- V2O5 production of 1,986 tonnes (4.4 million lbs1) in Q1

2021 vs. 2,831 tonnes in Q1 2020; Lower production in Q1 2021 was

largely a result of the planned shutdown associated with the

Company’s cost-efficient nameplate capacity increase

- Commissioning and ramp up of cost-efficient nameplate

capacity increase to 1,100 tonnes of V2O5 per month to be completed

by the end of Q2 2021

- Global V2O5 recovery rate2 of 77.4% in Q1 2021, a 3%

decrease over Q1 2020

- Total V2O5 equivalent sales of 2,783 tonnes in Q1 2021, a

12% decrease over Q1 2020 mainly due to lower production during Q1

2021

- Strong vanadium price increases with main indexes in Europe

and U.S. up approximately 30% to 50% in Q1 2021 on the back of

solid demand in all key regions

- 2021 production, sales and cost guidance maintained

Largo Resources Ltd. ("Largo" or the "Company")

(TSX: LGO) (NASDAQ: LGO) announces first quarter 2021

production and sales results from its Maracás Menchen Mine

featuring quarterly production of 1,986 tonnes (4.4 million lbs1)

of vanadium pentoxide (“V2O5”) and sales of 2,783 tonnes of

V2O5 equivalent.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210419005236/en/

Largo Resources Announces First Quarter

2021 Production and Sales Results; Strong Vanadium Market

Fundamentals Continue (Photo: Business Wire)

Paulo Misk, President and Chief Executive Officer for Largo,

stated: "Production was largely impacted during the quarter as a

result of the planned shutdown to complete the upgrades and

improvements associated with the Company’s cost-efficient nameplate

increase to 1,100 tonnes of V2O5 per month. The related work for

this project concluded in January 2021 and we expect to reach the

new nameplate capacity by the end of Q2 2021, following the

required commissioning and ramp up phases." He continued: “Strong

vanadium demand in the Company’s key regions has continued in Q1

2021 with solid volume increases in the steel and chemical sectors.

This was highlighted by a more than 50% increase in Europe’s

average V2O5 price per lb during Q1 2021 as quoted by Fastmarkets

Metal Bulletin. As a result of the severe impacts of COVID-19

pandemic, vanadium demand from the aerospace sector continues to

lag, but we expect a gradual recovery from Q3 2021 onwards. Overall

vanadium demand is expected to remain solid throughout 2021 as

stimulus packages linked to the COVID-19 economic recovery are

implemented. A continuous focus on global carbon emission reduction

will also support the increased use of vanadium in the traditional

steel market as well as in the fast-growing long duration energy

storage sector. Recent sales of large scale VRFB systems around the

world is further confirming the adaptation of this technology and

we remain extremely focused on developing our clean energy division

to service to this market with our VCHARGE± battery.”

A summary of the Company’s Q1 2021 production and sales results

is presented below:

Maracás Menchen Mine

Production and Sales

Q1 2021

Q1 2020

Total Ore Mined (tonnes)

263,966

203,966

Ore Grade Mined - Effective Grade

(%)3

1.22

1.61

Effective Grade of Ore Milled

(%)3

1.26

1.59

Concentrate Produced (tonnes)

100,467

100,072

Grade of Concentrate (%)

3.21

3.36

Contained V2O5 (tonnes)

3,223

3,365

Crushing Recovery (%)

96.8

98.3

Milling Recovery (%)

97.1

98.4

Kiln Recovery (%)

88.9

88.3

Leaching Recovery (%)

97.1

96.6

Chemical Plant Recovery (%)

95.3

96.8

Global Recovery (%)2

77.4

79.9

V2O5 produced (Flake + Powder)

(tonnes)

1,986

2,831

V2O5 produced (equivalent

pounds)1

4,378,375

6,241,279

V2O5 equivalent sold (tonnes)

2,783

3,170

Q1 2021 Production Results

Total production from the Maracás Menchen Mine was 1,986 tonnes

of V2O5, representing a decrease of 30% over Q1 2020. This

reduction is largely a result of the planned shutdown to implement

upgrades to the kiln and improvements in the cooler. During this

shutdown, the Company increased its intermediate stockpiles which

is expected to benefit production in the next quarter. Following

the commissioning and ramp up phase, these upgrades are expected to

increase the Company’s nameplate capacity to 1,100 tonnes of V2O5

per month by the end of Q2 2021. The Company also conducted a

preventative maintenance program downstream of the kiln and cooler

during this downtime.

In Q1 2021, 263,966 tonnes of ore with an effective V2O5 grade3

of 1.22% were mined compared to 203,966 tonnes in Q1 2020 with an

effective V2O5 grade3 of 1.61%. The Company also produced 100,467

tonnes of concentrate ore with an average V2O5 grade of 3.21% in Q1

2021 compared to 100,072 tonnes in Q1 2020 with an average V2O5

grade of 3.36%.

The Company achieved a global V2O5 recovery rate2 of 77.4% in Q1

2021 representing a decrease of 3.0% over Q1 2020 (79.9%). This is

primarily due to the planned shutdown in January 2021 and the

subsequent commissioning and ramp up activities in February and

March 2021. These activities are expected to conclude by the end of

Q2 2021 at which point the Company expects the global recoveries2

will return to levels achieved in 2020.

COVID-19 Preventative Measures

The Company continues to monitor the evolving COVID-19 pandemic

and has taken preventative measures at its mine site and corporate

offices to mitigate potential risks. Although there have been some

challenges with logistics, there continues to be no significant

impact on the Company’s production or on the shipment of products

out of Maracás. To date, there continues to be no significant

disruption to the Company's supply chain for its operations and the

level of critical consumables continues to be at normal levels. In

addition, the restrictions imposed by the government in Brazil have

not significantly impacted operations. The Company continues to

follow the recommendations provided by health authorities and all

corporate office personnel have been instructed to work from home

where possible. The Company continues to staff critical functions

at the Maracás Menchen Mine and has encouraged those in

non-essential roles to work from home.

The Company's 2021 guidance is presented on a "business as

usual" basis. The Company continues to monitor measures being

imposed by governments globally to reduce the spread of COVID-19

and the impact that this may have on the Company’s operations,

sales and guidance for 2021. Although these restrictions have not,

to date, had a material impact on the Company’s operations and

sales, the potential future impact of COVID-19 both in Brazil and

globally could have a significant impact on the Company’s

operations, sales efforts and logistics. The Company is continuing

to monitor the rapidly developing impacts of the COVID-19 pandemic

and will take all possible actions to help minimize the impact on

the Company and its people. However, these actions may

significantly change the guidance and forecasts presented and will,

if and when necessary, update its guidance accordingly.

About Largo Resources

Largo Resources is an industry preferred, vertically integrated

vanadium company. It services multiple vanadium market applications

through the supply of its unrivaled VPURE™ and VPURE+™ products,

from one of the world’s highest-grade vanadium deposits at the

Company’s Maracás Menchen Mine located in Brazil. Largo is also

focused on the advancement of renewable energy storage solutions

through its world-class VCHARGE± vanadium redox flow battery

technology. The Company's common shares are listed on the Toronto

Stock Exchange under the symbol "LGO".

For more information on Largo and VPURE™, please visit

www.largoresources.com and www.largoVPURE.com.

For additional information on Largo Clean Energy, please visit

www.largocleanenergy.com.

Forward-looking Information:

This press release contains forward-looking information under

Canadian securities legislation, some of which may be considered

"financial outlook" for the purposes of application Canadian

securities legislation ("forward-looking statements").

Forward-looking information in this press release includes, but is

not limited to, statements with respect to the timing and amount of

estimated future production and sales; costs of future activities

and operations; the extent of capital and operating expenditures;

the iron ore price environment, the timing and cost related to the

build out of the ilmenite plan, eventual production from the

ilmenite plant, the ability to sell ilmenite on a profitable basis

and the extent and overall impact of the COVID-19 pandemic in

Brazil and globally. Forward-looking information in this press

release also includes, but is not limited to, statements with

respect to our ability to build, finance and operate a VRFB

business, our ability to complete a listing on the Nasdaq, our

ability to protect and develop our technology, our ability to

maintain our IP, our ability to market and sell our VCHARGE±

battery system on specification and at a competitive price, our

ability to secure the required production resources to build our

VCHARGE± battery system, our ability to produce iron ore and the

adoption of VFRB technology generally in the market.

Forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or statements

that certain actions, events or results "may", "could", "would",

"might" or "will be taken", "occur" or "be achieved". All

information contained in this news release, other than statements

of current and historical fact, is forward looking information.

Forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Largo or Largo

Clean Energy to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to those risks described in the annual information form of

Largo and in its public documents filed on SEDAR from time to time.

Forward-looking statements are based on the opinions and estimates

of management as of the date such statements are made. Although

management of Largo has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Largo does not undertake to update any forward-looking

statements, except in accordance with applicable securities laws.

Readers should also review the risks and uncertainties sections of

Largo's annual and interim MD&As which also apply.

1 Conversion of tonnes to pounds, 1 tonne = 2,204.62 pounds or

lbs. 2 Global recovery is the product of crushing recovery, milling

recovery, kiln recovery, leaching recovery and chemical plant

recovery. 3 Effective grade represents the percentage of magnetic

material mined multiplied by the percentage of V2O5 in the magnetic

concentrate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210419005236/en/

Investor Relations: Alex Guthrie Senior Manager, External

Relations aguthrie@largoresources.com Tel: +1 416-861-9797

Media Enquiries: Crystal Quast Bullseye Corporate

Quast@bullseyecorporate.com Tel: +1 647-529-6364

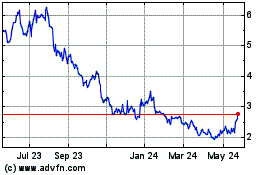

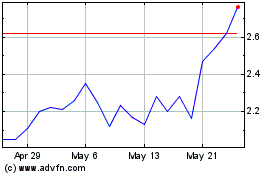

Largo (TSX:LGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Largo (TSX:LGO)

Historical Stock Chart

From Dec 2023 to Dec 2024