Current Report Filing (8-k)

20 May 2020 - 6:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 19, 2020

ADVANTEGO CORPORATION

(Exact name of Registrant as specified in its charter)

Colorado 0-23726 84-1116515

--------------------- ------------------- ------------------------

(State or other jurisdiction (Commission File No.) (IRS Employer

of incorporation) Identification No.)

|

3801 East Florida Ave., Suite 400, Denver, CO 80210

(Address of principal executive offices, including Zip Code)

Registrant's telephone number, including area code: (949) 627-8977

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligations of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b)

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-14c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol Name of each exchange on which registered

None N/A N/A

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (ss.203.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (ss.204.12b-2 of this

chapter.

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act.

Item 1.02 Termination of a Material Definitive Agreement

As of May 19, 2020, the Company plans to terminate its agreement with Aska

Electronics Co., Ltd of China.

On May 26, 2019 the Company had entered into an agreement with Aska

Electronics Co., Ltd of China.

ASKA, is a manufacturer of Bluetooth headphones, sport earbuds and

associated listening devices and provides its products as an OEM and as an ODM

for projects worldwide.

Under the Agreement:

o ASKA will provide its design and manufacturing services for the

Company's customers.

o the Company will provide branding, sales and distribution services

for existing and newly developed products that ASKA manufactures for sale

in the North American market;

o the Company will receive 2% of Aska's gross revenues resulting from

the sales of its products in North America, and

o Aska will receive 700,000 shares of the Company's Series I preferred

stock,

The Agreement contemplates the Company receiving a guaranteed minimum of

$280,000 in gross profit for calendar year 2019.

Each Preferred Share is convertible into one share of the Company's common

stock.

The Company, upon no less than thirty days written notice, may redeem the

Preferred Shares at a price of $2.00 per share.

The Preferred shares will automatically convert into shares of the

Company's common stock if the Company's common stock closes at a price of $2.20

or more during any 30 consecutive trading days and if the average trading volume

of the Company's common stock during such 30 consecutive trading days is at

least 10,000 shares per day.

A "leak out provision" was established such that Aska may not sell more

than 100,000 shares per month.

The May 26, 2019 agreement replaced the initial January 14, 2019 agreement

between the Company and Aska.

The agreement contained a clause that after one year, if the stock price of

Advantego declined to a certain level, the transaction could be rescinded.

During this past year, in an attempt to consummate the transaction, certain

structural requirements of the agreement had to be met. Unfortunately, US

banking regulations would not allow Advantego to open a pass-through bank

account to achieve those requirements. Additionally, both company's explored

setting up a similar account in China where Aska would collect the payments from

all customers and remit funds to Advantego. Unfortunately, that too was not be

permitted under Chinese banking regulations. Thus, the inability to secure the

required bank account framewowrk and the demise of the share price of Advantego

has undermined any chance of succeeding to fully consummate the agreement.

Therefore, the agreement has now been terminated.

Aska and Advantego had entered into a manufacturing and vendor agreement

separate and apart that were complimentary in nature. The companies will keep

those two agreements in place should future business opportunities arise.

Item 8.01. Other Events.

Inability to file Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2020 in a timely manner due to circumstances related to the COVID-19

global pandemic.

Advantego Corporation (the "Company") is unable to timely file its

Quarterly Report on Form 10-Q for its fiscal quarter ended March 31, 2020 (the

"10-Q") due to circumstances related to COVID-19. Because of the impact of

COVID-19, particularly on the Company's accounting staff and outside advisors,

the audit of the Company's financial statements, and the completion and review

of the Company's financial statements to be included in the 10-Q will not be

completed in the time required to timely file the 10-Q by the prescribed date.

We are relying on the SEC order dated March 25, 2020 (Release No. 34-88465,

which supersedes the SEC's order dated March 4, 2020 (Release No. 34-88318) to

extend the due date for the filing of our 10-Q until June 29, 2020 (45 days

after the original due date). We will work diligently to comply with such

requirement, and at this time, management believes that the Company will be

able to file the 10-Q by June 29, 2020.

Additional risk factor disclosure

The following is a risk factor applicable to the Company relating to the global

COVID-19 pandemic.

We are subject to risks arising from the recent global outbreak of the COVID-19

coronavirus.

The recent outbreak of the COVID-19 coronavirus has spread across the globe

and is impacting worldwide economic activity. A pandemic, including COVID-19 or

other public health epidemic, poses the risk that we or our employees,

suppliers, manufacturers and other commercial partners may be prevented from

conducting business activities for an indefinite period of time, including due

to the spread of the disease or shutdowns requested or mandated by governmental

authorities. While it is not possible at this time to estimate the full impact

that COVID-19 could have on our business, the continued spread of COVID-19 could

disrupt our ability to generate new sales, obtain new capital, and our other

activities, which could have a

material adverse effect on our business,

financial condition and results of operations. COVID-19 has also had an adverse

impact on global economic conditions which could impair our ability to raise

capital when needed. While we have not yet experienced any disruptions in our

business or other negative consequences relating to COVID-19, the extent to

which the COVID-19 pandemic impacts our results will depend on future

developments that are highly uncertain and cannot be predicted.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Dated May 19, 2020. ADVANTEGO CORPORATION

By: /s/ Robert W. Ferguson

---------------------------

Robert W. Ferguson

Chief Executive Officer

|

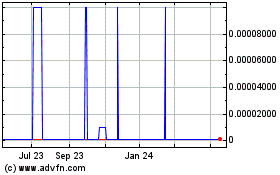

Advantego (CE) (USOTC:ADGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

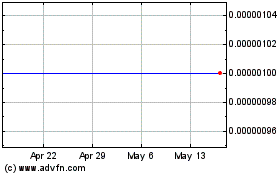

Advantego (CE) (USOTC:ADGO)

Historical Stock Chart

From Feb 2024 to Feb 2025