0001127703false00011277032024-05-282024-05-28

| | | | | |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

FORM | 8-K |

CURRENT REPORT |

| |

| Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934 |

|

Date of Report (Date of earliest event reported): May 28, 2024 |

|

| ProAssurance Corporation |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-16533 | 63-1261433 |

(State of Incorporation) | (Commission File No.) | (IRS Employer I.D. No.) |

| | | | | | | | | | | |

| 100 Brookwood Place, | Birmingham, | AL | 35209 |

| (Address of Principal Executive Office ) | (Zip code) |

| | | | | | | | |

Registrant’s telephone number, including area code: | (205) | 877-4400 |

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-(c) under the Exchange Act

(17CFR 240.13e-(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | PRA | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

ITEM 7.01 REGULATION FD DISCLOSURES

In this Current Report on Form 8-K, we are furnishing the news release issued on May 23, 2024, regarding new directors elected at the Annual Meeting of Shareholders on May 22 and summarizing other voting results. We are also furnishing presentation materials to be used starting May 28, 2024.

We have included the release and presentation materials in this Current Report on Form 8-K as Exhibits 99.1 and 99.2.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

We are furnishing Exhibit 99.1 and 99.2 to this Current Report on Form 8-K in accordance with Item 7.01, Regulation FD Disclosure. This exhibit shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 28, 2024

| | |

| PROASSURANCE CORPORATION |

| by: /s/ Jeffrey P. Lisenby |

| ----------------------------------------------------- |

Jeffrey P. Lisenby

General Counsel |

| | | | | |

NEWS RELEASE For More Information: Heather J. Wietzel SVP, Investor Relations 800-282-6242 • 205-776-3028 • InvestorRelations@ProAssurance.com | |

ProAssurance Announces Election of Richard J. Bielen, C.P.A., and Staci M. Pierce, J.D., to Board

BIRMINGHAM, Ala. - (May 23, 2024) - ProAssurance Corporation (NYSE:PRA) today announced that at its Annual Meeting of Shareholders held on May 22, shareholders elected new directors Richard J. Bielen, C.P.A., and Staci M. Pierce, J.D., and re-elected directors Bruce D. Angiolillo, J.D. (chairman), and Samuel A. Di Piazza, Jr., C.P.A., to serve three year terms expiring at the company's 2027 annual meeting. The company's board of directors now consists of 10 members, down from the previous 12.

In addition, shareholders approved the ProAssurance Corporation 2024 Equity Incentive Plan and ratified the selection of Ernst & Young, LLP as the independent auditing firm for the fiscal year ending December 31, 2024. Acting on matters related to compensation, shareholders approved, on an advisory basis, the compensation of our named executive officers. All proposals on the ballot were approved by a substantial supermajority of votes cast.

Bielen is the President and Chief Executive Officer of Protective Life Corporation. He brings more than 35 years of experience in various executive roles in the financial services industry.

Pierce is the Chief Executive Officer at Action Resources, a transportation and environmental services company headquartered in Birmingham, Alabama. She brings more than eight years of experience in executive and leadership roles in the transportation and environmental services industries, in addition to five years of experience as a practicing attorney.

"ProAssurance looks to its board of directors for a diversity of viewpoints, backgrounds, and experience, among other skills" said Ned Rand, President and Chief Executive Officer. "With the addition of Rich and Staci, our board is even better positioned as a resource as we work to achieve our objectives in our core lines of insurance - medical professional liability and workers’ compensation.”

About ProAssurance

ProAssurance Corporation is an industry-leading specialty insurer with extensive expertise in medical professional liability, products liability for medical technology and life sciences, legal professional liability, and workers’ compensation insurance.

ProAssurance Group is rated “A” (Excellent) by AM Best. ProAssurance and its operating subsidiaries (excluding NORCAL Group) are rated “A-” (Strong) by Fitch Ratings. For the latest on ProAssurance and its industry-leading suite of products and services, cutting-edge risk management and practice enhancement programs, follow @ProAssurance on X (formerly Twitter) or LinkedIn. ProAssurance’s YouTube channel regularly presents thought-provoking, insightful videos that communicate effective practice management, patient safety and risk management strategies.

Caution Regarding Forward-Looking Statements

Any statements in this news release that are not historical facts or explicitly stated as an opinion are specifically identified as forward-looking statements. These statements are based upon our estimates and anticipation of future events and are subject to significant risks, assumptions and uncertainties that could cause actual results to differ materially from the expected results described in the forward-looking statements. Forward-looking statements are identified by words such as, but not limited to, “anticipate,” “believe,” “estimate,” “expect,” “hope,” “hopeful,” “intend,” “likely,” “may,” “optimistic,” “possible,” “potential,” “preliminary,” “project,” “should,” “will,” and other analogous expressions.

Although it is not possible to identify all of these risks and factors, they include, among others, the following: inadequate loss reserves to cover the Company's actual losses; inherent uncertainty of models resulting in actual losses that are materially different than the Company's estimates; adverse economic factors; a decline in the Company's financial strength rating; loss of one or more key executives; loss of a group of agents or brokers that generate significant portions of the Company's business; failure of any of the loss limitations or exclusions the Company employs, or change in other claims or coverage issues; adverse performance of the Company's investment portfolio; adverse market conditions that affect its excess and surplus lines insurance operations; and other risks described in the Company's filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this release and the Company does not undertake and specifically declines any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

#####

Investor Update First quarter 2024 Accurate as of May 28, 2024

ProAssurance Overview

ProAssurance Investor Briefing | May 2024 3 Mission, Vision, & Values The ProAssurance Mission We Protect Others. Corporate Values Integrity | Leadership | Relationships | Enthusiasm Our Brand Promise We will honor these values in the execution of treated fairly to perform our mission and realize our vision.

ProAssurance Investor Briefing | May 2024 4 At a Glance All employee and financial data as of 03/31/24 Business Unit Principal Offices Employees Lines of Business Medical Professional Liability 9 704 Healthcare professional liability Medmarc 1 34 Medical technology liability Eastern 7 254 Workers’ Compensation & captive facilities (all lines) PRA Corporate 1 102 Corporate functions Healthcare-centric specialty insurance writer Specialty Property & Casualty Medical Professional Liability (MPL) Life Sciences and Medical Technology Liability Lloyd’s of London Syndicates Workers' Compensation Insurance Segregated Portfolio Cell (SPC) Reinsurance Total Assets: $5.7 billion Shareholders' Equity: $1.1 billion Claims-Paying Ratings A.M. Best: “A” (Excellent) Fitch: “A-” (Strong) 19 locations, with operations in three countries 1,094 employees as of March 31, 2024 Writing in 50 states & DC Cayman Islands Corporate Headquarters Claims Offices Claims/Underwriting Offices Underwriting Offices Lloyds

ProAssurance Investor Briefing | May 2024 5 ProAssurance Executive Leadership Executive Team bios available on our website at Investor.ProAssurance.com/OD Ned Rand - President & Chief Executive Officer Mr. Rand became President and CEO in 2019, after serving as COO, CFO, Executive VP, and Senior VP of Finance at ProAssurance since joining the company in 2004. Prior to joining ProAssurance, he served in a number of financial roles for insurance companies. Mr. Rand is a CPA and graduate of Davidson College (B.A., Economics) Kevin Shook President, Workers’ Compensation & Segregated Portfolio Cell Reinsurance Noreen Dishart Executive Vice President & Chief Human Resources Officer Dana Hendricks Executive Vice President & Chief Financial Officer Jeff Lisenby Executive Vice President & General Counsel Karen Murphy President Life Sciences Rob Francis President Healthcare Professional Liability

ProAssurance Investor Briefing | May 2024 6 ProAssurance Board of Directors Committee assignments effective June 1, 2024 Director bios available on our website at Investor.ProAssurance.com/OD Maye Head Frei C Edward L. Rand, Jr E Katisha T. Vance, MD N/C A - Audit Committee C - Compensation Committee E - Executive Committee N/C - Nominating/Corporate Governance Committee Underlined - Chair Scott C. Syphax N/C Samuel A. Di Piazza, Jr C, E Kedrick D. Adkins, Jr A Bruce D. Angiolillo , J.D. Independent Chair E Fabiola Cobarrubias, MD A, N/C Richard J. Bielen A Staci M. Pierce, J.D. C

ProAssurance Investor Briefing | May 2024 7 ProAssurance Brand Profile Specialty P&C Medical Professional Liability Workers’ Comp Alternative Risk Transfer Medical Technology & Life Sciences Products Liability Legal Professional Liability

ProAssurance Investor Briefing | May 2024 8 Significant Positives in First Quarter 2024 Results Operating earnings in the first quarter of $0.08 per share, benefiting from a six-point improvement in the calendar year loss ratio and a 12% increase in investment income We remain focused on driving underwriting improvement, which can be seen in the three-point improvement in our current accident year loss ratio and two-point improvement in the consolidated combined ratio over last year’s first quarter Markets in which ProAssurance operates continue to be challenging and we remain cautious about both the risks we underwrite AND loss cost trends, with gross premiums written down just slightly to $311 million We are focused on achieving pricing levels that help move us toward our long-term profitability goals and believe we are continuing to obtain rate beyond loss cost trends We continue to forego new business - and non-renew existing business - that does not meet our underwriting criteria Specialty P&C segment current accident year net loss ratio improved almost five points compared to last year's first quarter Gross premiums written declined $3.6 million quarter over quarter driven by our non-renewal of a large account We retained 86% of policies eligible for renewal, maintaining our disciplined underwriting and pricing criteria to achieve an average rate increase of 7% in addition to $10.4 million of new business priced at rates that move us toward our long-term profitability goals Workers’ Comp segment first-quarter accident year loss ratio was below full-year 2023, although higher than last year's first quarter due to the medical cost trends Caution about the current claims environment and our focus on operational discipline is beginning to be reflected in results, with no change in prior accident year reserve estimates in the first quarter of 2024 for this segment All prior period segment information has been recast to conform with our current segment reporting structure Comparisons to first quarter 2023 unless otherwise noted

ProAssurance Investor Briefing | May 2024 9 ProAssurance Specialty Property & Casualty • Medical Professional Liability (MPL) insures healthcare providers and facilities, including E&S coverages • The Small Business Unit insures podiatrists, chiropractors, dentists, and lawyers • Medmarc insures medical technology and life sciences companies that manufacture or distribute products and those conducting clinical trials • Includes the underwriting results from our participation in Lloyd's of London Syndicate 1729 and 6131 Eastern Alliance Workers’ Compensation • Specialty underwriter of workers’ compensation products and services • Focused in the East, South, and Midwest regions of the United States • Guaranteed cost, policyholder dividend, retro-rated, deductible, and alternative solutions policies available Inova Re/Eastern Re SPC Reinsurance • Segregated Portfolio Company structure • Workers’ compensation and healthcare professional liability coverage in a Cayman-based captive • Industries include healthcare, forestry, staffing, construction, petroleum, marine and recreation, and social services ProAssurance Corporate • Reports our investment results, interest expense, and U.S. income taxes • Includes corporate expenses and includes non-premium revenues generated outside of our insurance entities • Company-wide administrative departments reside in ProAssurance Corporate • Includes Investment results and assets solely allocated to our Lloyd’s Syndicate operations, net of U.K. income tax expense ProAssurance Reports Financial Results in Four Segments

ProAssurance Investor Briefing | May 2024 10 ProAssurance Specialty Property & Casualty Premiums Specialty Healthcare Life Sciences Podiatry, Chiropractic, Dental Standard Physicians Medical Professional Liability Insurance $45M$91M$415M $221M Gross Premiums Written for the 12 months ended 03/31/24 $832M Specialty Property & Casualty Deep expertise and broad product spectrum in healthcare and related sciences Consolidation in MPL → demand for comprehensive insurance solutions Life Sciences → offer liability solutions to companies that develop, test, and deliver healthcare products in the U.S. and worldwide Tail & Other Coverages $40M 3/31/2024 Subject to rounding Lloyd’s Syndicates $20M

ProAssurance Investor Briefing | May 2024 11 Disciplined individual account underwriting with focus on rate adequacy in rural territories Guaranteed Cost Policies Loss-Sensitive Dividend Plans Deductible Plans Retrospective Rating Plans ParallelPay–“Pay as you Go” Specialty Risk (high hazard) Claims Administration and Risk Management Workers’ Compensation Insurance Wide diversification – over 600 class codes and 32 market segments, primarily in rural territories Opportunity for organic growth outside of Pennsylvania and Indiana Proactive claim-closing strategies key to being recognized as a short-tail writer of workers’ compensation Between 2013 and 2022, averaged approximately 40% faster claims closure rate than industry 36 claims open from 2016 and prior, net of reinsurance Pharmacy spend as a percent of medical payments of 3.4% compared to the industry average of 7% Value-added risk management services and claims/underwriting expertise cement brand loyalty Banks Fast Food Restaurants Restaurants Outside Sales Automobile Dealers Retirement & Life Care Community Hospitals Physicians & Dentists Clerical & Office Colleges & Schools 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% *Excludes alternative markets business ceded to the Segregated Portfolio Cell Reinsurance segment Dedicated to effective claims management and returning injured workers to wellness Healthcare Related Non-Healthcare Top 10 Classes of Business by Payroll Exposure (Traditional Business*) as of 12/31/2023

ProAssurance Investor Briefing | May 2024 12 Segregated Portfolio Cell Reinsurance ProAssurance Fronting Arrangement Agency Group or Association establishes a cell Underwriting Claims Administration Risk Management Reinsurance Audit Asset Management Services + Cell Rental Fees + Participation in profits/losses of selected cells Fee Income to PRA MPL and workers’ compensation captive insurance solutions through Inova Re (Cayman Islands) SPCs are a high ROE product with favorable retention results Low capital requirement Strategic partnerships with select independent agencies looking to manage controllable expenses Alternative market solutions are in high demand Value-added risk management services and claims/underwriting expertise Inova Re Services 2023 gross premiums written: $70M Workers’ Compensation Insurance: $64M Medical Professional Liability: $6M 23 active cells Individually capitalized cells (companies) exist within the Inova Re structure. Assets of each are segregated from others. ProAssurance/Eastern participates in select cells

ProAssurance Investor Briefing | May 2024 13 $430M total debt principal at 3/31/2024 $180M of Contribution Certificates from NORCAL acquisition $125M Revolving Credit Agreement $125M Term Loan On November 15, 2023, ProAssurance refinanced its $250M Senior Notes with a $125M draw on its revolver and a $125M term loan with a total interest rate of 5.42% and 5.56%, respectively, as of December 31, 2023. The interest rates include a base rate of 3.2% which is effectively fixed by utilizing two interest rate swaps, plus a variable margin of 2.1% and 2.3%, respectively, that’s based on ProAssurance’s debt to cap ratio as of 12/31/23. The term loan is repayable in equal quarterly installments and any unpaid amounts under both facilities are due April 2028. ProAssurance Leverage Update Targeted Premium to Equity ratio is 0.75:1 Financial Leverage – Debt to Capital Operating Leverage – Premiums to Equity 16% 16% 24% 24% 25% 25% $- $0.5 $1.0 $1.5 $2.0 2019 2020 2021 2022 2023 03/31/24 $ in billions Debt Capital Debt to Capital 0.56 0.55 0.62 0.92 0.89 0.97 0.57 0.59 0.63 0.72 0.75 0.82 $- $0.4 $0.8 $1.2 $1.6 2019 2020 2021 2022 2023 03/31/24 $ in billions Net Premiums Written Equity Premiums to Equity Premiums to Equity (excluding AOCI)

ProAssurance Investor Briefing | May 2024 14 ProAssurance is recognized for our financial strength by top rating agencies We maintain a balance sheet that ensures stability and security for our customers Our conservative reserving philosophy enables success over the insurance cycles Financial Ratings & Balance Sheet Highlights Balance Sheet Highlights 3/31/2024 Total Assets $5,650,036 Total Investments $4,333,542 Net Loss Reserves $3,382,512 Total Debt (less Issuance Costs) $427,774 Shareholders’ Equity $1,113,065 Book Value per Share $21.82 Rating Agency Financial Strength Rating Date AM Best A 6/6/2023 Fitch A-1 10/20/2022 $ in thousands, except per share data All Public Debt Retired on November 15, 20232 1 Excludes NORCAL Group, which has not yet been rated by Fitch 2 On November 15, 2023, ProAssurance refinanced its $250M Senior Notes with a $125M draw on its revolver and a $125M term loan with a total interest rate of 5.42% and 5.56%, respectively, as of December 31, 2023. The interest rates include a base rate of 3.2% which is effectively fixed by utilizing two interest rate swaps, plus a variable margin of 2.1% and 2.3%, respectively, that’s based on ProAssurance’s debt to cap ratio as of 12/31/23. The term loan is repayable in equal quarterly instalments and any unpaid amounts under both facilities are due April 2028. All financial rating information is available on our website: https://investor.proassurance.com/financial-information/financial-ratings/default.aspx

Operational Discipline Designed for Ultimate Success in Competitive Markets

ProAssurance Investor Briefing | May 2024 16 A Foundation in Excellence “From our earliest days, we have operated with a strategy both responsive to near-term challenges and proactive to long-term opportunity.” -Ned Rand President & CEO Superior brand identity and reputation in the market Specialization • Deep expertise and commitment to our customers throughout the insurance cycles enable us to outperform our peers over time Experienced & Collaborative Leadership • Average executive leadership tenure of 20 years with PRA or subsidiaries History of Successful M&A • Selective M&A with best-in-class partners, and nearly 20 transactions in our 47 year history Scope & Scale • Regional hubs combined with local knowledge of market dynamics and regulatory environments

ProAssurance Investor Briefing | May 2024 17 C u rr en t St ra te gi c In it ia ti ve s SP&C Innovation and Operational Excellence Launch a state-of-the-art workflow solution across the segment Develop and launch a next generation online portal for customers and agents to provide superior service for our agency partners and insureds Begin filing a new standard policy form and underwriting manual to facilitate service and automation SP&C Product and Program Innovation Working Group Build out data science and predictive analytics strategy Continue implementation of predictive underwriting model for select specialties Develop and launch of straight through processing technologies for homogeneous account types Evaluate and consult on new product and program ideas and initiatives across Specialty P&C Strategic Initiatives Drive our Competitiveness

ProAssurance Investor Briefing | May 2024 18 C u rr en t St ra te gi c In it ia ti ve s Workers’ Compensation Insurance Strategic Focus Implementing new integrated policy, claims, risk management, and billing system. Capitalize on InsurTech investments, including underwriting and claims data analytics to guide and support operational decisions, to enhance profitability, productivity and efficiency. Continue to evaluate and further strengthen medical care and cost management strategies to minimize the impact of medical inflation. Corporate Segment Increase investment income through investment leverage and reinvesting of portfolio maturities Execute a defined statutory consolidation strategy Manage talent-acquisition and retention strategies to build and maintain high-quality talent Strategic Initiatives Drive our Competitiveness

ProAssurance Investor Briefing | May 2024 19 Returning to Sustained Profitability is Our Highest Priority Operationally Reflecting challenging market realities in our drive for rate and through our rigorous underwriting New and renewal business is being written at rates we believe will ultimately perform better than the business we are non-renewing We are not afraid to walk away from under priced business We will not grow for growth’s sake—better to shrink to profitability Corporately We recognize the need for higher ROE Our strategies for returning to profitability will drive us to higher ROE and, in turn, should positively affect the price of our stock Capital management is constantly evaluated Suspended our cash dividend in May 2023 $27 million in cash dividend paid between January 1, 2021 and May 31, 2023 Share repurchases have totaled $50.5 million since May 2023 We continue to believe there is value embedded in our shares and will consider repurchasing shares opportunistically

Appendix

ProAssurance Investor Briefing | May 2024 21 Income Statement Highlights (3/31/24) In millions, except per share data | Subject to rounding Three Months Ended March 31 2024 2023 Gross Premiums Written $ 311.3 $ 315.8 Net Premiums Earned $ 244.2 $ 239.8 Net Investment Result $ 36.9 $ 29.2 Net Investment Gains (Losses) $ (0.3) $ 2.9 Total Revenues $ 284.7 $ 272.7 Net Losses and Loss Adjustment Expenses $ 194.7 $ 205.3 Underwriting, Policy Acquisition & Operating Expenses $ 78.0 $ 67.8 Net Income (Loss) (Includes Realized Investment Gains & Losses) $ 4.6 $ (6.2) Non-GAAP Operating Income (Loss) $ 4.2 $ (7.4) Non-GAAP Operating Income (Loss) per Diluted Share $ 0.08 $ (0.14)

ProAssurance Investor Briefing | May 2024 22 Specialty P&C Financial Highlights (3/31/24) In millions, except ratios | Subject to rounding Three Months Ended March 31 2024 2023 Gross Premiums Written $ 238.7 $ 242.4 Net Premiums Earned $ 188.9 $ 183.7 Total Revenues $ 190.2 $ 184.7 Net Losses & Loss Adjustment Expenses $ (153.0) $ (166.0) Underwriting, Policy Acquisition & Operating Expenses $ (51.0) $ (42.7) Segment Results $ (13.8) $ (24.0) Current Accident Year Net Loss Ratio 81.7 % 86.4 % Effect of Prior Accident Year Reserve Development (0.7%) 4.0% Net Loss Ratio 81.0 % 90.4 % Underwriting Expense Ratio 27.0 % 23.2 % Combined Ratio 108.0 % 113.6 %

ProAssurance Investor Briefing | May 2024 23 Workers’ Compensation Insurance Financial Highlights (3/31/24) In millions, except ratios | Subject to rounding Three Months Ended March 31 2024 2023 Gross Premiums Written $ 72.6 $ 73.4 Net Premiums Earned $ 41.1 $ 40.8 Total Revenues $ 41.6 $ 41.4 Net Losses & Loss Adjustment Expenses $ (31.6) $ (30.8) Underwriting, Policy Acquisition & Operating Expenses $ (14.5) $ (13.0) Segment Results $ (4.6) $ (2.4) Current Accident Year Net Loss Ratio 77.0 % 72.6 % Effect of Prior Accident Year Reserve Development —% 3.0% Net Loss Ratio 77.0 % 75.6 % Underwriting Expense Ratio 35.3 % 31.8 % Combined Ratio 112.3 % 107.4 %

ProAssurance Investor Briefing | May 2024 24 Segregated Portfolio Cell Reinsurance Financial Highlights (3/31/24) In thousands, except ratios | Subject to rounding Three Months Ended March 31 2024 2023 Gross Premiums Written $ 15,934 $ 22,881 Net Premiums Earned $ 14,168 $ 15,300 Net Investment Income 693 420 Net Gains (Losses) 1,471 1,160 Other Income (Loss) (1) 1 Net Losses & Loss Adjustment Expenses (10,064) (8,423) Underwriting, Policy Acquisition & Operating Expenses (4,713) (5,035) SPC U.S. Federal Income Tax Expense (416) (532) SPC Net Results 1,138 2,891 Segregated Portfolio Cell Dividend (Expense)/Income (607) (1,942) Segment Results $ 531 $ 949 Current Accident Year Net Loss Ratio 65.1 % 64.9 % Effect of Prior Accident Year Reserve Development 5.9% (9.8%) Net Loss Ratio 71.0 % 55.1 % Underwriting Expense Ratio 33.3 % 32.9 % Combined Ratio 104.3 % 88.0 %

ProAssurance Investor Briefing | May 2024 25 Corporate Financial Highlights (3/31/24) In millions | Subject to rounding Three Months Ended March 31 2024 2023 Net investment income $ 33.2 $ 29.9 Equity in earnings (loss) of unconsolidated subsidiaries $ 3.0 $ (1.1) Net investment gains (losses) $ (1.7) $ 0.8 Other income $ 3.1 $ 0.3 Operating expenses $ 8.7 $ 8.2 Interest expense $ 5.7 $ 5.5 Income tax expense / (benefit) $ 0.7 $ (2.2) Segment results $ 22.5 $ 18.4

ProAssurance Investor Briefing | May 2024 26 YTD 2024 Net Investment Result and Equity Rollforward Data shown in thousands 2024 Beginning Equity $1,111,980 Employee Stock Transactions (1,069) Earnings 4,626 OCI (2,472) Total Equity $1,113,065 ($ in millions) 3/31/2024 3/31/2023 Change Net Investment Income Fixed maturities $ 31,451 $ 27,327 $ 4,124 Equities 892 807 85 Short-term investments including Other 3,411 3,350 61 BOLI 452 657 (205) Investment fees and expenses (2,309) (1,831) 478 Net investment income 33,897 30,310 3,587 Equity in Earnings (Loss) of Unconsolidated Subsidiaries All other investments, primarily investment fund LPs/LLCs 3,066 (767) 3,833 Tax credit partnerships (103) (354) 251 Equity in earnings (loss) 2,963 (1,121) 4,084 Net investment result $ 36,860 $ 29,189 $ 7,671

ProAssurance Investor Briefing | May 2024 27 Investment Philosophy & Portfolio (3/31/24) Total Investments $4.33 Billion 03/31/2023 Subject to rounding Details of our investment portfolio are available on our website at https://investor.proassurance.com/financial-information/quarterly-investment-supplements/default.aspx 15% 12% 10% 7% 8%5% 8% 6% 5% 20% 4% AAA A A+ BBB+ Below Investment Grade or Not Rated BBB A- AA- AA AA+ BBB- Fixed Maturity Credit Quality Portfolio Statistics 1Q24 1Q23 Avg Income Yield 3.3% 2.9% Wtd Avg Duration 3.21 3.41 Commentary Effective stewardship of capital ensures a position of financial strength through turbulent market cycles Optimizing our allocations for better risk-adjusted returns. Ensures non-correlation of returns Ongoing analysis of holdings to ensure lasting quality and profitability ABS 25% BOLI 2% Bond Funds 3% Corporate 40% Fixed Maturies Trading 1% Other 1% Short Term 5% Private Equity 3% Private Credit 2% State/Muni 11% Real Estate 1% US Govt/Agency 6%

ProAssurance Investor Briefing | May 2024 28 Combined Tax Credits Portfolio Detail & Projections The total credits column represents our current estimated schedule of tax credits that we expect to receive from our tax credit partnerships. The actual amounts of credits provided by the tax credit partnerships may prove to be different than our estimates. These tax credits are included in our Tax Expense (Benefit) on our Income Statement (below the line) and result in a Tax Receivable (or a reduction to a Tax Liability) on our Balance Sheet.

ProAssurance Investor Briefing | May 2024 29 Forward Looking Statements Non-GAAP Measures This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in our remarks and discussions with investors. The primary Non-GAAP measure we reference is Non-GAAP operating income (loss), a Non-GAAP financial measure that is widely used to evaluate performance within the insurance sector. In calculating Non-GAAP operating income (loss), we have excluded the after-tax effects of net realized investment gains or losses, foreign currency exchange gains or losses and guaranty fund assessments or recoupments that do not reflect normal operating results. We believe Non-GAAP operating income presents a useful view of the performance of our insurance operations, but should be considered in conjunction with net income (loss) computed in accordance with GAAP. A reconciliation of these measures to GAAP measures is available in our regular reports on Forms 10-Q and 10-K and in our latest quarterly news release, all of which are available in the Investor Relations section of our website, Investor.ProAssurance.com. IMPORTANT SAFE HARBOR & NON-GAAP NOTICES

© ProAssurance Corporation. All rights reserved. MAILING ADDRESS: ProAssurance Corporation 100 Brookwood Place Birmingham, AL 35209 CONTACT: Heather J. Wietzel SVP, Investor Relations 205.776.3028 InvestorRelations@ProAssurance.com

v3.24.1.1.u2

Document and Entity Information Document

|

May 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 28, 2024

|

| Entity Registrant Name |

ProAssurance Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-16533

|

| Entity Tax Identification Number |

63-1261433

|

| Entity Central Index Key |

0001127703

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

100 Brookwood Place,

|

| Entity Address, City or Town |

Birmingham,

|

| Entity Address, State or Province |

AL

|

| Entity Address, Postal Zip Code |

35209

|

| City Area Code |

(205)

|

| Local Phone Number |

877-4400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

PRA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

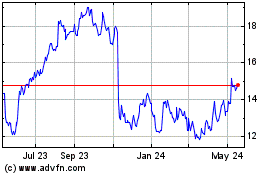

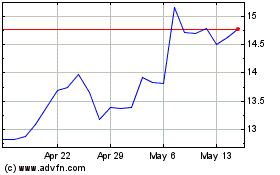

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Feb 2024 to Feb 2025