UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

STEM

HOLDINGS, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) |

Title

of each class of securities to which transaction applies: |

| |

|

| |

|

| (2) |

Aggregate

number of securities to which transaction applies: |

| |

|

| |

|

| (3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

| |

|

| (4) |

Proposed

maximum aggregate value of transaction: |

| |

|

| |

|

| (5) |

Total

fee paid: |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| (1) |

Amount

Previously Paid: |

| |

|

| |

|

| (2) |

Form,

Schedule or Registration Statement No.: |

| |

|

| |

|

| (3) |

Filing

Party: |

| |

|

| |

|

| (4) |

Date

Filed: |

| |

|

STEM

HOLDINGS, INC.

2201

NW Corporate Blvd, Suite 205

Boca

Raton, FL 33431

(561)

237-2931

NOTICE

OF ANNUAL

MEETING

OF SHAREHOLDERS TO BE

HELD

[date]

TO

OUR SHAREHOLDERS:

You

are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Stem Holdings, Inc., a Nevada

corporation (together with its subsidiaries, “Company”, “Stem”, “we”, “us” or “our”),

which will be held on December 28, 2022, at 12:00 Noon EST. The meeting will be conducted virtually at www.virtualshareholdermeeting.com/2022.

The meeting will be held for the following purposes:

| 1. | To

elect three (3) directors to hold office for a one-year term and until each of their successors

are elected and qualified; |

| 2. | To

ratify the appointment of LJ Soldinger, LLC, Certified Public Accountants, as our independent

registered public accounting firm for the fiscal year ending September 30, 2022; |

| 3. | To

authorize a reverse stock split within a range of one (1) post-split common share for each

ten (10) pre-split common shares outstanding on the record date and one hundred (100) pre-split

common shares outstanding on the record date, at any time within one (1) year of the approval

of this Proposal. In this regard, the Board of Directors reserves its right to elect not

to proceed, and abandon, the reverse stock split if it determines, in its sole discretion,

that this proposal is no longer in the best interests of the Company’s shareholders; |

| 4. | To

approve, on an advisory, non-binding basis, the compensation of our named executive officers

(“Say-on-Pay”); |

| 5. | To

consider and conduct a non-binding advisory vote on a proposal regarding the frequency of

advisory votes on executive compensation; and |

| 6. | To

transact such other business as may properly come before the Annual Meeting or any postponement

or adjournment thereof. |

A

copy of the Annual Report of the Company’s operations during the fiscal year ended September 30, 2021 is available on request or

at www.sec.gov.

The

Board of Directors has fixed the close of business on November 28, 2022, as the record date for the determination of shareholders entitled

to receive notice of and to vote at the Annual Meeting of Shareholders and any adjournment or postponement thereof. A complete list of

shareholders entitled to vote at the Annual Meeting will be available for inspection for ten days prior to the Annual Meeting at the

Offices of the Company located at 2201 NW Corporate Blvd, Suite 205, Boca Raton, FL 33431.

| |

By

Order of the Board of Directors |

| |

|

| |

/s/

Matthew Cohen |

| |

Matthew

Cohen |

| |

CEO

and CFO |

| November

23, 2022 |

|

| Boca

Raton, Florida |

|

YOUR

VOTE IS IMPORTANT

WHETHER

OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, TO ASSURE THAT YOUR SHARES WILL BE REPRESENTED, PLEASE COMPLETE, DATE, SIGN AND

RETURN THE ENCLOSED PROXY WITHOUT DELAY IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO ADDITIONAL POSTAGE IF MAILED IN THE UNITED STATES.

IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY.

TABLE

OF CONTENTS

STEM

HOLDINGS, INC.

2201

NW Corporate Blvd, Suite 205

Boca

Raton, FL 33431

PROXY

STATEMENT

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON DECEMBER 28, 2022

GENERAL

INFORMATION ABOUT THE PROXY STATEMENT AND ANNUAL MEETING

General

This

Proxy Statement is being furnished to the shareholders of Stem Holdings, Inc. (together with its subsidiaries, “Company”,

“Stem”, “we”, “us” or “our”) in connection with the solicitation of proxies by our Board

of Directors (the “Board of Directors” or the “Board”) for use at the Annual Meeting of Shareholders to be held

virtually on December 28, 2022, and at any and all adjournments or postponements thereof (the “Annual Meeting”) for the purposes

set forth in the accompanying Notice of Annual Meeting of Shareholders. Accompanying this Proxy Statement is a proxy/voting instruction

form (the “Proxy”) for the Annual Meeting, which you may use to indicate your vote as to the proposals described in this

Proxy Statement. It is contemplated that this Proxy Statement and the accompanying form of Proxy will be first mailed to Stem shareholders

on or about December 12, 2022.

The

Company will solicit shareholders by mail through its regular employees and will request banks and brokers and other custodians, nominees

and fiduciaries, to solicit their customers who have stock of the Company registered in the names of such persons and will reimburse

them for reasonable, out-of-pocket costs. In addition, the Company may use the service of its officers and directors to solicit proxies,

personally or by telephone, without additional compensation.

Voting

Securities

Only

shareholders of record as of the close of business on November 28, 2022 (the “Record Date”) will be entitled to vote at the

Annual Meeting and any adjournment or postponement thereof. As of the Record Date, there were approximately 226,548,835 shares of common

stock of the Company, issued and outstanding and entitled to vote representing approximately 691 holders of record, plus shares held

by CEDE. Shareholders may vote in person or by proxy. Each holder of shares of common stock is entitled to one vote for each share of

stock held on the proposals presented in this Proxy Statement. The Company’s bylaws provide that a majority of all the shares of

stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business

at the Annual Meeting. The enclosed Proxy reflects the number of shares that you are entitled to vote. Shares of common stock may not

be voted cumulatively.

Voting

of Proxies

All

valid proxies received prior to the Annual Meeting will be voted. The Board of Directors recommends that you vote by proxy even if you

plan to attend the Annual Meeting. To vote by proxy, you must fill out the enclosed Proxy, sign and date it, and return it in the enclosed

postage-paid envelope. Voting by proxy will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote

in person. However, if your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy executed

in your favor, from the holder of record to be able to vote at the Annual Meeting.

Revocability

of Proxies

All

Proxies which are properly completed, signed and returned prior to the Annual Meeting, and which have not been revoked, will be voted

in favor of the proposals described in this Proxy Statement unless otherwise directed. A shareholder may revoke his or her Proxy at any

time before it is voted either by filing with the Secretary of the Company, at its principal executive offices located at 2201 NW Corporate

Blvd., Suite 205, Boca Raton, FL 33431, a written notice of revocation or a duly-executed Proxy bearing a later date or by attending

the Annual Meeting and voting in person.

Required

Vote

Representation

at the Annual Meeting of the holders of at least twelve percent (12%) of the outstanding shares of our common stock entitled to vote,

either in person or by a properly executed Proxy, is required to constitute a quorum. Abstentions and broker non-votes, which are indications

by a broker that it does not have discretionary authority to vote on a particular matter, will be counted as “represented”

for the purpose of determining the presence or absence of a quorum. Under the Nevada Revised Statutes, once a quorum is established,

shareholder approval with respect to a particular proposal is generally obtained when the votes cast in favor of the proposal exceed

the votes cast against such proposal.

In

the election of our Board of Directors, shareholders are not allowed to cumulate their votes. Shareholders are entitled to cast a vote

for each of the openings on the Board to be filled at the Annual Meeting. The seven nominees receiving the highest vote totals will be

elected as our Board of Directors. For approval of all other Proposals, the votes cast in favor of the Proposal must exceed the votes

cast against the proposal. Accordingly, abstentions and broker non-votes will not affect the outcome of the vote.

Shareholders

List

For

a period of at least ten days prior to the Annual Meeting, a complete list of shareholders entitled to vote at the Annual Meeting will

be available at the principal executive offices of the Company located at 2201 NW Corporate Blvd, Suite 205, Boca Raton, FL 33431 so

that stockholders of record may inspect the list only for proper purposes.

Expenses

of Solicitation

The

Company will pay the cost of preparing, assembling and mailing this proxy-soliciting material, and all costs of solicitation, including

certain expenses of brokers and nominees who mail proxy material to their customers or principals.

PROPOSAL

NO. 1

ELECTION

OF THREE DIRECTORS

The

Company’s Board of Directors currently consists of eight (8) authorized directors. A total of three (3) directors will be elected

at the Annual Meeting to serve until the next annual shareholder meeting. The persons named as “Proxies” in the enclosed

Proxy will vote the shares represented by all valid returned proxies in accordance with the specifications of the shareholders returning

such proxies. If no choice has been specified by a shareholder, the shares will be voted FOR the nominees. If at the time of the Annual

Meeting any of the nominees named below should be unable or unwilling to serve, which event is not expected to occur, the discretionary

authority provided in the Proxy will be exercised to vote for such substitute nominee or nominees, if any, as shall be designated by

the Board of Directors. If a quorum is present and voting, the nominees for directors receiving the highest number of votes will be elected.

Abstentions and broker non-votes will have no effect on the vote.

NOMINEES

FOR ELECTION AS DIRECTOR

The

following sets forth certain information about each of the director nominees:

Matthew

J. Cohen (64)

Matthew

Cohen co-founded Stem Holdings, Inc. in 2016 and has been an independent consultant to Stem Holdings, Inc. the last five years. Currently,

Mr. Cohen serves as Chief Executive Officer and Chief Financial Officer. Mr. Cohen has over 38 years of experience serving in corporate

leadership roles, investing capital, structuring, and funding public/private partnerships, and providing strategic advisory services

to companies throughout the U.S., Europe, Asia and Latin America. Specifically, Mr. Cohen has held the titles of Chief Executive Officer,

Chief Operating Officer, Chief Financial Officer and Chief Recovery Officer, President, Vice President, and Secretary and has extensive

experience in business combinations and valuations, mergers and acquisitions, reverse mergers, revenue recognition, equity-based compensation,

initial public offerings, secondary offerings, debt offerings and REIT compliance. He is also knowledgeable in the requirements of the

Sarbanes-Oxley Act of 2002, including internal controls and Section 404, as well as the significant issues facing SEC registrants. Mr.

Cohen, as well as being a C-suite officer, has also served on many publicly traded company boards and was the Chairman of the Audit Committee

for several companies across a variety of industries including diagnostic services, aerospace, benefits and services company, consumer

retail, and biotech. He also worked in the Investment Banking Division at Oppenheimer as an Analyst early in his career. Mr. Cohen earned

a B.B.A. degree in Accounting from New Paltz State University in New York in 1980 and in that same year, was the recipient of the school’s

annual scholar athlete award. He is a member of the AICPA.

Robert

L. B. Diener (74)

Mr.

Diener has been the principal of the Law Offices of Robert Diener for over twenty years. He has nearly 50 years of experience as an attorney,

senior corporate executive and director, counsel and advisor. The focus of his legal practice is corporate and securities law, mergers

and acquisitions, finance and real estate. He has an extensive background and experience in corporate governance, public accounting and

finance and strategic planning.

Mr.

Diener currently serves as counsel to public and private companies, investors and companies which are focused on formation or acquisition

of public companies in the United States. His principal focus is on “going public” transactions and as “virtual general

counsel” to smaller publicly-reporting companies. His experience runs the full gamut from corporate finance, mergers and acquisitions,

investment activities, corporate governance, state and federal securities law compliance and major contract negotiations.

During

his career, Mr. Diener has served as President, CEO and a member of the board of American Health Properties, Inc. (NYSE), then one of

the largest real estate investment trusts in the country (now part of Healthpeak Properties Inc. with $15 billion in assets); a senior

executive of American Medical International, Inc. (NYSE), one of the country’s largest health care services providers; Chairman

of the Board and CEO of a publicly traded (NASDAQ) telecommunications company and a partner in a boutique investment banking group. He

also has extensive experience in international business, having had direct responsibility for transactions and development projects in

the United Kingdom, Spain, Germany, Switzerland, Greece, Egypt, Singapore, Australia, Israel, Hong Kong, Japan, Korea, Malaysia, Mexico,

Brazil, Venezuela, Bolivia and Ecuador

Mr.

Diener has served as a member or advisor to the boards of many public and private companies, including over 20 individual for-profit

and not-for-profit hospitals and health care facilities. He has previously served as a director of the Federation of American Hospital

Systems and the National Association of Real Estate Investment Trusts. He is currently a director of Prime Healthcare Services, Inc.

Mr.

Diener has been an active member of the State Bar of California since 1973. He received a Bachelor of Arts degree in Social Sciences

and Communications from the University of Southern California in 1969 and a Juris Doctor degree (Magna Cum Laude) from the University

of Santa Clara School of Law in 1973, where he was the Business Editor of the Law Review. He has a strong working knowledge of U.S. generally

accepted accounting principles (GAAP). Mr. Diener served in the United States Marine Corps Reserve from 1969 through 1975.

Roger

Rai (51)

Mr.

Rai was appointed a director of the Company on March 4, 2022, having previously served as a director of the Company from May 2018 to

February 2019. In his capacity as Special Advisor to the Chairman at Rogers Communications, Roger Rai advises Edward Rogers, who is the

representative controlling shareholder of Rogers Communications (TSX:RCI.b), on business development, revenue development, partnership

development, talent development and sports. Previously, Roger was the Managing Director for E.S. Rogers Enterprises from 2004 to 2018.

In that capacity, he gained extensive experience in strategic management services, including business processes assessment and advisory

services.

Roger

is currently the President of R3 Concepts Inc., a consulting and investments company located in Toronto, Canada. Since 2012, he has also

served as an advisor to Chobani, Inc., a retail food services company.

From

2010 to 2016, Roger was the Vice President, Business Development, Keek Inc. (TSXV:KEK). In this capacity, Roger was responsible for all

new business and partnership development at the Company.

Before

Keek Inc., Roger was the Director of Development at C.O.R.E. Feature Animation, a Company that produced the children’s animation

movie “The Wild.” He was the Founder and VP, Business Development of Fastvibe Inc., a web-streaming equipment and services

company located in Toronto. Roger also held various managerial positions at Rogers Cable Systems and Rogers Wireless, one Canada’s

largest Communications companies.

Roger

sits on the Board of Directors for CONSTANTINE Enterprises Inc., a privately held real estate Company based in Toronto, with operations

in Canada and the Bahamas.

Mr.

Rai holds a Bachelor of Arts from the University of Western Ontario and lives in Toronto.

RECOMMENDATION

OF THE BOARD OF DIRECTORS:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE DIRECTOR NOMINEES LISTED ABOVE.

PROPOSAL

NO. 2

RATIFICATION

OF APPOINTMENT OF INDEPENDENT

REGISTERED

PUBLICACCOUNTING FIRM

The

Board of Directors has appointed L J Soldinger Associates, LLC (“Soldinger”), independent registered public accounting firm,

as our independent registered public accounting firm for the fiscal year ending September 30, 2022 to examine the consolidated financial

statements of the Company for fiscal year ending September 30, 2022. The Board of Directors seeks an indication from shareholders of

their approval or disapproval of the appointment.

The

Board of Directors initially approved the engagement of Soldinger as the Company’s independent registered public accounting firm

in 2017. Soldinger will audit our consolidated financial statements for the fiscal year ended September 30, 2022. Representatives of

Soldinger are expected to attend the Annual Meeting, will have the opportunity to make a statement if they so desire, and are expected

to be available to respond to appropriate questions.

Our

consolidated financial statements for the fiscal years ended September 30, 2021 and 2020 were audited by Soldinger.

In

the event shareholders fail to ratify the appointment of Soldinger, the Board of Directors will reconsider this appointment. Even if

the appointment is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent registered

public accounting firm at any time during the year if the Board of Directors determines that such a change would be in the interests

of the Company and its shareholders.

The

affirmative vote of the holders of a majority of the Company’s common stock represented and voting at the Annual Meeting either

in person or by proxy will be required for approval of this proposal. Neither abstentions nor broker non-votes shall have any effect

on the outcome of this vote.

RECOMMENDATION

OF THE BOARD OF DIRECTORS:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF L J SOLDINGER ASSOCIATES, LLC AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PROPOSAL

NO. 3

REVERSE

SPLIT OF COMMON STOCK

The

Board of Directors believes that the proposed reverse stock split is beneficial to the Company because it provides the Company with the

flexibility it needs to raise additional capital consistent or consummate a stock-for-stock transaction with another entity.

Proposal

No. 3 authorizes a reverse stock split within a range of one (1) post-split common share for each ten (10) pre-split common shares outstanding

on the record date and one hundred (100) pre-split common shares outstanding on the record date, at any time within one (1) year of the

approval of this Proposal. The Board of Directors reserves its right to determine the exchange ratio of the reverse split and to elect

not to proceed, and abandon, the reverse stock split if it determines, in its sole discretion, that this proposal is no longer in the

best interests of the Company’s shareholders.

ADVANTAGES

AND CERTAIN RISK FACTORS ASSOCIATED WITH THE REVERSE STOCK SPLIT

There

can be no assurance that the total market capitalization of the Company’s Common Stock (the aggregate value of all Company’s

Common Stock at the then market price) after the proposed reverse stock split will be equal to or greater than the total market capitalization

before the proposed reverse stock split or that the per share market price of the Company’s Common Stock following the reverse

stock split will increase in proportion to the reduction in the number of shares of the Company’s Common Stock outstanding before

the reverse stock split.

A

decline in the market price of the Company’s Common Stock after the reverse stock split may result in a greater percentage decline

than would occur in the absence of a reverse stock split, and the liquidity of the Company’s Common Stock could be adversely affected

following such a reverse stock split.

IMPACT

OF THE PROPOSED REVERSE STOCK SPLIT IF IMPLEMENTED

If

approved and effected, the reverse stock split will be realized simultaneously for all of the Company’s Common Stock and the ratio

will be the same for all of the Company’s Common Stock. All fractional interests resulting from the reverse split will be rounded

up to the nearest whole share (see EFFECT ON FRACTIONAL SHAREHOLDERS, below). The reverse stock split will affect all of the Company’s

stockholders uniformly, however, the rounding of fractional shares may affect certain stockholders’ percentage ownership interests

and proportionate voting power in the Company. Because the number of authorized shares of the Company’s Common Stock will not be

reduced, the reverse stock split will increase the Board of Directors’ ability to issue authorized and unissued shares without

further stockholder action.

The

principal effect of the reverse stock split will be that:

| |

● |

the

number of shares of the Company’s Common Stock issued and outstanding will be reduced from approximately 230,000,000 shares

(a) to approximately 23,000,000 shares if the ratio of the reverse split is one for ten (b) to approximately 2,300,000 shares if

the ratio of the reverse split is one for one hundred; |

| |

|

|

| |

● |

the

number of shares that may be issued upon the exercise of conversion rights by holders of securities convertible into the Company’s

Common Stock will be reduced proportionately; and |

| |

|

|

| |

● |

proportionate

adjustments will be made to the per-share exercise price and the number of shares issuable upon the exercise of all outstanding options

and warrants entitling the holders to purchase shares of the Company’s Common Stock, which will result in approximately the

same aggregate price being required to be paid for such options upon exercise immediately preceding the reverse stock split. |

In

addition, the reverse stock split may increase the number of stockholders who own odd lots (less than 100 shares). Stockholders who hold

odd lots typically may experience an increase in the cost of selling their shares and may have greater difficulty in effecting sales.

EFFECT

ON FRACTIONAL STOCKHOLDERS

All

fractional interests resulting from the reverse split will be rounded up to the nearest whole share.

EFFECT

ON REGISTERED AND BENEFICIAL STOCKHOLDERS

Upon

a reverse stock split, we intend to treat stockholders holding the Company’s Common Stock in “street name”, through

a bank, broker or other nominee, in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers

or other nominees will be instructed to effect the reverse stock split for their beneficial holders holding the Company’s Common

Stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders

for processing the reverse stock split. If you hold your shares with a bank, broker or other nominee and if you have any questions in

this regard, we encourage you to contact your nominee.

EFFECT

ON REGISTERED CERTIFICATED SHARES

Some

of our registered stockholders hold all their shares in certificate form. If any of your shares are held in certificate form, you will

receive a transmittal letter from our transfer agent, Odyssey Stock Transfer, Inc., as soon as practicable after the effective date of

the reverse stock split. The letter of transmittal will contain instructions on how to surrender your certificate(s) representing your

pre-reverse stock split shares to the transfer agent. Upon receipt of your stock certificate, you will be issued the appropriate number

of shares electronically in book-entry form under the direct registration system.

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

AUTHORIZED

SHARES

The

reverse stock split would affect all issued and outstanding shares of the Company’s Common Stock and outstanding rights to acquire

the Company’s Common Stock. Upon the effectiveness of the reverse stock split, the number of authorized shares of the Company’s

Common Stock that are not issued or outstanding would increase due to the reduction in the number of shares of the Company’s Common

Stock issued and outstanding based on the reverse stock split ratio. As of August 10, 2022, we had 750,000,000 shares of authorized Common

Stock and approximately 230,000,000 shares of Common Stock issued and outstanding together with 100,000,000 shares of Preferred Stock

and no shares issued and outstanding. Authorized but unissued shares will be available for issuance, and we may issue such shares in

the future. If we issue additional shares, the ownership interest of holders of the Company’s Common Stock will be diluted.

ACCOUNTING

MATTERS

The

stated capital attributable to the Company’s Common Stock on its balance sheet will be unchanged. The per-share net income or loss

and net book value of the Company’s Common Stock will be restated because there will be fewer shares of the Company’s Common

Stock outstanding.

PROCEDURE

FOR EFFECTING REVERSE STOCK SPLIT

If

the Board of Directors decides to implement the reverse stock split, the Company will promptly file a Certificate of Amendment with the

Secretary of State of the State of Nevada to amend our existing Articles of Incorporation. The reverse stock split will become effective

on the date of filing the Certificate of Amendment, which is referred to as the “effective date.” Beginning on the effective

date, each certificate representing pre-reverse stock split shares will be deemed for all corporate purposes to evidence ownership of

post-reverse stock split shares. The text of the Certificate of Amendment is set forth in Exhibit A to this information statement. The

text of the Certificate of Amendment is subject to modification to include such changes as may be required by the office of the Secretary

of State of the State of Nevada and as the Board of Directors deems necessary and advisable to effect the reverse stock split.

NO

APPRAISAL RIGHTS

Under

applicable Nevada law, the Company’s stockholders are not entitled to appraisal rights with respect to the reverse stock split,

and we will not independently provide stockholders with any such right.

FEDERAL

INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT

The

following is a summary of certain material United States federal income tax consequences of the reverse stock split, does not purport

to be a complete discussion of all of the possible federal income tax consequences of the reverse stock split and is included for general

information only. Further, it does not address any state, local or foreign income or other tax consequences. Also, it does not address

the tax consequences to holders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies,

personal holding companies, foreign entities, nonresident alien individuals, broker-dealers and tax-exempt entities. The discussion is

based on the provisions of the United States federal income tax law as of the date hereof, which is subject to change retroactively as

well as prospectively. This summary also assumes that the pre-reverse stock split shares were, and the post-reverse stock split shares

will be, held as a “capital asset,” as defined in the Internal Revenue Code of 1986, as amended (i.e., generally, property

held for investment). The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder.

Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the reverse

stock split. As used herein, the term United States holder means a stockholder that is, for federal income tax purposes: a citizen or

resident of the United States; a corporation or other entity taxed as a corporation created or organized in or under the laws of the

United States, any State of the United States or the District of Columbia; an estate the income of which is subject to federal income

tax regardless of its source; or a trust if a U.S. court is able to exercise primary supervision over the administration of the trust

and one or more U.S. persons have the authority to control all substantial decisions of the trust.

No

gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-reverse stock split shares for post-reverse

stock split shares pursuant to the reverse stock split. The aggregate tax basis of the post-reverse stock split shares received in the

reverse stock split will be the same as the stockholder’s aggregate tax basis in the pre-reverse stock split shares exchanged therefor.

The stockholder’s holding period for the post-reverse stock split shares will include the period during which the stockholder held

the pre-reverse stock split shares surrendered in the reverse stock split.

Our

view regarding the tax consequences of the reverse stock split is not binding on the Internal Revenue Service or the courts. ACCORDINGLY,

EACH STOCKHOLDER SHOULD CONSULT WITH HIS OR HER OWN TAX ADVISOR WITH RESPECT TO ALL OF THE POTENTIAL TAX CONSEQUENCES TO HIM OR HER OF

THE REVERSE STOCK SPLIT.

RECOMMENDATION

OF THE BOARD OF DIRECTORS:

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” AUTHORIZATION OF THE REVERSE SPLIT DETAILED ABOVE.

PROPOSAL

NO. 4

ADVISORY

APPROVAL OF NAMED EXECUTIVE OFFICER COMPENSATION

As

required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Section 14A of the Exchange Act, we are providing

stockholders with the opportunity to cast an advisory, non-binding vote regarding the compensation of our named executive officers. The

advisory stockholder vote to approve the compensation of our named executive officers is often referred to as the “say-on-pay vote.”

This say-on-pay vote will not be binding on us, the Board of Directors, or the Compensation Committee. The most recent advisory vote

on named executive officer compensation was held at our 2016 Annual Meeting, and our stockholders voted in favor of the compensation

of our named executive officers. At the 2016 Annual Meeting, stockholders approved, by advisory vote, an annual frequency for future

advisory votes on the compensation of our named executive officers. This advisory vote was accepted by our Board of Directors. Stockholders

are expected to have the opportunity to vote on the frequency of future votes on named executive officer compensation, which will occur

no later than the Company’s 2024 Annual Meeting of Stockholders.

This

proposal allows our stockholders to express their views on the compensation of our named executive officers. This vote is not intended

to address any specific item of compensation or any single compensation philosophy, policy or practice, but rather the overall compensation

of our named executive officers as described in this proxy statement. In this regard, please refer to the summary of executive compensation

included in this Proxy Statement, which is incorporated herein by reference.

We

are asking our stockholders to indicate their support for the compensation of our named executive officers by voting “FOR”

the following advisory, non-binding resolution at our Annual Meeting:

“RESOLVED,

that the stockholders of Stem Holdings, Inc. approve, on an advisory, non-binding basis, the compensation of the Company’s named

executive officers, as disclosed in the Company’s proxy statement for the 2022 Annual Meeting of Stockholders pursuant to the compensation

disclosure rules of the Securities and Exchange Commission, including the Summary Compensation Table and the other related tables and

disclosure.”

While

the Board of Directors values the opinions of our stockholders, this vote is advisory and is not binding on the Company, the Board of

Directors or the Compensation Committee. We will consider the results of the vote, along with other relevant factors, when evaluating

our executive compensation practices and considering future executive compensation arrangements.

Vote

Required

This

proposal requires the affirmative vote of a simple majority of the total number of shares present in person or represented by proxy at

the meeting and entitled to vote on this matter. Abstentions will count as a vote “AGAINST” this proposal, and broker non-votes

will have no effect on the vote. Shares represented by properly executed proxies of record holders will be voted, if specific instructions

are not otherwise given, in favor of this proposal.

THE

BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE

OFFICERS, PURSUANT TO THE ABOVE NON-BINDING RESOLUTION.

PROPOSAL

NO. 5

NON-BINDING

ADVISORY VOTE REGARDING THE FREQUENCY OF ADVISORY VOTES ON

EXECUTIVE

COMPENSATION

The

Board and the Compensation Committee are seeking stockholder opinions on the frequency of future advisory votes regarding the Company’s

executive compensation. Consistent with the intent of the Dodd-Frank Act and SEC rules, the Board is providing stockholders with the

opportunity to cast a non-binding advisory vote. The compensation of the Company’s Named Officers is disclosed in the “Executive

Compensation” section of the proxy statement, below. The Board of Directors asks the stockholders to indicate the frequency

with which they would like future votes. We are providing stockholders with the option of selecting a frequency of one, two or three

years, or abstaining. In the interests of transparency and recognizing the importance of stockholder involvement with the Company, we

recommend that our stockholders select a frequency of voting on executive compensation every other year.

Vote

Required

This

proposal requires the affirmative vote of a simple majority of the total number of shares present in person or represented by proxy at

the meeting and entitled to vote on this matter. Abstentions will count as a vote “AGAINST” this proposal, and broker non-votes

will have no effect on the vote. Shares represented by properly executed proxies of record holders will be voted, if specific instructions

are not otherwise given, in favor of this proposal.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE OF “EVERY OTHER YEAR” FOR FUTURE ADVISORY VOTES ON THE COMPANY’S EXECUTIVE COMPENSATION.

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Set

forth below is certain biographical information concerning our current executive officers and directors.

| Name |

|

Age |

|

Position

with the Company |

| |

|

|

|

|

| Matthew

Cohen |

|

64 |

|

Chief

Executive Officer, Chief Financial Officer and Director |

Steven

Hubbard

|

|

75

|

|

Director

|

| Garrett M. Bender |

|

62 |

|

Director |

| Lindy

Snider |

|

62 |

|

Director |

Robert

Diener

|

|

74 |

|

Director

|

| Roger Rai |

|

51 |

|

Director |

| Darryl Simon |

|

59 |

|

Director |

Biographies

of our directors who are nominees are included in Proposal No. 1.

Board

Meetings and Annual Meeting Attendance

The

Board of Directors met twenty times during fiscal year ended September 30, 2022. No director attended less than 80% of the meetings.

Audit

Committee

The

Audit Committee is currently composed of Robert L. B. Diener, Chairman, Garrett Bender and Steven Hubbard . All members of the Audit

Committee are considered independent directors and all members of the Audit Committee are considered financially literate. The

Board of Directors ratified the formation of its Audit Committee effective April 26, 2017.

The

function of the Audit Committee, as detailed in the Audit Committee Charter, is to provide assistance to the Board in fulfilling its

responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, management practices,

reporting practices, and the quality and integrity of the financial reports of the Company. In so doing, it is the responsibility of

the Audit Committee to maintain free and open means of communication between the directors, the independent auditors and Company management.

The

independent directors meet the independence standards of the NASDAQ Stock Exchange, and the SEC.

The

Board of Directors pre-approved all services provided by our independent auditors for the fiscal year ended September 30, 2021.

Compensation

Committee

The

Compensation Committee’s responsibilities include, but are not limited to, the responsibilities which are required under the corporate

governance rules of NASDAQ, including the responsibility to determine compensation of the Chairman of the Board, the Chief Executive

Officer (“CEO”), the President and all other executive officers. The Compensation Committee’s actions shall generally

be related to overall considerations, policies and strategies.

The

Board of Directors ratified the formation of its Compensation Committee effective April 26, 2017. At this time, the Board has designated

Lindy Snider and Garrett Bander to serve on the Compensation Committee, each of whom are independent directors. Subsequently, Robert

Diener has been elected to serve on this committee.

The

Compensation Committee sets the overall compensation principles for the Company, subject to annual review. The Compensation Committee

may not delegate its authority. However, the Compensation Committee may retain counsel or consultants as necessary.

The

independent directors meet the independence standards of the NASDAQ Stock Exchange, the New York Stock Exchange and the SEC.

The

Compensation Committee establishes the Company’s general compensation policy and, except as prohibited by law, may take any and

all actions that the Board could take relating to compensation of directors, executive officers, employees and other parties. The Compensation

Committee’s role is to (i) evaluate the performance of the Company’s executive officers, (ii) set compensation for directors

and executive officers, (iii) make recommendations to the Board on adoption of compensation plans and (iv) administer Company compensation

plans. When evaluating potential compensation adjustments, the Compensation Committee solicits and considers input provided by the Chief

Executive Officer relating to the performance and/or contribution to the Company’s overall performance by executive officers and

other key employees.

Nominating/Corporate

Governance Committee

The

Nominating/Corporate Governance Committee’s responsibilities include, but are not limited to, the responsibilities which are required

under the corporate governance rules of NASDAQ, including the responsibilities to identify individuals who are qualified to become directors

of the Company, consistent with criteria approved by the Board, and make recommendations to the Board of nominees, including Stockholder

Nominees (nominees whether by appointment or election at the Annual Meeting of Stockholders) to serve as a directors of the Company.

At this time, the Board has designated Garrett Bender, Roger Rai, Lindy Snider, Daryl Simon and Robert Diener to serve on the Nominating/Corporate

Governance Committee, each of whom are independent directors.

To

fulfill its purpose, the responsibilities and duties of the Nominating/Corporate Governance Committee are as follows:

| |

● |

Evaluate,

in consultation with the Chairman of the Board and Chief Executive Officer (“CEO”), the current Composition, size, role

and functions of the Board and its committees to oversee successfully the business and affairs of the Company in a manner consistent

with the Company’s Corporate Governance Guidelines and make recommendations to the Board for approval. |

| |

|

|

| |

● |

Determine,

in consultation with the Chairman of the Board and CEO, director selection criteria consistent with the Company’s Corporate

Governance Guidelines and conduct searches for prospective directors whose skills and attributes reflect these criteria. |

| |

|

|

| |

● |

Assist

in identifying, interviewing and recruiting candidates for the Board. |

| |

|

|

| |

● |

Evaluate,

in consultation with the Chairman of the Board and CEO, nominees, including nominees nominated by stockholders in accordance with

the provisions of the Company’s Bylaws, and recommend nominees for election to the Board or to fill vacancies on the Board. |

| |

|

|

| |

● |

Before

recommending an incumbent, replacement or additional director, review his or her qualifications, including capability, availability

to serve, conflicts of interest, and other relevant factors. |

| |

|

|

| |

● |

Evaluate,

in consultation with the Chairman of the Board and CEO and make recommendations to the Board concerning the appointment of directors

to Board committees and the selection of the Chairman of the Board and the Board committee chairs consistent with the Company’s

Corporate Governance Guidelines. |

| |

|

|

| |

● |

Determine

the methods and execution of the annual evaluations of the Board’s and each Board committee’s effectiveness and support

the annual performance evaluation process. |

| |

● |

Evaluate

and make recommendations to the Board regarding director retirements, director re-nominations and directors’ changes in circumstances

in accordance with the Company’s Corporate Governance Guidelines. |

| |

|

|

| |

● |

Review

and make recommendations to the Board regarding policies relating to directors’ compensation, consistent with the Company’s

Corporate Governance Guidelines. |

| |

|

|

| |

● |

As

set forth herein, monitor compliance with, and at least annually evaluate and make recommendations to the Board regarding, the Company’s

Corporate Governance Guidelines and overall corporate governance of the Company. |

| |

|

|

| |

● |

Assist

the Board and the Company’s officers in ensuring compliance with an implementation of the Company’s Corporate Governance

Guidelines. |

| |

|

|

| |

● |

Develop

and implement continuing education programs for all directors, including orientation and training programs for new directors. |

| |

|

|

| |

● |

Annually

evaluate and make recommendations to the Board regarding the Committee’s performance and adequacy of this Charter. |

| |

|

|

| |

● |

Review

the Code of Ethics periodically and propose changes thereto to the Board, if appropriate. |

| |

|

|

| |

● |

Review

requests from outside the Committee for any waiver or amendment of the Company’s Code of Business Conduct and Ethics and recommend

to the Board whether a particular waiver should be granted or whether a particular amendment should be adopted. |

| |

|

|

| |

● |

Oversee

Committee membership and qualifications and the performance of members of the Board. |

| |

|

|

| |

● |

Make

recommendations annually to the Board as to the independence of directors under the Corporate Governance Guidelines. |

| |

|

|

| |

● |

Review

and make recommendations to the Board regarding the position the Company should take with respect to any proposals submitted by stockholders

for approval at any annual or special meeting of stockholders. |

| |

|

|

| |

● |

Regularly

report on Committee activities and recommendations to the Board. |

| |

|

|

| |

● |

Perform

any other activities consistent with this Charter, the Company’s Certificate of Incorporation And Bylaws, as amended from time

to time, the NASDAQ company guide, and any governing law, as the Board considers appropriate and delegates to the Committee. |

Code

of Ethics

The

Company has adopted a code of ethics that is applicable to our directors and officers.

Director’s

Compensation

Independent

members of the Board of Directors receive annual cash compensation of $5,000, payable in quarterly installments, together with periodic

stock option grants (see Grants of Plan-Based Awards, above). At this time, there is no other board of director compensation plan in

place.

Executive

Officer Compensation

The

following is a summary of the compensation we paid for each of the last two years ended September 30, 2021 and 2020, respectively (i)

to the persons who acted as our principal executive officer during our fiscal year ended September 30, 2021 and (ii) to the person who

acted as our next most highly compensated executive officer other than our principal executive officer who was serving as an executive

officer as of the end of our last fiscal year.

Name

and

Principal

Position | |

|

Year | | |

Salary

($) | | |

Bonus

($) | | |

Stock

Awards

($) | | |

Option

Awards ($) | | |

Non-Equity Incentive

Plan Compensation | | |

Non-Qualified Deferred Compensation Earnings ($) | | |

All

other Compensation ($) | | |

Total ($) | |

| Adam

Berk (1) | |

|

2021 | | |

$ | 300,000 | | |

$ | - | | |

$ | 540,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 840,000 | |

| CEO | |

|

2020 | | |

$ | 300,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 300,000 | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Steven

Hubbard (2) | |

|

2021 | | |

$ | 75,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 75,000 | |

| CFO | |

|

2020 | | |

$ | 45,000 | | |

$ | - | | |

$ | 26,000 | | |

$ | 21,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 92,000 | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Garrett

M. Bender | |

|

2021 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Director | |

|

2020 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lindy

Snider | |

|

2021 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Director | |

|

2020 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ellen

B. Deutsch (3) | |

|

2021 | | |

$ | 253,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 253,000 | |

| EVP

& COO | |

|

2020 | | |

$ | 240,000 | | |

$ | - | | |

$ | 82,000 | | |

$ | 26,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 348,000 | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dennis

Suskind (4) | |

|

2021 | | |

$ | - | | |

$ | - | | |

$ | 93,750 | | |

$ | 100,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 193,750 | |

| Director | |

|

2020 | | |

$ | - | | |

$ | - | | |

$ | 16,250 | | |

$ | 35,191 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 51,441 | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Brian

Hayek | |

|

2021 | | |

$ | 35,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 35,000 | |

| Director | |

|

2020 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Robert

Diener | |

|

2021 | | |

$ | 30,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 30,000 | |

| Director | |

|

2020 | | |

$ | 30,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 30,000 | |

| | |

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Salvador

Villanueva (5) | |

|

2021 | | |

$ | 21,900 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 21,900 | |

| Director | |

|

2020 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

(1)

Resigned December 16, 2021

(2)

Resigned March 28, 2022

(3)

Resigned November 24, 2021

(4)

Resigned February 8, 2022

(5)

Resigned December 15, 2021

2021

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

STOCK

AWARDS

Grants

of Plan-Based Awards

| Name | |

Grant Date

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | |

Option

Awards Equity

Incentive Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) | | |

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable (1) | | |

Option

Exercise Price

($) | | |

Option

Expiration Date |

| Dennis

Suskind, Director | |

6/11/2021 | |

- | | |

250,000 | | |

0.4 | | |

6/10/2025 |

| Equity

Compensation Plan Information |

| Plan

category | |

Number of

securities to be

issued upon

exercise of

outstanding

options,

warrants

and rights(a) | | |

Weighted-

average

exercise price

of

outstanding

options,

warrants

and rights | | |

Number of

securities

remaining

available for

future issuance

under equity

compensation

plans

(excluding

securities

reflected in

column (a) (1) | |

| Equity

compensation plans approved by security holders | |

| - | | |

| - | | |

| - | |

| Equity

compensation plans not approved by security holders | |

| 750,000 | | |

| 0.79 | | |

| 33,748,293 | |

| Total | |

| 750,000 | | |

| 0.79 | | |

| 33,748,293 | |

(1)

As of September 30, 2021

Warrants

Issued to Management

| Name |

|

Grant

Date |

|

|

Number of

Securities

Underlying

Unexercised

Exercisable

Warrants |

|

|

Number of

Securities

Underlying

Unexercised

Exercisable

Warrants |

|

|

Warrant

Exercise

Price($) |

|

|

Warrant

Expiration

Date |

|

| None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Family

Relationships

None.

Involvement

in Certain Legal Proceedings

To

the best of our knowledge during the past five years, no director or officer of the Company has been involved in any of the following:

(1) Any bankruptcy petition filed by or against such person individually, or any business of which such person was a general partner

or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) Any conviction in a criminal proceeding

or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) Being subject to any order,

judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily

enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities;

and (4) Being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to

have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

Adverse

Proceedings

There

exists no material proceeding to which any director or officer is a party adverse to the Company or has a material interest adverse to

the Company.

Compliance

with Section 16(a) of the Exchange Act

Section

16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who beneficially own 10% or more of

a class of securities registered under Section 12 of the Exchange Act to file reports of beneficial ownership and changes in beneficial

ownership with the SEC. Directors, executive officers and greater than 10% stockholders are required by the rules and regulations of

the SEC to furnish the Company with copies of all reports filed by them in compliance with Section 16(a). To the best of the Company’s

knowledge, any reports required to be filed were timely filed.

REPORT

OF THE AUDIT COMMITTEE

The

Board of Directors, acting as the Company’s Audit Committee has reviewed and discussed the audited financial statements for fiscal

year ended September 30, 2021 with Stem management.

The

Audit Committee has discussed with the Company’s independent auditors the matters required to be discussed by the Statement on

Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting

Oversight Board in Rule 3200T.

The

Audit Committee has received the written disclosures and the letter from the Company’s independent accountants required by Independence

Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), 2 as adopted

by the Public Company Accounting Oversight Board in Rule 3600T and has discussed with the independent accountant the independent accountant’s

independence.

Based

on the such review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be

included in the company’s annual report on Form 10-K for the last fiscal year for filing with the SEC.

Respectfully

Submitted,

/s/

Robert Diener

Audit

Committee Chairman

January

10, 2022

The

preceding Report of the Audit Committee will be filed with the records of the Company.

FEES

TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit

Fees

The

aggregate fees billed by our principal accountant for the audit of our annual financial statements, review of financial statements included

in the quarterly reports and other fees that are normally provided by the accountant in connection with statutory and regulatory filings

or engagements for the fiscal years ended September 30, 2021 and September 30, 2020, respectively, were approximately $630,000 and $398,000.

Tax

Fees

The

aggregate fees billed for professional services rendered by our principal accountant for tax compliance, tax advice and tax planning

for the fiscal years ended September 30, 2021 and 2020, respectively, were approximately $112,000 and $21,000.

All

Other Fees

The

other aggregate fees billed for professional services rendered by our principal accountant for work related to registration statements,

the Canadian prospectus, and consulting work related to the Employee Retention Tax Credit for the fiscal years ended September 30, 2021,

and 2020, respectively, were approximately $269,000 and $34,000.

Audit

Committee Pre-Approval Policies and Procedures

Effective

May 6, 2003, the SEC adopted rules that require that before our auditor is engaged by us to render any auditing or permitted non-audit

related service, the engagement be:

| |

● |

approved

by our audit committee; or |

| |

|

|

| |

● |

entered

into pursuant to pre-approval policies and procedures established by the audit committee, provided the policies and procedures are

detailed as to the particular service, the audit committee is informed of each service, and such policies and procedures do not include

delegation of the audit committee’s responsibilities to management. |

Pursuant

to the Sarbanes-Oxley Act of 2002, 100% of the fees and services provided as noted above were authorized and approved by the Audit Committee

in compliance with the pre-approval policies and procedures described herein.

TRANSACTIONS

WITH RELATED PERSONS

There

were the following transactions since the beginning of the Company’s last fiscal year, in which the Company was a participant and

in which any related person had or will have a direct or indirect material interest:

As

of September 30, 2021 and September 30, 2020, there were no amounts due to related parties.

Review,

Approval or Ratification of Transactions with Related Persons

The

Audit Committee of the Board of Directors, as stated in its charter, is responsible for the review, approval or ratification of all “transactions

with related persons” as that term refers to transactions required to be disclosed by Item 404 of Regulation S-K promulgated by

the SEC. In reviewing a proposed transaction, the Audit Committee must (i) satisfy itself that it has been fully informed as to the related

party’s relationship and interest and as to the material facts of the proposed transaction and (ii) consider all of the relevant

facts and circumstances available to the Audit Committee. After its review, the Audit Committee will only approve or ratify transactions

that are fair to the Company and not inconsistent with the best interests of the Company and its stockholders.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED

STOCKHOLDER MATTERS.

The

following table sets forth certain information with respect to the beneficial ownership of our voting securities by (i) any person or

group owning more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and president and

(iv) all executive officers and directors as a group as of September 30, 2021. Unless noted, the address for the following beneficial

owners and management is 2201 NW Corporate Blvd., Suite 205, Boca Raton, FL 33431.

| Title

of Class | |

Name

and Address of Beneficial Owner | |

Amount and

Nature of

Beneficial

Owner (1) | | |

Percent

of Class | |

| Common

Stock | |

Adam

Berk (2) | |

| 7,648,174 | | |

| 3.31 | % |

| Common

Stock | |

Steven

Hubbard (3) | |

| 1,053,007 | | |

| 0.45 | % |

| Common

Stock | |

Garrett

M. Bender (4) | |

| 5,631,887 | | |

| 2.44 | % |

| Common

Stock | |

Lindy

Snider (5) | |

| 209,044 | | |

| 0.00 | % |

| Common

Stock | |

Ellen

B. Deutsch (6) | |

| 100,000 | | |

| 0.00 | % |

| Common

Stock | |

Dennis

Suskind (7) | |

| 950,000 | | |

| 0.41 | % |

| Common

Stock | |

Robert

Diener (8) | |

| 118,000 | | |

| 0.00 | % |

| Common

Stock | |

Brian

Hayek (9) | |

| 4,837,752 | | |

| 2.10 | % |

| Common

Stock | |

All

executive officers and directors as a group | |

| 20,547,864 | | |

| 8.90 | % |

| |

(1) |

In

determining beneficial ownership of our Common Stock, the number of shares shown includes shares which the beneficial owner may acquire

upon exercise of debentures, warrants and options which may be acquired within 60 days. In determining the percent of Common Stock

owned by a person or entity on September 30, 2021, (a) the numerator is the number of shares of the class beneficially owned by such

person or entity, including shares which the beneficial ownership may acquire within 60 days of exercise of debentures, warrants

and options; and (b) the denominator is the sum of (i) the total shares of that class outstanding on September 30, 2021 (230,738,620

shares of Common Stock) and (ii) the total number of shares that the beneficial owner may acquire upon exercise of the debentures,

warrants and options. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares. |

| |

|

|

| |

(2) |

Includes

7,448,174 shares and options to purchase 200,000 shares. Mr. Berk resigned on December 16, 2021. |

| |

|

|

| |

(3) |

Includes

853,007 shares and options to purchase 200,000 shares. Mr.Hubbard resigned on March 28, 2022. |

| |

|

|

| |

(4) |

Includes

5,631,887 shares and no options to purchase shares |

| |

|

|

| |

(5) |

Includes

159,044 shares and options to purchase 50,000 shares |

| |

|

|

| |

(6) |

Includes

100,000 shares granted under Employment Agreement. Ms. Deutsch resigned on November 24, 2021. |

| |

|

|

| |

(7) |

Includes

450,000 shares and options to purchase 500,000 shares. Mr. Suskind resigned on February 8, 2022. |

| |

|

|

| |

(8) |

Includes

68,000 shares and options to purchase 50,000 shares |

| |

|

|

| |

(9)

|

Includes

4,337,752 shares and options to purchase 500,000 shares |

SHAREHOLDER

COMMUNICATIONS

The

Board of Directors of the Company has not adopted a formal procedure that shareholders must follow to send communications to it. The

Board of Directors does receive communications from shareholders, from time to time, and addresses those communications as appropriate.

Shareholders can send communication to the Board of Directors in writing, to Stem Holdings, Inc., 2201 NW Corporate Blvd, Suite 205,

Boca Raton, FL 33431, Attention: Board of Directors.

AVAILABILITY

OF ANNUAL REPORT ON FORM 10-K

A

copy of the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2021 as filed with the SEC is available

upon written request and without charge to shareholders by writing to the Company c/o Secretary,

2201

NW Corporate Blvd, Suite 205, Boca Raton, FL 33431, or by calling telephone number (561) 948-5410.

In

certain cases, only one Proxy Statement may be delivered to multiple shareholders sharing an address unless the Company has received

contrary instructions from one or more of the stockholders at that address. The Company will undertake to deliver promptly upon written

or oral request a separate copy of the Proxy Statement, as applicable, to a stockholder at a shared address to which a single copy of

such documents was delivered. Such request should also be directed to Secretary, Stem Holdings, Inc., at the address or telephone number

indicated in the previous paragraph. In addition, shareholders sharing an address can request delivery of a single copy of Proxy Statements

if they are receiving multiple copies of Proxy Statements by directing such request to the same mailing address.

OTHER

MATTERS

We

have not received notice of and do not expect any matters to be presented for vote at the Annual Meeting, other than the proposals described

in this Proxy Statement. If you grant a proxy, the person named as proxy holder, Matthew Cohen, or his nominees or substitutes, will

have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any unforeseen

reason, any of our nominees are not available as a candidate for director, the proxy holder will vote your proxy for such other candidate

or candidates nominated by our Board.

By

Order of the Board of Directors

| /s/

Matthew Cohen |

|

| Matthew

Cohen |

|

| Chief

Executive Officer |

|

| |

|

| Boca

Raton, Florida |

|

| November

23, 2022 |

|

PROXY

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF

DIRECTORS OF STEM HOLDINGS, INC.

The

undersigned hereby appoints Matthew Cohen as Proxy with full power of substitution to vote all the shares of common stock which the undersigned

would be entitled to vote if personally present at the Annual Meeting of Shareholders to be held on December 28, 2022 at 12 noon EDT

by Virtual Meeting, or at any postponement or adjournment thereof, and upon any and all matters which may properly be brought before

the Annual Meeting or any postponement or adjournments thereof, hereby revoking all former proxies.

Election

of Directors

The

nominees for the Board of Directors are:

| Matthew

Cohen ☐ |

Robert

Diener ☐ |

Roger

Rai ☐ |

|

|

Instruction:

To withhold authority to vote for any individual nominee(s), write the nominee(s) name on the spaces provided below:

The

Board of Directors recommends a vote FOR all Proposals.

| |

1. |

To

elect three (3) directors to hold office for a one-year term or until each of their successors are elected and qualified (except

as marked to the contrary above). |

☐

FOR ☐ AGAINST ☐ ABSTAINS ☐ WITHHOLDS

| |

2.

|

To

ratify the appointment of Soldinger as the independent registered public accounting firm of the Company. |

☐

FOR ☐ AGAINST ☐ ABSTAINS ☐ WITHHOLDS

| |

3.

|

To

authorize a reverse stock split within a range of one (1) post-split common share for each

ten (10) pre-split common shares outstanding on the record date and one hundred (100) pre-split

common shares outstanding on the record date, at any time within one (1) year of the approval

of this Proposal. In this regard, the Board of Directors reserves its right to elect not

to proceed, and abandon, the reverse stock split if it determines, in its sole discretion,

that this proposal is no longer in the best interests of the Company’s shareholders;

|

☐

FOR ☐ AGAINST ☐ ABSTAINS ☐ WITHHOLDS

| |

4.

|

To

approve, on an advisory, non-binding basis, the compensation of our named executive officers (“Say-on-Pay”); |

☐

FOR ☐ AGAINST ☐ ABSTAINS ☐ WITHHOLDS

| |

5.

|

To

consider and conduct a non-binding advisory vote on a proposal regarding the frequency of advisory votes on executive compensation. |

☐

FOR ☐ AGAINST ☐ ABSTAINS ☐ WITHHOLDS

| |

6. |

To

withhold the proxy’s discretionary vote on your behalf with regards to any other matters that are properly presented for a

vote at the Annual Meeting, please mark the box below. |

This

Proxy, when properly executed, will be voted in the matter directed herein by the undersigned shareholder. If no direction is made, this

Proxy will be voted FOR each of the proposals.

Dated:

________________, 2022

| |

|

| Signature

of Shareholder |

|

| |

|

| |

|

| Signature

of Shareholder |

|

Please

date and sign exactly as your name(s) appears hereon. If the shares are registered in more than one name, each joint owner or fiduciary

should sign personally. When signing as executor, administrator, trustee or guardian give full titles. Only authorized officers should

sign for a corporation.

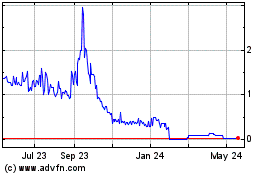

Stem (CE) (USOTC:STMH)

Historical Stock Chart

From Nov 2024 to Dec 2024

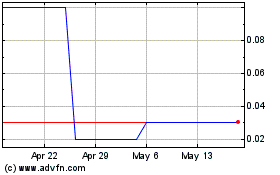

Stem (CE) (USOTC:STMH)

Historical Stock Chart

From Dec 2023 to Dec 2024