AsiaBaseMetals Inc. (TSX.V: ABZ)

(the “

Company”) is pleased to announce that it has

entered into an arrangement agreement (the "

Arrangement

Agreement") with its newly incorporated wholly-owned

subsidiaries, Mantra Exploration Inc. (“

SpinCo

1”), Mantra Pharma Inc. (“

SpinCo2”) and

Mantra 2 Real Estate Inc. (“

SpinCo 3”, and

collectively with SpinCo1 and SpinCo 2, the “

SpinCo

Entities”) pursuant to which the parties intend to

complete a spinout transaction by way of a court approved plan of

arrangement under the Business Corporations Act (British Columbia)

(the “

Arrangement”). Additionally, the

Company is pleased to announce that it has received an Interim

Order from the Supreme Court of British Columbia (the

"

Court") on July 17, 2020. The Interim Order

provides for, among other things, the holding of the annual general

and special meeting (the “

Meeting”) of

shareholders of the Company (“

Shareholders”) to

approve the Arrangement and the conditions that must be met to

apply for a final order of the Court (“

Final

Order”) approving the Arrangement.

The purpose of the Arrangement is to reorganize

the Company and its assets and operations into four separate

companies: the Company, SpinCo 1, SpinCo 2 and SpinCo 3. The board

of directors of the Company (the "Board") believes

this will provide Shareholders with additional investment choices

and flexibility and enhanced value as each of SpinCo 1, SpinCo 2

and SpinCo 3 will be solely focused on the pursuit and development

of their respective business operations and assets.

Arrangement Details

Pursuant to the Arrangement Agreement, and in

accordance with the plan of arrangement (the “Plan of

Arrangement”), among other things:

- SpinCo 1 will be transferred the

Company's Jean Iron Ore Project, SpinCo 2 will be transferred the

Company's option to acquire certain cannabis interests and SpinCo 3

will be transferred the Company's option to acquire certain real

property interests, all as more fully set forth in the Circular

(defined below).

- In consideration of the foregoing,

the SpinCo Entities will transfer to the Company, the respective

number of: (i) common shares in the capital of SpinCo 1

(“SpinCo 1 Shares”), (ii) common shares in the

capital of SpinCo 2, (“SpinCo 2 Shares”); and

(iii) common shares in the capital of SpinCo 3 (“SpinCo 3

Shares”, collectively with SpinCo 1 Shares and SpinCo 2

Shares, the “SpinCo Shares”), in each case, equal

to the number of common shares of the Company (“ABZ

Shares”) outstanding at the effective date of the

Arrangement, currently anticipated to be September 1, 2020 (the

“Effective Date”). The Company will retain its

remaining assets and working capital and continue as a mineral

exploration company.

- The authorized share structure of

the Company will be reorganized and altered by (i) renaming and

redesignating all of the issued and unissued ABZ Shares as “Class A

Shares”; and (ii) creating a new class of “common shares without

par value” (the “New ABZ Shares”). Thereafter,

each Class A Share outstanding as of the Effective Date (excluding

any Class A Shares held by Shareholders dissenting to the

Arrangement), will be exchanged for: (i) one New ABZ Share; (ii)

one SpinCo 1 Share; (iii) one SpinCo 2 Share; and (iv) one SpinCo 3

Share.

- The stock options and warrants of

the Company outstanding immediately prior to the Effective Date

will be adjusted by increasing the number of shares issuable upon

exercise thereof, and reducing the exercise price per share, of

such stock options and warrants.

Upon the Arrangement becoming effective, each of

SpinCo 1, SpinCo 2 and SpinCo 3 will cease to be a wholly owned

subsidiary of the Company and the Shareholders, as of the Share

Distribution Date (as defined below), will hold 100% of the

outstanding SpinCo Shares. The Company has set the record date to

determine eligibility to participate in the Arrangement and receive

the SpinCo Shares as the last trading date on the TSX Venture

Exchange (“TSXV”) immediately prior the Effective

date, being August 31, 2020 (the “Share Distribution

Date”).

The foregoing description is qualified in its

entirety by reference to the full text of the Plan of Arrangement,

attached as Exhibit “A” to the Arrangement Agreement, which will be

filed on SEDAR. The Arrangement is subject to approval of the

Court, the Shareholders and the TSXV and there can be no assurance

that such approvals will be obtained or that the Arrangement will

be completed on the terms contemplated, or at all. Further

information regarding the Arrangement will be contained in a

management information circular (the “Circular”)

that the Company will prepare, file and mail to the Shareholders in

connection with the Meeting. All securityholders of the Company are

urged to read the Circular once available as it will contain

additional important information concerning the Arrangement.

The securities to be issued under the

Arrangement have not been and will not be registered under the U.S.

Securities Act of 1933, and may not be offered or sold in the

United States absent registration or applicable exemption from

registration requirements. It is anticipated that any securities to

be issued under the Arrangement will be offered and issued in

reliance upon the exemption from the registration requirements of

the U.S. Securities Act of 1933 provided by Section 3(a)(10)

thereof. This press release does not constitute an offer to sell,

or the solicitation of an offer to buy, any securities.

Meeting Details

The Meeting will be held on August 19, 2020 at

10:00 am at 6153 Glendalough Place, Vancouver, B.C., V6N 1S5. In

addition to consideration of the Arrangement, Shareholders will be

asked to (i) fix the number of directors for the ensuing year at

six; (ii) elect directors for the ensuing year; (iii) appoint

Manning Elliott LLP, Chartered Accountants, as the Company’s

auditors for the ensuing fiscal year at a remuneration to be fixed

by the Board; and (iv) approve the Company’s 10% rolling stock

option plan.

Only Shareholders of record at the close of

business on July 13, 2020 will be entitled to vote at the Meeting.

The Arrangement is subject to shareholder approval of not

less than 66 2/3 % of the votes cast at the Meeting.

Board of Director’s

Recommendation

The Board approved the Arrangement, concluding

that it is in the best interests of the Company and its

Shareholders and recommends that Shareholders vote in favour of the

Arrangement at the Meeting. In reaching this conclusion, the Board

considered, among other things, the benefits to the Company and its

Shareholders, as well as the financial position, opportunities and

outlook for the future potential and operating performance of the

Company, SpinCo 1, SpinCo 2 and SpinCo 3, respectively.

Final Order

The Arrangement is subject to receipt of the

Final Order of the Court, which the Company will seek after the

Meeting if it receives the requisite Shareholder approval for the

Arrangement. The hearing in respect of the Final Order is currently

scheduled to take place on August 26, 2020 at 9:45

a.m. (Vancouver time). If the Final Order is obtained on

August 26, 2020, and all other conditions to completion of the

Arrangement are satisfied or waived, it is expected that the

Arrangement will be completed on the Effective Date.

On behalf of the Board of Directors of

the Company

“Raj I. Chowdhry”Chief Executive Officer

About AsiaBaseMetals Inc.

AsiaBaseMetals Inc., a company focused on

advancing its projects in the mining sector and developing and

evaluating additional opportunities in the cannabis sector, is led

by an experienced and successful business and mining team.

The Company is advancing its 100% owned Gnome Zinc/Cobalt Project

and, subject to completion of the Arrangement, its 100% owned Jean

Iron Ore Project in world-class mining districts in Canada, one of

the safest and mining friendly districts in the world. The Company

is advancing current opportunities and, subject to completion of

the Arrangement, is exploring additional opportunities in the

cannabis sector, with emphasis in Europe, and other non-mining

opportunities, including real estate and casino opportunities in

Croatia. In addition, the Company is seeking to further

diversify its portfolio, with special attention directed to

advanced acquisition targets in the Americas, Asia and Africa for

base metals {Copper (Cu)], alkali metals [Cobalt (Co)] / Lithium

(Li)] and precious metals [Gold (Au) / Silver (Ag)]. The

Company is awaiting the grant of exploration permits for lithium

pursuant to a submitted application in Myanmar.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements, trend analysis and other

information contained in this press release about anticipated

future events or results constitute forward-looking statements.

Forward-looking statements are often, but not always, identified by

the use of words such as “seek”, “anticipate”, “believe”, “plan”,

“estimate”, “expect” and “intend” and statements that an event or

result “may”, “will”, “should”, “could” or “might” occur or be

achieved and other similar expressions. All statements, other than

statements of historical fact, included herein, including, without

limitation, statements regarding, the completion of the

Arrangement, the Meeting, the Final Order hearing of the Court, the

anticipated benefits of the Arrangement, the Company’s plan to

develop its business, diversify its portfolio and explore certain

acquisition targets and anticipated permitting and development

milestones, are forward-looking statements. Although the Company

believes that the expectations reflected in such forward-looking

statements and/or information are reasonable, undue reliance should

not be placed on forward-looking statements since the Company can

give no assurance that such expectations will prove to be correct.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements, including the risks, uncertainties and other factors

identified in the Company’s periodic filings with Canadian

securities regulators, and assumptions made with regard to: the

Company’s ability to complete the proposed Arrangement on the terms

and conditions contemplated, or at all; the Companies' ability to

secure the necessary shareholder, Court and regulatory approvals

required to complete the Arrangement; the estimated costs

associated with the Arrangement; the timing of the Meeting, the

Final Order hearing and the Arrangement, and the general stability

of the economy and the industry in which the Company operates .

Forward-looking statements are subject to business and economic

risks and uncertainties and other factors that could cause actual

results of operations to differ materially from those contained in

the forward-looking statements. Important factors that could cause

actual results to differ materially from the Company expectations

include risks associated with the business of the Company; risks

related to the satisfaction or waiver of certain conditions to the

closing of the Arrangement; non-completion of the Arrangement;

risks related to the Company failing to obtain the requisite

shareholder approval required for the Arrangement; risks relating

the number of dissenting shareholders requiring fair value for

their securities in connection with the Arrangement; risks related

to reliance on technical information provided by the Company; risks

related to exploration and potential development of the Company

projects; business and economic conditions in the mining industry

generally; fluctuations in commodity prices and currency exchange

rates; the need for cooperation of government agencies and native

groups in the issuance of required permits; the need to obtain

additional financing to develop properties and uncertainty as to

the availability and terms of future financing; and other risk

factors as detailed from time to time and additional risks

identified in the Company filings with Canadian securities

regulators on SEDAR in Canada (available at www.sedar.com).

Forward-looking statements are based on estimates and opinions of

management at the date the statements are made. The Company does

not undertake any obligation to update forward-looking statements

except as required by applicable securities laws. Investors should

not place undue reliance on forward-looking statements.

For further information, please contact:

Raj Chowdhry, Chief Executive Officer

Email: info@asiabasemetals.com

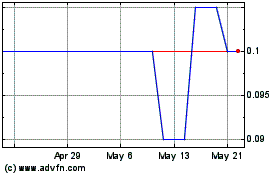

AsiaBaseMetals (TSXV:ABZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

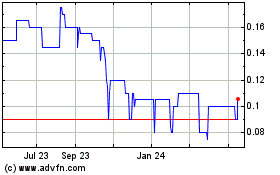

AsiaBaseMetals (TSXV:ABZ)

Historical Stock Chart

From Nov 2023 to Nov 2024