Xali Gold Enters Agreement for Mining in Historic Underground Workings, Exploration and Reducing Debt at El Oro Mexico

22 July 2024 - 9:00PM

Xali Gold Corp. (TSXV:XGC) ("

Xali Gold” or

“the

Company”) is very pleased to announce it has

signed a legally binding Letter of Intent (“

LOI”)

with Rio Verde Resources (“

Rio Verde”) on portions

of five mining concessions within the El Oro Mining District

(“

El Oro 5 Concessions”) in the State of Mexico

and Michoacán de Ocampo, Mexico.

Rio Verde has been granted the exclusive right

to explore and extract gold, silver and any other economic minerals

that may be found above the 2400 metre (“m”) level

in the historic workings covered by the El Oro 5 Concessions in

exchange for payment of a 3% Net Smelter Return

(“NSR”) to Xali Gold. The initial agreement has a

term of 5 years which may be extended for an additional 5 years

providing Xali Gold is receiving benefits totalling $1 Million

(“M”) per year. Xali Gold retains the

exclusive ownership of all mineral bodies discovered or delineated

below the 2400 m level.

“There couldn’t be a better time, since we

acquired the property in 2006 and gold prices were much lower than

the current $2400 per ounce, to be monetizing the mineralization

left behind in the historic workings and to be exploring for new

mineral bodies,” states Joanne Freeze, President and CEO of Xali

Gold. “Rio Verde is well known for their ability to get into

production in record time, to make good profits and to discover

mineral deposits. This new partnership will allow us to keep all

the exploration upside we have demonstrated by our previous

drilling underneath the historic workings, while we work together

with Rio Verde to test exploration concepts and get underground

access for future drilling as well as pay back our debts on the

mineral rights.”

Keith Piggott of Rio Verde has advised us that

their production will initially focus on the exploration target

identified by Luismin-Hillsborough in 1993.

Luismin-Hillsborough estimated there to be a potential for 762,000

ounces (“ozs”) gold (“Au”) and

9.8M ozs silver (“Ag”) (6.89M tonnes grading 3.44

g/t Au and 44 g/t Ag) in the historic workings after studying

2,600, 2 m interval mine level plans with grades, sections and

production documentation as well as 8 new drill holes. The

mineralization is understood to have been left behind in in-situ

vein, pillars and back-fill as it had grades below historical

cut-off of 8 g/t Au.

The LOI shall initially pertain to only the 5

mining concessions of El Carmen, El Oro VII, Dos Estrellas 77

Fracc.1, Dos Estrellas 77 and Dos Estrellas 77 Fracc. II. Rio Verde

shall maintain the concessions in good standing during this period,

by paying the semi-annual concession fees, by incurring the minimum

investments and the corresponding filings with the Mexican Mines

Bureau, by making the filings of statistical reports and by paying

the Governmental Royalties.

In addition to the 3% NSR payments, Rio Verde

has agreed to provide funding to pay concession fees owing,

initially on the 5 Concessions they plan to mine. Rio Verde and

Xali Gold will collaborate to negotiate a payment plan with the

Mexican Tax Authority for mineral rights fees owed over the last 5

years (all fees owing prior to that are no longer due).

Funds provided for concession fees will be

provided as participation in a Private Placement in Xali Gold under

the following terms: A Unit comprising one share and one-half

warrant will be priced at CAD$0.05. A full warrant will be

exercisable at CAD$0.10 per share for two years. Xali Gold will

grant Rio Verde the right to participate in future Private

Placements, terms of which will be in the context of the market at

the time when the funds are provided. Such funds are expected to

come from income generated from operations on the five concessions

and will be used to assist Xali Gold in paying off the remaining

fees due on the rest of the El Oro Property.

Rio Verde has also been granted the right to

appoint an additional member to the Board of Xali Gold and to the

position of Chair of the Board, when Rio Verde holds greater than

20% of the outstanding shares in the Company, provided that person

is deemed qualified by the current Board of Xali Gold.

About Rio Verde Resources

Rio Verde is a private company controlled and

managed by Keith Piggott, the former President and CEO of Goldgroup

Mining Inc. and Core Gold Inc. Mr. Piggott is a mining engineer

with over 50 years of experience in Zambia, Australia and PNG,

Mexico and South America. In the recent past, as well as

significant exploration success, he has started 3 mines: Cerro

Colorado, El Boludo and Cerro Prieto in Sonora, Mexico plus a

green-fields start in a record time of 3 months in Ecuador. These

mines have collectively produced approximately 500,000 ozs of gold

to date.

About Xali Gold

Xali Gold has gold and silver projects in Peru

and Mexico. The Company’s flagship project El Oro is a district

scale gold project encompassing a well-known prolific high-grade

gold dominant gold-silver epithermal vein system in Mexico. The

project covers 20 veins with past production and more than 57 veins

in total, from which approximately 6.4M ozs of gold and 74M ozs of

silver were reported to have been produced from just two of these

veins (Ref. Mexico Geological Service Bulletin Nr. 37, Mining of

the El Oro and Tlapujahua Districts. 1920, T. Flores).

Modern understanding of epithermal vein systems

indicates that several of the El Oro district’s veins hold

excellent discovery potential, particularly below and adjacent to

the historic workings of the San Rafael Vein, which was mined to an

average depth of only 200m.

Xali Gold is dedicated to being a responsible

Community partner.

Joanne C. Freeze, P.Geo., President and CEO is

the Qualified Person as defined by National Instrument 43-101 for

the projects discussed above. Ms. Freeze has reviewed and approved

the contents of this release. Neither the TSX Venture

Exchange nor its Regulation Services Provider accepts

responsibility for the adequacy or accuracy of this release.

Forward-looking InformationThis

news release may contain forward-looking information (as such term

is defined under Canadian securities laws) including but not

limited to historical production records. While such

forward-looking information is expressed by Xali Gold in good faith

and believed by Xali Gold to have a reasonable basis, they may

address future events and conditions and are therefore subject to

inherent risks and uncertainties including those set out in Xali

Gold’s MD&A. Factors that cause the actual results to differ

materially from those in forward-looking information include,

without limitation, gold prices, results of exploration and

development activities, regulatory changes, defects in title,

availability of materials and equipment, timeliness of government

approvals, potential environmental issues, availability of capital

and financing and general economic, market or business conditions.

Xali Gold expressly disclaims any intention or obligation to update

or revise any forward-looking information, whether as a result of

new information, future events or otherwise, except in accordance

with applicable securities laws.

On behalf of the Board of Xali Gold

Corp.

“Joanne Freeze” P.Geo.President, CEO and

Director

For further information please contact:Joanne

Freeze, President &

CEO

Tel:

+ 1 (604) 689-1957

info@xaligold.com NR

133

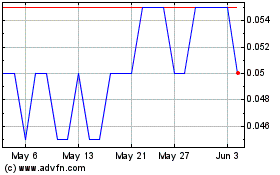

Xali Gold (TSXV:XGC)

Historical Stock Chart

From Dec 2024 to Jan 2025

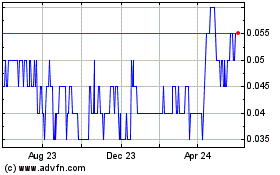

Xali Gold (TSXV:XGC)

Historical Stock Chart

From Jan 2024 to Jan 2025