Magna Announces New 10% Normal Course Issuer Bid and Automatic

Share Purchase Plan

AURORA, Ontario, Nov. 05, 2024 (GLOBE NEWSWIRE) -- Magna

International Inc. (TSX: MG, NYSE: MGA) today announced

the termination of its existing Normal Course Issuer Bid effective

since February 15, 2024 (the “Prior NCIB”) and the Toronto Stock

Exchange ("TSX") has accepted its Notice of Intention to establish

a new Normal Course Issuer Bid (the "Notice"). Pursuant to the

Notice, Magna may purchase up to 28,500,000 Magna Common Shares

(the "New NCIB"), representing approximately 10% of its public

float. As at October 31, 2024, Magna had 287,342,204 issued and

outstanding Common Shares, including a public float of 286,960,792

Common Shares.

Magna’s Prior NCIB announced in February 2024 for the purchase

of up to 300,000 Common Shares would have expired on February 14,

2025. With the approval of the TSX, the Prior NCIB will now

terminate at the close of trading on November 6, 2024. As at the

close of trading on November 6, 2024, Magna had purchased 98,636

Common Shares under the Prior NCIB at a weighted average price of

CDN $70.56 on open market through the facilities of the TSX. As a

result, the 98,636 Common Shares purchased under the Prior NCIB has

been deducted from the public float in calculating the New NCIB

limit, as per the requirements of the TSX.

The primary purposes of the New NCIB are purchases for

cancellation, as well as purchases to fund Magna’s stock-based

compensation awards or programs. Magna may purchase its Common

Shares for cancellation, from time to time, if it believes that the

market price of its Common Shares is attractive and that the

purchase would be an appropriate use of corporate funds and in the

best interests of the Corporation.

The New NCIB will commence on November 7, 2024, and will

terminate no later than November 6, 2025. All purchases of Common

Shares under the New NCIB may be made on the TSX, at the market

price at the time of purchase in accordance with the rules and

policies of the TSX or on the New York Stock Exchange ("NYSE") in

compliance with Rule 10b-18 under the U.S. Securities Exchange

Act of 1934. In addition to purchases made on the open market

through the facilities of the TSX and NYSE, Magna may also make

purchases through alternative trading systems in Canada and the

United States, and by private agreement or under a specific share

repurchase program pursuant to an issuer bid exemption order issued

by a securities regulatory authority (a “Specific Share Repurchase

Program”). Purchases made by way of such private agreements or a

Specific Share Repurchase Program will be at a discount to the

prevailing market price. The rules and policies of the TSX contain

restrictions on the number of shares that can be purchased under

the New NCIB, based on the average daily trading volumes of the

Common Shares on the TSX. Similarly, the safe harbor conditions of

Rule 10b-18 impose certain limitations on the number of shares that

can be purchased on the NYSE per day. As a result of such

restrictions, subject to certain exceptions for block purchases,

the maximum number of shares which can be purchased per day during

the New NCIB on the TSX is 202,962, based on 25% of the average

daily trading volume for the prior six months of the Prior NCIB

(being 811,850 Common Shares on the TSX). Magna may reset this

restriction in February 2025 based on 25% of the average daily

trading volume for the six months leading up to February 2025.

Subject to certain exceptions for block purchases, the maximum

number of shares which can be purchased per day on the NYSE will be

25% of the average daily trading volume for the four calendar weeks

preceding the date of purchase. Subject to regulatory requirements,

the actual number of Common Shares purchased and the timing of such

purchases, if any, will be determined by Magna having regard to

future price movements and other factors.

In conjunction with the New NCIB, Magna today also announced

that it has established an automatic share purchase plan (the

“Plan”) with a designated broker to facilitate the purchase of

Common Shares under the New NCIB. The Plan will be implemented

effective November 7, 2024. Under the Plan, Magna will provide

instructions and strict parameters regarding how its Common Shares

may be purchased during times when it would ordinarily not be

permitted to purchase Common Shares due to regulatory restrictions

or self-imposed blackout periods. The Plan will terminate on the

earliest of the date on which: (a) the purchase limit specified in

the Plan has been reached; (b) we terminate the Plan in accordance

with its terms, in which case we will issue a press release

confirming such termination; and (c) the New NCIB terminates.

INVESTOR CONTACT

Louis Tonelli, Vice-President, Investor Relations

louis.tonelli@magna.com │ 905.726.7035

MEDIA CONTACT

Tracy Fuerst, Vice-President, Corporate Communications & PR

tracy.fuerst@magna.com │ 248.761.7004

ABOUT MAGNA(1)

Magna is more than one of the world’s largest suppliers in the

automotive space. We are a mobility technology company built to

innovate, with a global, entrepreneurial-minded team of over

175,000(2) employees across 343 manufacturing operations

and 107 product development, engineering and sales centres spanning

28 countries. With 65+ years of expertise, our ecosystem of

interconnected products combined with our complete vehicle

expertise uniquely positions us to advance mobility in an expanded

transportation landscape.

For further information about Magna (NYSE:MGA; TSX:MG), please

visit www.magna.com or follow us on social.

FORWARD-LOOKING STATEMENTS

This press release may contain statements that, to the extent

that they are not recitations of historical fact, constitute

"forward-looking statements" within the meaning of applicable

securities legislation, including, but not limited to, future

purchases of our Common Shares under the Normal Course Issuer Bid,

including pursuant to private agreements or a Specific Share

Repurchase Program under an issuer bid exemption order issued by

the Ontario Securities Commission. Forward-looking statements may

include financial and other projections, as well as statements

regarding our future plans, objectives or economic performance, or

the assumptions underlying any of the foregoing. We use words such

as "may", "would", "could", "should", "will", "likely", "expect",

"anticipate", "believe", "intend", "plan", "forecast", "outlook",

"project", "estimate" and similar expressions suggesting future

outcomes or events to identify forward-looking statements. Any such

forward-looking statements are based on information currently

available to us, and are based on assumptions and analyses made by

us in light of our experience and our perception of historical

trends, current conditions and expected future developments, as

well as other factors we believe are appropriate in the

circumstances. However, whether actual results and developments

will conform to our expectations and predictions is subject to a

number of risks, assumptions and uncertainties, many of which are

beyond our control, and the effects of which can be difficult to

predict. These risks, assumptions and uncertainties include,

without limitation, the impact of: macroeconomic and geopolitical

events; economic cyclicality; relative foreign exchange rates;

financial flexibility risks; stock price fluctuations; legal and

regulatory proceedings against us; changes in laws and other

factors set out in our Annual Information Form filed with

securities commissions in Canada and our annual report on Form 40-F

filed with the United States Securities and Exchange Commission,

and subsequent filings. In evaluating forward-looking statements,

we caution readers not to place undue reliance on any

forward-looking statements and readers should specifically consider

the various factors which could cause actual events or results to

differ materially from those indicated by such forward-looking

statements.

(1)

Manufacturing operations, product development, engineering

and sales centres include certain operations accounted for under

the equity method.

(2) Number of employees includes

over 162,000 employees at our wholly owned or controlled entities

and over 13,000 employees at certain operations accounted for under

the equity method.

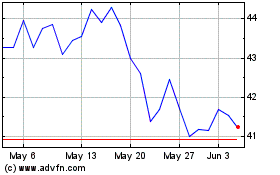

Magna (TG:MGA)

Historical Stock Chart

From Nov 2024 to Dec 2024

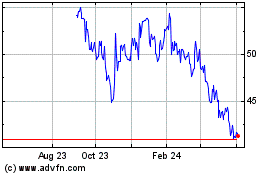

Magna (TG:MGA)

Historical Stock Chart

From Dec 2023 to Dec 2024