Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the first quarter ended March 31,

2013.

“Farmers & Merchants achieved a new milestone in the first

quarter, with the Bank’s total assets surpassing the $5 billion

mark for the first time,” said Henry Walker, president of Farmers

& Merchants Bank of Long Beach. “This achievement demonstrates

the Bank’s vitality during a challenging environment for our

industry. Steady and stable growth is a Farmers & Merchants

hallmark that has long attracted customers to the Bank.”

Income Statement

For the three months ended March 31, 2013, interest income was

$39.6 million, compared with $46.3 million in the first quarter of

2012; the decrease reflects the very competitive pricing

environment for loans. Interest expense for the 2013 first quarter

declined to $1.5 million from $1.8 million in the first quarter of

2012, primarily related to the continuance of the low interest rate

environment.

Net interest income for the 2013 first quarter was $38.1

million, compared with $44.4 million for the first quarter of 2012.

Farmers & Merchants’ net interest margin was 3.32% for the 2013

first quarter, compared with 4.07% in the 2012 first quarter.

The Bank did not have a provision for loan losses in the first

quarter of 2013, nor in the same period a year ago, reflecting the

asset quality of the Bank’s loan portfolio. The Bank’s allowance

for loan losses as a percentage of loans outstanding was 2.50% at

March 31, 2013, compared with 2.86% at March 31, 2012.

Non-interest income was $9.7 million for the 2013 first quarter,

which included a one-time gain of $3.6 million from the sale of a

closed branch building in North Long Beach. Non-interest income was

$6.4 million for the first quarter a year ago.

Net income for the 2013 first quarter totaled $16.7 million, or

$127.78 per diluted share, compared with net income of $18.5

million, or $141.48 per diluted share, for the 2012 first

quarter.

Balance Sheet

At March 31, 2013, net loans increased to $1.97 billion from

$1.93 billion at December 31, 2012. The Bank’s deposits totaled

$3.74 billion at the end of the 2013 first quarter, compared with

$3.69 billion at December 31, 2012. Non-interest bearing deposits

represented 39.4% of total deposits at March 31, 2013, versus 40.0%

of total deposits at December 31, 2012. Total assets increased to

$5.07 billion at the close of the 2013 first quarter from $4.99

billion at December 31, 2012.

At March 31, 2013, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 29.80%, a Tier 1 risk-based capital

ratio of 28.54%, and a Tier 1 leverage ratio of 14.44%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“We made strategic investments in people during the first

quarter to further enhance our lending and marketing activities,

while continuing to maintain the fundamentals that support a

healthy balance sheet,” said Daniel Walker, chief executive officer

and chairman of the board. “To continue down the path of reaching

new audiences, we enhanced the breadth of our marketing team,

naming Adam Michaelson as Chief Marketing Officer. Adam’s marketing

acumen and experience in the financial services industry are well

positioned for F&M, and we welcome him to the team.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 21 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG BEACH

Income Statements (Unaudited) (In Thousands, Except Per

Share Data) Three Months Ended

March 31, 2013 2012 Interest

income: Loans $ 25,559 $ 31,410 Securities

available-for-sale 2,240 3,015 Securities held-to-maturity 11,629

11,634 Deposits with banks 207 219 Total interest

income 39,635 46,278

Interest expense:

Deposits 1,261 1,567 Securities sold under repurchase agreements

273 268 Total interest expense 1,534 1,835

Net interest income 38,101 44,443

Provision for

loan losses - - Net int. income after provision

for loan losses 38,101 44,443

Non-interest

income: Service charges on deposit accounts 1,154 1,199

Gain on sale of securities 536 42 Merchant bankcard income 2,174

1,628 Other income 5,788 3,509 Total non-interest

income 9,652 6,378

Non-interest expense:

Salaries and employee benefits 13,340 11,761 FDIC and other

insurance expense 1,692 1,570 Occupancy expense 1,320 1,378

Equipment expense 1,435 1,337 Other real estate owned expense,net

(1,127 ) 1,296 Amortization of public welfare investments 2,020

2,201 Merchant bankcard expense 1,721 1,107 Legal and professional

services 748 464 Marketing expense 607 630 Other expense 1,429

1,395 Total non-interest expense 23,185 23,139

Income before income tax expense 24,568 27,682

Income tax expense 7,839 9,159

Net

income $ 16,729 $ 18,523

Basic and diluted earnings per common share $ 127.78

$ 141.48

FARMERS & MERCHANTS

BANK OF LONG BEACH Balance Sheets (Unaudited) (In

Thousands, Except Share and Per Share Data)

Mar. 31, 2013 Dec. 31, 2012

Assets Cash and due from banks:

Noninterest-bearing balances $ 56,606 $ 60,914 Interest-bearing

balances 276,830 253,087 Securities available-for-sale 569,261

630,055 Securities held-to-maturity 2,039,883 1,942,085 Gross loans

2,018,905 1,984,440 Less allowance for loan losses (50,465)

(50,994) Less unamortized deferred loan fees, net (280) (364) Net

loans 1,968,160 1,933,082 Other real estate owned, net 18,886

17,696 Public welfare investments 33,784 35,804 Bank premises and

equipment, net 61,105 60,504 Deferred tax assets 24,068 26,060

Other assets 22,825 29,674

Total assets $

5,071,408 $ 4,988,961

Liabilities and stockholders' equity

Liabilities: Deposits: Demand, non-interest bearing $

1,473,535 $ 1,474,215 Demand, interest bearing 357,654 346,991

Savings and money market savings 1,059,356 1,011,029 Time deposits

848,001 853,631 Total deposits 3,738,546 3,685,866

Securities sold under repurchase agreements 574,470 551,293 Other

liabilities 28,233 34,543

Total liabilities

4,341,249 4,271,702 Stockholders'

Equity: Common Stock, par value $20; authorized 250,000

shares; issued and outstanding 130,928 shares 2,619 2,619

Additional paid-in capital 12,044 12,044 Retained earnings 709,018

695,169 Accumulated other comprehensive income 6,478 7,427

Total stockholders' equity 730,159 717,259

Total liabilities and stockholders' equity $

5,071,408 $ 4,988,961

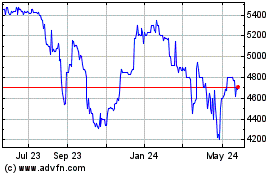

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

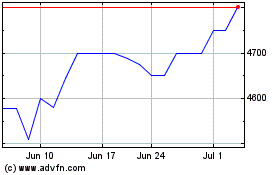

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025