0000061986false00000619862024-09-052024-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 05, 2024 |

The Manitowoc Company, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Wisconsin |

1-11978 |

39-0448110 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

11270 West Park Place Suite 1000 |

|

Milwaukee, Wisconsin |

|

53224 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 414 760-4600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.01 Par Value |

|

MTW |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On September 5, 2024, The Manitowoc Company, Inc. (the “Company”) issued a press release announcing that it has priced its previously announced offering of $300 million aggregate principal amount of senior secured second lien notes due 2031 (the “Notes”). The offering is expected to close on September 19, 2024, subject to market and other conditions, including the Company amending its existing ABL credit agreement to among other things increase the commitments by $50 million to $325 million. As of June 30, 2024, we would have had approximately $203.2 million of borrowings available under the ABL credit agreement, as amended, after taking into account the letters of credit and borrowing base availability. A copy of the press release is attached as Exhibit 99 hereto and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K shall not constitute an offer to sell, or a solicitation of an offer to buy, the Notes or any other securities and shall not constitute an offer to sell, or a solicitation of an offer to buy, or a sale of, the Notes or any other securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

THE MANITOWOC COMPANY, INC.

(Registrant) |

|

|

|

|

Date: |

September 5, 2024 |

By: |

/s/ Brian P. Regan |

|

|

|

Brian P. Regan

Executive Vice President and Chief Financial Officer |

Exhibit 99

The Manitowoc Company, Inc. Announces

Pricing of $300 Million of Senior Secured Second Lien Notes due 2031

Milwaukee, Wis.–September 5, 2024–The Manitowoc Company, Inc. (NYSE: MTW) (“Manitowoc”) announced today that it has priced its previously announced private offering (the “Offering”) of $300 million aggregate principal amount of senior secured second lien notes due 2031 (the “Notes”). The Notes will have an interest rate of 9.250% per annum and are being issued at a price equal to 100.000% of their face value. The Notes will be guaranteed on a senior secured second lien basis, jointly and severally, by each of Manitowoc’s domestic subsidiaries that will continue to guarantee Manitowoc’s asset-based revolving credit facility that will among other things increase the commitments by $50 million to $325 million (as amended, the “Amended ABL Credit Facility”). The Offering is expected to close on September 19, 2024, subject to market and other conditions, including Manitowoc entering into the Amended ABL Credit Facility. There can be no assurance that the Offering or the Amended ABL Credit Facility will be completed on a timely basis, or at all.

Manitowoc expects its net proceeds from the Offering, after deducting discounts and commissions and estimated offering expenses payable by Manitowoc, to be approximately $295.5 million. Manitowoc intends to use the net proceeds from the Offering, together with other cash on hand as necessary, to (i) redeem all of its outstanding 9.00% Senior Secured Second Lien Notes due 2026 (the “Existing Notes”); and (ii) pay related fees and expenses.

The Notes will be sold to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A and outside the United States to certain non-U.S. persons in reliance on Regulation S. The Notes and related guarantees have not been, and will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”), any state securities laws or the securities laws of any other jurisdiction and, unless so registered, may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws.

This press release shall not constitute an offer to sell, or a solicitation of an offer to buy, the Notes or any other securities and shall not constitute an offer to sell, or a solicitation of an offer to buy, or a sale of, the Notes or any other securities in any jurisdiction in which such offer, solicitation or sale is unlawful. This press release is not an offer to purchase or a solicitation of an offer to sell the Existing Notes and does not constitute a redemption notice for the Existing Notes.

Forward-Looking Statements

This press release includes “forward-looking statements” intended to qualify for the safe harbor from liability under the Private Securities Litigation Reform Act of 1995. Any statements contained in this press release that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which include, but are not limited to, statements regarding the Offering and the timing of the closing of the Offering and the anticipated use of proceeds therefrom, are based on the current expectations of the management of Manitowoc and are subject to uncertainty and changes in circumstances. Forward-looking statements include, without limitation, statements typically containing words such as “intends,” “expects,” “anticipates,” “targets,” “estimates,” and words of similar import. By their nature, forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results and developments to differ materially include, among others:

•Macroeconomic conditions, including inflation, high interest rates and recessionary concerns, as well as continuing global supply chain constraints, labor constraints, logistics constraints and cost pressures such as changes in raw material and commodity costs, have had, and may continue to have, a negative impact on Manitowoc’s ability to convert backlog into revenue which could, and has, impacted its financial condition, cash flows, and results of operations (including future uncertain impacts);

•changes in economic or industry conditions generally or in the markets served by Manitowoc;

•geopolitical events, including the ongoing conflicts in Ukraine and in the Middle East, other political and economic conditions and risks and other geographic factors, has had and may continue to lead to market disruptions, including volatility in commodity prices (including oil and gas), raw material and component costs, energy prices, inflation, consumer behavior, supply chain, and credit and capital markets, and could result in the impairment of assets;

•changes in customer demand, including changes in global demand for high-capacity lifting equipment, changes in demand for lifting equipment in emerging economies and changes in demand for used lifting equipment including changes in government approval and funding of projects;

•the ability to convert backlog, orders and order activity into sales and the timing of those sales;

•failure to comply with regulatory requirements related to the products and aftermarket services Manitowoc sells;

•the ability to capitalize on key strategic opportunities and the ability to implement Manitowoc’s long-term initiatives;

•impairment of goodwill and/or intangible assets;

•changes in revenues, margins and costs;

•the ability to increase operational efficiencies across Manitowoc and to capitalize on those efficiencies;

•the ability to generate cash and manage working capital consistent with Manitowoc’s stated goals;

•work stoppages, labor negotiations, labor rates and labor costs;

•Manitowoc’s ability to attract and retain qualified personnel;

•changes in the capital and financial markets;

•the ability to complete and appropriately integrate acquisitions, strategic alliances, joint ventures or other significant transactions;

•issues associated with the availability and viability of suppliers;

•the ability to significantly improve profitability;

•realization of anticipated earnings enhancements, cost savings, strategic options and other synergies, and the anticipated timing to realize those savings, synergies and options;

•the ability to focus on customers, new technologies and innovation;

•uncertainties associated with new product introductions, the successful development and market acceptance of new and innovative products that drive growth;

•the replacement cycle of technologically obsolete products;

•risks associated with high debt leverage;

•foreign currency fluctuation and its impact on reported results;

•the ability of Manitowoc's customers to receive financing;

•risks associated with data security and technological systems and protections;

•the ability to direct resources to those areas that will deliver the highest returns;

•risks associated with manufacturing or design defects;

•natural disasters, other weather events, pandemics and other public health crises disrupting commerce in one or more regions of the world;

•issues relating to the ability to timely and effectively execute on manufacturing strategies, general efficiencies and capacity utilization of Manitowoc’s facilities;

•the ability to focus and capitalize on product and service quality and reliability;

•issues associated with the quality of materials, components and products sourced from third parties and the ability to successfully resolve those issues;

•issues related to workforce reductions and potential subsequent rehiring;

•changes in laws throughout the world, including governmental regulations on climate change;

•the inability to defend against potential infringement claims on intellectual property rights;

•the ability to sell products and services through distributors and other third parties;

•issues affecting the effective tax rate for the year;

•other risks and factors detailed in Manitowoc's 2023 Annual Report on Form 10-K and its other filings with the United States Securities and Exchange Commission (the “SEC”).

Manitowoc undertakes no obligation to update or revise forward-looking statements, whether as a result of new information, future events or otherwise. Forward-looking statements only speak as of the date on which they are made. Information on the potential factors that could affect Manitowoc’s actual results of operations is included in its filings with the SEC, including but not limited to its Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

For more information:

Ion Warner

SVP, Marketing and Investor Relations

+1 414-760-4805

v3.24.2.u1

Document And Entity Information

|

Sep. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 05, 2024

|

| Entity Registrant Name |

The Manitowoc Company, Inc.

|

| Entity Central Index Key |

0000061986

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

1-11978

|

| Entity Incorporation, State or Country Code |

WI

|

| Entity Tax Identification Number |

39-0448110

|

| Entity Address, Address Line One |

11270 West Park Place

|

| Entity Address, Address Line Two |

Suite 1000

|

| Entity Address, City or Town |

Milwaukee

|

| Entity Address, State or Province |

WI

|

| Entity Address, Postal Zip Code |

53224

|

| City Area Code |

414

|

| Local Phone Number |

760-4600

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.01 Par Value

|

| Trading Symbol |

MTW

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

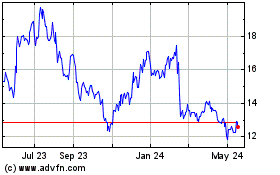

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Nov 2024 to Dec 2024

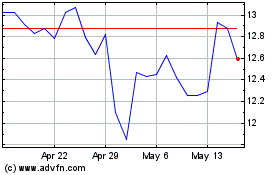

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Dec 2023 to Dec 2024