Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX:

ORAAF) (“

Aura” or the

“

Company”) announces that it has filed its

unaudited consolidated financial statements and management

discussion and analysis (together, “Financial and Operational

Results”) for the period ended September 30, 2023 (“Q3 2023”). The

full version of the Financial and Operational Results can be viewed

on the Company’s website at www.auraminerals.com or on SEDAR at

www.sedar.com. All amounts are in U.S. dollars unless stated

otherwise.

Rodrigo Barbosa, President and CEO of Aura,

commented: “During Q3, Aura achieved a critical milestone with a

year of zero lost-time incidents, demonstrating our unwavering

commitment to safety across all operations. Financially, we saw

significant growth with increases in volume, revenues, and EBITDA,

and we anticipate continued enhancements in volume and margins in

Q4. Despite lower-than-expected productivity at EPP due to

above-average rainfall, which delayed high-grade output from

Ernesto, our strategic progress was substantial: we launched

commercial production at Almas, pioneering industry standards for

efficiency; completed a pivotal Feasibility Study for Borborema

with 52% IRR (after tax and leveraged) at $1,900 Oz gold price;

acquired the final 20% share; and secured construction financing.

These efforts have solidified our strategy to reach an annualized

production rate of 450,000 GEO by 2025.”

Q3 2023 Financial and Operational

Highlights:

- Production

reached 64,875 GEO in Q3 2023, an increase of 34% compared to Q2

2023 and 12% compared to Q3 2022.

- Aranzazu:

Production of 27,933 GEO, was aligned with the Company's

expectations and compared to Q2 2023, production increased by 11%

due to increased tonnage and higher head grades. Production

increased by 7% compared to Q3 2022. This quarter's results were

further improved by the mine contractor's utilizing of advanced

drilling equipment.

- EPP: Production

of 11,185 Oz gold represented a 62% increase compared to Q2 2023.

The increase was mainly due to the mining of the high-grade zone at

Ernesto and the processing of low-grade ore from existing

stockpiles. Unexpected heavy and unusual rainfall during the

quarter slowed operation in high-grade Ernesto pit (“Ernesto”) and

impacted productivity, and now Ernesto is expected to be in

production until Q1 2024.

- San Andres:

Production of 17,543 Oz gold represented a 7% increase from Q2

2023, marking the third consecutive quarter of increased

production. Enhancements in the stacking system, including the

incorporation of new grasshoppers, contributed to improved

production and led to a 25% rise in production compared to Q3

2022.

- Almas:

Production of 8,214 Oz gold came from two months of commercial

operations, above industry benchmarks ramp up. Given the strong

initial performance of Almas, despite a slight decrease in

productivity expected for Q4 2023, the Company has committed to

investing in few plant enhancements to further increase the plant

processing capabilities in the coming quarters.

- Revenues were

$110,635 in Q3 2023, which represented an increase of 30% compared

to Q2 2023 and 36% compared to the same period in 2022.

- Sales volumes

were 32% higher than Q2 2023, mainly due to higher production in

Aranzazu, San Andres and EPP the commencement of commercial

production in Almas, as discussed above and 10% higher compared to

Q3 2022.

- Average gold

sale prices decreased 1% compared to Q2 2023, with an average of

$1,941/oz in the quarter and increased 13% compared to Q3

2022.

- Adjusted EBITDA

was $30,020 in Q3 2023, an improvement of 13% compared to $26,596

in Q2 2023, as a result of higher production and sales volumes.

Compared to Q3 2022, adjusted EBITDA was 80% higher, also mainly

due to higher production and sales volumes.

- AISC during Q3

2023 of $1,437/GEO, represented an increase of $89/GEO when

compared to Q2 2023 ($1,348/GEO) mainly due to processing of

low-grade stockpile material at EPP, and higher one-time costs at

San Andres in Q3 2023, both of which were non-recurring and not

expected to be repeated in Q4 2023.

- The Net Debt

position by the end of Q3 2023 was $112,110, marking a reduction

from the previous quarter, with strong recurring free Cash

flow.

Borborema Project:

- Q3 2023 marked

significant advancements related for the Borborema Project,

including:

- Increasing

ownership of the project to 100%and completion of the Borborema

Feasibility Study, anticipating production of 748,000 ounces of

gold over an initial 11.3-year mine life, with potential to

increase production with robust economics. The project has an NPV

of US$182 million and 21.9% IRR at a gold price of US$1,712/oz;

51.9% IRR and NPV of US$262 million at US$1,900/oz with US$100

million debt.

- Commencement of

construction of the Borborema project and securing term loan

amounting US$100 million to support the construction.

- Implementation

of a hedging program through gold collars in order to de-risk the

project and secure the return on capital invested during the first

three years of production. As part of the program, Aura was

entitled to receive premium payments from the counterparties,

totaling approximately US$14.5 million which will also be invested

to partially fund the construction.

- To date, 5.8% of

the project has been completed and is on track to start-up in

February 2025.

- The Company has

partnered with POYRY for Engineering, Procurement, and Construction

Management (EPCM) and activities are on track with the hire of

primary services and material packages are in progress.

Operational and Financial Overview ($

thousand):

|

|

For the three months ended September 30, 2023 |

For the three months ended September 30, 2022 |

For the nine months ended September 30, 2023 |

For the nine months ended September 30, 2022 |

|

Total Production1 (GEO) |

64,875 |

|

58,175 |

|

166,662 |

|

173,758 |

|

|

Sales2 (GEO) |

63,516 |

|

57,963 |

|

165,352 |

|

180,241 |

|

|

Net Revenue |

110,635 |

|

81,189 |

|

292,572 |

|

286,849 |

|

|

Adjusted EBITDA |

30,020 |

|

16,661 |

|

93,214 |

|

97,195 |

|

|

AISC per GEO sold |

1,437 |

|

1,251 |

|

1,330 |

|

1,154 |

|

|

Ending Cash balance |

178,989 |

|

120,916 |

|

178,989 |

|

120,916 |

|

|

Net Debt |

112,110 |

|

80,723 |

|

112,110 |

|

80,723 |

|

|

1 Considers capitalized production |

|

|

|

|

|

2 Does not consider capitalized production |

|

|

|

|

|

3 Considering the average price in Aranzazu |

|

|

|

|

2023 Guidance:The Company’s

updated gold equivalent production, AISC and cash operating cost

per gold equivalent ounce sold, and CAPEX guidance for 2023

detailed below.

ProductionThe table below details the Company’s

updated GEO production guidance for 2023 by business unit, and a

comparison to the previous guidance:

|

|

Gold equivalent thousand ounces ('000 GEO) production -

2023 |

|

|

Actuals |

Previous |

|

Aranzazu |

104-112 |

104-112 |

|

EPP Mines |

46-50 |

56-64 |

|

San Andres |

62-69 |

62-69 |

|

Almas |

19-22 |

23-28 |

|

Total |

231-253 |

245-273 |

For metal prices for previous guidance: Copper

price = $3.90/lb; Gold Price = $1,925/oz; Silver Price =

US$21,50/oz. For current guidance, the Company considered: Copper

price = $3.90/lb; Gold Price = $1,931/oz; Silver Price =

$23,60/oz.

Factors that contributed to the change in the Company’s guidance

include:

- Aranzazu:

Production Guidance unchanged.

- EPP Mines: The

primary reason for the reduction in guidance arises from

above-average rainfall during Q3 2023, which significantly slowed

mining operations, particularly in the high-grade Ernesto deposit.

In August and September 2023, monthly precipitation reached 45mm

and 84mm, with peaks of 81.5mm with heavy rains concentrated over a

few days, compared to historical averages of 3mm and 0mm per month.

As result, EPP fed the plant with only 166 ktons mined (45%) of

high-grade ore (~ 2.0g/ton), while about 200 ktons (55%) were fed

from medium and low-grade stockpiles (~0.5 g/ton). Aura expects

most of the impact of such delay to be on mine sequencing, with the

Ernesto pit now expected to produce until Q1 2024, as opposed to

the previous estimate of complete depletion in Q4 2023.

- San Andres:

Production Guidance unchanged.

- At Almas,

following an initially successful ramp-up phase, the mine operation

is now accessing the in-situ rock during Q4, which posed challenges

to productivity. These difficulties have resulted in reduced

material movement for Q4 2023. Almas is proactively engaging with

the contractor team to mitigate these issues, implementing targeted

interventions such as enhanced training programs and equipment

upgrades. These measures are designed to promptly address the

productivity setbacks. We are confident that these efforts will

realign the contractor's performance with our strategic objectives,

and we anticipate a return to planned productivity levels by the

onset of 2024

All in all, production of 231,000 to 253,000 GEO at current

prices in 2023, presented a decrease of 14,000 to 20,000 GEO (a

reduction of about 7%) when compared to the previous guidance.

Cash costsThe table below shows the Company’s

updated guidance for 2023 cash operating costs per GEO sold by

business unit ($/GEO), and a comparison to the previous

guidance:

|

|

Cash Cost per equivalent ounce of gold sold -

2023 |

|

|

Actuals |

Previous |

|

Aranzazu |

783-842 |

783-842 |

|

EPP Mines |

1,031-1,142 |

849-927 |

|

San Andres |

1,193-1,284 |

1,137-1,222 |

|

Almas |

956-1,100 |

865-995 |

|

Total |

949-1029 |

897-973 |

Assumes the following assumptions:For metal

prices for previous guidance: Copper price = $3.90/lb; Gold Price =

$1,925/oz; Silver Price = US$21,50/oz. For current guidance, the

Company considered: Copper price = $3.90/lb; Gold Price =

$1,931/oz; Silver Price = $23,60/oz.For foreign exchange rates

impacts: For previous guidance: MXN 17.00= USD 1.00; R$4.90=USD

1.00; HON 24.50=USD 1.00. For current guidance: MXN 16.80= USD

1.00; R$4.90=USD 1.00; HON 24.50=USD 1.00

Factors that contributed to the change in the Company’s guidance

include:

- Aranzazu: Cash

Cost Guidance unchanged.

- EPP Mines:

Increase in cash cost Guidance is mainly attributable to lower

production, for the reasons explained in the “Production” section

above. It is important to highlight that EPP's work-in-process

(stockpile) inventory was approximately $999/oz on June 30, 2023,

resulting of the lower production volume in Q2 2023. As production

increased towards the end of Q3, work-in-process inventory cost

reduced significantly, closing September at approximately $569/oz.

Once the Company is already increasing ore feed from the Ernesto

pit, it is expected to reduce AISC substantially in the upcoming

quarters.

- San Andres: The

slight increase in cash cost is mainly due to (i) non-recurring

expenses incurred in Q3 2023 with maintenance of plant equipment

and grasshoppers, (ii) equipment rentals and the preparation of new

areas for leaching that took place in Q3 2023, mainly in July and

August and changes in mine planning and (iii)an increase in ore

production and, consequently, in the costs related to it, which

sought to offset the slight loss of recovery in the metallurgical

plant due to the characteristics of the stacked ore (silicified

ore) during the period.

- Almas: Increase

in cash cost Guidance is mainly attributable to lower production,

for the reasons explained in the “Production” section above.

All In Sustaining costsThe table below shows

the Company’s updated 2023 guidance for all-in sustaining costs per

GEO sold by Business Unit ($/GEO), and a comparison to the previous

guidance:

|

|

AISC per equivalent ounce of gold sold - 2023 |

|

|

Actuals |

Previous |

|

Aranzazu |

1,025-1,101 |

1,025-1,101 |

|

EPP Mines |

1,602-1,752 |

1,342-1,463 |

|

San Andres |

1,297-1,394 |

1,241-1,333 |

|

Almas |

1,220-1,397 |

1,112-1,280 |

|

Total |

1,225-1,324 |

1,162-1,261 |

Assumes the following assumptions:For metal

prices for previous guidance: Copper price = $3.90/lb; Gold Price =

$1,925/oz; Silver Price = US$21,50/oz. For current guidance, the

Company considered: Copper price = $3.90/lb; Gold Price =

$1,931/oz; Silver Price = $23,60/oz.For foreign exchange rates

impacts: For previous guidance: MXN 17.00= USD 1.00; R$4.90=USD

1.00; HON 24.50=USD 1.00. For current guidance: MXN 16.80= USD

1.00; R$4.90=USD 1.00; HON 24.50=USD 1.00

Factors that contributed to the change in the Company’s guidance

include:

- Aranzazu: Cash

Cost Guidance unchanged.

- EPP Mines:

Increase in AISC Guidance is mainly attributable to lower

production, for the reasons explained in the “Production” section

above.

- San Andres:

Increase in AISC Guidance is mainly attributable to the reasons

discussed in the topic “Cash costs” above.

- Almas: Increase

in AISC Guidance is mainly attributable to lower production, for

the reasons explained in the “Production” section above and

increase in the expected Sustaining Capex due to anticipation in

Capex to debottleneck the tailing pipeline that was planed for next

year as part of the expansion plan of the plant.

Capex:

The table below shows the Company’s updated breakdown of

estimated capital expenditures by type of investment, and a

comparison to the previous guidance:

|

|

Capex (US$ million) - 2023 |

|

|

Actuals |

Previous |

|

New projects + Expansion |

54-58 |

44-45 |

|

Exploration |

12-14 |

12-14 |

|

Sustaining |

29-35 |

29-35 |

|

Total |

95-108 |

85-95 |

Assumes the following assumptions:For foreign

exchange rates impacts: For previous guidance: MXN 17.00= USD 1.00;

R$4.90=USD 1.00; HON 24.50=USD 1.00. For current guidance: MXN

16.80= USD 1.00; R$4.90=USD 1.00; HON 24.50=USD 1.00

- New projects and

expansions:

- The increase

mainly reflects the addition of the Borborema Project, as

previously announced. Aura announced the construction decision of

Borborema project on September 6, 2023, at an estimated total capex

of US$ 188 million to be incurred between 2023 and the first

quarter of 2025.

- Exploration:

Unchanged

- Sustaining:

Unchanged

Key Factors

The Company’s future profitability, operating cash flows, and

financial position will be closely related to the prevailing prices

of gold and copper. Key factors influencing the price of gold and

copper include, but are not limited to, the supply of and demand

for gold and copper, the relative strength of currencies

(particularly the United States dollar), and macroeconomic factors

such as current and future expectations for inflation and interest

rates. Management believes that the short-to-medium term economic

environment is likely to remain relatively supportive for commodity

prices but with continued volatility.

To decrease risks associated with commodity prices and currency

volatility, the Company will continue to evaluate and implement

available protection programs. For additional information on this,

please refer to the AIF.

Other key factors influencing profitability and

operating cash flows are production levels (impacted by grades, ore

quantities, process recoveries, labor, country stability, plant,

and equipment availabilities), production and processing costs

(impacted by production levels, prices, and usage of key

consumables, labor, inflation, and exchange rates), among other

factors.

Reconciliation from income for the quarter for EBITDA

and Adjusted EBITDA ($

thousand):

|

|

For the three months ended September 30, 2023 |

For the three months ended September 30, 2022 |

For the nine months ended September 30, 2023 |

For the nine months ended September 30, 2022 |

|

Profit (loss) from continued and discontinued operation |

7,759 |

|

70 |

|

37,788 |

|

43,934 |

|

|

Income tax (expense) recovery |

6,758 |

|

2,099 |

|

17,200 |

|

23,084 |

|

|

Deferred income tax (expense) recovery |

1,095 |

|

2,822 |

|

(6,323 |

) |

(262 |

) |

|

Finance costs |

5,946 |

|

5,912 |

|

14,399 |

|

5,626 |

|

|

Other gains (losses) |

(4,986 |

) |

(3,330 |

) |

(7,630 |

) |

(2,255 |

) |

|

Depreciation |

13,449 |

|

9,088 |

|

37,781 |

|

27,068 |

|

|

EBITDA |

30,020 |

|

16,661 |

|

93,214 |

|

97,195 |

|

|

Impairment |

- |

|

- |

|

- |

|

- |

|

|

ARO Change |

- |

|

- |

|

- |

|

- |

|

|

Adjusted EBITDA |

30,020 |

|

16,661 |

|

93,214 |

|

97,195 |

|

| |

|

|

|

|

Reconciliation from the consolidated

financial statements to cash operating costs per gold equivalent

ounce sold ($

thousand):

|

|

For the three months ended September 30, 2023 |

For the three months ended September 30, 2022 |

For the nine months ended September 30, 2023 |

For the nine months ended September 30, 2022 |

|

Cost of goods sold |

(84,097 |

) |

(65,361 |

) |

(206,691 |

) |

(192,335 |

) |

|

Depreciation |

13,318 |

|

9,061 |

|

36,972 |

|

26,931 |

|

|

COGS w/o Depreciation |

(70,779 |

) |

(56,300 |

) |

(169,719 |

) |

(165,404 |

) |

|

Gold Equivalent Ounces sold |

63,516 |

|

57,963 |

|

165,352 |

|

180,241 |

|

|

Cash costs per gold equivalent ounce sold |

1,114 |

|

971 |

|

1,026 |

|

918 |

|

| |

|

|

|

|

Reconciliation from the consolidated

financial statements to all in sustaining costs per gold equivalent

ounce sold ($

thousand):

|

|

For the three months ended September 30, 2023 |

For the three months ended September 30, 2022 |

For the nine months ended September 30, 2023 |

For the nine months ended September 30, 2022 |

|

Cost of goods sold |

(84,097 |

) |

(65,361 |

) |

(206,691 |

) |

(192,335 |

) |

|

Depreciation |

13,318 |

|

9,061 |

|

36,972 |

|

26,931 |

|

|

COGS w/o Depreciation |

(70,779 |

) |

(56,300 |

) |

(169,719 |

) |

(165,404 |

) |

|

Capex w/o Expansion |

13,755 |

|

10,477 |

|

34,103 |

|

32,044 |

|

|

Site G&A |

2,760 |

|

2,185 |

|

6,530 |

|

6,523 |

|

|

Lease Payments |

3,985 |

|

3,565 |

|

9,636 |

|

4,014 |

|

|

Gold Equivalent Ounces sold |

63,516 |

|

57,963 |

|

165,352 |

|

180,241 |

|

|

All In Sustaining costs per ounce sold |

1,437 |

|

1,251 |

|

1,330 |

|

1,154 |

|

| |

|

|

|

|

Reconciliation Net Debt ($

thousand):

|

|

For the three months ended September 30, 2023 |

For the three months ended September 30, 2022 |

For the nine months ended September 30, 2023 |

For the nine months ended September 30, 2022 |

|

Short Term Loans |

101,047 |

|

84,045 |

|

101,047 |

|

84,045 |

|

|

Long-Term Loans |

197,714 |

|

123,731 |

|

197,714 |

|

123,731 |

|

|

Plus / (Less): Derivative Financial Instrument for Debentures |

(7,662 |

) |

(5,537 |

) |

(7,662 |

) |

(5,537 |

) |

|

Less: Cash and Cash Equivalents |

(178,989 |

) |

(120,916 |

) |

(178,989 |

) |

(120,916 |

) |

|

Less: Restricted cash |

- |

|

(600 |

) |

- |

|

(600 |

) |

|

Less: Short term investments |

- |

|

- |

|

- |

|

- |

|

|

Net Debt |

112,110 |

|

80,723 |

|

112,110 |

|

80,723 |

|

Qualified Person

Farshid Ghazanfari, P.Geo. Mineral resources and

Geology Director for Aura Minerals Inc., has reviewed and approved

the scientific and technical information contained within this news

release and serves as the Qualified Person as defined in National

Instrument 43-101 – Standards of Disclosure for Mineral

Projects.

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on the development and operation of gold and base

metal projects in the Americas. The Company’s four producing assets

include the San Andres gold mine in Honduras, the EPP and the Almas

gold mines in Brazil and the Aranzazu copper-gold-silver mine in

Mexico. In addition, the Company has the Tolda Fria gold project in

Colombia and four projects in Brazil, of which three gold projects:

Borborema and Matupá, which are in development; and São Francisco,

which is on care and maintenance. The Company also owns the Serra

da Estrela copper project in Brazil, Carajás region, under

exploration stage.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which may include, but is not limited to, statements

with respect to the activities, events or developments that the

Company expects or anticipates will or may occur in the future,

including the Company’s exploration activities for 2023 and

potential results thereof; expected production from, and the

further potential of the Company’s properties production levels

(including production levels expressed in GEO); cash costs and AISC

across its operations; the timing and effect of the Company’s Almas

project entering production; the impact of new IFRS accounting

standards; the ability of the Company to achieve its longer-term

outlook and results thereof; amounts of mineral reserves and

mineral resources; and expected capital expenditure and mine

production costs. Often, but not always, forward-looking statements

can be identified by the use of words and phrases such as “plans,”

“expects,” “is expected,” “budget,” “scheduled,” “estimates,”

“forecasts,” “intends,” “anticipates,” or “believes” or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results “may,” “could,” “would,”

“might” or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties, and

other factors, many of which are beyond the Company’s ability to

predict or control, could cause actual results to differ materially

from those contained in the forward-looking statements if such

risks, uncertainties or factors materialize. Specific reference is

made to the most recent AIF on file with certain Canadian

provincial securities regulatory authorities for a discussion of

some of the factors underlying forward-looking statements, which

include, without limitation, volatility in the prices of gold,

copper and certain other commodities, changes in debt and equity

markets, the uncertainties involved in interpreting geological

data, increases in costs, environmental compliance and changes in

environmental legislation and regulation, interest rate and

exchange rate fluctuations, general economic conditions and other

risks involved in the mineral exploration and development industry.

Readers are cautioned that the foregoing list of factors is not

exhaustive of the factors that may affect the forward-looking

statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

Financial Outlook and Future-Oriented Financial

Information

To the extent any forward-looking statements in

this press release constitute “financial outlooks” within the

meaning of applicable Canadian securities legislation, such

information is being provided as certain estimated financial

metrics and the reader is cautioned that this information may not

be appropriate for any other purpose and the reader should not

place undue reliance on such financial outlooks. Such information

was approved by the Company’s Board of Directors on May 4, 2023.

Financial outlooks, as with forward-looking statements generally,

are, without limitation, based on the assumptions and subject to

various risks as set out herein. The Company’s actual financial

position and results of operations may differ materially from

management’s current expectations and, as a result, may differ

materially from values provided in this press release.

For more information, please contact:

Investor Relations

ir@auraminerals.com

www.auraminerals.com

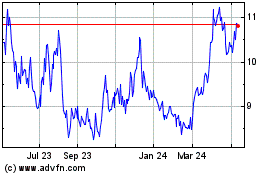

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Dec 2024 to Jan 2025

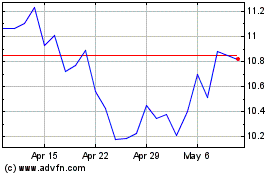

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Jan 2024 to Jan 2025