Minera Alamos Inc. (TSXV: MAI; OTCQX: MAIFF) (“

Minera

Alamos” or the “

Company”) is pleased to

announce that it has entered into an agreement with National Bank

Financial Inc. (“

NBF”) as lead underwriter and

bookrunner, and on behalf of a syndicate of underwriters

(collectively, the “

Underwriters”), pursuant to

which the Underwriters will purchase 28,333,000 common shares (the

“

Shares”) of the Company at a price of C$0.30 (the

“

Offering Price”) per Common Share, on a “bought

deal” private placement basis, with a right to arrange for

substituted purchasers, pursuant to the listed issuer financing

exemption (“

LIFE”), for aggregate gross proceeds

to the Company of approximately C$8.5 million (the

“

Offering”). The Company has also granted NBF an

option exercisable at any time up to 48 hours prior to the closing

of the Offering, to purchase for placement up to an additional

5,000,000 Shares at the Offering Price, for additional gross

proceeds of up to C$1.5 million.

The Offering will be made pursuant to the listed

issuer financing exemption available under National Instrument

45-106 – Prospectus Exemptions, in each of the provinces of Canada,

other than Québec. The Shares may also be offered for sale in the

United States pursuant to available exemptions from the

registration requirements under the U.S. Securities Act of 1933.

The Shares issued under the listed issuer financing exemption will

not be subject to a statutory hold period pursuant to applicable

Canadian securities laws.

The Company intends to use the net proceeds of

the Offering to fund the expansion and development of its Santana

open-pit, heap-leach mine in Sonora, to fund the exploration and

development activities at its Cerro de Oro Project in northern

Zacatecas and for working capital and general corporate

purposes.

The Offering is scheduled to close on or about

December 5, 2024 and is subject to certain conditions including,

but not limited to, the receipt of all necessary regulatory and

other approvals including the approval of the TSX Venture

Exchange.

There is an offering document relating to the

Offering that can be accessed under the Company’s profile at

www.sedarplus.ca and at www.mineraalamos.com. Prospective investors

should read this offering document before making an investment

decision.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein in the United States. The securities described

herein have not been and will not be registered under the United

States Securities Act of 1933, as amended (the “U.S.

Securities Act”), or any state securities laws, and may

not be offered or sold within the United States unless registered

under the U.S. Securities Act and applicable state securities laws

or an exemption from such registration requirements is

available.

For Further Information Please Contact:

| Minera Alamos

Inc. |

|

|

| Doug Ramshaw, President |

|

Victoria Vargas de Szarzynski, VP Investor Relations |

| Tel: 604-600-4423 |

|

Tel: 289-242-3599 |

| Email: dramshaw@mineraalamos.com |

|

Email: vvargas@mineraalamos.com |

| Website: www.mineraalamos.com |

|

|

| |

|

|

About Minera Alamos Inc.

Minera Alamos is a gold production and

development Company. The Company has a portfolio of high-quality

Mexican assets, including the 100%-owned Santana open-pit,

heap-leach mine in Sonora that is currently going through the

start-up of operations at the new Nicho Main deposit. The

100%-owned Cerro de Oro oxide gold project in northern Zacatecas

has considerable past drilling and metallurgical work completed and

the proposed mining project is currently being guided through the

permitting process by the Company’s permitting consultants. The La

Fortuna open pit gold project in Durango (100%-owned) has a

positive, robust preliminary economic assessment (PEA) completed,

and the main Federal permits are in place. Minera Alamos is built

around its operating team that together brought three open pit heap

leach gold mines into successful production in Mexico over the last

14 years.

The Company’s strategy is to develop very low

capex assets while expanding the projects’ resources and continuing

to pursue complementary strategic acquisitions.

Caution Regarding Forward-Looking

Statements

This news release may contain forward-looking

information and Minera Alamos cautions readers that forward-looking

information is based on certain assumptions and risk factors that

could cause actual results to differ materially from the

expectations of Minera Alamos included in this news release. This

news release includes certain “forward-looking statements”, which

often, but not always, can be identified by the use of words such

as “believes”, “anticipates”, “expects”, “estimates”, “may”,

“could”, “would”, “will”, or “plan”. These statements are based on

information currently available to Minera Alamos and Minera Alamos

provides no assurance that actual results will meet management’s

expectations. Forward-looking statements include statements

regarding anticipated completion of the Offering, and the proposed

use of proceeds of the Offering. Since forward-looking statements

are based on assumptions and address future events and conditions

that, by their very nature involve inherent risks and

uncertainties. Actual results relating to, among other things,

results of exploration, the economics of processing methods,

project development, reclamation and capital costs of Minera

Alamos’ mineral properties, the ability to complete a preliminary

economic assessment which supports the technical and economic

viability of mineral production could differ materially from those

currently anticipated in such statements for many reasons. Minera

Alamos’ financial condition and prospects could differ materially

from those currently anticipated in such statements for many

reasons such as: an inability to finance and/or complete an updated

resource and reserve estimate and a preliminary economic assessment

which supports the technical and economic viability of mineral

production; changes in general economic conditions and conditions

in the financial markets; changes in demand and prices for

minerals; litigation, legislative, environmental and other

judicial, regulatory, political and competitive developments;

technological and operational difficulties encountered in

connection with Minera Alamos’ activities; and other matters

discussed in this news release and in filings made with securities

regulators. This list is not exhaustive of the factors that may

affect any of Minera Alamos’ forward-looking statements. These and

other factors should be considered carefully, and readers should

not place undue reliance on Minera Alamos’ forward-looking

statements. Minera Alamos does not undertake to update any

forward-looking statement that may be made from time to time by

Minera Alamos or on its behalf, except in accordance with

applicable securities laws.

The Company does not have a feasibility study of

mineral reserves, demonstrating economic and technical viability

for the Santana project, and, as a result, there may be an

increased uncertainty of achieving any particular level of recovery

of minerals or the cost of such recovery, including increased risks

associated with developing a commercially mineable deposit.

Historically, such projects have a much higher risk of economic and

technical failure.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

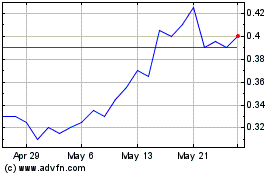

Minera Alamos (TSXV:MAI)

Historical Stock Chart

From Nov 2024 to Dec 2024

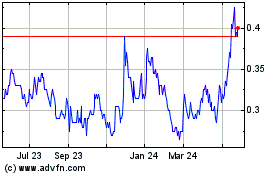

Minera Alamos (TSXV:MAI)

Historical Stock Chart

From Dec 2023 to Dec 2024