As filed with the Securities and Exchange Commission

on July 12, 2024

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Tencent Music Entertainment Group

(Exact name of registrant as specified in its charter)

| |

|

|

| Cayman Islands |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Unit

3, Building D, Kexing Science Park,

Kejizhongsan Avenue, Hi-tech Park, Nanshan District

Shenzhen, 518057, the People’s Republic of China

+86-755-8601-3388

(Address, Including Zip

Code, and Telephone Number, Including Area Code, of registrant’s Principal Executive Offices)

2024 Share Incentive Plan

(Full title of the plan)

Cogency

Global Inc.

122 East

42nd Street, 18th Floor

New York,

NY 10168

(800) 221-0102

(Name, address and telephone number, including

area code, of agent for service)

Copies to:

| |

|

|

|

Zhu Liang

Chief Executive Officer

Tencent Music Entertainment Group

Unit 3, Building

D, Kexing Science Park,

Kejizhongsan Avenue, Hi-tech Park

Nanshan District,

Shenzhen, 518057

the People’s

Republic of China

+86-755-8601-3388 |

|

Li He, Esq.

Davis Polk & Wardwell LLP

c/o 18th Floor, The Hong Kong Club building,

3A

Chater Road, Central

Hong Kong

+852 2533-3300 |

| |

|

|

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☒ |

Accelerated filer ☐ |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

ITEM 1. PLAN INFORMATION*

ITEM 2. REGISTRANT INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION*

* Information required by Part I to be contained in the Section 10(a)

prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act and the Note to Part I of

Form S-8. The documents containing information specified in this Part I will be separately provided to the participants in the Plan covered

by this Registration Statement, as specified by Rule 428(b)(1) under the Securities Act.

PART II

INFORMATION REQUIRED IN

THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE

The following documents previously filed with

the Securities and Exchange Commission (the “Commission”) by the Registrant are incorporated herein by reference.

(1) The

Registrant’s annual report on Form 20-F for the fiscal year ended December 31, 2023 filed on April 18, 2024 pursuant to Section

13(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and

(2) The

description of the Registrant’s Class A ordinary shares contained in the Registrant’s registration statement on Form 8-A

under the Exchange Act filed on December 3, 2018, as modified by any amendment or report filed for the purpose of updating such description

(Exchange Act File No. 001-38751).

All documents subsequently filed by the Registrant

pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates

that all securities offered have been sold, or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference herein and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein, or in any other subsequently filed document which also is incorporated or deemed to be

incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this Registration Statement.

ITEM 4. DESCRIPTION OF SECURITIES

Not applicable.

ITEM 5. INTEREST OF NAMED EXPERTS AND COUNSEL

Not applicable.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Cayman Islands law does not limit the extent to

which a company’s articles of association may provide for indemnification of officers and directors, except to the extent any such

provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud

or the consequences or committing a crime. The Registrant’s seventh amended and restated memorandum and articles of association

provide for indemnification of officers and directors

against all actions, proceedings, costs, charges, expenses, losses, damages or liabilities incurred or sustained by such officers and

directors, other than by reason of such directors or officers’ own dishonesty, willful default or fraud as determined by a court

of competent jurisdiction, in or about the conduct of the Registrant’s business or affairs (including as a result of any mistake

of judgement) or in the execution or discharge of his duties, powers, authorities or discretions, including without prejudice to the generality

of the foregoing, any costs, expenses, losses or liabilities incurred by such directors or officers in defending (whether successfully

or otherwise) any civil proceedings concerning the Registrant or its affairs in any court whether in the Cayman Islands or elsewhere.

Pursuant to the indemnification agreements, the

form of which was filed as Exhibit 10.1 to the Registrant’s registration statement on Form F-1, as amended (File No. 333-227656),

the Registrant has agreed to indemnify its directors and officers against, to the fullest extent permitted by applicable law, any and

all expenses and liabilities actually and reasonably incurred by reason of such director’s or officer’s corporate status.

The Registrant maintains standard policies of

insurance under which coverage is provided (a) to its directors and officers against loss arising from claims made by reason of breach

of duty or other wrongful act and (b) to the Registrant with respect to payments which may be made by the Registrant to such officers

and directors pursuant to the above indemnification provision or otherwise as a matter of law.

ITEM 7. EXEMPTION FROM REGISTRATION CLAIMED

Not applicable.

ITEM 8. EXHIBITS

The Exhibits listed on the accompanying Exhibit Index

are filed as a part of, or incorporated by reference into, this Registration Statement (See Exhibit Index below).

ITEM 9. UNDERTAKINGS

(a) The undersigned

Registrant hereby undertakes:

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in the Registration Statement; and |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement

or any material change to such information in the Registration Statement; |

provided, however, that paragraphs (a)(1)(i) and

(a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained

in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of

the Exchange Act that are incorporated by reference in the Registration Statement.

| (2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

(b) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated

by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a

claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director,

officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

EXHIBIT INDEX

Signatures

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and

has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the PRC, on July

12, 2024.

| |

Tencent Music Entertainment Group |

| |

|

|

| |

By: |

/s/ Zhu Liang |

| |

Name: |

Zhu Liang |

| |

Title: |

Chief Executive Officer |

POWER OF ATTORNEY

Each person whose signature appears below constitutes

and appoints Cussion Kar Shun Pang and Zhu Liang, and each of them acting individually and without the other, as his or her true and lawful attorneys-in-fact

and agents, with full power of substitution and re-substitution, for him or her and in his or her name, place, and stead, in any and all

capacities, to sign any and all amendments (including post-effective amendments, exhibits thereto and other documents in connection therewith)

to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the

Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every

act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or

could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them individually, or their

or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed by the following persons in the capacities indicated on July 12, 2024.

| |

|

| Signature |

Title |

| |

|

|

/s/ Cussion Kar Shun Pang |

|

| Name: Cussion Kar Shun Pang |

Executive Chairman |

| |

|

|

/s/ Zhu

Liang |

|

| Name: Zhu Liang |

Chief Executive Officer, Director |

| |

(principal executive officer) |

|

/s/ Min Hu |

|

| Name: Min Hu |

Chief Financial Officer, Director |

| |

(principal financial and accounting officer) |

|

/s/ James Gordon Mitchell |

|

| Name: James Gordon Mitchell |

Director |

| |

|

|

/s/ Brent

Richard Irvin |

|

| Name: Brent Richard Irvin |

Director |

| |

|

|

/s/ Matthew

Yun Ming Cheng |

|

| Name: Matthew Yun Ming Cheng |

Director |

| |

|

|

/s/ Edith Manling Ngan |

|

| Name: Edith Manling Ngan |

Independent Director |

| |

|

|

/s/ Adrian Yau Kee Mak |

|

| Name: Adrian Yau Kee Mak |

Independent Director |

| |

|

|

/s/ Jeanette Kim Yum Chan |

|

| Name: Jeanette Kim Yum Chan |

Independent Director |

SIGNATURE OF AUTHORIZED

REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities

Act of 1933, the undersigned, the duly authorized representative in the United States of Tencent Music Entertainment Group, has signed

this registration statement or amendment thereto in New York on July 12, 2024.

| |

Authorized U.S. Representative |

| |

|

|

| |

By: |

/s/ Colleen A. De Vries |

| |

|

Name: |

Colleen A. De Vries |

| |

|

Title: |

Senior Vice President |

Exhibit 5.1

Ref: KKZ/801545-000002/29745396v3

Tencent Music Entertainment Group

PO Box 309, Ugland House

Grand Cayman KY1-1104

Cayman Islands

12 July 2024

Dear Sir or Madam

Tencent Music Entertainment Group (the "Company")

We have acted as Cayman Islands legal counsel to

the Company in connection with a registration statement on Form S-8 to be filed with the Securities and Exchange Commission (the "Commission")

on 12 July 2024 (the "Registration Statement") relating to the registration under the United States Securities Act of

1933, as amended, (the "Securities Act") of 228,775,377 Class A ordinary shares, par value US$0.000083 per share (the

"Shares"), issuable by the Company pursuant to the Company's 2024 Share Incentive Plan (the "Plan").

For the purposes of giving this opinion, we have

examined copies of the Registration Statement and the Plan. We have also reviewed copies of the seventh amended and restated memorandum

and articles of association of the Company adopted by special resolution passed on 30 December 2022 (the "Memorandum and Articles")

and the written resolutions of the board of directors of the Company dated 26 April 2024 (the "Resolutions").

Based upon, and subject to, the assumptions and

qualifications set out below, and having regard to such legal considerations as we deem relevant, we are of the opinion that:

| 1. | The Shares to be issued by the Company and registered under the Registration Statement have been duly

and validly authorized. |

| 2. | When issued and paid for in accordance with the terms of the Plan and in accordance with the Resolutions,

and when appropriate entries are made in the register of members (shareholders) of the Company, the Shares will be validly issued, fully

paid and non-assessable. |

In this opinion letter, the phrase "non-assessable"

means, with respect to the issuance of Shares, that a shareholder shall not, in respect of the relevant Shares, have any obligation to

make further contributions to the Company's assets (except in exceptional circumstances, such as involving fraud, the establishment of

an agency relationship or an illegal or improper purpose or other circumstances in which a court may be prepared to pierce or lift the

corporate veil).

These opinions are subject to the qualification

that under the Companies Act (As Revised) of the Cayman Islands (the "Companies Act"), the register of members of a Cayman

Islands company is by statute regarded as prima facie evidence of any matters which the Companies Act directs or authorises to

be inserted therein. A third party interest in the shares in question would not appear. An entry in the register of members may yield

to a court order for rectification (for example, in the event of fraud or manifest error).

These opinions are given only as to, and based

on, circumstances and matters of fact existing and known to us on the date of this opinion letter. These opinions only relate to the laws

of the Cayman Islands which are in force on the date of this opinion letter. We express no opinion as to the meaning, validity or effect

of any references to foreign (i.e. non-Cayman Islands) statutes, rules, regulations, codes, judicial authority or any other promulgations.

We have also relied upon the assumptions, which

we have not independently verified, that (a) all signatures, initials and seals are genuine, (b) copies of documents, conformed copies

or drafts of documents provided to us are true and complete copies of, or in the final forms of, the originals, (c) where a document has

been provided to us in draft or undated form, it will be duly executed, dated and unconditionally delivered in the same form as the last

version provided to us, (d) the Memorandum and Articles remain in full force and effect and are unamended, (e) the Resolutions were duly

passed in the manner prescribed in the memorandum and articles effective at the time and have not been amended, varied or revoked in any

respect, (f) there is nothing under any law (other than the laws of the Cayman Islands) which would or might affect the opinions set out

above, and (g) upon the issue of any Shares, the Company will receive consideration which shall be equal to at least the par value of

such Shares.

We consent to the use of this opinion as an exhibit

to the Registration Statement and further consent to all references to us in the Registration Statement and any amendments thereto. In

giving such consent, we do not consider that we are “experts” within the meaning of such term as used in the Securities Act,

or the rules and regulations of the Commission issued thereunder, with respect to any part of the Registration Statement, including this

opinion as an exhibit or otherwise.

Yours faithfully

/s/ Maples and Calder (Hong Kong) LLP

Maples and Calder (Hong Kong) LLP

Exhibit 10.1

TENCENT MUSIC ENTERTAINMENT

GROUP

2024 SHARE INCENTIVE PLAN

TABLE OF CONTENTS

Page

| Section 1. Introduction. |

1 |

| Section 2. Definitions. |

1 |

| Section 3. Administration. |

5 |

| Section 4. General. |

7 |

| Section 5. Shares Subject to Plan and Share Limits. |

11 |

| Section 6. Terms and Conditions of Options. |

11 |

| Section 7. Terms and Conditions for Restricted Shares. |

12 |

| Section 8. Terms and Conditions of Restricted Share Units. |

13 |

| Section 9. Protection Against Dilution. |

14 |

| Section 10. Limitations on Rights. |

15 |

| Section 11. Withholding Taxes. |

16 |

| Section 12. Duration and Amendments. |

16 |

TENCENT MUSIC ENTERTAINMENT GROUP

2024 SHARE INCENTIVE PLAN

Section 1.

Introduction.

The purpose of the Plan is

to motivate and reward those employees and other individuals who are expected to contribute significantly to the success of the Company

to perform at the highest level and to further the best interests of the Company and its shareholders.

The Plan seeks to achieve

this purpose by providing for discretionary long-term incentive Awards (as defined below) in the form of Options, Restricted Shares, Restricted

Share Units or any other type of awards as determined by the Committee (as defined below) from time to time.

The Plan shall be governed

by, and construed in accordance with, Cayman Islands law (except its choice-of-law provisions). Sections 8 and 19(3) of the Electronic

Transactions Act shall not apply. Capitalized terms shall have the meaning provided in Section

2 unless otherwise provided in this Plan or any related Award Agreement.

Section 2.

Definitions.

(a)

“Affiliate” means any entity other than a Subsidiary, if the Company and/or one or more Subsidiaries own not

less than 50% of such entity in the aggregate.

(b)

“Applicable Laws” means all applicable laws, rules, regulations and requirements relating to the administration

of share plans, including, but not limited to, all applicable Cayman Islands laws, the laws of the People’s Republic of China, U.S.

federal and state laws, the rules and regulations of any stock exchange or quotation system on which the Ordinary Shares (or securities

representing the Ordinary Shares) are listed or quoted, and the applicable laws, rules, regulations or requirements of any foreign country

or jurisdiction where Awards are, or will be, granted under the Plan or where Participants reside or provide services, as such laws, rules,

regulations and requirements shall be in place from time to time.

(c)

“Award” means an Option, Restricted Share, Restricted Share Unit or any other type of awards as determined by

the Committee from time to time.

(d)

“Award Agreement” means any Share Option Agreement, Restricted Share Agreement, Restricted Share Unit Agreement

or such other agreement pursuant to which Awards are granted to Participants.

(e)

“Board” means the Board of Directors of the Company, as constituted from time to time.

(f)

“Cashless Exercise” means, to the extent that a Share Option Agreement so provides and as permitted by Applicable

Laws, a program approved by the Committee in which payment of the aggregate Exercise Price and/or satisfaction of any applicable tax withholding

obligations may be made all or in part by delivery (on a form prescribed by the Committee) of an

irrevocable direction to a securities broker to

sell Shares subject to an Option and to deliver all or part of the sale proceeds to the Company.

(g)

“Cause” means, with respect to any Participant, except as may otherwise be provided in a Participant’s

employment, non-compete or similar agreement or the Award Agreement, (i) Participant’s willful failure to perform his or her duties

and responsibilities to the Company; (ii) incompetence or negligence in the performance of his duties, or material violation of a written

Company policy; (iii) Participant’s commission of any act of fraud, embezzlement, dishonesty or serious misconduct, whether or

not in connection with his employment; (iv) willful disobedience or non-compliance with the terms of his employment, agency or consultancy

contract with the Company or any lawful orders or instructions given by the Company, or any other willful misconduct that has caused

or is reasonably expected to result in material injury to the Company; (v) unauthorized use or disclosure by the Participant of any proprietary

information or trade secrets of the Company or any other party to whom the Participant owes an obligation of nondisclosure as a result

of his or her relationship with the Company; (vi) Participant’s willful breach of any of his or her obligations under any written

agreement or covenant with the Company; (vii) Participant’s nonpayment of an obligation to the Company; (viii) Participant’s

breach of fiduciary duty or deliberate disregard of Company rules resulting in loss, damage or injury to the Company;

(h)

“Change of Control” means the consummation of any of the following transactions:

(i)

The sale of all or substantially all of the Company’s assets;

(ii)

The merger of the Company with or into another corporation in which securities possessing more than 50% of the total combined voting

power of the Company are transferred to a person or persons different from the persons holding those securities immediately prior to such

transaction; or

(iii) The acquisition, directly or indirectly, by any person or related group of persons (other than the Company or a person that directly

or indirectly controls, is controlled by,

or is under common control with, the Company)

of beneficial ownership (within the meaning of Rule 13d-3 of the Exchange Act) of securities of the Company representing more than 50%

of the total combined voting power of the Company’s then outstanding securities. For purposes of this paragraph, the term “person”

shall not include: (1) a trustee of other fiduciary holding securities under an employee benefit plan of the Company, a Subsidiary or

an Affiliate; or

A transaction shall not constitute a Change of Control if its sole

purpose is to change the place of the Company’s incorporation or to create a holding company that will be owned in substantially

the same proportions by the persons who held the Company’s securities immediately before such transactions.

(i)

“Committee” means a committee described in Section

3.

(j)

“Company” means Tencent Music Entertainment Group, an exempted company incorporated under the laws of the Cayman

Islands.

(k)

“Consultant” means an individual who provides bona fide services to the Company, a Parent, a Subsidiary or an

Affiliate, other than as an Employee or Director.

(l)

“Director” means a member of the Board.

(m)

“Disability” means that the Participant is classified as disabled under the long-term disability policy of the

Company or, if no such policy applies, the Participant is unable to engage in any substantial gainful activity by reason of any medically

determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for

a continuous period of not less than 12 months.

(n) “Effective Date” means 29 May 2024, the date on which the Plan is adopted by the Board and approved by Tencent

Holdings Limited or a Parent.

(o)

“Electronic Transaction Act” means the Electronic Transactions Act (As Revised) of the Cayman Islands.

(p)

“Employee” means any individual who is an employee of the Company, a Parent, a Subsidiary or an Affiliate (with

the status of employment determined based upon such factors as are deemed appropriate by the Committee in its discretion, subject to Applicable

Laws).

(q)

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

(r)

“Exercise Price” means, in the case of an Option, the amount for which a Share may be purchased upon exercise

of such Option, as specified in the applicable Share Option Agreement.

(s)

“Fair Market Value” means, unless otherwise determined in good faith by the Committee, the closing sales price

for such Shares as quoted on New York Stock Exchange or such other national exchange or system on such date; provided that if the

Shares are admitted to

quotation or are regularly quoted by a recognized

securities dealer but selling prices are not reported on the date in question, then the Fair Market Value shall be equal to the mean between

the bid and asked prices of the Shares reported for such date. Such determination shall be conclusive and binding on all persons.

(t)

“Grant Date” means the grant effective date of an Award.

(u)

“Option” means an option granted under the Plan entitling the Optionee to purchase Shares.

(v)

“Optionee” means an individual, estate or other entity that holds an Option.

(w)

“Ordinary Shares” means the Company’s Class A ordinary shares of a par value of US$0.000083 each, as adjusted

in accordance with the provisions of this Plan.

(x)

“Parent” means any corporation (other than the Company) in an unbroken chain of corporations ending with the

Company, if each of the corporations other than the Company owns share possessing 50% or more of the total combined voting power of all

classes of shares in one of the other corporations in such chain. A corporation that attains the status of a Parent on a date after the

adoption of the Plan shall be considered a Parent commencing as of such date.

(y)

“Participant” means an Employee, Director or Consultant who has been selected by the Committee to receive an

Award under the Plan to the extent permitted under applicable laws and regulation and the rules of the stock exchange(s) on which the

Company’s securities are listed.

(z)

“Plan” means this Tencent Music Entertainment Group 2024 Share Incentive Plan, as it may be amended from time

to time.

(aa)

“Restricted Share” means a Share subject to restrictions and certain other conditions (as applicable) pursuant

to the Plan or a Participant’s Restricted Share Agreement.

(bb)

“Restricted Share Agreement” means the agreement described in Section 8 evidencing a Restricted Share.

(cc)

“Restricted Share Unit” means a bookkeeping entry representing the equivalent of one Share awarded under the

Plan.

(dd)

“Restricted Share Unit Agreement” means the agreement described in Section 8 evidencing a Restricted Share Unit.

(ee)

“SEC” means the Securities and Exchange Commission.

(ff)

“Securities Act” means the Securities Act of 1933, as amended.

(gg)

“Service” means the service provided by an Employee, Director or Consultant as the case may be. A Participant’s

Service does not terminate if he or she is an Employee and goes on a bona fide leave of absence that was approved by the Company in writing

and the terms of the

leave provide for continued service crediting,

or when continued service crediting is required by Applicable Laws. Service terminates in any event when the approved leave ends, unless

such Employee immediately returns to active work. Further, unless otherwise determined by the Committee, a Participant’s Service

will not terminate merely because of a change in the capacity in which the Participant provides service to the Company, a Parent, Subsidiary

or Affiliate (including but are not limited to a situation in which a Consultant becoming an Employee or a Director), or a transfer between

entities (the Company or any Parent, Subsidiary, or Affiliate); provided that there is no interruption or other termination of

Service; or merely because of a change in the entity to which the Participant provides Services (be it the Company, a Parent, Subsidiary

or Affiliate);

(hh)

“Share” means one Ordinary Share.

(ii)

“Share Option Agreement” means the agreement described in Section 6 evidencing an Option.

(jj)

“Subsidiary” means any corporation (other than the Company) (i) in an unbroken chain of corporations beginning

with the Company, if each of the corporations other than the last corporation in the unbroken chain owns shares possessing 50% or more

of the total combined voting power of all classes of shares in one of the other corporations in such chain; or (ii) that is a consolidated

variable interest entity with respect to which the Company, through certain contractual arrangements, is considered the primary beneficiary

of such entity for accounting purposes and is able to consolidate such entity’s operating results in the Company’s financial

statements under International Financial Reporting Standards or other applicable accounting standards. A corporation that attains the

status of a Subsidiary on a date after the adoption of the Plan shall be considered a Subsidiary commencing as of such date.

For the purpose of this Plan,

an Award is considered "outstanding" as of a given date if it has been granted but has not yet been exercised (or, in the event

of Restricted Share Units or Restricted Shares, vested) or forfeited, cancelled, expired or lapsed as of that date; the determination

of whether an Award is outstanding shall be made by the Committee. Such determination shall be final, conclusive and binding upon all

parties, including the Company and Participants and any nominees or beneficiaries thereof.

Section 3.

Administration.

(a)

Committee Composition. The Company’s Compensation Committee (the “Committee”) shall administer

the Plan, unless otherwise determined by the Board. The Board may also at any time terminate the functions of the Committee and reassume

all powers and authority previously delegated to the Committee.

(b)

Authority of the Committee. Subject to the provisions of the Plan and Applicable Laws, the Committee shall have the full

authority, in its sole discretion, to take any actions it deems necessary or advisable for the administration of the Plan. Such actions

shall include without limitation to:

(i)

selecting Participants who are to receive Awards under the Plan;

(ii)

determining the Fair Market Value;

(iii)

determining the type, number, Grant Date, vesting requirements and other features and conditions of Awards;

(iv)

approving the forms of agreements to be used under the Plan;

(v)

amending any outstanding Awards;

(vi)

accelerating the vesting, or extending the post-termination exercise term, of Awards at any time and under such terms and conditions

as it deems appropriate;

(vii)

interpreting the Plan and any Award Agreement;

(viii) correcting any defect, supplying any omission or reconciling any inconsistency in the Plan or any Award Agreement;

(ix)

adopting such rules or guidelines as it deems appropriate to implement the Plan and any Award Agreement;

(x)

authorizing any person to execute on behalf of the Company any instrument required to effect the grant of an Award previously authorized

by the Committee;

(xi)

making all other decisions relating to the operation of the Plan; and

(xii)

adopting such plans or subplans as may be deemed necessary or appropriate to comply with the laws of certain jurisdictions, allow

for tax-preferred treatment of the Awards or otherwise provide for the participation by Participants who reside in such jurisdictions.

To the extent permitted by Applicable Laws, the

Committee may delegate to one or more officers of the Company or to another committee of the Board (which may consist of solely one member

of the Board) the authority to grant all types of Awards or take one or more of the actions set forth above in accordance with the Plan

and Applicable Laws.

The Committee’s determinations under the

Plan shall be final, conclusive and binding upon all parties, including the Company and Participants and any nominees or beneficiaries

thereof.

(c)

Indemnification. To the maximum extent permitted by Applicable Laws, each member of the Committee, the delegated officer(s)

or each member of other committee as described under Section 3 (b) shall be indemnified and held harmless by the Company against and

from (i) any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by him or her in connection with or resulting

from any claim, action, suit, or proceeding to which he or she may be a party or in which he or she may be involved by reason of any

action taken or failure to act under the Plan or any Award Agreement, and (ii) from any and all amounts paid by him or her in settlement

thereof, with the Company’s approval, or paid by him or her in satisfaction of any judgment in any such claim, action, suit, or

proceeding against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the

same before he or she undertakes to handle and defend it on his or her own behalf. The foregoing right

of indemnification shall not be exclusive of any

other rights of indemnification to which such persons may be entitled by contract, as a matter of law, or otherwise, or under any power

that the Company may have to indemnify them or hold them harmless.

Section 4.

General.

(a)

General Eligibility. Only Employees, Directors and Consultants shall be eligible to participate in the Plan.

(b)

Restrictions on Shares. Any Shares issued pursuant to an Award shall be subject to such rights of repurchase, rights of

first refusal and other transfer restrictions as the Committee may determine, in its sole discretion. Such restrictions shall apply in

addition to any restrictions that may apply to holders of Shares generally and shall also comply to the extent necessary with Applicable

Laws. In no event shall the Company be required to issue fractional Shares under this Plan.

(c)

Beneficiaries. Unless stated otherwise in an Award Agreement and then only to the extent permitted by and enforceable under

Applicable Laws, a Participant may designate one or more beneficiaries with respect to an Award by timely filing the prescribed form with

the Company (or the Company’s designee). A beneficiary designation may be changed by filing the prescribed form with the Company

(or the Company’s designee) at any time before the Participant’s death. If no beneficiary was designated or if no designated

beneficiary survives the Participant, then after a Participant’s death any vested Award(s) shall be transferred or distributed to

the Participant’s estate or to such other person as the Company may designate.

(d)

No Rights as a Shareholder. A Participant, or a transferee or beneficiary of a Participant, shall have no rights as a shareholder

with respect to any Ordinary Shares covered by an Award until such person has satisfied all of the terms and conditions to receive such

Ordinary Shares, has satisfied any applicable withholding or tax obligations relating to the Award and the Shares have been issued (as

evidenced by an appropriate entry on the register of members of the Company).

(e)

Termination of Service. The Committee may provide, by rule or regulation or in any Award Agreement, or may determine in

any individual case, the circumstances in which, and the extent to which, an Award may be vested, exercised, settled, paid or forfeited,

in the event of a Participant’s termination of Service with the Company, a Parent, a Subsidiary or an Affiliate prior to the vest,

exercise or settlement of such award. Subject to the other terms of this Plan, unless the applicable Award Agreement or the applicable

employment agreement provides otherwise, the following rules shall govern the vesting, exercisability and term of outstanding Awards

held by a Participant in the event of termination of such Participant’s Service: (i) upon termination of Service for any reason

(for Cause or otherwise), regardless of whether such termination is the Participant’s voluntary choice or not, the unvested portions

of any outstanding Awards shall be immediately forfeited without consideration with effect from the date on which such Participant’s

Service is terminated; (ii) if Service is terminated for Cause, then all outstanding Awards shall terminate and be forfeited immediately

without consideration with effect from the date on which such Participant’s Service is terminated; (iii) if Service is terminated

for any reason other than for Cause, death or Disability, then the vested portion of the Participant’s Awards shall

still be held by such Participant or his or her

personal representative (to the extent not forfeited, cancelled, expired or lapsed as of the date of such termination) , and any vested

Options shall lapse automatically and not be exercisable (to the extent not already exercised) unless such vested Options are exercised

by the Participant (or his or her personal representative) within three months starting from the date of such termination; and (iv) if

Service is terminated due to death or Disability, the vested portion of the Participant’s Awards shall still be held by such Participant

or his or her personal representative (to the extent not forfeited, cancelled, expired or lapsed as of the date of such termination),

and any vested Options shall lapse automatically and not be exercisable (to the extent not already exercised) unless such vested Options

are exercised by the Participant (or his or her personal representative) within twelve (12) months starting from the date of such termination;

notwithstanding anything to the contrary and for the avoidance of doubt, in the event that a Participant becomes a Defective Participant

as described under Section 4(h) or is subject to any investigation or administrative or judicial proceedings by any authorities or any

of the Company’s internal investigation and thus may have the potential to become a Defective Participant, regardless of whether

his or her Service remains unterminated, the Committee, the delegated officer(s) or other committee as described under Section 3 (b)

shall have the power to suspend the vesting of any outstanding Awards granted to such Participant, and/or freeze personal Award management

account of such Participant, and/or take any such actions as it deems appropriate to administer the Plan, without the approval of such

Participant.

(f)

Change of Control.

(i)

In the event that the Company is a party to a Change of Control, outstanding Awards shall be subject to the applicable agreement

of merger or reorganization. Such agreement may provide, without limitation, for the assumption of outstanding Awards by the surviving

corporation or its parent, for their continuation by the Company (if the Company is a surviving corporation), for accelerated vesting

or for their cancellation with or without consideration, in all cases without the consent of the Participant.

(ii)

The Committee may also set forth the treatment of such Awards upon a Change of Control in the applicable Award Agreement. Except

as otherwise provided in the applicable Award Agreement, upon a Change of Control, a merger or consolidation involving the Company or

any other event with respect to which the Committee deems it appropriate, the Committee may cause any Award to be canceled in consideration

of (i) the full acceleration of such Award and either (A) a period of at least ten days prior to the effective date of such Change of

Control to exercise the Award or (B) a payment in cash or other consideration to the Participant who holds such Award in an amount equal

to the Intrinsic Value of such award (which may be equal to but not less than zero), which, if in excess of zero, shall be payable upon

the effective date of such Change of Control, merger, consolidation or other event or (ii) a substitute award (which immediately upon

grant shall have an Intrinsic Value equal to the Intrinsic Value of such award); as used in this section, “Intrinsic Value”

means (i) the excess, if any, of the price or implied price per Share in a Change of Control or other event over (ii) the exercise or

hurdle price of such Award multiplied by (iii) the number of Shares covered by such Award.

(iii)

Notwithstanding the foregoing, the Committee may determine, at the time of grant of an Award or thereafter, that such Award shall

become vested and exercisable, in full or in part, in the event that the Company is a party to a Change of Control.

(iv)

To the extent not previously exercised or settled, Award shall terminate immediately prior to the dissolution or liquidation of

the Company.

(g)

Lapse of Awards. An outstanding Award shall lapse automatically and, in the event of Options, not be exercisable (to the

extent not already exercised), and any unvested Awards will not vest on the relevant vesting date and any Reference Amount (as defined

below) paid by the Company in respect of the relevant Awards shall be returned to the Company immediately, in any of the following events;

provided that, all vested Awards can still be held by or transferred to such holder, if so determined by the Committee (as used

in this Plan, “Reference Amount” refers to the amount paid from the Company’s resources or any Subsidiary’s

or Affiliate’s resources into a designated account for the purchase and/or subscription of Shares for the purposes of granting Awards

to eligible Participants, as determined by the Committee at any time at its discretion):

(i)

the expiry of the term of the Award as specified in the relevant Award Agreement;

(ii)

in the event of Options, the expiry of any of the exercise periods referred to in Section 3(e);

(iii)

the date on which, (i) where the Participant is an Employee, the Participant ceases to be an Employee by reason of Cause; or (ii)

where the Participant is any other individual who provides Services to the Company, a Parent, a Subsidiary or an Affiliate, and is under

any contract with the Company, a Parent, a Subsidiary or an Affiliate, such contract is terminated by reason of breach of contract on

the part of such individual; or (iii) where the Participant is any other individual who provides Services to the Company, a Parent, a

Subsidiary or an Affiliate, the Participant appears either to be unable to pay or have no reasonable prospect to be able to pay debts,

or has become insolvent, or has made any arrangement (including a voluntary arrangement) or composition with his creditors generally,

or ceases or threatens to cease to carry on his business, or is bankrupted, or has been convicted of any criminal offence involving integrity

or honesty;

(iv)

in the event that prior to or on the vesting of any Awards, the holder of such Awards ceases to be an eligible Participant pursuant

to the terms of this Plan;

(v)

the holder of such Awards is found to be a person who is resident in a place where the award of such Awards and/or the vesting

of such Awards pursuant to the terms of this Plan is not permitted under the laws and regulations of such place or where in the view of

the Committee, compliance with applicable laws and regulations in such place makes it necessary or expedient to exclude such holder;

(vi)

an order for the winding-up of the Company is made or a resolution is passed for the voluntary winding-up of the Company (otherwise

than for the purposes of, and followed by, an amalgamation or reconstruction in such circumstances that

substantially the whole of the undertaking,

assets and liabilities of the Company pass to a successor company);

(vii)

the date of consummation of the winding-up, dissolution or liquidation of the Company;

(viii)

the date on which the Participant commits a breach of Section 4(h); or

(ix)

the date on which certain circumstances as provided in the related Award Agreement or otherwise agreed upon between the Company

and the Participant are satisfied.

(h)

Defective Participants. In the event that prior to or on the vesting of any Awards, (i) the holder of such Awards has breached

any provisions of any non-competition agreement or deed entered into between the Company on the one hand and such holder on the other

hand or any other relevant non-compete undertaking; (ii) the holder of such Awards has violated any relevant policy(ies) of the Company;

or (iii) there occur any other event(s) which could be detrimental to the interest of the Company or its shareholders, as determined by

the Committee, the following shall take place:

(i)

the Awards granted to such holder will automatically lapse forthwith, accordingly the unvested Awards will not vest on the relevant

vesting date;

(ii)

any Shares underlying any Awards that have vested but not yet transferred to such holder (as evidenced by an appropriate entry

on the books of the Company or a duly authorized transfer agent of the Company) will no longer be transferred to such holder and will

be returned to the Company;

(iii)

any Reference Amount paid by the Company in respect of the relevant Awards will be returned to the Company immediately; and

(iv)

such holder shall be held by the Company to account for any proceeds arising out of dealing in any Shares underlying the relevant

Awards that have been or to be transferred to such holder.

as

used in this section, the term “Company” shall include any Subsidiary, Parent, Affiliate, or ay successor thereto,

if appropriate.

(i)

Restrictive Covenants; Violation of Non-Competition and Confidentiality Obligation. The Committee may impose restrictions

on any Award with respect to non-competition, confidentiality and any other events that it considers to be detrimental to the Company

and impose other restrictive covenants as it deems necessary or appropriate in its sole discretion. In the event that these restrictions

are breached, the Committee may request the grantees to return all benefits made available to them under the Plan and such grantees shall

cease to be entitled to potential benefits intended to be made available to them under the Plan. Without prejudice to the generality to

the foregoing, subject to the other terms of this Plan, if a Participant breaches any obligations in relation to non-competition, confidentiality

and any other events that is considered

to be detrimental to the Company under any written

agreement or covenant with the Company before or/and after his/her termination of service, then all Awards shall terminate and be forfeited

immediately without consideration, and the Committee may, in its sole discretion, require all shares and rights benefits and interests

of the Shares in relation to the Awards (including any exercised Options) shall be surrendered to the Company without consideration. For

avoidance of any doubt, as used in this section, the term “Company” shall include any Subsidiary, Parent, Affiliate,

or ay successor thereto, if appropriate.

Section 5.

Shares Subject to Plan and Share Limits.

(a)

Basic Limitation. The maximum number of Shares available for issuance under the Plan is 228,775,377. Awards lapsed or forfeited

in accordance with the terms of this Plan will not be counted for the purpose of calculating the foregoing limit, subject to adjustment

pursuant to the provisions in this Plan.

(b)

Share Count. Shares issued pursuant to Awards will count against the Shares available for issuance under the Plan as one

(1) Share for every one (1) Share issued in connection with the Award. If Awards are settled in cash, the Shares that would have been

delivered had there been no cash settlement shall not be counted against the Shares available for issuance under the Plan. If Awards are

forfeited or are terminated for any reason before vesting or being exercised, then the Shares underlying such Awards shall again become

available for Awards under the Plan.

Section 6.

Terms and Conditions of Options.

(a)

Share Option Agreement. Each Option granted under the Plan shall be evidenced and governed exclusively by a Share Option

Agreement between the Participant and the Company. Such Option shall be subject to all applicable terms and conditions of the Plan and

may be subject to any other terms and conditions that are not inconsistent with the Plan and that the Committee deems appropriate for

inclusion in a Share Option Agreement. The provisions of the various Share Option Agreements entered into under the Plan need not be identical.

(b)

Number of Shares. Each Share Option Agreement shall specify the number of Shares that are subject to the Option, which number

is subject to adjustment pursuant to the provisions in this Plan.

(c)

Exercise Price. Each Share Option Agreement shall specify the Option’s Exercise Price which shall be established by

the Committee at the time of grant; provided, however, that such Exercise Price of a Share shall be at least the higher of (i) the nominal

value of a Share; (ii) the Fair Market Value of a Share on the date of grant; and (iii) the average Fair Market Value of a Share for the

five business days immediately preceding the date of grant. Notwithstanding anything to the contrary contained herein, the Exercise Price

is subject to adjustment pursuant to the provisions in this Plan.

(d)

Exercisability and Term. Each Share Option Agreement shall specify the date when all or any installment of the Option is

to become exercisable and may include performance conditions. The Share Option Agreement shall also specify the maximum term of the Option;

provided that the maximum term of an Option shall in no event exceed ten (10) years from the Grant Date. A Share Option Agreement may

provide for accelerated vesting in the event of the

Participant’s death, Disability or other

events. Notwithstanding any other provision of the Plan or the Share Option Agreement, no Option can be exercised after the expiration

date provided in the applicable Share Option Agreement.

(e)

Method of Exercise. An Option may be exercised, in whole or in part, by giving written notice of exercise to the Company

(or, subject to Applicable Laws and if the Company permits, by electronic or voice methods) of the number of Shares to be purchased. Such

notice shall be accompanied by payment in full of the aggregate Exercise Price, plus any required withholdings (unless satisfactory arrangements

have been made to satisfy such withholdings). The Company reserves the right to delay issuance of the Shares if such payments are not

satisfactory.

(f)

Payment for Option Shares. The Exercise Price of an Option shall be paid, at the time of exercise, in cash, by surrender

of Share, through Cashless Exercise or, or in such other form as provided for in the applicable Share Option Agreement to the extent permitted

by Applicable Laws, regulations and rules and approved by the Committee.

(g)

Modification or Assumption of Options. Within the limitations of the Plan, the Committee may modify, extend or assume outstanding

options (such as modification of Exercise Price) or may accept the cancellation of outstanding options (whether granted by the Company

or by another issuer) in return for the grant of new Options for the same or a different number of Shares and at the same or a different

Exercise Price.

(h)

Assignment or Transfer of Options. Except as otherwise provided in the applicable Share Option Agreement and then only to

the extent such transfer is otherwise permitted by Applicable Laws and is not a transfer for value (unless such transfer for value is

approved in advance by the Committee), no Option or interest therein shall be transferred, assigned, pledged or hypothecated by the Optionee

during his or her lifetime, whether by operation of law or otherwise, or be made subject to execution, attachment or similar process,

other than by will or by the laws of descent and distribution and an Option may be exercised during the lifetime of the Optionee only

or by the guardian or legal representative of the Optionee.

Section 7.

Terms and Conditions for Restricted Shares.

(a)

Time, Amount and Form of Awards. Awards under this Section 7 may be granted in the form of Restricted Shares.

(b)

Restricted Share Agreement. Each grant of Restricted Shares awarded under the Plan shall be evidenced and governed exclusively

by a Restricted Share Agreement between the Participant and the Company. Each grant of Restricted Shares shall be subject to all applicable

terms and conditions of the Plan and may be subject to any other terms and conditions that are not inconsistent with the Plan that the

Committee deems appropriate for inclusion in the applicable Restricted Share Agreement. The provisions of the Restricted Share Agreements

entered into under the Plan need not be identical.

(c)

Payment for Restricted Shares. Restricted Shares may be issued with or without cash consideration under the Plan, provided

that they are issued at a consideration equivalent to the value of not less than the par value of each Restricted Share; it being understood

that services rendered by the relevant Participant may constitute the foregoing consideration, provided that, as

determined by the Committee, the value of those

services is not less than the par value of any Restricted Share issued.

(d)

Vesting Conditions. The Committee shall determine the vesting schedule and conditions of each grant of Restricted Shares.

Vesting shall occur, in full or in installments, upon satisfaction of the conditions specified in the Restricted Share Agreement which

may include performance conditions. A Restricted Share Agreement may provide for accelerated vesting in the event of the Participant’s

death, Disability, or other events. Notwithstanding any other provisions of this Plan (but subject to Applicable Laws), the Committee

is at liberty to waive the vesting condition referred to in this section.

(e)

Assignment or Transfer of Restricted Shares. Except as otherwise provided in the applicable Restricted Share Agreement and

then only to the extent such transfer is otherwise permitted by Applicable Laws and is not a transfer for value (unless such transfer

for value is approved in advance by the Committee), no unvested Restricted Shares or interest therein shall be transferred, assigned,

pledged or hypothecated by the Participant during his or her lifetime, whether by operation of law or otherwise, or be made subject to

execution, attachment or similar process, other than by will or by the laws of descent and distribution.

(f)

Voting and Dividend Rights. Except as otherwise determined by the Committee or provided in the applicable Restricted Share

Agreement, the holder of Restricted Shares awarded under the Plan shall have the same voting, dividend and other rights as the Company’s

other shareholders. A Restricted Share Agreement may require that the holder of such Restricted Shares invest any cash dividends received

in additional Shares subject to the grant. Such additional Shares and any Shares received as a dividend pursuant to the Restricted Shares

shall be subject to the same conditions and restrictions as the grant of Restricted Shares with respect to which the dividends were paid.

Such additional Shares subject to the grant of Restricted Shares shall not reduce the number of Shares available for issuance under Section

5.

(g)

Modification or Assumption of Restricted Shares. Within the limitations of the Plan, the Committee may modify or assume

outstanding Restricted Shares or may accept the cancellation of outstanding Restricted Shares (including share granted by another issuer)

in return for the grant of new Restricted Shares for the same or a different number of Shares.

Section 8.

Terms and Conditions of Restricted Share Units.

(a)

Restricted Share Unit Agreement. Each Restricted Share Unit granted under the Plan shall be evidenced by a Restricted Share

Unit Agreement between the Participant and the Company. Such Restricted Share Units shall be subject to all applicable terms of the Plan

and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Restricted Share Unit Agreements

entered into under the Plan need not be identical.

(b)

Number of Shares. Each Restricted Share Unit Agreement shall specify the number of Shares to which the Restricted Share

Unit pertains, which number is subject to adjustment pursuant to the provisions in this Plan.

(c)

Payment for Restricted Share Units. To the extent that an Award is granted in the form of Restricted Share Units, no cash

consideration shall be required of the Award recipients

unless otherwise determined by the Committee or

as required in the relevant Award Agreement; provided that any Shares issued to the Participant pursuant to the vesting of any Restricted

Share Units shall be issued at a consideration equivalent to the value of not less than the par value of each such Share; it being understood

that services rendered by the Participant may constitute the foregoing consideration, provided that, as determined by the Committee, the

value of those services is not less than the par value of any Share issued.

(d)

Vesting Conditions. The Committee shall determine the vesting schedule of each Restricted Share Unit. Vesting shall occur,

in full or in installments, upon satisfaction of the conditions specified in the Restricted Share Unit Agreement which may include performance

conditions. A Restricted Share Unit Agreement may provide for accelerated vesting in the event of the Participant’s death, Disability,

or other events. Notwithstanding any other provisions of this Plan (but subject to Applicable Laws), the Committee is at liberty to waive

the vesting condition referred to in this section.

(e)

Form and Time of Settlement of Restricted Share Units. Settlement of vested Restricted Share Units may be made in the form

of (i) cash, (ii) Shares or (iii) any combination of both, as determined by the Committee at the time of the grant of the Restricted

Share Units, in its sole discretion. Vested Restricted Share Units may be settled in a lump sum or in installments. The distribution

of Restricted Share Units may occur or commence when the vesting conditions applicable to the Restricted Share Units have been satisfied

or have lapsed; such distribution may be deferred to any later date to allow for sufficient time for the execution of procedures as deemed

necessary by the Committee and to the extent permitted by Applicable Laws.

(f)

Voting and Dividend Rights. Restricted Share Units carry no voting rights or dividend rights.

(g)

Creditors’ Rights. A holder of Restricted Share Units shall have no rights other than those of a general creditor

of the Company. Restricted Share Units represent an unfunded and unsecured obligation of the Company, subject to the terms and conditions

of this Plan and the applicable Restricted Share Unit Agreement.

(h)

Modification or Assumption of Restricted Share Units. Within the limitations of the Plan, the Committee may modify or assume

outstanding Restricted Share Units or may accept the cancellation of outstanding restricted share units (including restricted share units

granted by another issuer) in return for the grant of new Restricted Share Units for the same or a different number of Shares.

(i)

Assignment or Transfer of Restricted Share Units. Except as otherwise provided in the applicable Restricted Share Unit Agreement

and then only to the extent such transfer is otherwise permitted by Applicable Laws and is not a transfer for value (unless such transfer

for value is approved in advance by the Committee), no Restricted Share Unit or interest therein shall be transferred, assigned, pledged

or hypothecated by the Participant during his or her lifetime, whether by operation of law or otherwise, or be made subject to execution,

attachment or similar process, other than by will or by the laws of descent and distribution.

Section 9.

Protection Against Dilution.

(a)

Adjustments. In the event of a subdivision of the issued and outstanding Shares, a declaration of a dividend payable in

Shares, a declaration of a dividend payable in a form other than Shares in an amount that has a material effect on the price of Shares,

a combination or consolidation of the issued and outstanding Shares (by reclassification or otherwise) into a lesser number of Shares,

a recapitalization, a spin-off or a similar occurrence, the Committee may make appropriate adjustments in one or more of:

(i)

the number of Shares and the kind of shares or securities available for future Awards under Section

5;

(ii)

the number of Shares and the kind of shares or securities covered by each outstanding Award; or

(iii)

the Exercise Price under each outstanding Option.

(b)

Participant Rights. Except as provided in this Section 9, a Participant shall have no rights by reason of any issue by the

Company of shares of any class or securities convertible into shares of any class, any subdivision or consolidation of shares of any class,

the payment of any share dividend or any other increase or decrease in the number of shares of any class. If by reason of an adjustment

pursuant to this Section 9 a Participant’s Award covers additional or different shares or securities, then such additional or different

shares and the Award in respect thereof shall be subject to all of the terms, conditions and restrictions which were applicable to the

Award and the Shares subject to the Award prior to such adjustment.

(c)

Fractional Shares. Any adjustment of Shares pursuant to this Section 9 shall be rounded down to the nearest whole number

of Shares. Under no circumstances shall the Company be required to authorize or issue fractional shares and no consideration shall be

provided as a result of any fractional shares not being issued or authorized.

Section 10.

Limitations on Rights.

(a)

Participant Rights. A Participant’s rights, if any, in respect of or in connection with any Award is derived solely

from the discretionary decision of the Company to permit the individual to participate in the Plan and to benefit from a discretionary

Award. By accepting an Award under the Plan, a Participant expressly acknowledges that there is no obligation on the part of the Company

to continue the Plan and/or grant any additional Awards. Any Award granted hereunder is not intended to be compensation of a continuing

or recurring nature, or part of a Participant’s normal or expected compensation, and in no way represents any portion of a Participant’s

salary, compensation, or other remuneration for purposes of pension benefits, severance, redundancy, resignation or any other purpose.

Neither the Plan nor any Award

granted under the Plan shall be deemed to give any individual a right to remain an employee, consultant or director of the Company, a

Parent, a Subsidiary or an Affiliate. The Company and its Parent, Subsidiaries and Affiliates reserve the right to terminate the Service

of any person at any time, and for any reason, subject to Applicable Laws, and any applicable written employment agreement (if any), and

such terminated person shall

be deemed irrevocably to have waived any claim

to damages or specific performance for breach of contract or dismissal, compensation for loss of office, tort or otherwise with respect

to the Plan or any Award that is forfeited and/or is terminated by its terms or to any future Award.

(b)

Shareholders’ Rights. a Participant shall have no dividend rights, voting rights or other rights as a shareholder

with respect to any Shares covered by his or her Award prior to the issuance of such Shares (as evidenced by an appropriate entry on the

register of members of the Company). No adjustment shall be made for cash dividends or other rights for which the record date is prior

to the date when such Shares are issued, except as expressly provided in Sections 9.

(c)

Regulatory Requirements. Notwithstanding any other provision of the Plan, the obligation of the Company to issue Shares

or other securities under the Plan shall be subject to all Applicable Laws and such approval by any regulatory body as may be required.

The Company reserves the right to restrict, in whole or in part, the issuance of Shares or delivery of other securities pursuant to any

Award prior to the satisfaction of all legal requirements relating to the issuance of such Shares or delivery of other securities, to

their registration, qualification or listing or to an exemption from registration, qualification or listing.

Section 11.

Withholding Taxes.

(a)

General. A Participant shall make arrangements satisfactory to the Company for the satisfaction of any withholding tax obligations

that arise in connection with his or her Award. The Company shall have the right to deduct from any amount payable under the Plan, including

issuance or transfer of Shares to be made pursuant to an Award granted under the Plan, all federal, state, city, local or foreign taxes

of any kind required by law to be withheld with respect to such payment and the Company may take any such actions as may be necessary

in the opinion of the Company to satisfy all obligations for the payment of such taxes. The Company shall not be required to issue any

Shares or make any cash payment under the Plan until such obligations are satisfied.

(b)

Share Withholding. The Committee may permit a Participant to satisfy all or part of his or her withholding or income tax

obligations by Cashless Exercise, by having the Company withhold all or a portion of any Shares that otherwise would be issued to him

or her or by surrendering all or a portion of any Shares that he or she previously acquired; provided that Shares withheld or previously

owned Shares that are tendered shall not exceed the amount necessary to satisfy the Company’s tax withholding obligations at the

minimum statutory withholding rates, including, but not limited to, the People’s Republic of China, U.S. federal and state income

taxes, payroll taxes and foreign taxes, if applicable, unless the previously owned Shares have been held for the minimum duration necessary

to avoid financial accounting charges under applicable accounting guidance or as otherwise permitted by the Committee in its sole and

absolute discretion. Any payment of taxes by assigning Shares to the Company may be subject to restrictions, including, but not limited

to, any restrictions required by rules of the SEC and/or the Hong Kong Stock Exchange. If any Shares are used to satisfy withholding taxes,

such Shares shall be valued based on the Fair Market Value thereof on the date when the withholding for taxes is required to be made.

Section 12.

Duration and Amendments.

(a)

Term of the Plan. The Plan shall terminate on the 10th anniversary of the date the plan becomes effective and

may be terminated on any earlier date pursuant to this Section 12.

(b)

Right to Amend or Terminate the Plan. The Board may amend or terminate the Plan at any time and for any reason. Any such

termination of the Plan, or any amendment thereof, shall not impair any Award previously granted under the Plan. No Awards shall be granted

under the Plan after the Plan’s termination. An amendment of the Plan shall be subject to the approval of the Company’s shareholders

only to the extent such approval is required by Applicable Laws, regulations or rules.

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in this Registration

Statement on Form S-8 of Tencent Music Entertainment Group of our report dated April 18, 2024

relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Tencent Music

Entertainment Group's Annual Report on Form 20-F for the year ended December 31, 2023.

/s/ PricewaterhouseCoopers Zhong Tian LLP

Shenzhen, the People’s Republic of China

July 12, 2024

EXHIBIT 107

Calculation of Filing Fee Table

FORM

S-8

(Form Type)

Tencent

Music Entertainment Group

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| Security Type |

Security

Class

Title(1) |

Fee

Calculation

Rule |

Amount

Registered(2) |

Proposed

Maximum

Offering Price

Per Unit |

Maximum

Aggregate

Offering Price |

Fee Rate |

Amount of

Registration Fee |

| Equity |

Class A ordinary shares, par value $0.000083 per share |

Rule 457(h) |

38,915,598 (3) |

$3.84 |

$149,435,896.32 |

$0.0001476 |

$22,056.74 |

| Equity |

Class A ordinary shares, par value $0.000083 per share |

Rule 457(c)

and (h) |

42,166,596 (4) |

$7.15 |

$301,491,161.40 |

$0.0001476 |

$44,500.10 |

| Equity |

Class A ordinary shares, par value $0.000083 per share |

Rule 457(c)

and (h) |

147,693,183 (5) |

$7.15 |

$1,056,006,258.45 |

$0.0001476 |

$155,866.52 |

| Total Offering Amounts |

|

|

|

$222,423.36 |

| Total Fees Previously Paid |

|

|

|

— |

| Total Fee Offsets |

|

|

|

— |

| Net Fee Due |

|

|

|

$222,423.36 |

(1) The Class A ordinary shares of Tencent Music Entertainment

Group (the “Registrant”) registered hereunder are represented by the Registrant’s American depositary shares (“ADSs”),

each representing two Class A ordinary shares, par value $0.000083 per share. The registrant’s ADSs issuable upon deposit of the

Class A ordinary shares have been registered under a separate registration statement on Form F-6 (333-228610).

(2) Represents Class A ordinary shares which are issuable

upon exercise of options and pursuant to other awards granted under the 2024 Share Incentive Plan (the “Plan”) of the Registrant.

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement is

deemed to cover an indeterminate number of Class A ordinary shares which may be offered and issued to prevent dilution resulting from

share splits, share dividends or similar transactions as provided in the Plan.

(3) Represents Class A ordinary shares which are issuable

upon the exercise of outstanding options previously granted under the Plan as of the date of this registration statement and the corresponding

proposed maximum offering price per share represents the weighted average of the exercise price of options which have been already granted

and are outstanding under the Plan.

(4) Represents outstanding restricted share units previously

granted under the Plan as of the date of this registration statement. The proposed maximum offering price per share, which is estimated

solely for the purposes of calculating the registration fee under Rule 457(h) and Rule 457(c) under the Securities Act, is based on US$14.30

per ADS, the average of the high and low prices for the Registrant’s ADSs as quoted on the New York Stock Exchange on July 8, 2024.

(5) Represents Class A ordinary shares to be issued pursuant

to the Plan. The proposed maximum offering price per share, which is estimated solely for the purposes of calculating the registration

fee under Rule 457(h) and Rule 457(c) under the Securities Act, is based on US$14.30 per ADS, the average of the high and low prices for

the Registrant’s ADSs as quoted on the New York Stock Exchange on July 8, 2024.

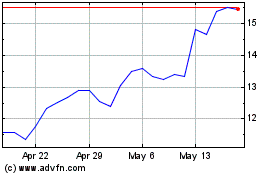

Tencent Music Entertainm... (NYSE:TME)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tencent Music Entertainm... (NYSE:TME)

Historical Stock Chart

From Dec 2023 to Dec 2024