)

(62

)

(47

)

Income before income taxes

308

569

1,345

2,128

Income tax provision (benefit)

Current

96

97

369

428

Deferred

(85

)

56

(145

)

75

Total Income tax provision

11

153

224

503

NET INCOME

$

297

$

416

$

1,121

$

1,625

Earnings per share - Basic

$

0.40

$

0.55

$

1.51

$

2.14

Weighted-average common shares

outstanding

736

751

742

756

_______________________________________________________________________________

(1) Includes the impact of our

performance share awards and restricted stock.

CONDENSED CONSOLIDATED BALANCE

SHEET (Unaudited)

(In

millions)

December 31,

2024

December 31,

2023

ASSETS

Current assets

$

3,321

$

2,015

Properties and equipment, net (successful

efforts method)

17,890

17,933

Other assets

414

467

$

21,625

$

20,415

LIABILITIES, REDEEMABLE PREFERRED STOCK

AND STOCKHOLDERS' EQUITY

Current liabilities

$

1,136

$

1,085

Current portion of long-term debt

—

575

Long-term debt, net (excluding current

maturities)

3,535

1,586

Deferred income taxes

3,274

3,413

Other long term liabilities

550

709

Cimarex redeemable preferred stock

8

8

Stockholders’ equity

13,122

13,039

$

21,625

$

20,415

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS (Unaudited)

Quarter Ended December

31,

Twelve Months Ended

December 31,

(In

millions)

2024

2023

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income

$

297

$

416

$

1,121

$

1,625

Depreciation, depletion and

amortization

486

456

1,840

1,641

Deferred income tax expense

(85

)

55

(145

)

74

(Gain) loss on sale of assets

—

—

(3

)

(12

)

Exploratory dry hole cost

—

—

5

—

(Gain) loss on derivative instruments

51

(101

)

3

(230

)

Net cash received (paid) in settlement of

derivative instruments

8

46

98

284

Stock-based compensation and other

18

14

61

57

Income charges not requiring cash

1

(5

)

(12

)

(18

)

Changes in assets and liabilities

(150

)

(121

)

(173

)

237

Net cash provided by operating

activities

626

760

2,795

3,658

CASH FLOWS FROM INVESTING

ACTIVITIES

Capital expenditures for drilling,

completion and other fixed asset additions

(425

)

(468

)

(1,754

)

(2,089

)

Capital expenditures for leasehold and

property acquisitions

(11

)

(2

)

(17

)

(10

)

Proceeds from sale of assets

1

—

9

40

Proceeds from sale of short-term

investments

—

—

250

—

Purchase of short-term investments

—

—

(250

)

—

Net cash used in investing activities

(435

)

(470

)

(1,762

)

(2,059

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Net borrowings (repayments) of debt

1,491

—

1,415

—

Common stock repurchases

(54

)

(20

)

(455

)

(405

)

Dividends paid

(155

)

(151

)

(625

)

(890

)

Capitalized debt issuance costs

(33

)

(7

)

(33

)

(7

)

Other

(11

)

(3

)

(23

)

(15

)

Net cash provided by (used in) financing

activities

1,238

(181

)

279

(1,317

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

$

1,429

$

109

$

1,312

$

282

Supplemental Non-GAAP Financial Measures

(Unaudited)

We report our financial results in accordance with accounting

principles generally accepted in the United States (GAAP). However,

we believe certain non-GAAP performance measures may provide

financial statement users with additional meaningful comparisons

between current results and results of prior periods. In addition,

we believe these measures are used by analysts and others in the

valuation, rating and investment recommendations of companies

within the oil and natural gas exploration and production industry.

See the reconciliations below that compare GAAP financial measures

to non-GAAP financial measures for the periods indicated.

We have also included herein certain forward-looking non-GAAP

financial measures, including, among others, the reinvestment rate,

which is defined as capital expenditures (non-GAAP) as a percentage

of Discretionary Cash Flow (non-GAAP). We believe the reinvestment

rate provides investors with useful information on management's

projected use and reinvestment of its future cash flows back into

Coterra's operations. Due to the forward-looking nature of these

non-GAAP financial measures, we cannot reliably predict certain of

the necessary components of the most directly comparable

forward-looking GAAP measures, including changes in assets and

liabilities (including future impairments) and cash paid for

certain capital expenditures. Accordingly, we are unable to present

a quantitative reconciliation of such forward-looking non-GAAP

financial measures to their most directly comparable

forward-looking GAAP financial measures. Reconciling items in

future periods could be significant.

Reconciliation of Net Income to Adjusted Net

Income and Adjusted Earnings Per Share

Adjusted Net Income and Adjusted Earnings per Share are

presented based on our management's belief that these non-GAAP

measures enable a user of financial information to understand the

impact of identified adjustments on reported results. Adjusted Net

Income is defined as net income plus gain and loss on sale of

assets, non-cash gain and loss on derivative instruments,

stock-based compensation expense, severance expense, merger-related

expenses and tax effect on selected items. Adjusted Earnings per

Share is defined as Adjusted Net Income divided by weighted-average

common shares outstanding. Additionally, we believe these measures

provide beneficial comparisons to similarly adjusted measurements

of prior periods and use these measures for that purpose. Adjusted

Net Income and Adjusted Earnings per Share are not measures of

financial performance under GAAP and should not be considered as

alternatives to net income and earnings per share, as defined by

GAAP.

Quarter Ended December

31,

Twelve Months Ended

December 31,

(In millions,

except per share amounts)

2024

2023

2024

2023

As reported - net income

$

297

$

416

$

1,121

$

1,625

Reversal of selected items:

(Gain) loss on sale of assets

—

—

(3

)

(12

)

(Gain) loss on derivative

instruments(1)

59

(55

)

101

54

Stock-based compensation expense

19

15

62

59

Severance expense

—

2

—

12

Tax effect on selected items

(17

)

9

(36

)

(26

)

Adjusted net income

$

358

$

387

$

1,245

$

1,712

As reported - earnings per share

$

0.40

$

0.55

$

1.51

$

2.14

Per share impact of selected items

0.09

(0.03

)

0.17

0.12

Adjusted earnings per share

$

0.49

$

0.52

$

1.68

$

2.26

Weighted-average common shares

outstanding

736

751

742

756

_______________________________________________________________________________

(1)

This amount represents the non-cash mark-to-market changes of

our commodity derivative instruments recorded in Gain (loss) on

derivative instruments in the Condensed Consolidated Statement of

Operations.

Reconciliation of Discretionary Cash Flow

and Free Cash Flow

Discretionary Cash Flow is defined as cash flow from operating

activities excluding changes in assets and liabilities.

Discretionary Cash Flow is widely accepted as a financial indicator

of an oil and gas company’s ability to generate available cash to

internally fund exploration and development activities, return

capital to shareholders through dividends and share repurchases,

and service debt and is used by our management for that purpose.

Discretionary Cash Flow is presented based on our management’s

belief that this non-GAAP measure is useful information to

investors when comparing our cash flows with the cash flows of

other companies that use the full cost method of accounting for oil

and gas producing activities or have different financing and

capital structures or tax rates. Discretionary Cash Flow is not a

measure of financial performance under GAAP and should not be

considered as an alternative to cash flows from operating

activities or net income, as defined by GAAP, or as a measure of

liquidity.

Free Cash Flow is defined as Discretionary Cash Flow less cash

paid for capital expenditures. Free Cash Flow is an indicator of a

company’s ability to generate cash flow after spending the money

required to maintain or expand its asset base, and is used by our

management for that purpose. Free Cash Flow is presented based on

our management’s belief that this non-GAAP measure is useful

information to investors when comparing our cash flows with the

cash flows of other companies. Free Cash Flow is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flows from operating activities or net income,

as defined by GAAP, or as a measure of liquidity.

Quarter Ended December

31,

Twelve Months Ended

December 31,

(In

millions)

2024

2023

2024

2023

Cash flow from operating activities

$

626

$

760

$

2,795

$

3,658

Changes in assets and liabilities

150

121

173

(237

)

Discretionary cash flow

776

881

2,968

3,421

Cash paid for capital expenditures for

drilling, completion and other fixed asset additions

(425

)

(468

)

(1,754

)

(2,089

)

Free cash flow

$

351

$

413

$

1,214

$

1,332

Capital Expenditures

Quarter Ended December

31,

Twelve Months Ended

December 31,

(In

millions)

2024

2023

2024

2023

Cash paid for capital expenditures for

drilling, completion and other fixed asset additions

$

425

$

468

$

1,754

$

2,089

Change in accrued capital costs

(8

)

(11

)

3

15

Exploratory dry-hole cost

—

—

5

—

Capital expenditures

$

417

$

457

$

1,762

$

2,104

Reconciliation of Adjusted EBITDAX

Adjusted EBITDAX is defined as net income plus interest expense,

other expense, income tax expense, depreciation, depletion, and

amortization (including impairments), exploration expense, gain and

loss on sale of assets, non-cash gain and loss on derivative

instruments, stock-based compensation expense, severance expense

and merger-related expense. Adjusted EBITDAX is presented on our

management’s belief that this non-GAAP measure is useful

information to investors when evaluating our ability to internally

fund exploration and development activities and to service or incur

debt without regard to financial or capital structure. Our

management uses Adjusted EBITDAX for that purpose. Adjusted EBITDAX

is not a measure of financial performance under GAAP and should not

be considered as an alternative to cash flows from operating

activities or net income, as defined by GAAP, or as a measure of

liquidity.

Quarter Ended December

31,

Twelve Months Ended

December 31,

(In

millions)

2024

2023

2024

2023

Net income

$

297

$

416

$

1,121

$

1,625

Plus (less):

Interest expense

29

23

106

73

Interest income

(11

)

(15

)

(62

)

(47

)

Income tax expense

11

153

224

503

Depreciation, depletion and

amortization

486

456

1,840

1,641

Exploration

6

6

25

20

(Gain) loss on sale of assets

—

—

(3

)

(12

)

Non-cash (gain) loss on derivative

instruments

59

(55

)

101

54

Stock-based compensation

19

15

62

59

Severance expense

—

2

—

12

Adjusted EBITDAX

$

896

$

1,001

$

3,414

$

3,928

Reconciliation of Net Debt

The total debt to total capitalization ratio is calculated by

dividing total debt by the sum of total debt and total

stockholders’ equity. This ratio is a measurement which is

presented in our annual and interim filings and our management

believes this ratio is useful to investors in assessing our

leverage. Net Debt is calculated by subtracting cash and cash

equivalents from total debt. The Net Debt to Adjusted

Capitalization ratio is calculated by dividing Net Debt by the sum

of Net Debt and total stockholders’ equity. Net Debt and the Net

Debt to Adjusted Capitalization ratio are non-GAAP measures which

our management believes are also useful to investors when assessing

our leverage since we have the ability to and may decide to use a

portion of our cash and cash equivalents to retire debt. Our

management uses these measures for that purpose. Additionally, as

our planned expenditures are not expected to result in additional

debt, our management believes it is appropriate to apply cash and

cash equivalents to reduce debt in calculating the Net Debt to

Adjusted Capitalization ratio.

(In

millions)

December 31,

2024

December 31,

2023

Current portion of long-term debt

$

—

$

575

Long-term debt, net

3,535

$

1,586

Total debt

$

3,535

$

2,161

Stockholders’ equity

13,122

13,039

Total capitalization

$

16,657

$

15,200

Total debt

$

3,535

$

2,161

Less: Cash and cash equivalents

(2,038

)

(956

)

Net debt

$

1,497

$

1,205

Net debt

$

1,497

$

1,205

Stockholders’ equity

13,122

13,039

Total adjusted capitalization

$

14,619

$

14,244

Total debt to total capitalization

ratio

21.2

%

14.2

%

Less: Impact of cash and cash

equivalents

11.0

%

5.7

%

Net debt to adjusted capitalization

ratio

10.2

%

8.5

%

Reconciliation of Net Debt to Adjusted

EBITDAX

Total debt to net income is defined as total debt divided by net

income. Net debt to Adjusted EBITDAX is defined as net debt divided

by trailing twelve month Adjusted EBITDAX. Net debt to Adjusted

EBITDAX is a non-GAAP measure which our management believes is

useful to investors when assessing our credit position and

leverage.

(In

millions)

December 31,

2024

December 31,

2023

Total debt

$

3,535

$

2,161

Net income

1,121

$

1,625

Total debt to net income ratio

3.2 x

1.3 x

Net debt (as defined above)

$

1,497

$

1,205

Adjusted EBITDAX (Twelve months ended

December 31)

3,414

3,928

Net debt to Adjusted EBITDAX

0.4 x

0.3 x

2025 Guidance

The tables below present full-year and first quarter 2025

guidance.

Full Year Guidance

2024 Guidance

2024 Actual

2025 Guidance

Low

Mid

High

Low

Mid

High

Total Equivalent Production (MBoed)

660

668

675

677

710

740

770

Gas (Mmcf/day)

2,735

2,755

2,775

2,800

2,675

2,775

2,875

Oil (MBbl/day)

107

108

108

108.8

152

160

168

Net wells turned in line

Marcellus Shale

40

41

10

13

15

Permian Basin

80

85

90

87

150

158

165

Anadarko Basin

21

24

27

26

15

20

25

Incurred capital expenditures ($ in

millions)

Total Company

$1,750

$1,800

$1,850

$1,762

$2,100

$2,250

$2,400

Drilling and completion

Marcellus Shale

$300 midpoint

$286

$250 midpoint

Permian Basin

$1,050 midpoint

$1,051

$1,570 midpoint

Anadarko Basin

$300 midpoint

$287

$230 midpoint

Midstream, saltwater disposal and

infrastructure

$150 midpoint

$137

$200 midpoint

First Quarter Guidance

Fourth Quarter 2024

Guidance

Fourth Quarter 2024

Actual

First Quarter 2025

Guidance

Low

Mid

High

Low

Mid

High

Total Equivalent Production (MBoed)

630

645

660

682

710

730

750

Gas (Mmcf/day)

2,530

2,595

2,660

2,779

2,850

2,925

3,000

Oil (MBbl/day)

106

108

110

113

134

139

144

Net wells turned in line

Marcellus Shale

11

11

0

Permian Basin

13

18

23

18.1

35

40

45

Anadarko Basin

1

4

7

5.6

0

Incurred capital expenditures ($ in

millions)

Total Company

$410

$455

$500

$417

$525

$575

$625

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224266260/en/

Investor Contact Daniel Guffey - VP - Finance, IR,

& Treasurer 281.589.4875

Hannah Stuckey - Investor Relations Manager

281.589.4983

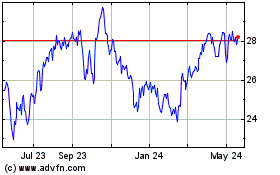

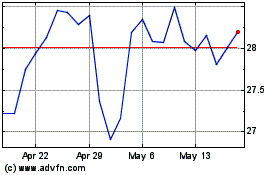

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Feb 2024 to Feb 2025