- First-half revenue stable at nearly €300m despite

unfavorable year-end holiday season calendar

- Double-digit growth in profitability1 expected in H1

2024-2025

- Deconsolidation of the myDevices division

- Ruling issued in Luxembourg in legal proceedings with Mr.

Pierre Cesarini

This press release presents unaudited Group

consolidated revenue, prepared in accordance with IFRS.

Regulatory News:

Claranova (Euronext Paris: FR0013426004 - CLA) reported strong

revenue for H1 2024-2025 (July - December 2024) of €294m, holding

steady in relation to last year's first-half like-for-like (-1% at

actual exchange rates). The performance in H1 2024-2025 is all the

more noteworthy given the unfavorable year-end holiday season

calendar for the Group's key markets (United States and United

Kingdom). In particular, the exceptional proximity of Thanksgiving

and Christmas (less than 4 weeks) reduced the number of sale days

for key products during this period (greeting cards, gift cards,

personalized gifts, etc.). This shorter period also put

considerable pressure on the supply chain for delivering

personalized Christmas goods such as gift cards made from

traditional Thanksgiving photos.

In this context, Claranova's teams overcame these logistical

challenges and confirmed their ability to effectively execute

digital marketing campaigns with Q2 2024-2025 revenue remaining

steady at €206m versus €207m last year.

In addition to demonstrating the resilience of sales, in line

with Group's strategy, the teams continued to focus on improving

profitability. Thanks to this fine-tuned management of sales and

the first measures of the “One Claranova” plan (start of work on

tax optimization, capitalization of R&D expenses), Claranova is

expecting double-digit growth in EBITDA2 for H1 2024-2025.

Based on this positive momentum for profitability, the Group

reaffirms its 20273 target of 5%-8%4 for CAGR or total annual

revenue of €575m-€625m, accompanied by an EBITDA margin of 13%-15%,

and a ratio of net financial debt to EBITDA of less than 1x.

Eric Gareau, Chief Executive Officer of Claranova commented:

"Claranova's teams were able to overcome the commercial and

logistical hurdles created by a tighter calendar for the year-end

holiday season. Not only did they execute their plans with success,

but they also further improved their operating margins despite 5

fewer promotional days than last year. Thanks to our resilience and

agility, we reported solid sales for the first half and are on

track for achieving further gains in profitability."

Revenue trends by division for Q2 2024-2025:

In €m

Oct.-Dec. 2024* (3

months)

Oct.-Dec. 2023** (3

months) Comparable consolidation scope

Oct.-Dec. 2023 (3 months)

Reported basis

Change

Comparable consolidation

scope

Change at constant exchange

rates

Change at constant consolidation

scope

Change on a like-for-like

basis

PlanetArt

174

174

174

-1%

-2%

-1%

-2%

Avanquest

33

33

33

0%

0%

0%

1%

myDevices

0

0

3

na

na

na

na

Revenue

206

207

210

-1%

-2%

0%

-1%

Revenue trends by division for H1 2024-2025:

In €m

Jul.-Dec. 2024* (6

months)

Jul.-Dec. 2023** (6

months)

Comparable consolidation

scope

Jul.-Dec. 2023 (6

months)

Reported basis

Change

Comparable consolidation

scope

Change at constant exchange

rates

Change at constant consolidation

scope

Change on a like-for-like

basis

PlanetArt

234

235

235

0%

-1%

0%

-1%

Avanquest

60

61

61

-3%

-1%

1%

3%

myDevices

0

0

5

na

na

na

na

Revenue

294

296

301

-1%

-1%

0%

0%

*Because the myDevices division is henceforth considered as a

non-core business, on November 5, 2024, Claranova tasked the

investment bank, Canaccord Genuity, with the mission of selling

this division. As a result, the division is no longer included in

the Group's scope of consolidation under IFRS 5. ** 2023-2024

revenue restated to exclude the myDevices division

PlanetArt: Robust business with a focus on

profitability

PlanetArt, the Group's e-commerce division for personalized

objects, reported consolidated sales for H1 2024-2025 of €234m,

compared with €235m one year earlier, despite a shorter promotional

period during the year-end holiday season as explained above. This

good level of sales, particularly in the Mobile segment, confirms

the pertinence of the new customer acquisition channels rolled out

in recent years, the division's ability to optimize its marketing

campaigns, and its agility in terms of product logistics.

Avanquest: new developments planned for the second

half

Avanquest, the software publishing subsidiary, reported H1

revenue of €60m, up 3% like-for-like (-3% at actual exchange rates,

largely reflecting the proportion of non-core activities sold off

in October 20235). With the contribution of non-core activities in

the U.S. continuing to decline, it now accounts for only 8% of the

division's sales for the first half of the year, or €4.8m at

December 31, 2024.

On this basis, the percentage of core business consisting of the

sale of proprietary SaaS products accounted for 92% of total H1

revenue (down from 88% one year earlier) or €55.2m, representing

growth of +2%. During the first half, Avanquest teams developed new

technologies and applications for the division's key segments,

which are expected to drive growth in sales in H2 2024-2025.

Update on legal proceedings pending with Pierre Cesarini:

judgment rendered by the Luxembourg Labor Court

As mentioned in previous Group communications6, Mr. Pierre

Cesarini filed lawsuits against Group companies contesting his

dismissals and seeking total compensation of €15m, including

approximately €14m in a claim filed with the Luxembourg Labor Court

(Tribunal du Travail de et à Luxembourg).

The Luxembourg Labor Court issued its ruling on the claim filed

by Mr. Pierre Cesarini against Claranova Development SARL on

January 16, 2025. In particular, this court determined that it

lacked jurisdiction to rule on this matter as it was not

established that Mr. Pierre Cesarini had been an employee of

Claranova Development SARL. It also ordered Mr. Pierre Cesarini to

pay the costs of the proceedings. To date, Pierre Cesarini has not

appealed this ruling.

Financial calendar: March 27, 2025: H1

2024-2025 results

About Claranova:

Claranova is a global leader in e-commerce for personalized

objects (photo prints, photo books, children's books, etc.),

software publishing (PDF, Photo and Security) and the Internet of

Things (IoT). As a truly international group, in 2024 it reported

revenue of nearly a half a billion euros, with 95% of this amount

originating from outside France.

Through its products and solutions sold in over 160 countries,

the Group's mission is to "Transform technological innovation into

user-centric solutions". By leveraging its digital marketing

expertise, AI and the analysis of data from over 100 million active

customers worldwide, Claranova develops technological solutions,

available online, on mobile devices and tablets, for a wide range

of private and professional customers.

Operating in high-potential markets, the Group will pursue a

growth strategy focused on profitability and operational

excellence, in line with its "One Claranova" strategic roadmap.

Claranova is eligible for French “PEA-PME” tax-advantaged

savings accounts

For more information on Claranova Group:

https://www.claranova.com or

https://twitter.com/claranova_group

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

Definitions and calculation methods for alternative

performance indicators:

“Like-for-like” (organic) growth is defined as the change in

revenue at constant structure (scope of consolidation) and exchange

rates. “Exchange rate effects” are calculated by applying year N-1

exchange rates to year N revenue. “Consolidation scope effects” are

calculated by taking into account acquisitions in the current year,

contributions to the current year from acquisitions in the previous

year up to the anniversary date of acquisitions and businesses

deconsolidated in the current year, minus any contributions from

the previous year. By definition, sales for the previous year plus

the effects of changes in Group scope of consolidation, exchange

rate effects and like-for-like growth for the period correspond to

sales for the current year. Percentages for exchange rate effects,

Group consolidation scope effects and like-for-like growth

percentages are calculated on the basis of the previous year's

sales.

1 EBITDA as a percentage of revenue. 2 EBITDA (earnings before

interest, taxes, depreciation and amortization) is a non-GAAP

aggregate used to measure the operating performance of the

businesses. It equals Recurring Operating Income before the impact

of IFRS 2 (share-based payment expenses), depreciation and

amortization, and the IFRS 16 impact on the recognition of leases.

3 FY 2026-2027 4 At constant consolidation scope without external

growth 5 Press release of October 19, 2023 6 Press releases of

August 1, 2024 and October 30, 2024

CODES Ticker: CLA ISIN: FR0013426004

www.claranova.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211296692/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 68

ir@claranova.com

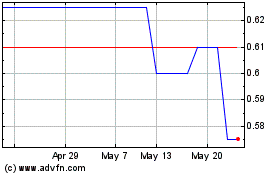

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jan 2025 to Feb 2025

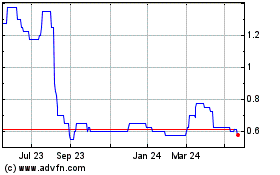

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Feb 2024 to Feb 2025