false

0001447380

0001447380

2024-05-03

2024-05-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 3, 2024

Mobivity

Holdings Corp.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53851 |

|

26-3439095 |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation) |

|

File

Number) |

|

Identification

No.) |

3133

West Frye Road, # 215

Chandler,

Arizona 85226

(Address

of principal executive offices) (Zip Code)

(877)

282-7660

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

None |

|

None |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01. |

Entry

into a Material Definitive Agreement. |

On

May 3, 2024, Mobivity Holdings Corp. (the “Company”) entered into Amendment No. 2 (the “Amendment”) to Amended

and Restated Credit Facility Agreement and Convertible Notes, which amends our existing Amended and Restated Credit Facility Agreement,

dated as of November 11, 2022, between the Company and Thomas B. Akin, a director of the Company, as amended by that certain Amendment

No. 1 to Amended and Restated Credit Facility Agreement and Convertible Notes, dated as of January 31, 2023 (the “Existing Credit

Agreement” and as amended by the Amendment, the “Credit Agreement”) and any convertible notes issued thereunder. The

Amendment further amends the Existing Credit Agreement to extend the maturity of the Credit Agreement and related convertible notes thereunder

until June 30, 2026. Principal payments have been deferred to a period beginning on July 31, 2024 and ending June 30, 2026, and further

provides that any accrued interest on unpaid advances under the Credit Agreement is to be paid quarterly in kind in shares of the Company’s

common stock, at a price per share equal to the volume-weighted average price of the Company’s common stock quoted on the OTCQB

® Venture Market operated by OTC Markets Group Inc. over the ninety (90) trading days immediately preceding such date. The Amendment

provides for corresponding amendments to the form of convertible note to be issued under the Credit Agreement in the future and any outstanding

convertible notes issued under the Existing Credit Agreement.

The

foregoing description of the Amendment does not purport to be complete and is qualified by reference to the Amendment, a copy of which

is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item

2.03. |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The

information disclosed in Item 1.01 is incorporated by reference into this Item 2.03.

| Item

3.02. |

Unregistered

Sales of Equity Securities. |

The

information disclosed in Item 1.01 is incorporated by reference into this Item 3.02.

The

foregoing securities were sold to an “accredited investor” as that term is defined in Rule 501 of Regulation D of the U.S.

Securities and Exchange Commission (“SEC”), without the use of any general solicitations or advertising to market or otherwise

offer the securities for sale. Based on the foregoing, we believe that the offer and sale of these securities were exempt from the registration

requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) and Rule 506(b) thereof. Registration of sales to

“accredited investors” is preempted from state regulation by Section 18 of the Securities Act, though states may require

the filing of notices, a fee and other administrative documentation.

| Item

9.01. |

Financial

Statements and Exhibits. |

(d)

Exhibits

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MOBIVITY

HOLDINGS CORP. |

| |

|

|

| Date:

May 9, 2024 |

By: |

/s/

Skye Fossey-Tomaske |

| |

|

Skye

Fossey-Tomaske |

| |

|

Interim

Chief Financial Officer |

Exhibit

10.1

AMENDMENT

NO. 2 TO

AMENDED

AND RESTATED CREDIT FACILITY AGREEMENT and convertible noteS

THIS

AMENDMENT NO. 2 TO AMENDED AND RESTATED CREDIT FACILITY AND CONVERTIBLE NOTES is dated as of May 3, 2024 (this “Amendment”),

between Mobivity Holdings Corp., a Nevada corporation (“Borrower”) and Thomas B. Akin, an individual (“Lender”)

(each, a “Party” and together, the “Parties”).

BACKGROUND

A.

The Parties entered into that certain Amended and Restated Credit Facility Agreement dated as of November 11, 2022, as amended by that

certain Amendment No. 1 to Amended and Restated Credit Facility Agreement and Convertible Notes, dated as of January 31, 2023 (the “Existing

Credit Agreement”);

B.

Advances under the Existing Credit Agreement were evidenced by the terms of one or more convertible notes (the “Existing Notes”),

a form of which is attached to the Existing Credit Agreement;

C.

The Parties now desire to amend the Existing Credit Agreement and the Existing Notes as provided herein; and

D.

Unless otherwise defined herein, capitalized terms used in this Amendment shall have the meanings ascribed to them in the Existing Credit

Agreement.

NOW,

THEREFORE, in consideration of the mutual agreements, provisions and covenants contained herein, and intending to be legally bound, the

Parties hereto agree as follows:

AGREEMENT

1. Amendments

to Existing Credit Agreement. Upon satisfaction of the conditions set forth in Section 3 hereof, the Existing Credit

Agreement is amended pursuant to this Amendment to:

| |

(a) |

Amend

and restate Section 2.3(b) in its entirety to read as follows: |

| |

|

|

| |

|

“Without

limiting the foregoing Section 2.3(a), Borrower shall repay the principal amount of all Advances in 24 equal monthly installments

commencing on July 31, 2024 and continuing thereafter on the first day of each month (or, if such first day is not a Business Day,

on the Business Day immediately succeeding such first day). Interest on the unpaid Advances will accrue from the date of each Advance

at a rate equal to fifteen percent (15%) per annum and shall be paid quarterly in kind in Common Stock of the Borrower at a price

per share equal to the volume-weighted average price of the Common Stock quoted on the OTCQB ® Venture Market operated by OTC

Markets Group Inc. over the ninety (90) Trading Days immediately preceding such date. Interest will be calculated on the basis of

365 days in a year.” |

| |

(b) |

Amend

Section 1 of Exhibit A to Existing Credit Agreement in its entirety to read as follows: |

| |

|

|

| |

|

“1.

Payment Terms; Maturity. This Note shall bear interest on the unpaid principal amount at the rate of fifteen percent (15%) per

annum and shall be paid quarterly in kind in Common Stock of the Borrower at a price per share equal to the volume-weighted average

price of the Common Stock quoted on the OTCQB ® Venture Market operated by OTC Markets Group Inc. over the ninety (90) Trading

Days immediately preceding such date. The unpaid principal amount shall be paid in 24 equal monthly installments commencing on July

31, 2024 and continuing on the first day of each of the next 23 months thereafter (or, if such first day is not a Business Day, on

the Business Day immediately succeeding such first day), with a final payment due on June 30, 2026 at which time all principal shall

be due and payable. All payments of principal under this Note will be made in lawful money of the United States of America in immediately

available funds at such place as may be designated by Lender to Borrower in writing.” |

2.

Amendments to Existing Notes. Upon satisfaction of the conditions set forth in Section 3 hereof, each Existing Note is

amended pursuant to this Amendment to:

| |

(a) |

Amend

Section 1 in its entirety to read as follows: |

| |

|

|

| |

|

“1.

Payment Terms; Maturity. This Note shall bear interest on the unpaid principal amount at the rate of fifteen percent (15%) per

annum and shall be paid quarterly in kind in Common Stock of the Borrower at a price per share equal to the volume-weighted average

price of the Common Stock quoted on the OTCQB ® Venture Market operated by OTC Markets Group Inc. over the ninety (90) Trading

Days immediately preceding such date. The unpaid principal amount shall be paid in 24 equal monthly installments commencing on July

31, 2024 and continuing on the first day of each of the next 23 months thereafter (or, if such first day is not a Business Day, on

the Business Day immediately succeeding such last day), with a final payment due on June 30, 2026 at which time all principal shall

be due and payable. All payments of principal under this Note will be made in lawful money of the United States of America in immediately

available funds at such place as may be designated by Lender to Borrower in writing.” |

3.

Conditions. Notwithstanding any other provision of this Amendment and without affecting in any manner the rights of the Lender

hereunder, it is understood and agreed that the effectiveness of Sections 1 and 2 hereof is subject to the execution and

delivery of this Amendment by Borrower and Lender.

4.

No Modification. Except as expressly set forth herein, nothing contained herein shall be deemed to constitute a waiver of compliance

with any term or condition contained in the Existing Credit Agreement, the Existing Notes or constitute a course of conduct or dealing

among the parties. Except as amended or consented to hereby, the Existing Credit Agreement and Existing Notes remain unmodified and in

full force and effect.

5.

Counterparts. This Amendment may be executed in any number of counterparts, each of which when so executed and delivered shall

be deemed an original, but all such counterparts together shall constitute but one and the same instrument. Electronically delivered

signature pages (PDFs, facsimile, etc.) shall be deemed to be the functional equivalent of originally executed signature pages for all

purposes.

6.

Successors and Assigns. This Amendment shall be binding upon the parties hereto and their respective successors and assigns and

shall inure to the benefit of the parties hereto and the successors and permitted assigns of Lenders. Neither Borrower’s rights

or obligations hereunder nor any interest therein may be assigned or delegated without the prior written consent of the Lender.

7.

Governing Law. This Amendment and the rights and obligations of the parties hereunder shall be governed by, and construed in accordance

with, the law of the State of Arizona.

8.

Severability. In case any provision in or obligation under this Amendment or any instrument or agreement required hereunder shall

be invalid, illegal or unenforceable in any jurisdiction, the validity, legality and enforceability of the remaining provisions or obligations,

or of such provision or obligation in any other jurisdiction, shall not in any way be affected or impaired thereby.

9.

Headings. Section headings herein are included herein for convenience of reference only and shall not constitute a part hereof

for any other purpose or be given any substantive effect.

10.

Reaffirmation. Borrower hereby (i) ratifies and reaffirms all of its payment and performance obligations, contingent or otherwise,

under the Existing Credit Agreement (after giving effect hereto), and (ii) ratifies and reaffirms the grant of security interest in the

Collateral. Borrower hereby consents to this Amendment and acknowledges that the Existing Credit Agreement otherwise remains in full

force and effect and is hereby ratified and reaffirmed. The execution of this Amendment shall not operate as a waiver of any right, power

or remedy of the Lender or constitute a waiver of any provision of any of the Existing Credit Agreement or the Existing Notes, except

as expressly set forth herein.

11.

Entire Understanding. This Amendment sets forth the entire understanding of the Parties with respect to the matters set forth

herein, and shall supersede any prior negotiations or agreements, whether written or oral, with respect thereto.

[Remainder

of Page Intentionally Left Blank; Signature Pages Follow]

IN

WITNESS WHEREOF, each of the undersigned has executed this Amendment as of the date set forth above.

| |

BORROWER: |

| |

|

|

| |

MOBIVITY

HOLDINGS CORP., |

| |

a

Nevada corporation |

| |

|

| |

By: |

/s/

Skye Fossey-Tomaske |

| |

Name: |

Skye

Fossey-Tomaske |

| |

Title: |

Interim

Chief Financial Officer |

| |

|

|

| |

LENDER:

|

| |

|

|

| |

By: |

/s/

Thomas B. Akin |

| |

|

Thomas

B. Akin |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

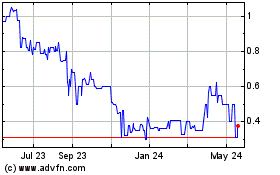

Mobivity (QB) (USOTC:MFON)

Historical Stock Chart

From Dec 2024 to Jan 2025

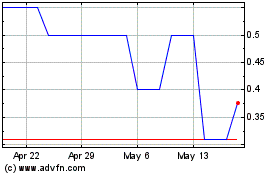

Mobivity (QB) (USOTC:MFON)

Historical Stock Chart

From Jan 2024 to Jan 2025