Lincoln Financial Expands Life Insurance Portfolio With Launch of Two New Variable Universal Life Products

21 January 2025 - 11:45PM

Business Wire

Lincoln AssetEdge® VUL (2025) and Lincoln

AssetEdge® SVUL offer a wide range of investment options, death

benefit protection and optional features for increased growth

potential

Lincoln Financial (NYSE: LNC) launched two new Variable

Universal Life (VUL) products in the next generation of Lincoln

AssetEdge – an enhanced version of Lincoln AssetEdge VUL (2025) and

the all-new Lincoln AssetEdge SVUL – to meet the diverse financial

goals and protection needs of individuals, couples and

businesses.

“Our new AssetEdge solutions offer clients looking for growth

potential an opportunity to build a portfolio with optionality and

the flexibility to meet multiple planning goals in a tax-advantaged

way,” said Jared Nepa, senior vice president and head of Insurance

Solutions Distribution for Lincoln. “With performance-based

products representing 70% of VUL products sold in 20231, these new

offerings round out our suite of VUL products and demonstrate

Lincoln’s commitment to offering flexible life insurance solutions

that deliver both protection and the freedom to pursue long-term,

market-driven wealth accumulation potential.”

Lincoln AssetEdge VUL (2025) Building on the foundation

of Lincoln’s current individual-life product, the enhancements

incorporated in the new Lincoln AssetEdge VUL (2025) offer

additional consumer value by:

- Including a new Enhanced Overloan Protection Endorsement with

no upfront fee to protect highly funded, heavily loaned policies

against lapse if certain conditions are met. The rider

automatically invokes if Death Benefit Option 1 is in effect and

includes earlier exercise ability (age 65 vs 75).

- Removing the indexed account allocation threshold, resulting in

access to the indexed accounts without limitations in the earlier

policy years, offering consumers more options for investing their

assets.

- Including two hedged equity investment options and lower2 fund

fee model portfolios3 to offer consumers additional

optionality.

- Providing for a lower no-lapse premium if the Lincoln Enhanced

Allocation Rider4 is attached to the policy and active.

Lincoln AssetEdge SVUL Designed to mirror the Lincoln

AssetEdge individual-life product, Lincoln AssetEdge SVUL is a

survivorship VUL policy that insures two lives, paying a benefit

after the second insured’s death. The product was designed to help

couples and businesses looking for death benefit protection and tax

advantages by:

- Optimizing death benefit protection via competitive short-pay

pricing, with premiums paid over a set period of time, and a

competitive no lapse guarantee.

- Maximizing growth potential through market participation in the

same fund line up as Lincoln AssetEdge VUL, including index options

and model portfolios for built-in simplicity.5

- Offering additional options for growth and liquidity through

riders including the Enhanced Allocation Rider, the new Enhanced

Overloan Protection Endorsement and two living benefit

options.6

“Lincoln is committed to delivering a range of solutions that

empower financial professionals to meet their clients’ unique

needs,” said Darrel Tedrow, senior vice president, president of

Life Solutions at Lincoln. “Our SVUL solution enhances financial

professionals’ ability to support clients who want to insure two

lives, offering financial flexibility and addressing critical

planning needs such as estate tax funding, wealth transfer and

building a lasting financial legacy.”

1 LIMRA Q4 2023 U.S. Individual Life Insurance Sales Report

excluding COLI/BOLI (March 2024). 2 The model portfolios will have

lower fees relative to funds within each target-risk allocation

category 3 These features were recently added to the currently sold

version as of May 2024 as well as being available on Lincoln

AssetEdge VUL 2025. 4 Can be added at issue for no additional

premium. 5 Policy values will fluctuate and are subject to market

risk and possible loss of principal. 6 Additional fees apply to

riders.

About Lincoln Financial

Lincoln Financial helps people confidently plan for their vision

of a successful financial future. As of December 31, 2023,

approximately 17 million customers trust our guidance and solutions

across four core businesses – annuities, life insurance, group

protection, and retirement plan services. As of September 30, 2024,

the company has $324 billion in end-of-period account balances, net

of reinsurance. Headquartered in Radnor, Pa., Lincoln Financial is

the marketing name for Lincoln National Corporation (NYSE: LNC) and

its affiliates. Learn more at LincolnFinancial.com.

Note: Jared Nepa and Darrel Tedrow are spokespersons for Lincoln

Life Solutions. Jared Nepa holds a leadership role within Lincoln

Financial Distribution, the wholesaling broker-dealer of Lincoln

Financial. Darrel Tedrow holds a leadership role within Lincoln

Financial. They are compensated by Lincoln and are shareholders of

Lincoln National Corporation.

Important Information

Lincoln AssetEdge® VUL (2025) is issued on policy form

24-VUL616/ICC24-VUL616 and state variations with the Enhanced

Overloan Protection Endorsement (24END-7120/ICC24END-7120) and

Lincoln Enhanced Allocation Rider (22LEAR-7100/ICC22LEAR-7100) and

Lincoln AssetEdge® SVUL is issued on policy form

24-SVUL618/ICC24-SVUL618 and state variations with the Enhanced

Overloan Protection Endorsement (24END-7120JS/ICC24END-7120JS) and

Lincoln Enhanced Allocation Rider (22LEAR-7100/ICC22LEAR-7100) by

The Lincoln National Life Insurance Company, Fort Wayne, IN, and

distributed by Lincoln Financial Distributors, Inc., a

broker-dealer. The Lincoln National Life Insurance Company does

not solicit business in the state of New York, nor is it authorized

to do so. Not available in NY.

All guarantees and benefits of the insurance policy are

subject to the claims-paying ability of the issuing insurance

company. They are not backed by the broker-dealer and/or

insurance agency selling the policy, or any affiliates of those

entities other than the issuing company affiliates, and none makes

any representations or guarantees regarding the claims-paying

ability of the issuer.

Variable products are sold by prospectus. Consider the

investment objectives, risks, charges, and expenses of the variable

product and its underlying investment options carefully before

investing. The prospectus contains this and other information about

the variable product and its underlying investment options. A

prospectus is available on LincolnFinancial.com or you may request

one from your registered representative. Read it carefully before

investing.

Products and features subject to state availability. Limitations

and exclusions may apply.

NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL

GOVERNMENT AGENCY. NOT GUARANTEED BY ANY BANK OR SAVINGS

ASSOCIATION. MAY GO DOWN IN VALUE.

LCN-7500943-010625

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121041943/en/

Media: Joe Gardner Joseph.Gardner@lfg.com

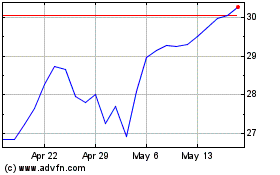

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Dec 2024 to Jan 2025

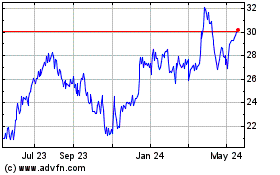

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Jan 2024 to Jan 2025