- Three-quarters (78%) of Americans report generosity as a core

value

- Half (51%) report not having enough money to give

While generosity is a core value for three-quarters of

Americans, economic concerns have caused some to tighten their

purse strings. Three in ten (29%) Americans report that they have

given less to charity this year compared to the year before and a

full half (51%) feel they don’t have enough money to give to

charity at all.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241112192002/en/

Wells Fargo: American Generosity Squeezed

by Economic Uncertainty (Photo: Wells Fargo)

Even so, 67% of Americans still reported giving something in the

past year, with more than half (54%) saying they give to charity

even though they don’t have a lot of extra money. The study found

that economic concern is a significant factor in declined giving,

with more than half (52%) of Americans reporting that their reduced

giving is a direct result of the current economy.

“The data shows us that the pinch of rising costs is driving a

moral dilemma. Many Americans are in a standoff between what they

want to do and what they can do,” said Stephanie Buckley, head of

Trust Philanthropic Services with Wells Fargo Wealth &

Investment Management.

Despite this dilemma, the study reveals that among the two in

three Americans who made a charitable donation this year, 53% still

report giving the same amount to charity as last year and another

19% report giving more. In fact, 60% of these Americans are so

committed to their giving that they list charity as part of their

budget and one in four (24%) will go as far as to defer their own

financial needs in order to give money.

The study – which is based on a national poll conducted by Ipsos

on behalf of Wells Fargo of 1,004 U.S. adults age 18 and older –

also found that Americans reported giving $1,632 on average to

charity in the past year.

Happiness drives giving

Driving factors of American giving are largely altruistic.

Almost half of Americans are motivated to give to charity because

it makes them happy (46%) and aligns with their personal values

(45%). A third (32%) give because they have a personal connection

to the cause, and a quarter (25%) say they give out of moral

obligation. 20% give out of habit and 17% give because it helps

them feel connected to others.

Comparatively, financial benefits and peer pressure have very

little to do with why Americans give, with only 10% of Americans

giving for tax deduction purposes and even fewer (5%) giving

because their peers are also giving.

“There is a misnomer that many people give for selfish reasons,

particularly among the affluent. When in actuality, I’ve found that

no matter the level of wealth, giving tends to almost always be

driven by wanting to make an impact,” said Buckley. “In fact,

anonymous giving continues to be a rising trend which I believe

lends itself to the idea that most people tend to give

altruistically.”

Givers want to be more strategic

More than half (52%) of Americans do not get any advice about

giving. A quarter (27%) report getting their advice from friends

and family, 21% from internet research, 11% use a charity watchdog

website, and only 6% get advice about giving from a financial

professional like a financial advisor or accountant. Despite the

lack of advice, the majority (57%) of Americans want to be more

strategic in their charitable giving – a sentiment that could be

amplified by the fact that half (49%) of Americans report being

bombarded with request for donations.

“Not having a plan can often lead to a ‘smear the peanut butter’

approach, where people write checks and donate without thinking

about how it aligns to what’s really important to them. Whether you

are giving money, time, or talent, having a plan can help block out

some of the noise and help ensure you are giving with intention,”

said Buckley.

“What’s Giving Tuesday?”

The study also looked at Americans’ awareness of Giving Tuesday

and the impact on giving trends. The majority (64%) of Americans

report not having heard of Giving Tuesday, which was introduced in

2012 on the first Tuesday after Thanksgiving to raise awareness of

the year-end giving season. Among the 36% of respondents who have

heard of Giving Tuesday, 40% report participating and 17% say it

causes them to donate more than planned.

As compared to other trends around that time of year, 31% of

those who have heard of Giving Tuesday report donating as much to

charity on Giving Tuesday as they spend on Cyber Monday or Black

Friday.

“The idea behind Giving Tuesday is to inspire a wave of

generosity. It’s a moment to bring us together, with intention, to

have an impact on the communities around us,” said Buckley.

“Whether you’ve participated before or are just hearing about it, I

would encourage everyone to be thinking about where they can donate

their time, dollars, or talent to the causes that matter most to

them.”

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial

services company that has approximately $1.9 trillion in assets. We

provide a diversified set of banking, investment and mortgage

products and services, as well as consumer and commercial finance,

through our four reportable operating segments: Consumer Banking

and Lending, Commercial Banking, Corporate and Investment Banking,

and Wealth & Investment Management. Wells Fargo ranked No. 34

on Fortune’s 2024 rankings of America’s largest corporations. In

the communities we serve, the company focuses its social impact on

building a sustainable, inclusive future for all by supporting

housing affordability, small business growth, financial health, and

a low-carbon economy. News, insights, and perspectives from Wells

Fargo are also available at Wells Fargo Stories.

Wealth & Investment Management provides financial products

and services through various bank and brokerage affiliates of Wells

Fargo & Company.

Additional information may be found at www.wellsfargo.com

LinkedIn: https://www.linkedin.com/company/wellsfargo

About the Study

These are some of the findings of an Ipsos poll, conducted

September 20-23 2024, on behalf of Wells Fargo. For this survey, a

sample of 1,004 adults age 18+ from the continental U.S., Alaska,

and Hawaii was interviewed online in English.

The sample for this study was randomly drawn from Ipsos’ online

panel, partner online panel sources, and “river” sampling and does

not rely on a population frame in the traditional sense. Ipsos uses

fixed sample targets, unique to each study, in drawing a sample.

After a sample has been obtained from the Ipsos panel, Ipsos

calibrates respondent characteristics to be representative of the

U.S. population using standard procedures such as raking-ratio

adjustments. The source of these population targets is U.S. Census

2023 American Community Survey data. Posthoc weights were made to

the population characteristics on gender, age, race/ethnicity,

region, and education.

News Release Category: WF-ERS

PM-04302026-7251366.1.1

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112192002/en/

Media Desari Mueller Desari.Mueller@wellsfargo.com

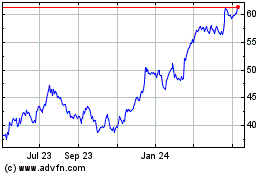

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Feb 2025 to Mar 2025

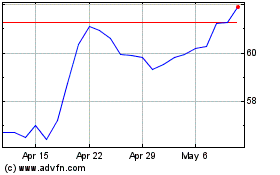

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Mar 2025