NOHO SERVES DEMAND LETTER TO GREENFIELD FARMS FOOD, INC.

FOR BREACH AND LIQUIDATED DAMAGES

Phoenix, AZ -- December 11, 2017 -- InvestorsHub NewsWire --

NOHO, Inc. (OTC

PINK: DRNK), a Wyoming corporation (the

"Company"), announced that it has served a demand letter

("Demand") to Greenfield Farms Food, Inc. ("GRAS") (USOTC:

GRAS), serving its CEO, Ron Heineman, notifying GRAS of its

intentional breach of the Asset Purchase Agreement dated June 7,

2017. See attached.

Pursuant to the Asset Purchase Agreement ("APA"), NOHO's wholly

owned subsidiary, Cherry Hill Financial, LLC, acquired 49% newly

issued common shares of GRAS, as well as, indefinite proxy over

1,000 Series D Preferred Shares giving NOHO voting control over

GRAS ("Proxy Shares"). NOHO wants to point out that the Proxy

Shares are owned by Ronald Heineman who personally signed the Asset

Purchase Agreement and tendered the Proxy Shares to NOHO. Thus, the

subsequent 8-K filed with the Securities and Exchange Commission on

December 1, 2017, was materially misleading because that action was

not authorized by NOHO.

On December 7, 2017, the Company sent a Demand Letter to Mr.

Heineman and the announced acquisition partner, Ngen Technologies

USA Corp. ("Ngen") that the disclosed transaction was in violation

of the Asset Purchase Agreement, and in violation of the 1934

Exchange Act as the unauthorized acquisition was intentionally and

materially leading. The Company's position is that Heineman's

course of conduct was purposeful and deliberate, subjecting the

Board of Directors and shareholders involved to potential personal

liability.

In response to GRAS' action, NOHO, Inc. CEO, David Mersky, said,

"We were taken by surprise at GRAS' announcement and the Company is

taking all appropriate actions to insure that the Ngen transaction

will not take place. The shares owned by NOHO are a significant

asset to the company and our shareholders and we will enforce our

rights to the fullest extent of the law." Since the closing was

completed on June 7, 2017, NOHO has carried the securities on its

Balance Sheet and now must reserve the shares until disposition of

this matter.

Update on DRNK

While the company has not issued press releases over the last

few months, CEO, David Mersky, indicated, "I am aware that the lack

of communication with our shareholders has been a genuine cause for

concern. I'd like to take this opportunity to advise our

shareholders and the public that operations for NOHO are very

active. I am engaged in positioning NOHO for the future and want to

assure our shareholders that we are looking forward to providing

updates on this process as they occur.

Mr. Mersky further provided, "It has been a lengthy process, but

I'd like to remind everyone that I took over NOHO by accepting 54

billion shares, conveying 90% of the common stock at that time.

Shortly thereafter, between converting all of my common stock to

preferred and then cancelling that class entirely, we reduced the

amount of shares to approximately 6 billion, before the conversion

of pre-existing notes. Today, the current shares outstanding is

approximately 9.2 billion, which was achieved without effecting as

reverse-split, as promised. The 25 billion authorized but unissued

shares must remain temporarily as a reserve for the remainder of

the convertible notes. Management believes these notes will not be

converted and will be handled in another manner. However, if in the

restructuring process, the company incorporates a plan, which

contemplates a reverse-split, I am announcing today that the

decision will be put to the shareholders for vote and I will

abstain from using the controlling preferred class B shares in that

event."

Sibannac, Inc. (USOTC:

SNNC)

In an effort to once again clarify the operations of SNNC, the

proposed name change to IMBUTEK has no effect on the assets or

interests of NOHO. No assets of NOHO were conveyed in the merger

transaction whatsoever and no assets were moved off of NOHO's

Balance Sheet.

Mr. Mersky continued, "While SNNC's business model has allowed

us to move forward and raise capital, I am committed to moving NOHO

forward into the future together and believe that our success will

continue to help restructure the company. However, despite the

total independence of the companies at this time, I look forward to

announcing a plan of operation that will benefit both companies as

we move into 2018. Sometimes it is necessary to work quietly while

this process takes place."

For additional information on NOHO please visit www.nohodrink.com and at www.instagram.com/nohodrink,

as well as at www.twitter.com/nohodrink.

Cautionary Note Regarding Forward-Looking Statements.

This press release contains statements that constitute

forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These statements

appear in a number of places in this release and include all

statements that are not statements of historical fact regarding the

intent, belief or current expectations of the Noho, Inc. (the

"Company"), its directors or its officers with respect to, among

other things: (i) financing plans; (ii) trends affecting its

financial condition or results of operations; (iii) growth

strategy and operating strategy. The words "may," "would,"

"will," "expect," "estimate," "can," "believe," "potential"

and similar expressions and variations thereof are intended to

identify forward-looking statements. Investors are cautioned

that any such forward-looking statements are not guarantees

of future performance and involve risks and uncertainties,

many of which are beyond the Company's ability to control, and

actual results may differ materially from those projected in the

forward looking statements as a result of various factors. You

should not place undue reliance on forward-looking statements since

they involve known and unknown risks, uncertainties and other

factors, which are, in some cases, beyond the Company's control and

which could, and likely will, materially affect actual results,

levels of activity, performance or achievements. The Company

assumes no obligation to publicly update or revise these

forward-looking statements for any reason, or to update the reasons

actual results could differ materially from those anticipated in

these forward-looking statements, even if new information becomes

available in the future. Important factors that could cause actual

results to differ materially from the company's expectations

include, but are not limited to, those factors that are disclosed

under the heading "Risk Factors" and elsewhere in documents filed

by the company from time to time with the United States Securities

and Exchange Commission and other regulatory authorities.

2907

Shelter Island Drive, Suite 105 • San Diego, CA 92106 •

619.300.6971. www.zouvaslaw.com

Investor/Media

Contact:

Mr. Clifford M. Rhee

Mr. Ronald Heineman

Greenfield Farms Food, Inc.

118 West 5th

Street

Covington, KY 41011

info@nohodrink.com

VIA FEDERAL EXPRESS AND ELECTRONIC

CORRESPONDENCE

Re: Demand for Issuance of Common Stock and Liquidated Damages

for Breach.

Dear Mssrs. Rhee and Heineman:

As you are aware, this firm represents NOHO, Inc. and its

subsidiary, Cherry Hill, Inc. (collectively hereinafter referred to

as the “Company and/or NOHO”). We are writing to convey to you our

demands as current bona-fide shareholders of Greenfield Farms Food,

Inc. (“GRAS”). GRAS is in default of its obligations to the Company

pursuant to the asset purchase agreement executed on June 7, 2017

(hereinafter referred to as the “APA”), and, on that basis, we

demand: (i) the immediate issuance of 49% of the Issued and

Outstanding Common Stock of GRAS as of the Closing Date of the APA;

and (ii) Assignment of the majority shareholder proxy (“Majority

Proxy”) as agreed pursuant to Section 6.4(c) of the APA, assigned

to David Mersky; and (iii) Retraction of the Press Release and 8-K

filed on December 1, 2017 as it was not authorized by the majority

shareholder; and (iv) Class D Preferred Stock is null and void

pursuant to Section 13 and Section of the Exchange Act; and payment

of $2,000,000.00; (and (v) waiver and release from all potential

claims arising from your gross negligence and multiple regulatory

violations as defined below (collectively referred to hereinafter

as the “Demand”).

Based on a review of the facts, neither Heineman nor Rhee has

the authorization from the majority shareholders of GRAS to take

any of the corporate actions memorialized in the 8-K filed on

December 1, 2017. Failure to comply with our Demand, will force us

to exhaust all available remedies, both in law and in equity, as

recourse for your refusal. To be clear, the extent of the recourse

available to the Company include, but are not limited to: (i)

filing a complaint with the Securities and Exchange Commission (the

“SEC”) and the Financial Industry Regulatory Authority (“FINRA”);

and (ii) filing a lawsuit against GRAS for contractual and punitive

damages, as well as attorneys’ fees, govern yourselves

accordingly.

The following is a brief summary of the basis for the

Demand.

a. Violation of Federal Securities Laws

i. Violation of FINRA Ban and Section 15 of the Exchange

Act

Subsequent the Closing of the APA on June 7, 2017, Mr. Heineman

ceased having any legal right to negotiate, take part in, and/or

sign any future agreement, but did so in the Letter of Intent

(“LOI”) between GRAS and Ngen Technologies USA Corp. dated

November 28, 2017. Heineman’s actions amount to gross recklessness

and disregard for any regulations or regulatory

authority.

As you are aware, the Securities Exchange Act of 1934 (the

“Exchange Act”) makes it unlawful for any person who is not

registered as a broker and/or dealer with the Securities and

Exchange Commission (the “SEC”) to effectuate, induce or attempt to

induce the purchase or sale of any security. Section 15(a) of the

Exchange Act provides:

“It shall be unlawful for any broker or dealer

which is either a person other than a natural person or a natural

person not associated with a broker or dealer which is a person

other than a natural person (other than such a broker or dealer

whose business is exclusively intrastate and who does not make use

of any facility of a national securities exchange) to make use of

the mails or any means or instrumentality of interstate commerce to

effect any transactions in, or to induce or attempt to

induce the purchase or sale of, any security (other than

an exempted security or commercial paper, bankers' acceptances, or

commercial bills) unless such broker or dealer is

registered in accordance with subsection (b) of this

section” (emphasis added).

The penalty for willfully violating the Exchange Act, for which

you are clearly culpable, is severe and can result in: (i) a

fine of up to Five Million

Dollars ($5,000,000); and (ii)

imprisonment for up to Twenty

Years (20 years) in a Federal penitentiary. Section

32(a) of the Exchange Act provides the following:

“Willful violations; false and misleading statements

Any person who willfully violates any provision of this title

(other than section 30A), or any rule or regulation thereunder the

violation of which is made unlawful or the observance of which is

required under the terms of this title, or any person who willfully

and knowingly makes, or causes to be made, any statement in any

application, report, or document required to be filed under this

title or any rule or regulation thereunder or any undertaking

contained in a registration statement as provided in subsection (d)

of section 15, or by any self-regulatory organization in connection

with an application for membership or participation therein or to

become associated with a member thereof, which statement was false

or misleading with respect to any material fact, shall upon

conviction be fined not more than

$5,000,000, or imprisoned not

more than 20 years, or both, except that when such

person is a person other than a natural person, a fine not

exceeding $25,000,000 may be imposed; but no person shall be

subject to imprisonment under this section for the violation of any

rule or regulation if he proves that he had no knowledge of such

rule or regulation.” See section 32(a) of the Securities Exchange

Act of 1934.

Given the significant sanctions that can be levied upon you both

for making false statements in the 8-K filed on December 1, 2017.

We will be forced to file a complaint with the SEC and FINRA if you

do not comply, and you will be personally liable for the derivative

shareholder lawsuit we are preparing to file.

A. Violation under Rule 13e-3

SEC Rule 13e-31 prohibits

issuers subject to the registration or reporting provisions of the

Exchange Act from taking certain actions without making certain

filings with the SEC and disseminating extensive information

to the issuer’s stockholders. You both failed to file the

Preliminary and Definitive 14C with the SEC and therefore any

actions filed on the Form 8-K are null and void by operation of

law.

1. Transactions to Which the Rule

Applies

SEC Rule 13e-3 governs several transactions by an issuer or

between an issuer and one or more of its affiliates (i.e., any

person directly controlling, controlled by, or under common control

with the issuer) that are intended to or may reasonably be expected

to result in one or more of the following: (A) causing any class of

equity securities of the issuer which is subject to 12(g) or

section 15(d) of the Exchange Act to be held of record by less than

300 persons; or (B) causing any class of equity securities of the

issuer which is either listed on a national securities exchange or

authorized to be quoted in an inter-dealer quotation system of a

registered national securities association to be neither listed on

any national securities exchange nor authorized to be quoted on an

inter-dealer quotation system of any registered national securities

association.

The rule applies to transactions which involve the purchase of

any equity security by its issuer or by an affiliate of the issuer;

a tender offer for an equity security by its issuer or by an

affiliate of the issuer; a proxy or consent solicitation or

distribution of information statements pursuant to Exchange Act

Regulations 14A or 14C with respect to a merger, consolidation,

reclassification, recapitalization, reorganization, sale of assets,

or similar types of transactions between an issuer (or its

subsidiaries) and any of its affiliates; and reverse stock splits

involving the purchase of fractional interests. The gross

recklessness of Mr. Heineman will undoubtedly allow the rightful

shareholders of GRAS to pierce the corporate veil and sue any and

all standing directors personally.

Mr. Heineman also committed violations of Sections 17(a)(2) and

17(a)(3) of the Securities Act. In the offer or sale of securities,

Section 17(a)(2) makes it unlawful “to obtain money or property by

means of any untrue statement of a material fact or any omission to

state a material fact necessary in order to make the statements

made, in light of the circumstances under which they were made, not

misleading;” and Section 17(a)(3) proscribes “any transaction,

practice, or course of business which operates or would operate as

a fraud or deceit upon the purchaser.” Violations of Section

17(a)(2) and 17(a)(3) may be established by a showing of

negligence. Aaron v. SEC, 446 U.S. 680, 697 (1980); SEC v. Glt.

Dain Rauscher, Inc., 254 F.3d 852, 856 (9th Cir. 2001).

B. Rule 10b-5 Anti-Fraud

SEC Rule 10b-5 requires full and accurate disclosure of all

material facts regarding the transaction and any corporation must

carefully abide by the requirements of this rule at all times when

effectuating any transaction involving the sale of

securities.

Rule 10b-5 is the principal anti-fraud provision in the federal

securities laws. Rule 10b-5 provides:

“shall be unlawful for any person, directly or indirectly, by

the use of any means or instrumentality of interstate commerce, or

of the mails or of any facility of any national securities

exchange,

a. To employ any device, scheme, or artifice to

defraud,

b. To make any untrue statement of a material fact or to omit to

state a material fact necessary in order to make the statements

made, in the light of the circumstances under which they were made,

not misleading, or

c. To engage in any act, practice, or course of business which

operates or would operate as a fraud or deceit upon any

person, in connection with the purchase or sale of any

security.”

To prove securities fraud under Rule 10b-5, a plaintiff must

establish the following: (1) material misrepresentation or omission

by the defendant; (2) intent to defraud or recklessness; (3) a

connection between the misrepresentation or omission and the

purchase or sale of a security; (4) reliance upon the

misrepresentation or omission (transaction causation); (5) economic

loss; and (6) loss causation. In this case, you both have clearly

committed fraud because: (i) GRAS made a material misrepresentation

as to the status of the APA; and (ii) you both had the intent to

defraud because you decided to ignore the Asset Purchase Agreement

which Heineman executed and then filed an 8-K announcing an

unauthorized LOI Between GRAS and Ngen; (iii) the misrepresentation

by Heineman was made as an inducement for the Ngen to purchase the

securities of GRAS; (iv) the Company relied upon the

misrepresentation from GRAS as inducement to enter into the Merger

transaction; (v) the Company suffered substantial economic loss in

the form of loss of investment capital needed for operations,

enhanced regulatory and accounting costs, loss of goodwill, equity

dilution, declines in share price, and the loss of good will as a

result of GRAS’s fraud; and (vi) these losses are attributable to

the fraudulent actions of you both.

The penalty for willfully violating the Securities Act, for

which you are clearly culpable, is severe and can result in: (i) a

fine; and (ii)

imprisonment for up to Twenty

Five Years (25 years) in a Federal penitentiary. 18

USC § 1346(2) of the Securities Act of 1933 (the “Securities Act”)

provides the following:

“Whoever knowingly executes, or attempts to execute, a scheme or

artifice …

(2) to obtain, by means of false or

fraudulent pretenses, representations, or

promises, any money or property in connection with the purchase or

sale of any commodity for future delivery, or any option on a

commodity for future delivery, or any security of

an issuer with a class of securities registered under section 12 of

the Securities Exchange Act of 1934 (15 U.S.C. 78l) or that is required to file reports

under section 15(d) of the Securities Exchange Act of 1934

(15 U.S.C. 78o (d));

shall be fined under this title, or imprisoned

not more than 25 years, or both” (emphasis added).

See 18 USC § 1346(2).

Given the significant sanctions that can be levied upon you and

GRAS, it is advisable that you comply with the Demand or we will be

forced to file a complaint with the SEC and FINRA. If you do not

comply, you will be at risk of potential imprisonment and the

imposition of monetary sanctions.

Our complaint against you will charge you with failing to

disclose material facts to all shareholders and intentional

misrepresentation, and failing to maintain physical possession or

control of securities. We will seek appropriate injunctive relief,

damages, costs and possible attorneys’ fees, together with any and

all possible available remedies, such causes of action will include

the violations discussed above, but may also include:

1. Violations of the Sherman Act, 15 U.S.C. § 1 -

Conspiracy to Restrain Trade – We believe that you have

engaged in concerted action with others and that this concerted

action produced anticompetitive effects with respect to NOHO’s

stock and geographic markets; and

2. Unjust Enrichment – We will allege that you

were enriched by your illegal practices and that our client

suffered in the amount that you profited from the shares you naked

shorted and that there was no justification for this conduct;

and

3. Conversion – our client had a property

interest in its own stock and the right to issue stock, further our

client had a right to possession of the shares of its own stock

that you illegally sold. Accordingly, our client suffered damages

as a result of your illegal conversion; and

4. Deceptive Trade Practices – we will be able

to prove that, in the course of your business you passed off our

client’s stock as your own, caused a likelihood of confusion or of

misunderstanding as to the source, sponsorship, approval, or

certification of the goods, caused a likelihood of confusion or of

misunderstanding as to filiation, connection, association with, or

certification by our client, used deceptive representations or

designations of geographic origin in connection with goods,

represented that goods had the sponsorship and/or approval of our

client, and that you had quantities of our client’s stock that you

did not have, that you advertised goods with intent not to sell

them as advertised, that you advertised goods with intent not to

supply reasonably expectable public demand and that this willful

conduct created a likelihood of confusion and/or misunderstanding;

and

5. Civil Conspiracy - a confederation or

combination of two or more persons and or entities, including you

engaged in the unlawful acts described in the preceding paragraphs,

this conduct was done in furtherance of a conspiracy to harm our

client in the ways described in the preceding paragraphs, and with

the goal of driving down our client’s stock price so that the you

and your conspirators would profit through selling. Our client

suffered actual damage as a result of the conspiracy; and

6. Negligence – at all relevant times, you

breached the duty of care you owed to the company, individual

shareholders and the public to employ reasonable means and

practices to ensure that trade transactions conducted on their own

behalf or on behalf of third parties were not conducted for the

purpose of, or which it is reasonable to foresee may or will have

had the result of, improperly, deceptively, or fraudulently

manipulating the market price of our client’s stock or presenting

false or misleading information concerning the price, actual

trading activity and/or trading and/or failures to deliver

securities. All representation you have made regarding our client’s

stock were made intentionally and/or negligently and were

materially false and misleading; and

7. Fraud – you knowingly defrauded the Company,

the shareholders and the public by manipulating the price of the

shares in the marketplace through the practice of illegally selling

the shares without consent; and

8. Civil RICO 18 U.S.C § 1962 – we believe that

you have acted with others as an enterprise engaged in and whose

activities were fraudulent and otherwise illegal and otherwise

effecting interstate commerce. During the course of the underlying

transaction, you and others devised a scheme and artifice to

defraud and mislead the public through illegal stock market

manipulation. The sole purpose of this enterprise was to create

illegally obtained profits. At all times, you knew your conduct was

illegal and in connection with this conduct utilized interstate

commerce, the internet and interstate phone services. Under this

statute, we would be able to recover triple damages in addition to

attorney’s fees.

Our claims against you also involve conversion or misuse of

customer funds, misuse of customer securities, as well as failure

to maintain possession or control of fully paid securities. We

believe and can prove that you have misused customers’ fully-paid

securities by selling shares without the customer’s

knowledge.

Based on our research we believe your potential exposure

to damages could easily be upward of $10,000,000.00, not including

attorney’s fees and likely punitive damages.

Please feel free to contact me by e-mail at lzouvas@zouvaslaw.com or by

telephone at (619) 300-6971 in case you have any additional

questions or comments regarding this matter. We look forward to

hearing from you and resolving this matter amicably and

expeditiously.

Regards,

Luke C. Zouvas, Esq.

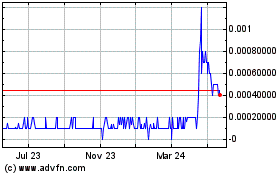

NoHo (PK) (USOTC:DRNK)

Historical Stock Chart

From Dec 2024 to Jan 2025

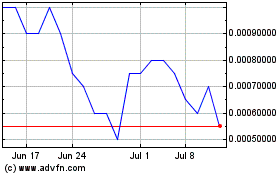

NoHo (PK) (USOTC:DRNK)

Historical Stock Chart

From Jan 2024 to Jan 2025