TIDMGV1O

RNS Number : 6785Q

Gresham House Renewable EnergyVCT1

29 June 2022

29 June 2022

Gresham House Renewable Energy VCT 1 PLC

LEI: 213800IVQHJXUQBAAC06

Half Year Results

These half-year results will be available on the Company's

website at

https://greshamhouse.com/real-assets/new-energy-sustainable-infrastructure/gresham-house-renewable-energy-vct-1-plc/

.

In accordance with Listing Rule 9.6.1, copies of these documents

will also be submitted to the UK Listing Authority via the National

Storage Mechanism and will be available for viewing shortly at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

For further information, please contact:

Gresham House Asset Management renewablevcts@greshamhouse.com

Investor Relations Tel: 020 7382 0999

JTC (UK) Limited GreshamVCTs@jtcgroup.com

Company Secretary Tel: 020 3846 9774

Shareholder information

Performance summary

27 June 31 March 30 September 31 March

2022 2022 2021 2021

Pence Pence Pence Pence

Net asset value per Ordinary Share 90.8 90.1 92.5

------- -------- ------------ --------

Net asset value per 'A' Share 0.1 0.1 0.1

------- -------- ------------ --------

Cumulative dividends* 57.1 57.1 57.1

------- -------- ------------ --------

Total Return* 148.0 147.3 149.7

------- -------- ------------ --------

Share Price - Ordinary (GV1O) 88.0 88.0 91.0 97.0

------- -------- ------------ --------

Share Price - A Shares (GV1A) 5.05 5.05 5.05 5.05

------- -------- ------------ --------

* for a holding of one Ordinary Share and A Share

Dividends

Ordinary

Shares 'A' Shares Total

Pence Pence Pence

2011 Final 30 March 2012 3.5 - 3.5

------------------ -------- ---------- ------

2012 Final 28 March 2013 5.0 - 5.0

------------------ -------- ---------- ------

2013 Special 28 February 2014 7.3 3.7 11.0

------------------ -------- ---------- ------

2013 Final 28 March 2014 5.0 - 5.0

------------------ -------- ---------- ------

2015 Interim 18 September 2015 5.0 - 5.0

------------------ -------- ---------- ------

2016 Interim 16 September 2016 5.0 - 5.0

------------------ -------- ---------- ------

2017 Interim 15 September 2017 5.0 - 5.0

------------------ -------- ---------- ------

2018 Interim 14 December 2018 5.5 0.5 6.0

------------------ -------- ---------- ------

2019 Interim 20 December 2019 5.3 0.5 5.8

------------------ -------- ---------- ------

2020 Interim 31 December 2020 5.3 0.5 5.8

------------------ -------- ---------- ------

51.9 5.2 57.1

-------------------------------- -------- ---------- ------

Dividends are paid by the registrar on behalf of the VCT.

Shareholders who wish to have dividends paid directly into their

bank account and did not complete these details on their original

application form can complete a mandate form for this purpose.

Forms can be obtained from Link Asset Services.

Chairman's statement

I am pleased to present the Half-Yearly Report of Gresham House

Renewable Energy VCT 1 plc ("VCT") for the period ended 31 March

2022.

The period under review has less solar irradiation than the

second half of the year over the spring and summer months. The

total revenue from the renewable assets was just 0.3% behind

budget, at GBP3.5 million. This was despite higher than expected

irradiation (6.7%) as some of the assets are showing signs of their

age and under performing. Much time and effort has been spent over

the period on correcting the problems that have occurred.

Inevitably there are cost attached to such repairs and this has

impacted the cash flow available to the VCT, however I am pleased

to report that the work carried out in the last financial year on

three major assets has resulted in very significantly improved

performance for those sites, and we anticipate that the further

work being undertaken will similarly improve performance

shortly.

Turning to the matter of the sale of the solar assets, it had

been hoped that the sales process, commenced in the late summer of

2021, would have been concluded by the end of 2021. However,

certain issues were uncovered during the due diligence process

which were complex and/or requiring negotiation with third parties,

resulted in the process being more protracted than expected. These

issues have taken some time to resolve to the satisfaction of the

potential purchaser. A couple of key issues remain outstanding, but

it is hoped that these can be addressed soon so that a sale can be

agreed and closed. Given the age of the portfolio, it is not wholly

unsurprising that potential buyers raised additional concerns

largely relating to warranties and performance of the

equipment.

Investment portfolio

At the period end, the VCT held a portfolio of 16 investments,

which were valued at GBP27.2 million.

The portfolio is analysed (by value) between the different types

of assets as follows:

Ground mounted solar 80.1%

Rooftop solar 8.5%

Small wind 4.3%

Non-renewable assets 7.1%

The Board has reviewed the investment valuations at the

half-year and notes that the valuation of the portfolio has not

changed and remains at GBP27.2 million. Although the overall

valuation of the 16 investments has not changed since the valuation

at year end, there have been some movements in value between the

different types of assets.

Whilst the valuation of the portfolio at the half-year has been

positively impacted by the increase in power prices in the six

month period and by the increases in inflation projections, with

most of the revenue being linked to RPI, this increases the overall

profitability, and therefore valuation of the assets, these have

been offset by two key factors with the result that the valuation

of the portfolio has remained flat. Firstly, an increase in the

discount rate used by 50bp to 6.25% for the solar assets, as

explained below, and secondly a doubling of the allowance made for

the financial and administrative management fees of the underlying

companies.

The Board felt it prudent to adopt a more conservative approach

to the discount rate taking into consideration a backdrop of high

inflation and rising interest rates. It should be noted that the

revised rate is now more in line with the sector and other similar

portfolios. The sales process has indicated that the allowances

made for the financial and administrative management fees for the

underlying companies were insufficient given rising costs and the

complexity of managing a portfolio of this type and age. The Board

therefore decided to increase these costs.

As referred to above several problems have emerged during the

sale process. One in particular is worthy of mention, although the

Board do not expect it to be a problem in the longer-term. The

solar farm at South Marston sells its power to Honda, but Honda is

leaving the site and selling it to a third party. The negotiations

are proving complex and there is thus some uncertainty as to the

contractual arrangements for the sale of power going forward,

although it seems unlikely that the purchaser of the Honda site

would not want to have access to an existing and proven supply of

renewable energy on its doorstep.

Venture Capital investments

The VCT also holds two investments that are not in renewable

energy. A follow-on investment of GBP67,500 was made into bio-bean

Limited ("bio-bean") in December 2021 to fund the growth and

development of the business. The valuation of bio-bean has been

held at cost as at 31 March 2022, while the valuation of the VCT's

investment into Rezatec has increased by GBP0.2 million or 24.7%

since the investment was made, driven by non-cash interest income

accumulating on the preference shares in Rezatec.

Further detail on the investment portfolio is provided in the

Investment Adviser's Report.

Net asset value and results

At 31 March 2022, the Net Asset Value ("NAV") per Ordinary Share

stood at 90.8p and the NAV per 'A' Share stood at 0.1p, producing a

combined total of 90.9p per "pair" of Shares. The movement in the

NAV per share during the half-year is detailed in the table

below:

Pence per

'pair' of

shares

NAV as at 1 October

2021 90.2

Plus NAV increase 0.7

NAV as at 31 March

2022 90.9

Total dividends paid to date for a combined holding of one

Ordinary Share and one 'A' Share stand at 57.1p (September 2021:

57.1p). The NAV Total Return (NAV plus cumulative dividends) has

increased by 0.5% in the six months and now stands at 148.0p

excluding the initial 30% VCT tax relief, compared to the cost to

investors in the initial fundraising of GBP1.00 or 70.0p net of

income tax relief.

The profit on ordinary activities after taxation for the

half-year was GBP0.2 million (March 2021: GBP2.1 million loss),

comprising a revenue profit of GBP297,000 (March 2021: GBP229,000)

and a capital loss of GBP115,000 (March 2021: capital loss of

GBP2.3 million) as shown in the Income Statement.

2022 Annual General Meeting ("AGM")

The VCT's eleventh AGM was held on 23 March 2022 at 11.00 a.m.

and all resolutions were passed by way of a poll.

Outlook

As we look ahead the portfolio is in much better shape than it

was this time last year thanks to all the effort that has gone into

repairs and renewals. We very much hope that a sale of the solar

assets will be satisfactorily concluded in the near term. However,

if despite all the efforts made by the Board and the Investment

Adviser, with the sale process led by EY, this proves not to be

possible then, so as to comply with shareholders wishes to wind up

the company, the VCT will have to continue until the time is right

to re-market the assets. We would expect this re-marketing to take

place once the full financial year results are known and the

aforementioned issues have been resolved.

Gill Nott

Chairman

29June 2022

Investment Adviser's report

Portfolio highlights

Gresham House Renewable Energy VCT 1 plc remains principally

invested in the renewable energy projects that the VCT and VCT 2

have co-owned for a period of eight to eleven years, depending on

the asset, with the value of these projects representing well over

90% of the value of the portfolio. The total generation capacity of

assets co-owned by the VCT is 34.4MWp. The VCT also has two venture

capital investments.

During the half-year the sale process of the solar energy

projects that are owned jointly with Gresham House Renewable Energy

VCT 2 plc ("VCT 2"), was progressed. The two VCTs appointed EY to

prepare and run the sales process. A number of parties carried out

initial due diligence on the portfolio, and submitted non-binding

offers subject to further due diligence. One potential buyer was

granted exclusivity to perform detailed due diligence and

engagement with that party is ongoing.

The Investment Adviser has, in the meantime, continued to manage

the assets as if holding them for the long-term, whilst also

supporting the Board of the VCT and its advisers in advancing the

sale process.

The Investment Adviser has undertaken a valuation exercise and

provided the Directors with several valuation scenarios based on

different assumptions. The Directors have the responsibility of

valuing these assets. Although there is a sales process in

progress, it should be noted that the valuation is based on a

long-term hold basis.

The vast majority of the assets held by the VCT produce solar

power. The solar portfolio is relatively old compared to other

solar farms across the UK. They are older than well over 90% of

total solar capacity in the UK, but this means that the VCT's solar

farms have secured higher incentives than most other solar

installations in the UK.

The total revenue from renewable energy generation was

GBP3,521,029 and of this, GBP3,058,789 was from government

incentives and inflation-linked contracts. The total revenue from

the renewable assets was 0.3% behind budget.

The downside of the VCT's older assets is the additional

maintenance required to keep them operating effectively. Projects

to repair or replace certain components across the three worst

performing older sites were completed during the last financial

year. Performance since completion of the works has been

encouraging, with consistently increased output and reliability at

Kingston Farm and Lake Farm with new, 10-year warranties on some of

the key equipment (replacement inverters) and UK based technical

staff available for ongoing repairs or maintenance. The repairs at

Beechgrove Farm highlighted other issues which have since been

repaired under warranty during this half-year. These further

repairs are expected to deliver increased output during the second

half of this financial year.

In terms of available resources, the half-year benefited from

strong solar irradiation which came in at 6.7% ahead of budget.

This should have resulted in better generation performance but

there were technical issues at two of the ground mounted sites

(Beechgrove and Ayshford Court, as described below) and poorer than

expected performance of the roof mounted portfolio. These legacy

issues have been addressed through a successful warranty claim and

repair works.

In terms of the wider economy, the effects on the portfolio are

summarised below:

Power prices were significantly reduced through the pandemic and

price fixes were therefore sought in 2020 and early 2021, as soon

as Power Purchase Agreement ("PPA") providers began offering above

the budgeted levels at the time. Fixing the prices under PPAs

provided security of revenues. However, the fixed prices meant that

the portfolio has not been able to benefit from the increases in

wholesale power prices during the autumn and the further increases

that have been experienced after the Russian invasion of Ukraine.

These PPAs have started to expire and all will have expired by the

end of 2022. Assuming power price projections remain high, the

assets should have the opportunity to earn significantly higher

revenue from the sale of electricity (either on the wholesale

market or on new PPAs with higher prices) on expiry of the current

PPAs.

Whilst all works had to be suspended on residential roof mounted

solar installations last year as engineers were not permitted to

enter properties during lockdown, much of these have now been

carried out. Nevertheless, there continue to be some residents who

are shielding or are reticent to allow people into their homes and

so there are some repairs still outstanding.

With much of the portfolio's revenue being inflation linked,

higher inflation increases the profitability of the assets and

therefore their value, even though most of the cost base and the

debt facilities are also inflation-linked.

The VCT also holds newer investments in growth businesses;

bio-bean Limited, the world's largest recycler of waste coffee

grounds, which produces sustainable, clean fuels as well as

advanced biochemicals for use in the food industry; and Rezatec

Limited ("Rezatec"), a climate technology company and software

developer. Rezatec applies Artificial Intelligence based algorithms

to a range of earth observation data sources (satellite imagery,

soil data, weather data, topographic data etc.) to generate an

information services platform to help monitor land-based assets in

the forestry, agriculture and infrastructure sectors. Both

businesses continued to grow revenues in the period, though fell

short of their business plan objectives due to a number of factors

that will be covered later in the report.

Portfolio composition

Portfolio composition by asset type

31 March 2022 30 September 2021

% of % of

Value Portfolio Value Portfolio

Asset Type kWp ('000) value ('000) value

------- ----------- ----------- ---------- -----------

Ground mounted solar (FIT)* 20,325 GBP19,455 71.6% GBP19,341 71.2%

------- ----------- ----------- ---------- -----------

Ground mounted solar (ROC)** 8,699 GBP2,295 8.5% GBP2,264 8.3%

------- ----------- ----------- ---------- -----------

Total ground mounted

solar 29,024 GBP21,750 80.1% GBP21,605 79.5%

------- ----------- ----------- ---------- -----------

Rooftop solar (FIT) 4,304 GBP2,311 8.5% GBP2,602 9.5%

------- ----------- ----------- ---------- -----------

Total solar 33,328 GBP 24,061 88.6% GBP24,207 89.0%

------- ----------- ----------- ---------- -----------

Wind assets (FIT) 1,030 GBP1,177 4.3% GBP1,172 4.3%

------- ----------- ----------- ---------- -----------

Total renewable generating

assets 34,358 GBP25,238 92.9% GBP25,379 93.3%

------- ----------- ----------- ---------- -----------

Venture Capital investments N.A. GBP1,942 7.1% GBP1,814 6.7%

------- ----------- ----------- ---------- -----------

TOTAL 34,358 GBP27,180 100.0% GBP27,193 100.0%

------- ----------- ----------- ---------- -----------

* Feed in Tariff (FIT)

** Renewables Obligation Certificate (ROC)

The 34.4MWp of renewable energy projects in the portfolio of the

VCT and VCT 2 generated 9,810,747 kilowatt-hours of electricity

over the six months, sufficient to meet the annual electricity

consumption of circa 2,840 homes. The Investment Adviser estimates

that the carbon dioxide savings achieved by generating this output

from solar and wind versus gas-fired power, are equivalent to what

circa 5,700 mature trees would remove from the atmosphere. During

the half-year, residential rooftops of 5kWp capacity were written

off as the costs of rectification could not be justified by the

projected revenues even once repaired.

Portfolio summary

Approximately 93% of the portfolio value, and over 99% of the

income for the portfolio, is derived from the renewable energy

generation assets.

Renewable energy revenue by asset type

The performance against budget is shown below:

Portfolio revenues by asset type (GBP Sterling)

Budgeted Actual Revenue

Asset type revenue revenue performance

Ground mounted solar

(FIT) GBP2,582,878 GBP2,648,266 102.5%

-------------- -------------- -------------

Ground mounted solar

(ROC) GBP375,938 GBP380,968 101.3%

-------------- -------------- -------------

Roof mounted solar GBP343,256 GBP306,042 89.2%

-------------- -------------- -------------

Wind assets GBP231,071 GBP185,753 80.4%

-------------- -------------- -------------

TOTAL GBP3,533,143 GBP3,521,029 99.7%

-------------- -------------- -------------

The revenue is affected by:

Renewable energy resources (solar irradiation or wind, as

relevant);

The performance of the assets in converting the resources into

revenue (i.e. how the assets are performing, any technical issues,

etc); and

The revenue per unit of energy generated.

These themes will be expanded on below.

Renewable energy resources

The portfolio is heavily weighted to solar (96% by capacity of

the renewable assets, and 89% of total portfolio by value).

During the year the assets benefited from better solar resources

than budgeted, with solar irradiation being 6.7% ahead for the half

year.

Technical performance

The table below shows the technical performance for each of the

groups of assets.

Portfolio technical performance by asset type (kWh)

Actual output

(in the

same

Budgeted Actual Technical period last

Asset type output output performance year)

Ground mounted solar (FIT) 5,743,540 5,917,840 103.0% 4,345,581

---------- ----------- ------------ -------------

Ground mounted solar (ROC) 2,455,190 2,441,622 99.5% 2,296,349

---------- ----------- ------------ -------------

Roof mounted solar 998,414 934,415 93.6% 920,595

---------- ----------- ------------ -------------

Wind assets 642,972 516,870 80.4% 535,070

---------- ----------- ------------ -------------

TOTAL 9,840,116 9,810,747 99.7% 8,097,595

---------- ----------- ------------ -------------

The ground mounted solar (FIT) assets performed ahead of budgets

and significantly ahead of the same period last year.

The results of the successful repowering works at Kingston Farm

and Lake Farm (each with 4.98MW capacity, FIT assets) were evident

with Kingston Farm performing better than budget, even when

adjusting for better irradiation. The figures for Lake Farm were

slightly lower than budget when adjusted for irradiation but

nevertheless a significant improvement compared to the previous

year.

Beechgrove's (3.98MW, FIT) repowering works were completed just

before the end of the last financial year, however performance was

held back by another issue, cracking connectors at the back of its

solar panels which in turn were causing isolation faults on the

system. Following a root cause analysis this degradation of the

connectors was found to be caused by the high salt content in the

air due to the site's proximity to the sea. A warranty claim was

initiated against Jinko Solar, the manufacturer, and replacement

works involving the blanket replacement of all original connectors

with ones made from an improved polymer, which can withstand the

marine environment, are now taking place. The early signs are that

these will result in a significant improvement from the second half

of this financial year and going forward for the long-term.

Overall, the replacement works are expected to have a payback of

under five years and were largely paid for from cash held in

reserves for performing such works.

Ayshford Court (5.45MW, ROC) also exhibited lower than expected

performance. This was caused by a small number of failing solar

modules taking down entire strings across several modules. The

string-based configuration of many solar plants means that a small

number of module failures can take large parts of the plant

offline. The solution to this is close monitoring and a

rearrangement and redistribution of the solar modules such that the

faulty modules are grouped together. These works were carried out

in March and April 2022. A warranty claim is also in progress

against the manufacturer.

South Marston (4.97MW FIT) has historically sold all its power

to a Honda production plant adjacent to the site at Swindon. Honda

has closed down this facility and its exit is leading to changes of

contractual arrangements for the sale of power and potentially for

the technical set-up of the grid connection. The The Investment

Adviser is working with Honda and the new site owner to ensure

continuity of supply of power by the solar farm.

Generation of the rooftop solar portfolio was 6.4% lower than

budget and slightly up on the same period last year. Irradiation

cannot be measured at roof mounted solar installations as it is not

cost effective to install pyranometers but one can assume that the

irradiation at these sites was in line with the irradiation at the

ground mounted assets. The Investment Adviser continues to work

with the O&M contractors and landlords to get access to the

rooftop installations that are underperforming, to effect repairs

as soon as possible.

The small wind portfolio performed 19.6% lower than budget,

continuing the poor performance experienced in recent years. Small

wind accounts for only 3% of the portfolio in terms of capacity. In

the last financial year, the fleet of Huaying HY5 wind turbines,

which was plagued with technical issues and had been a net cash

drain, was disposed of. The VCT continues to own the fleet of R9000

wind turbines, which have generally performed better and have the

support of an experienced O&M contractor with easy access to

spare parts.

Revenue per kilowatt hour of renewable energy generated

The UK Government has used several mechanisms to encourage

investment into renewable energy generation, including the Feed in

Tariff ("FIT") and Renewables Obligation Certificate ("ROC")

support mechanisms.

The VCT's renewable assets benefit from these schemes which

provide revenues predominantly linked to the Retail Price Index

("RPI"). As both the costs and perceived risks of building new

renewable energy generating capacity have fallen, so have the value

of the incentives offered for new installations. For example, an

asset that generates electricity from solar power that was

commissioned and accredited for the FIT before the end of July 2011

received just under 40 pence for every kilowatt hour (kWh) of

electricity it produced (with the added extra of a floor price

support to ensure it may also sell this power at a reasonable

price). The incentives for new capacity have fallen consistently

since the assets owned by the VCT were commissioned, and new solar

installations built today receive no such incentives and must rely

on selling power for their income. In the six months to the end of

March 2022 the average spot price (day ahead) of power was 13 pence

per kWh so a new asset selling power at the spot price would earn

13 pence, whereas an older solar asset, like some of those owned by

the VCT, could earn at a minimum 3.95 pence per kWh for exporting

the power (given the FIT export price floor) plus 39.75 pence per

kWh FIT generation revenue.

Of total revenues generated of GBP3,521,029 in the half-year,

85% was earned from government backed incentives for generating

renewable electricity. Included within export revenue above, a

further 4% is inflation linked, either through the FIT export floor

price for selling electricity or contracts for the sale of

electricity, taking the government backed or RPI linked revenues to

89% of the total.

Such a high proportion of income that is fixed by the

government, is RPI linked and is not exposed to wholesale power

prices, is a significant driver of value in this portfolio. This

enabled the portfolio to be largely insulated from the very

significant reduction in the wholesale price of electricity

experienced during the pandemic. Whilst predictable, government

backed revenues reduce the risk, given the low power prices through

the first few months of the pandemic, when prices increased the

assets entered into fixed price contracts of various lengths to

sell power. This further reduced the risk of variability in

revenues from wholesale power price fluctuations. This was

beneficial when coming out of the pandemic but it has also meant

that the assets have not benefited from the increase in wholesale

power prices resulting from the war in Ukraine from February 2022.

The PPA contracts will expire during 2022 and so new contracts, at

higher prices, are expected to be available at the relevant

time.

Operating costs

The vast majority of the cost base is fixed and/ or contracted

and includes rent, business rates, and regular O&M costs.

The main cost item that shows variability from year-to-year is

repair and maintenance costs. Repair and maintenance spend

involving solar panels and inverters, the key components of a solar

project, is covered by cash held in the maintenance reserves. At

the year end these reserves totalled GBP1.1 million and are in

place for all the ground mounted solar assets and for the majority

of the roof mounted solar assets. During the year GBP0.2 million

was spent on the works at Beechgrove.

The Investment Adviser has historically modelled its charges for

managing the SPVs as being the relevant charges to include for

future periods. However, feedback from the sales process has

indicated that third parties would charge more to account for the

complexity of managing a portfolio of this type and age and which

includes leverage and a large number of distributed roof mounted

solar assets. The Investment Adviser has therefore updated the

ongoing cost assumptions used in the portfolio valuation to reflect

a 100% increase.

Venture Capital investments

The VCT holds an investment of GBP0.70 million (including the

GBP67,500 additional investment made in the half-year) in bio-bean,

the world's largest recycler of waste coffee grounds. bio-bean

sources waste coffee grounds from major retail coffee chains by

offering the cheapest and most sustainable avenue for disposing of

them. bio-bean then converts these into coffee logs for use in wood

burning stoves as well as into pellets for combustion in

biomass-fed energy generators. It sells the logs online, through

large supermarkets and through home improvement chains. bio-bean

also markets and sells dried coffee grounds for use in a diverse

set of applications including cosmetics, bioplastics and the

automotive industry. Demand for the coffee logs (the main product)

remains strong; it was adversely impacted by a warm spring but high

energy costs are likely to benefit it over the longer-term. The

new, higher margin dried coffee grounds is a developing market,

with first revenues achieved during the half-year and a pipeline of

business development opportunities that could lead to a

significantly improved profit outlook.

The key challenge will be to realise the investment in this

growth business in line with the disposal of the other VCT assets.

The market for secondary stakes in private, venture capital funded

companies is less liquid than the market for renewable energy

investments.

The VCT's other growth investment, Rezatec Limited ("Rezatec"),

has also made steady progress in the period, but not at the pace

envisaged by the company's management at the time of the investment

in January 2020. Companies with subscription-based business models

such as Rezatec are valued on the basis of Annual Recurring Revenue

(ARR), and the growth in this metric (Compound Annual Growth Rate

(CAGR) of 86% over the last five years) has been slower than

forecast.

The investment by the VCT was structured in a way that provided

an element of protection against slower than expected growth and

the dilution that can come with additional funding rounds.

Portfolio valuation

Whilst the Investment Adviser is supporting the proposed sale of

the VCT's renewable assets and notes that a firm offer to purchase

the assets will be the best indication of value, consistent with

prior years the Net Asset Value ("NAV") of the renewable portfolio

is imputed from the valuation of future projected cash flows

generated by the renewable energy assets, as well as the cash held

by the companies in the portfolio and the cash held by the VCT. The

NAV of the overall portfolio also includes the value of the venture

capital investments into bio-bean and Rezatec.

The future cash flow projections for renewable assets are

impacted by:

Renewable resources. Despite this year having higher solar

irradiation than budgeted, we have not changed the assumptions on

irradiation.

Technical performance. As noted above, the repairs at Lake Farm

and Kingston Farm resolved their historic performance issues, but

the repairs at Beechgrove identified unrelated issues that needed

to be resolved during the half-year. Ayshford Court suffered

technical issues that were repaired. Despite expectations that

these repairs will bring performance back up to budget, we have not

taken the benefits immediately as there is not a long enough

history of post repowering performance.

Prices. Power price forecasts that were initially adversely

impacted by COVID-19 have now risen well over pre-pandemic levels

due to rising commodity prices and acceleration of demand post the

lockdowns ending and the Russian Federation's invasion of Ukraine.

The latest forecasts provided by a leading market consultant, and

current offers for PPAs from purchasers for the power generated are

used.

Costs. Up-to-date costs for the assets are included, reflecting

all commercial negotiations and also expectations for lower

maintenance costs after the older assets are repaired. The asset

management costs going forward have been doubled from those charged

by the Investment Adviser, following feedback from the sales

process.

Corporation tax. The actual corporation tax paid will impact on

the cash available to shareholders.

Inflation. With most of the revenues being linked to RPI, any

increase in inflation projections increases the overall

profitability, and therefore valuation of the assets.

Once the free cash projected to be generated by the assets is

calculated, the value of these cash flows has to be estimated. The

Investment Adviser notes that these cash flows are supported by a

very high proportion of government backed and index linked

revenues. In the current financial market, such cash flows are

dependable and therefore valuable. With greater certainty of output

at the three large ground mounted solar assets that comprise 40% of

the installed capacity there is greater visibility on the returns

on these assets. The discount rates used reflect the Investment

Adviser's experience in the market and evidence of third-party

transactions, as well as based on feedback from the VCT's advisers

who are marketing the portfolio for sale.

The discount rates used to value the future cash flows have been

increased by 0.5% for the solar asset portfolio since the end of

the financial year and remain unchanged at 6.75% for the small wind

portfolio (2021: 5.5% to 6.75%).

The technical assumptions, including the performance ratio (the

efficiency of converting solar power into electricity), have been

changed for the Kingston Farm, Lake Farm, Beechgrove Farm and

Ayshford Court assets. The successful repairs of the first three

are reflected in improved output, although the full potential

increase has not been included until actual performance

demonstrates this. A small number of module failures at Ayshford

Court took down entire strings with several modules. The lower than

expected performance, although repair work was carried out in March

and April 2022, raised the need for a reduction in the value of

Ayshford Court.

There has been an increase in inflation projections to reflect

the increased inflation experienced during the half year and higher

levels of market inflation expectations.

The value of the new investments in bio-bean and Rezatec has

been determined using International Private Equity Valuation

Guidelines and are held at a valuation of GBP1.9 million, including

the GBP67,500 additional investment in bio-bean made during the

half-year. The total invested is GBP1.7 million. The increase in

the value of the Rezatec stake is due to the rolling-up of non cash

interest payments.

Outlook

The Investment Adviser's continued focus is to ensure that the

assets operate at or above budget whilst it supports the ongoing

sale process, especially in relation to demonstrating the solid

generation profile of the projects and addressing the contractual

status of the grid connection arrangement at South Marston. The

repairs of the underperforming assets that were completed in the

last financial year appear to have been successful, as have

warranty claims for the Beechgrove ground mounted solar asset and

these have provided greater visibility and reliability of revenues.

The performance assumptions for these assets as well as the

Ayshford Court solar project have been mildly marked down in the

valuation model in order to reflect the fact that there is, at this

moment, not a long enough history of performance data post the

repairs.

There is an observable impact of age on many of the assets that

have not yet been repowered in the portfolio. The Investment

Adviser remains vigilant for the purpose of spotting any signs of

degradation early so that the impact on availability can be managed

and reduced. Further maintenance provisions have been incorporated

into the financial model to cover the risk of higher maintenance

expenditure on roof mounted assets.

The higher inflation outlook, whilst of concern from the point

of view of the wider UK and global economy, is positive for the

owners of subsidised UK renewable assets. Although most costs also

rise in line with inflation, as does the cost of servicing the two

debt facilities, the net benefit of increased inflation is strongly

positive since it increases the inflation linked revenues more than

it increases the costs. All eight ground mounted solar assets will

have come out of their fixed price power purchase agreements by the

end of 2022, and assuming power prices remain high, should have the

opportunity to enjoy prices substantially higher than those locked

in during 2020 and early 2021.

It is however very challenging to predict the future course of

inflation and power prices, with the range of forecasts for medium

to long-term inflation being very diverse. There are plausible

future scenarios that could bring the levels of inflation as well

as power prices down substantially from current levels.

The risk of government intervention to ease budgetary

constraints and pressures on consumers in the future cannot be

ruled out entirely. Renewable energy projects in the portfolio are

not expected to be subject to a "windfall tax" according to the UK

Government's latest announcement but should power prices stay

elevated for very long, a windfall tax on smaller renewable

generation assets could come back on the agenda or potentially

other energy market reform measures.

Gresham House Asset Management Limited

29 June 2022

Unaudited Income Statement

For the six months ended 31 March 2022

Year ended

30

Six months ended 31 Six months ended 31 September

March 2022 March 2021 2021

Revenue Capital Total Revenue Capital Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Income 589 - 589 521 - 521 576

(Losses)/gains on investments

Unrealised - (80) (80) - (2,280) (2,280) (2,628)

Realised - - - - 16 16 -

589 (80) 509 521 (2,264) (1,743) (2,052)

Investment advisory fees (103) (35) (138) (115) (38) (153) (291)

Other expenses (189) - (189) (177) - (177) (351)

Profit/(loss) on ordinary

activities

before taxation 297 (115) 182 229 (2,302) (2,073) (642)

Tax on total comprehensive - - - - - - -

income and ordinary activities

Profit/(loss) attributable

to equity shareholders 297 (115) 182 229 (2,302) (2,073) (2,694)

Earnings per Ordinary

Share 1.2p (0.4p) 0.7p 0.9p (9.0p) (8.1p) (10.6p)

Earnings per 'A' Share - - - - - - -

The total column within the Income Statement represents the

Statement of Total Comprehensive Income of the VCT prepared in

accordance with Financial Reporting Standards ("FRS 102"). The

supplementary revenue and capital return columns are prepared in

accordance with the Statement of Recommended Practice issued in

November 2014 (updated in April 2021) by the Association of

Investment Companies ("AIC SORP").

A Statement of Total Recognised Gains and Losses has not been

prepared as all gains and losses are recognised in the Income

Statement as noted above.

Unaudited Balance Sheet

As at 31 March 2022

31 March 31 March 30 September

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

Fixed assets

Investments - 28,038 -

Current assets

Investments 9 27,180 - 27,193

Costs incurred on sale of VCT's assets 387 - 181

Debtors 52 220 60

Cash at bank and in hand 1 54 31

27,620 275 27,465

Creditors: amounts falling due within one year (1,876) (1,348) (1,901)

Net current assets/(liabilities) 25,744 (1,073) 25,564

Creditors: amounts falling due after more than

one year (2,532) (3,314) (2,534)

Net assets 23,212 23,651 23,030

Capital and reserves

Called up share capital 69 69 69

Share premium account 8 9,541 9,541 9,541

Treasury shares 8 (2,991) (2,991) (2,991)

Special reserve 8 4,171 4,171 4,171

Revaluation reserve 8 14,976 14,613 15,056

Capital redemption reserve 8 3 3 3

Capital reserve - realised 8 (2,274) (1,448) (2,239)

Revenue reserve 8 (283) (307) (580)

Equity shareholders' funds 23,212 23,651 23,030

Net asset value per Ordinary Share 90.8p 92.5p 90.1p

Net asset value per 'A' Share 0.1p 0.1p 0.1p

90.9p 92.6p 90.2p

Unaudited Statement of Changes in Equity

For the six months ended 31 March 2022

Called

up Share Capital Capital

share premium Treasury Special Revaluation redemption reserve- Revenue

capital account shares reserve reserve reserve realised reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 30 September

2020 69 9,541 (2,991) 5,714 16,893 3 (1,426) (536) 27,267

Total comprehensive

loss - - - - (2,644) - (6) (44) (2,694)

Transfer of net

realised

loss to

Capital reserve -

realised - - - - 807 - (807) - -

Transaction with

owners

Dividends paid - - - (1,543) - - - - (1,543)

As at 30 September

2021 69 9,541 (2,991) 4,171 15,056 3 (2,239) (580) 23,030

Total comprehensive

(loss)/profit - - - - (80) - (35) 297 182

Transaction with

owners

Dividends paid - - - - - - - - -

As at 31 March 2022 69 9,541 (2,991) 4,171 14,976 3 (2,274) (283) 23,212

Unaudited Statement of Cash Flows

For the six months ended 31 March 2022

31 March 31 March 30 September

2022 2021 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Gain/(loss) on ordinary activities before

taxation 182 (2,073) (2,694)

Losses on investments 80 2,280 2,628

Dividend Income (570) - (522)

Interest Income (18) - (54)

Decrease in other debtors 4 9 1

(Decrease)/increase in other creditors (180) 1,215 161

Net cash (outflow)/inflow from operating activities (502) 1,431 (480)

Cash flows from investing activities

Purchase of investments (67) (13) (13)

Sale of investments/ loan note redemptions - 122 137

Cost incurred as part of the sale of VCT's

assets (51) - (19)

Interest received 22 - 223

Dividend income received 570 - 315

Net cash inflow from investing activities 474 109 643

Net cash (outflow)/inflow before financing

activities (28) 1,540 163

Cash flows from financing activities

Equity dividends paid - (1,543) (1,543)

Long-term loans (2) - 1,354

Net cash outflow from financing activities (2) (1,543) (189)

Net decrease in cash (30) (3) (26)

Cash and cash equivalents at start of period 31 57 57

Cash and cash equivalents at end of period 1 54 31

Cash and cash equivalents comprise:

Cash at bank and in hand 1 54 31

Total cash and cash equivalents 1 54 31

Summary of Investment Portfolio and Movements

For the six months ended 31 March 2022

Investment portfolio as at 31 March 2022

Unrealised

gain/(loss) % of

Qualifying and partially Cost Valuation in period portfolio

qualifying investments Operating sites Sector GBP'000 GBP'000 GBP'000 by value

South Marston,

Lunar 2 Limited* Beechgrove Ground solar 1,330 14,264 155 52.5%

---------------------- ----------------- -------- --------- ------------ ----------

Kingston Farm,

Lunar 1 Limited* Lake Farm Ground solar 125 2,281 63 8.4%

---------------------- ----------------- -------- --------- ------------ ----------

Wychwood Solar

New Energy Era Limited Farm Ground solar 884 1,767 (17) 6.5%

---------------------- ----------------- -------- --------- ------------ ----------

Ayshford Solar (Holding)

Limited* Ayshford Ground solar 827 1,373 11 5.1%

---------------------- ----------------- -------- --------- ------------ ----------

Rezatec Limited United Kingdom Clean energy 1,000 1,246 61 4.6%

---------------------- ----------------- -------- --------- ------------ ----------

Vicarage Solar Limited Parsonage Farm Ground solar 871 1,143 (86) 4.2%

---------------------- ----------------- -------- --------- ------------ ----------

Tumblewind Limited* Priory Farm Small wind/solar 979 922 19 3.4%

---------------------- ----------------- -------- --------- ------------ ----------

Gloucester Wind Limited Gloucester Roof solar 1,000 780 (77) 2.9%

---------------------- ----------------- -------- --------- ------------ ----------

HRE Willow Limited HRE Willow Small wind 875 710 9 2.6%

---------------------- ----------------- -------- --------- ------------ ----------

bio-bean Limited Cambridgeshire Clean energy 695 695 - 2.6%

---------------------- ----------------- -------- --------- ------------ ----------

Hewas Solar Limited Hewas Roof solar 1,000 683 (149) 2.5%

---------------------- ----------------- -------- --------- ------------ ----------

St Columb Solar Limited St Columb Roof solar 650 491 (42) 1.8%

---------------------- ----------------- -------- --------- ------------ ----------

Penhale Solar Limited Penhale Roof solar 825 358 (23) 1.3%

---------------------- ----------------- -------- --------- ------------ ----------

Minsmere Power Limited Minsmere Small wind/solar 975 323 (1) 1.2%

---------------------- ----------------- -------- --------- ------------ ----------

Small Wind Generation

Limited Small Wind Generation Small wind 975 144 (3) 0.4%

---------------------- ----------------- -------- --------- ------------ ----------

Lunar 3 Limited* Ground solar 1 - - 0.0%

---------------- -------- --------- ------------ ----------

13,012 27,180 (80)

------------------------------------------------------------------ -------- --------- ------------ ----------

Cash at bank and in hand 1

-------- --------- ------------ ----------

Total investments 27,181 100.0%

-------- --------- ------------ ----------

* Partially qualifying investment

Investment disposals

There were no Investment disposals during the half-year to 31

March 2022.

Notes to the Unaudited Financial Statements

1. General information

Gresham House Renewable Energy VCT 1 plc ("VCT") is a Venture

Capital Trust established under the legislation introduced in the

Finance Act 1995 and is domiciled in the United Kingdom and

incorporated in England and Wales under the Companies Act 2006.

At the General Meeting on 13 July 2021 a formal decision was

made to wind the VCT up. Similar to the financial statements

prepared for the year ended 30 September 2021, the unaudited

half-yearly financial statements to 31 March 2022 have been

prepared on a non-going concern basis. The adjustments required in

respect of applying the non-going concern basis were to transfer

the investments held at fair value through profit or loss from

non-current to current assets.

2. Accounting policies - basis of accounting

The unaudited half-yearly results cover the six months to 31

March 2022 and have been prepared in accordance with the accounting

policies set out in the annual accounts for the year ended 30

September 2021 which were prepared under FRS 102 "The Financial

Reporting Standard applicable in the UK and Republic of Ireland"

and in accordance with the Statement of Recommended Practice

("SORP") "Financial Statements of Investment Trust Companies and

Venture Capital Trusts" issued by the Association of Investment

Companies ("AIC") in November 2014 and revised in October 2019

(updated in April 2021) ("SORP") as well the Companies Act

2006.

3. All revenue and capital items in the Income Statement derive from continuing operations.

4. The VCT has only one class of business and derives its income

from investments made in shares, securities and bank deposits.

5. Net asset value per share at the period end has been

calculated on 25,515,242 Ordinary Shares and 38,512,032 'A' Shares,

being the number of shares in issue at the period end, excluding

Treasury Shares.

6. Return per share for the period has been calculated on

25,515,242 Ordinary Shares and 38,512,032 'A' Shares, being the

weighted average number of shares in issue during the period,

excluding Treasury Shares.

7. Dividends

No dividends were paid to shareholders during the six months to

31 March 2022.

8. Reserves

Period

ended Year ended

31 March 30 September

2022 2021

GBP'000 GBP'000

Share premium account 9,541 9,541

--------- -------------

Treasury shares (2,991) (2,991)

--------- -------------

Special reserve 4,171 4,171

--------- -------------

Revaluation reserve 14,976 15,056

--------- -------------

Capital redemption reserve 3 3

--------- -------------

Capital reserve - realised (2,274) (2,239)

--------- -------------

Revenue reserve (283) (580)

--------- -------------

23,143 22,961

--------- -------------

The Special reserve is available to the VCT to enable the

purchase of its own shares in the market without affecting its

ability to pay dividends. The Special reserve, Capital reserve -

realised and Revenue reserve are all distributable reserves. At 31

March 2022, distributable reserves were GBP1,614,000 (30 September

2021: GBP1,352,000).

9. Investments

The fair value of investments is determined using the detailed

accounting policies as referred to in note 2.

The VCT has categorised its financial instruments using the fair

value hierarchy as follows:

Level 1 Reflects financial instruments quoted in an active market;

Level 2 Reflects financial instruments that have prices that are

observable either directly or indirectly; and

Level 3

Reflects financial instruments that use valuation techniques

that are not based on observable market data (unquoted equity

investments and loan note investments).

Level Level Level 31 March Level Level Level 30 September

1 2 3 2022 1 2 3 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------- ------- ------- -------- ------- ------- ------- ------------

Unquoted loan notes - - 1,686 1,686 - - 1,686 1,686

------- ------- ------- -------- ------- ------- ------- ------------

Unquoted equity - - 25,494 25,494 - - 25,507 25,507

------- ------- ------- -------- ------- ------- ------- ------------

- - 27,180 27,180 - - 27,193 27,193

------- ------- ------- -------- ------- ------- ------- ------------

A reconciliation of fair value for Level 3 financial instruments

held at the period end is shown below:

Unquoted Unquoted

loan notes equity Total

GBP'000 GBP'000 GBP'000

Balance at 30 September 2021 1,686 25,507 27,193

----------- -------- --------

Movements in the income statement:

----------- -------- --------

Unrealised loss in the income statement - (80) (80)

----------- -------- --------

Purchased at cost - 67 67

----------- -------- --------

Balance at 31 March 2022 1,686 25,494 27,180

----------- -------- --------

10. Risks and uncertainties

Under the Disclosure and Transparency Directive, the Board is

required in the VCT's half-year results to report on principal

risks and uncertainties facing the VCT over the remainder of the

financial year.

The Board has concluded that the key risks facing the VCT over

the remainder of the financial period are as follows:

(i) investment risk associated with investing in small and immature businesses;

(ii) market risk in respect of the various assets held by the investee companies;

(iii) failure to maintain approval as a VCT;

iv) risk surrounding the sale of the VCT's solar assets; and

v) economic risk due to several factors including the Russian Federation's invasion of Ukraine

In order to make VCT qualifying investments, the VCT has to

invest in small businesses which are often immature. The Investment

Adviser follows a rigorous process in vetting and careful

structuring of new investments and, after an investment is made,

close monitoring of the business. The Investment Adviser also seeks

to diversify the portfolio to some extent by holding investments

which operate in various sectors. The Board is satisfied with this

approach.

The VCT's compliance with the VCT regulations is continually

monitored by the VCT Status Adviser, who reports regularly to the

Board on the current position. The VCT has reappointed Philip Hare

& Associates LLP as VCT Status Adviser, who will work closely

with the Investment Adviser and provide regular reviews and advice

in this area. The Board considers that this approach reduces the

risk of a breach of the VCT regulations to a minimal level.

There is a risk that the VCT's solar assets may not be realised

at their carrying value, and the sale commissions, such as

liquidation costs and other costs associated with the realisation

of the VCT's assets, may reduce cash available for distribution to

shareholders. Furthermore, there is a risk that the sale of the

VCT's assets may prove materially more complex than anticipated

which may delay distribution of proceeds to shareholders. To

mitigate these risks, the VCT's Board has engaged several experts

in this field to ensure that a timely and appropriate sale price is

achieved. In addition, the Board reviews quarterly cash flow

forecasts, prepared by the Investment Adviser, and has considered

the impact of additional costs likely to be incurred during the

managed wind-down of the VCT.

The Board has considered the Russian Federation's invasion of

Ukraine and the impact of the increasing inflation on the VCT. The

higher inflation outlook, whilst of concern from the point of view

of the wider UK and global economy, is positive for the owners of

subsidised UK renewable assets. Although most costs also rise in

line with inflation, as does the cost of servicing the two debt

facilities, the net benefit of increased inflation is strongly

positive since it increases the inflation linked revenues more than

it increases the costs. It is however very challenging to predict

the future course of inflation, with the range of forecasts for

medium to long-term inflation being very diverse.

11. Going concern

In assessing the VCT as a going concern, the Directors have

considered the forecasts which reflect the proposed strategy for

portfolio investments and the results of the continuation votes at

the AGM and General Meeting held on 22 March 2021 and 13 July 2021

respectively.

Although the continuation vote was passed by this VCT at the

AGM, there were a significant number of votes against this

resolution and the shareholders of VCT 2 voted against

continuation. This required the VCTs to draw up proposals for

voluntary liquidation, reconstruction or other re-organisation for

consideration by the members at the General Meeting held on 13 July

2021. At this meeting the proposed special resolution was approved

by shareholders, resulting in the VCT entering a managed wind-down

and a new investment policy replacing the existing investment

policy. The Board agreed to realise the VCT's investments in a

manner that achieves balance between maximising the net value

received from those investments and making timely returns to

shareholders.

Given a formal decision has been made to wind the VCT up, the

financial statements have been prepared on a basis other than going

concern. The Board notes that the VCT has sufficient liquidity to

pay its liabilities as and when they fall due, during the managed

wind-down, and that the VCT has adequate resources to continue in

business until the formal liquidation and wind-up commences.

12. The unaudited financial statements set out herein do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006 and have not been delivered to the Registrar

of Companies.

13. The Directors confirm that, to the best of their knowledge,

the half-yearly financial statements have been prepared in

accordance with the "Statement: Half-Yearly Financial Reports"

issued by the UK Accounting Standards Board and the Half-Yearly

Report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements, and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period, and any changes in the related party transactions

described in the last annual report that could do so.

14. Copies of the Half-Yearly Report will shortly be sent to

shareholders who have elected this communication preference.

Further copies can be obtained from the VCT's registered office or

can be downloaded from

https://greshamhouse.com/real-assets/new-energy-sustainable-infrastructure/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BXGDLGBDDGDC

(END) Dow Jones Newswires

June 29, 2022 09:15 ET (13:15 GMT)

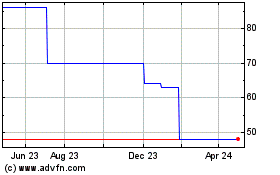

Gresham House Renewable ... (LSE:GV1O)

Historical Stock Chart

From Jan 2025 to Feb 2025

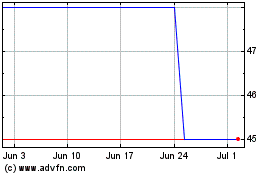

Gresham House Renewable ... (LSE:GV1O)

Historical Stock Chart

From Feb 2024 to Feb 2025