-- Net Loans Grew 13% in Year-to-Date

Comparison --

Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the second quarter and six-months

ended June 30, 2014.

“Farmers & Merchants achieved strong loan growth during the

first half of the year, as the Bank’s expanded lending team

continues to deliver results,” said Henry Walker, president of

Farmers & Merchants Bank of Long Beach. “At the same time, the

Bank made steady gains in deposit growth, which is a testament to

Farmers & Merchants’ focus on providing superior service with

sound and stable fundamentals.”

Income Statement

For the three months ended June 30, 2014, interest income rose

to $45.0 million from $39.2 million in the second quarter of 2013.

Interest income for the first half of 2014 increased to $88.3

million from $78.8 million reported for the first half of 2013.

Interest expense for the 2014 second quarter was $1.7 million,

compared with $1.5 million in the second quarter of 2013. Interest

expense for the first half of 2014 was $3.3 million, versus $3.0

million reported for the corresponding period last year.

Net interest income for the 2014 second quarter advanced to

$43.3 million from $37.6 million for the second quarter of 2013.

Net interest income for the first half of 2014 increased to $85.0

million from $75.7 million for the six months ended June 30,

2013.

Farmers & Merchants’ net interest margin was 3.48% for the

2014 second quarter, up from 3.20% in the 2013 second quarter. Net

interest margin was 3.44% for the first half of 2014, versus 3.24%

for the same period in 2013.

The Bank did not have a provision for loan losses in the first

half of 2014, nor in the same period a year ago, reflecting the

continued strength of Farmers & Merchant’s loan portfolio. The

Bank’s allowance for loan losses as a percentage of loans

outstanding was 1.86% at June 30, 2014, compared with 2.09% at

December 31, 2013.

Non-interest income was $9.8 million for the 2014 second

quarter, compared with $10.4 million in the same period a year ago.

In the first half of 2014, non-interest income was $16.4 million,

compared with $21.2 million for the six months ended June 30,

2013.

Non-interest expense for the 2014 second quarter was $29.7

million, compared with $26.4 million for the same period last year.

Non-interest expense for the first half of 2014 was $57.9 million,

compared with $50.1 million for the first half of 2013.

Net income for the 2014 second quarter increased to $16.1

million, or $123.05 per diluted share, from $14.9 million, or

$113.76 per diluted share, for the 2013 second quarter. Net income

for the first half of 2014 was $30.2 million, or $230.44 per

diluted share, compared with $32.1 million, or $245.44 per diluted

share, for the six months ended June 30, 2013.

Balance Sheet

At June 30, 2014, net loans increased to $2.71 billion from

$2.40 billion at December 31, 2013. The Bank’s deposits rose to

$4.00 billion at the end of the 2014 second quarter from $3.83

billion at December 31, 2013. Non-interest bearing deposits

represented 39.3% of total deposits at June 30, 2014, versus 38.5%

of total deposits at December 31, 2013. Total assets increased to

$5.41 billion at the close of the 2014 second quarter from $5.21

billion at December 31, 2013.

At June 30, 2014, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 24.38%, a Tier 1 risk-based capital

ratio of 23.13%, and a Tier 1 leverage ratio of 14.54%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“As a key pillar to the strength and stability of Farmers

&Merchants Bank, we continued to maintain a healthy balance

sheet in the first half of the year,” said Daniel Walker, chief

executive officer and chairman of the board. “As Farmers &

Merchants Bank further enhances its presence in Southern

California, we remain committed to implementing our growth strategy

with the very prudence, integrity and tact that has led to the

Bank’s profitability on an annual basis for more than a

century.”

About Farmers & Merchants Bank of Long Beach

Founded in Long Beach in 1907 by C.J. Walker, Farmers &

Merchants Bank has 23 branches in Los Angeles and Orange Counties.

The Bank specializes in commercial and small business banking along

with business loan programs. Farmers & Merchants Bank of Long

Beach is a California state chartered bank with deposits insured by

the Federal Deposit Insurance Corporation (Member FDIC) and an

Equal Housing Lender. For more information about F&M, please

visit www.fmb.com.

FARMERS & MERCHANTS BANK OF LONG BEACH Income

Statements (Unaudited) (In thousands except per share

data) Three Months Ended June

30, Six Months Ended June 30, 2014

2013 2014 2013

Interest income: Loans $ 31,122 $ 25,252 $ 59,992 $

50,811 Securities available-for-sale 1,328 2,069 2,858 4,309

Securities held-to-maturity 12,446 11,688 25,299 23,317 Deposits

with banks 88 146 141 353 Total interest income 44,984

39,155 88,290 78,790

Interest expense:

Deposits 1,424 1,224 2,772 2,485 Federal funds purchased - - 4 -

Securities sold under repurchase agreements 280 284 554 557

Total interest expense 1,704 1,508 3,330 3,042 Net interest

income 43,280 37,647 84,960 75,748

Provision for loan

losses - - - - Net interest income after provision for

loan losses 43,280 37,647 84,960 75,748

Non-interest

income: Service charges on deposit accounts 1,154 1,115

2,287 2,268 Gains on sale of securities - - 425 1,048 Other real

estate owned income 338 153 503 463 Merchant bankcard income 2,429

2,388 4,703 4,562 Other income 5,853 6,771 8,445 12,838

Total non-interest income 9,774 10,427 16,363 21,179

Non-interest expense: Salaries and employee benefits

16,247 13,383 31,926 26,724 FDIC and other insurance expense 769

1,707 1,521 3,399 Occupancy expense 1,982 1,673 3,753 3,271

Equipment expense 1,589 1,538 3,070 2,972 Other real estate owned

expense 1,162 811 1,783 (6) Amortization of public welfare

investments 2,117 2,020 4,234 4,041 Merchant bankcard expense 1,938

1,939 3,725 3,660 Legal and professional services 782 1,001 1,726

1,749 Marketing expense 1,279 786 2,768 1,375 Other expense 1,807

1,507 3,360 2,954 2,922 2,922 Total non-interest expense 29,672

26,365 57,866 50,139 Income before income tax expense 23,382

21,709 43,457 46,788

Income tax expense 7,271 6,815

13,286 14,653

Net income $ 16,111

$ 14,894 $ 30,171 $

32,135 Basic and diluted earnings per common share $

123.05 $ 113.76 $ 230.44 $ 245.44

FARMERS & MERCHANTS

BANK OF LONG BEACH Balance Sheets (Unaudited) (In

thousands except share and per share data) June 30,

2014 Dec. 31, 2013 Assets Cash and

due from banks: Noninterest-bearing balances $ 67,663 $ 65,261

Interest-bearing balances 130,141 20,755 Securities

available-for-sale 303,262 427,942 Securities held-to-maturity

1,985,486 2,145,289 Loans held for sale 1,254 465 Gross loans

2,759,914 2,454,302 Less allowance for loan losses (51,275)

(51,251) Less unamortized deferred loan fees, net (1,852) (1,704)

Net loans 2,706,787 2,401,347 Other real estate owned, net 12,075

14,502 Public welfare investments 50,519 27,722 Bank premises and

equipment, net 87,004 66,212 Net deferred tax assets 23,089 23,512

Federal Home Loan Bank stock 25,000 - Other assets 22,584 21,579

Total assets $

5,414,864

$

5,214,586

Liabilities and Stockholders' Equity

Liabilities: Deposits: Demand, non-interest bearing $

1,572,185 $ 1,475,888 Demand, interest bearing 408,256 413,291

Savings and money market savings 1,168,541 1,080,774 Time deposits

848,716 861,489 Total deposits 3,997,698 3,831,442

Securities sold under repurchase agreements 594,043 595,991 Other

liabilities 38,806 27,986

Total liabilities

4,630,547

4,455,419

Stockholders' Equity: Common Stock, par value

$20; authorized 250,000 shares; issued and outstanding 130,928

shares 2,619 2,619 Additional paid-in capital 112,044 12,044

Retained earnings 666,818 742,408 Accumulated other comprehensive

income 2,836 2,096

Total stockholders' equity

784,317 759,167 Total liabilities and

stockholders' equity $

5,414,864

$

5,214,586

Farmers & Merchants Bank of Long BeachJohn HinrichsExecutive

Vice President562-437-0011, ext. 5035orPondelWilkinson Inc.Evan

PondelCorporate and Investor

Relations310-279-5980investor@pondel.com

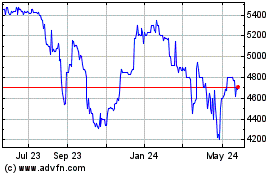

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

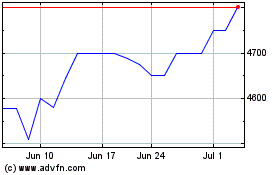

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025