NanoXplore Inc. (“NanoXplore” or “the Corporation”) (TSX: GRA and

OTCQX: NNXPF), a world-leading graphene company, reported

today financial results for the year ended June 30,

2024.

All amounts in this press release are in

Canadian dollars, unless otherwise stated.

Key Financial Highlights

Q4-2024

- Record total revenues of

$38,125,566 compared to $33,318,964 last year, representing a 14%

increase;

- Adjusted gross margin* on revenues

from customers of 23.6% compared to 20.8% last year;

- Loss of $2,421,110 compared to

$2,003,549 last year;

- Adjusted EBITDA* of $2,488,304

compared to $526,140 last year;

- Adjusted EBITDA* of $3,329,793

compared to $1,130,962 last year for the Advanced Materials,

Plastics and Composite Products segment;

- Adjusted EBITDA* loss of $841,489

compared to $604,822 last year for the Battery Cells segment

(VoltaXplore initiative);

- Total liquidity of $36,504,880 as

at June 30, 2024, including cash and cash equivalents of

$26,504,880;

- Total long-term debt of $6,346,503

as at June 30, 2024, down by $1,529,385 compared to June 30,

2023.

Key Financial Highlights Fiscal

Year 2024

- Record total revenues of

$129,992,368 in 2024 compared to $123,857,171 in 2023, representing

a 5% increase;

- Adjusted gross margin* on revenues

from customers of 21.1% in 2024 compared to 17.4% in last

year;

- Loss of $11,665,006 compared to

$12,798,174 last year;

- Adjusted EBITDA* of $2,519,134

compared to a loss of $857,887 last year;

- Adjusted EBITDA* of $5,176,437 in

2024 compared to a loss of $234,795 last year for the Advanced

Materials, Plastics and Composite Products segment;

- Adjusted EBITDA* loss of $2,657,303

in 2024 compared to $623,092 last year for the Battery Cells

segment (VoltaXplore initiative).

Overview

Pedro Azevedo, Chief Financial Officer, said:

“After a slow beginning to the year, I am very pleased with our 4th

quarter and full year performance and financial results. We

continued to execute on our expansion in graphene-enhanced SMC

materials capacity and margin improvement plans. In addition,

we also expanded, and continue to expand, our customer base for

graphene powder and graphene-enhanced composites demonstrating the

economic value of our graphene offering. These have resulted

in our highest ever annual sales, highest ever gross margins and

highest ever adjusted EBITDA. Growing our graphene and

graphene-enhanced materials sales mix will continue to positively

impact gross margins. We are in the 2nd stage of our growth plan

but our financials do not yet fully reflect the full potential

upside graphene sales will bring. We are once again well positioned

for our next fiscal year and continue to execute on our 5-year

strategic plan initiatives.”

Soroush Nazarpour, President & Chief

Executive Officer, said: “We faced some headwinds and uncertainties

at the beginning of this fiscal year namely high interest rate,

inflation cost pressure and tight labour market but NanoXplore’s

team performed well in this environment, and we delivered record

revenues, while gross and EBITDA margins continued to expand. I

expect this trend of organic growth and margin performance to

continue in 2025 due to broader acceptance of our graphene base

products. During the year, we received increased volumes on

existing programs and won new customers, demonstrating the

innovative nature of our graphene-based solutions and our ability

to grow organically. We have a first mover advantage in an emerging

advance material sector, and we intend on staying a market leader

through developing innovative graphene-enhanced solutions for our

customers while expanding our manufacturing capabilities as well as

ensuring we maintain a strong balance sheet.”

* Non-IFRS Measures

The Corporation prepares its financial

statements under IFRS. However, the Corporation considers certain

non-IFRS financial measures as useful additional information in

measuring the financial performance and condition of the

Corporation. These measures, which the Corporation believes are

widely used by investors, securities analysts and other interested

parties in evaluating the Corporation’s performance, do not have a

standardized meaning prescribed by IFRS and therefore may not be

comparable to similarly titled measures presented by other publicly

traded companies, nor should they be construed as an alternative to

financial measures determined in accordance with IFRS. Non-IFRS

measures include "Adjusted EBITDA” and “Adjusted gross margin”.

The following tables provide a reconciliation of

IFRS “Loss” to Non-IFRS “Adjusted EBITDA” and of IFRS “Gross

margin” to Non-IFRS “Adjusted Gross margin” for the three-month

periods and for the years ended June 30, 2024 and 2023.

IFRS “Loss” to Non-IFRS “Adjusted

EBITDA”

|

|

Q4-2024 |

|

Q4-2023 |

|

FY 2024 |

|

FY 2023 |

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

| Loss |

(2,421,110 |

) |

(2,003,549 |

) |

(11,665,006 |

) |

(12,798,174 |

) |

| Current and deferred income

tax expenses (recovery) |

1,220,221 |

|

(239,724 |

) |

966,577 |

|

(38,650 |

) |

| Net interest revenues |

33,861 |

|

22,924 |

|

(78,794 |

) |

(63,342 |

) |

| Share of loss of a joint

venture |

— |

|

— |

|

— |

|

1,059,880 |

|

| Loss (gain) on disposal of

property, plant and equipment |

(193 |

) |

131,974 |

|

(18,453 |

) |

131,974 |

|

| Foreign exchange |

111,928 |

|

(329,788 |

) |

287,302 |

|

725,221 |

|

| Share-based compensation

expenses |

498,655 |

|

273,910 |

|

1,557,425 |

|

1,118,772 |

|

| Non-operational items (1) |

189,783 |

|

— |

|

459,783 |

|

116,000 |

|

|

Depreciation and amortization |

2,855,159 |

|

2,670,393 |

|

11,010,300 |

|

8,890,432 |

|

|

Adjusted EBITDA |

2,488,304 |

|

526,140 |

|

2,519,134 |

|

(857,887 |

) |

|

- From Advanced Materials, Plastics and Composite

Products |

3,329,793 |

|

1,130,962 |

|

5,176,437 |

|

(234,795 |

) |

|

- From Battery Cells |

(841,489 |

) |

(604,822 |

) |

(2,657,303 |

) |

(623,092 |

) |

|

|

|

|

|

|

(1) Non-operational items consist of

professional fees mainly due debt renegotiation and to prospectuses

related fees.

IFRS “Gross margin” to Non-IFRS

“Adjusted Gross margin”

|

|

Q4-2024 |

Q4-2023 |

FY 2024 |

FY 2023 |

|

|

$ |

$ |

$ |

$ |

|

|

|

|

|

|

| Revenues from customers |

37,717,688 |

33,010,658 |

128,600,936 |

122,700,485 |

| Cost of

sales |

28,811,991 |

26,154,539 |

101,486,565 |

101,414,290 |

|

Adjusted gross margin |

8,905,697 |

6,856,119 |

27,114,371 |

21,286,195 |

|

Depreciation (production) |

1,657,615 |

1,535,165 |

6,362,339 |

5,873,873 |

|

Gross margin |

7,248,082 |

5,320,954 |

20,752,032 |

15,412,322 |

Reporting Segments

results

NanoXplore reports its financials in two

distinct segments: Advanced Materials, Plastics and Composite

Products and Battery cells.

| |

Q4-2024 |

|

Q4-2023 |

|

Variation |

|

YTD 2024 |

|

YTD 2023 |

|

Variation |

|

|

|

$ |

|

$ |

|

$ |

|

% |

|

$ |

|

$ |

|

$ |

|

% |

|

| |

|

|

|

|

|

|

|

|

| From

Advanced materials, plastics and composite products |

| Revenues |

38,125,566 |

|

33,318,964 |

|

4,806,602 |

|

14 |

% |

129,964,625 |

|

123,857,171 |

|

6,107,454 |

|

5 |

% |

| Non-IFRS Measure

* |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

3,329,793 |

|

1,130,962 |

|

2,198,831 |

|

194 |

% |

5,176,437 |

|

(234,795 |

) |

5,411,232 |

|

2 305 |

% |

| |

|

|

|

|

|

|

|

|

| From

Battery cells |

| Revenues |

— |

|

— |

|

— |

|

N/A |

|

27,743 |

|

— |

|

27,743 |

|

N/A |

|

| Non-IFRS Measure

* |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

(841,489 |

) |

(604,822 |

) |

(236,667 |

) |

(39 |

%) |

(2,657,303 |

) |

(623,092 |

) |

(2,034,211 |

) |

N/A |

|

A. Results of operations

variance analysis - Three-month periods

Revenues

|

|

Q4-2024 |

Q4-2023 |

Variation |

|

Q3-2024 |

Variation |

|

|

|

$ |

$ |

$ |

% |

|

$ |

$ |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues from customers |

37,717,688 |

33,010,658 |

4,707,030 |

14 |

% |

33,617,106 |

4,100,582 |

12 |

% |

| Other

income |

407,878 |

308,306 |

99,572 |

32 |

% |

250,641 |

157,237 |

63 |

% |

|

Total revenues |

38,125,566 |

33,318,964 |

4,806,602 |

14 |

% |

33,867,747 |

4,257,819 |

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

All revenues are coming from the segment of

Advanced Materials, Plastics and Composite Products.

Revenues from customers increased from

$33,617,106 in Q3-2024 to $37,717,688 in Q4-2024. This increase is

mainly due to a positive product mix and higher volume.

Revenues from customers increased from

$33,010,658 in Q4-2023 to $37,717,688 in Q4-2024. This increase is

mainly due to higher volume and higher tooling revenues.

Other income increased from $308,306 in Q4-2023

to $407,878 in Q4-2024. Other income amounted to $250,641 in

Q3-2024. The variation is mainly in grants received for R&D

programs.

Adjusted EBITDA

1) From Advanced

Materials, Plastics and Composite Products

The adjusted EBITDA improved from $1,130,962 in

Q4-2023 to $3,329,793 in Q4-2024. The variation is explained as

follows:

- Gross margin on revenues from

customers increased by $2,049,578 compared to last year due to

higher volume, favourable product mix, improved productivity and

cost control;

- Higher other income of $99,572 as

explained above.

2) From Battery

Cells

The adjusted EBITDA loss increased from $604,822

in Q4-2023 to $841,489 in Q4-2024. The variation is explained by

the operational expenses increase (Selling, General &

Administration “SG&A” and Research & Development “R&D”)

of $236,667 due to higher than usual 3rd party pre-engineering

expenses undertaken during the quarter.

B. Results

of operations variance analysis – Year ended

Revenues

|

|

FY 2024 |

FY 2023 |

Variation |

|

|

$ |

$ |

$ |

% |

|

|

|

|

|

|

|

Revenues from customers |

128,600,936 |

122,700,485 |

5,900,451 |

5 |

% |

| Other

income |

1,391,432 |

1,156,686 |

234,746 |

20 |

% |

|

Total revenues |

129,992,368 |

123,857,171 |

6,135,197 |

5 |

% |

|

|

|

|

|

|

All revenues are coming from the Advanced

Materials, Plastics and Composite Products segment, except for

$27,743 of other income [2023 – Nil] from the Battery Cells

segment.

Revenues from customers increased from

$122,700,485 last year to $128,600,936 this year. This increase is

mainly due to higher volume and higher tooling revenues.

Other income increased from $1,156,686 last year

to $1,391,432 this year. The variation is mainly in grants received

for R&D programs.

Adjusted EBITDA

1) From Advanced

Materials, Plastics and Composite Products

The adjusted EBITDA improved from a loss of

$234,795 last year to a profit of $5,176,437 this year. The

variation is explained as follows:

- Gross margin on revenues from

customers increased by $5,828,176 compared to last year due to

higher volume, favourable product mix, improved productivity and

cost control;

- Higher other income of $234,746 as

described above; and

- Partially offset by higher

operating expenses (SG&A and R&D) of $967,730 mainly due to

higher wages, including higher variable compensation.

2) From Battery

Cells

The adjusted EBITDA loss increased from $623,092

last year to $2,657,303 this year. The variation is explained by

the operating expenses (G&A and R&D) of $2,685,046 due in

part to the acquisition during 2023 of the Martinrea share in

VoltaXplore.

C. Other

Additional information about the Corporation,

including the Corporation’s Management Discussion and Analysis for

the years ended June 30, 2024 and 2023 (“MD&A”) and the

Corporation’s consolidated financial statements for the for years

ended June 30, 2024 and 2023 (the “financial statements”) can

be found at www.nanoxplore.ca.

Webcast

NanoXplore will hold a webcast tomorrow,

September 19, 2024, at 8:30 am EDT to review its year ended June

30, 2024. Soroush Nazarpour, CEO and President of NanoXplore, and

Pedro Azevedo, Chief Financial Officer, will host the event. To

access the webcast please click on the link

https://edge.media-server.com/mmc/p/3gw4uj5b or you can access

through our website in the Investors section under Events and

Presentations. A replay of this event can be accessed via the above

link or on our website.

About NanoXplore

NanoXplore is a graphene company, a manufacturer

and supplier of high-volume graphene powder for use in

transportation and industrial markets. Also, the Corporation

provides standard and custom graphene-enhanced plastic and

composite products to various customers in transportation,

packaging, electronics, and other industrial sectors. The

Corporation is also a silicon-graphene-enhanced Li-ion battery

manufacturer for the Electric Vehicle and grid storage markets.

NanoXplore is headquartered in Montreal, Quebec with manufacturing

facilities in Canada, the United States and Europe.

Forward-Looking Statements

This press release contains forward-looking

statements and forward-looking information (together,

“forward-looking statements”) within the meaning of applicable

securities laws. All statements, other than statements of

historical facts, are forward-looking statements, and subject to

risks and uncertainties. All forward-looking statements are based

on our beliefs as well as assumptions based on information

available at the time the assumption was made and on management’s

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors deemed

appropriate in the circumstances. No assurance can be given that

these assumptions and expectations will prove to be correct.

Forward-looking statements are not facts, but only predications and

can generally be identified by the use of statements that include

phrases such as “anticipate”, “believe”, “continue”, “could”,

“estimate”, “foresee”, “grow”, “expect”, “plan”, “intend”,

“forecast”, “future”, “guidance”, “may”, “predict”, “project”,

“should”, “strategy”, “target”, “will” or similar expressions

suggesting future outcomes.

Forward-looking information is not a guarantee

of future performance and involves a number of risks and

uncertainties. Such forward-looking information necessarily

involves known and unknown risks and uncertainties, including the

relevant assumptions and risks factors set out in NanoXplore’s most

recent annual management discussion and analysis filed on SEDAR+

at www.sedarplus.ca, which may cause NanoXplore’s actual

results to differ materially from any projections of future results

expressed or implied by such forward-looking information. These

risks, uncertainties and other factors include, among others, the

uncertain and unpredictable condition of global economy, notably as

a consequence of the Covid-19 pandemic. Any forward-looking

information is made as of the date hereof and, except as required

by law, NanoXplore does not undertake any obligation to update or

revise any forward–looking statement as a result of new

information, subsequent events or otherwise.

Forward-looking statements reflect management's

current beliefs, expectations and assumptions and are based on

information currently available to management. Readers are

cautioned not to place undue reliance on forward-looking

statements, as there can be no assurance that the future

circumstances, outcomes or results anticipated or implied by such

forward-looking statements will occur or that plans, intentions or

expectations upon which the forward-looking statements are based

will occur. By their nature, forward-looking statements involve

known and unknown risks and uncertainties and other factors that

could cause actual results to differ materially from those

contemplated by such statements.

No securities regulatory authority has either

approved or disapproved the contents of this press release.

For further information, please

contact: Pierre Yves

TerrisseVice-President Corporate Development

py.terrisse@nanoxplore.caTel: 1 438 476-1965

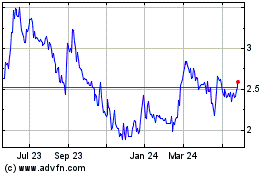

NanoXplore (TSX:GRA)

Historical Stock Chart

From Nov 2024 to Dec 2024

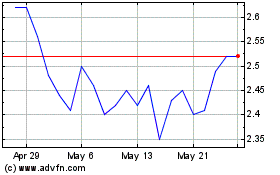

NanoXplore (TSX:GRA)

Historical Stock Chart

From Dec 2023 to Dec 2024