TIDMGRL

RNS Number : 3720S

Goldstone Resources Ltd

13 July 2022

13 July 2022

GOLDSTONE RESOURCES LIMITED

("GoldStone" or the "Company")

Conversion of Loan

Issue of Equity

GoldStone Resources Limited (AIM: GRL), the emerging gold

producer and developer focussed on Ghana,

is pleased to announce that it has reached agreement with

Paracale Gold Limited ("Paracale") for the conversion of its total

outstanding loan and associated interest into fully paid new

ordinary shares of 1p each in the Company ("Ordinary Shares") (the

"Loan Conversion").

As announced 28 December 2018, Paracale, a company associated

with Bill Trew, Chairman of Goldstone, provided the Company with a

loan of US$1.224 million which accrues interest at 6% per annum

(the "Loan"). On 29 July 2021, Paracale reduced the principal

amount and interest due by the exercise of warrants to subscribe

for 20,000,000 new Ordinary Shares at a price of 1.2 pence per

Ordinary Share (the "Warrant Conversion Exercise") at nil cost,

with the Warrant Conversion Exercise proceeds being set off against

the Loan. Accordingly, following the Warrant Conversion Exercise,

the balance of the Loan was reduced to US$723,669. Interest

continued to accrue on this outstanding principal balance in

accordance with the terms of the Loan agreement.

The outstanding Loan, totalling US$766,522 (including the

accrued interest of US$42,853), which equates to GBP642,085 at an

exchange rate of 0.83766, will be converted into 9,802,821 new

Ordinary Shares (the "Conversion Shares") at a price of 6.55 p per

Ordinary Share, being the closing mid-market price per share on 12

July 2022, being the latest practicable date at the time of

signing.

Following the Loan Conversion, there are no outstanding loans or

warrants held by Paracale.

Emma Priestley, CEO of GoldStone, commented :

"Paracale Gold share our vision for the development of the

Akrokeri-Homase Project in Ghana and have been a tremendous support

to GoldStone in recent years and continue to be so following the

conversion of their outstanding loan to equity.

"As the Company has transitioned from explorer and developer to

commercial gold producer, the future of GoldStone is very

encouraging. The elimination of Paracale's loan will reduce debt on

the balance sheet and will further support the growth of the

Company. With sufficient cash being generated from gold sales

already, this latest conversion will go further to maintain the

Company's cash position for operational developments and the Board

is confident that it remains well positioned to continue the ramp

up of production at Homase."

Admission and Total Voting Rights

The Conversion Shares will rank pari passu with the existing

Ordinary Shares and application will be made for the 9,802,821

Conversion Shares to be admitted to trading on AIM ("Admission").

It is expected that Admission will become effective and dealings in

the Conversion Shares will commence at 8.00 a.m. on or around 19

July 2022.

On Admission, Paracale, which currently holds 115,853,754

Ordinary Shares in GoldStone, representing 24.0% of the Company's

current issued share capital, will hold 125,656,575 Ordinary Shares

representing 25.52% of the Company's enlarged share capital.

Together with his direct interest in the Company of 4,000,000

Ordinary Shares, Bill Trew, as a director and shareholder of

Paracale, will, in aggregate, hold an interest in 129,656,575

Ordinary Shares representing approximately 26.33% of the Company's

enlarged share capital on Admission.

Upon Admission, the Company's issued ordinary share capital will

consist of 492 ,436,817 Ordinary Shares with one voting right each.

The Company does not hold any Ordinary Shares in treasury,

therefore the total number of Ordinary Shares and voting rights in

the Company on Admission will be 492 ,436,817. With effect from

Admission, this figure may be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the share capital of the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Related Party Transactions

Paracale, a company of which Bill Trew, Chairman of Goldstone,

is a director and substantial shareholder, is a substantial

shareholder of the Company and is a related party of the Company as

defined in the AIM Rules for Companies ("AIM Rules").

Accordingly, the Loan Conversion is deemed to be a related party

transaction pursuant to Rule 13 of the AIM Rules and the

independent directors, being Emma Priestley, Richard Wilkins and

Orrie Fenn, consider, having consulted with the Company's nominated

adviser, Strand Hanson Limited, that the terms and conditions of

the Loan Conversion are fair and reasonable insofar as the

shareholders of the Company are concerned.

- ENDS-

For further information, please contact:

GoldStone Resources Limited

Bill Trew / Emma Priestley Tel: +44 (0)1534 487 757

Strand Hanson Limited

James Dance / James Bellman Tel: +44 (0)20 7409 3494

S. P. Angel Corporate Finance

LLP

Ewan Leggat / Charlie Bouverat Tel: +44 (0)20 3470 0501

About GoldStone Resources Limited

GoldStone Resources Limited (AIM: GRL) is an AIM quoted

exploration and development company with projects in Ghana that

range from grassroots exploration to development.

The Company is focused on developing the Akrokeri-Homase project

in south-western Ghana, which hosts a JORC Code compliant 602,000

oz gold resource at an average grade of 1.77 g/t. The existing

resource is confined to a 4km zone of the Homase Trend, including

Homase North, Homase Pit and Homase South.

The project hosts two former mines, the Akrokerri Ashanti Mine

Ltd, which produced 75,000 oz gold at 24 g/t recovered grade in the

early 1900s, and the Homase Pit which AngloGold Ashanti developed

in 2002/03 producing 52,000 oz gold at 2.5 g/t recovered. It is the

Company's intention to build a portfolio of high-quality gold

projects in Ghana, with a particular focus on the highly

prospective Ashanti Gold Belt.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CONDZGMNZFVGZZM

(END) Dow Jones Newswires

July 13, 2022 09:00 ET (13:00 GMT)

Goldstone Resources (LSE:GRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

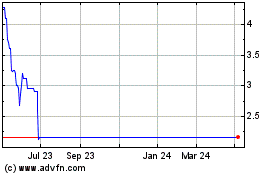

Goldstone Resources (LSE:GRL)

Historical Stock Chart

From Apr 2023 to Apr 2024