- Current report filing (8-K)

14 August 2012 - 6:41AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 13, 2012

Adia Nutrition, Inc.

(Exact Name of Registrant as Specified in Charter)

NEVADA 000-33625 87-0618509

(State or other jurisdiction (Commission (IRS Employer

of incorporation) File Number) Identification No.)

|

4041 MacArthur Blvd., Suite 175, Newport Beach, CA 92660

(Address of principal executive offices) (Zip code)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: (949) 999-2709

PIVX SOLUTIONS, INC.

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Item 9.01(d) Financial Statements and Exhibits.

Adia Nutrition, Inc. (the "Company") filed a Notice of Termination of

Registration on September 25, 2008 and therefore is no longer subject to the

reporting requirements of the Securities Exchange Act of 1934 (the "34 Act").

Nonetheless, the Company files this Current Report for the sole purpose of

informing shareholders and the public of certain events. This filing is not

intended to imply that the Company intends to become subject to the 34 Act or

comply with any other disclosure or filing requirements thereof.

Exhibit 1.

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

Date: August 13, 2012

Adia Nutrition, Inc.

By: /s/ Wen Peng

-------------------------------------

Wen Peng, Chief Executive Officer and

Chief Financial Officer

|

EXHIBIT 1

Discussion about financial results for June 30, 2012

Statement of Operations

1. The $49,219 of revenue for the six months ended June 30 represents sales

of four flavor of probiotic drink mixes and two flavor of probiotic chews.

In June, we introduced our Raspberry Lemonade Probiotic Drink Mix which

2. We sold more than 3,500 units as of June 30, 2012.

3. General and Administrative expense has decreased as salary expense decreased.

We switched one full time employee for an hourly accountant.

6. As of the date of this filing, there are 71,899,861 shares outstanding.

Adia Nutrition, Inc.

Statement of Operations

For the six months ended June 30, 2012

(Unaudited)

Revenue

Sales $50,906

Discount (1,687)

Total Revenue 49,219

Cost of Goods Sold 29,585

Gross Profit 19.634

Operating Expenses

Sales and Marketing 36,933

General and Administrative 73,274

Total Operating Expenses 110,207

|

Net Income/(Loss) $(90,573)

CONTACT:

Adia Nutrition, Inc.

Mike Matsie

949.945.5384

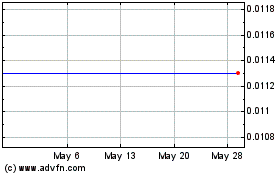

Adia Nutrition (PK) (USOTC:ADIA)

Historical Stock Chart

From Nov 2024 to Dec 2024

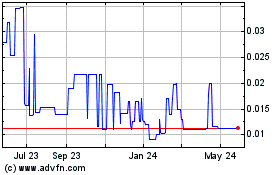

Adia Nutrition (PK) (USOTC:ADIA)

Historical Stock Chart

From Dec 2023 to Dec 2024