RBC Bearings Incorporated (NYSE: RBC, RBCP), a leading

international manufacturer of highly engineered precision bearings,

components and essential systems for the industrial, defense and

aerospace industries, today reported results for the fourth quarter

and full year fiscal 2024.

Fourth Quarter Financial

Highlights

- Fourth quarter net sales of $413.7 million increased 4.9% over

last year, Aerospace/Defense up 16.8% and Industrial down

0.4%.

- Gross margin of 43.1% for the fourth quarter of fiscal 2024

compared to 42.2% last year.

- Fourth quarter net income attributable to common stockholders

as a percentage of net sales of 13.5% vs 11.0% last year; Adjusted

EBITDA as a percentage of net sales of 31.4% vs 30.7% last

year.

- Fourth quarter free cash flow conversion of 113.3% vs 120.0%

last year.

Three Month Financial

Highlights

($ in millions)

Fiscal 2024

Fiscal 2023

Change

GAAP

Adjusted (1)

GAAP

Adjusted (1)

GAAP

Adjusted (1)

Net sales

$413.7

$394.4

4.9%

Gross margin

$178.3

$178.3

$166.5

$166.6

7.1%

7.0%

Gross margin %

43.1%

43.1%

42.2%

42.2%

Operating income

$94.2

$96.3

$86.1

$88.6

9.3%

8.6%

Operating income %

22.8%

23.3%

21.8%

22.5%

Net income

$61.6

$78.0

$49.2

$67.7

25.5%

15.3%

Net income attributable to common

stockholders

$55.9

$72.4

$43.4

$61.9

29.0%

16.8%

Diluted EPS

$1.91

$2.47

$1.49

$2.13

28.2%

16.0%

(1) Results exclude items in

reconciliation below.

Fiscal 2024 Financial

Highlights

- Fiscal 2024 net sales of $1,560.3 million increased 6.2% over

last year, Aerospace/Defense up 20.7% and Industrial up 0.2%.

- Gross margin of 43.0% for fiscal 2024 compared to 41.2% last

year.

- Fiscal 2024 net income attributable to common stockholders as a

percentage of net sales of 12.0% vs 9.8% last year; Adjusted EBITDA

as a percentage of net sales of 30.9% vs 29.5% last year.

- Free cash flow conversion of 115.0% in fiscal 2024 vs 107.2% in

fiscal 2023.

Twelve Month Financial

Highlights

($ in millions)

Fiscal 2024

Fiscal 2023

Change

GAAP

Adjusted (1)

GAAP

Adjusted (1)

GAAP

Adjusted (1)

Net sales

$1,560.3

$1,469.3

6.2%

Gross margin

$670.5

$670.8

$604.8

$604.9

10.9%

10.9%

Gross margin %

43.0%

43.0%

41.2%

41.2%

Operating income

$342.2

$345.5

$293.0

$304.6

16.8%

13.4%

Operating income %

21.9%

22.1%

19.9%

20.7%

Net income

$209.9

$274.6

$166.7

$240.5

25.9%

14.2%

Net income attributable to common

stockholders

$186.9

$251.7

$143.8

$217.6

30.1%

15.7%

Diluted EPS

$6.41

$8.62

$4.94

$7.48

29.8%

15.2%

(1) Results exclude items in

reconciliation below.

“Fiscal 2024 marked another record year for RBC and we expect to

carry that momentum into fiscal 2025,” said Dr. Michael J.

Hartnett, Chairman and Chief Executive Officer. “Our Aerospace and

Defense segment continued its strong secular growth with revenues

expanding 20.7% in the year, and our Industrial segment continued

to outpace broader industry trends with notable outgrowth relative

to peers. We also delivered healthy margin expansion fueled by

operating efficiencies and ongoing Dodge synergies coupled with

record levels of free cash flow generation, which was used to

further reduce debt to a post-Dodge low. We look to another year of

strong free cash flow generation and debt reduction, with the

Company poised to finish Fiscal 2025 with net leverage nicely below

2.0x.”

Fourth Quarter Results

Net sales for the fourth quarter of fiscal 2024 were $413.7

million, an increase of 4.9% from $394.4 million in the fourth

quarter of fiscal 2023. Net sales for the Industrial segment

decreased 0.4%, while net sales for the Aerospace/Defense segment

increased 16.8%. Gross margin for the fourth quarter of fiscal 2024

was $178.3 million compared to $166.5 million for the same period

last year.

SG&A for the fourth quarter of fiscal 2024 was $64.4

million, an increase of $4.8 million from $59.6 million for the

same period last year. As a percentage of net sales, SG&A was

15.6% for the fourth quarter of fiscal 2024 compared to 15.1% for

the same period last year.

Other operating expenses for the fourth quarter of fiscal 2024

totaled $19.7 million compared to $20.7 million for the same period

last year. For the fourth quarter of fiscal 2024, other operating

expenses included $17.7 million of amortization of intangible

assets, $2.0 million of restructuring costs and $0.1 million of

acquisition costs offset by $0.1 million of other income items. For

the fourth quarter of fiscal 2023, other operating expenses

included $17.7 million of amortization of intangible assets, $2.5

million of restructuring costs, and $0.5 million of other

items.

Operating income for the fourth quarter of fiscal 2024 was $94.2

million compared to $86.1 million for the same period last year. On

an adjusted basis, operating income was $96.3 million for the

fourth quarter of fiscal 2024 compared to $88.6 million for the

same period last year. Refer to the tables below for details on the

adjustments made to operating income to arrive at adjusted

operating income.

Interest expense, net, was $18.8 million for the fourth quarter

of fiscal 2024 compared to $21.7 million for the same period last

year.

Income tax expense for the fourth quarter of fiscal 2024 was

$12.5 million compared to $11.2 million for the same period last

year. The effective income tax rate for the fourth quarter of

fiscal 2024 was 16.8% compared to 18.5% for the same period last

year. The effective income tax rate for the three-month period

ended March 30, 2024 of 16.8% included $5.9 million of discrete tax

benefits associated with stock-based compensation windfalls, a

reduction in unrecognized tax benefits due to the expiration of the

statute of limitations, and the accrual of deferred tax assets

related to state tax modifications; the effective income tax rate

without these net benefits would have been 24.7%. The effective

income tax rate for the three-month period ended April 1, 2023 of

18.5% included $1.9 million of discrete tax benefits associated

with stock-based compensation and other items; the effective income

tax rate without these benefits would have been 21.7%.

Net income for the fourth quarter of fiscal 2024 was $61.6

million compared to $49.2 million for the same period last year. On

an adjusted basis, net income was $78.0 million for the fourth

quarter of fiscal 2024 compared to $67.7 million for the same

period last year. Refer to the tables below for details on the

adjustments made to net income to arrive at adjusted net income.

Net income attributable to common stockholders for the fourth

quarter of fiscal 2024 was $55.9 million compared to $43.4 million

for the same period last year. On an adjusted basis, net income

attributable to common stockholders for the fourth quarter of

fiscal 2024 was $72.4 million compared to $61.9 million for the

same period last year.

Diluted EPS attributable to common stockholders for the fourth

quarter of fiscal 2024 was $1.91 compared to $1.49 for the same

period last year. On an adjusted basis, diluted EPS attributable to

common stockholders was $2.47 for the fourth quarter of fiscal 2024

compared to $2.13 for the same period last year.

Backlog as of March 30, 2024, was $726.1 million compared to

$652.1 million as of December 30, 2023 and $663.8 million as of

April 1, 2023. The $726.1 million backlog amount excluded $95.4

million of orders that we expected to fulfill beyond 12 months from

March 30, 2024; the $652.1 million backlog amount excluded $118.6

million of orders that we expected to fulfill beyond 12 months from

December 30, 2023; the $663.8 million backlog amount excluded $95.6

million of orders that we expected to fulfill beyond 12 months from

April 1, 2023. Beginning in fiscal year 2025, we will disclose our

full backlog for periods presented.

Preferred Stock Conversion in Fiscal

2025

The Company’s Series A mandatory convertible preferred stock is

set to automatically convert on October 15, 2024, at which point

the Company will no longer be required to pay a 5.0% dividend ($5.7

million per quarter), which reduces net income attributable to

common stockholders. This will lead to $23.0 million of annual cash

savings in future periods. Fiscal 2025 will include the final three

quarterly dividend payments.

If the preferred stock conversion were to have taken place

during the fourth quarter of fiscal 2024, it would have resulted in

an additional 2,029,980 shares of outstanding common stock. If

these 2,029,980 shares were added to the total diluted shares

outstanding in lieu of the preferred stock quarterly dividend of

$5.7 million, diluted EPS for this quarter would have been $1.97

rather than the reported $1.91, and adjusted diluted EPS would have

been $2.49 rather than the reported $2.47.

Outlook for the First Quarter Fiscal

2025

The Company expects net sales to be approximately $415.0 million

to $420.0 million in the first quarter of fiscal 2025, compared to

$387.1 million this year, a growth rate of 7.2% to 8.5%.

Live Webcast

RBC Bearings Incorporated will host a webcast on Friday, May

17th, 2024, at 11:00 a.m. ET to discuss the quarterly results. To

access the webcast, go to the investor relations portion of the

Company’s website, www.rbcbearings.com, and click on the webcast

icon. If you do not have access to the Internet and wish to listen

to the call, dial 877-407-4019 (international callers dial +1

201-689-8337) and provide conference ID # 13746497. An audio replay

of the call will be available from 2:00 p.m. ET May 17th, 2024,

until 2:00 p.m. ET May 31st, 2024. The replay can be accessed by

dialing 877-660-6853 (international callers dial +1 201-612-7415)

and providing conference ID # 13746497. Investors are advised to

dial into the call at least ten minutes prior to the call to

register.

Non-GAAP Financial

Measures

In addition to disclosing results of operations that are

determined in accordance with U.S. generally accepted accounting

principles (GAAP), this press release also discloses non-GAAP

results of operations that exclude certain items. These non-GAAP

measures adjust for items that management believes are unusual, as

well as other non-cash items including but not limited to

depreciation, amortization, and equity-based incentive

compensation. Management believes that the presentation of these

non-GAAP measures provides useful information to investors

regarding the Company’s results of operations as these non-GAAP

measures allow investors to better evaluate ongoing business

performance. Investors should consider non-GAAP measures in

addition to, not as a substitute for, financial measures prepared

in accordance with GAAP. A reconciliation of the non-GAAP measures

disclosed in this press release with the most comparable GAAP

measures are included in the financial table attached to this press

release.

Free Cash Flow Conversion Free cash flow conversion measures our

ability to convert operating profits into free cash flow and is

calculated as free cash flow (cash provided by operating activities

less capital expenditures) divided by net income.

Adjusted Gross Margin and Adjusted Operating Income Adjusted

gross margin excludes the impact of restructuring costs associated

with the closing of a plant. Adjusted operating income excludes

acquisition expenses (including the impact of acquisition-related

fair value adjustments in connection with purchase), restructuring

and other similar charges, and other non-operational, non-cash or

non-recurring losses. We believe that adjusted operating income is

useful in assessing our financial performance by excluding items

that are not indicative of our core operating performance or that

may obscure trends useful in evaluating our continuing results of

operations.

Adjusted Net Income Attributable to Common Stockholders and

Adjusted Earnings Per Share Attributable to Common Stockholders

Adjusted net income attributable to common stockholders and

adjusted earnings per share attributable to common stockholders

(calculated on a diluted basis) exclude non-cash expenses for

amortization related to acquired intangible assets, stock-based

compensation, amortization of deferred finance fees, acquisition

expenses (including the impact of acquisition-related fair value

adjustments in connection with purchase), restructuring and other

similar charges, gains or losses on divestitures, discontinued

operations, gains or losses on extinguishment of debt, and other

non-operational, non-cash or non-recurring losses, net of their

income tax impact. We believe that adjusted net income and adjusted

earnings per share are useful in assessing our financial

performance by excluding items that are not indicative of our core

operating performance or that may obscure trends useful in

evaluating our continuing results of operations.

Adjusted EBITDA We use the term “Adjusted EBITDA” to describe

net income adjusted for the items summarized in the “Reconciliation

of GAAP to Non-GAAP Financial Measures” table below. Adjusted

EBITDA is intended to show our unleveraged, pre-tax operating

results and therefore reflects our financial performance based on

operational factors, excluding non-operational, non-cash or

non-recurring losses or gains. In view of our debt level, Adjusted

EBITDA aids our investors in understanding our compliance with our

debt covenants. Management and various investors use the ratio of

total debt less cash to Adjusted EBITDA, or “net debt leverage,” as

a measure of our financial strength and ability to incur

incremental indebtedness when making investment decisions and

evaluating us against peers. Lastly, management and various

investors use the ratio of the change in Adjusted EBITDA divided by

the change in net sales (referred to as “incremental margin” in the

case of an increase in net sales or “decremental margin” in the

case of a decrease in net sales) as an additional measure of our

financial performance and some investors utilize it when making

investment decisions and evaluating us against peers.

Adjusted EBITDA is not a presentation made in accordance with

GAAP, and our definition of Adjusted EBITDA may vary from the

definition used by others in our industry. Adjusted EBITDA should

not be considered as an alternative to net income, income from

operations, or any other performance measures derived in accordance

with GAAP. Adjusted EBITDA has important limitations as an

analytical tool, and you should not consider it in isolation, or as

a substitute for analysis of our results as reported under GAAP.

For example, Adjusted EBITDA does not reflect (a) our capital

expenditures, future requirements for capital expenditures or

contractual commitments; (b) changes in, or cash requirements for,

our working capital needs; (c) the significant interest expenses,

or the cash requirements necessary to service interest or principal

payments, on our debt; (d) tax payments that represent a reduction

in cash available to us; (e) any cash requirements for the assets

being depreciated and amortized that may have to be replaced in the

future; or (f) the impact of earnings or charges resulting from

matters that we and the lenders under our credit agreement may not

consider indicative of our ongoing operations. In particular, our

definition of Adjusted EBITDA adds back certain non-cash,

non-operating or non-recurring charges that are deducted in

calculating net income, even though these are expenses that may

recur or vary greatly, are difficult to predict, and can represent

the effect of long-term strategies as opposed to short-term

results. In addition, certain of these expenses can represent the

reduction of cash that could be used for other corporate purposes.

Further, although not included in the calculation of Adjusted

EBITDA below, the measure may at times (i) include estimated cost

savings and operating synergies related to operational changes

ranging from acquisitions to dispositions to restructurings and/or

(ii) exclude one-time transition expenditures that we anticipate we

will need to incur to realize cost savings before such savings have

occurred.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and

marketer of highly engineered precision bearings, components and

essential systems. Founded in 1919, the Company is primarily

focused on producing highly technical or regulated bearing products

and components requiring sophisticated design, testing, and

manufacturing capabilities for the diversified industrial,

aerospace and defense markets. The Company is headquartered in

Oxford, Connecticut.

Safe Harbor for Forward Looking

Statements

Certain statements in this press release contain

“forward-looking statements.” All statements other than statements

of historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including the following: the

section of this press release entitled “Outlook”; any projections

of earnings, revenue or other financial items relating to the

Company, any statement of the plans, strategies and objectives of

management for future operations; any statements concerning

proposed future growth rates in the markets we serve; any

statements of belief; any characterization of and the Company’s

ability to control contingent liabilities; anticipated trends in

the Company’s businesses; and any statements of assumptions

underlying any of the foregoing. Forward-looking statements may

include the words “may,” “would,” “estimate,” “intend,” “continue,”

“believe,” “expect,” “anticipate,” and other similar words.

Although the Company believes that the expectations reflected in

any forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Our future financial condition and

results of operations, as well as any forward-looking statements,

are subject to change and to inherent risks and uncertainties

beyond the control of the Company. These risks and uncertainties

include, but are not limited to, risks and uncertainties relating

to general economic conditions, geopolitical factors, future levels

of aerospace/defense and industrial market activity, future

financial performance, our debt level, our level of goodwill,

market acceptance of new or enhanced versions of the Company’s

products, the pricing of raw materials, changes in the competitive

environments in which the Company’s businesses operate, the outcome

of pending or future litigation and governmental proceedings and

approvals, estimated legal costs, increases in interest rates, tax

legislation and changes, the Company’s ability to acquire and

integrate complementary businesses, and risks and uncertainties

listed or disclosed in our reports filed with the Securities and

Exchange Commission, including, without limitation, the risks

identified under the heading “Risk Factors” set forth in the

Company’s most recent Annual Report on Form 10-K filed with the

SEC. The Company does not intend, and undertakes no obligation, to

update or alter any forward-looking statements.

RBC Bearings Incorporated Consolidated Statements of

Operations (dollars in thousands, except share and per share

data) (Unaudited) Three Months

Ended Twelve Months Ended March 30, April

1, March 30, April 1,

2024

2023

2024

2023

Net sales

$

413,680

$

394,422

$

1,560,280

$

1,469,294

Cost of sales

235,399

228,010

889,778

864,543

Gross margin

178,281

166,412

670,502

604,751

Operating expenses: Selling, general and administrative

64,409

59,561

253,537

229,690

Other, net

19,720

20,747

74,775

82,078

Total operating expenses

84,129

80,308

328,312

311,768

Operating income

94,152

86,104

342,190

292,983

Interest expense, net

18,768

21,663

78,679

76,695

Other non-operating expense

1,295

4,120

1,718

6,610

Income before income taxes

74,089

60,321

261,793

209,678

Provision for income taxes

12,419

11,166

51,889

43,019

Net income

61,670

49,155

209,904

166,659

Preferred stock dividends

5,686

5,750

22,936

22,936

Net income attributable to common stockholders

$

55,984

$

43,405

$

186,968

$

143,723

Net income per common share attributable to common

stockholders: Basic

$

1.93

$

1.51

$

6.47

$

5.00

Diluted

$

1.91

$

1.49

$

6.41

$

4.94

Weighted average common shares: Basic

29,011,673

28,822,172

28,917,008

28,764,092

Diluted

29,285,853

29,132,950

29,189,056

29,072,429

Three Months Ended Twelve Months Ended

Reconciliation of Reported Gross Margin to March 30,

April 1, March 30, April 1, Adjusted Gross

Margin:

2024

2023

2024

2023

Reported gross margin

$

178,281

$

166,412

$

670,502

$

604,751

Restructuring and consolidation

-

190

289

190

Adjusted gross margin

$

178,281

$

166,602

$

670,791

$

604,941

Three Months Ended Twelve Months Ended

Reconciliation of Reported Operating Income to March

30, April 1, March 30, April 1,

Adjusted Operating Income:

2024

2023

2024

2023

Reported operating income

$

94,152

$

86,104

$

342,190

$

292,983

Transaction and related costs

145

6

283

79

Transition services

-

(114

)

-

8,831

Restructuring and consolidation

1,998

2,643

2,984

2,660

Adjusted operating income

$

96,295

$

88,639

$

345,457

$

304,553

Three Months Ended Twelve Months Ended

Reconciliation of Reported Net Income to Adjusted Net

March 30, April 1, March 30, April 1,

Income Attributable to Common Stockholders:

2024

2023

2024

2023

Reported net income

$

61,670

$

49,155

$

209,904

$

166,659

Transaction and related costs

145

6

283

79

Transition services

-

(114

)

-

8,831

Restructuring and consolidation

1,998

2,643

2,984

2,660

Foreign exchange translation loss/(gain)

-

-

-

(417

)

M&A related amortization

16,409

16,278

65,477

65,110

Stock compensation expense

4,114

2,965

17,428

14,012

Amortization of deferred finance fees

748

1,044

3,044

7,208

Pension settlement

455

4,317

-

4,317

Insurance proceeds paid/(received)

1,113

-

(519

)

-

Tax impact of adjustments and other tax matters

(8,606

)

(8,600

)

(24,000

)

(27,962

)

Adjusted net income

$

78,046

$

67,694

$

274,601

$

240,497

Preferred stock dividends

5,686

5,750

22,936

22,936

Adjusted net income attributable to common

stockholders

$

72,360

$

61,944

$

251,665

$

217,561

Adjusted net income per common share attributable to

common stockholders: Basic

$

2.49

$

2.15

$

8.70

$

7.56

Diluted

$

2.47

$

2.13

$

8.62

$

7.48

Weighted average common shares: Basic

29,011,673

28,822,172

28,917,008

28,764,092

Diluted

29,285,853

29,132,950

29,189,056

29,072,429

Three Months Ended Twelve Months Ended

Reconciliation of Reported Net Income to March 30,

April 1, March 30, April 1, Adjusted

EBITDA:

2024

2023

2024

2023

Reported net income

$

61,670

$

49,155

$

209,904

$

166,659

Interest expense, net

18,768

21,663

78,679

76,695

Provision for income taxes

12,419

11,166

51,889

43,019

Stock compensation expense

4,114

2,965

17,428

14,012

Depreciation and amortization

29,690

29,544

119,256

115,355

Other non-operating (income)/expense

(273

)

(197

)

2,237

2,293

Transaction and related costs

145

6

283

79

Transition services

-

(114

)

-

8,831

Restructuring and consolidation

1,998

2,643

2,984

2,660

Pension settlement

455

4,317

-

4,317

Insurance proceeds paid/(received)

1,113

-

(519

)

-

Adjusted EBITDA

$

130,099

$

121,148

$

482,141

$

433,920

Three Months Ended Twelve Months Ended

March 30, April 1, March 30, April 1,

Selected Financial Data:

2024

2023

2024

2023

Cash provided by operating activities

$

79,360

$

71,428

$

274,683

$

220,686

Capital expenditures

$

9,506

$

12,423

$

33,222

$

42,000

Total debt

$

1,191,868

$

1,395,043

Cash and cash equivalents

$

63,536

$

65,379

Total debt minus cash and cash equivalents

$

1,128,332

$

1,329,664

Repurchase of common stock

$

10,977

$

7,763

Backlog

$

726,100

$

663,830

Segment Data: Three Months Ended

Twelve Months Ended March 30, April 1,

March 30, April 1, Net External Sales:

2024

2023

2024

2023

Aerospace and defense segment

$

142,313

$

121,828

$

519,349

$

430,307

Industrial segment

271,367

272,594

1,040,931

1,038,987

Total net external sales

$

413,680

$

394,422

$

1,560,280

$

1,469,294

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240517055432/en/

Rob Moffatt Director of Investor Relations

investors@rbcbearings.com

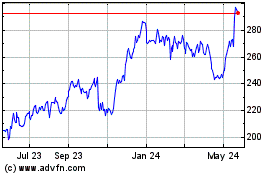

RBC Bearings (NYSE:RBC)

Historical Stock Chart

From Dec 2024 to Jan 2025

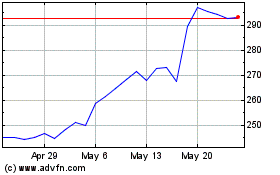

RBC Bearings (NYSE:RBC)

Historical Stock Chart

From Jan 2024 to Jan 2025