PERSHING SQUARE HOLDINGS: Pershing Square Holdings, Ltd. Releases Monthly Net Asset Value and Performance Report for December 2023

03 January 2024 - 6:00PM

UK Regulatory

TIDMPSH

Pershing Square Holdings, Ltd. (LN:PSH) (LN:PSHD) (NA:PSH) today

released the following regular monthly Net Asset Value (NAV) and

Performance Report for the month of December 2023. The information

has also been posted to the PSH website,

www.pershingsquareholdings.com. Monthly net asset value and

performance are calculated at the close of business on the last

business day of the month.

PERSHING SQUARE HOLDINGS,

PERSHING SQUARE CAPITAL MANAGEMENT, L.P. LTD.

Portfolio Update

December 31, 2023

Summary Results (1) Number of Positions (2)

December YTD 2023

Gross

Performance 11.0% 31.8% Long 11

Net

Performance 9.3% 26.7% Short 0

NAV/Share (in

USD) $65.04 Total 11

NAV/Share (in

GBP) GBP51.02

Equity & Debt Exposure Composition By Portfolio Composition by

Market Cap (3) (4) Sector (5)

Net

Portfolio Long Short

Large Cap 90% 90% 0% Financials Retail

Special Purpose

Mid Cap 12% 12% 0% Hospitality Rights Company

Small Cap 0% 0% 0% Media Technology

Total 102% 102% 0% RE Corp. Transportation

Note: Large Cap >= $5b; Mid Cap >= $1b;

Small Cap < $1b Restaurant

Notional Credit Default Swap

Assets Under Management Exposure

Pershing Square

Holdings, Ltd. AUM(6)* $ 14,725.9M

Single Name

and

Total Core Strategy Sovereign

AUM(7)* $ 16,810.7M CDS $ 0.0M

Total Firm AUM (Includes

PS VII)(8)* $ 18,330.2M

*Includes bond proceeds

of $1.8 billion and

EUR500 million

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All

investments involve the possibility of profit and the risk of loss,

including the loss of principal. This document does not constitute an offer

to sell or the solicitation of an offer to purchase any security or

investment product. All information is current as of the date hereof and is

subject to change in the future.

(1) Performance results are presented on a gross and net-of-fees basis. Net

returns reflect the deduction of, among other expenses, management fees,

brokerage commissions, administrative fees, and accrued and/or crystallized

performance fees, if any, and include the reinvestment of all dividends,

interest, and capital gains from our underlying portfolio companies. Net

returns reflect the performance of Pershing Square Holdings, Ltd.'s (the

"Company") Public Shares. Depending on the timing of an individual

investor's specific investment, net performance for an individual investor

may vary from the net performance as stated herein. Gross returns reflect

the performance of the Company's shares in the aggregate and are presented

before the deduction of management fees and performance fees, if any. The

Company has periodically engaged in share repurchases whereby its buyback

agent has repurchased Public Shares subject to certain limitations. Any

positive impact on performance due to these share buybacks is reflected

herein. Performance data and other information contained herein are

estimated and unaudited. Performance is based on the dollar return for the

specific period, including any and all dividends paid by the Company,

calculated from the beginning of such period to the end of such period. (2)

Reflects the number of positions in issuers in which the Company has

previously publicly disclosed an investment, which occurs after the Company

has completed its accumulation. Cash, cash equivalents, direct or indirect

currency or other hedges and income/expense items are excluded. Multiple

financial instruments (for example, common stock and derivatives on common

stock) associated with one (1) issuer count as one (1) position. A position

that is included in the number of positions will be removed from the table

only if the investment becomes 0.0% of the portfolio. (3) For the purpose

of determining the equity and debt exposures, investments are valued as

follows: (a) equity or debt is valued at market value, (b) options

referencing equity or debt are valued at market value, (c) long call

options and short put options (or vice-versa, short call options and long

put options) held on the same underlying issuer and with the same strike

and same expiry are grouped together and treated as synthetic equity

positions, and are valued at the market value of the equivalent long equity

position (or vice-versa, the equivalent short equity position), and (d)

swaps or forwards referencing equity or debt are valued at the market value

of the notional equity or debt underlying the swaps or forwards. Whether a

position is deemed to be long or short is determined by whether an

investment has positive or negative exposure to price increases or

decreases. For example, long puts are deemed to be short exposure. (4)

Includes all issuer equity, debt, and derivatives related to issuer equity

and debt, and associated currency hedges. Cash, cash equivalents, direct or

indirect currency or other hedges and income/expense items are excluded.

The market values of associated currency hedges are included as part of the

associated investment. In the event that there is a change in market cap

category with respect to any non-publicly disclosed position, this

information is not updated until such position is publicly disclosed. (5)

Portfolio composition is reflective of the publicly disclosed portfolio

positions as of the date of this report. A position in an issuer is only

assigned to a sector once it has been publicly disclosed. (6) "Pershing

Square Holdings, Ltd. AUM" equals the net assets of Pershing Square

Holdings, Ltd. calculated in accordance with GAAP without deducting amounts

attributable to accrued performance fees, while adding back the principal

value of the Company's debt outstanding ($1.8 billion and EUR500 million

translated into USD at the prevailing exchange rate at the reporting date,

1.10). Any performance fees crystallized as of the end of the year will be

reflected in the following period's AUM. (7) "Total Core Strategy AUM"

equals the net assets of Pershing Square, L.P., Pershing Square

International, Ltd. and Pershing Square Holdings, Ltd. (collectively, the

"Core Funds") calculated in accordance with GAAP without deducting amounts

attributable to accrued performance fees, while adding back the principal

value of the Company's debt outstanding ($1.8 billion and EUR500 million

translated into USD at the prevailing exchange rate at the reporting date,

1.10). Redemptions effective as of the end of any period (including

redemptions attributable to crystallized performance fees, if any) will be

reflected in the following period's AUM. (8) "Total Firm AUM" equals "Total

Core Strategy AUM" as defined in footnote 7, plus the net assets of PS VII

Master, L.P. and PS VII A International, L.P. (together, the "PSVII Funds")

calculated in accordance with GAAP, without double counting investments

made by any Core Fund in the PSVII Funds. The PSVII Funds operate as

co-investment vehicles investing primarily in securities of (or otherwise

seeking to be exposed to the value of securities issued by) Universal Music

Group N.V.

Note: Each Public Share in the Company carries at all times one vote per

share. The total voting rights in the Company ("Total Voting Rights") may

vary over time given the capital and voting structure of the Company. As of

December 31, 2023, Total Voting Rights were 371,665,623. There are

185,461,146 Public Shares and 1 Special Voting Share (held by VoteCo)

outstanding (the share classes have 1 vote and 186,204,477 votes per share,

respectively). In addition, the Company currently holds 25,495,604 Public

Shares in Treasury; these Public Shares are not eligible to vote. In

connection with the payment of a dividend on December 15, 2023, the high

water mark per share has been adjusted to $56.23.

Under the Dutch Financial Supervision Act (Wet op het financieel toezicht),

anyone who, directly or indirectly, acquires or disposes of shares in the

Company and holds voting rights reaching, exceeding or falling below

certain thresholds (including 3%, 5% and 10%) of the Total Voting Rights is

required to notify the Netherlands Authority for the Financial Markets

(Stichting Autoriteit Financële Markten). In addition, under the

Company's Articles of Incorporation, a person is required to notify the

Company of the number of the Public Shares it holds or is deemed to hold

(through such person's direct or indirect holding of financial instruments)

if this number reaches, exceeds or falls below 3%, 4%, 4.25%, 4.50%, 4.75%

or 5% of the total number of outstanding Public Shares.

As of the date of the placing of the Public Shares, the total offset

amount, which is part of the performance fee calculation, was $120M. As of

December 31, 2023, the offset amount has been reduced in the aggregate by

approximately $84.4M to $35.6M. The performance fee that may be charged

from time to time on fee-bearing shares equals 16% of NAV appreciation

minus the "additional reduction." The additional reduction is equal to 20%

of the aggregate performance allocations/fees earned by the investment

manager on the gains of certain other funds managed by the investment

manager plus any amount of additional reduction carried forward from the

previous period ($0.0M as of December 31, 2023), and is calculated after

giving effect to the offset amount. The offset amount offsets the

additional reduction until it is fully reduced to zero. As of the date of

the placing, the total offset amount was set by reference to the sum of the

fees and other costs of the placing and admission of the Public Shares, as

well as commissions paid to placement agents and other formation and

offering expenses prior to admission that had been borne by the investment

manager.

About Pershing Square Holdings, Ltd.

Pershing Square Holdings, Ltd. (LN:PSH) (LN:PSHD) (NA:PSH) is an

investment holding company structured as a closed-ended fund.

Category: (PSH:MonthlyNAV)

Media

Camarco

Ed Gascoigne-Pees / Julia Tilley +44 (0)20 3781 8339,

media-pershingsquareholdings@camarco.co.uk

View source version on businesswire.com:

https://www.businesswire.com/news/home/20240102456755/en/

CONTACT:

Pershing Square Holdings, Ltd.

SOURCE: Pershing Square Holdings, Ltd.

Copyright Business Wire 2024

(END) Dow Jones Newswires

January 03, 2024 02:00 ET (07:00 GMT)

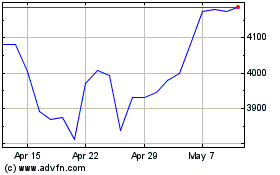

Pershing Square (LSE:PSH)

Historical Stock Chart

From Oct 2024 to Nov 2024

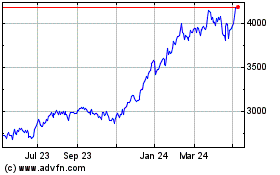

Pershing Square (LSE:PSH)

Historical Stock Chart

From Nov 2023 to Nov 2024