Gran Tierra Energy Inc. (“

Gran Tierra” or the

“

Company”)

(NYSE

American:GTE)(TSX:GTE)(LSE:GTE) today announced the

commencement of offers to Eligible Holders (as defined herein) to

exchange (such offers, the “

Exchange Offers”)

(i) any and all of the outstanding 6.250% Senior Notes due

2025 issued by Gran Tierra Energy International Holdings Ltd.

(“

GTEIH”) on February 15, 2018 (CUSIP:

38502HAA3 / G4066TAA0; ISIN: US38502HAA32 / USG4066TAA00) (the

“

2025 Notes”), and (ii) any and all of

the outstanding 7.750% Senior Notes due 2027 issued by the Company

on May 23, 2019 (CUSIP: 38502JAA9 / U37016AA7; ISIN:

US38502JAA97 / USU37016AA70) (the

“

2027 Notes” and, together with the

2025 Notes, the “

Existing Notes”) for newly

issued 9.500% Senior Secured Amortizing Notes due 2029 (the

“

New Notes”), pursuant to the terms and subject to

the conditions set forth in the exchange offer memorandum and

consent solicitation statement, dated September 19, 2023 in

respect of the Exchange Offers and Solicitations of Consents (each,

as defined below) (the “

Exchange Offer

Memorandum”). Any capitalized terms used in this press

release without definition have the respective meanings assigned to

such terms in the Exchange Offer Memorandum.

|

Existing Notes |

|

CUSIP/ISIN Numbers |

|

Principal Amount Outstanding |

|

Early Participation

Premium(1) |

|

Exchange

Consideration(2) |

|

Total

Consideration(3) |

|

6.250% Senior Notes due 2025 |

|

38502HAA3 / G4066TAA0US38502HAA32 / USG4066TAA00 |

|

US$271,909,000 |

|

US$80(4) |

|

US$1,000 |

|

US$1,080(4) |

|

7.750% Senior Notes due 2027 |

|

38502JAA9 / U37016AA7US38502JAA97 / USU37016AA70 |

|

US$300,000,000 |

|

US$70 |

|

US$950 |

|

US$1,020 |

_______________

|

(1) |

Early Participation Premium payable on the Settlement Date (as

defined below) per each US$1,000 aggregate principal amount of

Existing Notes validly tendered (and not validly withdrawn) on or

prior to the Early Participation Deadline. |

| (2) |

Exchange Consideration per each

US$1,000 aggregate principal amount of Existing Notes validly

tendered (and not validly withdrawn) after the Early Participation

Deadline but on or prior to the Expiration Deadline. The Exchange

Consideration will be payable in principal amount of New Notes on

the Settlement Date. The Exchange Consideration does not include

the applicable Accrued Interest. Accrued Interest will be paid in

cash on the Settlement Date. Holders who validly tender

Existing Notes after the Early Participation Deadline but prior to

the Expiration Deadline will receive only the Exchange

Consideration and Accrued Interest. |

| (3) |

Total Consideration payable per

each US$1,000 aggregate principal amount of Existing Notes validly

tendered (and not validly withdrawn) on or prior to the Early

Participation Deadline. The Total Consideration for (i) the

2025 Notes will be payable in a combination of cash and

principal amount of New Notes, and (ii) for the

2027 Notes will be payable in principal amount of New Notes,

in each case on the Settlement Date. The Total Consideration

(i) includes the Early Participation Premium, and

(ii) does not include the applicable Accrued Interest (as

defined below), which will be paid in cash on the Settlement

Date. Holders who tender after the Early Participation

Deadline but prior to the Expiration Deadline will receive only the

Exchange Consideration. |

| (4) |

Eligible Holders validly

tendering (and not withdrawing) the 2025 Notes on or prior to

the Early Participation Deadline will receive, in the aggregate,

US$60.0 million of the Total Consideration in cash on the

Settlement Date, with the remainder of the Total Consideration in

principal amount of New Notes. At the Early Participation Deadline,

(i) the pro rata cash portion of the Total Consideration

(which includes the Early Participation Premium) payable in cash

and (ii) the balance payable in principal amount of New Notes,

per US$1,000 principal amount of 2025 Notes validly tendered

(and not validly withdrawn) on or prior to the Early Participation

Deadline, will be determined based on the aggregate principal

amount of 2025 Notes validly tendered (and not validly withdrawn)

on or prior to the Early Participation Deadline and accepted for

exchange. |

Simultaneously with the Exchange Offers,

(i) GTEIH is conducting a solicitation (the “2025

Solicitation”) of consents (the “2025

Consents”) from Eligible Holders of 2025 Notes to

effect certain proposed amendments (the “2025 Proposed

Amendments”) to the indenture dated as of

February 15, 2018, under which the 2025 Notes were issued (the

“2025 Existing Indenture”), and (ii) the

Company is conducting a solicitation (the “2027

Solicitation” and, together with the 2025 Solicitation,

the “Solicitations”) of consents (the

“2027 Consents” and, together with the 2025

Consents, the “Consents”) from Eligible Holders of

2027 Notes to effect certain proposed amendments (the “2027

Proposed Amendments” and, together with the 2025 Proposed

Amendments, the “Proposed Amendments”) to the

indenture dated as of May 23, 2019, under which the 2027 Notes

were issued (the “2027 Existing Indenture”

and, together with the 2025 Existing Indenture, the

“Existing Indentures”). The Proposed Amendments

would provide for, among other things, (i) the elimination of

substantially all of the restrictive covenants and events of

default and related provisions with respect to the applicable

series of Existing Notes, and (ii) the amendment of certain

defined terms and covenants in the Existing Indentures. It is also

expected that the guarantees of the Existing Notes may be released

as described in the Exchange Offer Memorandum. Each Exchange Offer

and Solicitation is a separate offer, and each Exchange Offer and

Solicitation may be individually amended, extended, terminated or

withdrawn without amending, extending, terminating or withdrawing

any other Exchange Offer or Solicitation, provided that each

Exchange Offer is subject to the satisfaction of the Minimum

Exchange Condition (as defined below). The New Notes will be issued

pursuant to an indenture and will be senior secured

obligations.

Important Dates and Times

|

Commencement |

September 19, 2023. |

| Early Participation

Deadline |

5:00 p.m., New York City time, on October 2, 2023, unless

extended or earlier terminated by the Company, in its sole

discretion. |

| Withdrawal

Deadline |

5:00 p.m., New York City time, on October 2, 2023, unless

extended or earlier terminated by the Company, in its sole

discretion. |

| Expiration

Deadline |

11:59 p.m., New York City time, on October 18, 2023,

unless extended or earlier terminated by the Company, in its sole

discretion. |

| Settlement

Date |

Promptly following the Expiration Deadline and is expected to be

the second business day after the Expiration Deadline, on

October 20, 2023, unless extended. |

Existing Notes tendered for their exchange on or

prior to the Early Participation Deadline may be validly withdrawn,

and the related Consents may be validly revoked, at any time prior

to 5:00 p.m., New York City time, on October 2, 2023, unless

extended by the Company, in its sole discretion (the

“Withdrawal Deadline”).

Eligible Holders who validly tender Existing

Notes and deliver Consents, and do not validly revoke such tenders

and Consents, on or prior to 5:00 p.m., New York City time, on

October 2, 2023, unless extended or earlier terminated by the

Company, in its sole discretion (the “Early Participation

Deadline”) and whose Existing Notes are accepted for

exchange by the Company will receive (i) for each US$1,000

aggregate principal amount of 2025 Notes validly tendered (and not

validly withdrawn) on or before the Early Participation Deadline,

US$1,080 (the “2025 Notes Total Consideration”), a

portion of which will be payable in cash and the remainder will be

payable in principal amount of New Notes, and (ii) for each

US$1,000 aggregate principal amount of 2027 Notes validly tendered

(and not validly withdrawn) on or prior to the Early Participation

Deadline is equal to US$1,020 in principal amount of New Notes (the

“2027 Notes Total Consideration” and, together

with the Total 2025 Notes Consideration, the “Total

Consideration”).

The 2025 Notes Total Consideration includes

the early participation premium, for each US$1,000 aggregate

principal amount of 2025 Notes validly tendered (and not validly

withdrawn) on or prior to the Early Participation Deadline, equal

to US$80, payable on the Settlement Date (the “2025 Notes

Early Participation Premium”). The 2027 Notes Total

Consideration includes the early participation premium, for each

US$1,000 aggregate principal amount of 2027 Notes validly tendered

(and not validly withdrawn) on or prior to the Early Participation

Deadline, equal to US$70, payable on the Settlement Date (the

“2027 Notes Early Participation Premium” and,

together with the 2025 Notes Early Participation Premium, the

“Early Participation Premium”).

The aggregate cash consideration payable as part

of the 2025 Notes Total Consideration (which includes the 2025

Notes Early Participation Premium) to all Eligible Holders whose

2025 Notes are validly tendered (and not validly withdrawn) on or

prior to the Early Participation Deadline and whose 2025 Notes are

accepted for exchange is equal to US$60.0 million. The pro rata

portion of the US$60.0 million cash consideration as part of the

2025 Notes Total Consideration for each US$1,000 aggregate

principal amount of 2025 Notes validly tendered (and not validly

withdrawn) on or prior to the Early Participation Deadline, and

accepted for exchange, will be determined at the Early

Participation Deadline, based on the aggregate amount of

2025 Notes validly tendered (and not validly withdrawn) on or

prior to the Early Participation Deadline. The greater the amount

of 2025 Notes validly tendered (and not validly withdrawn), the

lower the pro rata portion of the US$60.0 million cash

consideration per US$1,000 aggregate principal amount of 2025 Notes

tendered (and not validly withdrawn). For example: (i) if 100%

of the 2025 Notes outstanding is validly tendered (and not validly

withdrawn) on or prior to the Early Participation Deadline, each

Eligible Holder will receive, for each US$1,000 aggregate principal

amount of 2025 Notes validly tendered (and not validly withdrawn),

approximately US$221 in cash and approximately US$859 in aggregate

principal amount of New Notes, and (ii) if 50% of the 2025

Notes outstanding is validly tendered (and not validly withdrawn)

on or prior to the Early Participation Deadline, each Eligible

Holder will receive, for each US$1,000 aggregate principal amount

of 2025 Notes validly tendered (and not validly withdrawn),

approximately US$441 in cash and approximately US$639 in aggregate

principal amount of New Notes.

The Company expects to draw US$50 million

under its amended and restated senior secured credit facility,

established by the credit agreement, dated as of August 18,

2022, by and among the Company, Gran Tierra Energy Colombia GmbH

(formerly known as Gran Tierra Energy Colombia LLC), Gran Tierra

Operations Colombia GmbH (formerly known as Gran Tierra Colombia

Inc.), and Trafigura PTE Ltd. (“Trafigura”), as a

lender, to finance a portion of the cash consideration for the

exchange of the 2025 Notes validly tendered (and not validly

withdrawn) on or prior to the Early Participation Deadline, and to

fund the remainder of the cash consideration with cash on hand. On

September 19, 2023, in connection with the Exchange Offers,

the Company amended and restated such senior secured credit

facility to, among other things, adjust the initial commitment of

US$100 million to US$50 million (maintaining the

potential option of up to an additional US$50 million, subject

to approval by the lender), and extend the availability period

until December 31, 2023. The repayment of the credit facility

will continue to be made by way of deductions of the price payable

by Trafigura for the crude oil delivered under commercial oil

marketing contracts, which we have in place with Trafigura. As at

June 30, 2023, after giving effect to the amendment, the

credit facility was undrawn.

Eligible Holders who validly tender Existing

Notes and deliver Consents, and do not validly revoke such tenders

and Consents, after the Early Participation Deadline and on or

prior to 5:00 p.m., New York City time, on October 18,

2023, unless extended by the Company, in its sole discretion (the

“Expiration Deadline”) and whose Existing Notes

are accepted for exchange by us will receive (i) for each

US$1,000 aggregate principal amount of 2025 Notes validly tendered

(and not validly withdrawn), US$1,000 aggregate principal amount of

New Notes (the “2025 Notes Exchange

Consideration”) and (ii) for each US$1,000 aggregate

principal amount of 2027 Notes validly tendered (and not validly

withdrawn), US$950 aggregate principal amount of New Notes (the

“2027 Notes Exchange Consideration” and, together

with the 2025 Notes Exchange Consideration, the

“Exchange Consideration”).

Eligible Holders whose Existing Notes are

accepted for exchange will be paid accrued and unpaid interest on

such Existing Notes from, and including, the most recent date on

which interest was paid on such Holder’s Existing Notes to, but not

including, the Settlement Date (the “Accrued

Interest”), payable on the Settlement Date. Accrued

Interest will be paid in cash on the Settlement Date. Interest will

cease to accrue on the Settlement Date for all Existing Notes

accepted for exchange in the applicable Exchange Offer.

Our obligation to accept Existing Notes tendered

pursuant to the Exchange Offers and Consents delivered pursuant to

the Solicitations is subject to the satisfaction of certain

conditions described in the Exchange Offer Memorandum, which

include, (i) the non-occurrence of an event or events or the

likely non-occurrence of an event or events that would or might

reasonably be expected to prohibit, restrict or delay the

consummation of the Exchange Offers or materially impair the

contemplated benefits to us of the Exchange Offers, (ii) the

receipt of both (a) the 2025 Consents of Eligible Holders of

2025 Notes that, in the aggregate, represent not less than 50% in

aggregate principal amount of the 2025 Notes outstanding (the

“2025 Required Holders”), and (b) the 2027

Consents of Eligible Holders of 2027 Notes that, in the aggregate,

represent not less than 50% in aggregate principal amount of the

2027 Notes outstanding (the “2027 Required

Holders”), prior to the Expiration Deadline (collectively,

the “Minimum Exchange Condition”), and

(iii) certain other customary conditions.

At any time after the Withdrawal Deadline and

before the Expiration Deadline, if both GTEIH and the Company have

received the 2025 Consent of Eligible Holders of 2025 Notes and the

2027 Consent of Eligible Holders of 2027 Notes, respectively, that,

in the aggregate, represent Holders that own not less than 50% of

the 2025 Notes and not less than 50% of the 2027 Notes,

respectively, on such date, GTEIH and the Company, as applicable,

and the trustee under the Existing Indentures may execute and

deliver a Supplemental Indenture to the Existing Indentures, which

will give effect to the Proposed Amendments to the Existing Notes,

that will be effective upon execution but will only become

operative upon consummation of the Exchange Offer on the Settlement

Date.

The Company will not receive any cash proceeds

from the issuance of the New Notes in the Exchange Offers and the

Solicitations. Existing Notes surrendered in connection with the

Exchange Offers, and accepted for exchange, will be cancelled.

The Exchange Offers are made, and the New Notes

will be offered and issued, only (a) in the United States to

holders of Existing Notes who are reasonably believed to be

“qualified institutional buyers” (as defined in Rule 144A

under the Securities Act of 1933, as amended (the

“Securities Act”)) in reliance upon the exemption

from the registration requirements of the Securities Act, and

(b) outside the United States to holders of Existing Notes who

are persons other than “U.S. persons” (as defined in

Rule 902 under the Securities Act) in reliance upon

Regulation S under the Securities Act and who are

non-U.S. qualified offerees and eligible purchasers in other

jurisdictions as set forth in the Exchange Offer Memorandum.

Holders who have returned a duly completed eligibility letter

certifying that they are within one of the categories described in

the immediately preceding sentences are authorized to receive and

review the Exchange Offer Memorandum and to participate in the

Exchange Offers and the Solicitations (such holders,

“Eligible Holders”). Holders who desire to obtain

and complete an eligibility letter should either visit the website

for this purpose at www.dfking.com/gte, or call

D.F. King & Co., Inc., the Information Agent and

Exchange Agent for the Exchange Offers and the Solicitation of

Consents at +1 (800) 859-8509 (toll free),

+1 (212) 269-5550 (banks and brokers), or email at

gte@dfking.com.

This press release does not constitute an offer

to buy or the solicitation of an offer to sell the Existing Notes

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction. This press release does

not constitute an offer to sell or the solicitation of an offer to

buy the New Notes, nor shall there be any sale of the New Notes in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction. The New Notes will not be

registered under the Securities Act or the securities laws of any

state and may not be offered or sold in the United States

absent registration or an exemption from the registration

requirements of the Securities Act and applicable state securities

laws.

The Exchange Offers are made, and the New Notes

will be offered and issued in Canada on a private placement basis

to holders of Existing Notes who are “accredited investors” and

“permitted clients,” each as defined under applicable Canadian

provincial securities laws.

None of the Company, the dealer manager, the

trustee, any agent or any affiliate of any of them makes any

recommendation as to whether Eligible Holders should tender or

refrain from tendering all or any portion of the principal amount

of such Eligible Holder’s Existing Notes for New Notes in the

Exchange Offers or Consent to any of the Proposed Amendments to the

Existing Indentures in the Solicitations. Eligible Holders will

need to make their own decision as to whether to tender Existing

Notes in the Exchange Offer and participate in the Solicitation

and, if so, the principal amount of Existing Notes to tender.

This press release is being issued pursuant to

and in accordance with Rule 135c under the Securities Act.

Cautionary Statement Regarding Forward-Looking

Statements

This press release includes forward-looking

statements within the meaning of Section 27A of the Securities Act,

Section 21E of the Securities Exchange Act of 1934, as amended, and

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995 or “forward-looking information” within the

meaning of applicable Canadian securities laws. All statements

other than statements of historical facts included in this press

release, and those statements preceded by, followed by or that

otherwise include the words “may,” “might,” “will,” “would,”

“could,” “should,” “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “project,” “target,” “goal,” “guidance,” “budget,”

“plan,” “objective,” “potential,” “seek,” or similar expressions or

variations on these expressions are forward-looking statements. The

Company can give no assurances that the assumptions upon which the

forward-looking statements are based will prove to be correct or

that, even if correct, intervening circumstances will not occur to

cause actual results to be different than expected. Because

forward-looking statements are subject to risks and uncertainties,

actual results may differ materially from those expressed or

implied by the forward-looking statements. There are a number of

risks, uncertainties and other important factors that could cause

our actual results to differ materially from the forward-looking

statements, including, but not limited to, the form and results of

the Exchange Offers and Solicitations of Consents; the Company’s

ability to comply with covenants in its Existing Indentures; the

Company’s ability to obtain amendments to the covenants in its

Existing Indentures; and those factors set out in the Exchange

Offer Memorandum under “Risk Factors,” in Part I, Item 1A, “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022, and in the Company’s other filings

with the U.S. Securities and Exchange Commission (the “SEC”).

Although the Company believes the expectations reflected in the

forward-looking statements are reasonable, the Company cannot

guarantee future results, level of activity, performance or

achievements. Moreover, neither the Company nor any other person

assumes responsibility for the accuracy or completeness of any of

these forward-looking statements. Eligible Investors should not

rely upon forward-looking statements as predictions of future

events. The information included herein is given as of the date of

this press release and, except as otherwise required by the

securities laws, the Company disclaims any obligation or

undertaking to publicly release any updates or revisions to, or to

withdraw, any forward-looking statement contained in this press

release to reflect any change in the Company’s expectations with

regard thereto or any change in events, conditions or circumstances

on which any forward-looking statement is based.

ABOUT GRAN TIERRA ENERGY INC.

Gran Tierra Energy Inc. together with its subsidiaries is an

independent international energy company currently focused on oil

and natural gas exploration and production in Colombia and Ecuador.

The Company is currently developing its existing portfolio of

assets in Colombia and Ecuador and will continue to pursue

additional new growth opportunities that would further strengthen

the Company’s portfolio. The Company’s common stock trades on the

NYSE American, the Toronto Stock Exchange and the London Stock

Exchange under the ticker symbol GTE. Additional information

concerning Gran Tierra is available at www.grantierra.com. Except

to the extent expressly stated otherwise, information on the

Company’s website or accessible from the Company’s website or any

other website is not incorporated by reference into, and should not

be considered part of, this press release. Investor inquiries may

be directed to info@grantierra.com or (403) 265-3221.

Gran Tierra’s filings with (i) the SEC are

available on the SEC website at www.sec.gov, (ii) the Canadian

securities regulatory filings are available on SEDAR at

www.sedar.com, and (iii) the UK regulatory filings are

available on the National Storage Mechanism (“the NSM”) website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism. Gran

Tierra’s filings on the SEC, SEDAR and the NSM websites are not

incorporated by reference into this press release.

For investor and media inquiries please contact:Gary Guidry,

President & Chief Executive OfficerRyan Ellson, Executive Vice

President & Chief Financial OfficerRodger Trimble, Vice

President, Investor Relations+1-403-265-3221info@grantierra.com

SOURCE Gran Tierra Energy Inc.

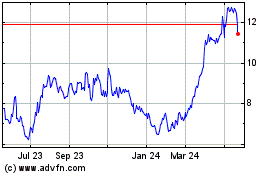

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

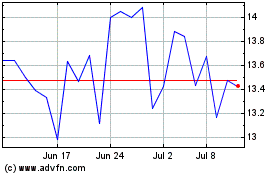

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Nov 2023 to Nov 2024