Global Ship Lease Announces Introduction of Quarterly Supplemental Dividend for Common Shareholders

29 May 2024 - 6:15AM

Global Ship Lease, Inc. (NYSE:GSL) (the “Company”), a containership

charter owner, today announced the introduction of a quarterly

supplemental dividend to common shareholders.

Recent containership charter market strength is

enabling Global Ship Lease to secure higher-than-anticipated

cashflows from time charters with longer-than-anticipated

durations. As a result, in addition to the sustainable dividend of

$0.375 per Class A common share per quarter, commencing with the

dividend payable after the release of the Company’s earnings for

the second quarter of 2024, Global Ship Lease expects to initiate a

supplemental dividend of $0.075 per Class A common share per

quarter, an increase of 20%, for as long as conditions are

supportive.

Thomas Lister, Chief Executive Officer of Global

Ship Lease, commented, “Our capital allocation is disciplined and

dynamic, shaped by our ongoing assessment of multiple factors

including value, risk, forward visibility, capital market dynamics,

and market context and events. On this basis, we are pleased to be

paying a supplemental dividend to share the benefits of this

unanticipated uplift in earnings with our shareholders for as long

as conditions are supportive. While we will review the supplemental

dividend on an ongoing basis, we are comfortable that we already

have sufficient forward visibility to support it for at least the

next several quarters.”

About Global Ship Lease

Global Ship Lease is a leading independent

owner of containerships with a diversified fleet of mid-sized and

smaller containerships. Incorporated in the Marshall

Islands, Global Ship Lease commenced operations

in December 2007 with a business of owning and chartering

out containerships under fixed-rate charters to top tier container

liner companies. It was listed on the New York Stock

Exchange in August 2008.

As of March 31, 2024, Global Ship

Lease owned 68 containerships, ranging from 2,207 to 11,040

TEU, with an aggregate capacity of 375,406 TEU. 36 ships are

wide-beam Post-Panamax.

As of March 31, 2024, the average remaining

term of the Company’s charters, to the mid-point of redelivery,

including options under the Company’s control and other than if a

redelivery notice has been received, was 1.9 years on a

TEU-weighted basis. Contracted revenue on the same basis

was $1.59 billion. Contracted revenue was $1.96 billion,

including options under charterers’ control and with latest

redelivery date, representing a weighted average remaining term of

2.6 years.

Dividend Policy

The declaration and payment of dividends will be

subject at all times to the discretion of the Company’s Board of

Directors. The timing and amount of dividends, if any, will depend

on the Company’s earnings, financial condition, cash flow, capital

requirements, growth opportunities, restrictions in its loan

agreements and financing arrangements, the provisions of Marshall

Islands law affecting the payment of dividends, and other factors.

For further information on the Company’s dividend policy, please

see its most recent Annual Report on Form 20-F.

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements provide the Company’s

current expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts. Words or phrases such as

“anticipate,” “believe,” “continue,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “will” or similar words or phrases, or the negatives of

those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a

statement is not forward-looking. These forward-looking statements

are based on assumptions that may be incorrect, and the Company

cannot assure you that the events or expectations included in these

forward-looking statements will come to pass. Actual results could

differ materially from those expressed or implied by the

forward-looking statements as a result of various factors,

including the factors described in “Risk Factors” in the Company’s

Annual Report on Form 20-F and the factors and risks the Company

describes in subsequent reports filed from time to time with the

U.S. Securities and Exchange Commission. Accordingly, you should

not unduly rely on these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to publicly revise any forward-looking statement to

reflect circumstances or events after the date of this press

release or to reflect the occurrence of unanticipated events.

Investor and Media Contact: The IGB GroupBryan

Degnan646-673-9701or Leon Berman 212-477-8438

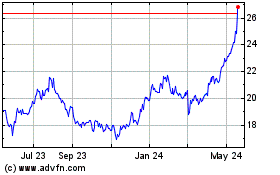

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

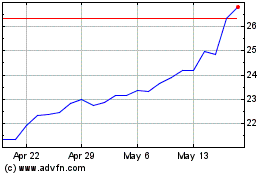

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Dec 2023 to Dec 2024