Amerigo Announces Q4-2013 and Full Year Production Results

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan 24, 2014) -

Amerigo Resources Ltd. (TSX:ARG) ("Amerigo" or the "Company")

announced today production results for the fourth quarter of 2013

from Minera Valle Central ("MVC"), the Company's operations located

near Rancagua, Chile. MVC produced 12.254 million pounds of copper

and 0.181 million pounds of molybdenum during the three months

ended December 31, 2013, for a total of 45.673 million pounds of

copper and 0.809 million pounds of molybdenum for the full

year.

Dr. Klaus Zeitler, Amerigo's Chairman and CEO, stated, "I am

pleased to report that despite the fact tonnage and recoveries from

Colihues are still being adversely affected by the April slide

event, copper production of 45.673 million pounds and estimated

cash costs of $2.14/lb copper both met the Company's previously

announced annual guidance. We are estimating 2014 production to

remain steady at 45 million pounds of copper and 800,000 pounds

molybdenum, not accounting for the Company's planned Cauquenes

expansion".

Rob Henderson, Amerigo's President and Chief Operating Officer,

added, "Under the constraints of lower metal prices in 2013,

management's focus was on safety and operating margin. MVC's cash

costs in 2013 were 13% lower than cash costs of $2.46/lb in 2012.

Copper production in Q4 includes 1.479 million pounds of copper

produced pursuant to a tolling contract with Minera Maricunga,

which will continue throughout 2014. Development of the Cauquenes

expansion project remains a priority."

Key operating and sales metrics are shown below.

|

Production Metrics: |

Q4-2013 |

Q3-2013 |

Q2-2013 |

Q1-2013 |

Q4-2012 |

|

Copper Production(million lbs) |

|

12.254 |

|

11.035 |

|

9.550 |

|

12.834 |

|

13.561 |

|

Molybdenum Production (million lbs) |

|

0.181 |

|

0.193 |

|

0.176 |

|

0.258 |

|

0.291 |

|

Ore milled (Tonnes 000's) |

|

14,164 |

|

14,604 |

|

13,464 |

|

13,502 |

|

14,727 |

|

Copper Grade (%) |

|

0.162 |

|

0.159 |

|

0.158 |

|

0.160 |

|

0.155 |

|

Copper Recovery (%) |

|

21.3 |

|

21.5 |

|

20.3 |

|

27.0 |

|

27.0 |

|

Power Costs (per kwh) |

$ |

0.154 |

$ |

0.080 |

$ |

0.086 |

$ |

0.097 |

$ |

0.185 |

|

Sales Metrics: |

|

Q4-2013 |

|

Q3-2013 |

|

Q2-2013 |

|

Q1-2013 |

|

Q4-2012 |

|

Copper Sales1 (Million lbs) |

|

12.595 |

|

10.856 |

|

9.437 |

|

12.482 |

|

13.712 |

|

Company's Recorded Copper Price ($US/lb)2 |

|

3.16 |

|

3.19 |

|

3.40 |

|

3.52 |

|

3.52 |

|

Molybdenum Sales (million lbs) |

|

0.174 |

|

0.205 |

|

0.178 |

|

0.241 |

|

0.286 |

|

Company's Recorded Molybdenum Price ($US/lb) |

|

9.67 |

|

9.41 |

|

11.00 |

|

11.34 |

|

11.08 |

1 Copper sales per the Company's records, which may differ from

copper sales per the smelter. All differences between Company and

smelter records for a quarter will be recorded as settlement

adjustments in subsequent quarters until settled.

2 Copper price recorded for the Company's financial statements

for the quarter before smelter and refinery charges and settlement

adjustments to prior quarters' sales. The Company calculates this

number by dividing quarterly dollar sales as recorded in its

financial statements (calculated based on copper deliveries per the

smelter) over quarterly copper sales per the Company's own

records.

The Company will release 2013 annual financial results at market

open on Thursday February 26, 2014 and will hold an investor

conference call to discuss the results on Friday February 27, 2014

at 11:00 am Pacific Standard Time/2:00 pm Eastern Standard

Time.

To participate in the call, please dial the following

number:

1-866-226-1792 (Toll-Free North America)

Please let the operator know you wish to participate in the

Amerigo Resources conference call.

Media are invited to attend on a listen-only basis.

Following management's discussion of the quarterly results, the

analyst and investment community will be invited to ask

questions.

Amerigo Resources Ltd. produces copper and molybdenum under a

long term partnership with the world's largest copper producer,

Codelco, by means of processing fresh and old tailings from the

world's largest underground copper mine, El Teniente near Santiago,

Chile. Tel: (604) 681-2802; Fax: (604) 682-2802; Web:

www.amerigoresources.com; Listing: ARG:TSX.

Certain of the information and statements contained herein

that are not historical facts, constitute "forward-looking

information" within the meaning of the Securities Act (British

Columbia), Securities Act (Ontario) and the Securities Act

(Alberta) ("Forward-Looking Information"). Forward-Looking

Information is often, but not always, identified by the use of

words such as "seek", "anticipate", "believe", "plan", "estimate",

"expect" and "intend"; statements that an event or result is "due"

on or "may", "will", "should", "could", or might" occur or be

achieved; and, other similar expressions. More specifically,

Forward-Looking Information contained herein includes, without

limitation, information concerning future tailings

production volumes and the Company's copper and molybdenum

production, all of which involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company, or industry results, to

be materially different from any future results, performance or

achievements expressed or implied by such Forward-Looking

Information; including, without limitation, material factors and

assumptions relating to, and risks and uncertainties associated

with, the supply of tailings from El Teniente and extraction of

tailings from the Colihues tailings impoundment, the achievement

and maintenance of planned production rates, the evolving legal and

political policies of Chile, the volatility in the Chilean economy,

military unrest or terrorist actions, metal price fluctuations,

governmental relations, the availability of financing for

activities when required and on acceptable terms, the estimation of

mineral resources and reserves, current and future environmental

and regulatory requirements, the availability and timely receipt of

permits, approvals and licenses, industrial or environmental

accidents, equipment breakdowns, availability of and competition

for future mineral acquisition opportunities, availability and cost

of insurance, labour disputes, land claims, the inherent

uncertainty of production and cost estimates, currency

fluctuations, expectations and beliefs of management and other

risks and uncertainties, including those described under Risk

Factors in the Company's Annual Information Form and in

Management's Discussion and Analysis in the Company's financial

statements.

Such Forward-Looking Information is based upon the Company's

assumptions regarding global and Chilean economic, political and

market conditions and the price of metals, including copper and

molybdenum, and future tailings production volumes and the

Company's copper and molybdenum production. Among the factors that

have a direct bearing on the Company's future results of operations

and financial conditions are changes in project parameters as plans

continue to be refined, interruptions in the supply of fresh

tailings from El Teniente, further delays in the extraction of

tailings from the Colihues tailings impoundment, a change in

government policies, competition, currency fluctuations and

restrictions and technological changes, among other things. Should

one or more of any of the aforementioned risks and uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from any conclusions, forecasts

or projections described in the Forward-Looking Information.

Accordingly, readers are advised not to place undue reliance on

Forward-Looking Information. Except as required under applicable

securities legislation, the Company undertakes no obligation to

publicly update or revise Forward-Looking Information, whether as a

result of new information, future events or otherwise.

Amerigo Resources Ltd.Dr. Klaus ZeitlerChairman & CEO(604)

218-7013Amerigo Resources Ltd.(604)

697-6201www.amerigoresources.com

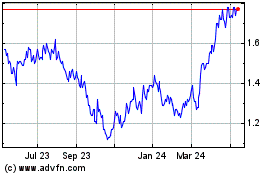

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Dec 2024 to Jan 2025

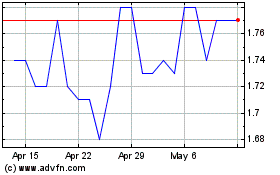

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Jan 2024 to Jan 2025