As filed with the Securities and Exchange Commission

on February 5, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Vale S.A.

(Exact name of registrant as specified in its charter)

N.A.

(Translation of Registrant’s name into English)

| |

|

|

| The Federative Republic of Brazil |

|

N/A |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Praia de Botafogo 186 —

offices 701-1901 — Botafogo

Rio de Janeiro, RJ, Brazil

(Address of Registrant’s Principal Executive

Offices)

Performance Shares Unit Program

(Full title of the Plan)

Vale Americas LLC

140 E. Ridgewood Avenue, Suite 415

South Tower, Paramus, New Jersey 07652

(Name and address of agent for service)

(416) 687- 6041

(Telephone number, including area code, of agent

for service)

Copies to:

Julia L. Petty

Cleary Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, NY 10006

+1 (212) 225-2000

Indicate by check mark whether the Registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| |

|

|

|

|

|

|

| Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

| |

|

|

|

| Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

Emerging growth

Company ☐

If an emerging growth company, indicate by check mark if the Registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement relates to the

registration of 6,605,593 shares, par value US$0.000 per share (the “Common Stock”), of the Registrant to be offered

and sold under the Performance Shares Unit Program (the “Plan”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

|

The document(s) containing the information specified

in Part I will be sent or given to employees as specified by Rule 428(b)(1) (§230.428(b)(1)). Such documents are not being filed

with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as

prospectuses or prospectus supplements pursuant to Rule 424 (§230.424). These documents and the documents incorporated by reference

in this Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements

of Section 10(a) of the Securities Act. See Rule 428(a)(1) (§230.428(a)(1)). |

| |

|

|

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

| |

|

Item 3. Incorporation of Documents by Reference.

The rules of the Commission allow us to incorporate

by reference information into this Registration Statement. The information incorporated by reference is considered to be a part of this

Registration Statement, and information that we file later with the Commission will automatically update and supersede this information.

This Registration Statement incorporates by reference the documents listed below. In addition, any Report on Form 6-K of the Registrant

hereafter furnished to the Commission pursuant to the Exchange Act shall be incorporated by reference into this Registration Statement

if and to the extent provided in such document. |

| |

(a) |

The Registrant’s annual report on Form 20-F for the fiscal year ended December 31, 2022, filed with the Commission on April 13, 2023 (File No. 001-15030), which includes the Registrant’s audited consolidated financial statements as of December 31, 2022 and 2021. |

| |

(b) |

All other reports filed by the Registrant pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) since December 31, 2021. |

|

All reports and other documents subsequently filed

by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment

to this Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities remaining

unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing

of such reports and other documents. Except as provided in the last sentence of the first paragraph of the section of this Registration

Statement entitled “Item 3. Incorporation of Documents by Reference”, nothing in this Registration Statement shall be deemed

to incorporate any information provided in documents that is furnished (rather than filed) or is otherwise not deemed to be filed under

applicable Commission rules. |

| |

|

|

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

None.

Item 6. Indemnification of Directors and Officers.

Neither the laws of Brazil nor Vale’s bylaws

or other constitutive documents provide for indemnification of directors and officers. Under the Brazilian Civil Code, a person engaged

in an illegal action must indemnify any third person that incurred losses or damages arising from such illegal action. Vale has also entered

into an indemnification agreement with each of its directors and officers, providing for indemnification for losses incurred by such director

or officer as a result of actions or omissions in the performance of his or her functions or as a result of being a director or officer

of Vale, subject to certain exceptions. Vale maintains standard policies of insurance under which coverage is provided (a) to its directors

and officers against loss rising from claims made by reason of breach of duty or other wrongful act, and (b) to Vale itself with respect

to payments which may be made by Vale to such officers and directors pursuant to the above indemnification provisions or otherwise as

a matter of law.

Item 7. Exemption from Registration Claimed.

Not applicable.

*Filed herewith

‡ Incorporated herein by reference

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales

are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3)

of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising

after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in

the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which

was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus

filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in

the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration

statement;

(iii) To include any material information with respect to

the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration

statement;

Provided, however, that paragraphs (a)(1)(i)

and (a)(1)(ii) do not apply if the registration statement is on Form S-8, and the information required to be included in a post-effective

amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Registrant pursuant to Section

13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference herein.

(2) That for the purpose of determining any liability

under the Securities Act, each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that,

for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to section

13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration

Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against

such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of

the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled

by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public

policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the

Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly

caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Brazil, on February 5,

2024.

| |

|

|

| Vale S.A. |

| |

|

| By: |

|

/s/ Eduardo de Salles Bartolomeo |

| |

|

Name: Eduardo de Salles Bartolomeo |

| |

|

Title: Chief Executive Officer

|

| |

|

|

| |

| |

|

| By: |

|

/s/ Gustavo Duarte Pimenta |

| |

|

Name: Gustavo Duarte Pimenta |

| |

|

Title: Chief Financial Officer

|

POWER OF ATTORNEY

We, the undersigned directors and officers of

Vale S.A. (the “Company”), do hereby severally constitute and appoint Eduardo de Salles Bartolomeo and Gustavo Duarte

Pimenta, each our true and lawful attorneys and agents, to do any and all acts and things in our name and on our behalf in our capacities

as directors and officers and to execute any and all instruments for us and in our names in the capacities indicated below, which said

attorneys and agents, or any of them, may deem necessary or advisable to enable said Company to comply with the Securities Act of 1933,

as amended (the “Securities Act”) and any rules, regulations and requirements of the Securities and Exchange Commission,

in connection with the Registration Statement of the Company on Form S-8 including specifically, but without limitation, power and authority

to sign for us or any of us in our names in the capacities indicated below, any and all amendments (including post-effective amendments)

hereto; and we do each hereby ratify and confirm all that said attorneys and agents, or any one of them, shall do or cause to be done

by virtue hereof. This Power of Attorney may be executed in multiple counterparts, each of which shall be deemed an original, but which

taken together shall constitute one instrument.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed by the following persons in the indicated capacities as of the 5th of February,

2024.

| Signatures |

Title |

|

| /s/ Eduardo de Salles Bartolomeo |

|

|

| Eduardo de Salles Bartolomeo |

Chief Executive Officer |

|

| |

|

|

| /s/ Gustavo Duarte Pimenta |

|

|

| Gustavo Duarte Pimenta |

Chief Financial Officer |

|

| |

|

|

| /s/ Daniel André Stieler |

|

|

| Daniel André Stieler |

Chairman of the Board of Directors |

|

| |

|

|

| /s/ Fernando Jorge Buso Gomes |

|

|

| Fernando Jorge Buso Gomes |

Director |

|

| |

|

|

| /s/ João Luiz Fukunaga |

|

|

| João Luiz Fukunaga |

Director |

|

| |

|

|

| /s/ José Luciano Duarte Penido |

|

|

| José Luciano Duarte Penido |

Director |

|

| |

|

|

| /s/ Manuel Lino Silva de Sousa Oliveira |

|

|

| Manuel Lino Silva de Sousa Oliveira |

Director |

|

| |

|

|

| /s/ Shunji Komai |

|

|

| Shunji Komai |

Director |

|

| |

|

|

| /s/ Vera Marie Inkster |

|

|

| Vera Marie Inkster |

Director |

|

| |

|

|

| /s/ Paul Casbar |

|

|

| Paul Casbar |

Authorized Representative of Vale S.A. in the United States |

|

SHARE-BASED COMPENSATION PLAN

Rio de Janeiro, February 5, 2024

Ladies and Gentlemen:

I am the General Counsel of Vale S.A. (“Vale”),

a corporation organized and existing under the laws of Brazil, and have acted as Brazilian counsel of Vale, in connection with the preparation

and filing by Vale, under the United States Securities Act of 1933, as amended (the “Securities Act”), of a registration

statement on Form S-8 (the “Registration Statement”) with the United States Securities and Exchange Commission (the

“SEC”) relating to the registration of up to 6,605,593 common shares, no par value, of Vale (the “Shares”)

to be issued from time to time pursuant to equity awards granted under Vale’s “Performance Shares Unit Program (PSU)”,

approved by shareholders of Vale on April 30, 2021 (the “Program”). All capitalized terms used herein and not otherwise

defined shall have the meanings assigned to such terms in the Registration Statement.

1.

In rendering the opinions set forth below, I have examined copies of the documents listed below:

(i)

the Registration Statement and the documents incorporated by reference therein;

(ii)

the by-laws of Vale as last amended at the Ordinary and Extraordinary General Shareholders’

Meeting held on April 28, 2023;

(iii)

the minutes of the Ordinary and Extraordinary General Shareholders’ Meeting of Vale dated as

of April 28, 2023, which, among other matters, recorded the approval of the election of the current members of Vale’s Board of Directors;

(iv)

the minutes of the meetings of the Board of Directors of Vale dated as of March 15, 2021, September

20, 2021 and December 22, 2022 at which the current officers of Vale were appointed; and

(v)

the Program.

2.

I have also examined the records, agreements, instruments and documents and made such investigations

of law as I have deemed relevant or necessary as the basis for the opinions hereinafter expressed.

3.

I have not undertaken any investigation of the laws of any jurisdiction outside the Federative Republic

of Brazil (“Brazil”) and this opinion is given solely in respect of Brazilian law as effective on the date hereof,

and not in respect of any other law. In particular, we have made no independent investigation of the laws of the State of New York and

do not express or imply any opinion on such laws.

4.

I have further assumed, without independent investigation or verification of any kind, the genuineness

of all signatures, the legal capacity of natural persons, and the authenticity of all documents we have examined, the conformity with

the originals of all documents submitted to us as certified or photostatic copies, and the authenticity of the originals of such latter

documents.

5.

My opinions are delivered on the basis of my professional legal judgment and on the basis of the

knowledge and investigation of the Vale Legal Department, which I oversee.

6.

Based upon the foregoing and subject to the qualifications and limitations set forth herein, I am

of the opinion that:

(i)

Vale has been duly incorporated and is validly existing as a sociedade anônima under

the laws of Brazil; and

(ii)

the Shares to be offered and issued by Vale pursuant to the provisions of the Program have been duly

authorized for issue, and when issued by Vale pursuant to the provisions of the Program, will be validly issued and will be fully paid

and non-assessable.

7. I

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. I further consent to the incorporation by

reference of this opinion into any registration statement on Form S-8 or post-effective amendment filed pursuant to Rule 462(b)

under the Securities Act of 1933, as amended, with respect to the registration of additional securities issuable under the

Program.

8.

I am qualified to practice law in Brazil only, and I do not express any opinion in respect of any

laws of any other jurisdiction. This opinion is based upon and limited in all respects to the law applicable in Brazil as presently published,

existing and in force.

9.

I expressly disclaim any responsibility to advise you or any other person who is permitted to rely

on the opinions expressed herein as specified above of any development or circumstance of any kind including any change of law or fact

that may occur after the date of this letter even though such development, circumstance or change may affect the legal analysis, a legal

conclusion or any other matter set forth in or relating to this letter. Accordingly, any person relying on this letter at any time should

seek advice of its counsel as to the proper application of this letter at such time. This opinion may be relied upon, as of the date rendered,

only by you and no other person may rely upon this opinion without my prior written consent.

| Very truly yours, |

|

|

|

/s/ Alexandre Silva D’Ambrosio |

| Alexandre Silva D’Ambrosio |

| General Counsel of Vale S.A. |

| |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in this Registration Statement

on Form S-8 of Vale S.A. of our report dated February 16, 2023 relating to the financial statements and the effectiveness of internal

control over financial reporting, which appears in Vale S.A.'s Annual Report on Form 20-F for the year ended December 31, 2023.

/s/ PricewaterhouseCoopers Auditores Independentes

Rio de Janeiro, Brazil

February 5, 2024

Exhibit 107

CALCULATION OF FILING FEE TABLES

Form S-8

(Form Type)

Vale S.A.

(Exact name of Registrant as specified in its

charter)

Table 1: Newly Registered Securities

| Security Type |

Security Class Title |

Fee Calculation Rule |

Amount Registered (1) |

Proposed Maximum Offering Price Per Unit (2) |

Maximum Aggregate Offering Price (2) |

Fee Rate |

Amount of Registration Fee |

| Equity |

Common Shares(3), reserved for issuance pursuant to the Performance Shares Unit Program |

Other (2) |

6,605,593 |

US$13.70

|

US$90,496,624.1

|

0.00014760 |

US$13,357.30 |

| Total Offering Amounts |

US$90,496,624.1 |

|

US$13,357.30 |

| Total Fee Offsets |

|

|

N/A |

| Net Fee Due |

|

|

$13,357.30 |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as

amended (the “Securities Act”), this Registration Statement on Form S-8 (the “Registration Statement”)

shall also cover any additional Common Shares of Vale S.A. (the “Registrant”) as may become available for issuance

pursuant to the Performance Shares Unit Program (the “Plan”) by reason of any stock dividend, stock split, recapitalization

or other similar transaction effected without the receipt of consideration that results in an increase in the number of the Registrant’s

outstanding Common Shares.

(2) The Proposed Maximum Offering Price Per Common Share has been

estimated solely for the purposes of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act, on

the basis of the average of the high and low reported prices of a common ADS (defined below) as reported on the New York Stock Exchange

on February 1, 2024.

(3) The Common Shares of the Registrant being registered hereby

may be represented in the form of the Registrant’s American Depositary Shares (“ADSs”), evidenced by American

Depositary Receipts (“ADRs”), with each ADS representing one Common Share. ADRs issuable upon the deposit of the Common

Shares registered hereby have been or will be registered under a separate registration statement on Form F-6. Each ADR will represent

one Common Share.

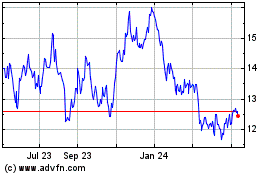

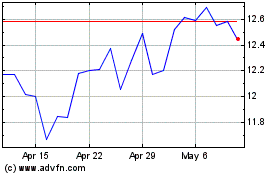

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2024 to May 2024

Vale (NYSE:VALE)

Historical Stock Chart

From May 2023 to May 2024