TIDMAADV

(Albion Development VCT PLC)

LEI Code 213800FDDMBD9QLHLB38

As required by the UK Listing Authority's Disclosure Guidance

and Transparency Rule 4.2, Albion Development VCT PLC today makes

public its information relating to the Half-yearly Financial Report

(which is unaudited) for the six months to 30 June 2023. This

announcement was approved by the Board of Directors on 19 September

2023.

The full Half-yearly Financial Report (which is unaudited) for

the period to 30 June 2023 will shortly be sent to shareholders and

will be available on the Albion Capital Group LLP website by

clicking

https://www.globenewswire.com/Tracker?data=xxDqXwgVWFMVrM-eJ1XEtdibHA1XxbY6_FnGlYia8EV5Q28Fsuy4brIPt7SV3A00vY4Ilm3rZ0wRrxj_9fDg3DMAxpNyUB5SkY4np9pyRAL_31ntSxS2PLUmnptNwROchRkmkebiVTKMv-rwSBejdsyW6jViwNcCVGEIWon-2Nk=

www.albion.capital/funds/AADV/30Jun2023.pdf.

Investment policy

The Company will invest in a broad portfolio of higher growth

businesses with a stronger focus on technology companies across a

variety of sectors of the UK economy. Allocation of assets will be

determined by the investment opportunities which become available

but efforts will be made to ensure that the portfolio is

diversified in terms of sector and stage of maturity of

company.

Funds held pending investment or for liquidity purposes will be

held as cash on deposit or up to 8% of its assets, at the time of

investment, in liquid open-ended equity funds providing income and

capital equity exposure (where it is considered economic to do

so).

Risk diversification and maximum exposures

Risk is spread by investing in a number of different businesses

within venture capital trust qualifying industry sectors using a

mixture of securities. The maximum amount which the Company will

invest in a single portfolio company is 15% of the Company's assets

at cost thus ensuring a spread of investment risk. The value of an

individual investment may increase over time as a result of trading

progress and it is possible that it may grow in value to a point

where it represents a significantly higher proportion of total

assets prior to a realisation opportunity being available.

The Company's maximum exposure in relation to gearing is

restricted to 10% of the adjusted share capital and reserves.

Financial calendar

8 September 2023 Record date for second dividend

29 September 2023 Payment of second dividend

31 December Financial year end

Financial summary

Unaudited six months ended Unaudited six months ended Audited year ended

Ordinary 30 June 2023 30 June 2022 31 December 2022

shares (pence per share) (pence per share) (pence per share)

-------------- -------------------------- -------------------------- -------------------

Opening net

asset value 88.65 94.98 94.98

Capital

return/(loss) 4.89 0.69 (2.36)

Revenue return 0.26 0.26 0.49

-------------------------- -------------------------- -------------------

Total

return/(loss) 5.15 0.95 (1.87)

Dividends paid (2.22) (2.37) (4.71)

Impact of

share capital

movements 0.17 (0.01) 0.25

-------------------------- -------------------------- -------------------

Net asset

value 91.75 93.55 88.65

-------------- -------------------------- -------------------------- -------------------

Total dividends paid to 30 June 2023 115.79

Net asset value as at 30 June 2023 91.75

------

Total shareholder value to 30 June 2023 207.54

---------------------------------------- ------

The financial summary above is for the Company, Albion

Development VCT PLC Ordinary shares only. Details of the financial

performance of the C shares and D shares, which have been merged

into the Ordinary shares, can be found at

https://www.globenewswire.com/Tracker?data=xxDqXwgVWFMVrM-eJ1XEtdibHA1XxbY6_FnGlYia8EXXTVbHAsFtXefBCCLZJl88L4McMChNQaGiVcAwibmdIsybTAMiO2mD7L1wsWzF4bD7GCEpeYbVN0eqnFg7whad

www.albion.capital/funds/AADV under the 'Financial summary for

previous funds' section.

A more detailed breakdown of the dividends paid per year can be

found at

https://www.globenewswire.com/Tracker?data=xxDqXwgVWFMVrM-eJ1XEtdibHA1XxbY6_FnGlYia8EXT82Zzg7QA6epLHt6X-Sb9bG9zxU7BwQFodk5pKw4gQjLzvCYRfyv6_COB31kGNi8lett4DtNp_sc3wbVKHD7h

www.albion.capital/funds/AADV under the 'Dividend History'

section.

In addition to the dividends summarised above, the Board has

declared a second dividend for the year ending 31 December 2023, of

2.29 pence per Ordinary share to be paid on 29 September 2023 to

shareholders on the register on 8 September 2023.

Interim management report

Introduction

In the six months to 30 June 2023, the Company generated a

positive total return of 5.15 pence per share, representing a 5.8%

return on opening net asset value ("NAV"). During the period, the

Company continued to face a difficult macroeconomic and

geopolitical backdrop, including persistent high levels of

inflation, rising interest rates and volatility of quoted

technology companies. Despite this, the Board is encouraged by the

positive total return generated by the Company and optimistic that

many of the portfolio companies will continue to grow.

Valuations and results

The total gain on investments for the period to 30 June 2023 was

GBP7.7 million (30 June 2022: GBP1.9 million; 31 December 2022:

loss of GBP0.6 million). The key movement to the total gain was

Quantexa increasing its value by GBP10.0 million following an

externally led $129 million Series E fundraising, which completed

in April 2023. The latest funding round made it the first "Unicorn"

of 2023 (a private company valuation over $1 billion) and the Board

are excited about its future prospects.

Other gains in the period included Radnor House School and

Ophelos, which resulted in a combined uplift of GBP0.9 million.

These gains were partially offset by write downs with the most

significant being in Black Swan Data which decreased by GBP1.7

million.

The NAV per share has increased to 91.75 pence per share (30

June 2022: 93.55 pence per share; 31 December 2022: 88.65 pence per

share).

Our top 3 portfolio companies now account for 33.8% of the

Company's NAV (30 June 2022: 26.6%; 31 December 2022: 27.6%).

Further details of the portfolio of investments can be found

below.

Dividends

In line with our variable dividend policy targeting 5% of NAV

per annum, the Company paid a dividend of 2.22 pence per share

during the period to 30 June 2023 (30 June 2022: 2.37 pence per

share). The Company will pay a second dividend for the financial

year ending 31 December 2023 of 2.29 pence per share on 29

September 2023 to shareholders on the register on 8 September 2023,

being 2.5% of this 30 June 2023 NAV.

This will bring the total dividends paid for the year ending 31

December 2023 to 4.51 pence per share, which equates to a 5.1%

yield on the opening NAV of 88.65 pence per share.

Investment activity

Given the economic uncertainty of high inflation and rising

interest rates, in addition to the 15 new investments the Company

made in 2022, the first half of 2023 has been more subdued in terms

of new investment activity. During the period the Company has

invested GBP0.6 million into existing portfolio companies to help

support them as they continue to grow, including GBP0.4 million

into Proveca and GBP0.1 million into Seldon Technologies.

Investment activity has started to increase after the period

end, with GBP1.6 million invested into new and follow on

investments since 30 June 2023.

The chart at the end of this announcement illustrates the

composition of the portfolio by industry sector as at 30 June

2023.

Share buy-backs

It remains the Board's primary objective to maintain sufficient

resources for investment in existing and new portfolio companies

and for the continued payment of dividends to shareholders. The

Board's policy is to buy back shares in the market, subject to the

overall constraint that such purchases are in the Company's

interest.

It is the Board's intention for such buy-backs to be in the

region of a 5% discount to net asset value, as far as market

conditions and liquidity permit.

Risks and uncertainties

The Company faces a number of significant risks including rising

interest rates, high levels of inflation, the ongoing impact of

geopolitical tensions, and an expected period of economic

stagnation, or even recession in the UK. The concentration risk to

the technology sector, is noted as technology company valuations

have become more volatile in the current economic climate. Overall

investment risk is mitigated through a variety of processes. The

Manager is continually assessing the exposure to these risks for

each portfolio company and appropriate actions, where possible, are

being implemented.

In accordance with the Disclosure Guidance and Transparency

Rules ("DTR"), the Board confirms that the principal risks and

uncertainties facing the Company have not materially changed from

those identified in the Annual Report and Financial Statements for

the year ended 31 December 2022. There is heightened uncertainty,

but this has not changed the nature of the principal risks. The

Board considers that the present processes for mitigating those

risks remain appropriate.

The principal risks faced by the Company are:

-- Investment, performance, technology and valuation risk;

-- VCT approval risk;

-- Regulatory and compliance risk;

-- Operation and internal control risk;

-- Cyber and data security risk;

-- Economic, political and social risk;

-- Liquidity risk; and

-- Environmental, social and governance ("ESG") risk.

A detailed analysis of the principal risks and uncertainties

facing the business can be found in the Annual Report and Financial

Statements for the year ended 31 December 2022 on pages 23 to 25,

copies of which are available on the Company's webpage on the

Manager's website at www.albion.capital/funds/AADV under the

'Financial Reports and Circulars' section.

Transactions with the Manager

Details of transactions with the Manager for the reporting

period can be found in note 5. Details of related party

transactions can be found in note 11.

Albion VCTs Top Up Offers

The 2022/23 Offers were fully subscribed and closed having

raised GBP13 million for the Company. The Board was pleased to see

the high level of demand for the Company's shares from existing and

new shareholders.

The proceeds are being used to provide support to our existing

portfolio companies and to enable us to take advantage of new

investment opportunities as they arise. Details on the share

allotments during the period can be found in note 8.

Shareholder seminar

The Board is pleased to report that the Manager, Albion Capital,

is to host a physical shareholder seminar this year on 15 November

2023, at the Royal College of Surgeons, Lincoln's Inn Fields,

London. The Board considers this an important interactive event and

invites shareholders to attend. To reserve a place, please email

https://www.globenewswire.com/Tracker?data=ltpelyvt5bzG98-_ZymFmtkrZv7r4FCKBvK6d840DrJFyP7i-FBANa4QCDTvcsjaDRWkPzNJ8J7zFbnrn6EdmDDdZkqmkPCvcPPClMq7tTg=

info@albion.capital.

Move to electronic communications

The Board wishes to minimise the environmental impact of how the

Company communicates with its shareholders. With this in mind,

those shareholders that continue to receive physical copies of the

Annual Report and other documentation, will receive a letter

alongside this Half-yearly Financial Report explaining the

forthcoming move to electronic communications.

Prospects

Although there remains many uncertainties facing the Company,

with the high levels of inflation, elevated interest rates and

geopolitical tensions, the results for the period demonstrate the

resilience of our portfolio during these challenging times. The

portfolio remains well diversified, with companies at different

stages of maturity and across a variety of different sectors, many

of which have minimal exposure to consumer expenditure. We remain

confident that the Company will continue to provide positive

results to its shareholders over the long-term.

Ben Larkin

Chairman

19 September 2023

Portfolio of investments

As at 30 June 2023

Fixed asset % voting Cost Cumulative movement in value Value Change in value for the period*

investments rights GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------- -------- -------------------------------

Quantexa 2.1 2,101 22,857 24,958 10,046

Egress Software

Technologies 6.9 2,332 6,517 8,849 (174)

Proveca 11.8 2,244 5,957 8,201 165

Oviva 2.8 2,601 1,179 3,780 (375)

Radnor House School

(TopCo) 8.5 1,560 1,943 3,503 484

The Evewell Group 5.8 1,407 1,454 2,861 21

Healios 3.3 1,977 522 2,499 -

Chonais River Hydro 4.6 1,705 714 2,419 86

The Street by

Street Solar

Programme 12.4 1,291 952 2,243 (132)

Convertr Media 6.2 992 913 1,905 (35)

Regenerco Renewable

Energy 11.9 1,204 606 1,810 (176)

Threadneedle

Software Holdings

(T/A Solidatus) 2.0 1,209 488 1,697 (248)

Panaseer 3.1 1,122 532 1,654 (283)

Cantab Research

(T/A

Speechmatics) 1.6 1,337 235 1,572 (188)

Runa Network 1.9 1,259 285 1,544 -

Peppy Health 1.6 1,424 - 1,424 -

Toqio FinTech

Holdings 1.9 1,369 - 1,369 -

Aridhia Informatics 5.8 1,129 88 1,217 (183)

Gravitee TopCo 2.2 923 236 1,159 -

TransFICC 1.8 891 196 1,087 -

InCrowd Sports 4.1 642 433 1,075 165

Alto Prodotto Wind 9.4 590 425 1,015 46

Seldon Technologies 2.9 1,002 - 1,002 -

Elliptic

Enterprises 0.7 984 - 984 -

PeakData 2.1 922 54 976 (15)

Ophelos 2.0 527 441 968 441

Beddlestead 8.6 1,026 (121) 905 (38)

NuvoAir Holdings 1.4 570 234 804 (41)

GX Molecular (T/A

CS Genetics) 2.5 741 - 741 -

Cisiv 5.3 686 29 715 307

OutThink 2.4 610 - 610 -

Locum's Nest 5.6 663 (57) 606 (358)

Perchpeek 1.9 597 - 597 -

Accelex Technology 2.0 361 195 556 195

Diffblue 2.2 509 - 509 -

The Q Garden

Company 16.6 466 32 498 -

PetsApp 2.3 425 - 425 -

Koru Kids 1.8 573 (160) 413 (69)

AVESI 10.5 340 70 410 (44)

Imandra 1.8 236 112 348 (16)

Arecor Therapeutics

PLC 0.5 190 157 347 (12)

5Mins AI 1.9 340 - 340 -

Dragon Hydro 5.5 187 133 320 13

Brytlyt 2.0 416 (98) 318 (98)

Neurofenix 2.6 523 (296) 227 (296)

Ramp Software 1.8 267 - 267 -

uMedeor (T/A uMed) 1.2 192 68 260 66

MHS 1 3.3 231 14 245 -

Tem Energy 1.6 212 - 212 -

Greenenerco 4.0 96 75 171 9

DySIS Medical 1.0 1,038 (869) 169 12

Regulatory Genome

Development 0.8 125 42 167 42

Premier Leisure

(Suffolk) - 109 21 130 -

Erin Solar 4.3 120 3 123 -

Mirada Medical 2.7 909 (806) 103 -

Symetrica 0.3 102 (6) 96 12

Infact Systems 1.8 91 - 91 -

Black Swan Data 6.3 3,307 (3,257) 50 (1,660)

uMotif 3.1 941 (940) 1 (93)

Limitless

Technology 2.4 648 (648) - (326)

Elements Software 0.6 3 (3) - -

Total fixed asset investments 52,594 40,951 93,545 7,250

----------------------------- -------- ---------------------------- -------- -------------------------------

* As adjusted for additions and disposals during the year;

including realised gains/(losses).

Investment

realisations

in the period

to 30 June Cost Opening value Disposal proceeds Total realised gain/(loss) Gain/(loss) on opening value

2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- -------- ------------- ----------------- -------------------------- ----------------------------

Disposals:

-------------

Zift Channel

Solutions 885 326 468 (417) 142

Arecor

Therapeutics

PLC 104 196 203 99 7

Oxsensis 439 10 11 (428) 1

Forward

Clinical

(T/A Pando) 219 - - (219) -

Loan stock

repayments

and other:

-------------

Alto Prodotto

Wind 28 42 42 14 -

Greenenerco 4 6 6 2 -

Escrow

adjustments* - - 74 74 74

Total 1,679 580 804 (875) 224

------------- -------- ------------- ----------------- -------------------------- ----------------------------

* These comprise fair value movements on deferred consideration

on previously disposed investments

GBP'000

Total change in value of investments for the year 7,250

Movement in accrued loan stock interest 33

-------

Unrealised gains on fixed asset investments sub-total 7,283

Realised gains in the current period 224

Unwind of discount on deferred consideration 168

-------

Total gains on investments as per Income statement 7,675

-------------------------------------------------------- -------

Responsibility statement

The Directors, Ben Larkin, Lyn Goleby, Lord O' Shaughnessy and

Patrick Reeve, are responsible for the preparation of the

Half-yearly Financial Report. In preparing these condensed

Financial Statements for the period to 30 June 2023 we, the

Directors of the Company, confirm that to the best of our

knowledge:

(a) the condensed set of Financial Statements, which has been

prepared in accordance with Financial Reporting Standard 104

"Interim Financial Reporting", give a true and fair view of the

assets, liabilities, financial position and profit and loss of the

Company as required by DTR 4.2.4R;

(b) the Interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

(c) the Interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

This Half-yearly Financial Report has not been audited or

reviewed by the Auditor.

For and on behalf of the Board

Ben Larkin

Chairman

19 September 2023

Condensed income statement

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

---------------------------------------------------------- ---- ---------------------------- ---------------------------- ----------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Gains/(losses) on investments 3 - 7,675 7,675 - 1,880 1,880 - (636) (636)

Investment income 4 684 - 684 591 - 591 1,194 - 1,194

Investment Manager's fees 5 (133) (1,201) (1,334) (120) (1,079) (1,199) (245) (2,207) (2,452)

Other expenses (201) - (201) (168) - (168) (358) - (358)

---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit/(loss) on ordinary activities before tax 350 6,474 6,824 303 801 1,104 591 (2,843) (2,252)

Tax charge on ordinary activities - - - - - - - - -

---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit/(loss) and total comprehensive income attributable

to shareholders 350 6,474 6,824 303 801 1,104 591 (2,843) (2,252)

---------------------------------------------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Basic and diluted return/(loss) per share (pence)* 7 0.26 4.89 5.15 0.26 0.69 0.95 0.49 (2.36) (1.87)

---------------------------------------------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

* adjusted for treasury shares

The accompanying notes below form an integral part of this

Half-yearly Financial Report.

Comparative figures have been extracted from the unaudited

Half-yearly Financial Report for the six months ended 30 June 2022

and the audited statutory accounts for the year ended 31 December

2022.

The total column of this Condensed income statement represents

the profit and loss account of the Company. The supplementary

revenue and capital columns have been prepared in accordance with

The Association of Investment Companies' Statement of Recommended

Practice.

Condensed balance sheet

Unaudited Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

Note GBP'000 GBP'000 GBP'000

----------------------- ---- ------------- ------------- -----------------

Fixed asset investments 93,545 80,152 86,286

Current assets

Trade and other

receivables 2,531 2,604 2,403

Cash in bank and at

hand 29,273 33,776 26,491

------------- ------------- -----------------

31,804 36,380 28,894

Payables: amounts

falling due within one

year

Trade and other

payables (958) (933) (722)

------------- ------------- -----------------

Net current assets 30,846 35,447 28,172

Total assets less

current liabilities 124,391 115,599 114,458

------------- ------------- -----------------

Equity attributable to

equity holders

Called-up share capital 8 1,536 1,388 1,456

Share premium 34,277 20,772 26,837

Unrealised capital

reserve 40,897 33,434 32,516

Realised capital

reserve 6,125 10,759 8,032

Other distributable

reserve 41,556 49,246 45,617

------------- ------------- -----------------

Total equity

shareholders' funds 124,391 115,599 114,458

------------- ------------- -----------------

Basic and diluted net

asset value per share

(pence)* 91.75 93.55 88.65

----------------------- ---- ------------- ------------- -----------------

*excluding treasury shares

The accompanying notes below form an integral part of this

Half-yearly Financial Report.

Comparative figures have been extracted from the unaudited

Half-yearly Financial Report for the six months ended 30 June 2022

and the audited statutory accounts for the year ended 31 December

2022.

These Financial Statements were approved by the Board of

Directors and authorised for issue on 19 September 2023, and were

signed on its behalf by

Ben Larkin

Chairman

Company number: 03654040

Condensed statement of changes in equity

Capital Unrealised Realised Other

Called-up share Share redemption capital capital distributable

capital premium reserve reserve reserve* reserve* Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------- --------------- ------- ---------- ---------- -------- ------------- -------

As at 1 January 2023 1,456 26,837 - 32,516 8,032 45,617 114,458

Profit/(loss) and total comprehensive income for the

period - - - 7,283 (809) 350 6,824

Transfer of previously unrealised losses on disposal

of investments - - - 1,098 (1,098) - -

Purchase of shares for treasury - - - - - (1,399) (1,399)

Issue of equity 80 7,639 - - - - 7,719

Cost of issue of equity - (199) - - - - (199)

Dividends paid - - - - - (3,012) (3,012)

As at 30 June 2023 1,536 34,277 - 40,897 6,125 41,556 124,391

----------------------------------------------------- --------------- ------- ---------- ---------- -------- ------------- -------

As at 1 January 2022 1,167 - - 36,048 7,344 53,080 97,639

Profit/(loss) and total comprehensive income for the

period - - - (885) 1,686 303 1,104

Transfer of previously unrealised gains on disposal

of investments - - - (1,729) 1,729 - -

Purchase of shares for treasury - - - - - (1,212) (1,212)

Issue of equity 221 21,297 - - - - 21,518

Cost of issue of equity - (525) - - - - (525)

Dividends paid - - - - - (2,925) (2,925)

As at 30 June 2022 1,388 20,772 - 33,434 10,759 49,246 115,599

----------------------------------------------------- --------------- ------- ---------- ---------- -------- ------------- -------

As at 1 January 2022 1,167 - - 36,048 7,344 53,080 97,639

Profit/(loss) and total comprehensive income for the

year - - - (3,258) 415 591 (2,252)

Transfer of previously unrealised gains on disposal

of investments - - - (273) 273 - -

Purchase of shares for treasury - - - - - (2,244) (2,244)

Issue of equity 288 27,509 - - - - 27,797

Cost of issue of equity - (672) - - - - (672)

Dividends paid - - - - - (5,810) (5,810)

----------------------------------------------------- --------------- ------- ---------- ---------- -------- ------------- -------

As at 31 December 2022 1,456 26,837 - 32,516 8,032 45,617 114,458

----------------------------------------------------- --------------- ------- ---------- ---------- -------- ------------- -------

*Included within these reserves is an amount of GBP26,789,000

(30 June 2022: GBP31,131,000; 31 December 2022: GBP24,619,000)

which is considered distributable. Over the next two years an

additional GBP18,627,000 will become distributable. This is due to

the HMRC requirement that the Company cannot use capital raised in

the past three years to make a payment or distribution to

shareholders.

Condensed statement of cash flows

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

--------------------- ----------------- ----------------- -----------------

Cash flow from

operating activities

Loan stock income

received 452 586 996

Dividend income

received 5 78 133

Income from fixed

term funds received 95 9 59

Deposit interest

received 131 9 47

Investment Manager's

fees paid (1,247) (2,916) (4,216)

Other cash payments (220) (213) (338)

Corporation tax paid - - -

----------------- ----------------- -----------------

Net cash flow

generated from

operating

activities (784) (2,447) (3,319)

Cash flow from

investing activities

Purchase of fixed

asset investments (589) (5,136) (14,235)

Disposal of fixed

asset investments 887 7,265 7,946

Net cash flow

generated from

investing

activities 298 2,129 (6,289)

----------------- ----------------- -----------------

Cash flow from

financing activities

Issue of share

capital 7,043 20,491 26,132

Cost of issue of

shares (19) - (36)

Equity dividends

paid* (2,508) (2,405) (4,785)

Purchase of own

shares (including

costs) (1,248) (1,024) (2,244)

----------------- ----------------- -----------------

Net cash flow

generated from

financing

activities 3,268 17,062 19,067

----------------- ----------------- -----------------

Increase in cash in

bank and at hand 2,782 16,744 9,459

Cash in bank and at

hand at start of

period 26,491 17,032 17,032

----------------- ----------------- -----------------

Cash in bank and at

hand at end of

period 29,273 33,776 26,491

--------------------- ----------------- ----------------- -----------------

*The equity dividends paid shown in the cash flow are different

to the dividends disclosed in note 6 as a result of the non-cash

effect of the Dividend Reinvestment Scheme.

Notes to the condensed Financial Statements

1. Basis of preparation

The Financial Statements have been prepared in accordance with

applicable United Kingdom law and accounting standards, including

Financial Reporting Standard 102 ("FRS 102"), and with the

Statement of Recommended Practice "Financial Statements of

Investment Trust Companies and Venture Capital Trusts" ("SORP")

issued by The Association of Investment Companies ("AIC"). The

Financial Statements have been prepared on a going concern

basis.

The preparation of the Financial Statements requires management

to make judgements and estimates that affect the application of

policies and reported amounts of assets, liabilities, income and

expenses. The most critical estimates and judgements relate to the

determination of carrying value of investments at Fair Value

Through Profit and Loss ("FVTPL") in accordance with FRS 102

sections 11 and 12. The Company values investments by following the

International Private Equity and Venture Capital Valuation ("IPEV")

Guidelines as updated in 2022 and further detail on the valuation

techniques used are outlined in note 2 below.

Company information can be found on page 4 of the full

Half-yearly Financial Report.

2. Accounting policies

Fixed asset investments

The Company's business is investing in financial assets with a

view to profiting from their total return in the form of income and

capital growth. This portfolio of financial assets is managed and

its performance evaluated on a fair value basis, in accordance with

a documented investment policy, and information about the portfolio

is provided internally on that basis to the Board.

In accordance with the requirements of FRS 102, those

undertakings in which the Company holds more than 20% of the equity

as part of an investment portfolio are not accounted for using the

equity method. In these circumstances the investment is measured at

FVTPL.

Upon initial recognition (using trade date accounting)

investments, including loan stock, are classified by the Company as

FVTPL and are included at their initial fair value, which is cost

(excluding expenses incidental to the acquisition which are written

off to the Income statement).

Subsequently, the investments are valued at 'fair value', which

is measured as follows:

-- Investments listed on recognised exchanges are valued at their bid prices

at the end of the accounting period or otherwise at fair value based on

published price quotations.

-- Unquoted investments, where there is not an active market, are valued

using an appropriate valuation technique in accordance with the IPEV

Guidelines. Indicators of fair value are derived using established

methodologies including earnings multiples, revenue multiples, the level

of third party offers received, cost or price of recent investment rounds,

net assets, and industry valuation benchmarks. Where price of recent

investment is used as a starting point for estimating fair value at

subsequent measurement dates, this has been benchmarked using an

appropriate valuation technique permitted by the IPEV guidelines.

-- In situations where cost or price of recent investment is used,

consideration is given to the circumstances of the portfolio company

since that date in determining fair value. This includes consideration of

whether there is any evidence of deterioration or strong definable

evidence of an increase in value. In the absence of these indicators,

other valuation techniques are employed to conclude on the fair value as

at the measurement date. Examples of events or changes that could

indicate a diminution include:

-- the performance and/or prospects of the underlying business are

significantly below the expectations on which the investment was based;

-- a significant adverse change either in the portfolio company's business

or in the technological, market, economic, legal or regulatory

environment in which the business operates; or

-- market conditions have deteriorated, which may be indicated by a fall in

the share prices of quoted businesses operating in the same or related

sectors.

Investments are recognised as financial assets on legal

completion of the investment contract and are de-recognised on

legal completion of the sale of an investment.

Dividend income is not recognised as part of the fair value

movement of an investment, but is recognised separately as

investment income through the other distributable reserve when a

share becomes ex-dividend.

Current assets and payables

Receivables (including debtors due after more than one year),

payables and cash are carried at amortised cost, in accordance with

FRS 102. Deferred consideration meets the definition of a financing

transaction held at amortised cost, and interest will be recognised

through capital over the credit period using the effective interest

method. There are no financial liabilities other than payables.

Investment income

Dividend income

Dividend income is included in revenue when the investment is

quoted ex-dividend.

Unquoted loan stock

Fixed returns on non-equity shares and debt securities are

recognised when the Company's right to receive payment and expect

settlement is established. Where interest is rolled up and/or

payable at redemption then it is recognised as income unless there

is reasonable doubt as to its receipt.

Fixed term funds income

Funds income is recognised on an accruals basis using the agreed

rate of interest.

Bank deposit income

Interest income is recognised on an accruals basis using the

rate of interest agreed with the bank.

Investment management fee, performance incentive fee and other

expenses

All expenses have been accounted for on an accruals basis.

Expenses are charged through the other distributable reserve except

the following which are charged through the realised capital

reserve:

-- 90% of management fees and 100% of performance incentive fees, if any,

are allocated to the realised capital reserve; and

-- expenses which are incidental to the purchase or disposal of an

investment are charged through the realised capital reserve.

Taxation

Taxation is applied on a current basis in accordance with FRS

102. Current tax is tax payable (refundable) in respect of the

taxable profit (tax loss) for the current period or past reporting

periods using the tax rates and laws that have been enacted or

substantively enacted at the financial reporting date. Taxation

associated with capital expenses is applied in accordance with the

SORP.

Deferred tax is provided in full on all timing differences at

the reporting date. Timing differences are differences between

taxable profits and total comprehensive income as stated in the

Financial Statements that arise from the inclusion of income and

expenses in tax assessments in periods different from those in

which they are recognised in the Financial Statements. As a VCT the

Company has an exemption from tax on capital gains. The Company

intends to continue meeting the conditions required to obtain

approval as a VCT in the foreseeable future. The Company therefore,

should have no material deferred tax timing differences arising in

respect of the revaluation or disposal of investments and the

Company has not provided for any deferred tax.

Reserves

Called-up share capital

This accounts for the nominal value of the Company's shares.

Share premium

This accounts for the difference between the price paid for

shares and the nominal value of those shares, less issue costs and

transfers to the other distributable reserves.

Capital redemption reserve

This reserve accounts for amounts by which the issued share

capital is diminished through the repurchase and cancellation of

the Company's own shares.

Unrealised capital reserve

Increases and decreases in the valuation of investments held at

the year end against cost are included in this reserve.

Realised capital reserve

The following are disclosed in this reserve:

-- gains and losses compared to cost on the realisation of investments, or

permanent diminutions in value (including gains recognised on the

realisation of investment where consideration is deferred that are not

distributable as a matter of law);

-- finance income in respect of the unwinding of the discount on deferred

consideration that is not distributable as a matter of law;

-- expenses, together with the related taxation effect, charged in

accordance with the above policies; and

-- dividends paid to equity holders where paid out by capital.

Other distributable reserve

The special reserve, treasury share reserve and the revenue

reserve were combined in 2012 to form a single reserve named other

distributable reserve.

This reserve accounts for movements from the revenue column of

the Income statement, the payment of dividends, the buy-back of

shares, transfers from the share premium and capital redemption

reserve, and other non-capital realised movements.

Dividends

Dividends by the Company are accounted for when the liability to

make the payment (record date) has been established.

Segmental reporting

The Directors are of the opinion that the Company is engaged in

a single operating segment of business, being investment in smaller

companies principally based in the UK.

3. Gains/(losses) on investments

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

---------------------

Unrealised

gains/(losses) on

fixed asset

investments 7,283 (885) (3,258)

Realised gains on

fixed asset

investments 224 2,621 2,322

Unwinding of discount

on deferred

consideration 168 144 300

7,675 1,880 (636)

----------------- ----------------- -----------------

4. Investment income

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

---------------------

Loan stock interest 420 474 916

Dividend income 37 100 172

Income from fixed

term funds 95 9 59

Bank interest 132 8 47

----------------- ----------------- -----------------

684 591 1,194

----------------- ----------------- -----------------

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

5. Investment Manager's fees GBP'000 GBP'000 GBP'000

-----------------------------

Investment management fee

charged to revenue 133 120 245

Investment management fee

charged to capital 1,201 1,079 2,207

1,334 1,199 2,452

----------------- ----------------- -----------------

Further details of the Management agreement under which the

investment management fee and performance incentive fee are paid

are given in the Strategic report on page 18 of the Annual Report

and Financial Statements for the year ended 31 December 2022.

During the period, services to a total value of GBP1,344,000 (30

June 2022: GBP1,199,000; 31 December 2022: GBP2,452,000) were

purchased by the Company from Albion Capital Group LLP ("Albion").

At the financial period end, the amount due to Albion in respect of

these services was GBP690,000 (30 June 2022: GBP650,000; 31

December 2022: GBP618,000). The total annual running costs of the

Company are capped at an amount equal to 2.5% of the Company's net

assets, with any excess being met by Albion by way of a reduction

in management fees. During the period, the management fee was

reduced by GBP10,000 as a result of this cap (30 June 2022: GBPnil;

31 December 2022: GBP41,000).

During the period, the Company was not charged by Albion in

respect of Patrick Reeve's services as a Director (30 June 2022:

GBPnil; 31 December 2022: GBPnil).

Albion, its Partners and staff (including Patrick Reeve) hold

1,158,636 Ordinary shares in the Company as at 30 June 2023.

The Manager is, from time to time, eligible to receive

arrangement fees and monitoring fees from portfolio companies.

During the period ended 30 June 2023, fees of GBP65,000

attributable to the investments of the Company were paid pursuant

to these arrangements (30 June 2022: GBP108,000; 31 December 2022:

GBP257,000).

The Company has entered into an offer agreement relating to the

Offers with the Company's investment manager Albion, pursuant to

which Albion will receive a fee of 2.5% of the gross proceeds of

the Offers and out of which Albion will pay the costs of the

Offers, as detailed in the Prospectus.

6. Dividends

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

--------------------------------------------------------

First dividend of 2.22p per share paid on 31 May 2023

(31 May 2022: 2.37p per share) 3,012 2,925 2,925

Second dividend of 2.34p per share paid on 30 September

2022 - - 2,892

Unclaimed dividends - - (7)

3,012 2,925 5,810

----------------- ----------------- -----------------

In addition to the dividends summarised above, the Board has

declared a second dividend for the year ending 31 December 2023 of

2.29 pence per share (total approximately GBP3,105,000), payable on

29 September 2023 to shareholders on the register on 8 September

2023.

7. Basic and diluted return/(loss) per share

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

Revenue Capital Revenue Capital Revenue Capital

-------------- --------- -------- --------- -------- --------- --------

Return/(loss)

attributable

to Ordinary

shares

(GBP'000) 350 6,474 303 801 591 (2,843)

Weighted

average

shares in

issue 132,550,358 115,738,554 120,150,815

Return/(loss)

per Ordinary

share

(pence) 0.26 4.89 0.26 0.69 0.49 (2.36)

The weighted average number of shares is calculated after

adjusting for treasury shares of 18,036,957 (30 June 2022:

15,282,637; 31 December 2022: 16,468,548).

There are no convertible instruments, derivatives or contingent

share agreements in issue so basic and diluted return per share are

the same.

8. Called-up share capital

Allotted, called-up and fully paid Ordinary shares Unaudited Unaudited Audited

of 1 penny each 30 June 2023 30 June 2022 31 December 2022

---------------------------------------------------

Number of shares 153,611,717 138,850,411 145,582,300

Nominal value of allotted shares (GBP'000) 1,536 1,388 1,456

Voting rights (number of shares net of treasury

shares) 135,574,760 123,567,774 129,113,752

During the period to 30 June 2023 the Company purchased

1,568,409 Ordinary shares (nominal value GBP15,684) for treasury at

a cost of GBP1,399,000. The total number of Ordinary shares held in

treasury as at 30 June 2023 was 18,036,957 (30 June 2022:

15,282,637; 31 December 2022: 16,468,548) representing 11.7% of the

Ordinary shares in issue as at 30 June 2023.

Under the terms of the Dividend Reinvestment Scheme, the

following new Ordinary shares of nominal value 1 penny each, were

allotted during the period to 30 June 2023:

Aggregate

Number nominal

of value of Issue price Net

Date of shares shares (pence per invested Opening market price on allotment date (pence per

allotment allotted (GBP'000) share) (GBP'000) share)

31 May

2023 536,739 5 92.70 478 88.50

Under the terms of the Albion VCTs Prospectus Top Up Offers

2022/23, the following new Ordinary shares, of nominal value 1

penny each, were allotted during the period to 30 June 2023:

Aggregate

nominal Net

Number of value of Issue price consideration

Date of shares shares (pence per received Opening market price on allotment date (pence per

allotment allotted (GBP'000) share) (GBP'000) share)

31 March

2023 7,134,319 71 96.40 6,706 89.50

14 April

2023 98,702 - 95.40 93 89.50

14 April

2023 26,068 - 95.90 24 89.50

14 April

2023 233,589 2 96.40 220 89.50

7,492,678 7,043

--------- -------------

9. Commitments and contingencies

As at 30 June 2023, the Company had no financial commitments (30

June 2022: GBPnil; 31 December 2022: GBPnil).

There were no contingencies or guarantees of the Company as at

30 June 2023 (30 June 2022: GBPnil; 31 December 2022: GBPnil).

10. Post balance sheet events

There have been no material post balance sheet events since 30

June 2023.

11. Related party transactions

Other than transactions with the Manager as disclosed in note 5,

there are no other related party transactions or balances requiring

disclosure.

12. Going concern

The Board has conducted a detailed assessment of the Company's

ability to meet its liabilities as they fall due. Cash flow

forecasts are updated and discussed quarterly at Board level and

have been stress tested to allow for the forecasted impact of of

the current economic climate and increasingly volatile geopolitical

backdrop. The Board have revisited and updated their assessment of

liquidity risk and concluded that it remains unchanged since the

last Annual Report and Financial Statements. Further details can be

found on page 88 of those accounts.

The portfolio of investments is diversified in terms of sector

and the major cash outflows of the Company (namely investments,

dividends and share buy-backs) are within the Company's control.

Accordingly, after making diligent enquiries, the Directors have a

reasonable expectation that the Company has adequate cash and

liquid resources to continue in operational existence for the

foreseeable future. For this reason, the Directors have adopted the

going concern basis in preparing this Half-yearly Financial Report

and this is in accordance with the Guidance on Risk Management,

Internal Control and Related Financial and Business Reporting

issued by the Financial Reporting Council in September 2014, and

the subsequent updated Going concern, risk and viability guidance

issued by the FRC in 2021.

13. Other information

The information set out in this Half-yearly Financial Report

does not constitute the Company's statutory accounts within the

terms of section 434 of the Companies Act 2006 for the periods

ended 30 June 2023 and 30 June 2022 and is unaudited. The

information for the year ended 31 December 2022, does not

constitute statutory accounts within the terms of section 434 of

the Companies Act 2006 but is derived from the audited statutory

accounts for the financial year, which have been delivered to the

Registrar of Companies. The Auditor reported on those accounts;

their report was unqualified and did not contain a statement under

s498 (2) or (3) of the Companies Act 2006.

14. Publication

This Half-yearly Financial Report is being sent to shareholders

and copies will be made available to the public at the registered

office of the Company, Companies House, the National Storage

Mechanism and also electronically at

https://www.globenewswire.com/Tracker?data=xxDqXwgVWFMVrM-eJ1XEtdibHA1XxbY6_FnGlYia8EVvnzgLrTTqlwj4N_KQrFLYqPNti0oXVC1aEDwRBkMXw2-pW9IaiKIhOyG32RlrylkBZXgrLy8mqTSE-RAbDLqg

www.albion.capital/funds/AADV, where the Report can be accessed

from the 'Financial Reports and Circulars' section.

Attachment

-- AADV Pie Chart 30 June 2023

https://ml-eu.globenewswire.com/Resource/Download/912c9c4a-2670-49c5-9828-23c01fb5154d

(END) Dow Jones Newswires

September 19, 2023 06:00 ET (10:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

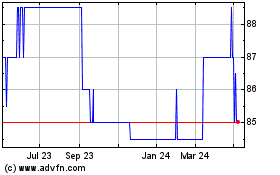

Albion Development Vct (LSE:AADV)

Historical Stock Chart

From Mar 2024 to Apr 2024

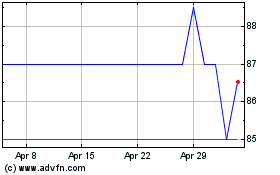

Albion Development Vct (LSE:AADV)

Historical Stock Chart

From Apr 2023 to Apr 2024