Itafos (TSX VENTURE: IFOS) (the “

Company”)

announced today that it has entered into a binding letter of intent

with CL Fertilizers Holding LLC (“

CLF”) for a

US$36,000,000 capital raise through a non-brokered private

placement financing of US$15,000,000 and an amendment to increase

the availability of a previously issued unsecured subordinated

promissory note by US$21,000,000. The proceeds of the capital raise

are expected to be used to fund general working capital and capital

expenditure needs of the Company and its subsidiaries.

Pursuant to the letter of intent, CLF will

subscribe for up to 38,076,923 shares in the capital of the Company

(the “Subject Shares”) at an offering price of

CAD$0.52 per share on a non-brokered private placement basis, for

aggregate gross proceeds of US$15,000,000 (equivalent to

approximately CAD$19,800,000) (the “Private

Placement”). No finder’s fees or commissions will be

payable in connection with the Private Placement.

Also pursuant to the letter of intent, the

Company and CLF will amend the convertible unsecured and

subordinated promissory note in favor of CLF that was issued by the

Company on September 11, 2019, to make the promissory note

non-convertible and increase the availability by US$21,000,000 (the

“Amended CLF Promissory Note” and together with

the Private Placement, the “Transaction”). At

closing, the Company intends to borrow US$5,000,000 of the

available US$21,000,000, with the balance of US$16,000,000

remaining available to be drawn by the Company at its sole

discretion through December 31, 2020. An availability fee of 4% per

year shall apply on undrawn amounts during the availability period

with such fee to be capitalized and added to principal on a

quarterly basis.

Other than the changes specified in this news

release, all other terms of the Amended CLF Promissory Note shall

remain unchanged. In this regard, the Amended CLF Promissory Note

shall (i) remain subordinate to the Company’s existing senior

credit facility and subject to the terms of subordination

incorporated thereunder, (ii) continue to accrue an interest rate

of 15% per year, (iii) continue to be payable on demand no earlier

than six months after the date on which the Company’s existing

senior credit facility is paid in full, and (iv) continue to add

interest to and increase the outstanding principal balance on a

quarterly basis.

Closing of the Transaction is subject to various

conditions, including, without limitation, satisfaction of any

regulatory requirements and receipt of the approval of the TSX

Venture Exchange.

Related Party Transaction

CLF is a “related party” to the Company under

Multilateral Instrument 61-101 - Protection of Minority

Security Holders in Special Transactions (“MI

61-101”) by virtue of CLF’s shareholdings being in excess

of 10% of the Company’s issued and outstanding share capital.

Accordingly, the completion of the Private Placement and the

entering into of the Amended CLF Promissory Note each constitute a

“related party transaction” under MI 61-101. The Transaction is

exempt from (i) the formal valuation requirements under Section 5.4

of MI 61-101 pursuant to Subsection 5.5(b) of MI 61-101; and (ii)

the minority approval requirements under Section 5.6 of MI 61-101

pursuant to Subsection 5.7(1)(a) as it relates to the Private

Placement and the amendment to make the Amended CLF Promissory Note

non-convertible and Subsection 5.7(1)(f) as it relates to the

increase in availability under the Amended CLF Promissory Note.

United States Securities

Legislation

In accordance with United States securities

legislation, the Subject Shares will be subject to resale

restrictions pursuant to a ‘distribution compliance period’ (as

defined in Regulation S under the United States Securities Act of

1933, as amended) of one year from the date the Subject Shares are

issued. Concurrently, in accordance with applicable Canadian

securities legislation, the Subject Shares will be subject to a

statutory hold period of four months plus a day from the date the

Subject Shares are issued.

This news release does not constitute an offer

of securities for sale in the US. The securities being offered have

not been, nor will they be, registered under the United States

Securities Act of 1933, as amended, and such securities may not be

offered or sold within the US absent US registration or an

applicable exemption from US registration requirements. Hedging

transactions involving the Shares may not be conducted unless in

compliance with the United States Securities Act of 1933, as

amended.

About Itafos

The Company is a vertically integrated phosphate

fertilizers and specialty products company with an attractive

portfolio of long-term strategic businesses and projects located in

key fertilizer markets worldwide.

The Company owns, operates and is developing the

following businesses and projects:

- Itafos Conda – a vertically

integrated phosphate mine and fertilizer business with production

and sales capacity of approximately 550kt per year of monoammonium

phosphate (“MAP”), MAP with micronutrients

(“MAP+”), superphosphoric acid

(“SPA”), merchant grade phosphoric acid

(“MGA”) and specialty products including ammonium

polyphosphate (“APP”) located in Idaho, US;

- Itafos Arraias – a phosphate

fertilizer business with production and sales capacity of

approximately 500kt per year of single superphosphate

(“SSP”), SSP with micronutrients

(“SSP+”), premium PK compounds and approximately

40kt per year of excess sulfuric acid located in Tocantins,

Brazil;

- Itafos Farim – a high-grade

phosphate mine project located in Farim, Guinea-Bissau;

- Itafos Paris Hills – a high-grade

phosphate mine project located in Idaho, US;

- Itafos Santana – a vertically

integrated high-grade phosphate mine and fertilizer plant project

located in Pará, Brazil;

- Itafos Mantaro – a large phosphate

mine project located in Junin, Peru; and

- Itafos Araxá – a vertically

integrated rare earth elements and niobium mine and extraction

plant project located in Minas Gerais, Brazil.

For more information, or to join the Company’s

mailing list to receive notification of future news releases,

please visit the Company’s website, www.itafos.com.

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information. All information

other than information of historical fact is forward-looking

information. The use of any of the words “intend”, “anticipate”,

“plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”,

“should”, “would”, “believe”, “predict” and “potential” and similar

expressions are intended to identify forward-looking information.

Forward-looking information in this news release includes, but is

not limited to, statements with respect to: the intended use of

proceeds; the amount which the Company intends to borrow under the

Amended CLF Promissory Note; and the timing and conditions to

closing of the Transaction. This information involves known and

unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that this information will prove to be correct and such

forward-looking information included in this news release should

not be unduly relied upon.

Forward-looking information is subject to a

number of risks and other factors that could cause actual results

and events to vary materially from that anticipated by such

forward-looking information including, without limitation, not

obtaining the approval of the TSX Venture Exchange for the

Transaction. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended. Factors that may cause actual

results to differ materially from expected results described in

forward-looking statements include, but are not limited to, those

risk factors set out in the Company’s Management Discussion and

Analysis and other disclosure documents available under the

Company’s profile at www.sedar.com. Readers are cautioned that the

foregoing list of risks, uncertainties and assumptions are not

exhaustive. The forward-looking information included in this news

release is expressly qualified by this cautionary statement and is

made as of the date of this news release. Itafos undertakes no

obligation to publicly update or revise any forward-looking

information except as required by applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

For further information, please

contact:

Itafos Investor

Relationsinvestor@itafos.comwww.itafos.com

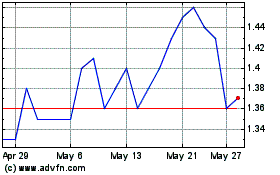

Itafos (TSXV:IFOS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Itafos (TSXV:IFOS)

Historical Stock Chart

From Nov 2023 to Nov 2024