kneat.com, inc. (TSX: KSI, OTC: KSIOF) (“Kneat” or the

“Company”), a leader in digitizing and automating

validation and quality processes, today announced financial results

for the three-month period ended September 30, 2024. All dollar

amounts are presented in Canadian dollars unless otherwise stated.

- Third-quarter 2024 total revenue reaches $12.8 million, an

increase of 52% year over year

- Annual Recurring Revenue (ARR)1 at September 30, 2024 grows 59%

year over year, to $49.9 million

- Third-quarter gross profit reaches $9.8 million, an increase of

78% year over year

“Our team continues to deliver standout results. We

launched the latest version of Kneat Gx and welcomed new strategic

customers while advancing towards profitability. Increasingly, our

customers are using Kneat Gx as their single platform for all their

Validation needs, from CQV through to CSV.”

- said Eddie Ryan, Chief Executive Officer of Kneat.

Q3 2024 Financial Highlights

- Total revenues increased 52% to

$12.8 million for the third quarter of 2024, compared to $8.4

million for the third quarter of 2023.

- SaaS revenue for the third quarter

of 2024 grew 48% to $11.5 million, versus $7.7 million for the

third quarter of 2023.

- Third-quarter 2024 gross profit was

$9.8 million, up 78% from $5.5 million in gross profit for the

third quarter of 2023.

- Gross margin in the third quarter of

2024 was 77%, compared to 65% for the third quarter of 2023.

- Net income for the third quarter of

2024 was $1.2 million, compared with ($3.6) million for the third

quarter of 2023.

- EBITDA1 in the third quarter of 2024

was $4.3 million, compared with ($1.4) million for the third

quarter of 2023.

- Adjusted EBITDA1 in the third

quarter of 2024 was $2.9 million, compared with ($0.5) million for

the third quarter of 2023.

- Total ARR1, which includes SaaS

license and recurring maintenance fees, was $49.9 million at

September 30, 2024, an increase of 59% from $31.4 million at

September 30, 2023.

Q3 YTD Financial Highlights

- Total revenues year to date

increased 44% to $35.2 million, compared to $24.4 million for the

same nine-month period of 2023.

- SaaS revenue grew 51% to $32 million

for the nine months ended September 30, 2024, versus $21.1 million

for the same period of 2023.

- 2024 year-to-date gross profit was

$26.4 million, up 63% from $16.2 million for the same year-to-date

period of 2023.

- Gross margin for the nine months

ended September 30, 2024 was 75%, compared to 66% for the same

period of 2023.

- Net income for the nine months ended

September 30, 2024 was ($5.3) million, compared with ($11.5)

million for the nine months ended September 30, 2023.

- 2024 year-to-date EBITDA1 was $4.3

million, compared with ($5.5) million for the same year-to-date

period of 2023.

- 2024 year-to-date Adjusted EBITDA1

was $5.0 million, compared with ($2.9) million for the same

year-to-date period of 2023.

____________________________1 ARR and SaaS ARR are supplementary

measures. EBITDA and Adjusted EBITDA are non-IFRS measures and are

not recognized, defined or standardized measures under IFRS. These

measures are defined in the “Supplementary and Non-IFRS Measures”

section of this news release.

Recent Business Highlights

- On October 10, 2024, the Company

announced the closing of its previously announced bought deal

offering ("the Offering") of common shares with a syndicate of

investment dealers led by Cormark Securities Inc ("the

Underwriters"). Pursuant to the Offering, the Company issued a

total of 7,500,000 common shares at a price of $4.75 per common

share (the "Offering Price") for gross proceeds of $35,625,000,

which includes 131,500 common shares issued at the Offering Price

as a result of the partial exercise by the Underwriters of the

over-allotment option granted by the Company to the

Underwriters.

- In early October, Kneat announced

that a global pharmaceutical company signed a three-year Master

Services Agreement with Kneat to digitize its validation processes.

Headquartered in Germany with over 11,000 employees across more

than a dozen facilities, the company is a trusted maker of

household consumer health care brands and generic and specialty

pharmaceuticals for customers in over 120 countries. The company

plans to use the Kneat Gx platform initially for Computer System

Validation (CSV).

- In late October, Kneat announced

that a global and diverse medical devices manufacturer signed a

three-year Master Services Agreement with Kneat to digitize its

validation processes. Headquartered in Germany with over 11,000

employees and more than 30 production sites across 15 countries,

the Company provides solutions to the pharma, biotech and cosmetic

industries. The company plans to use the Kneat Gx platform

initially for Commissioning, Qualification and Validation.

“Our current trajectory is in the direction of continued SaaS

sales expansion, greater platform efficiencies and greater

optionality, thanks to our recent funding. With this set-up, Kneat

is stronger than ever, and firmly on a path toward even greater

achievements ahead.”

-said Hugh Kavanagh, Chief Financial Officer of Kneat.

Quarterly Conference Call

Eddie Ryan, Chief Executive Officer of Kneat, and Hugh Kavanagh,

Chief Financial Officer of Kneat, will host a conference call to

discuss Kneat’s third-quarter results and hold a Q&A session

for analysts and investors via webcast on Thursday, November 7,

2024, at 9:00 a.m. ET.

Interested parties can register for the live webcast via the

following link:

Register here

Supplementary and Non-IFRS Financial

Measures

The Company uses supplementary financial measures as key

performance indicators in its MD&A and other communications.

Management uses both IFRS measures and supplementary, non-IFRS

financial measures as key performance indicators when planning,

monitoring and evaluating the Company’s performance.

Annual Recurring Revenue (“ARR”)

ARR is used by Kneat to assess the expected recurring annual

revenues from the customers that are live on the Kneat Gx platform

at the end of the period. ARR is calculated using the licenses

delivered to customers at the period end, multiplied by the

expected customer retention rate of 100% and multiplied by the full

agreed annual SaaS license or maintenance fee. Since many of the

customer contracts are in currencies other than the Canadian

dollar, the Canadian dollar equivalent is calculated using the

related period end exchange rate multiplied by the contracted

currency amount.

Software-as-a-Service Annual Recurring Revenue (“SaaS ARR”)

SaaS ARR is a component of ARR that is used by Kneat to assess

the expected recurring revenues exclusively from license

subscriptions to the Kneat Gx platform at the end of the period.

SaaS ARR is calculated as the SaaS licenses delivered to customers

at the period end, multiplied by the expected customer retention

rate of 100% and multiplied by the full agreed annual SaaS license

fee. Since many of the customer contracts are in currencies other

than the Canadian dollar, the Canadian dollar equivalent is

calculated using the related period end exchange rate multiplied by

the contracted currency amount.

Earnings before Interest, Taxes, Depreciation and Amortization

(“EBITDA”)

EBITDA is calculated as net income (loss) attributable to

kneat.com excluding interest income (expense), provision for income

taxes, depreciation and amortization. We provide and use this

non-IFRS measure of our operating performance to highlight trends

in our core business that may not otherwise be apparent when

relying solely on IFRS financial measures and to inform financial

comparisons with other companies. A reconciliation of EBITDA to

IFRS financial measures is provided in the financial statements

accompanying this press release.

Earnings before Interest, Taxes, Depreciation and Amortization

(“Adjusted EBITDA”)

Adjusted EBITDA is calculated as net income (loss) attributable

to kneat.com excluding interest income (expense), provision for

income taxes, depreciation and amortization, foreign exchange loss

(gain), and stock-based compensation expense. We provide and use

this non-IFRS measure of our operating performance to highlight

trends in our core business that may not otherwise be apparent when

relying solely on IFRS financial measures and to inform financial

comparisons with other companies. A reconciliation of Adjusted

EBITDA to IFRS financial measures is provided in the financial

statements accompanying this press release.

About Kneat

Kneat Solutions provides leading companies in highly regulated

industries with unparalleled efficiency in validation and

compliance through its digital validation platform Kneat Gx. We

lead the industry in customer satisfaction with an unblemished

record for implementation, powered by our user-friendly design,

expert support, and on-demand training academy. Kneat Gx is an

industry-leading digital validation platform that enables highly

regulated companies to manage any validation discipline from

end-to-end. Kneat Gx is fully ISO 9001 and ISO 27001 certified,

fully validated, and 21 CFR Part 11/Annex 11 compliant. Multiple

independent customer studies show a 40% or more reduction in

validation cycle times, nearly 20% faster speed to market, and 80%

reduced changeover time. For more information

visit www.kneat.com.

Cautionary and Forward-Looking Statements

Except for the statements of historical fact contained herein,

certain information presented constitutes "forward-looking

information" within the meaning of applicable Canadian securities

laws. Such forward-looking information includes, but is not limited

to, the relationship between Kneat and the customer, Kneat's

business development activities, the use and implementation

timelines of Kneat's software within the customer's validation

processes, the ability and intent of the customer to scale the use

of Kneat's software within the customer's organization, our ability

to win business from new customers and expand business from

existing customers, our expected use of the net proceeds from the

IPF Facility and/or any future offering, the anticipated effects of

the IPF Facility and/or any future offering on our business and

operations, and the compliance of Kneat's platform under regulatory

audit and inspection. These and other assumptions, risks and

uncertainties may cause Kneat's actual results, performance,

achievements and developments to differ materially from the

results, performance, achievements or developments expressed or

implied by forward-looking statements.

Material risks and uncertainties relating to our business are

described under the headings "Cautionary Note Regarding

Forward-Looking Statements and Information" and "Risk Factors" in

our MD&A dated November 6, 2024, under the heading "Risk

Factors" in our Annual Information Form dated February 21, 2024 and

in our other public documents filed with Canadian securities

regulatory authorities, which are available at www.sedar.com.

Forward-looking statements are provided to help readers understand

management's expectations as at the date of this release and may

not be suitable for other purposes. Readers are cautioned not to

place undue reliance on forward-looking statements. Kneat assumes

no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise, except as expressly required by law. Investors should

not assume that any lack of update to a previously issued

forward-looking statement constitutes a reaffirmation of that

statement. Continued reliance on forward-looking statements is at

an investor's own risk.

For further information:

Katie Keita, Kneat Investor RelationsP: + 1

902-450-2660E: katie.keita@kneat.com

| |

| kneat.com,

inc. |

| Unaudited

Condensed Interim Consolidated Statements of Loss and Comprehensive

Loss |

| (expressed in

Canadian dollars) |

| |

| |

|

|

Three-month

period ended |

|

Nine-month

period ended |

| |

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

SaaS License fees |

|

|

11,479,130 |

|

|

|

7,738,841 |

|

|

|

32,032,738 |

|

|

|

21,144,414 |

|

| |

On-premise

license fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

436,126 |

|

| |

Maintenance

fees |

|

|

64,190 |

|

|

|

24,223 |

|

|

|

198,668 |

|

|

|

230,380 |

|

| |

Professional

services and other |

|

|

1,218,754 |

|

|

|

642,198 |

|

|

|

2,973,403 |

|

|

|

2,598,489 |

|

|

Total Revenue |

|

|

12,762,074 |

|

|

|

8,405,262 |

|

|

|

35,204,809 |

|

|

|

24,409,409 |

|

| |

|

|

|

|

|

|

|

|

|

|

Cost of Revenue |

|

|

(2,991,384 |

) |

|

|

(2,923,725 |

) |

|

|

(8,807,493 |

) |

|

|

(8,226,657 |

) |

|

Gross Profit |

|

|

9,770,690 |

|

|

|

5,481,537 |

|

|

|

26,397,316 |

|

|

|

16,182,752 |

|

|

Gross Margin |

|

|

77 |

% |

|

|

65 |

% |

|

|

75 |

% |

|

|

66 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

(3,915,509 |

) |

|

|

(3,836,971 |

) |

|

|

(12,722,947 |

) |

|

|

(11,924,972 |

) |

|

Sales and marketing |

|

|

(3,934,685 |

) |

|

|

(3,119,679 |

) |

|

|

(12,334,854 |

) |

|

|

(9,412,699 |

) |

|

General and administrative |

|

|

(2,149,414 |

) |

|

|

(1,701,840 |

) |

|

|

(6,450,002 |

) |

|

|

(5,317,083 |

) |

|

Total Expenses |

|

|

(9,999,608 |

) |

|

|

(8,658,490 |

) |

|

|

(31,507,803 |

) |

|

|

(26,654,754 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Operating Loss |

|

|

(228,918 |

) |

|

|

(3,176,953 |

) |

|

|

(5,110,487 |

) |

|

|

(10,472,002 |

) |

|

Interest expense |

|

|

(892,318 |

) |

|

|

(343,519 |

) |

|

|

(2,630,674 |

) |

|

|

(452,060 |

) |

|

Interest income |

|

|

172,005 |

|

|

|

1,896 |

|

|

|

380,079 |

|

|

|

6,015 |

|

|

Foreign exchange gain (loss) |

|

|

2,208,615 |

|

|

|

(72,852 |

) |

|

|

2,227,902 |

|

|

|

(537,900 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

|

1,259,384 |

|

|

|

(3,591,428 |

) |

|

|

(5,133,180 |

) |

|

|

(11,455,947 |

) |

|

Income taxes |

|

|

(86,253 |

) |

|

|

- |

|

|

|

(130,692 |

) |

|

|

(8,550 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Net income (loss) for period |

|

|

1,173,131 |

|

|

|

(3,591,428 |

) |

|

|

(5,263,872 |

) |

|

|

(11,464,497 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) / income |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment to presentation

currency |

|

|

(1,363,967 |

) |

|

|

141,830 |

|

|

|

(1,598,137 |

) |

|

|

486,432 |

|

| |

|

|

|

|

|

|

|

|

|

|

Comprehensive loss for the period |

|

|

(190,836 |

) |

|

|

(3,449,598 |

) |

|

|

(6,862,009 |

) |

|

|

(10,978,065 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share - Basic and diluted |

|

$ |

0.01 |

|

|

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.15 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Weighted Average Number of Common Shares Outstanding -

Basic |

|

|

85,915,834 |

|

|

|

77,824,761 |

|

|

|

84,173,809 |

|

|

|

77,744,726 |

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation: |

|

|

|

|

|

|

|

|

| |

Total income

(loss) for the period |

|

|

1,173,131 |

|

|

|

(3,591,428 |

) |

|

|

(5,263,872 |

) |

|

|

(11,464,497 |

) |

| |

Interest expense |

|

|

892,318 |

|

|

|

343,519 |

|

|

|

2,630,674 |

|

|

|

452,060 |

|

| |

Interest income |

|

|

(172,005 |

) |

|

|

(1,896 |

) |

|

|

(380,079 |

) |

|

|

(6,015 |

) |

| |

Income taxes |

|

|

86,253 |

|

|

|

- |

|

|

|

130,692 |

|

|

|

8,550 |

|

| |

Depreciation expense |

|

|

189,272 |

|

|

|

190,795 |

|

|

|

570,889 |

|

|

|

594,047 |

|

| |

Amortization expense |

|

|

2,126,011 |

|

|

|

1,654,910 |

|

|

|

6,649,072 |

|

|

|

4,897,794 |

|

| |

EBITDA |

|

|

4,294,980 |

|

|

|

(1,404,100 |

) |

|

|

4,337,376 |

|

|

|

(5,518,061 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

Adjustments

to EBITDA |

|

|

|

|

|

|

|

|

| |

Foreign exchange (gain) loss |

|

|

(2,208,615 |

) |

|

|

72,852 |

|

|

|

(2,227,902 |

) |

|

|

537,900 |

|

| |

Stock-based compensation expense |

|

|

763,657 |

|

|

|

795,148 |

|

|

|

2,914,820 |

|

|

|

2,069,228 |

|

| |

Adjusted EBITDA |

|

|

2,850,022 |

|

|

|

(536,100 |

) |

|

|

5,024,294 |

|

|

|

(2,910,933 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

| kneat.com,

inc. |

| Unaudited

Condensed Interim Consolidated Statements of Financial

Position |

| (expressed

in Canadian dollars) |

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

| Cash |

31,681,064 |

|

|

15,252,526 |

|

| Accounts

receivable |

13,322,678 |

|

|

11,601,558 |

|

|

Prepayments |

1,407,512 |

|

|

1,138,382 |

|

| |

46,411,254 |

|

|

27,992,466 |

|

| |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

| Accounts

receivable |

1,914,572 |

|

|

1,650,795 |

|

| Property and

equipment |

6,966,819 |

|

|

7,209,953 |

|

| Intangible

assets |

34,132,237 |

|

|

27,642,752 |

|

| |

|

|

|

|

|

|

Total Assets |

89,424,882 |

|

|

64,495,966 |

|

| |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

| Accounts

payable and accrued liabilities |

8,273,692 |

|

|

7,874,332 |

|

| Contract

liabilities |

20,760,819 |

|

|

13,647,071 |

|

| Lease

liabilities |

500,577 |

|

|

535,832 |

|

| Loan

payable |

3,025,980 |

|

|

- |

|

| |

|

|

|

|

|

| |

32,561,068 |

|

|

22,057,235 |

|

| |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

| Contract

liabilities |

64,112 |

|

|

41,084 |

|

| Lease

liabilities |

5,810,671 |

|

|

5,976,380 |

|

| Loan payable

and accrued interest |

20,100,157 |

|

|

21,657,423 |

|

| |

|

|

|

|

|

|

Total Liabilities |

58,536,008 |

|

|

49,732,122 |

|

| |

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Shareholders' equity |

30,888,874 |

|

|

14,763,844 |

|

| |

|

|

|

|

|

|

Total Liabilities and Equity |

89,424,882 |

|

|

64,495,966 |

|

| |

|

|

|

|

|

| |

| kneat.com,

inc. |

| Unaudited

Condensed Interim Consolidated Statement of Cash

Flows |

| (expressed in

Canadian dollars) |

| For the period

ended |

|

|

9 months |

|

9 months |

|

|

September 30, |

|

September 30, |

|

|

2024 |

|

2023 |

|

Operating activities |

|

|

|

|

Net loss for the period |

(5,263,872 |

) |

|

(11,464,497 |

) |

| Charges to

loss not involving cash: |

|

|

|

|

Depreciation of property and equipment |

570,889 |

|

|

594,047 |

|

|

Share-based compensation expense |

2,914,820 |

|

|

2,069,228 |

|

|

Interest expense |

2,630,674 |

|

|

452,060 |

|

|

Tax expense |

130,692 |

|

|

8,550 |

|

|

Amortization of the intangible asset |

6,649,072 |

|

|

4,897,794 |

|

|

Amortization of loan issuance costs |

121,237 |

|

|

26,331 |

|

|

Impact of lease termination |

- |

|

|

(65,936 |

) |

|

Write-off of property and equipment |

- |

|

|

26,632 |

|

|

Impact of lease termination |

- |

|

|

- |

|

|

Other non-cash adjustments |

- |

|

|

- |

|

|

Foreign exchange (gain) loss |

(2,227,902 |

) |

|

537,900 |

|

|

Increase/(Decrease) in non-current contract liabilities |

20,795 |

|

|

(879,551 |

) |

| Net change

in non-cash working capital related to operations |

5,343,945 |

|

|

2,431,164 |

|

| |

|

|

|

| |

|

|

|

| Net

cash provided by (used in) operating activities |

10,890,350 |

|

|

(1,366,278 |

) |

| |

|

|

|

|

Financing activities |

|

|

|

| Proceeds

received from public equity financing |

20,000,110 |

|

|

- |

|

| Share

issuance costs associated with public equity financing |

(1,626,257 |

) |

|

- |

|

| Payment of

principal and interest on the loan payable |

(1,896,196 |

) |

|

(196,276 |

) |

| Proceeds

from the exercise of stock options |

1,698,366 |

|

|

74,750 |

|

| Repayment of

lease liabilities |

(564,010 |

) |

|

(559,090 |

) |

| Proceeds

received from loan financing |

- |

|

|

14,353,000 |

|

| Issuance

costs associated with loan financing |

- |

|

|

(540,085 |

) |

| |

|

|

|

| Net

cash provided by financing activities |

17,612,013 |

|

|

13,132,299 |

|

| |

|

|

|

|

Investing activities |

|

|

|

| Additions to

the intangible asset |

(14,794,310 |

) |

|

(12,702,025 |

) |

| Additions to

property and equipment |

(104,354 |

) |

|

(109,931 |

) |

| Collection

of research and development tax credits |

2,353,578 |

|

|

- |

|

| |

|

|

|

| Net

cash used in investing activities |

(12,545,086 |

) |

|

(12,811,956 |

) |

| |

|

|

|

|

Effects of foreign exchange rates on cash |

471,261 |

|

|

245,433 |

|

| |

|

|

|

| Net

change in cash during the period |

16,428,538 |

|

|

(800,502 |

) |

| |

|

|

|

| Cash

- Beginning of period |

15,252,526 |

|

|

12,282,478 |

|

| |

|

|

|

| Cash

- End of period |

31,681,064 |

|

|

11,481,976 |

|

| |

|

|

|

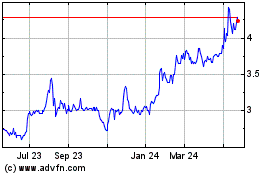

Kneat Com (TSX:KSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

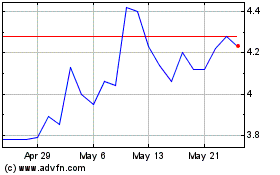

Kneat Com (TSX:KSI)

Historical Stock Chart

From Jan 2024 to Jan 2025