TomaGold

Corporation (TSXV: LOT,

OTC:

TOGOF)

FOLLOW

TOMAGOLD AND REGISTER HERE

A

recent report by Goldman Sachs spoke to the start of a

commodity

super cycle and without

going into the current discussion of gold vs crypto let me just

remind people that you cannot crypto "mine" unless you have the

commodity; particularly

metals from

mining that create NVidia

video cards,

electricity for power and the building or coolant to keep these

energy intensive pursuits going. You do not have crypto without

real mining and before we get carried away on what the future holds

lets deal with the reality of that necessity.

We need resources and there is a

company in the right location, with the smart

investors,

great

trading

volumes and activity that is positioned to make a strong move in

2021. Tomagold

has hit most

of the checkboxes to position itself for success with

the right

commodity in gold, excellent

strategic partnerships, impressive

trading

volume, outstanding regions to be

working in and exciting drill targets.

Watch video

interview with the CEO of Tomagold - Click Here

2021 looks

good for Tomagold.

Tomagold

is

known for acquisition, assessment, exploration and development of

gold mineral properties. The

company has interests

in five gold properties near the Chibougamau mining camp in

northern Quebec: Obalski,

Monster Lake East, Monster Lake West, Hazeur

and Lac

Doda

and

a

joint venture with Evolution Mining Ltd and New Gold Inc., through

which it holds a 24.5% interest in the Baird property, near the Red

Lake mining camp in Ontario.

The

last

6

months has been a

flurry of activity as the company canceled a proposed spinout back

in August as gold

continued its strength and the value of their assets increased.

More opportunities presented themselves and Tomagold

have

been nimble enough

to pivot and complete several transactions, strategic board and

advisory member changes with

focus on

its Obalski

Project.

The company

has drawn

attention and

60

million shares have traded hands over the past half year. That

illustrates the strong interest in the new vision of the new team

as we enter this

commodity

super cycle.

Six

Projects

Baird

Property

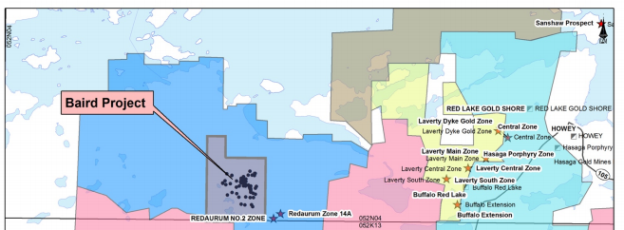

The Baird

property is a joint venture with Evolution

Mining and New Gold Inc. in the central Red Lake gold

belt six kilometres north of the Madsen Mine and fourteen

kilometres southwest of the Goldcorp Red Lake

Mine. TomaGold holds a 24.5% interest in the

property, with New Gold Inc. holding a 24.5% interest and

Evolution Mining as operator, owning the

remaining 51% interest. The nearly 8 billion market

cap Evolution Mining purchased the entire

Red Lake District from Goldcorp back in 2019.

Having such an impressive partner is this region provides blue

sky potential for

TomaGold.

Chibougamau

mining camp in northern Quebec.

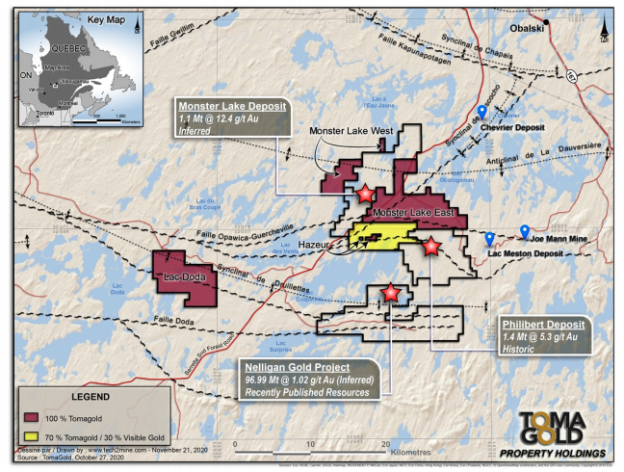

Tomagold

has five projects

in this mining camp: Lac Doda, Monster Lake East &

West, Hazeur and the flagship

Obalski

Property. Let us

consider this chronologically:

July

9th

Tomagold

signing of an

option agreement (the "Agreement") for the sale of up to an 80%

interest in the Lac Doda Property

to Goliath

Resources Limited (TSXV: GOT) ("Goliath"). The Lac

Doda

Property consists

of 80 mining claims covering 4,478 hectares and is located

approximately 20 km southwest of the Monster Lake property in the

Chibougamau mining camp in Quebec.

625,000 common

shares and 625,000 warrants, each warrant entitling the holder to

acquire one common share of Goliath at a price of $0.24 over a

36-month period. Today GOT.V is trading at $0.45 which is almost a

100% gain in 6 months on this transaction. If you are curious about

Goliath Resources and its potential,

please look at

the following:

Goliath and

Goliath News.

Sept

17 Last

month it closed a deal to sell its 25% undivided interest in the

Monster Lake project and the related mineral rights to IAMGOLD

(TSX: IMG, NYSE: IAG). It received $500,000 and was issued 1,464,377

common shares of IMG. At a $4.59 price for IMG, the current market

value of this deal is $7.2 million.

Obalski Property

On

December

8th,

2020 Tomagold announced of a seven-hole, 2,500-metre

drilling program on its flagship Obalski project. The company owns a 100%

stake in this 345-hectare

property, a

former gold-copper producer that hosts seven currently known

mineralized zones. It's 2 km south of Chibougamau, Quebec, in the

heart of the Chibougamau mining camp. It produced 100,273 tonnes

at grades of 1.14% Cu, 2.08 g/t Au and 6.04 g/t Ag between 1964 to

1972 and around 9,000 tonnes at a reported grade of 8.5 g/t Au in

1984.

Management

With strong partnerships and

new board and team members breathing life into an exciting

commodity cycle, the company is best

considered as a fresh and new project. President and CEO David

Grondin has had one heck of a tie in the past 2 years assembling,

creating and dealing Tomagold into a strong position

with

great potential

for success. The news release from October

6, 2020 details the capital markets, geological technical acumen

and current success in the mining sector. There are far too many

wonderful additions,

but my

subscribers will recognize Victor Cantore, President and CEO of

Amex Exploration on the Advisory Board.

"With

the Monster Lake transaction, our stronger financial position and

our promising gold projects in the Chibougamau and Red Lake mining

camps, it was time to better align our corporate structure with our

new stated objective of becoming a premier Canadian gold mining

company,"

said David Grondin, President and Chief Executive Officer of

TomaGold.

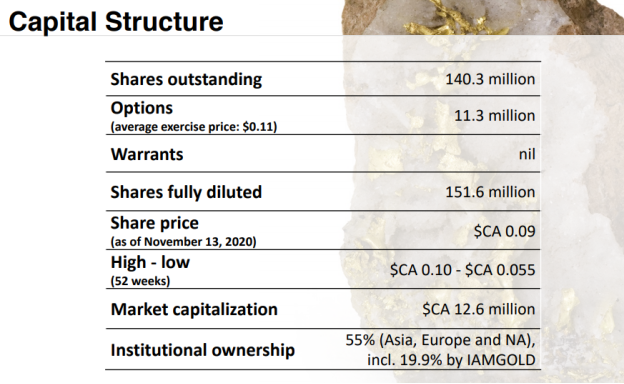

Capital Structure and Stock

Tomagold

has roughly

140

million shares out with 11.3 million stock options

out. This is a

decent amount of stock out, but the past 6 months

has

shown a big turnover of old investors for new. This bodes well not

only for liquidity but in the continued strength in the mining

sector.

One final

comment: back in January 2020 TomaGold sold its 39.5% interest in

Sidace

Lake property

to Pacton Gold Inc. (TSXV: PAC, OTC:

PACXF) for $250,000 and issue 10,000,000

common shares to TomaGold. There are details to this

transaction which did complete back on April 30, 2020 but if you

look at Pacton Gold the company is doing

exceptionally well.

This is a strong

consideration. Great mining friendly locations, looking for gold

which will continue to shine and attract many with its stability in

chaotic times. I am looking forward to what the new team and new

vision brings to TomaGold.

Watch video

interview with the CEO of Tomagold - Click Here

FOLLOW TOMAGOLD

AND REGISTER HERE

Don't forget to

follow us @Chargingstocks for real-time news updates on

Twitter!

Securities

Disclosure: I, Andrew O'Donnell have stock and have been paid

for this article.

General

Disclaimer: I am not a certified financial analyst, licensed

broker, fund dealer, Exempt Market dealer nor hold a professional

license to offer investment advice. We provide no legal opinion

regarding accounting, tax or law. Nothing in an article, report,

commentary, interview, and other content constitutes or can be

construed as investment advice or an offer or solicitation to buy

or sell stock or commodity. These are all expressed opinions of the

author. Information is obtained from research of public media,

news, original source documents and content available on the

company's website, regulatory filings, various stock exchange

websites, and stock information services, through discussions with

company representatives, agents, other professionals and investors,

and field visits. While the information is believed to be accurate

and reliable, it is not guaranteed or implied to be so. The

material on this site may contain technical or inaccuracies,

omissions, or typographical errors, we assume no responsibility.

SuperChargedStock.com does not warrant or make any representations

regarding the use, validity, accuracy, completeness or reliability

of any claims, statements or information on this site. It is

provided in good faith but without any legal responsibility or

obligation to provide future updates. I accept no responsibility,

or assume any liability, whatsoever, for any direct, indirect or

consequential loss arising from the use of the information. All

information is subject to change without notice, may become

outdated, and will not be updated. A report, commentary, this

website, interview, and other content reflect my personal opinions

and views and nothing more. All content of this website is subject

to international copyright protection and no part or portion of

this website, report, commentary, interview, and other content may

be altered, reproduced, copied, emailed, faxed, or distributed in

any form without the express written consent of Andrew O

Donnell.

Tomagold (PK) (USOTC:TOGOF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tomagold (PK) (USOTC:TOGOF)

Historical Stock Chart

From Dec 2023 to Dec 2024