mdf commerce inc. (“mdf commerce”) (TSX: MDF), a

leader in SaaS commerce technology solutions, is pleased to

announce that it has entered into a definitive agreement with

Periscope Parent Holding, L.P. to acquire the business of Periscope

Intermediate Corp. (“Periscope”) (the “Acquisition”), a portfolio

company of Parthenon Capital Partners (“Parthenon Capital”). The

purchase price is approximately $259.9 million, on a cash-free

debt-free basis, subject to customary closing and post-closing

adjustments (the “Purchase Price”).

Periscope is a leading eProcurement solution

provider with over 20 years of history that offers a fully

integrated, end-to-end procurement solution to both state and local

government agencies and suppliers in the U.S. Periscope’s

end-to-end eProcurement solution—offered through both a SaaS and a

transaction fee solution—is built specifically for the public

sector, allowing government agencies to more efficiently purchase

goods and services, source contracts, analyze spend, post bids and

transact on a public procurement platform that offers a

consumer-like shopping experience. Periscope operates from its two

offices in Austin, Texas, and American Fork, Utah.

Legacy procurement systems are hindering U.S.

state and local government agencies from efficiently and

transparently getting the most value of over US$1.8 trillion in

taxpayer funds for procurement purposes. Government agencies

transacting through Periscope’s network spend approximately US$20

billion per year, with opportunities to grow significantly as

governments seek to optimize their procurement process. Together,

mdf commerce and Periscope are well positioned to capitalize on

governments’ critical need to rapidly digitize procurement

workflows, as well as on massive increases in government spending

arising from the approximately US$1 trillion U.S. infrastructure

spending bill, among others.

Periscope’s solutions, through its ePro product

suite, are offered as both a SaaS solution and a transaction fee

solution. Under its SaaS solutions, Periscope acts as a vendor to

government agencies and suppliers and receives a fixed annual

subscription fee. Periscope’s transaction fee solution provides

government agencies with an innovative way to self-fund their

eProcurement solution. The transaction fee solution provides

significant scalability as revenue becomes a function of statewide

transaction spend. The successful onboarding of new customers on

SaaS and transaction fee solutions has already driven increased

growth, as seen through the first six months of 2021 revenues

growing by 32.2% year-over-year, from US$10.9 million to US$14.4

million. Given year-to-date performance and high near-term

visibility for contracted revenue and pipeline developments,

management believes Periscope can achieve revenues of approximately

US$33 million in calendar year 2021, compared to US$23.1 million in

calendar year 2020, implying a year-over-year growth rate of 43.4%.

Management believes strong industry tailwinds, including current

trends toward eProcurement adoption, will underpin significant

growth over the long term.

“This is a very interesting day in the history

of mdf commerce. The acquisition of Periscope marks a turning point

in our transformation plan and solidifies our commitment to

profitable growth. Periscope will strengthen our leading position

in the North American public eProcurement industry. This

accelerates our vision to become a leading player enabling the flow

of commerce for the B2B and B2G markets,” said Luc Filiatreault,

President and Chief Executive Officer of mdf commerce.

“With this transformational acquisition, we see

a tremendous amount of accelerated growth across our combined

platform. I’m very excited about the opportunity to lead mdf

commerce’s Strategic Sourcing operations as we evolve into full

eProcurement, positioning us well for this new chapter of growth,”

said Mark Eigenbauer, President of mdf commerce Strategic

Sourcing.

Brian Utley, President and Chief Executive

Officer of Periscope, said: “Today marks an important milestone in

the history of Periscope since I founded the company in 2001. I am

thrilled to join the mdf commerce team. Together, with our combined

operational strengths, I am convinced we can accelerate the

transformation of the public eProcurement industry.”

As part of the Acquisition, Parthenon Capital

agreed to re-invest $4 million in mdf commerce shares, the maximum

allowed under the applicable private placement rules given the

concurrent investment by Investissement Québec and Fonds de

solidarité FTQ. Zachary Sadek, Partner at Parthenon Capital, said:

“We believe that Periscope is a great strategic fit for mdf

commerce and are pleased to participate in the upside potential as

a new shareholder of mdf commerce going forward. We are

appreciative of our successful seven year partnership with Brian

Utley and the entire Periscope team and are excited to see them

continue to support their customers and bring value to every dollar

spent.”

The Acquisition has been approved by the board

of directors of both mdf commerce and the governing entity of

Periscope Parent Holding L.P. The Acquisition, which remains

subject to certain customary closing conditions and receipt of

applicable antitrust approval under Hart Scott Rodino Antitrust

Improvements Act, is expected to be completed in the second quarter

of mdf commerce’s fiscal year 2022.

Acquisition Rationale

Becoming a Public eProcurement Leader in North

American Market with Untapped Opportunities

- Combined company

powers government procurement systems for 8 U.S. state customers,

while solidifying its presence in 40 U.S. states and all Canadian

provinces

- Combined

platform enables over 6,000 government agencies, as well as

harnesses a large database of approximately 1,000,000 suppliers, of

which 500,000 have actively pursued opportunities in the last

twelve months

Fully Integrated, End-to-End Solution Servicing

the Full Spectrum of Government Agencies

- Broadens mdf

commerce’s SaaS offering with a leading fully integrated,

end-to-end procurement solution purpose-built for the public

sector, which provides an innovative and intuitive consumer-like

shopping experience

- Expands mdf

commerce’s total addressable market and improves the company’s

ability to fully cater to existing and prospective customers’

evolving needs

Innovative Transaction Fee Solution Providing

Highly Scalable and Attractive Economics

- Only public sector eProcurement

provider actively managing transaction fee solutions at the U.S.

state level

- Opportunity to

leverage Periscope’s ePro and Marketplace solutions under a

transaction fee solution—in which revenues are driven by the volume

of highly scalable and recurring statewide government spend—to

existing and prospective government agency customers

Highly Synergistic Acquisition Expected to

Provide Significant Revenue and Cost Saving Opportunities

- Estimated annual

revenue synergies of at least $15 million expected within 3 years,

primarily driven by Periscope’s ePro transaction fee solution

- mdf commerce and

Periscope to leverage each other’s customer base, as well as key

government relationships, to sell ePro to additional U.S. states

and Canadian provinces

- mdf commerce to

offer Periscope’s Marketplace solution to its existing network of

over 3,500 government agencies and 300,000 active suppliers

- Estimated annual

cost synergies of approximately $5 million expected within 3 years,

primarily driven by (i) workforce-related initiatives alleviating

the need to hire additional talent for sales, product development,

and other key functions, (ii) efficiencies gained through the

harmonization of content aggregation systems and processes, and

(iii) product integration eliminating reliance on third

parties

Compelling Combined Financial Profile Positioned

for Enhanced Growth

- Revenues of

$84.7M for mdf commerce increase by 36.6% to combined revenues of

$115.7M2, with Strategic Sourcing platform accounting for over

half3 of total combined revenues

- Year-over-year

growth in revenues of 13.1% for mdf commerce increases to 18.0%

combined4

- mdf commerce’s recurring revenue as

a percentage of revenues increases from 76% to 80%5

Financing of the

Acquisition

The Purchase Price will be financed through a

combination of:

- $92.0 million of

available cash on hand

- $50.2 million

draw on amended and upsized revolving and term credit

facilities

- $67.8 million

bought deal public offering (the “Offering”) of subscription

receipts of mdf commerce (the “Subscription Receipts”)

- $52.6 million

private placement (the “Concurrent Private Placement”) of

subscription receipts of mdf commerce (the “Private Placement

Subscription Receipts”) with Fonds de solidarité FTQ (“FSTQ”) and

Investissement Québec (together with FSTQ, the “Private Placement

Subscribers”), mdf commerce’s two largest shareholders

- The issuance of $4.1 million in

rollover shares, as well as the creation of a $4.1 million

retention bonus

Public Offering of Subscription Receipts

on a Bought Deal Basis

To finance the payment of a portion of the

Purchase Price and related expenses, mdf commerce has entered into

an agreement with Scotiabank, as sole bookrunner, and Echelon

Capital Markets, as co-lead manager, on behalf of a syndicate of

underwriters (the “Underwriters”) under which they have agreed to

purchase on a bought deal basis from mdf commerce 8,480,000

Subscription Receipts at a purchase price of $8.00 per Subscription

Receipt (the “Offering Price”) for gross proceeds of $67.8 million.

Each Subscription Receipt will entitle the holder thereof to

receive, upon the satisfaction of certain conditions and without

payment of additional consideration or further action, one common

share of mdf commerce.

In addition, mdf commerce has granted the

Underwriters an option to purchase up to 1,272,000 additional

Subscription Receipts at the Offering Price at any time up to 30

days after closing of the Offering (the “Over-Allotment Option”),

for additional gross proceeds of up to $10.2 million. The

Subscription Receipts will be offered in all provinces of Canada

pursuant to a short form prospectus to be filed by mdf commerce in

accordance with National Instrument 44-101 – Short Form Prospectus

Distributions.

The issuance of the Subscription Receipts

pursuant to the Offering is subject to customary approvals of

applicable securities regulatory authorities, including the Toronto

Stock Exchange (“TSX”). Closing of the Offering is expected to

occur on or about August 31, 2021. The Offering is conditional upon

closing of the Concurrent Private Placement (described below) are

conditional upon each other. The Offering is also conditional upon

there being no termination of the Acquisition or announcement of

such termination prior to the closing of the Offering.

Private Placement of Subscription

Receipts

Concurrently with the Offering, mdf commerce has

entered into subscription agreements pursuant to which it will

complete the Concurrent Private Placement with FSTQ and

Investissement Québec who will acquire, on a private placement

basis and at the Offering Price, 3,587,667 and 2,989,722 Private

Placement Subscription Receipts, respectively, for aggregate gross

proceeds of $52.6 million. Each Private Placement Subscription

Receipt will entitle the holder thereof to receive, upon the

satisfaction of certain conditions and without payment of

additional consideration or further action, one common share of mdf

commerce. The Private Placement Subscription Receipts will be

subject to a four month hold from the closing date of the

Concurrent Private Placement.

The issuance of the Private Placement

Subscription Receipts pursuant to the Concurrent Private Placement

is subject to the approval of the TSX. Closing of the Concurrent

Private Placement is scheduled to occur concurrently with the

closing of the Offering. The Concurrent Private Placement is

conditional upon closing of the Offering. The Concurrent Private

Placement is also conditional upon there being no termination of

the Acquisition or announcement of such termination prior to the

closing of the Concurrent Private Placement.

Amended and Upsized Credit

Facilities

mdf commerce has received a committed term sheet

from Scotiabank providing for amendments and upsize of its existing

credit facilities by $20 million, to $70 million (the “Upsized

Credit Facilities”), in order to partially finance the payment of

the Purchase Price and for general corporate purpose.

The net proceeds of the Offering, the Concurrent

Private Placement and the Upsized Credit Facilities will be used by

mdf commerce to finance the payment of a portion of the Purchase

Price payable in respect of the Acquisition and the financing and

transaction costs incurred as part of the Acquisition.

Advisors

Scotiabank acted as exclusive financial advisor

to mdf commerce on the Acquisition, as sole bookrunner and co-lead

manager on the Offering and as sole placement agent on the

Concurrent Private Placement. Legal advice to mdf commerce is being

provided by McCarthy Tétrault LLP with respect to Canadian law, and

by Foley & Lardner LLP with respect to U.S. law. Legal advice

is being provided to the Underwriters and the Private Placement

Subscribers by Davies Ward Phillips & Vineberg LLP.

Stephens Inc. is the exclusive financial advisor

to Periscope. Periscope received legal advice from Jackson Walker

LLP, Kirkland & Ellis LLP and Blake, Cassels & Graydon

LLP.

Conference Call Information

mdf commerce will hold a conference call for the

financial community on Wednesday, August 11 at 5:00 p.m. (Eastern

Daylight Time). The dial-in numbers are (833) 732-1201 (toll-free)

or (720) 405-2161 (international). A live webcast will be

available: register here. Media may hear the call in listen-in only

mode or tune in to the simultaneous audio broadcast on mdf

commerce’s website, which will then be archived for 30 days.

Availability of Documents

Copies of related documents, such as the

preliminary short form prospectus, underwriting agreement,

subscription agreements and stock purchase agreement relating to

the Acquisition will be available under mdf commerce’s profile on

SEDAR at www.sedar.com and on mdf commerce’s website at

www.mdfcommerce.com.

General Information

In this press release, “mdf commerce” or the

words “we”, “our” and “us” refer, depending on the context, either

to mdf commerce inc. or to mdf commerce inc. together with its

subsidiaries and entities in which it has an economic interest. All

dollar amounts refer to Canadian dollars, unless otherwise

expressly stated.

This press release is dated August 11, 2021 and,

unless specifically stated otherwise, all information disclosed

herein is provided as at June 30, 2021, the end of mdf commerce’s

most recent quarter.

Currency

All dollar amounts refer to Canadian dollars,

unless otherwise expressly stated. Estimated consideration to be

paid was converted using an exchange rate of 1 USD = 1.2540 CAD,

which represents the daily exchange rate of the Bank of Canada on

August 10, 2021. The revenues of Periscope for the six-month

periods ended June 30, 2021 and June 30, 2020 and the twelve-month

period ended December 31, 2020 were converted using exchange rates

of 1 USD = 1.2471, 1 USD = 1.3646 CAD (using constant currency) and

1 USD = 1.3415, respectively, which represent, in each case, the

average daily exchange rate of the Bank of Canada for the six

months ended June 30, 2021 and June 30, 2020 and the twelve months

ended December 31, 2020, respectively.

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable securities

legislation, including those regarding the Acquisition of

Periscope. Forward-looking information also includes, but is not

limited to, statements regarding mdf commerce's business

objectives, expected growth, results of operations, performance and

financial results, statements with respect to the expected timing

and completion of the Acquisition, and statements with respect to

the anticipated benefits of the Acquisition and mdf commerce's

ability to successfully integrate Periscope’s business, which

include, without limitation, cost saving synergies, annual revenue

synergies, future revenues, adjusted EBITDA, adjusted EBITDA

margin, combined cash flow per share, recurring revenue, leverage

post-Acquisition, management strategy and growth prospect following

the Acquisition. The combined financial information set forth in

this press release should not be considered as a prediction of what

the actual financial position or other results of operation of mdf

commerce would have necessarily been had the Acquisition been

completed as, at, or for the periods stated. This press release

also contains forward-looking information with respect to the

Offering, the Concurrent Private Placement and the indebtedness to

be incurred under an amended and upsized credit facilities and the

aggregate purchase price payable in connection with the Acquisition

of Periscope (including the rollover shares and retention bonus).

Although the forward-looking information is based on what mdf

commerce believes are reasonable assumptions, current expectations

and estimates, investors are cautioned from placing undue reliance

on this information as actual results may vary from the

forward-looking information. Forward-looking information may be

identified by the use of forward-looking terminology such as

“believe”, “forecast”, “synergies”, “intend”, “may”, “will”,

“expect”, “estimate”, “anticipate”, “continue” or similar terms,

variations of those terms or the negative thereof, and the use of

the conditional tense as well as similar expressions.

Actual results and developments are likely to

differ, and may differ materially, from those expressed or implied

by the forward-looking statements contained in this press release.

Such statements are based on a number of assumptions which may

prove to be incorrect, including, but not limited to, assumptions

about, mdf commerce’s ability to retain its customers, mdf

commerce’s ability to implement its growth strategy through

acquisition, mdf commerce’s response to the industry’s rapid pace

of change, the competitive environment, mdf commerce’s ability to

protect its computer environment and deal with defects in software

or failures in processing transactions, mdf commerce’s use of “open

source” software, intellectual property and other proprietary

rights, mdf commerce’s management and employees, mdf commerce’s

cyber security, regulatory changes, mdf commerce’s ability to do

business in emerging countries, mdf commerce’s ability to execute

its strategic plan, the effect of the COVID-19 global pandemic,

foreign currency, liquidity, credit, current global financial

conditions, additional financing and dilution and market liquidity

of the common shares of mdf commerce, all as further and more fully

described in the “Risk Factors and Uncertainties” section of mdf

commerce’s annual information form dated June 9, 2021 for the

fiscal year ended March 31, 2021, management’s discussion and

analysis of financial condition and results of operation of mdf

commerce dated June 9, 2021, as at and for the years ended March

31, 2021 and 2020, management’s discussion and analysis of

financial condition and results of operation of mdf commerce dated

August 11, 2021, as at and for the three-month period ended June

30, 2021 and elsewhere in mdf commerce’s filings with the Canadian

securities regulators, as applicable. In relation to the

Acquisition and the Offering, mdf commerce makes the following

material assumptions, without limitation: availability of capital

resources, performance of operating facilities, strength of market

conditions, customer demand and satisfaction of customary closing

conditions, including antitrust approvals and receipt of regulatory

approval with respect to the Offering and the Concurrent Private

Placement. If these assumptions are inaccurate, mdf commerce's or

the combined entity's actual results could differ materially from

those expressed or implied in such forward-looking information.

mdf commerce cautions readers against placing

undue reliance on forward-looking statements when making decisions,

as the actual results could differ considerably from the opinions,

plans, projections, objectives, expectations, forecasts, estimates

and intentions expressed in such forward-looking statements due to

various risk factors. These risk factors include, but are not

limited to: the possible failure to realize anticipated benefits of

the Acquisition or to achieve the full amount of anticipated cost

saving synergies and revenue synergies, failure to close the

Acquisition, changes in the terms of the Acquisition, increased

indebtedness, transitional risks, Acquisition integration related

risks, loss of certain key personnel of Periscope, potential

undisclosed costs or liabilities associated with the Acquisition,

the information provided by Periscope not being accurate or

complete, changes in interest rates, inflation levels and general

economic conditions, legislative and regulatory developments and

changes in competition. Although mdf commerce has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended.

This forward-looking information is used to

assist readers in obtaining a better understanding of mdf

commerce's business, current objectives, strategic priorities,

expectations and plans, including following the Acquisition, and

may not be appropriate for other purposes. Such forward-looking

information that is not historical fact, including statements based

on management’s belief and assumptions cannot be considered as

guarantees of future performance. The forward-looking information

contained herein reflect mdf commerce’s expectations and beliefs as

at the date hereof, and are subject to change after this date. mdf

commerce undertakes no obligation to update publicly any

forward-looking information whether as a result of new information,

future events or otherwise, other than as required by applicable

legislation. All subsequent forward-looking statements made by mdf

commerce or any of its directors, officers or employees or any

persons authorized to be acting on their behalf, whether written or

oral, are expressly qualified in their entirety by the foregoing

cautionary statements. Financial outlook information contained in

this press release about prospective results of operations,

financial position or combined cash flows is based on assumptions

about future events and management's assessment of the relevant

information available as of the date of this press release. Readers

are cautioned that such financial outlook information contained in

this press release should not be used for the purposes other than

for which it is disclosed herein or therein, as the case may

be.

Financial Information and Non-IFRS

Measures

mdf commerce reports its financial results in

accordance with International Financial Reporting Standards

(“IFRS”). Periscope reports its financial results in accordance

with U.S. generally accepted accounting principles. For this press

release, such financial results and information have been presented

in IFRS.

This press release contains references to

certain non-IFRS measures and key performance indicators that are

used by mdf commerce and/or Periscope as indicators of financial

performance measures which do not have standardized meanings under

IFRS and are not likely to be comparable to similarly designated

measures reported by other corporations. mdf commerce believes that

these measures are useful supplemental information that may assist

investors in assessing their investment in the subscription

receipts.

Investors are cautioned that these measures are

being reported in order to complement, and not replace, the

analyses of financial results in accordance with IFRS. In this

press release, mdf commerce uses non-IFRS measures, including

EBITDA, adjusted EBITDA, combined revenues, combined adjusted

EBITDA, combined cash flow per share, recurring revenues, combined

recurring revenues and constant currency. Other than as provided

below, the terms and definitions associated with non-IFRS measures

as well as a reconciliation to the most comparable IFRS measures,

and key performance indicators are presented in the section

“Non-IFRS Financial Measures and Key Performance Indicators” in mdf

commerce’s Management’s Discussion and Analysis (MD&A) for the

three-month period ended June 30, 2021 and for the year ended March

31, 2021.

References to non-IFRS measures and key

performance indicators used throughout this press release have the

following meaning:

“EBITDA” of mdf commerce is calculated as profit

(loss) before interest, taxes, depreciation and amortization.

“EBITDA” of Periscope is calculated as profit

(loss) before interest, taxes, depreciation and amortization.

“Adjusted EBITDA” of mdf commerce or Periscope,

as applicable, is calculated as profit (loss) before interest,

taxes, depreciation and amortization, adjusted according to the

foreign exchange gain (loss), the gain (loss) on the sale of a

subsidiary and the compensation under mdf commerce’s stock option

plan, acquisition related costs and restructuring costs.

“Combined revenues” means the summation of the

mdf commerce’s revenues for its fiscal year ended March 31, 2021

combined with Periscope’s revenues for its fiscal year ended

December 31, 2020 without any pro forma or other adjustments.

“Combined adjusted EBITDA” means the summation

of mdf commerce’s adjusted EBITDA calculated based on mdf

commerce’s financial information for its fiscal year ended March

31, 2021 combined with Periscope’s adjusted EBITDA for its fiscal

year ended December 31, 2020 before giving effect to the

Acquisition, the Offering and the Concurrent Private Placement and

without any pro forma or other adjustments.

“Combined cash flow per share” is composed of

combined adjusted EBITDA less mdf commerce and Periscope combined

capital expenditures divided by the total number of outstanding

shares of mdf commerce and including management’s estimate of year

3 revenue and cost synergies.

“Recurring revenues” of mdf commerce is composed

of subscription and support revenues that are recurring in nature.

Therefore, they exclude onetime fees and professional fees and

other types of non-recurring revenues.

“Recurring revenues” of Periscope is composed of

subscription and support revenues that are recurring in nature.

“Combined recurring revenues” means the

summation of mdf commerce’s recurring revenues for its fiscal year

ended March 31, 2021 combined with Periscope’s recurring revenues

for its fiscal year ended December 31, 2020 without any pro forma

or other adjustments.

“Constant currency,” certain revenue figures and

changes from prior period are analyzed and presented on a constant

currency basis and are obtained by translating revenues from the

comparable period of the prior year denominated in foreign

currencies at the foreign exchange rates of the current period.

Reconciliation of Non-IFRS Measure:

| |

mdf commerceLTM Mar. 2021 (in C$) |

PeriscopeLTM Dec. 2020 (in C$) |

Combined |

| (Loss)

profit |

($ |

7,591.0 |

) |

($ |

779.0 |

) |

($ |

8,370.0 |

) |

|

Impairment loss of assets charge |

|

- |

|

|

- |

|

|

- |

|

|

Income tax (recovery) expense |

($ |

1,618.0 |

) |

$ |

50.3 |

|

($ |

1,567.7 |

) |

|

Depreciation of property and equipment and amortization of

intangible assets |

$ |

4,217.0 |

|

$ |

1,945.0 |

|

$ |

6,162.0 |

|

|

Amortization of acquired intangible assets |

$ |

3,815.0 |

|

|

- |

|

$ |

3,815.0 |

|

|

Amortization of right of use assets |

$ |

1,735.0 |

|

$ |

208.8 |

|

$ |

1,943.8 |

|

|

Amortization of deferred financing costs |

$ |

135.0 |

|

($ |

150.0 |

) |

($ |

15.0 |

) |

|

Interest on lease liability |

$ |

381.0 |

|

$ |

99.6 |

|

$ |

480.6 |

|

|

Interest on long-term debt |

$ |

536.0 |

|

$ |

974.7 |

|

$ |

1,510.7 |

|

|

Interest revenue |

($ |

61.0 |

) |

($ |

5.1 |

) |

($ |

66.1 |

) |

| EBITDA |

$ |

1,549.0 |

|

$ |

2,344.4 |

|

$ |

3,893.4 |

|

|

Foreign exchange loss (gain) |

$ |

1,427.0 |

|

|

- |

|

$ |

1,427.0 |

|

|

Loss (gain) on sale of a subsidiary |

|

- |

|

|

- |

|

|

- |

|

|

Share-based compensation |

$ |

467.0 |

|

$ |

24.2 |

|

$ |

491.2 |

|

|

Restructuring costs |

$ |

1,966.0 |

|

$ |

158.3 |

|

$ |

2,124.3 |

|

|

Acquisition related costs |

$ |

337.0 |

|

|

- |

|

$ |

337.0 |

|

| Adjusted

EBITDA |

$ |

5,746.0 |

|

$ |

2,526.8 |

|

$ |

8,272.8 |

|

U.S. Non-Solicitation

This press release is not an offer of securities

for sale in the United States and is not an offer to sell or

solicitation of an offer to buy any securities of mdf commerce, nor

shall it form the basis of, or be relied upon in connection with

any contract for purchase or subscription. The subscription

receipts of mdf commerce will only be offered in the provinces of

Canada by means of a shot form prospectus. Securities may not be

offered or sold in the United States absent registration under the

United States Securities Act of 1933 (the “U.S. Securities Act”) or

an exemption from registration thereunder. These securities have

not been and will not be registered under the U.S. Securities Act

or the securities laws of any state and may not be offered or sold

in the United States absent registration under the U.S. Securities

Act and applicable state securities laws or pursuant to an

applicable exemption therefrom.

About mdf commerce inc.

mdf commerce inc. (TSX: MDF) enables the flow of

commerce by providing a broad set of SaaS solutions that optimize

and accelerate commercial interactions between buyers and sellers.

Our platforms and services empower businesses around the world,

allowing them to generate billions of dollars in transactions on an

annual basis. Our Strategic Sourcing, Unified Commerce and

emarketplace platforms are supported by a strong and dedicated team

of approximately 700 employees based in Canada, the United States,

Denmark, Ukraine and China. For more information, please visit us

at mdfcommerce.com, follow us on LinkedIn or call at

1-877-677-9088.

About Periscope Intermediate

Corp.

Periscope is a leading eProcurement solution

provider with over 20 years of industry experience that offers a

fully integrated, end-to-end procurement solution to both state and

local government agencies and suppliers in the U.S. Periscope’s

end-to-end eProcurement solution is built specifically for U.S.

government agencies, allowing them to more efficiently purchase

goods and services, source contracts, analyze spend, post bids and

transact on a public procurement platform that offers a

consumer-like shopping experience. For more information, visit

www.periscopeholdings.com

About Parthenon Capital

Partners

Parthenon Capital is a leading growth-oriented

private equity firm with offices in Boston, San Francisco and

Austin. Parthenon Capital utilizes niche industry expertise and a

deep execution team to invest in growth companies in service and

technology industries. Parthenon Capital seeks to be an active and

aligned partner to management, either through recapitalization

transactions or by backing new executives. Parthenon Capital has

particular expertise in financial and insurance services

healthcare, and technology services, but seeks any service,

technology or delivery business with a strong value proposition and

proprietary know-how. For more information, visit

www.parthenoncapital.com.

For further information:

mdf commerce inc.

Luc Filiatreault, President & CEO Toll free: 1-877-677-9088,

ext. 2004 Email: luc.filiatreault@mdfcommerce.com

Deborah Dumoulin, Chief Financial Officer Toll free:

1-877-677-9088, ext. 2134 Email:

deborah.dumoulin@mdfcommerce.com

André Leblanc, Vice President, Marketing and Public Affairs Toll

Free: 1-877-677-9088, ext. 8220 Email:

andre.leblanc@mdfcommerce.com

1 Combined cash flow per share is a non-IFRS measure. Please

refer to the section entitled Non-IFRS Measures for more details.2

Combined revenues is a non-IFRS measure. Combined revenues are

derived from the summation of the mdf commerce’s revenues for its

fiscal year ended March 31, 2021 combined with Periscope’s revenues

for its fiscal year ended December 31, 2020, without any pro forma

or other adjustments. Please refer to the section entitled

“Non-IFRS Measures” for more details.3 Percentage of total combined

revenues based on mdf commerce’s revenues for its fiscal year ended

March 31, 2021 and Periscope’s revenues for its fiscal year ended

December 31, 2020; assumes Periscope contributes 100% toward mdf

commerce’s Strategic Sourcing platform.4 Historical revenue growth

calculation is based on the combined revenues of mdf commerce,

which are derived from the summation of mdf commerce and

Periscope’s revenues for the six-month period ended June 30, 2021,

without any pro forma or other adjustments as compared to the

six-month period ended June 30, 2020 using constant currency

(average USD / CAD exchange rate of 1.2471 for the six month period

ended June 30, 2021). Combined revenues is a non-IFRS measure.

Please refer to the section entitled “Non-IFRS Measures” for more

details.5 Recurring revenue is a key performance indicator and a

non-IFRS measure. Increase calculation is based on the summation of

mdf commerce’s recurring revenues for its fiscal year ended March

31, 2021 combined with Periscope’s recurring revenues for its

fiscal year ended December 31, 2020, without any pro forma or other

adjustments. Please refer to the section entitled Non-IFRS Measures

for more details.

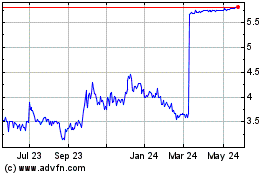

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Mar 2025 to Apr 2025

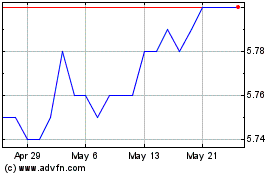

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Apr 2024 to Apr 2025