- Spire entered into agreement to sell its maritime business for

~$241 million; purchase price ~5.8x trailing twelve months

revenue

- Company intends to eliminate debt through sale proceeds

- Company intends to invest in growth and innovation of its data

analytics and radio frequency geolocation solution offerings to

address climate change and global security challenges for its

customers

Spire Global, Inc. (NYSE: SPIR) (“Spire” or “the Company”), a

global provider of space-based data, analytics and space services,

today announced an agreement to a sell its maritime business to

Kpler for approximately $241 million. The Company intends to use

the proceeds of the sale to retire all outstanding debt and invest

in near-term growth opportunities. The Company will hold a webcast

at 10:00 am ET today to discuss the announcement.

The $241 million transaction consists of a $233.5 million

purchase price and $7.5 million for services over a twelve-month

period, post close. The purchase price values the portfolio at

approximately 5.8x the revenue generated by the business over the

last twelve months. Spire will retain its satellite network,

technology and infrastructure and will continue to serve its

aviation, weather and space services customers, along with the

existing U.S. government portion of its maritime customer

portfolio.

“This move further focuses Spire on our core mission: helping

humanity tackle climate change and global security challenges — two

of the macrotrends driving the space economy,” said Peter Platzer,

Spire CEO. “We are now even better equipped with the resources,

technology and experience to serve governments and commercial

clients to fulfill their missions, whether through our advanced

data solutions or empowering them with our sophisticated space

services offering.”

“In addition to these benefits for Spire, we expect this sale

will benefit our maritime customers and team members by allowing

our maritime business to grow even faster within a global

organization leading the digitalization of the maritime industry,”

Platzer added.

“By acquiring Spire Maritime, we will materially improve our

satellite AIS offering which together with our comprehensive

terrestrial AIS network, significantly enhances real-time

visibility and analytics for the maritime and commodity markets,”

said Mark Cunningham, CEO of Kpler. “This will provide our clients

with a clearer view of developments across maritime and commodity

markets, to support better decision-making in a globally

interconnected economy.”

“By capitalizing the business in a non-dilutive manner and

eliminating interest payments and other operational restrictions,

we are transforming our cost structure and operating model,” said

Leo Basola, Spire CFO. “This approach mitigates risk by removing

the most significant external financial pressures, while also

providing us with capital to invest in core projects that generate

long-term value.”

The transaction is expected to close by the first quarter of

2025, subject to satisfying customary closing conditions.

Spire’s financial advisor for the transaction was Evercore, with

legal counsel provided by Faegre Drinker. Kpler’s legal counsel was

provided by Cooley.

Conference Call

Spire will webcast a conference call to discuss the announcement

at 10:00 a.m. ET today. The webcast will be available on Spire’s

Investor Relations website at ir.spire.com. A replay of the call

will be available on the site for three months.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws, which statements

involve substantial risks and uncertainties. Forward-looking

statements generally relate to future events or the Company’s

anticipated financial or operating performance. In some cases, you

can identify forward-looking statements because they contain words

such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,”

“could,” “would,” “intend,” “target,” “project,” “contemplate,”

“believe,” “estimate,” “predict,” “project,” “potential,” “seek” or

“continue” or the negative of these words or other similar terms or

expressions that concern the Company’s expectations, strategy,

plans or intentions. Statements about the transactions contemplated

by the Share Purchase Agreement (the “Purchase Agreement”) for the

sale of portions of the Company’s maritime customer portfolio and

certain related assets and liabilities (the “Transactions”),

including with respect to whether or when any of the conditions to

the Transactions will be satisfied, whether and when the

Transactions may occur, the potential consequences of the

Transactions, the potential future relationships contemplated by

the Purchase Agreement, and the Company’s intent to use the

proceeds from the Transactions to eliminate debt and invest in

growth and innovation of its data analytics and radio frequency

geolocation solution offerings, are forward-looking statements.

The Company cautions you that the foregoing list may not contain

all of the forward-looking statements made in this press release.

You should not rely upon forward-looking statements as predictions

of future events. Factors that may cause future results to differ

materially from the Company’s current expectations include, among

other things, (1) risks related to the consummation of the

Transactions, including the risks that (a) the proposed transaction

may not be consummated within the anticipated time period, or at

all, (b) required regulatory clearances and approvals may not be

obtained, (c) other conditions to the consummation of the

Transactions may not be satisfied, and (d) all or part of the

buyer’s financing may not become available; (2) the effects that

any termination of the Purchase Agreement may have on the Company

or its business, including the risks that the Company stock price

may decline significantly if the Transactions are not completed;

(3) the effects that the announcement or pendency of the

Transactions, or developments with respect thereto, may have on the

Company and its business, including the risks that as a result (a)

the Company’s business, operating results or stock price may

suffer, (b) the Company’s current plans and operations may be

disrupted, (c) the Company’s ability to retain or recruit key

employees may be adversely affected, (d) the Company’s business

relationships (including, customers, data providers, and other

suppliers) may be adversely affected, or (e) time and attention of

Company personnel may be diverted from other important matters; (4)

the effect of limitations that the Purchase Agreement places on the

Company’s ability to operate its business during the pendency of

the Transactions; (5) the nature, cost and outcome of any

litigation and other legal proceedings; (6) the risk that the

Transactions may involve unexpected costs, liabilities or delays;

(7) other economic, business, competitive, legal, regulatory,

and/or tax factors; (8) the Company’s future financial results and

any further delay in the filing of required periodic reports, and

(9) the other risk factors affecting the Company described under

“Risk Factors” in the Company’s Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. Moreover, the Company operates in a

very competitive and rapidly changing environment. New risks and

uncertainties emerge from time to time and it is not possible for

the Company to predict all risks and uncertainties that could have

an impact on the forward-looking statements contained in this press

release. The Company cannot assure you that the results, events,

and circumstances reflected in the forward-looking statements will

be achieved or occur, and actual results, events, or circumstances

could differ materially from those described in the forward-looking

statements.

Neither the Company nor any other person assumes responsibility

for the accuracy and completeness of any of these forward-looking

statements. Moreover, the forward-looking statements made in this

press release relate only to expectations as of the date on which

the statements are made. The Company undertakes no obligation to

update any forward-looking statements made in this press release to

reflect events or circumstances after the date of this press

release or to reflect new information or the occurrence of

unanticipated events, except as required by law. The Company may

not actually achieve the plans, intentions or expectations

disclosed in the forward-looking statements and you should not

place undue reliance on the forward-looking statements.

About Spire Global, Inc.

Spire (NYSE: SPIR) is a global provider of space-based data,

analytics and space services, offering unique datasets and powerful

insights about Earth so that organizations can make decisions with

confidence in a rapidly changing world. Spire builds, owns, and

operates a fully deployed satellite constellation that observes the

Earth in real time using radio frequency technology. The data

acquired by Spire’s satellites provides global weather

intelligence, ship and plane movements, and spoofing and jamming

detection to better predict how their patterns impact economies,

global security, business operations and the environment. Spire

also offers Space as a Service solutions that empower customers to

leverage its established infrastructure to put their business in

space. Spire has nine offices across the U.S., Canada, UK,

Luxembourg, Germany and Singapore. To learn more, visit

spire.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112273569/en/

For Media: Kristina Spychalski Head of Communications

Kristina.Spychalski@spire.com

For Investors: Benjamin Hackman Head of Investor

Relations Benjamin.Hackman@spire.com

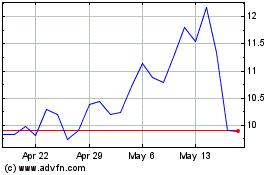

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Oct 2024 to Nov 2024

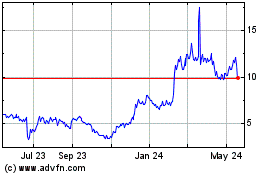

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Nov 2023 to Nov 2024