2ND UPDATE:National Grid:To Restructure US Business, Cut 1,200 Jobs

01 February 2011 - 4:39AM

Dow Jones News

U.K. gas and electricity network operator National Grid PLC

(NG.LN) Monday said it was restructuring its U.S. business in a

plan that targets a reduction in operating costs by $200 million a

year, primarily to be achieved through around 1,200 job cuts in the

U.S., or around 7% of the workforce there.

The job cuts, from management and administrative positions,

represent around 70% of the annual savings with the rest of the

cost reductions coming from property and providing IT to the

organization and other efficiencies, National Grid Chief Executive

Steve Holliday said.

The restructuring, which also includes the appointment of Tom

King as U.S. executive director and president and the creation of

several regional presidents in the states where the company

operates, comes after the regulator in New York granted the company

a smaller-than-expected increase in electricity distribution and

transmission rates on Jan. 21.

Analysts said the announcement of the U.S. restructure, which

was also released with a trading update that was in line with

expectations, was positive for the company and was largely behind

the 3.3% increase in the share price earlier Monday.

Holliday said the restructuring of the U.S. business hadn't been

forced upon the company by the series of disappointing regulatory

decisions on rates the company can charge in the U.S.

He said the restructure was planned and the company had been

waiting to complete the full cycle of regulatory filings before it

could make the announcement.

"It's not a knee jerk, it has been thought through for some

time," Holliday told reporters on a conference call.

"We're hitting more and more of our performance targets every

year, but we are not earning adequate returns thus far in all of

our U.S. regulatory jurisdictions so despite an increase in

revenues, operating costs in the U.S. are still higher than we are

recovering through today's rates," Holliday told reporters on a

conference call.

In a separate announcement, the company also said it expects

operating profit for 2010/2011 to be significantly ahead of the

same period a year ago, in line with expectations.

"The strong momentum seen in the first half has continued and

has further improved, driven by cold winter weather following the

hot weather in the U.S. in the summer," the company said in a

statement.

National Grid is to recommend an 8% increase in its full-year

dividend, also in line with previous statements.

"It helps when you announce the restructuring with a positive

trading update--the two reinforce each other. But the restructure

is more significant in the short term than the trading

performance," said Deutsche Bank utilities analyst Martin

Brough.

Deutsche Bank has a target price of 620 pence and a buy rating

on the stock.

However, Citigroup analysts said in a research note that

although the restructuring was "very sensible" and re-created

National Grid's U.S. model that had been abandoned in 2007, it

still begged the question of a sale of the U.S. assets.

"But the question that NG has not answered is this: is keeping

GBP15 billion of capital tied up in the U.S. the best use of that

capital given the demands for investment in the U.K.?," the note

said.

The majority of National Grid's business in the U.S is regulated

and is mostly in electricity and gas distribution. The company

operates in New York, Rhode Island and Massachusetts.

National Grid shares closed up 1.2% at 552.50 pence,

outperforming the U.K. power utility sector and the broader FTSE

index of which it is a component.

-By Selina Williams, Dow Jones Newswires +44 207 842 9262l;

selina.williams@dowjones.com (Jana Weigand contributed to this

story.)

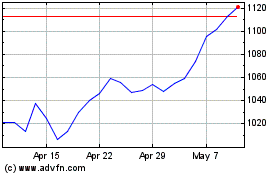

National Grid (LSE:NG.)

Historical Stock Chart

From Jan 2025 to Feb 2025

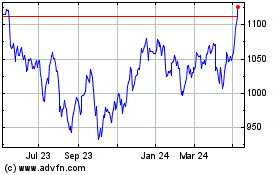

National Grid (LSE:NG.)

Historical Stock Chart

From Feb 2024 to Feb 2025