- Both leading proxy advisory firms – ISS and Glass Lewis – have

recommended Shareholders vote FOR the Arrangement

- The Arrangement delivers immediate, significant, and certain

value following a robust strategic review process overseen by an

independent Special Committee of the Board

- Q4 sets the record straight regarding FINSIGHT’s misleading

criticisms of the Arrangement – which are based on ill-informed

speculation, questionable motives, and faulty assumptions

- Urges Shareholders to vote FOR the proposed Arrangement today

or well in advance of the deadline of January 22, 2024 at 10 a.m.

Toronto Time.

Q4 Inc. (TSX:QFOR) (“Q4” or the “Company”), the leading capital

markets access platform, today issued a letter to shareholders

reiterating why they should support the proposed arrangement

transaction (the “Arrangement”), whereby Q4 would be acquired by a

newly formed entity controlled by Sumeru Equity Partners

(“Sumeru”), a leading technology-focused investment firm. A special

meeting (the “Special Meeting”) of holders (the “Shareholders”) of

the Company’s common shares (the “Common Shares”) related to the

proposed Arrangement will be held on January 24, 2024 at 10:00 a.m.

(Toronto Time).

In the letter – signed by the independent Special Committee (the

“Special Committee”) of the Board of Directors – Q4 highlights a

number of crucial points it believes Shareholders should consider

before voting. The Company also addresses recent criticism of the

proposed transaction from FINSIGHT Group Inc. (“FINSIGHT”), a New

York City based financial technology provider that competes with

Q4.

Additional information regarding the Special Meeting and the

Arrangement, including a recently released investor presentation,

can be found here:

https://investors.q4inc.com/Special-Meeting-Vote/Special-Meeting/

The full letter is included below:

Dear Shareholders,

The Q4 Inc. (TSX:QFOR) (“Q4” or the “Company”) Special Meeting

of Shareholders (“Special Meeting”) – to be held on January 24,

2024 at 10 a.m. (Toronto Time) – is fast approaching. At the

Special Meeting, you will have an opportunity to vote on the

proposed Arrangement (the “Arrangement”), whereby Q4 would be

acquired by a newly formed entity controlled by Sumeru Equity

Partners (“Sumeru”), a leading technology-focused investment

firm.

The Board (other than those directors who declared an interest

in the transaction and did not participate in the deliberations)

unanimously recommends that you vote “FOR” the proposed

Arrangement, because it will deliver immediate, significant, and

certain value following a robust strategic review process overseen

by an independent Special Committee (the “Special Committee”) of

the Board of Directors.

FINSIGHT Group Inc. ("FINSIGHT"), a New York City based

financial technology competitor to Q4, has launched what we believe

to be a misleading and ill-informed campaign to block the deal. We

encourage you to keep the facts in mind and consider the following

before casting your vote:

The Arrangement resulted from a robust and independent

strategic review process

- Q4’s review of all strategic options – including continuing to

operate the Company’s standalone business strategy – was overseen

and directed by a Special Committee of independent directors advised by sophisticated

legal and financial advisors.

- From start to finish, the process was conducted over

approximately 121 days – the agreement to

transact with Sumeru was in no way rushed.

- The initial exploration of interest from the likeliest

potential acquirers was arm’s length and competitive, resulting in

four expressions of interest, three non-binding bids, and a final

$6.05 per share proposal from Sumeru that was an improvement from

its initial $5.75 per share proposal.

- Post-announcement, the deal process was supplemented with a

typical 35-day Go-Shop process that featured contact with 23

parties and five confidentiality agreements but resulted in

no acquisition proposals.

- At no point before the price was set did funds associated with

Ten Coves Capital (“Ten Coves”), Darrell Heaps, the Founder,

President, and Chief Executive Officer of the Company, Neil

Murdoch, a director of the Company, and another individual

shareholder (collectively, the “Rolling Shareholders”) have input

into the merger consideration that would be offered to non-rolling

Shareholders. The fact that certain Shareholders agreed to roll

allowed for a higher price to be offered to non-rolling

Shareholders.

- FINSIGHT’s criticism of the strategic

review process ignores the clear reality that the Special Committee

ensured there was every opportunity for a better offer to emerge.

None did.

The proposed transaction delivers fair value and is in the

best interests of ALL Shareholders

- The Arrangement offers Shareholders a compelling 36%

premium over Q4’s share price on the last trading date prior to the

transaction announcement.1 Further, the premium is 43% over

the 20-day pre-deal volume-weighted average price, and 46%

over the 60-day VWAP.

- Stifel Nicolaus Canada Inc., which was retained by the Special

Committee to provide an independent formal valuation, concluded

that Q4’s fair market value was in the range of $5.50 to $6.80 per

share, based on an analysis of a discounted cash flow model, market

comparables, and precedent transactions. The consideration under

the Arrangement is well within this valuation

range.

- FINSIGHT’s use of EQS Group AG’s (“EQS”) proposed acquisition

by Thoma Bravo as a comparable transaction is highly misleading.

Whereas Q4’s revenue grew approximately 5% in 2023 and its EBITDA

margin was nil, EQS grew revenue 18% with a 14% EBITDA margin. Q4’s

management forecasts expect the Company will not deliver levels of

revenue growth and profitability akin to those of EQS until 2026

(18.2% revenue growth and 19.7% EBITDA margin).

- EQS was acquired at over 7x ARR because it has a Rule of 40

score of 42 (2024 revenue growth of 22% plus 2024 EBITDA margin of

20%), in contrast to Q4’s Rule of 40 score of 15.8 (12.1% growth

plus 3.7% EBITDA).2 The two companies’ expected cash flows are not

comparable, and neither are their expected values in a

takeout.

- FINSIGHT’s assessment of Q4’s potential

future value is highly speculative and is based on faulty

assumptions.

The Arrangement with Sumeru mitigates operating risk and is

the best path forward for Q4

- Q4’s revenues are highly dependent on initial public offering

volume, which in 2023 declined to less than half of the annual IPO

volume at the time that Q4 shares started trading publicly.

Shareholders are currently exposed to

uncertainty regarding when IPO volume will recover.

- Before its IPO, Q4 was able to grow by more than 30% annually;

half of this growth was through acquisitions. Absent this M&A,

Q4’s prospects of growth are materially

impaired.

- FINSIGHT’s perspective that Q4 is “well positioned for growth”

with “multiple options for unlocking immediate value” ignores the

practical realities of operating in a challenging macroeconomic

environment as a small scale, microcap public technology company

listed on the TSX. Further, this type of growth and

value-enhancement would be delayed and potentially limited without

the flexibility provided by being a private company backed by a

private equity sponsor.

- Termination of the Arrangement will eliminate the offer control premium in the share

price and result in an immediate share price decline.

- The notion that FINSIGHT has a better

line of sight than management and the Board into the dynamics of

Q4’s business and its future performance is deliberately

misleading. The downside risk for Q4’s business – and for its

Shareholders if it remains public – is very real.

The proposed transaction has received broad support from

leading independent third parties

- Leading proxy advisors Institutional Shareholder Services Inc.

(“ISS”) and Glass Lewis & Co. (“Glass Lewis”) have recommended

that Q4 Shareholders vote FOR the Arrangement.

- ISS concluded that: “The sale process was ultimately conducted

on a comparable basis to other recent notable Canadian software

transactions and helped facilitate price discovery,” and that, “The

offer represents a significant premium to the unaffected price and

the valuation appears credible.”3

- Glass Lewis found that: “All told, we believe the board has

presented a sufficient case to support its view that the strategic

opportunity presented by the Purchaser is attractive.”

- Sell-side analysts Canaccord Genuity, Eight Capital, and RBC

Royal Bank have issued reports that respectively found the

Arrangement to be a “positive outcome,” “reasonable,” and

“attractive.”

- Where is the third-party support for

FINSIGHT’s case? Nowhere. Because it doesn’t exist.

FINSIGHT’s misguided campaign is not in Shareholders’ best

interests

- FINSIGHT is not a typical investor – it is a financial

technology company that competes in many areas with Q4.

- FINSIGHT’s claim that Q4 has multiple options for immediately

unlocking value is naïve at best and

purposefully misleading at worst.

- The truth is, Q4 management has explored

a wide variety of options to stimulate the share price,

including product and market expansion, discontinuing unprofitable

businesses, operational cost reductions, lower R&D

expenditures, workforce reductions, offshoring talent, and share

repurchases.

- Although FINSIGHT claims to speak for Shareholders who have

been invested since the IPO, it is a short-term investor that, we understand, began

investing in late 2022, built its position by March of 2023, and

therefore acquired most of its shares for less than $3. As it has

noted, FINSIGHT stands to make a significant

return on the Sumeru transaction it is publicly fighting

against.

- If Shareholders follow FINSIGHT’s recommendation and reject the

transaction without a superior proposal on the table, Q4 will be

liable for significant transaction costs, including up to US$4.85

million in expense reimbursement to Sumeru. The result will be a Q4

with less cash on its balance sheet, a

greater likelihood of needing to access its debt facility, and

lower share liquidity due to the broken sale.

- FINSIGHT’s expectation of a higher share

price under those circumstances is irrational.

- In our conversations with other Shareholders, several have

asked us what FINSIGHT’s end game truly

is. Our response has been simple: you

will have to ask FINSIGHT.

- Shareholders should question FINSIGHT’s

true motivations for seeking to block the Arrangement – is it about

what is best for Q4 and its shareholders, or what is only best for

FINSIGHT?

***

Shareholders are urged to read the Circular and its appendices

carefully and in its entirety as the Circular contains extensive

detail regarding the background to the Arrangement, detailed

reasons for the recommendation of the Special Committee and the

Board (including the above reasons) and other factors considered.

FINSIGHT’s narrative doesn’t hold up.

After careful consideration of all these factors, including the

recommendations of the Company’s financial advisors and the

unanimous recommendation of the Special Committee, the Board (with

conflicted directors not in attendance or participating in the

decision) unanimously determined the Arrangement is the best

interests of the Company and is fair to Shareholders (other than

the Rolling Shareholders).

As such, we strongly encourage you to vote “FOR” the

proposed Arrangement.

Thank you for your continued support of Q4.

Sincerely,

The Special Committee of the Board of Directors of Q4

Due to the Essence of Time, Shareholders are

encouraged to vote online or by telephone as described in the

enclosed voting form and on Q4’s website at:

https://investors.q4inc.com/Special-Meeting.

The proxy voting deadline is on January 22,

2024 at 10 a.m. Toronto Time.

Shareholder Questions and Assistance

Shareholders who have questions regarding the

Arrangement or require assistance with voting may contact Laurel

Hill Advisory Group, the Company’s shareholder communications

advisor and proxy solicitation agent at:

Laurel Hill Advisory Group North American Toll

Free: 1-877-452-7184 (+1 416-304-0211 Outside North America) Email:

assistance@laurelhill.com.

About Q4 Inc.

Q4 Inc. (TSX: QFOR) is the leading capital markets access

platform that is transforming how issuers, investors, and the

sell-side efficiently connect, communicate, and engage with each

other.

The Q4 Platform facilitates interactions across the capital

markets through IR website products, virtual events solutions,

engagement analytics, investor relations CRM, shareholder and

market analysis, surveillance, and ESG tools. The Q4 Platform is

the only holistic capital markets access platform that digitally

drives connections, analyzes impact, and targets the right

engagement to help public companies work faster and smarter.

The company is a trusted partner to more than 2,500 public

companies globally, including many of the most respected brands in

the world, and maintains an award-winning culture where team

members grow and thrive.

Q4 is headquartered in Toronto, with offices in New York and

London. Learn more at investors.Q4inc.com.

All dollar figures in this release are in Canadian dollars

unless otherwise indicated.

About Sumeru Equity Partners

Sumeru Equity Partners provides growth capital at the

intersection of people and innovative technology. Sumeru seeks to

embolden innovative founders and management teams with capital and

scaling partnership. Sumeru has invested over US$3 billion in more

than fifty platform and add-on investments across enterprise and

vertical SaaS, data analytics, education technology, infrastructure

software and cybersecurity. The firm typically invests in companies

throughout North America and Europe. For more information, please

visit sumeruequity.com.

Cautionary Note Regarding Forward-Looking Information

This release includes “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

statements”) within the meaning of applicable securities laws.

Forward-looking statements include, but are not limited to,

statements with respect to the purchase by the Purchaser of all of

the issued and outstanding Common Shares, the rationale of the

Board for entering into the Arrangement Agreement, the anticipated

timing and the various steps to be completed in connection with the

Arrangement, including receipt of Shareholder and court approvals,

the anticipated timing for closing of the Arrangement, the

potential impacts to the Company and its share price if the

Arrangement is terminated, the Company’s operations and financial

performance and potential growth opportunities.

In some cases, but not necessarily in all cases, forward-looking

statements can be identified by the use of forward-looking

terminology such as “plans” “targets”, “expects” or “does not

expect”, “is expected”, “an opportunity exists”, “is positioned”,

“estimates”, “intends”, “assumes”, “anticipates” or “does not

anticipate” or “believes”, or variations of such words and phrases

or state that certain actions, events or results “may”, “could”,

“would”, “might”, “will” or “will be taken”, “occur” or “be

achieved”. In addition, any statements that refer to expectations,

projections or other characterizations of future events or

circumstances contain forward-looking statements. Forward-looking

statements are not historical facts, nor guarantees or assurances

of future performance but instead represent management’s current

beliefs, expectations, estimates and projections regarding future

events and operating performance. Forward-looking statements are

necessarily based on a number of opinions, assumptions and

estimates that, while considered reasonable by the Company as of

the date of this release, are subject to inherent uncertainties,

risks and changes in circumstances that may differ materially from

those contemplated by the forward-looking statements. Important

factors that could cause actual results to differ, possibly

materially, from those indicated by the forward-looking statements

include, but are not limited to, the possibility that the proposed

Arrangement will not be completed on the terms and conditions, or

on the timing, currently contemplated, or at all, the possibility

of the Arrangement Agreement being terminated in certain

circumstances, the ability of the Board to consider and approve a

Superior Proposal for the Company, and the other risk factors

identified under “Risk Factors” in the Company’s latest annual

information form and management’s discussion and analysis for the

year ended December 31, 2022 and in the management’s discussion and

analysis for the period ended September 30, 2023, and in other

periodic filings that the Company has made and may make in the

future with the securities commissions or similar regulatory

authorities in Canada, all of which are available under the

Company’s SEDAR+ profile at www.sedarplus.ca. These factors are not

intended to represent a complete list of the factors that could

affect the Company. However, such risk factors should be considered

carefully. There can be no assurance that such estimates and

assumptions will prove to be correct. You should not place undue

reliance on forward-looking statements, which speak only as of the

date of this release.

Although the Company has attempted to identify important risk

factors that could cause actual results to differ materially from

those contained in forward-looking statements, there may be other

risk factors not currently known to us or that we currently believe

are not material that could also cause actual results or future

events to differ materially from those expressed in such

forward-looking statements. There can be no assurance that such

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. Accordingly, you should not place undue reliance on

forward-looking statements. The forward-looking statements

represent the Company’s expectations as of the date of this release

(or as the date it is otherwise stated to be made) and are subject

to change after such date. However, the Company disclaims any

intention and undertakes no obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required under applicable

Canadian securities laws. All of the forward-looking statements

contained in this release are expressly qualified by the foregoing

cautionary statements.

1

As of November 10, 2023

2

Source: S&P Global Market

Intelligence

3

Permission to quote ISS was neither sought

nor obtained.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240115036629/en/

Investor Laurel Hill Advisory Group North America Toll

Free: 1-877-452-7184 Collect Calls Outside North America:

1-416-304-0211 assistance@laurelhill.com

Edward Miller Director, Investor Relations (437) 291-1554

ir@q4inc.com

Media Longacre Square Partners Scott Deveau

sdeveau@longacresquare.com

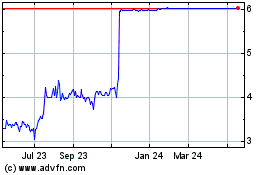

Q4 (TSX:QFOR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Q4 (TSX:QFOR)

Historical Stock Chart

From Dec 2023 to Dec 2024