True North Gems Announces $1.5 Million Private Placement Financing

28 December 2013 - 2:34AM

Marketwired Canada

True North Gems Inc. (TSX VENTURE:TGX) ("True North" or the "Company") is

pleased to announce that it will be conducting a non-brokered private placement

equity financing under which it intends to issue up to 16,666,667 units at a

price of $0.09 per unit for gross proceeds of up to $1,500,000. Each unit will

be comprised of one common share of the Company and one-half of one common share

purchase warrant, with each full warrant exercisable for two years for an

additional share at a price of $0.12. The securities to be issued under the

financing will be subject to a four month hold period. The terms of the

financing are subject to the approval of the TSX Venture Exchange.

The Company intends to use the net proceeds of the Transaction to advance the

development of the Company's Aappaluttoq Ruby Project in Greenland, and also as

general working capital.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the securities in the United States. The securities have not

been and will not be registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act") or any state securities laws and may not

be offered or sold within the United States or to U.S. Persons unless registered

under the U.S. Securities Act and applicable state securities laws or an

exemption from such registration is available.

Visit our website: www.truenorthgems.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

This document contains "forward-looking information" and "forward-looking

statements" (together, "forward-looking statements") within the meaning of

applicable securities legislation, which are made as of the date of this

document or the document(s) referred to herein. Statements that express

predictions, expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words or phrases

such as "expects", "anticipates", "plans", "projects", "estimates", "intends",

"strategy", "goals", "objectives" or variations thereof or stating that certain

actions, events or results "may", "could", "would", "might" or "will" be taken,

occur or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be forward-looking

statements. Forward-looking statements include, without limitation, statements

with respect to: the amount of mineral reserves and mineral resources; the

amount of future production over any period; net present value and internal

rates of return of the proposed mining operation; capital costs; operating

costs; strip ratios and mining rates; and mine life. The forward-looking

statements are made based upon certain assumptions which, if untrue, could cause

the actual results, performances or achievements of the Company to be materially

different from future results, performances or achievements expressed or implied

by the forward-looking statements. These assumptions include, without

limitation: the price of gemstone products produced; anticipated costs; the

presence of and continuity of gemstones at modeled grades and values; the

capacities of various machinery and equipment; the availability of personnel,

machinery and equipment at estimated prices; exchange rates; appropriate

discount rates; tax rates applicable to the proposed mining operation; financing

structure and costs; anticipated mining losses and dilution; gemstone recovery

rates; reasonable contingency requirements; and receipt of regulatory approvals

on acceptable terms. By their very nature, forward-looking statements involve

inherent risks and uncertainties that could cause actual results, performances

or achievements to differ materially from those in the forward-looking

statements. These include, without limitation: price volatility, discrepancies

between actual and estimated production, mineral reserves and resources and

metallurgical recoveries, mining operational and development risks, regulatory

restrictions (including environmental regulatory restrictions and liability),

activities by governmental authorities (including changes in taxation), currency

fluctuations, the speculative nature of gemstone exploration, the global

economic climate, dilution, share price volatility, competition, loss of key

employees; additional funding requirements and defective title to mineral claims

or property).

This list is not exhaustive. See also, for example, the risks disclosed in the

Company's other disclosure documents filed at www.sedar.com, including, without

limitation, those disclosed in the Company's management's discussion & analysis.

The Company expressly disclaims any intention or obligation to update or revise

any forward-looking statements, except as otherwise required by applicable

securities legislation.

FOR FURTHER INFORMATION PLEASE CONTACT:

True North Gems Inc.

Nicholas Houghton

President and CEO

604-687-8055

True North Gems Inc.

Joanna Hall

Corporate Coordinator

604-687-8055

info@truenorthgems.com

www.truenorthgems.com

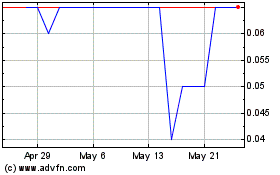

TGX Energy and Resources (TSXV:TGX)

Historical Stock Chart

From Nov 2024 to Dec 2024

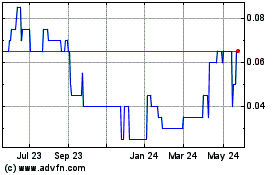

TGX Energy and Resources (TSXV:TGX)

Historical Stock Chart

From Dec 2023 to Dec 2024