0001855457false00018554572024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 14, 2024

_____________________

KORE Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | |

| Delaware | 001-40856 | 86-3078783 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3 Ravinia Drive NE, Suite 500

Atlanta, GA 30346

877-710-5673

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_____________________

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | KORE | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 15, 2024, KORE Group Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter and six months ended June 30, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 2.05. Costs Associated with Exit or Disposal Activities.

On August 15, 2024, the Company announced efforts to prioritize its growth initiatives and improve operational efficiency, including a reduction in force plan affecting approximately 19% of the Company’s employee base (the “Restructuring Plan”). The Company’s Board of Directors (the “Board”) approved the Restructuring Plan on July 29, 2024 and affected employees were informed of the plan beginning on August 14, 2024. The Company expects the Restructuring Plan to be substantially completed by December 31, 2024.

Total costs and cash expenditures for the Restructuring Plan are estimated to be in the range of $5 million to $6 million, substantially all of which are related to employee severance and benefits costs. The Company expects to incur most of these pre-tax reduction in force charges in the third quarter of 2024. Additionally, a portion of the savings from the reduction in force and other efficiency measures will be reinvested into growth initiatives focused on higher-growth and more profitable areas of our business.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of President and Chief Executive Officer and as a Member of the Board of Directors.

On August 15, 2024, the Company announced the appointment of Ronald Totton, effective August 14, 2024, as its President and Chief Executive Officer. Mr. Totton, age 52, had been serving as the Company’s interim President and Chief Executive Officer since May 3, 2024. Effective August 14, 2024, Mr. Totton was also appointed as a member of the Board of the Company to serve as a Class III director of the Company until the 2027 Annual Meeting of Stockholders.

Prior to joining the Company, Mr. Totton served as an advisor to Indigo Telecom, a provider of engineering services for owners and operators of digital and network infrastructure, from January 2022 to April 2024. Prior to that, from May 2020 to January 2021, Mr. Totton served as Operating Partner for Financial Services Capital Partners LLP, a private equity firm. From October 2017 to November 2019, Mr. Totton served as Chief Executive Officer for STT Cloud, a public cloud solution provider, and, from September 2010 to October 2017, held various roles at British Telecommunications plc, a telecommunications company. From January 2021 to January 2022 and November 2019 to May 2020, Mr. Totton was an independent management consultant. Mr. Totton studied Economics at McMaster University in Hamilton, Ontario, Canada.

There are no arrangements or understandings between Mr. Totton and any other person pursuant to which he was selected to serve as an officer or director of the Company. There are also no family relationships between Mr. Totton and any director or executive officer of the Company, and he has no direct or indirect material interest in any transaction or proposed transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Executive Employment Agreement with Ronald Totton and Grants of Restricted Stock Units and Long-Term Cash Incentive Award.

On August 14, 2024, the Company and KORE Wireless Group, Inc., a subsidiary of the Company (“KWG”), entered into an employment agreement (the “Totton Employment Agreement”) with Mr. Totton. The material terms of Mr. Totton’s compensation arrangements and the Agreement are summarized below:

The Totton Employment Agreement provides for an initial term of five (5) years, and thereafter automatically extends for successive additional one (1) year terms unless either the Company or Mr. Totton affirmatively gives notice that they do not wish to renew the agreement. Pursuant to the Totton Employment Agreement, Mr. Totton is entitled to an initial salary of $600,000. Mr. Totton’s salary will be reviewed annually by the Board solely for upward adjustment at the Board’s discretion. The Totton Employment Agreement also provides that Mr. Totton is eligible to earn an annual bonus, with a target bonus opportunity of 75% of his base salary. Mr. Totton is entitled to receive severance payments and benefits upon a qualifying termination of his employment by the Company without Cause (as defined in the Totton Employment Agreement) or by Mr. Totton for Good Reason (as defined in the Totton Employment Agreement) consisting of the following, in addition to accrued benefits: (i) any annual bonus earned but unpaid with respect to the Company’s fiscal year ending on or preceding the date of termination (the “Totton Prior Year Bonus”), (ii) payment of base salary in effect immediately preceding the date of termination (or, if greater, his base salary in effect immediately preceding a material reduction in his then current base salary, for which he has terminated his employment for Good Reason) equal to 12 months (the “Totton Severance Period”), payable in accordance with the established payroll practices of the Company; (iii) a prorated annual bonus for the fiscal year in which the termination occurs, calculated based on actual achievement and paid at the same time annual bonuses are generally paid to other executives for the relevant year (the “Totton Prorated Bonus”), (iv) continuation of any health care (medical, dental and vision) plan

coverage provided to him and his dependents during the Totton Severance Period (provided that such continued coverage will terminate in the event he becomes eligible for coverage under another employer’s plans), and (v) all unvested equity or equity-based awards in the Company or its affiliates that vest solely based on passage of time will automatically vest.

If Mr. Totton’s employment terminates by reason of his death, in addition to any accrued benefits, his estate is entitled to receive payment of any Totton Prior Year Bonus and the Totton Prorated Bonus, as well as any benefits to which he is entitled by law.

Any severance benefits or payments payable to Mr. Totton under the Totton Employment Agreement are subject to his execution of a release of claims.

Pursuant to the Totton Employment Agreement, while employed by the Company (or any subsidiary or affiliate of the Company) and during the 12-month period following termination (if termination is without Cause or if Mr. Totton resigns for Good Reason) or 24-month period following termination (if Mr. Totton’s employment ends for any other reason), Mr. Totton is subject to non-competition and non-solicitation of customers and employees covenants, as well as perpetual confidentiality.

The foregoing descriptions of the material terms of the Totton Employment Agreements is qualified in their entirety by reference to the full text of the Totton Employment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Grant of Restricted Stock Units. Effective August 14, 2014 (the “Totton RSU Grant Date”), the Board approved grants to Mr. Totton of (a) 150,000 restricted stock units each representing a right to receive one share of the Company’s common stock (“RSUs”) that will vest, subject to Mr. Totton’s continuous employment or service to the Company through the vesting date, in installments as follows: 25% vesting on the second anniversary of the Totton Grant Date, 25% vesting on the third anniversary of the Totton RSU Grant Date, and 50% vesting on the fourth anniversary of the Totton Grant Date and (b) 50,000 RSUs that will vest, subject to Mr. Totton’s continuous employment or service to the Company through the vesting date, in equal installments on each of the following three anniversaries of the Totton RSU Grant Date.

Grant of Long-Term Cash Incentive Award. Mr. Totton also received a long-term cash award, with a potential aggregate payment of $700,000 (the “Totton Cash Award”). $200,000 of the Totton Cash Award (the “Totton Time-Vesting Cash Award”) shall vest and become payable in three equal installments on the three following anniversaries of the grant date, subject to the continued employment of Mr. Totton by the Company (or any successor thereof) from the grant date through the applicable vesting date; provided, however, that the Totton Time-Vesting Cash Award shall vest and become payable in the event of a termination without Cause (as defined in Mr. Totton’s employment agreement) or Mr. Totton resigns for Good Reason (as defined in Mr. Totton’s employment agreement). $500,000 of the Totton Cash Award shall vest and become payable based upon the Company’s achievement of specified corporate performance metrics during two specific performance periods (the “Totton Performance-Vesting Cash Award”), subject to the continued employment of Mr. Totton by the Company (or any successor thereof) from the grant date through the applicable performance vesting date; provided, however, that the portion of the Totton Performance-Vesting Cash Award payable after the end of the first performance period shall vest and become payable otherwise in accordance with the terms of the Award in the event of a termination without Cause or Mr. Totton resigns for Good Reason.

Departure of Bryan Lubel as Executive Vice President, GM, Global Industries

On August 14, 2024, Bryan Lubel, Executive Vice President, GM, Global Industries, the Company and KWG mutually agreed that Mr. Lubel would depart as an executive officer of the Company. To help ensure a smooth transition of his responsibilities, the Company and Mr. Lubel entered into a Transition Agreement on August 14, 2024 (the “Transition Agreement”).

Pursuant to the terms of the Transition Agreement, Mr. Lubel will transition from Executive Vice President, GM, Global Industries, to an Advisor, effective August 14, 2024 (the “Transition Date”), and his employment with the Company will terminate on October 31, 2024 (the “Termination Date”). As of the Transition Date, Mr. Lubel will no longer serve as an executive officer of the Company. Upon the Transition Date and until the Termination Date (the “Transition Period”), Mr. Lubel will serve as an employee of the Company providing transition advice and consultation service to the leaders of his existing teams and to the Company’s President and Chief Executive Officer. During the Transition Period, Mr. Lubel’s base salary will remain $430,000, and he will continue to be eligible to participate in the Company’s short-term incentive bonus plan per his existing Amended and Restated Executive Employment Agreement, dated March 15, 2022, with the Company (the “Lubel Employment Agreement”). Mr. Lubel’s previously awarded restricted stock units of the Company and long-term cash incentive awards will continue to vest during the Transition Period. Unless (i) Mr. Lubel earlier resigns his employment voluntarily or (ii) Mr. Lubel’s employment is earlier terminated by the Company for Cause (as defined in the Lubel Employment Agreement), and if Mr. Lubel executes and does not revoke a General Release at the end of the Transition Period, Mr. Lubel would receive separation benefits consistent with a termination without Cause or resignation for Good Reason (as defined in the Lubel Employment Agreement).

The foregoing description of the material terms of the Transition Agreement is qualified in its entirety by reference to the full text of the Transition Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and is incorporated by reference herein.

Appointment of Jared Deith as Executive Vice President, Connected Health

On August 15, 2024, the Company announced the appointment of Jared Deith as its Executive Vice President, Connected Health. Mr. Deith, age 34, had been serving as contracted advisor to the Company and its subsidiaries since April 2024. Previously, Mr. Deith had served as Senior Vice President, Indirect Channels and E-Commerce for the Company from January 2023 through April 2024 and as Senior Vice President, Integration from February 2022 through January 2023. Mr. Deith joined the Company in February 2022 after the Company’s acquisition of Business Mobility Partners, Inc. and Simon IoT LLC, where he served as President and Founder from July 2016 to February 2022 and as CEO and Co-Founder from September 2018 through February 2022, respectively.

There are no arrangements or understandings between Mr. Deith and any other person pursuant to which he was selected to serve as an officer of the Company. There are also no family relationships between Mr. Deith and any director or executive officer of the Company, and he has no direct or indirect material interest in any transaction or proposed transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Executive Employment Agreement with Jared Deith and Grants of Restricted Stock Units and Long-Term Cash Incentive Award.

On August 15, 2024, the Company and KWG entered into an employment agreement (the “Deith Employment Agreement”) with Mr. Deith.

The Deith Employment Agreement provides for an initial term of five (5) years, and thereafter automatically extends for successive additional one (1) year terms unless either the Company or Mr. Deith affirmatively gives notice that they do not wish to renew the agreement. Pursuant to the Deith Employment Agreement, Mr. Deith is entitled to an initial salary of $350,000. Mr. Deith’s salary will be reviewed annually by the Board solely for upward adjustment at the Board’s discretion. The Deith Employment Agreement also provides that Mr. Deith is eligible to earn an annual bonus, with a target bonus opportunity of 75% of his base salary. Mr. Deith is entitled to receive severance payments and benefits upon a qualifying termination of his employment by the Company without Cause (as defined in the Deith Employment Agreement) or by Mr. Deith for Good Reason (as defined in the Deith Employment Agreement) consisting of the following, in addition to accrued benefits: (i) any annual bonus earned but unpaid with respect to the Company’s fiscal year ending on or preceding the date of termination (the “Deith Prior Year Bonus”), (ii) payment of base salary in effect immediately preceding the date of termination (or, if greater, his base salary in effect immediately preceding a material reduction in his then current base salary, for which he has terminated his employment for Good Reason) equal to 12 months (the “Deith Severance Period”), payable in accordance with the established payroll practices of the Company; (iii) a prorated annual bonus for the fiscal year in which the termination occurs, calculated based on actual achievement and paid at the same time annual bonuses are generally paid to other executives for the relevant year (the “Deith Prorated Bonus”), (iv) continuation of any health care (medical, dental and vision) plan coverage provided to him and his dependents during the Deith Severance Period (provided that such continued coverage will terminate in the event he becomes eligible for coverage under another employer’s plans), and (v) all unvested equity or equity-based awards in the Company or its affiliates that vest solely based on passage of time will automatically vest.

If Mr. Deith’s employment terminates by reason of his death, in addition to any accrued benefits, his estate is entitled to receive payment of any Deith Prior Year Bonus and the Deith Prorated Bonus, as well as any benefits to which he is entitled by law.

Any severance benefits or payments payable to Mr. Deith under the Deith Employment Agreement are subject to his execution of a release of claims.

Pursuant to the Deith Employment Agreement, while employed by the Company and during the 24-month period following termination, Mr. Deith is subject to non-competition and non-solicitation of customers and employees covenants, as well as perpetual confidentiality.

The foregoing descriptions of the material terms of the Deith Employment Agreements are not complete and are qualified in their entirety by reference to the full text of the Deith Employment Agreement, a copy of which is filed as Exhibit 10.3 to this Current Report on Form 8-K and is incorporated by reference herein.

Grant of Restricted Stock Units. Effective August 15, 2014 (the “Deith RSU Grant Date”), the Compensation Committee of the Board approved grants to Mr. Deith of 24,000 RSUs that will vest, subject to Mr. Deith’s continuous employment or service to the Company through the vesting date, in equal installments on each of the following three anniversaries of the Deith RSU Grant Date.

Grant of Long-Term Cash Incentive Award. Mr. Deith also received a long-term cash award, with a potential aggregate payment of $360,000 (the “Deith Cash Award”). $120,000 of the Deith Cash Award (the “Deith Time-Vesting Cash Award”) shall vest and become payable in three equal installments on the three following anniversaries of the grant date, subject to the continued employment of Mr. Deith by the Company (or any successor thereof) from the grant date through the applicable vesting date; provided, however, that the Deith Time-Vesting Cash Award shall vest and become payable in the event of a termination without Cause (as defined in Mr. Deith’s employment agreement) or Mr. Deith resigns for Good Reason (as defined in Mr. Deith’s employment agreement). $240,000 of the Deith Cash Award shall vest and become payable based upon the Company’s achievement of specified corporate performance metrics during two specific performance periods, subject to the continued employment of Mr. Deith by the Company (or any successor thereof) from the grant date through the applicable performance vesting date.

Item 8.01. Other Events.

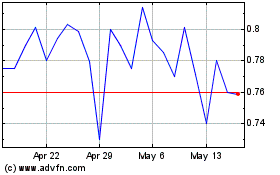

On August 14, 2024, the Company received a letter from the New York Stock Exchange (the “NYSE”) stating that the Company has regained compliance with Section 802.01C of the NYSE Listed Company Manual (“Section 802.01C”), which requires listed companies to maintain an average closing price per share of at least $1.00 over a 30 consecutive trading-day period.

As previously disclosed, on September 5, 2023, the Company received a letter from the NYSE, indicating that the Company was not then in compliance with Section 802.01C. On July 1, 2024, the Company completed a 1-for-5 reverse stock split, and trading on the NYSE on a split-adjusted basis commenced on July 1, 2024. As of the date of this Current Report on Form 8-K, the Company is in compliance with all NYSE continued listing standards.

This Current Report on Form 8-K contains “forward-looking statements” within the meaning established by the Private Securities Litigation Reform Act of 1995, which are identified by words such as “plans,” “will,” “expects,” “may,” “believes,” “estimates” or “estimated, “intends,” and other similar words, expressions, and formulations. This Report contains forward-looking statements regarding the timing and scope of the Restructuring Plan; and the amount and timing of the related charges. Many factors could affect the actual results of the reduction in force plan, and variances from the Company's current expectations regarding such factors could cause actual results of the Restructuring Plan to differ materially from those expressed in these forward-looking statements. The Company presently considers the following to be a non-exclusive list of important factors that could cause actual results to differ materially from its expectations: estimates of employee headcount reductions and cash expenditures that may be made by the Company in connection with the Restructuring Plan. A detailed discussion of these and other risks and uncertainties that could cause the Company's actual results to differ materially from these forward-looking statements is included in the documents that the Company files with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K. These forward-looking statements speak only as of the date of this Current Report on Form 8-K, and the Company does not undertake any obligation to revise or update such statements, whether as a result of new information, future events, or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| KORE Group Holdings, Inc. |

| | |

| Date: August 15, 2024 | By: | /s/ Jack W. Kennedy Jr. |

| Name: | Jack W. Kennedy Jr. |

| Title: | Executive Vice President, Chief Legal Officer, and Secretary |

EXECUTIVE EMPLOYMENT AGREEMENT

THIS EXECUTIVE EMPLOYMENT AGREEMENT (this “Agreement”) is made as of August 14, 2024 (the “Effective Date”), by and among KORE Group Holdings, Inc. (the “Company”), KORE Wireless Group Inc. (“KORE”) and Ronald Totton (the “Executive”). Certain capitalized terms used in this Agreement are defined in Section 10.

WHEREAS, on April 29, 2024, the Company and the Executive entered into that certain Letter Agreement whereby the Executive was employed by the Company as the Interim President and Chief Executive Officer of the Company (the “Letter Agreement”); and

WHEREAS, effective as of the Effective Date, the parties desire to enter into this Agreement to supersede any prior agreements, term sheets, understandings, discussions or negotiations, whether written or oral, among the parties hereto relating to the subject matter hereof, including without limitation the Letter Agreement, and to set out the terms of the Executive’s employment with the Company.

NOW, THEREFORE, in consideration of the mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Termination of Letter Agreement and Employment.

(a)The Letter Agreement is hereby terminated effective as of the Effective Date and is void and shall have no further force or effect as of such date.

(b)The Company will employ the Executive, and the Executive hereby accepts employment with the Company, upon the terms and conditions set forth in this Agreement, for the period beginning on the Effective Date (the “Start Date”) and ending on the fifth anniversary of the Start Date (the “Initial Term”), unless earlier terminated as provided in Section 5 or extended as provided below (the “Employment Period”). The term under this Agreement (the “Term”) will automatically extend for one (1) additional year starting immediately after the expiration of the Initial Term, and for one (1) additional year starting on each annual anniversary thereafter, unless either party gives the other party notice of such party’s election not to extend the Term not fewer than thirty (30) days prior to the date that would otherwise be the end of the Term.

2.Position and Duties. During the Employment Period, the Executive will serve as the President and Chief Executive Officer of the Company and render such services to the Company and its Subsidiaries, as may be reasonably assigned to the Executive from time to time, by the Board of Directors of the Company (the “Board”). The Executive will devote substantially all of the Executive’s business time and attention (except for permitted vacation periods and reasonable periods of illness or other incapacity) to the business and affairs of Company and its Subsidiaries; provided that the Executive will be permitted to (i) serve, with the prior written consent of the Board (which consent shall not be unreasonably withheld), as a member of the board of directors or advisory board (or their equivalents, in the case of a non-corporate entity) of

non-competing businesses and charitable organizations, (ii) engage in charitable activities and community affairs and (iii) manage the Executive’s personal investments and affairs, except that the Executive will limit the time devoted to the activities described in clauses (i), (ii) and (iii) so as not to interfere, other than in a de minimis manner, individually or in the aggregate, with the performance of the Executive’s duties and responsibilities hereunder. The Executive will report directly to the Board. The Executive will perform the Executive’s duties and responsibilities to the best of his abilities in a diligent, trustworthy, businesslike and efficient manner. As long as the Executive serves as the Chief Executive Officer of the Company, the Company shall use reasonable efforts to cause the Executive to be elected to serve on the Board, subject to the limitations of applicable law and securities exchange rules.

3.Salary and Benefits.

(a)Salary. During the Employment Period, the Company will pay the Executive salary at a rate equal to $600,000.00 per annum (as in effect from time to time, the “Salary”) as compensation for services. The Salary will be payable in regular installments (no less frequently than monthly) in accordance with the general payroll practices of the Company and its Subsidiaries and subject to any applicable withholding requirements. The Salary will be reviewed annually solely for upward adjustment, if any, in the Board’s discretion.

(b)Benefits. During the Employment Period, the Company will provide the Executive with benefits under such plans as the Board may establish or maintain from time to time in which senior executives of the Company and its Subsidiaries may participate, including the Company’s group medical, dental and prescription insurance plans and 401(k) defined contribution savings plan, in each case, if any, in accordance with the terms of such plans. The Executive will be entitled to four (4) weeks of paid vacation each year, which must be used, carried over, and paid out in accordance with the Company’s policies.

(c)Reimbursement of Expenses. During the Employment Period, the Company will reimburse the Executive for all reasonable out-of-pocket expenses incurred by the Executive in the course of performing the Executive’s duties under this Agreement that are consistent with the Company’s policies in effect from time to time with respect to travel, entertainment and other business expenses, subject to the Company’s requirements with respect to reporting and documentation of such expenses and Section 11 below.

4.Bonus Opportunities.

(a)Annual Bonus Opportunity. During the Employment Period, the Executive shall be eligible to receive an annual incentive payment under the Company’s annual bonus plan as may be in effect from time to time (the “Annual Bonus”), based on a target bonus opportunity of seventy-five percent (75%) of the Executive’s Salary (the “Target Bonus”), upon the achievement of 100% of the pre-established performance objectives, which are initially expected to consist of revenue and EBITDA objectives (with a sliding scale for performance above and below target performance) as determined by the Board (or a committee thereof) after consultation with the Executive. Any Annual Bonus payable hereunder shall be paid in the calendar year following the calendar year to which such Annual Bonus relates at the same time

annual bonuses are paid to other senior executives of the Company and after the delivery of the audit, which payment is expected to occur no later than April 30th of each calendar year, subject to the Executive’s continued employment with the Company at the time of payment (except as provided in Sections 5(b)(i) and 5(b)(iii)). Notwithstanding the foregoing, the Executive shall not be entitled to receive any Annual Bonus in respect of calendar year 2024.

(b)Signing Bonus. Executive shall receive a one-time special signing bonus in an amount equal to $450,000, payable in cash in two installments, less all applicable withholdings (the “Signing Bonus”). The first payment of $225,000 of the Signing Bonus shall be made no later than December 31, 2024, and the second payment of $225,000 of the Signing Bonus shall be made no later than March 15, 2025.

5.Termination.

(a)The Employment Period will continue until the earliest of: (i) the end of the Term; (ii) the Executive’s resignation without Good Reason; (iii) the Executive’s death or determination of Disability (which determination of Disability shall be made in good faith by a qualified physician selected by the Board or the Company’s insurers and reasonably acceptable to the Executive or the Executive’s legal representative); (iv) the giving of notice of a termination by the Company upon a determination made by the Board that the Executive’s employment is being terminated (A) for Cause, or (B) for any other reason or for no reason (a termination described in this clause (iv)(B) being a termination by the Company “Without Cause”); and (v) the Executive’s resignation with Good Reason. Termination of the Employment Period by reason of the expiration of the Term will constitute a termination by the Company Without Cause, if such termination results from notice given by the Company not to extend the Term.

(b)If the Company terminates the Employment Period Without Cause (other than due to the Executive’s death or Disability) or if the Executive resigns with Good Reason, subject to Executive’s continued compliance with Sections 6 and 7 of this Agreement, the Company shall provide to the Executive, subject to Section 11 below:

(i)any Annual Bonus which has been earned but remains unpaid with respect to the Company fiscal year ending prior to the date of termination (the “Termination Date”), payable in accordance with Section 4 (the “Accrued Bonus”);

(ii)payment of the Executive’s Salary in effect immediately preceding the Termination Date (or, if greater, the Executive’s Salary in effect immediately preceding a material reduction in the Executive’s then current Salary, for which the Executive has terminated the Executive’s employment for Good Reason) for the period equal to twelve (12) months (the “Severance Period”), payable in accordance with the established payroll practices of the Company (but no less frequently than monthly), beginning on the first payroll date following 60 days after the Termination Date, with the Executive to receive at that time a lump sum payment with respect to any installments the Executive was entitled to receive during the first 60 days following the Termination Date, and the remaining payments made as if they had commenced immediately following the Termination Date;

(iii)payment of an amount equal to the Executive’s actual earned full-year Annual Bonus for the Company fiscal year in which the termination of Executive’s employment occurs, prorated based on the number of days the Executive was employed during such year, payable in accordance with Section 4 had the Executive continued employment until the time of payment (the “Prorated Bonus”);

(iv)vesting of the outstanding and unvested equity or equity-based awards that would have vested solely based on continued employment (i.e., time-vesting, not performance-vesting, awards);

(v)continuation after the Termination Date of any health care (medical, dental and vision) plan coverage provided to the Executive and the Executive’s spouse and dependents as of the Termination Date for the Severance Period, on the same basis and at the same cost to the Executive as available to similarly-situated active employees during such Severance Period, provided that (1) such continued participation is possible under the general terms and provisions of such plans and programs; (2) Executive and Executive’s spouse and dependents as of the Termination Date elect COBRA (defined herein); and (3) such continued coverage by the Company shall terminate in the event the Executive becomes eligible for any such coverage under another employer’s plans. If the Company reasonably determines that maintaining such coverage for the Executive or the Executive’s spouse or dependents is not feasible under the terms and provisions of such plans and programs (or where such continuation would adversely affect the tax status of the plan or program pursuant to which the coverage is provided), the Company shall pay the Executive cash, on a monthly basis, in an after-tax amount equal to the portion of COBRA premiums the Company would have subsidized had the Executive and the Executive’s spouse and dependents continued coverage for such same period of time, with such payments to be made in accordance with the established payroll practices of the Company (not less frequently than monthly) for the period during which such cash payments are to be provided; and

(vi)payment or provision, as applicable, of any Accrued Rights. For purposes of this Agreement, “Accrued Rights” shall mean the sum of (A) the Executive’s Salary through the Executive’s termination of employment which remains unpaid as of the Termination Date, (B) any reimbursements for expenses incurred but not yet paid as of the Termination Date and (C) any benefits or other amounts, including both cash and stock components, which pursuant to the terms of any plans, policies or programs have been earned or become payable, but which have not yet been paid to the Executive as of the Termination Date, including payment for any unused paid time-off. The Accrued Rights will be paid, as applicable, to the Executive in a lump sum within thirty (30) days following the Termination Date, except that benefits or other amounts, including both cash and stock components, which become payable shall be paid in accordance with the terms of the plans, policies or programs under which they become payable;

(vii)payment of one year of outplacement services from an outplacement service provider of the Executive’s choice, limited to $20,000 paid in total. The outplacement services benefit will be forfeited if the Executive does not begin using such services within 60 days following the Termination Date.

(c)If the Employment Period terminates by reason of the Executive’s death or Disability, then the Executive (or the Executive’s estate in the case of the Executive’s death) will be entitled to receive payment or provision, as applicable, of any Accrued Rights, the Accrued Bonus and the Prorated Bonus, as well as any Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”) coverage (at the Executive’s sole expense) and any benefits to which the Executive is entitled by law, in each case, payable as described above. Any and all amounts payable and benefits or additional rights provided pursuant to Sections 5(b) and 5(c) (other than the Accrued Rights) shall only be payable or provided if the Executive (or Executive’s estate and other beneficiaries, after Executive’s death) delivers to the Company and does not revoke a general release of employment-related claims in favor of the Company in the form attached hereto as Exhibit A within sixty (60) days following the Termination Date. Any severance payments payable to the Executive by the Company are subject to all applicable withholding requirements.

(d)If the Employment Period terminates by reason of (i) the Company’s termination for Cause or (ii) the Executive’s resignation without Good Reason (including a termination resulting from notice given by the Executive not to extend the Term), then the Executive will be entitled to receive the Accrued Rights, payable, as applicable, in a lump sum within thirty (30) days following the Termination Date, or such earlier date as may be required by applicable law, as well as any COBRA benefits to which the Executive is entitled by law (at the Executive’s sole expense) and any benefits to which the Executive is entitled by law, payable as described above.

(e)Upon the Termination Date, the Executive will be deemed to have resigned from each position (if any) that the Executive then holds as an officer or director of the Company or any of its Subsidiaries, and the Executive will take any action that the Company or any of its Subsidiaries may reasonably request in order to confirm or evidence such resignation.

(f)The Executive is not required to mitigate the amount of any payment or benefit provided for in this Agreement by seeking other employment or otherwise.

6.Restrictive Covenants.

(a)Confidential Information. The Executive acknowledges that the information, observations and data that have been or may be obtained by the Executive during the Executive’s employment or other relationship with, or through the Executive’s involvement as a direct and indirect owner of, the Company, any Subsidiary or affiliate thereof or any direct or indirect successor to or predecessor of any of them or any of their businesses (collectively with the Company, the “Related Companies”), prior to or after the execution and delivery of this Agreement, of or concerning the Related Companies or their businesses or affairs (collectively, “Confidential Information”), are and will be the property of the Related Companies; provided, that the term “Confidential Information” shall not include any information (including techniques, know-how or strategies) that the Executive can demonstrate (i) is or becomes publicly available otherwise than through a breach of this Agreement, (ii) is or becomes known or available to the Executive on a non-confidential basis and not in contravention of applicable law from a source that is entitled to disclose such information to the Executive, (iii) is required to be disclosed

pursuant to any applicable law or court order or governmental or regulatory body or (iv) is appropriate or necessary to be disclosed in connection with any dispute related to the Executive’s employment. Confidential Information includes but is not limited to (i) the identities of the Related Companies’ customers or potential customers, their purchasing histories, and the terms or proposed terms upon which the Related Companies offer or may offer their products and services to such customers and the technical specifications of those contracts, (ii) the terms and conditions upon which the Related Companies employ their employees and independent contractors, (iii) marketing and/or business plans and strategies, (iv) financial reports and analyses regarding the revenues, expenses, profitability and operations of the Related Companies, (v) the nature, origin, composition and development of the Related Companies’ products and services, (vi) any trade secrets of the Related Companies, as defined under applicable law, and (vii) information provided to the Related Companies by third parties under a duty to maintain the confidentiality of such information. Therefore, the Executive agrees that the Executive will not, during the Employment Period or thereafter, disclose to any unauthorized Person or use for the account of the Executive or any other Person (other than the Company and its Affiliates and their officers, directors and employees, in the course of performing the Executive’s duties as an employee of the Company) any Confidential Information without the prior written consent of the Company (by the action of the Board), unless and to the extent that such disclosure is required by law. The Executive will deliver or cause to be delivered to the Company at, or within two (2) weeks after, the final day of the Executive’s employment by the Company, or at any other time the Company or its Affiliates may request, all memoranda, notes, plans, records, reports, computer tapes and software and other documents and materials (and copies thereof) containing or relating to Confidential Information or the business of any Related Company that the Executive may then possess or have under the Executive’s control; provided, that Executive may retain copies of the Executive’s compensation records and documents, information reasonably needed for tax purposes and any other personal property, such as rolodexes or other personal contacts. Nothing in this Agreement or in any other agreement between the Executive and any Related Company (x) limits, restricts or in any other way affects the Executive from communicating with any governmental agency or entity, or communicating with any official or staff person of a governmental agency or entity, concerning matters relevant to the governmental agency or entity, including reporting any good faith allegation of unlawful employment practices or criminal conduct or participating in any related proceeding or (y) prevents the Executive from making any truthful statements or disclosures required by law, regulation or legal process, or from requesting or receiving confidential legal advice, or requires the Executive to furnish notice to the Related Companies of the any of the foregoing.

(b)Noncompete and Nonsolicitation. The Executive acknowledges that (i) the Executive performs services of a unique nature for the Company and its Subsidiaries that are irreplaceable, and that the Executive’s performance of such services to a competing business will result in irreparable harm to the Related Companies; (ii) the Executive has had and/or will have access to Confidential Information which, if disclosed, would unfairly and inappropriately assist in competition against the Related Companies; (iii) in the course of the Executive’s employment by a competitor, the Executive would inevitably use or disclose such Confidential Information, (iv) the Related Companies have substantial relationships with their customers, and the Executive has had and/or will have access to these customers; (v) the Executive has received and/or will receive specialized training from the Related Companies; and (vi) the Executive has

generated and/or will generate goodwill for the Related Companies in the course of the Executive’s employment. Accordingly, the Executive hereby agrees as follows:

(i)During the “Non-Compete Period” (as defined below), the Executive will not engage in activity that is competitive with any Related Company by, directly or through an Affiliate or otherwise, own any interest in, managing, controlling, providing consulting services for, or operating any Person for whom the Restricted Business represents 10% or more of such Person’s annual revenues (other than on behalf of the Company or its Affiliates); provided, however, that the Executive shall not be prohibited from managing, controlling, being employed by, providing consulting services for or operating any portion, division, department, section or business of any Person for whom the Restricted Business represents less than 10% of such Person’s annual revenues, so long as the Executive is not engaging in any of the foregoing activities with respect to the Restricted Business. Nothing in the foregoing is intended to prevent the Executive from (A) owning (I) up to 5% of the outstanding stock of any corporation that is engaged in a Restricted Business and publicly traded on a national securities exchange or in the over the counter market or (II) up to 5% of a private entity through passive investments made through hedge funds, private equity funds and similar vehicles, in each case, so long as the Executive has no active participation in connection with the business of any such entity, or (B) continuing to own, manage, control, provide consultant services for or operate any Person that is engaged in a business described in clause (iii) of the definition of Restricted Business if such ownership or other activity arose prior to the date on which the Related Companies took active steps to engage in such business.

(ii)For the Non-Compete Period, the Executive will not directly or indirectly (A) induce or attempt to induce any employee, officer, director or consultant to leave the employ or service of any Related Company, (B) hire any individual who was an employee, officer, director or consultant of any Related Company at any time during the six (6) month period prior to the Termination Date; provided, however, that the foregoing shall not apply to individuals (I) hired as a result of the use of an independent employment agency (so long as the agency was not directed to solicit a particular individual) or as a result of the use of general solicitations not specifically targeted at employees of any Related Company or (II) whose employment with or services provided to the Related Company terminated for a period of at least six (6) months prior to the commencement of employment discussions with such other entity, or (C) induce or attempt to induce any customer, supplier, vendor, service provider, licensee, licensor, lessor, franchisee or other business relation of any Related Company to cease doing business with any Related Company, or in any way materially and adversely interfere with the relationship between any such customer, supplier, vendor, service provider, employee, licensee, licensor, lessor, franchisee or other business relation and any Related Company (including making any negative statements or communications about the Company or any Related Company); provided, that the restrictions in this clause (C) shall not prohibit the ordinary course solicitation of any of the foregoing for purposes of a business that is not a Restricted Business, so long as such solicitation is not designed or intended to interfere with the Company’s or any Related Company’s work in the Restricted Business. For the avoidance of doubt, the foregoing shall not prohibit the Executive from providing an employment reference for any Person.

(c)Reasonableness of Covenants. In signing this Agreement, the Executive gives the Company assurance that the Executive has carefully read and considered all of the terms and conditions of this Agreement, including the restraints imposed under this Section 6. The Executive agrees that these restraints are necessary for the reasonable and proper protection of any Related Company and the Confidential Information and that each and every one of the restraints is reasonable in respect to subject matter, length of time and geographic area, and that these restraints, individually or in the aggregate, will not prevent the Executive from obtaining other suitable employment during the period in which the Executive is bound by the restraints. The Executive acknowledges that each of these covenants has a unique, very substantial and immeasurable value to the Related Companies, and that the Executive has sufficient assets and skills to provide a livelihood while such covenants remain in force. It is also agreed that each of the Related Companies (other than the Company) is an express, third-party beneficiary of, and will have the right to enforce, all of the Executive’s obligations to that Related Company under this Agreement, including pursuant to this Section 6. The obligations contained in Section 6 hereof shall survive the termination or expiration of the Employment Period and the Executive’s employment with the Company and shall be fully enforceable thereafter.

7.Assignment. The Executive acknowledges and agrees that all discoveries, concepts, ideas, inventions, innovations, improvements, developments, methods, designs, analyses, drawings, reports, works of authorship, mask works and intellectual property (whether or not including any Confidential Information), all other proprietary information and all similar or related materials, documents, work product or information (whether or not patentable) which are conceived, developed or made by the Executive (whether alone or jointly with others) while employed by the Company or its Affiliates, whether before or after the date of this Agreement (collectively, the “Work Product”), will be the sole, exclusive and absolute property of the Company or such Affiliate, and the Executive hereby irrevocably assigns, transfers and conveys (to the extent permitted by applicable law) all rights, including intellectual property rights, therein on a worldwide basis to the Company or such other entity as the Company may designate, to the extent ownership of any such rights does not vest originally in the Company and waives any moral rights therein to the fullest extent permitted under applicable law. The Executive will promptly disclose any such Work Product to the Company (except where it is lawfully protected from disclosure as the trade secret of a third party or by any other lawful bar to such disclosure) and will, at the request of the Company and without additional compensation, perform all actions reasonably requested by the Company to establish and confirm such ownership, including executing any patent, trademark or copyright papers covering such Work Product, as well as any papers which may be considered necessary or helpful by the Company in the prosecution of applications for patents thereon or which may relate to any litigation or controversy in connection therewith, with the Company bearing all expenses of performing such actions (including expenses incident to the filing of such application, the prosecution thereof and the conduct of any such litigation).

8.Enforcement. The Company and the Executive agree that if, at the time of enforcement of Sections 6 or 7, a court holds that any restriction stated in any such Section is unreasonable under circumstances then existing, then the maximum period, scope or geographical area reasonable under such circumstances will be substituted for the otherwise-

applicable period, scope or area. The Executive agrees that money damages would be an inadequate remedy for any breach of Sections 6 or 7. Therefore, in the event of a breach of Sections 6 or 7, any Related Company may, in addition to other rights and remedies existing in their favor, apply to any court of competent jurisdiction for specific performance and/or injunctive or other relief in order to enforce, or prevent any violations of, the provisions of Sections 6 and 7.

9.Representations and Warranties. The Executive represents and warrants: (a) the Executive is not a party to or bound by any employment, noncompete, nonsolicitation, nondisclosure, confidentiality or similar agreement with any other Person that would materially affect the Executive’s performance under this Agreement; and (b) this Agreement constitutes a valid and legally binding obligation of the Executive, enforceable against the Executive in accordance with its terms. The Company represents that this Agreement constitutes a valid and legally binding obligation of the Company, enforceable against the Company in accordance with its terms. All representations and warranties contained herein will survive the execution and delivery of this Agreement.

10.Certain Definitions. When used in this Agreement, the following terms will have the following meanings:

“Accrued Bonus” is defined in Section 5(b)(i).

“Affiliate” means, with respect to any Person, any other Person that, directly or indirectly through one or more of its intermediaries, controls, is controlled by or is under common control with such Person. With respect to the Company, for purposes hereunder, the Company’s Affiliates will be deemed to include the Company and any of the Company’s directly or indirectly controlled Subsidiaries.

“Agreement” is defined in the preamble.

“Annual Bonus” is defined in Section 4.

“Board” is defined in Section 2.

“Business Day” means a day that is not a Saturday, a Sunday or a statutory or civic holiday in the State of New York or Commonwealth of Massachusetts.

“Cause” means any of (i) the Executive’s gross negligence, willful misconduct or willful and continuing failure (except where due to Disability or where performance of the Executive’s duties is prohibited by law) or refusal to perform the Executive’s duties hereunder, and which action or inaction results in material detriment to the Company or any of its Affiliates; (ii) any willful act or omission by the Executive that has had or could reasonably be expected to have a material adverse effect on the reputation or business of the Company or any of its Affiliates; (iii) the Executive’s conviction of, or a plea of guilty or no contest or similar plea with respect to, a felony or commission of an act of fraud or embezzlement that results in material injury to the Company; (iv) the Executive’s material breach of a fiduciary duty of loyalty to the

Company or any of its Affiliates Subsidiaries or equity owners that results in material injury to the Company; or (v) the Executive’s material breach of a material term of this Agreement. Prior to a termination for Cause, the Company shall provide written notice (the “Cause Notice”) to the Executive of the reason or reasons for a potential Cause determination no later than forty-five (45) days after any member of the Board first becomes aware of the facts allegedly constituting Cause and the Executive shall have thirty (30) days to cure the deficiency or deficiencies set forth in the Company’s notice, if such deficiencies are capable of being cured. If cured, “Cause” shall no longer apply to the reason or reasons set forth in the Company’s notice. If not cured, a termination for Cause shall occur upon the expiration of the thirty (30)- day notice period. For purposes of this definition, “willful” shall mean in bad faith and not with the reasonable belief such action or inaction was in the best interests of the Company. Any act, or failure to act, based upon authority given pursuant to an instruction from the Board to the Executive shall be conclusively presumed to be done, or omitted to be done, by the Executive in good faith and in the best interests of the Company. The Executive shall have the right to be heard before the Board with counsel prior to a final Cause determination being made.

“COBRA” is defined in Section 5(c).

“Company” is defined in the preamble.

“Confidential Information” is defined in Section 6(a).

“Disability” means the inability of the Executive to perform the essential functions of the Executive’s position as a result of incapacity due to injury or illness of any kind, for a period of (i) two hundred (200) consecutive days, or (ii) a period (whether or not consecutive) of two hundred seventy (270) days during any twelve (12)-month period, exclusive of any leave that the Executive may take under the Family and Medical Leave Act, 29 U.S.C. § § 12101 et seq.; and subject to Company’s full compliance with its obligations under the Americans with Disabilities Act, 29 U.S.C. § § 2601 et seq., including, but not limited to, its obligation to offer reasonable accommodation to the Executive. In the event of a disagreement concerning the Executive’s “Disability,” a qualified unbiased physician selected by the Company and reasonably acceptable to the Executive or the Executive’s legal representative shall determine whether the Executive is suffering a “Disability.” The Executive agrees to submit to such examinations as may be reasonably necessary for this purpose.

“Effective Date” is defined in the recitals.

“Employment Period” is defined in Section 1(b).

“Executive” is defined in the preamble.

“Good Reason” shall exist if (i) the Company, without the Executive’s written consent, (A) materially reduces the Executive’s then current authority, duties or responsibilities, (B) materially reduces the Executive’s then current Salary, (C) commits a material breach of this Agreement, (D) relocates the Executive’s principal place of employment by more than fifty (50) miles (unless closer to the Executive’s residence) or (E) requires that the Executive report

directly to anyone other than the Board; (ii) the Executive provides written notice to the Company of any such action within forty-five (45) days of the date on which such action first occurs and provides the Company with thirty (30) days to remedy such action (the “Cure Period”); (iii) the Company fails to remedy such action within the Cure Period; and (iv) the Executive resigns within thirty (30) days of the expiration of the Cure Period. Good Reason shall not include any isolated, insubstantial or inadvertent action that is not taken in bad faith or any action that is remedied by the Company within the Cure Period.

“Initial Term” is defined in Section 1(b).

“KORE” is defined in the recitals.

“Non-Compete Period” shall mean (a) the period in which the Executive is employed by any Related Company and (b) the post-employment period following the time in which Executive ceases to be employed by any Related Company equal to (i) the Severance Period (if applicable), or (ii) twenty-four (24) months if the Severance Period is not applicable because the Executive’s employment with any Related Company ends because of a determination of Disability or because notice is given by the Executive not to extend the Term, or because the Executive resigns without Good Reason or because the Company terminates the Executive for Cause.

“Person” means an individual, a partnership, a corporation, an association, a limited liability company, a joint stock company, a trust, a joint venture, an unincorporated organization or any other entity (including any governmental entity or any department, agency or political subdivision thereof).

“Prorated Bonus” is defined in Section 5(b)(iii).

“Related Companies” is defined in Section 6(a).

“Restricted Business” means (i) the business of providing machine-to-machine cellular connectivity services anywhere in the world, (ii) any other material business conducted by the Related Companies as of the date hereof and (iii) any other material business in which the Related Companies take active steps to engage during the Non-Compete Period.

“Salary” is defined in Section 3(a).

“Severance Period” is defined in Section 5(b)(ii).

“Start Date” is defined in Section 1(b).

“Subsidiary” of any Person means another Person (other than a natural Person), an aggregate amount of the voting securities, or other voting ownership or voting partnership interests, of which is sufficient to elect at least a majority of the Board or other governing body (or, if there are no such voting interests, 50% or more of the equity interests of which are owned directly or indirectly by such first Person).

“Target Bonus” is defined in Section 4(a).

“Term” is defined in Section 1(b).

“Termination Date” means the date on which the Employment Period ends pursuant to Section 5(b)(i).

“Without Cause” is defined in Section 5(a).

“Work Product” is defined in Section 7.

11.Code Section 409A.

(a)The intent of the parties is that payments and benefits under this Agreement that constitute deferred compensation shall be exempt from, or, if that is not possible, then shall comply with, Internal Revenue Code Section 409A and the regulations and guidance promulgated thereunder (collectively, “Code Section 409A”), and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted in accordance with such intent. In no event whatsoever shall the Company or any of its Affiliates be liable for any additional tax, interest or penalty that may be imposed on the Executive by Code Section 409A or damages for failing to comply with Code Section 409A.

(b)A termination of employment shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment of any amount or benefit that constitutes deferred compensation upon or following a termination of employment unless such termination is also a “separation from service” within the meaning of Code Section 409A, and, for purposes of any such provision of this Agreement, references to a “termination,” “termination of employment” or like terms shall mean “separation from service.” Notwithstanding anything to the contrary in this Agreement, if the Executive is deemed on the Termination Date to be a “specified employee” within the meaning of that term under Code Section 409A(a)(2)(B), then with regard to any payment or the provision of any benefit that is considered deferred compensation subject to Code Section 409A payable on account of a “separation from service,” such payment or benefit shall not be made or provided until the date which is the earlier of (i) the expiration of the six (6)-month period measured from the date of such “separation from service” of the Executive and (ii) the date of the Executive’s death, to the extent required under Code Section 409A. Upon the expiration of the foregoing delay period, all payments and benefits delayed pursuant to this Section 11(b) (whether they would have otherwise been payable in a single sum or in installments in the absence of such delay) shall be paid or reimbursed to the Executive in a lump sum, and any remaining payments and benefits due under this Agreement shall be paid or provided in accordance with the normal payment dates specified for them herein.

(c)To the extent that reimbursements or other in-kind benefits under this Agreement constitute “nonqualified deferred compensation” for purposes of Code Section 409A, (i) all such expenses or other reimbursements hereunder shall be made on or prior to the last day of the taxable year following the taxable year in which such expenses were incurred by the

Executive; (ii) any right to such reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit; and (iii) no such reimbursement, expenses eligible for reimbursement or in-kind benefits provided in any taxable year shall in any way affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other taxable year.

(d)For purposes of Code Section 409A, the Executive’s right to receive any installment payments pursuant to this Agreement shall be treated as a right to receive a series of separate and distinct payments. Whenever a payment under this Agreement specifies a payment period with reference to a number of days, the actual date of payment within the specified period shall be within the sole discretion of the Company.

(e)Notwithstanding any other provision of this Agreement to the contrary, in no event shall any payment under this Agreement that constitutes “nonqualified deferred compensation” for purposes of Code Section 409A be subject to offset by any other amount unless otherwise permitted by Code Section 409A.

12.Miscellaneous.

(a)Notices. All notices, demands or other communications to be given or delivered by reason of the provisions of this Agreement will be in writing and will be deemed to have been given on the date of personal delivery to the recipient or an officer of the recipient, or when sent by telecopy or facsimile machine to the number shown below on the date of such confirmed facsimile or telecopy transmission (provided that a confirming copy is sent via overnight mail), or when properly deposited for delivery by a nationally recognized commercial overnight delivery service, prepaid, or by deposit in the United States mail, certified or registered mail, postage prepaid, return receipt requested. Such notices, demands and other communications will be sent to each party at the address indicated for such party below:

if to the Executive, to:

The address on file in the books and records of the Company

if to the Company:

KORE Group Holdings, Inc.

3 Ravinia Drive NE

Suite 500

Atlanta, Georgia 30346

Attention: Chief Legal Officer

Email: jkennedy@korewireless.com

or to such other address or to the attention of such other person as the recipient party has specified by prior written notice to the sending party.

(b)Consent to Amendments. No modification, amendment or waiver of any provision of this Agreement will be effective against any party hereto unless such modification, amendment or waiver is approved in writing by such party. No other course of dealing among any Related Company and the Executive or any delay in exercising any rights hereunder will operate as a waiver by any of the parties hereto of any rights hereunder.

(c)No Mitigation and No Set-Off. The payments required to be paid to the Executive by the Company pursuant to Section 5 shall not be reduced or mitigated by amounts which the Executive is capable of earning or does earn during any period following the Termination Date.

(d)Assignment; Successors and Assigns. The Executive may not make any assignment of this Agreement or any interest herein, by operation of law or otherwise, without the prior written consent of the Company, and without such consent, any attempted transfer or assignment of such type will be null and of no effect. Any assignment of this Agreement by a Person will not release such Person of such Person’s obligations under this Agreement. All covenants and agreements contained in this Agreement by or on behalf of any of the parties hereto will bind and inure to the benefit of the respective successors and assigns of the parties hereto whether so expressed or not.

(e)Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be prohibited by or invalid under applicable law, such provision will be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of this Agreement.

(f)Counterparts. This Agreement may be executed simultaneously in two (2) or more counterparts (including by facsimile or scanned copy), any one of which need not contain the signatures of more than one (1) party, but all such counterparts taken together will constitute one and the same Agreement.

(g)Descriptive Headings; Interpretation. The descriptive headings of this Agreement are inserted for convenience only and do not constitute a substantive part of this Agreement. The use of the word “including” in this Agreement will be by way of example rather than by limitation.

(h)Governing Law. ISSUES AND QUESTIONS CONCERNING THE CONSTRUCTION, VALIDITY, ENFORCEMENT AND INTERPRETATION OF THIS AGREEMENT AND ANY EXHIBITS OR SCHEDULES HERETO WILL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF DELAWARE, WITHOUT GIVING EFFECT TO ANY CHOICE OF LAW OR CONFLICT OF LAW RULES OR PROVISIONS (WHETHER OF THE STATE OF DELAWARE OR ANY OTHER JURISDICTION) THAT WOULD CAUSE THE APPLICATION OF THE LAWS OF ANY JURISDICTION OTHER THAN THE STATE OF DELAWARE. IN FURTHERANCE OF THE FOREGOING, THE INTERNAL LAW OF THE STATE OF DELAWARE WILL CONTROL THE INTERPRETATION AND CONSTRUCTION OF THIS AGREEMENT

(AND ANY SCHEDULE HERETO), EVEN THOUGH UNDER DELAWARE’S CHOICE OF LAW OR CONFLICT OF LAW ANALYSIS, THE SUBSTANTIVE LAW OF SOME OTHER JURISDICTION WOULD ORDINARILY APPLY. EACH OF THE PARTIES AGREES THAT ANY DISPUTE BETWEEN THE PARTIES SHALL BE RESOLVED ONLY IN THE COURTS OF THE STATE OF DELAWARE OR THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE AND THE APPELLATE COURTS HAVING JURISDICTION OF APPEALS IN SUCH COURTS.

(i)Waiver of Jury Trial. EACH PARTY TO THIS AGREEMENT HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY LAW, ANY RIGHT TO TRIAL BY JURY OF ANY CLAIM, DEMAND, ACTION, OR CAUSE OF ACTION (A) ARISING UNDER THIS AGREEMENT OR (B) IN ANY WAY CONNECTED WITH OR RELATED OR INCIDENTAL TO THE DEALINGS OF THE PARTIES HERETO IN RESPECT OF THIS AGREEMENT OR ANY OF THE TRANSACTIONS RELATED HERETO, IN EACH CASE, WHETHER NOW EXISTING OR HEREAFTER ARISING, AND WHETHER IN CONTRACT, TORT, EQUITY OR OTHERWISE. EACH PARTY TO THIS AGREEMENT HEREBY AGREES AND CONSENTS THAT ANY SUCH CLAIM, DEMAND, ACTION OR CAUSE OF ACTION WILL BE DECIDED BY COURT TRIAL WITHOUT A JURY, AND THAT THE PARTIES TO THIS AGREEMENT MAY FILE AN ORIGINAL COUNTERPART OR A COPY OF THIS AGREEMENT WITH ANY COURT AS WRITTEN EVIDENCE OF THE CONSENT OF THE PARTIES HERETO TO THE WAIVER OF THEIR RIGHT TO TRIAL BY JURY.

(j)SERVICE OF PROCESS. WITH RESPECT TO ANY AND ALL SUITS, LEGAL ACTIONS OR PROCEEDINGS ARISING OUT OF THIS AGREEMENT, EACH PARTY WAIVES PERSONAL SERVICE OF ANY SUMMONS, COMPLAINT OR OTHER PROCESS AND AGREES THAT SERVICE THEREOF MAY BE MADE BY ANY MEANS SPECIFIED FOR NOTICE PURSUANT TO SECTION 12(a).

(k)No Strict Construction. The parties hereto have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement will be construed as if drafted jointly by the parties hereto, and no presumption or burden of proof will arise favoring or disfavoring any party by virtue of the authorship of any of the provisions of this Agreement.

(l)Entire Agreement. Except as otherwise expressly set forth in this Agreement, this Agreement embodies the complete agreement and understanding among the parties to this Agreement with respect to the subject matter of this Agreement and supersedes and preempts any prior understandings, agreements or representations by or among the parties or their predecessors, written or oral, that may have related to the subject matter of this Agreement in any way; provided that the covenants contained in Sections 6 and 7 shall be in addition to, and not in replacement of, any similar restrictions to which the Executive may be subject.

(m)Time. Whenever the last day for the exercise of any privilege or the discharge or any duty hereunder falls upon a day that is not a Business Day, the party having

such privilege or duty may exercise such privilege or discharge such duty on the next succeeding day that is a Business Day.

(n)Actions by the Company. Any action, election or determination by the Board or any committee thereof pursuant to or relating to this Agreement will be effective if, and only if, it is taken or made by (or with the prior approval of) a majority of the members of the Board who are not at the time employees of the Company or any of its Subsidiaries.

(o)Withholding. The Company may withhold from any and all amounts payable under this Agreement or otherwise such federal, state and local taxes as may be required to be withheld pursuant to any applicable law or regulation. The Executive agrees and acknowledges that neither the Company nor any of its Affiliates makes any representations with respect to the application of any tax law to any amounts described hereunder, and the Executive agrees to accept any such tax consequences.

(p)Indemnification. In addition to any rights to indemnification to which the Executive is entitled under the Company’s organizational documents, the Executive shall be covered to the same extent as directors of the Board under any directors and officers liability insurance policy maintained in effect by the Company. This Section survives any termination of the Executive’s employment.

(q)Attorneys’ Fees. In the event of litigation relating to this Agreement, the prevailing party will be entitled to recover attorneys’ fees and costs of litigation in addition to all other remedies available at law or in equity. For purposes of this Agreement, the prevailing party is the party in whose favor a judgment (or the arbitration equivalent), decree, final order or any kind of dismissal in rendered based on the most substantial claim or claims asserted in the proceeding. The Company shall pay directly to the Executive’s legal counsel Executive’s reasonable legal fees and costs incurred in connection with the negotiation of the terms of this Agreement and its related agreements referenced herein. Payments will be made within 30 days of the Company’s receipt of applicable invoices and such invoices must be submitted to the Company within 45 days of the execution of this Agreement.

* * * *

[Remainder of this page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first written above.

KORE WIRELESS GROUP INC.

By: /s/ Jack W. Kennedy Jr.

Name: Jack W. Kennedy Jr.

Title: Executive Vice President, Chief Legal Officer & Secretary

KORE GROUP HOLDINGS, INC.

By: /s/ Jack W. Kennedy Jr.

Name: Jack W. Kennedy Jr.

Title: Executive Vice President, Chief Legal Officer & Secretary

THE EXECUTIVE

/s/ Ronald Totton

Ronald Totton

Employment Agreement Signature Page

EXHIBIT A

GENERAL RELEASE

I, Ronald Totton, in consideration of and subject to the performance by KORE Group Holdings, Inc. (together with its subsidiaries, the “Company”), of its obligations under the Employment Agreement dated as of August 14, 2024 (the “Agreement”), do hereby release and forever discharge as of the date hereof the Company and its Affiliates and all present, former and future managers, directors, officers, employees, successors and assigns of the Company and its affiliates and direct or indirect owners (collectively, the “Released Parties”) to the extent provided below (this “General Release”). The Released Parties (other than the Company) are intended to be third-party beneficiaries of this General Release, and this General Release may be enforced by each of them in accordance with the terms hereof in respect of the rights granted to such Released Parties hereunder. Terms used herein but not otherwise defined shall have the meaning given to them in the Agreement.

1) I understand that any payments or benefits paid or granted to me under Section 5(b) or 5(c) of the Agreement (other than the Accrued Rights) represent, in part, consideration for signing this General Release and are not salary, wages or benefits to which I was already entitled. I understand and agree that I will not receive certain of the payments and benefits specified in Section 5 of the Agreement unless I execute this General Release and do not revoke this General Release within the time period permitted hereafter. Such payments and benefits will not be considered compensation for purposes of any employee benefit plan, program, policy or arrangement maintained or hereafter established by the Company or its affiliates.

2) Except as provided in paragraphs 5 and 6 below, I knowingly and voluntarily (for myself and my heirs, executors, administrators and assigns) release and forever discharge the Company and the other Released Parties from any and all claims, suits, controversies, actions, causes of action, cross-claims, counter-claims, demands, debts, compensatory damages, liquidated damages, punitive or exemplary damages, other damages, claims for costs and attorneys’ fees or liabilities of any nature whatsoever, in law and in equity, both past and present (through the date on which I execute this General Release) and whether known or unknown, suspected or claimed against the Company or any of the Released Parties, which I, my spouse or any of my heirs, executors, administrators or assigns may have, by reason of any matter, cause or thing whatsoever, from the beginning of my initial dealings with the Company to the date on which I execute this General Release, and particularly, but without limitation of the foregoing general terms, any claims arising from or relating in any way to my employment relationship with the Company, the terms and conditions of that employment relationship and the termination of that employment relationship (including, but not limited to, any allegation, claim or violation arising under: Title VII of the Civil Rights Act of 1964, as amended; the Civil Rights Act of 1991; the Age Discrimination in Employment Act of 1967, as amended (including the Older Workers Benefit Protection Act); the Equal Pay Act of 1963, as amended; the Americans with Disabilities Act of 1990; the Family and Medical Leave Act of 1993; the Worker Adjustment Retraining and Notification Act; the Employee Retirement Income Security Act of 1974; any applicable Executive Order Programs; the Fair Labor Standards Act; or their state or local counterparts; or under any other federal, state or local civil or human rights law, or under any