Seadrill Limited (“Seadrill” or the “Company”) (NYSE: SDRL)

today announced its fourth quarter and full year 2024 results.

Highlights

- Delivered net income of $446 million and Adjusted EBITDA(1) of

$378 million in 2024

- Secured long-term contracts for West Jupiter and West Tellus,

adding $1 billion in backlog

- Exited benign jack-up market through divestment of West

Prospero for $45 million in cash proceeds

- Finished the quarter with a cash balance of $505 million

- Repurchased $100 million of shares during the fourth quarter,

increasing total share repurchases to $792 million, or 22%, of

issued share count since initiating repurchase programs in

September 2023

Financial Highlights

Figures in USD million, unless otherwise

indicated

Three months ended December

31, 2024

Three months ended September

30, 2024

Total Operating Revenues

289

354

Contract Revenues

204

263

Net income

101

32

Adjusted EBITDA(1)

28

93

Adjusted EBITDA Margin(1)

9.7

%

26.3

%

Diluted Earnings Per Share ($)

1.54

0.49

“During the fourth quarter, we secured long-term contracts for

West Jupiter and West Tellus, adding $1 billion in backlog; sold

the cold-stacked West Prospero at a favorable valuation compared to

recent sales by our peers; and repurchased $100 million of shares

under our share repurchase program,” said President and Chief

Executive Officer, Simon Johnson. “With a strong balance sheet, and

durable backlog that extends meaningfully into 2029, we are

well-positioned to navigate any market volatility.”

Financial and Operational Results

Fourth quarter 2024 operating revenues totaled $289 million,

compared to $354 million in the prior quarter, a decrease of 18%,

primarily due to lower contract revenues. Contract revenues were

$204 million, a sequential decrease of 22%, due to fewer operating

days following scheduled contract completions for the West Phoenix

and West Capella and planned out-of-service time for the West

Neptune. Management contract revenues were $62 million in the

fourth quarter, consistent with the prior quarter. Leasing revenues

were also in line, with the fourth quarter at $8 million, compared

to $9 million in the third quarter. Reimbursable revenues were $15

million for the quarter.

Fourth quarter 2024 total operating expenses increased by 5% to

$323 million, compared to $307 million in the third quarter. The

impact of reduced vessel and rig operating expenses was offset by

increases in merger and integration related expenses, management

contract expenses and selling, general and administrative expenses.

Vessel and rig operating expenses decreased $8 million, or 5%, to

$164 million due to fewer operating days. Merger and integration

related expenses, an adjusting item to Adjusted EBITDA(1),

increased $15 million, to $17 million due to additional costs

following the handover of the final Aquadrill drillships in the

fourth quarter. Management contract expenses increased $6 million,

or 13%, to $51 million due to the timing of planned repair and

maintenance projects. Reimbursable expenses of $15 million offset

reimbursable revenues. Selling, general, and administrative

expenses increased $4 million, to $31 million, primarily due to

adjustments to year-end accruals and severance costs following

steps taken in the fourth quarter to reduce the Company's cost

base.

Income tax benefit was $133 million for the fourth quarter,

compared to income tax expense of $7 million in the prior quarter.

Favorable resolution of uncertain tax positions and the partial

release of valuation allowances drove the benefit in the fourth

quarter.

Net income for the fourth quarter was $101 million. Adjusted

EBITDA(1) was $28 million, compared to $93 million in the prior

quarter.

Balance Sheet and Cash Flow

At quarter-end, Seadrill had gross principal debt of $625

million and $505 million in cash and cash equivalents, including

$27 million of restricted cash, for a net debt position of $120

million. Net cash provided by operating activities during the

fourth quarter of 2024 was $7 million. Capital expenditures were

$132 million, mostly related to contract preparation for West

Auriga and West Polaris, in addition to the planned survey and

upgrades for West Neptune. Payments for long-term maintenance,

reported in operating cash flows were $94 million, with $38 million

in capital upgrades captured in investing cash flows. Free Cash

Flow(1) was negative $31 million. In addition, the cold-stacked

benign jack-up West Prospero was sold in December 2024 for cash

proceeds of $45 million.

During the fourth quarter, Seadrill repurchased a total of

approximately 2.5 million shares for $100 million under its current

$500 million share repurchase authorization. Since initiating its

repurchase programs in September 2023, the Company has returned a

total of approximately $792 million to shareholders, repurchasing a

total of approximately 17.8 million shares, reducing issued share

count by approximately 22%.

Commercial Activity

- In December 2024, the West Jupiter and the West Tellus secured

long-term contracts with Petrobras in Brazil. The 1,095 day

contracts, scheduled to commence in the first and second quarter of

2026 respectively, add $1 billion in backlog, securing the rigs'

utilization into 2029.

- The West Vela drilled its most recent well ahead of schedule.

Following exceptional operational performance, the rig secured 40

days of additional work and added approximately $20 million in

backlog, which is expected to keep the rig working into September

2025.

- The Sevan Louisiana continued its existing contract with an

independent operator in the U.S. Gulf, securing the rig’s services

into June 2025.

As of February 26, 2025, Seadrill’s Order Backlog(2) was

approximately $3.0 billion. For 2025, the Company has approximately

75% of available rig days contracted across its marketed and

managed rig fleet. The Company today provided an updated fleet

status report on the Investor Relations section of its website,

www.seadrill.com.

Operational Updates

- The West Auriga and West Polaris commenced their contracts with

Petrobras on December 20, 2024 and February 18, 2025, respectively.

The West Polaris commencement was impacted by the commissioning and

testing of upgraded equipment.

- The West Tellus incurred 50 days of downtime during the first

quarter of 2025 responding to regulatory matters in Brazil.

- The West Neptune recommenced drilling activities on February

16, 2025, following the completion of the planned survey and

upgrades. The timeline was affected by vendor issues and adverse

weather.

Conference Call Information

The Company will host a conference call to discuss its results

on Thursday, February 27 at 09:00 CT / 16:00 CET. Interested

participants may join the call by dialing +1 (800) 715-9871

(Conference ID: 5348977) at least 15 minutes prior to the scheduled

start time. The Company will webcast the call live on the Investor

Relations section of its website, where a replay will be available

afterwards.

About Seadrill

Seadrill is setting the standard in deepwater oil and gas

drilling. With its modern fleet, experienced crews, and advanced

technologies, Seadrill safely, efficiently, and responsibly unlocks

oil and gas resources for national, integrated, and independent oil

companies. For further information, visit www.seadrill.com.

(1) These are non-GAAP measures. For a definition and a

reconciliation to the most comparable GAAP measure, see Appendices.

(2) Order Backlog includes all firm contracts at the contractual

operating dayrate multiplied by the number of days remaining in the

firm contract period. It includes management contract revenues and

lease revenues from bareboat charter arrangements and excludes

revenues for mobilization, demobilization, contract preparation,

and other incentive provisions and backlog relating to

non-consolidated entities.

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements other than statements of historical facts included

in this news release, including, without limitation, those

regarding the Company’s outlook and guidance, plans, strategies,

business prospects, financial performance, operations, rig

activity, share repurchases and changes and trends in its business

and the markets in which it operates, are forward-looking

statements. These forward-looking statements can often, but not

necessarily, be identified by the use of forward-looking

terminology, including the terms "assumes", "projects",

"forecasts", "estimates", "expects", "anticipates", "believes",

"plans", "intends", "may", "might", "will", "would", "can",

"could", "should" or, in each case, their negative, or other

variations or comparable terminology. These statements are based on

management’s current plans, expectations, assumptions and beliefs

concerning future events impacting the Company and therefore

involve a number of risks, uncertainties and assumptions that could

cause actual results to differ materially from those expressed or

implied in the forward-looking statements. Important factors that

could cause actual results to differ materially from those in the

forward-looking statements include, but are not limited to: those

described under Item 3D, “Risk Factors” in the Company’s Annual

Report on Form 20-F for the year ended December 31, 2023, filed

with the U.S. Securities and Exchange Commission (the “SEC”) on

March 27, 2024, offshore drilling market conditions including

supply and demand, dayrates, customer drilling programs and effects

of new or reactivated rigs on the market, contract awards and rig

mobilizations, contract backlog, dry-docking and other costs of

maintenance, special periodic surveys, upgrades and regulatory work

for the drilling rigs in the Company’s fleet, the performance of

the drilling rigs in the Company’s fleet, delay in payment or

disputes with customers, the Company's ability to successfully

employ its drilling units, procure or have access to financing,

ability to comply with loan covenants, fluctuations in the

international price of oil, international financial market

conditions, inflation, changes in governmental regulations that

affect the Company or the operations of the Company’s fleet,

increased competition in the offshore drilling industry, the review

of competition authorities, the impact of global economic

conditions and global health threats, pandemics and epidemics, our

ability to maintain relationships with suppliers, customers,

employees and other third parties, our ability to maintain adequate

financing to support our business plans, our ability to

successfully complete and realize the intended benefits of any

mergers, acquisitions and divestitures, and the impact of other

strategic transactions, our liquidity and the adequacy of cash

flows to satisfy our obligations, future activity under and in

respect of the Company’s share repurchase program, our ability to

satisfy (or timely cure any noncompliance with) the continued

listing requirements of the New York Stock Exchange, the

cancellation of drilling contracts currently included in reported

contract backlog, losses on impairment of long-lived fixed assets,

shipyard, construction and other delays, the results of meetings of

our shareholders, political and other uncertainties, including

those related to the conflicts in Ukraine and the Middle East, and

any related sanctions, the effect and results of litigation,

regulatory matters, settlements, audits, assessments and

contingencies, including any litigation related to acquisitions or

dispositions, the concentration of our revenues in certain

geographical jurisdictions, limitations on insurance coverage, our

ability to attract and retain skilled personnel on commercially

reasonable terms, the level of expected capital expenditures, our

expected financing of such capital expenditures and the timing and

cost of completion of capital projects, fluctuations in interest

rates or exchange rates and currency devaluations relating to

foreign or U.S. monetary policy, tax matters, changes in tax laws,

treaties and regulations, tax assessments and liabilities for tax

issues, legal and regulatory matters in the jurisdictions in which

we operate, customs and environmental matters, the potential

impacts on our business resulting from decarbonization and

emissions legislation and regulations, the impact on our business

from climate change generally, the occurrence of cybersecurity

incidents, attacks or other breaches to our information technology

systems, including our rig operating systems, and other important

factors described from time to time in the reports filed or

furnished by us with the SEC.

The foregoing risks and uncertainties are inherently subject to

significant business, economic, competitive, regulatory and other

risks and uncertainties, many of which are difficult to predict and

beyond our control. In many cases, we cannot predict the risks and

uncertainties that could cause our actual results to differ

materially from those indicated by the forward-looking statements.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those indicated. All subsequent written and

oral forward-looking statements attributable to us or to any

person(s) acting on our behalf are expressly qualified in their

entirety by reference to these risks and uncertainties. You should

not place undue reliance on forward-looking statements. Each

forward-looking statement speaks only as of the date of the

particular statement. We expressly disclaim any obligations or

undertaking to release publicly any updates or revisions to any

forward-looking statement to reflect any change in our expectations

or beliefs with regard to the statement or any change in events,

conditions or circumstances on which any forward-looking statement

is based, except as required by law.

Investors should note that we announce material financial

information in SEC filings, press releases and public conference

calls. Based on guidance from the SEC, we may use the Investors

section of our website (www.seadrill.com) to communicate with

investors. It is possible that the financial and other information

posted there could be deemed to be material information. The

information on our website is not part of, and is not incorporated

into, this news release.

Seadrill Limited

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In $ millions, except per share

data)

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Operating revenues

Contract revenues

204

315

1,009

1,154

Reimbursable revenues (1)

15

19

70

58

Management contract revenues (1)

62

60

247

245

Leasing revenues (1)

8

11

54

33

Other revenues (1)

—

3

5

12

Total operating revenues

289

408

1,385

1,502

Operating expenses

Vessel and rig operating expenses

(164

)

(220

)

(681

)

(705

)

Reimbursable expenses

(15

)

(18

)

(68

)

(55

)

Depreciation and amortization

(45

)

(44

)

(168

)

(155

)

Management contract expense

(51

)

(45

)

(175

)

(174

)

Merger and integration related

expenses

(17

)

(3

)

(24

)

(24

)

Selling, general and administrative

expenses

(31

)

(26

)

(107

)

(74

)

Total operating expenses

(323

)

(356

)

(1,223

)

(1,187

)

Other operating items

Gain on disposals

31

—

234

14

Other operating income

—

—

16

—

Total other operating items

31

—

250

14

Operating (loss)/profit

(3

)

52

412

329

Financial and other non-operating

items

Interest income

5

13

25

35

Interest expense

(15

)

(15

)

(61

)

(59

)

Share in results from associated companies

(net of tax)

4

10

(9

)

37

Other financial items

(23

)

(6

)

(34

)

(25

)

Total financial and other non-operating

items, net

(29

)

2

(79

)

(12

)

Profit before income taxes

(32

)

54

333

317

Income tax benefit/(expense)

133

19

113

(17

)

Net income

101

73

446

300

Basic EPS ($)

1.58

0.97

6.56

4.23

Diluted EPS ($)

1.54

0.95

6.37

4.12

(1) Includes revenue received from related parties of $73

million and $319 million, for the three months and year ended

December 31, 2024, respectively, and $79 million and $298 million

for the three months and year ended December 31, 2023,

respectively.

Seadrill Limited

UNAUDITED CONSOLIDATED BALANCE

SHEETS

(In $ millions, except share

data)

December 31,

2024

December 31,

2023

ASSETS

Current assets

Cash and cash equivalents

478

697

Restricted cash

27

31

Accounts receivables, net

193

222

Amounts due from related parties, net

—

9

Other current assets

230

199

Total current assets

928

1,158

Non-current assets

Investment in associated companies

68

90

Drilling units

2,946

2,858

Deferred tax assets

63

46

Equipment

5

10

Other non-current assets

146

56

Total non-current assets

3,228

3,060

Total assets

4,156

4,218

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities

Trade accounts payable

118

53

Other current liabilities

383

336

Total current liabilities

501

389

Non-current liabilities

Long-term debt

610

608

Deferred tax liabilities

11

9

Other non-current liabilities

116

229

Total non-current liabilities

737

846

Commitments and contingencies

SHAREHOLDERS' EQUITY

Common shares of par value US$0.01 per

share: 375,000,000 shares authorized at December 31, 2024 (December

31, 2023: 375,000,000) and 62,154,422 issued at December 31, 2024

(December 31, 2023: 74,048,962)

1

1

Additional paid in capital

1,969

2,480

Accumulated other comprehensive income

1

1

Retained earnings

947

501

Total shareholders' equity

2,918

2,983

Total liabilities and shareholders'

equity

4,156

4,218

Seadrill Limited

UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In $ millions)

Year ended December

31,

2024

2023

Cash Flows from Operating

Activities

Net income

446

300

Adjustments to reconcile net income to net

cash provided by operating activities:

Change in allowance for credit losses

—

(1

)

Depreciation and amortization

168

155

Gain on disposal of assets

(234

)

(14

)

Amortization of debt issue costs

4

2

Share in results from associated companies

(net of tax)

9

(37

)

Deferred tax benefit

(13

)

(13

)

Share based compensation expense

17

8

Other

5

1

Other cash movements in operating

activities

Payments for long-term maintenance

(261

)

(108

)

Changes in operating assets and

liabilities, net of effect of acquisitions and disposals

Trade accounts receivable

29

(25

)

Trade accounts payable

65

(34

)

Prepaid expenses/accrued revenue

(24

)

(1

)

Deferred revenue

22

1

Deferred mobilization costs

(92

)

25

Related party receivables

9

19

Other assets

2

(22

)

Other liabilities

(64

)

31

Net cash flows provided by operating

activities

88

287

Cash Flows from Investing

Activities

Additions to drilling units and

equipment

(157

)

(101

)

Proceeds from disposal of assets

383

14

Net proceeds from disposal of business

—

21

Acquisition of subsidiary

—

24

Proceeds from sales of tender-assist

units

—

84

Net cash flows provided by investing

activities

226

42

Cash Flows from Financing

Activities

Shares repurchased

(532

)

(263

)

Proceeds from debt

—

576

Repayments of secured credit

facilities

—

(478

)

Share issuance costs

—

(4

)

Debt issuance costs

—

(31

)

Net cash used in by financing

activities

(532

)

(200

)

Effect of exchange rate changes on

cash

(5

)

1

Net (decrease)/increase in cash and

cash equivalents, including restricted cash

(223

)

130

Cash and cash equivalents, including

restricted cash, at beginning of the period

728

598

Cash and cash equivalents, including

restricted cash, at the end of period

505

728

Supplementary disclosure of cash flow

information

Interest paid

(54

)

(36

)

Net taxes paid

(17

)

(24

)

Appendix I - Reconciliation of Net income to Adjusted EBITDA

(Unaudited)

Adjusted EBITDA represents Net income before depreciation and

amortization, taxes, total financial items and other income and

similar non-cash charges. Additionally, in any given period, the

Company may have significant, unusual or non-recurring items which

may be excluded from Adjusted EBITDA for that period. When

applicable, these items are fully disclosed and incorporated into

the reconciliation provided below. Adjusted EBITDA Margin

represents Adjusted EBITDA as a percentage of Total operating

revenues. Adjusted EBITDA excluding Reimbursables, represents

Adjusted EBITDA, excluding Reimbursable revenues and Reimbursable

expenses. Adjusted EBITDA Margin excluding Reimbursables represents

Adjusted EBITDA excluding Reimbursables as a percentage of Total

operating revenues excluding Reimbursable revenues.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA

excluding Reimbursables and Adjusted EBITDA Margin excluding

Reimbursables are non-GAAP financial measures. The Company believes

that the aforementioned non-GAAP financial measures assist

investors by excluding the potentially disparate effects between

periods of depreciation and amortization, income tax

benefit/expense, total financial items and other income, merger and

integration related expenses, gain on disposals and other

adjustments specified, which are affected by various and possibly

changing financing methods, capital structure and historical cost

basis and which may significantly affect Net income between

periods.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA

excluding Reimbursables and Adjusted EBITDA Margin excluding

Reimbursables should not be considered as alternatives to Net

income or any other indicator of Seadrill Limited’s performance

calculated in accordance with GAAP. Because the definitions of

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA excluding

Reimbursables and Adjusted EBITDA Margin excluding Reimbursables

(or similar measures) may vary among companies and industries, they

may not be comparable to other similarly titled measures used by

other companies.

The tables below reconcile Net income, the most directly

comparable GAAP measure, to Adjusted EBITDA, Adjusted EBITDA

Margin, Adjusted EBITDA excluding Reimbursables and Adjusted EBITDA

Margin excluding Reimbursables.

Figures in USD million, unless otherwise

indicated

Three months ended December

31, 2024

Three months ended September

30, 2024

Year ended December 31,

2024

Net income (a)

101

32

446

Depreciation and amortization

45

42

168

Income tax (benefit)/expense

(133

)

7

(113

)

Total financial items and other income

29

8

79

Merger and integration related

expenses

17

2

24

Gain on disposals

(31

)

—

(234

)

Other adjustments (1)

—

2

8

Adjusted EBITDA (b)

28

93

378

Total operating revenues (c)

289

354

1,385

Net income margin (a)/(c)

34.9

%

9.0

%

32.2

%

Adjusted EBITDA margin (b)/(c)

9.7

%

26.3

%

27.3

%

Figures in USD million, unless otherwise

indicated

Three months ended December

31, 2024

Three months ended September

30, 2024

Adjusted EBITDA (b)

28

93

Reimbursable revenues

(15

)

(20

)

Reimbursable expenses

15

19

Adjusted EBITDA excluding Reimbursables

(d)

28

92

Total operating revenues (c)

289

354

Reimbursable revenues

(15

)

(20

)

Total operating revenues excluding

Reimbursable revenues (e)

274

334

Adjusted EBITDA margin excluding

Reimbursables (d)/(e)

10.2

%

27.5

%

(1) Primarily related to costs associated with the closure of

the Company's London office, announced in 2023.

Appendix II - Contract Revenues Supporting Information

(Unaudited)

Contract Revenues Supporting

Information(1)

Three months ended December

31, 2024

Three months ended September

30, 2024

Average number of rigs on contract(2)

8

10

Average contractual dayrates(3) (in $

thousands)

289

304

Economic utilization(4)

93.0

%

95.3

%

(1) Excludes three drillships managed on behalf of Sonadrill

(West Gemini, Sonangol Quenguela, Sonangol Libongos); and excludes

rig bareboat chartered to Sonadrill (West Gemini). (2) The average

number of rigs on contract is calculated by dividing the aggregate

days the Company's rigs were on contract during the reporting

period by the number of days in that reporting period. (3) The

average contractual dayrate is calculated by dividing the aggregate

contractual dayrates during a reporting period by the aggregate

number of days for the reporting period. (4) Economic utilization

is defined as dayrate revenue earned during the period, excluding

bonuses, divided by the contractual operating dayrate, multiplied

by the number of days on contract in the period. If a drilling unit

earns its full operating dayrate throughout a reporting period, its

economic utilization would be 100%. However, there are many

situations that give rise to a dayrate being earned that is less

than the contractual operating rate, such as planned downtime for

maintenance. In such situations, economic utilization reduces below

100%.

Appendix III - Reconciliation of Net cash flows provided

by/(used in) operating activities to Free Cash Flow

(Unaudited)

The Company also presents Free Cash Flow as a non-GAAP liquidity

measure. Free Cash Flow is calculated as Net cash provided by/(used

in) operating activities less additions to drilling units and

equipment. The Company believes Free Cash Flow is useful to

investors, as it allows greater transparency of the generation or

utilization of cash by the business. Because the definition of Free

Cash Flow may vary among companies and industries, it may not be

comparable to other similarly titled measures used by other

companies. The table below reconciles Net cash flows provided

by/(used in) operating activities, the most directly comparable

GAAP measure, to Free Cash Flow for the three months ended December

31, 2024 and September 30, 2024.

Figures in USD million

Three months ended December

31, 2024

Three months ended September

30, 2024

Net cash flows provided by/(used in)

operating activities

7

(27

)

Additions to drilling units and

equipment

(38

)

(53

)

Free Cash Flow

(31

)

(80

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226579036/en/

Kevin Smith Vice President of Corporate Finance and Investor

Relations ir@seadrill.com

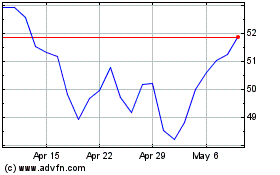

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Feb 2025 to Mar 2025

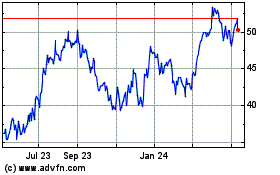

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Mar 2024 to Mar 2025