Genco Shipping & Trading Limited (NYSE: GNK) (“Genco” or the

“Company”), the largest U.S. headquartered drybulk shipowner

focused on the global transportation of commodities, today mailed a

letter to shareholders in connection with the Company’s 2024 Annual

Meeting of Shareholders (the “Annual Meeting”), scheduled to be

held on May 23, 2024. Shareholders of record as of March 28, 2024

will be entitled to vote at the meeting.

Highlights from the letter, the full text of which is below,

include:

- Examples of Economou’s record at companies listed in our letter

below, which the Company believes demonstrate instances of loss of

investor value, related party transactions and poor governance. The

Company also explains how the Ukrainian government designated

Economou’s TMS Tankers as “an international sponsor of war.”

- An overview of Robert Pons’ record at the companies on which he

sat on the board which the Company believes demonstrate instances

of declining shareholder value and underperformance, poor judgment

and poor governance.

- Reinforcing that the Board and management team are focused on

executing our Comprehensive Value Strategy, which has enabled the

Company to outperform its proxy peers and the market.

The Genco Board of Directors unanimously recommends that Genco

shareholders vote “FOR” the re-election of each of

Genco’s seven nominees currently serving on the Genco Board and

against Economou's nominee by voting

“WITHHOLD” and “AGAINST” Economou’s shareholder

proposal on the WHITE proxy card.

The full text of the letter follows:

With our Annual Meeting just a few weeks away, we are seeking

your vote FOR Genco’s director nominees.

George Economou is looking to add his nominee Robert Pons to our

Board of Directors in furtherance of an agenda that our Board

reviewed and determined is not in the best

interest of all Genco shareholders. We believe Economou is

not a typical investor. He is a drybulk competitor

of the Company,1 and we believe he brings with him a record of

related party transactions and poor corporate governance that

benefitted him at the expense of other shareholders as detailed

below. Our Board is of the view that his nominee, Pons, brings

no relevant industry experience to our Board, and

his record is one of declining shareholder value and

underperformance as also described in this letter.

We want to make sure shareholders have the context about

Economou and his nominee so you can make a fully informed decision

in voting FOR Genco’s nominees.

We Believe Genco Shareholders Should Be

Concerned with Economou’s Record at Other

Companies

We believe that Economou’s prior actions and how he has

conducted business should serve as a warning to Genco shareholders.

Here are some examples:

- Lost bondholder value at Alpha Shipping PLC. A

month after Economou established Alpha Shipping in 1998 as the

holding company for DryTank, Economou’s first shipping company,

Alpha Shipping issued $175 million of bonds.2 Within months, the

bonds were downgraded, and the company defaulted on an $8.4 million

interest payment. In a restructuring a year later, bondholders

would receive equity in a new company in exchange for their bonds,

and Economou obtained the exclusive right to buy back Alpha

Shipping’s 26-ship fleet for $64.75 million (37% of the principal

amount of the bonds) which would be returned to the new company’s

investors. Industry sources said Economou could sell the fleet at a

profit.3

- Taking control of DryShips without paying other

investors a control premium. Economou took his ownership

stake in DryShips from 0.01% in March 2017 to 83% of the stock less

than two years later through large-scale, highly dilutive equity

offerings and related party transactions that resulted in a

complete washout of shareholder value and gave control of DryShips

to Economou without other shareholders receiving any control

premium.4

- Related party transactions. As outlined below,

on multiple occasions, DryShips sold vessels to Economou-controlled

entities, in one case using the proceeds to pay down debt it had

taken on from another Economou-controlled entity.5 Examples

of Economou’s Transactions:

- While Economou was its CEO, DryShips purchased nine Capesize

vessels from Economou-affiliated private entities and third party

sellers for $1.17 billion, near all-time high asset value levels in

October 2008.6 This occurred after the onset of the global

financial crisis of 2007-2008 and an approximately 60% decline in

Capesize freight rates in September 2008.7 Subsequently, the

transaction was canceled for consideration of DryShips’ warrants

issued to the Economou-affiliated entities and DryShips’ shares

issued to the third party sellers, diluting shareholders.8

- In 2015, DryShips initiated a spin-off of Tankships Investment

Holdings into a separate company. According to the prospectus,

Tankships would pay fees to two other Economou entities.9 DryShips

ultimately abandoned that plan, instead selling ships directly to

Economou himself.10

- DryShips also entered into management agreements with

Economou-controlled entities, Cardiff Marine and later TMS

Bulkers11 that included substantial fees, payments for monitoring

controls, financing and advisory commissions, and discretionary

performance payments. DryShips’ financial advisor noted that “costs

in the agreements are higher than other drybulk public companies

with a potential NPV impact of $0.58 to $0.88 per share.” The

termination fee alone represented a reduction of approximately 9%

in the net asset value of the company as calculated by its

financial advisor at the time.12

- Taking DryShips private at a discount. In

2019, Economou took DryShips private at a share price that was

approximately 21% below net asset value calculated by DryShips’

financial advisor.13

- Loss of shareholder value at Ocean Rig. When

Economou was Chairman and CEO of DryShips, the company acquired a

controlling interest in Ocean Rig, an offshore deepwater drilling

services company unrelated to DryShips’ core business. Ocean Rig

conducted a series of equity offerings between 2011 and 2017 to pay

down the debt it owed to DryShips, significantly diluting existing

shareholders.14 With Ocean Rig stock declining in value, DryShips

also conducted a series of highly dilutive equity raises. Economou

was also Chairman and CEO of Ocean Rig at the time.15

- Ocean Rig filed for bankruptcy in 2017. At the completion of

the process, some common shares of the reorganized entity were

issued to an Economou-controlled entity, as well as an agreement to

provide an annual fee to the Economou entity of up to $15.5 million

plus 1% of all earnings under existing and future drilling

contracts.16 The equity of other Ocean Rig shareholders was

wiped out.17

- We believe he demonstrated poor governance at another

company. While a director at Danaos, he failed to promptly

disclose that he funded his personal ship building plans by

pledging more than half his Danaos stock to Samsung Heavy

Industries to secure six oil tankers.18 He also attended fewer than

25% of the Danaos Board meetings from 2012 to 201719 and fewer than

75% of the meetings in 2018 and 2019.20

- TMS Tankers being designated an “international sponsor

of war.” Economou’s TMS Tankers was the second largest

carrier of Russian oil in 2022, which landed TMS on the Ukrainian

government’s list of “international sponsors of war.”21

What people have said about George

Economou:

- About the Alpha bond offering: “At the end of

the day this deal will make Economou a richer man. And

yes, it has been at the expense of the high-yield market," said one

analyst.22

- About how he acted at DryShips: “I believe he

runs DryShips as if it's his own private company,” says Steven

Abernathy, who heads a New York hedge fund that recently dumped its

DryShips holdings. “I am not going to be part of anything where a

chief executive is self-dealing.” 23

- From DryShips’ own disclosures: “The interests

of our Chairman and Chief Executive Officer may be different from

your interests.”24

Our Board Strongly Recommends Genco

Shareholders Vote WITHHOLD on

Pons on the Proxy Card

Our Board is committed to strong corporate governance. To that

end, it reviewed Pons’ nomination and interviewed him as it would

any director nominee. From that review, our Board firmly believes

he would not be additive to our already strong, focused and

experienced Board. We believe that shareholders should be aware

that:

- We believe Pons has no experience in industries

relevant to Genco’s business. Based on our interview of

Pons and information about him in public filings with the SEC, he

has served as a director mainly at micro or nano cap companies,

none of which are involved in shipping, commodities, cyclical

businesses or other industries relevant to Genco’s business.25 The

market caps of the companies that Pons served on were all below

$205 million at the time he started as a director.

- We believe Pons has a record of declining shareholder

value and underperformance. Most companies on whose boards

he served declined in value or underperformed the S&P 500

during his tenure, as demonstrated in the below charts.26

- We believe Pons has shown poor judgment in his

associations. He has served as a board designee for the

family of Gary Singer, a convicted felon barred by the SEC for

acting as an officer of a public company.27 He has also been

nominated by a dissident slate proposed by Murchinson Ltd., a hedge

fund that settled charges of violations of short sale rules with

the SEC in 2021 and whose owner, Marc Bistricer, is the subject of

enforcement action by the Ontario Securities Commission. In his

interview with the Company’s Nominating and Corporate Governance

Committee, Pons stated that “George’s partner” Bistricer had

introduced him to Economou.

- We believe he has overseen related party transactions

for the benefit of his sponsors at other investors’

expense. Companies on which he has sat on the Board have

entered into transactions that have benefited his activist

sponsors, including selling assets of Arbinet Corporation to

Singer-controlled companies and instituting a 1-for-3,000 reverse

stock split at CCUR Holdings that squeezed out smaller shareholders

when one of the Singers owned nearly 40% of the company.28

Economou has attacked Genco’s Chairman Jim Dolphin in his proxy

materials. We believe shareholders should recognize that Pons’ lack

of relevant experience and his record as a director stand in stark

contrast to that of Mr. Dolphin, who has established a record of

shareholder value creation in the shipping industry and played a

key role in helping develop Genco’s value-creating strategies.

Please see Mr. Dolphin’s biographical information in Genco’s proxy

statement for further details.

Our Board strongly recommends that Genco shareholders

vote AGAINST Pons by voting WITHHOLD

on the proxy card next to his name.

Genco’s Comprehensive Value Strategy Is

Working

In contrast to Economou and Pons, our Board and management team

are focused on executing our Comprehensive Value Strategy, which

has enabled the Company to outperform its proxy peers and the

market.29 The Board implemented this strategy in 2021 following

rigorous and in-depth debate and review about the best path to

create sustainable value in the cyclical drybulk markets. Today, we

are making clear progress on each of our key strategic

priorities:

- Compelling dividends: We have paid 18

consecutive quarterly dividends – the longest series in our peer

group – and returned $5.155 per share to shareholders, or ~25% of

the current share price;30

- Lowering debt: We have reduced Genco’s debt by

55% since 2021 and lowered our cash flow breakeven rate to the

lowest in our peer group; and

- Investing in our fleet: We have invested $520

million in fleet expansion and modernization since 2018, increasing

our earnings capacity, while reducing costs and improving fuel

efficiency.

At the same time, we are maintaining our commitment to

best-in-class governance. Our well-planned and well-executed

corporate governance and sustainability initiatives have us ranked

#1 in the annual Webber Research ESG Scorecard three years in a

row.31

We Need Your Vote FOR Genco’s Nominees

Today

The Genco Board of Directors unanimously recommends that Genco

shareholders vote “FOR” the re-election of each of

Genco’s seven nominees currently serving on the Genco Board and

against Economou's nominee by voting

“WITHHOLD” and “AGAINST” Economou’s shareholder

proposal on the WHITE proxy card.

We thank you for your continued support.

Sincerely, on behalf of the entire Board and management

team,

|

James G. DolphinChairman of the Board |

John C. WobensmithChief Executive Officer |

| |

|

Vote Today

By Phone / Online / By Signing and Returning Your Proxy

Learn more at www.VoteForGenco.com

|

If you have any questions or require any assistance with voting

your shares, please call or email Genco’s proxy solicitor:MacKenzie

Partners, Inc.Toll Free: 800-322-2885Email:

proxy@mackenziepartners.com |

| |

About Genco Shipping & Trading Limited

Genco Shipping & Trading Limited is a U.S. based drybulk

ship owning company focused on the seaborne transportation of

commodities globally. We provide a full-service logistics solution

to our customers utilizing our in-house commercial operating

platform, as we transport key cargoes such as iron ore, grain,

steel products, bauxite, cement, nickel ore among other commodities

along worldwide shipping routes. Our wholly owned high quality,

modern fleet of dry cargo vessels consists of the larger Capesize

(major bulk) and the medium-sized Ultramax and Supramax vessels

(minor bulk) enabling us to carry a wide range of cargoes. We make

capital expenditures from time to time in connection with vessel

acquisitions. As of April 30, 2024, Genco Shipping & Trading

Limited’s fleet consists of 16 Capesize, 15 Ultramax and 12

Supramax vessels with an aggregate capacity of approximately

4,490,000 dwt and an average age of 11.8 years.

"Safe Harbor" Statement under the Private Securities

Litigation Reform Act of 1995

This release contains certain forward-looking statements

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements use

words such as “expect,” “intend,” “plan,” “believe,” and other

words and terms of similar meaning in connection with a discussion

of potential future events, circumstances or future operating or

financial performance. These forward-looking statements are based

on management’s current expectations and observations. For a

discussion of factors that could cause results to differ, please

see the Company's filings with the Securities and Exchange

Commission, including, without limitation, the Company’s Annual

Report on form 10-K for the year ended December 31, 2023, and the

Company's reports on Form 10-Q and Form 8-K subsequently filed with

the SEC. We do not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Additional Information and Where to Find It

On April 16, 2024, Genco filed with the SEC a definitive proxy

statement on Schedule 14A (the “Definitive Proxy Statement”),

containing a form of WHITE proxy card, with respect to its

solicitation of proxies for Genco’s 2024 Annual Meeting of

Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO)

FILED BY GENCO AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and

security holders may obtain copies of these documents and other

documents filed with the SEC by Genco free of charge through the

website maintained by the SEC at www.sec.gov. Copies of the

documents filed by Genco are also available free of charge by

accessing Genco’s website at www.gencoshipping.com.

Participants

Genco, its directors and certain of its executive officers, will

be participants in the solicitation of proxies from shareholders in

respect of the 2024 Annual Meeting of Shareholders, including John

C. Wobensmith (Chief Executive Officer and President), Peter Allen

(Chief Financial Officer), Joseph Adamo (Chief Accounting Officer),

Jesper Christensen (Chief Commercial Officer), and Genco’s

directors other than Mr. Wobensmith, namely James G. Dolphin,

Paramita Das, Kathleen C. Haines, Basil G. Mavroleon, Karin Y.

Orsel, and Arthur L. Regan. Investors and security holders may

obtain more detailed information regarding the Company’s directors

and executive officers, including a description of their direct or

indirect interests, by security holdings or otherwise, under the

captions “Management,” “Executive Compensation,” and “Security

Ownership of Certain Beneficial Owners and Management” in Genco’s

Definitive Proxy Statement. To the extent holdings of such

participants in Genco’s securities changed since the amounts

described in the Definitive Proxy Statement, such changes will be

reflected on Initial Statements of Beneficial Ownership on Form 3

or Statements of Change in Ownership on Form 4 filed with the SEC.

These documents are available free of charge as described

above.

_________________________

1 Based on conversations between George Economou and members of

our Board. See also TradeWinds, “Economou strikes again to lift

newbuilding tally to 40,” by Irene Ang, December 13, 2023 at

https://www.tradewindsnews.com/tankers/economou-strikes-again-to-lift-newbuilding-tally-to-40/2-1-1570434

(“He is said to have ordered . . . four Kamsarmax bulk carriers.”)

and TradeWinds, “Economou’s TMS Dry stacks orderbook with midsize

bulk carrier newbuildings,” by Irene Ang, July 28, 2023 at

https://www.tradewindsnews.com/bulkers/economou-s-tms-dry-stacks-orderbook-with-midsize-bulk-carrier-newbuildings/2-1-1492558

2 Lloyd’s List International, “Alpha appeals to investors,”

February 13, 19983 Forbes, “Curious George,” by Nathan Vardi,

February 8, 2008 at

https://www.forbes.com/forbes/2008/0225/095.html?sh=71431d7b47f8,

Lloyd’s List, “Collision of Interests,” December 15, 2008 at

https://lloydslist.com/LL086367/Collision-of-interests and

TradeWinds, “Economou to Claim the Spoils of Alpha” by Liz Shuker

Stamford, July 16, 1999 at

https://www.tradewindsnews.com/weekly/economou-to-claim-the-spoils-of-alpha/1-1-156488https://www.tradewindsnews.com/weekly/economou-to-claim-the-spoils-of-alpha/1-1-1564884

Form 20-F of DryShips Inc. for the year ended December 31, 2016, p.

128, filed with the SEC on March 13, 2027 at

https://www.sec.gov/Archives/edgar/data/1308858/000091957417002663/d7424585_20-f.htm,

(reporting Economou’s 0.01% beneficial ownership of DryShips);

Schedule 13D of SPII Holdings Inc., Sierra Investments Inc.,

Mountain Investments Inc., and George Economou filed with the SEC

on September 5, 2017 at

https://www.sec.gov/Archives/edgar/data/1308858/000091957417006592/d7628587_13-d.htm

(reporting Economou’s 53.5% beneficial ownership of Dryships after

a private placement; Amendment No. 1 to Schedule 13D of SPII

Holdings Inc., Sierra Investments Inc., Mountain Investments Inc.,

and George Economou filed with the SEC on October 6, 2017 at

https://www.sec.gov/Archives/edgar/data/1308858/000091957417007140/d7674066_13d-a.htm

(reporting Economou’s 69.5% ownership following a rights

offering)Presentation materials prepared by Evercore Group L.L.C.,

dated August 18, 2019, for the Special Committee of the Board

of Directors of DryShips Inc. at

https://www.sec.gov/Archives/edgar/data/1308858/000114420419043847/tv528973_exc6.htm

and Related party transactions: Amendment No. 1 to Schedule 13D

filed by SPII Holdings Inc., Sierra Investments Inc., Mountain

Investments Inc., and George Economou, filed with the SEC on

October 6, 2017 at

https://www.sec.gov/Archives/edgar/data/1308858/000091957417007140/d7674066_13d-a.htmhttps://www.sec.gov/Archives/edgar/data/1308858/000091957417007140/d7674066_13d-a.htm5

“DryShips Inc. Announces Certain Developments,” issued by DryShips,

Inc. on April 5, 2016 at

https://www.globenewswire.com/news-release/2016/04/05/1258223/0/en/DryShips-Inc-Announces-Certain-Developments.html,

“DryShips Inc. Announces Closing of Sale of Ocean Rig UDW Inc.

Shares,” issued by DryShips, Inc. on April 5, 2016 at

https://finance.yahoo.com/news/dryships-inc-announces-closing-sale-200500715.html

and “DryShips Announces Vessel Sales,” issued by DryShips, Inc. on

October 31, 2016 at

https://www.globenewswire.com/news-release/2016/10/31/1258399/0/en/DryShips-Inc-Announces-Vessel-Sales.html

6 Form 6-K filed by DryShips, Inc. on October 6, 2008 at

https://www.sec.gov/Archives/edgar/data/1308858/000131786108000342/f100608adrys6k.htm7

Based on data from Clarksons Research Services Limited.8 Form 20-F

of Dryships Inc. for the year ended December 31, 2008, p. 47, at

https://www.sec.gov/Archives/edgar/data/1308858/000119312509066364/d20f.htm9

Form F-1 Registration Statement of Tankships Investment Holdings

Inc., p. 37, at

https://www.sec.gov/Archives/edgar/data/1627482/000119312515016272/d836806df1.htm10

TradeWinds, “George Economou in league of his own,” by Gillian

Whittaker Athens, November 5, 2015 at

https://www.tradewindsnews.com/weekly/george-economou-in-league-of-his-own/1-1-376048

, and TradeWinds, “Economou buys from DryShips,” by Eric Martin, 30

March 2015 at

https://www.tradewindsnews.com/tankers/economou-buys-from-dryships/1-1-357081

and “Dryships Announces Agreements to Sell Its Tanker Fleet,”

issued by DryShips, Inc. on March 30, 2015 at

https://www.globenewswire.com/news-release/2015/03/30/1257863/0/en/DryShips-Inc-Announces-Agreements-to-Sell-Its-Tanker-Fleet.html11

https://www.sec.gov/Archives/edgar/data/1308858/000091957416014489/R10.htm

Form 20-F of DryShips, Inc. for the year ended December 31, 2012,

filed with the SEC on March 22, 2013 at

https://www.sec.gov/Archives/edgar/data/1308858/000091957413002527/d1368326_20-f.htm12

Presentation materials prepared by Evercore Group L.L.C., dated

August 18, 2019, for the Special Committee of the Board of

Directors of DryShips Inc., pp. 7 and 35, at

https://www.sec.gov/Archives/edgar/data/1308858/000114420419043847/tv528973_exc6.htm13

Presentation materials prepared by Evercore Group L.L.C., dated

August 18, 2019, for the Special Committee of the Board of

Directors of DryShips Inc. p. 35 at

https://www.sec.gov/Archives/edgar/data/1308858/000114420419043847/tv528973_exc6.htm14

“OCEAN RIG UDW INC. ANNOUNCES PUBLIC OFFERING OF ITS SHARES BY

DRYSHIPS INC” issued by Ocean Rig on April 9, 2012 at

http://cdn.capitallink.com/files/docs/companies/ocean_rig/press/2012/oceanrig040912a.pdf

and ”Ocean Rig UDW Inc. Announces Public Offering of Its Shares by

DryShips Inc.” issued by Ocean Rig on February 11, 2013 at

http://cdn.capitallink.com/files/docs/companies/ocean_rig/press/2013/oceanrig021113.pdf

“Ocean Rig UDW Inc. Announces Offering of Common Stock” issued by

Ocean Rig on June 2, 2015 at

http://cdn.capitallink.com/files/docs/companies/ocean_rig/press/2015/oceanrig060215.pdf

and “Ocean Rig UDW Inc. Announces the Completion of Its

Restructuring and the Occurrence of the Restructuring Effective

Date” issued by Ocean Rig on September 22, 2017 at

https://www.globenewswire.com/news-release/2017/09/22/1258740/0/en/Ocean-Rig-UDW-Inc-Announces-the-Completion-of-Its-Restructuring-and-the-Occurrence-of-the-Restructuring-Effective-Date.htmlhttps://www.globenewswire.com/news-release/2017/09/22/1258740/0/en/Ocean-Rig-UDW-Inc-Announces-the-Completion-of-Its-Restructuring-and-the-Occurrence-of-the-Restructuring-Effective-Date.html15

Economou has served as CEO of DryShips since he founded the company

in 2005 through October 11, 2019 when Economou took the company

private (“DryShips Inc. Announces Completion of Acquisition by SPII

Holding Inc.” issued by DryShips on October 11, 2019 at

https://www.globenewswire.com/news-release/2019/10/11/1928554/0/en/DryShips-Inc-Announces-Completion-of-Acquisition-by-SPII-Holding-Inc.html)

Economou served as CEO of OceanRig from July 14, 2008, when

DryShips acquired OceanRig (”DryShips Inc. Completes Acquisition of

Ocean Rig ASA” issued by DryShips on July 14, 2008 at

https://www.globenewswire.com/zi/news-release/2008/07/14/1259360/0/en/DryShips-Inc-Completes-Acquisition-of-Ocean-Rig-ASA.html)

until December 29, 2017 (“Ocean Rig UDW Inc. Announces Management

Changes” issued by Ocean Rig on December 29, 2017 at

https://www.globenewswire.com/news-release/2017/12/29/1276747/0/en/Ocean-Rig-UDW-Inc-Announces-Management-Changes.html).16

Form F-1A filed by Ocean Rig in 2017 at

https://www.sec.gov/Archives/edgar/data/1447382/000091957417007215/d7671684_f-1a.htm17

“Ocean Rig UDW Inc. Announces That U.S. Bankruptcy Court Has Issued

an Order Giving Full Force and Effect in the United States to

Cayman Islands Schemes of Arrangement” issued by Ocean Rig on

September 20, 2017 at

https://www.globenewswire.com/news-release/2017/09/20/1258739/0/en/Ocean-Rig-UDW-Inc-Announces-That-U-S-Bankruptcy-Court-Has-Issued-an-Order-Giving-Full-Force-and-Effect-in-the-United-States-to-Cayman-Islands-Schemes-of-Arrangement.html

and Form F-1/A filed October 10, 2017 at

https://www.sec.gov/Archives/edgar/data/1447382/000091957417007215/d7671684_f-1a.htm18

Danaos Corp. Form 13D/A filed February 27, 2019 at

https://www.sec.gov/Archives/edgar/data/1369241/000106823819000050/danaos13da.htmhttps://www.sec.gov/Archives/edgar/data/1369241/000106823819000050/danaos13da.htm19

Danaos Corp., Form 20-F filed March 30, 2012 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746912003699/a2208498z20-f.htm,

Danaos Corp., Form 20-F filed March 1, 2013 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746913002051/a2213181z20-f.htm,

Danaos Corp., Form 20-F filed February 28, 2014 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746914001551/a2218451z20-f.htm,

Danaos Corp., Form 20-F filed March, 10, 2015 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746915001897/a2223241z20-f.htm,

Danaos Corp., Form 20-F filed March 15, 2016 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746916011187/a2227685z20-f.htm,

Danaos Corp., Form 20-F filed March 6, 2017 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746917001295/a2231197z20-f.htm

and Danaos Corp., Form 20-F filed March 7, 2018 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746918001368/a2234648z20-f.htm20

Danaos Corp., Form 6-K filed June 21, 2019, Exhibit 99.1 at

https://www.sec.gov/Archives/edgar/data/1369241/000104746919003794/a2239038z6-k.htm

and Form 6-K filed June 19, 2020, Exhibit 99.1. at

https://www.sec.gov/Archives/edgar/data/1369241/000104746920003737/a2241852z6-k.htm21

The Wall Street Journal, “The ‘Bad Boy’ of Shipping Cashes In on

Russian Oil”, By Joe Wallace and Costas Paris, May 4, 2023 at

https://www.wsj.com/articles/the-bad-boy-of-shipping-cashes-in-on-russian-oil-4668c23822

TradeWinds, “Economou to Claim the Spoils of Alpha.”, by Liz Shuker

Stamford, July 16, 1999 at

https://www.tradewindsnews.com/weekly/economou-to-claim-the-spoils-of-alpha/1-1-156488

23 Forbes, “Curious George,” by Nathan Vardi, February 8, 2008 at

https://www.forbes.com/forbes/2008/0225/095.html?sh=71431d7b47f824

Form 20-F of DryShips Inc. for the year ended December 31, 2016,

filed with the SEC on March 1, 2019, at

https://www.sec.gov/Archives/edgar/data/1308858/000091957419002125/d8124519_20-f.htmhttps://www.sec.gov/Archives/edgar/data/1308858/000091957419002125/d8124519_20-f.htm

25 Companies include Network-1 Security Solutions, Inc.; Marpai,

Inc.;; Alaska Communications Systems Group, Inc..; LiveWire Mobile,

Inc. (renamed Live Microsystems, Inc.), SmartServ Online, Inc.

(renamed Uphonia, Inc.), MRV Communications, Inc.; SeaChange

International, Inc.; Dragonwave Inc., CCUR Holdings, Inc., Arbinet

Corporation, Primus Telecommunications Group Inc. (renamed PTGI

Holdings, Inc., HC2 Holdings, Inc., and Innovate Corp.) Novatel

Wireless, Inc. (-Inseego Corp. became the new public holding

company) and Concurrent Computer Corp. (renamed CCUR Holdings).

Additional information on performance for each company can be found

on the chart at the end of this letter and at www.VoteForGenco.com.

26 Based on publicly available information regarding Pons' board

positions. See chart at the end of this letter. 27 “SEC charges

investment adviser and associated individuals with causing

violations of Regulation SHO,” SEC press release No. 2021-156,

August 17, 2021 at

https://www.sec.gov/news/press-release/2021-15628 “Arbinet

Corporation to be Acquired by Primus Telecommunications Group in

Stock-for-Stock Transaction” issued by Arbinet Corporation on

November 11, 2010 at

https://www.prnewswire.com/news-releases/arbinet-corporation-to-be-acquired-by-primus-telecommunications-group-in-stock-for-stock-transaction-107211548.html

and Primus Telecommunications Group Inc. 13G filed June 15, 2010 at

https://www.sec.gov/Archives/edgar/data/1265181/000095012310058233/y03639sc13g.htm

and “Arbinet appoints Robert M. Pons to the board of directors,”

Arbinet press release, April 13, 2009 and Arbinet Corporation, Form

10-K/A, filed April 29, 2009 at

https://www.sec.gov/Archives/edgar/data/1136655/000114420409022960/v147452_10ka.htm

and “Alaska Communications Reaches Agreement with TAR Holdings”

issued by Alaska Communications on May 9, 2018 at

https://www.businesswire.com/news/home/20180509006522/en/Alaska-Communications-Reaches-Agreement-with-TAR-Holdings

and

https://www.businesswire.com/news/home/20180509006522/en/Alaska-Communications-Reaches-Agreement-with-TAR-Holdings29

Represents the total shareholder returns of Genco, the Company's

peers as listed in its proxy statement and the S&P 500 total

return index, as of the closing price on April 12, 2024, for the

past 1-, 3- and 5-year periods.30 As of April 4, 2024. 31 Based on

the Webber Research 2023, 2022 and 2021 ESG scorecard.

Permission to cite the above sources was neither sought nor

obtained.

Chart for endnotes 25 and 26

Certain companies on whose boards Pons was a director were

renamed or otherwise are successors to other companies. These

consist of Primus Telecommunications Group, Inc., PTGI Holdings

Inc., and HC2 Holdings, Inc.; Concurrent Computer Corp. and CCUR

Holdings, Inc.; and Novatel Wireless, Inc. and Inseego Corp.

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/8cd63d0d-5553-4598-b009-8197dee20ed8

https://www.globenewswire.com/NewsRoom/AttachmentNg/48e14a4b-20d4-49a6-b22a-e4a68011d29c

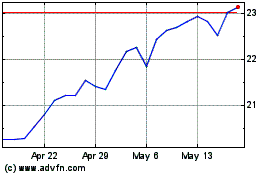

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Nov 2023 to Nov 2024