Transcontinental Inc. Completes Two Acquisitions and Increases its

Profitability in the Second Quarter

MONTREAL, QUEBEC--(Marketwired - Jun 5, 2014) -

(TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D)

|

(in millions of dollars, except per share data) |

Q2-14 |

Q2-13(1) |

% |

|

YTD 2014 |

YTD 2013(1) |

% |

|

|

Revenues |

498.2 |

517.8 |

(3.8 |

) |

997.5 |

1,043.4 |

(4.4 |

) |

|

Adjusted operating earnings before amortization (Adjusted

EBITDA) |

82.8 |

80.4 |

3.0 |

|

151.4 |

149.8 |

1.1 |

|

|

Adjusted operating earnings (Adjusted EBIT) |

58.5 |

54.2 |

7.9 |

|

102.0 |

97.7 |

4.4 |

|

|

Adjusted net earnings applicable to participating shares |

36.8 |

32.6 |

12.9 |

|

63.2 |

59.0 |

7.1 |

|

|

Per share |

0.47 |

0.42 |

11.9 |

|

0.81 |

0.76 |

6.6 |

|

|

Net earnings applicable to participating shares |

34.7 |

25.3 |

37.2 |

|

51.9 |

41.0 |

26.6 |

|

|

Per share |

0.45 |

0.32 |

40.6 |

|

0.67 |

0.52 |

28.8 |

|

| Please refer to the table "Reconciliation of Non-IFRS

financial measures" in this press release. |

|

(1) |

2013

figures have been restated to take into account the effects of

amended IAS 19 - Employee Benefits, IFRS 11 - Joint Arrangements

and other elements. |

Highlights

- Revenues decreased 3.8%, primarily due to the soft advertising

market.

- Adjusted net earnings applicable to participating shares grew

12.9%, from $32.6 million to $36.8 million. On a per share basis,

they rose from $0.42 to $0.47.

- Completed the acquisition of the assets of Capri Packaging, a

producer of flexible packaging.

- Completed the acquisition of the weekly newspapers owned by Sun

Media Corporation in Quebec and their related Web properties. Under

the terms of the agreement with the Competition Bureau, the

Corporation must put some weekly newspapers up for sale.

- Closed a private financing agreement of $250 million in senior

unsecured notes.

- Signed a multi-year agreement with Postmedia Network Inc. to

print The Gazette newspaper.

Transcontinental

Inc.'s (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D) revenues decreased by

3.8% in the second quarter, from $517.8 million to $498.2 million,

primarily due to the soft advertising market, which continues to

influence our marketing products printing as well as our newspaper

and magazine publishing operations. This decrease was partially

offset by the sustained performance of our flyer printing

operations and by new contracts in both operating sectors.

Adjusted operating

earnings rose from $54.2 million to $58.5 million. This performance

is due to the company-wide optimization of our cost structure and

our highly efficient printing platform. It was partially offset by

the soft advertising market as mentioned above. Net earnings

applicable to participating shares increased from $25.3 million, or

$0.32 per share, to $34.7 million, or $0.45 per share. This

improvement is due to lower restructuring and other costs, an

increase in adjusted operating earnings and lower financial

expenses, partially offset by an increase in income taxes. Adjusted

net earnings applicable to participating shares grew 12.9%, from

$32.6 million, or $0.42 per share, to $36.8 million, or $0.47 per

share.

"We are proud to

have completed two major transactions that position TC

Transcontinental strategically for the future. With the acquisition

of the Capri Packaging assets, we have taken a first step into the

flexible packaging market, which is a new promising growth area for

the Corporation. In addition, the acquisition of the Sun Media

weekly newspapers in Quebec strengthens our assets in this market,

while ensuring our ability to evolve our local solutions offering

in Quebec. Furthermore, our second quarter results were

satisfactory. Despite the pressure we are experiencing in the

advertising market, the increase in our profitability demonstrates

the effectiveness of our strategy, namely strengthening existing

assets and developing new revenue sources," said François Olivier,

President and Chief Executive Officer.

"For coming

quarters, our excellent financial position combined with our

ability to generate significant cash flows gives us the flexibility

we need to integrate our recent acquisitions, continue our

transformation and invest in the future of the Corporation," Mr.

Olivier added.

Supplementary

Information

- On April 10, 2014, the Corporation announced the renewal of its

normal course issuer bid from April 15, 2014 to April 14,

2015.

- On May 3, 2014, the Corporation completed the acquisition of

the assets of Capri Packaging, a producer of flexible packaging,

operating two facilities located in Clinton, Missouri. The

acquisition will add about US$72 million to TC Transcontinental's

revenues. As part of the transaction, the seller, Schreiber Foods,

Inc. has signed a 10-year agreement to secure Capri Packaging as a

strategic supplier of flexible packaging, which represents about

75% of Capri's total revenues.

- On May 5, 2014, TC Transcontinental Printing signed a

multi-year agreement with Postmedia Network Inc. to print The

Gazette, published primarily for the Montreal market. This

agreement builds on our recent announcement to print the

Vancouver Sun and the Calgary Herald. The

contract with Postmedia Network will take effect in August

2014.

- On May 8, 2014, the Corporation completed a private financing

agreement for an amount of $250 million of 3.897% senior unsecured

notes due in 2019. Transcontinental Inc. intends to use the net

proceeds to repay outstanding indebtedness under its revolving

credit facility and for general corporate purposes.

- On June 1, 2014, Transcontinental Inc. completed the

acquisition of the weekly newspapers owned by Sun Media Corporation

in Quebec and their related Web properties. Under the terms of the

agreement with the Competition Bureau, the Corporation must put

some weekly newspapers up for sale. Despite this requirement, the

transaction will add about $20 million to the operating earnings

before amortization of Transcontinental Inc. and further advance

the local multiplatform offering for businesses and

communities.

Highlights of the

First Half

In the first half of

2014, TC Transcontinental's revenues decreased 4.4%, from $1,043.4

million to $997.5 million. This decrease stems primarily from the

soft advertising market in our two operating sectors. Adjusted

operating earnings grew 4.4%, from $97.7 million to $102.0 million,

due to the optimization of our cost structure. This increase was

partially offset by the factors mentioned above. Net earnings

applicable to participating shares rose from $41.0 million, or

$0.52 per share, to $51.9 million, or $0.67 per share. This

improvement is due to lower financial expenses, a decrease in

restructuring and other costs, as well as an increase in adjusted

operating earnings, partially offset by an increase in income

taxes. Excluding unusual items, adjusted net earnings applicable to

participating shares grew 7.1%, from $59.0 million, or $0.76 per

share, to $63.2 million, or $0.81 per share.

For more detailed

financial information, please see Management's Discussion and

Analysis for the second quarter ended April 30th,

2014 as well as the financial statements in the "Investors"

section of our website at www.tc.tc

Outlook

New agreements to

print magazines, newspapers and marketing products signed since the

start of the fiscal year will reduce the impact of difficult market

conditions in these niches. We believe that our printing offering

to major retail chains will remain relatively stable and we are

continuing to improve our point-of-purchase marketing services. The

Printing Sector will also continue to optimize its cost structure

and operations in order to maintain its longer-term

profitability.

The Media Sector

should continue to benefit from cost-structure optimization

initiatives and the new flyer-distribution agreements that will

help stabilize our operating margin and reduce the impact of

difficult conditions in the advertising market. We will also

continue to invest in the development and commercialization of new

digital products. The acquisition of the Sun Media Corporation

weekly papers in Quebec should also enable us to strengthen our

media assets and improve our offering in local markets.

The Corporation

completed the transaction to acquire the assets of Capri Packaging

in order to start a new growth vector in flexible packaging. We

have initiated the operational integration process, modifying our

organizational structure and creating a packaging division headed

by a team of senior executives with outstanding capabilities in

manufacturing. The long-term agreement with the seller, Schreiber

Foods, Inc., will secure most of the revenues for this division. In

the coming months we will be implementing a plan to build the

loyalty of our existing customers and attract new ones to ensure

our success in this promising niche.

We have secured

additional long-term financing to give us the financial flexibility

required to pursue our transformation and execute our growth

strategy. Given our excellent financial position, we will continue

our balanced approach to capital management, which allows us to

reduce our debt, pay dividends and invest in our transformation

focused on our core competencies. We will also keep on developing

internal projects and evaluating strategic acquisitions to maintain

our position in our niches, while developing our new packaging

growth vector to ensure the long-term success and profitability of

the business.

Reconciliation of

Non-IFRS Financial Measures

Financial data have

been prepared in conformity with IFRS. However, certain measures

used in this press release do not have any standardized meaning

under IFRS and could be calculated differently by other companies.

We believe that many readers analyze our results based on certain

non-IFRS financial measures because such measures are more

appropriate for evaluating the Corporation's operating performance.

Internally, management uses such non-IFRS financial information as

an indicator of business performance, and evaluates management's

effectiveness with specific reference to these indicators. These

measures should be considered in addition to, not as a substitute

for or superior to, measures of financial performance prepared in

accordance with IFRS.

The following table

reconciles IFRS financial measures to non-IFRS financial

measures.

| Reconciliation of Non-IFRS Financial Measures |

| (unaudited) |

|

|

|

|

|

Three months ended April 30 |

|

|

Six months ended April 30 |

|

|

|

(in millions of dollars, except per share amounts) |

|

2014 |

|

|

2013 (1) |

|

|

2014 |

|

|

|

2013 (1) |

|

|

|

Net earnings applicable to participating shares |

$ |

34.7 |

|

$ |

25.3 |

|

$ |

51.9 |

|

|

$ |

41.0 |

|

|

|

Dividends on preferred shares, net of related taxes |

|

1.7 |

|

|

1.7 |

|

|

3.4 |

|

|

|

3.4 |

|

|

|

Non-controlling interests |

|

0.4 |

|

|

0.4 |

|

|

0.1 |

|

|

|

0.1 |

|

|

|

Income tax |

|

14.9 |

|

|

10.7 |

|

|

23.6 |

|

|

|

13.7 |

|

|

|

Share of earnings in interests in joint ventures, net of related

taxes |

|

(0.2 |

) |

|

(0.3 |

) |

|

(0.5 |

) |

|

|

(0.4 |

) |

|

|

Net financial expenses |

|

4.0 |

|

|

6.5 |

|

|

8.6 |

|

|

|

15.2 |

|

|

|

Impairment of assets |

|

0.1 |

|

|

0.7 |

|

|

0.5 |

|

|

|

2.8 |

|

|

|

Restructuring and other costs |

|

2.9 |

|

|

9.2 |

|

|

14.4 |

|

|

|

21.9 |

|

|

|

Adjusted operating earnings |

$ |

58.5 |

|

$ |

54.2 |

|

$ |

102.0 |

|

|

$ |

97.7 |

|

|

|

Amortization |

|

24.3 |

|

|

26.2 |

|

|

49.4 |

|

|

|

52.1 |

|

|

|

Adjusted operating earnings before amortization |

$ |

82.8 |

|

$ |

80.4 |

|

$ |

151.4 |

|

|

$ |

149.8 |

|

|

|

Net earnings applicable to participating shares |

$ |

34.7 |

|

$ |

25.3 |

|

$ |

51.9 |

|

|

$ |

41.0 |

|

|

|

Impairment of assets (after tax) |

|

0.1 |

|

|

0.6 |

|

|

0.4 |

|

|

|

2.1 |

|

|

|

Restructuring and other costs (after tax) |

|

2.0 |

|

|

6.7 |

|

|

10.9 |

|

|

|

15.9 |

|

|

|

Adjusted net earnings applicable to participating shares |

$ |

36.8 |

|

$ |

32.6 |

|

$ |

63.2 |

|

|

$ |

59.0 |

|

|

|

Weighted Average number of participating shares outstanding |

|

78.0 |

|

|

77.9 |

|

|

78.0 |

|

|

|

78.0 |

|

|

|

Adjusted net earnings applicable to participating shares per

share |

$ |

0.47 |

|

$ |

0.42 |

|

$ |

0.81 |

|

|

$ |

0.76 |

|

|

|

|

|

|

|

|

|

|

|

|

As at |

|

|

|

As at |

|

|

|

|

|

|

|

|

|

|

|

April 30, |

|

|

|

October 31, |

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

2013 (1) |

|

|

|

Long-term debt |

|

|

|

|

|

|

$ |

119.7 |

|

|

$ |

128.9 |

|

|

|

Current portion of long-term debt |

|

|

|

|

|

|

|

161.9 |

|

|

|

218.3 |

|

|

|

Cash |

|

|

|

|

|

|

|

(29.9 |

) |

|

|

(26.4 |

) |

|

|

Net indebtedness |

|

|

|

|

|

|

$ |

251.7 |

|

|

$ |

320.8 |

|

|

|

Adjusted operating earnings before amortization (last 12

months) |

|

|

|

|

|

|

$ |

340.2 |

|

|

$ |

338.6 |

|

|

|

Net indebtedness ratio |

|

|

|

|

|

|

|

0.74 |

|

x |

|

0.95 |

|

x |

|

(1) |

2013

figures have been restated to take into account the effects of IAS

19 amended - Employee Benefits, IFRS 11 - Joint Arrangements and

other elements. |

Dividends

Dividend on

Participating Shares

The Corporation's

Board of Directors declared a quarterly dividend of $0.16 per share

on Class A Subordinate Voting Shares and Class B Shares. This

dividend is payable on July 17, 2014 to shareholders of record at

the close of business on June 30, 2014.

Dividend on

Preferred shares

The Corporation's

Board of Directors declared a quarterly dividend of $0.4207 per

share on Cumulative 5-Year Rate Reset First Preferred Shares,

Series D. This dividend is payable on July 15, 2014. On an annual

basis, this represents a dividend of $1.6875 per preferred

share.

Additional

Information

Conference

Call

Upon releasing its

second quarter 2014 results, the Corporation will hold a conference

call for the financial community today at 4:15 p.m. The dial-in

numbers are 1 647-788-4922 or 1 877-223-4471. Media may hear the

call in listen-in only mode or tune in to the simultaneous audio

broadcast on the Corporation's website, which will then be archived

for 30 days. For media requests or interviews, please contact

Nathalie St-Jean, Senior Advisor, Corporation Communications of TC

Transcontinental, at 514-954-3581.

Profile

Largest printer and

a leading provider of media and marketing activation solutions in

Canada, TC Transcontinental creates products and services that

allow businesses to attract, reach and retain their target

customers. The Corporation specializes in print and digital media,

the production of magazines, newspapers, books and custom content,

mass and personalized marketing, interactive and mobile

applications, door-to-door distribution, and also manufactures a

range of flexible packaging products in the United States.

Transcontinental

Inc. (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D), including TC

Transcontinental, TC Media, TC Transcontinental Printing and TC

Transcontinental Packaging, has over 9,000 employees in Canada and

the United States, and revenues of C$2.1 billion in 2013. Website

www.tc.tc.

Forward-looking

Statements

Our public

communications often contain oral or written forward-looking

statements which are based on the expectations of management and

inherently subject to a certain number of risks and uncertainties,

known and unknown. By their very nature, forward-looking statements

are derived from both general and specific assumptions. The

Corporation cautions against undue reliance on such statements

since actual results or events may differ materially from the

expectations expressed or implied in them. Forward-looking

statements may include observations concerning the Corporation's

objectives, strategy, anticipated financial results and business

outlook. The Corporation's future performance may also be affected

by a number of factors, many of which are beyond the Corporation's

will or control. These factors include, but are not limited to, the

economic situation in the world and particularly in Canada and the

United States, structural changes in the industries in which the

Corporation operates, the exchange rate, availability of capital,

energy costs, competition, the Corporation's capacity to engage in

strategic transactions and integrate acquisitions into its

activities, the regulatory environment, the safety of our packaging

products used in the food industry, innovation of our offering and

concentration of our sales in certain segments. The main risks,

uncertainties and factors that could influence actual results are

described in Management's Discussion and Analysis (MD&A)

for the fiscal year ended on October 31st,

2013, in the latest Annual Information Form and have

been updated in the MD&A for the second quarter ended April

30th, 2014.

Unless otherwise

indicated by the Corporation, forward-looking statements do not

take into account the potential impact of nonrecurring or other

unusual items, nor of divestitures, business combinations, mergers

or acquisitions which may be announced after the date of June 5,

2014.

The forward-looking

statements in this press release are made pursuant to the "safe

harbour" provisions of applicable Canadian securities

legislation.

The forward-looking

statements in this release are based on current expectations and

information available as at June 5, 2014. Such forward-looking

information may also be found in other documents filed with

Canadian securities regulators or in other communications. The

Corporation's management disclaims any intention or obligation to

update or revise these statements unless otherwise required by the

securities authorities.

|

|

| CONSOLIDATED STATEMENTS OF EARNINGS |

| Unaudited |

|

|

Three months ended |

Six months ended |

|

|

April 30 |

April 30 |

|

(in millions of Canadian dollars, except per share data) |

|

2014 |

|

2013 Restated |

|

2014 |

|

2013 Restated |

|

|

Revenues |

$ |

498.2 |

$ |

517.8 |

$ |

997.5 |

$ |

1,043.4 |

|

Operating expenses |

|

415.4 |

|

437.4 |

|

846.1 |

|

893.6 |

|

Restructuring and other costs |

|

2.9 |

|

9.2 |

|

14.4 |

|

21.9 |

|

Impairment of assets |

|

0.1 |

|

0.7 |

|

0.5 |

|

2.8 |

|

|

Operating earnings before amortization |

|

79.8 |

|

70.5 |

|

136.5 |

|

125.1 |

|

Amortization |

|

24.3 |

|

26.2 |

|

49.4 |

|

52.1 |

|

|

Operating earnings |

|

55.5 |

|

44.3 |

|

87.1 |

|

73.0 |

|

Net financial expenses |

|

4.0 |

|

6.5 |

|

8.6 |

|

15.2 |

|

|

Earnings before share of net earnings in interests in joint

ventures and income taxes |

|

51.5 |

|

37.8 |

|

78.5 |

|

57.8 |

|

Share of net earnings in interests in joint ventures, net of

related taxes |

|

0.2 |

|

0.3 |

|

0.5 |

|

0.4 |

|

Income taxes |

|

14.9 |

|

10.7 |

|

23.6 |

|

13.7 |

|

|

Net earnings |

|

36.8 |

|

27.4 |

|

55.4 |

|

44.5 |

|

Non-controlling interests |

|

0.4 |

|

0.4 |

|

0.1 |

|

0.1 |

|

Net earnings attributable to shareholders of the Corporation |

|

36.4 |

|

27.0 |

|

55.3 |

|

44.4 |

|

Dividends on preferred shares, net of related taxes |

|

1.7 |

|

1.7 |

|

3.4 |

|

3.4 |

|

Net earnings attributable to participating shares |

$ |

34.7 |

$ |

25.3 |

$ |

51.9 |

$ |

41.0 |

|

|

Net earnings per participating share - basic |

$ |

0.45 |

$ |

0.32 |

$ |

0.67 |

$ |

0.52 |

|

|

Net earnings per participating share - diluted |

$ |

0.44 |

$ |

0.32 |

$ |

0.66 |

$ |

0.52 |

|

|

Weighted average number of participating shares outstanding - basic

(in millions) |

|

78.0 |

|

77.9 |

|

78.0 |

|

78.0 |

|

|

Weighted average number of participating shares - diluted (in

millions) |

|

78.2 |

|

77.9 |

|

78.2 |

|

78.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|

| Unaudited |

|

|

Three months ended |

|

Six months ended |

|

|

April 30 |

|

April 30 |

|

| (in millions of Canadian dollars) |

|

2014 |

|

|

2013 Restated |

|

|

2014 |

|

|

2013 Restated |

|

|

|

| Net earnings |

$ |

36.8 |

|

$ |

27.4 |

|

$ |

55.4 |

|

$ |

44.5 |

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items that will be reclassified to net earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change related to cash flow hedges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in the fair value of derivatives designated as cash flow

hedges |

|

0.8 |

|

|

(1.1 |

) |

|

0.2 |

|

|

1.0 |

|

|

|

Reclassification of the net change in the fair value of derivatives

designated as cash flow hedges in prior periods, recognized in net

earnings during the period |

|

0.8 |

|

|

1.4 |

|

|

- |

|

|

(0.1 |

) |

|

|

Related income taxes |

|

0.3 |

|

|

0.1 |

|

|

0.1 |

|

|

0.3 |

|

|

|

1.3 |

|

|

0.2 |

|

|

0.1 |

|

|

0.6 |

|

|

|

|

Cumulative translation differences |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized exchange gains (losses) on the translation of the

financial statements of foreign operations |

|

(0.1 |

) |

|

0.6 |

|

|

2.8 |

|

|

0.3 |

|

|

|

Unrealized exchange gains (losses) on the translation of a debt

designated as a hedge of a net investment in foreign

operations |

|

0.1 |

|

|

(0.2 |

) |

|

(2.4 |

) |

|

(0.6 |

) |

|

|

- |

|

|

0.4 |

|

|

0.4 |

|

|

(0.3 |

) |

|

|

| Items that will not be reclassified to net

earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in actuarial gains and losses in respect of

defined benefit plans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actuarial gains (losses) in respect of defined benefit plans |

|

17.2 |

|

|

(8.6 |

) |

|

11.2 |

|

|

3.4 |

|

|

|

Related income taxes |

|

4.6 |

|

|

(2.2 |

) |

|

3.0 |

|

|

0.8 |

|

|

|

12.6 |

|

|

(6.4 |

) |

|

8.2 |

|

|

2.6 |

|

|

|

| Other comprehensive income (loss) |

|

13.9 |

|

|

(5.8 |

) |

|

8.7 |

|

|

2.9 |

|

| Comprehensive income |

$ |

50.7 |

|

$ |

21.6 |

|

$ |

64.1 |

|

$ |

47.4 |

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders of the Corporation |

$ |

50.3 |

|

$ |

21.2 |

|

$ |

64.0 |

|

$ |

47.3 |

|

|

Non-controlling interests |

|

0.4 |

|

|

0.4 |

|

|

0.1 |

|

|

0.1 |

|

|

$ |

50.7 |

|

$ |

21.6 |

|

$ |

64.1 |

|

$ |

47.4 |

|

|

|

|

|

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

|

Unaudited |

|

|

| (in

millions of Canadian dollars) |

|

|

|

|

Attributable to shareholders of the Corporation |

|

|

|

|

|

|

|

|

|

|

|

Share capital |

|

Contributed surplus |

Retained earnings |

|

Accumulated other comprehensive loss |

|

Total |

|

Non- controlling interests |

|

Total equity |

|

|

|

| Balance as at October 31, 2013 (Restated) |

$ |

462.8 |

|

$ |

2.9 |

$ |

362.5 |

|

$ |

(13.2 |

) |

$ |

815.0 |

|

$ |

0.4 |

|

$ |

815.4 |

|

| Net earnings |

|

- |

|

|

- |

|

55.3 |

|

|

- |

|

|

55.3 |

|

|

0.1 |

|

|

55.4 |

|

| Other comprehensive income |

|

- |

|

|

- |

|

- |

|

|

8.7 |

|

|

8.7 |

|

|

- |

|

|

8.7 |

|

| Shareholders' contributions and distributions to

shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

|

- |

|

|

- |

|

(27.2 |

) |

|

- |

|

|

(27.2 |

) |

|

- |

|

|

(27.2 |

) |

|

Stock-option based compensation |

|

- |

|

|

0.3 |

|

- |

|

|

- |

|

|

0.3 |

|

|

- |

|

|

0.3 |

|

| Balance as at April 30, 2014 |

$ |

462.8 |

|

$ |

3.2 |

$ |

390.6 |

|

$ |

(4.5 |

) |

$ |

852.1 |

|

$ |

0.5 |

|

$ |

852.6 |

|

|

|

| Balance as at November 1, 2012 |

$ |

467.7 |

|

$ |

2.5 |

$ |

514.2 |

|

$ |

(84.4 |

) |

$ |

900.0 |

|

$ |

1.4 |

|

$ |

901.4 |

|

| Net earnings |

|

- |

|

|

- |

|

44.4 |

|

|

- |

|

|

44.4 |

|

|

0.1 |

|

|

44.5 |

|

| Other comprehensive income |

|

- |

|

|

- |

|

- |

|

|

2.9 |

|

|

2.9 |

|

|

- |

|

|

2.9 |

|

| Shareholders' contributions and distributions to

shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participating share redemptions |

|

(6.4 |

) |

|

- |

|

(5.2 |

) |

|

- |

|

|

(11.6 |

) |

|

- |

|

|

(11.6 |

) |

|

Dividends |

|

- |

|

|

- |

|

(103.9 |

) |

|

- |

|

|

(103.9 |

) |

|

(1.4 |

) |

|

(105.3 |

) |

|

Stock-option based compensation |

|

- |

|

|

0.4 |

|

- |

|

|

- |

|

|

0.4 |

|

|

- |

|

|

0.4 |

|

| Balance as at April 30, 2013 (Restated) |

$ |

461.3 |

|

$ |

2.9 |

$ |

449.5 |

|

$ |

(81.5 |

) |

$ |

832.2 |

|

$ |

0.1 |

|

$ |

832.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

|

|

Unaudited |

|

|

|

| (in millions of Canadian dollars) |

|

As at |

|

|

As at |

|

|

|

April 30, |

|

October 31, |

|

|

|

2014 |

|

|

2013 |

|

|

|

|

|

|

Restated |

|

|

|

| Current assets |

|

|

|

|

|

|

|

Cash |

$ |

29.9 |

|

$ |

26.4 |

|

|

Accounts receivable |

|

381.8 |

|

|

419.2 |

|

|

Income taxes receivable |

|

16.5 |

|

|

12.1 |

|

|

Inventories |

|

80.2 |

|

|

82.0 |

|

|

Prepaid expenses and other current assets |

|

15.1 |

|

|

13.9 |

|

|

|

523.5 |

|

|

553.6 |

|

|

|

| Property, plant and equipment |

|

577.2 |

|

|

596.0 |

|

| Intangible assets |

|

191.3 |

|

|

194.1 |

|

| Goodwill |

|

324.0 |

|

|

324.0 |

|

| Investments in joint ventures |

|

1.3 |

|

|

0.8 |

|

| Deferred income taxes |

|

143.6 |

|

|

147.7 |

|

| Other assets |

|

56.8 |

|

|

34.6 |

|

|

$ |

1,817.7 |

|

$ |

1,850.8 |

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

237.8 |

|

$ |

272.8 |

|

|

Provisions |

|

5.6 |

|

|

10.3 |

|

|

Income taxes payable |

|

11.1 |

|

|

6.3 |

|

|

Deferred revenues and deposits |

|

61.2 |

|

|

55.9 |

|

|

Current portion of long-term debt |

|

161.9 |

|

|

218.3 |

|

|

|

477.6 |

|

|

563.6 |

|

|

|

| Long-term debt |

|

119.7 |

|

|

128.9 |

|

| Deferred income taxes |

|

83.0 |

|

|

67.1 |

|

| Provisions |

|

39.8 |

|

|

40.2 |

|

| Other liabilities |

|

245.0 |

|

|

235.6 |

|

|

|

965.1 |

|

|

1,035.4 |

|

|

|

| Equity |

|

|

|

|

|

|

|

Share capital |

|

462.8 |

|

|

462.8 |

|

|

Contributed surplus |

|

3.2 |

|

|

2.9 |

|

|

Retained earnings |

|

390.6 |

|

|

362.5 |

|

|

Accumulated other comprehensive loss |

|

(4.5 |

) |

|

(13.2 |

) |

| Attributable to shareholders of the Corporation |

|

852.1 |

|

|

815.0 |

|

| Non-controlling interests |

|

0.5 |

|

|

0.4 |

|

|

|

852.6 |

|

|

815.4 |

|

|

$ |

1,817.7 |

|

$ |

1,850.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

| Unaudited |

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

April 30 |

|

|

April 30 |

|

| (in millions of Canadian dollars) |

|

2014 |

|

|

2013 Restated |

|

|

2014 |

|

|

2013 Restated |

|

|

|

| Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

$ |

36.8 |

|

$ |

27.4 |

|

$ |

55.4 |

|

$ |

44.5 |

|

| Adjustments to reconcile net earnings and cash flows

from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

31.4 |

|

|

32.1 |

|

|

63.4 |

|

|

64.3 |

|

|

Impairment of assets |

|

0.1 |

|

|

0.7 |

|

|

0.5 |

|

|

2.8 |

|

|

Financial expenses on long-term debt |

|

3.8 |

|

|

4.5 |

|

|

8.4 |

|

|

10.4 |

|

|

Net losses (gains) on disposal of assets |

|

0.2 |

|

|

0.1 |

|

|

0.1 |

|

|

(0.1 |

) |

|

Income taxes |

|

14.9 |

|

|

10.7 |

|

|

23.6 |

|

|

13.7 |

|

|

Stock-option based compensation |

|

0.1 |

|

|

0.2 |

|

|

0.3 |

|

|

0.4 |

|

|

Other |

|

(0.8 |

) |

|

(0.6 |

) |

|

0.4 |

|

|

1.5 |

|

| Cash flows generated by operating activities before

changes in non-cash operating items and income taxes paid |

|

86.5 |

|

|

75.1 |

|

|

152.1 |

|

|

137.5 |

|

| Changes in non-cash operating items |

|

(14.7 |

) |

|

(1.5 |

) |

|

(13.1 |

) |

|

156.8 |

|

| Income taxes paid |

|

(4.1 |

) |

|

(3.1 |

) |

|

(1.3 |

) |

|

(13.9 |

) |

| Cash flows from operating activities |

|

67.7 |

|

|

70.5 |

|

|

137.7 |

|

|

280.4 |

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business combinations |

|

- |

|

|

(1.7 |

) |

|

(1.0 |

) |

|

(25.0 |

) |

|

Disposals of subsidiaries |

|

1.5 |

|

|

- |

|

|

1.5 |

|

|

- |

|

|

Acquisitions of property, plant and equipment |

|

(9.9 |

) |

|

(9.2 |

) |

|

(18.7 |

) |

|

(20.3 |

) |

|

Disposals of property, plant and equipment |

|

0.1 |

|

|

1.9 |

|

|

0.8 |

|

|

2.2 |

|

|

Increase in intangible assets |

|

(4.9 |

) |

|

(7.8 |

) |

|

(11.2 |

) |

|

(12.0 |

) |

|

Cash flows from investing activities |

|

(13.2 |

) |

|

(16.8 |

) |

|

(28.6 |

) |

|

(55.1 |

) |

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reimbursement of long-term debt |

|

(16.9 |

) |

|

(0.6 |

) |

|

(25.5 |

) |

|

(81.2 |

) |

|

Net increase (decrease) in revolving term credit facility |

|

(18.0 |

) |

|

44.0 |

|

|

(46.0 |

) |

|

(2.5 |

) |

|

Financial expenses on long-term debt |

|

(4.5 |

) |

|

(4.8 |

) |

|

(8.0 |

) |

|

(11.4 |

) |

|

Dividends on participating shares |

|

(12.5 |

) |

|

(89.2 |

) |

|

(23.8 |

) |

|

(100.5 |

) |

|

Dividends on preferred shares |

|

(1.7 |

) |

|

(1.7 |

) |

|

(3.4 |

) |

|

(3.4 |

) |

|

Dividends paid to non-controlling interests |

|

- |

|

|

- |

|

|

- |

|

|

(1.4 |

) |

|

Participating share redemptions |

|

- |

|

|

- |

|

|

- |

|

|

(12.1 |

) |

|

Cash flows from financing activities |

|

(53.6 |

) |

|

(52.3 |

) |

|

(106.7 |

) |

|

(212.5 |

) |

|

|

| Effect of exchange rate changes on cash denominated in

foreign currencies |

|

0.1 |

|

|

0.1 |

|

|

1.1 |

|

|

- |

|

|

|

| Net change in cash |

|

1.0 |

|

|

1.5 |

|

|

3.5 |

|

|

12.8 |

|

| Cash at beginning of period |

|

28.9 |

|

|

24.1 |

|

|

26.4 |

|

|

12.8 |

|

| Cash at end of period |

$ |

29.9 |

|

$ |

25.6 |

|

$ |

29.9 |

|

$ |

25.6 |

|

|

|

| Non-cash investing and financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in capital asset acquisitions financed by accounts

payable |

$ |

1.4 |

|

$ |

0.2 |

|

$ |

- |

|

$ |

(4.6 |

) |

Media: Nathalie St-JeanSenior Advisor, Corporate -

CommunicationsTC

Transcontinental514-954-3581nathalie.st-jean@tc.tcwww.tc.tcFinancial

Community: Jennifer F. McCaugheySenior Director, Investor

Relationsand External Corporate Communications - TC

Transcontinental514-954-2821jennifer.mccaughey@tc.tcwww.tc.tc

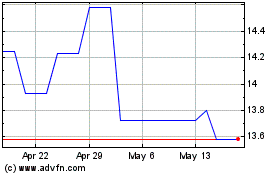

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Nov 2024 to Dec 2024

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Dec 2023 to Dec 2024