TIDMRBD

RNS Number : 9001N

Reabold Resources PLC

28 September 2023

28 September 2023

REABOLD RESOURCES PLC

("Reabold" or the "Company")

Unaudited Interim Results for the Six Months Ended 30 June

2023

Reabold Resources plc (AIM: RBD), the oil & gas investing

company with a diversified portfolio of exploration, appraisal and

development projects, announces its unaudited interim results for

the six months ended 30 June 2023. The results are included below

and are also available at

https://reabold.com/investor-relations/reports-and-presentations/

.

Highlights

-- Good progress with onshore UK licence, PEDL183:

o The PEDL183 Joint Venture partnership (the "JV") agreed a

specific well path for the West Newton B-2 ("WN B-2") well, which

has been approved by the East Riding of Yorkshire Council. The

operator has received the necessary permit variation from the

Environmental Agency for the use of oil-based fluids at the A and B

sites. Drilling and testing of the B-2 well is expected by June

2024, once Rathlin (UK) Energy Limited's ("Rathlin") funding

solutions have been confirmed as operator of the licence.

o Reabold identified Crawberry Hill, a significant potential

discovery, on PEDL183, which was drilled by Rathlin in 2013 and

could add materially to the already significant resource within the

licence.

-- Acquisition of 16.2% equity interest in LNEnergy Limited

("LNEnergy") which was further increased to 17.6% post period end

for a total consideration of GBP2.5 million, GBP1.0 million of

which was in cash and GBP1.5 million of which was satisfied via the

issue of 810,810,811 new ordinary shares of 0.1p each in the

capital of the Company ("Ordinary Shares"). Recent indicative

national and regional approvals have enabled the Colle Santo gas

field to enter operational phase:

o LNEnergy's primary asset is an exclusive option over a 90%

interest in the Colle Santo gas field, a highly material gas

resource with an estimated 65bcf of 2P reserves [1] , with two

production wells already drilled. The field is development ready,

subject to approvals and permits.

o LNEnergy expects all the necessary approvals to be received in

order to carry out the Early Production Programme allowing early

revenue generation from the Colle Santo project.

o Reabold retains an option to increase its stake in LNEnergy to

26.1% for consideration of GBP1.8 million, which expires on 29

December 2023.

-- Reabold North Sea licences portfolio management:

o Post period end, Reabold announced the high-grading of its UK

North Sea offshore licences and will retain its interests in four

key licences in the North Sea, including the key Dunrobin prospect

on licence P2478.

o A CPR prepared by RPS was released in April 2023 covering all

four retained licences, which included 201 mmboe ([2]) aggregate

gross unrisked ([3]) Pmean Prospective Resources on licence

P2478.

o Completed acquisition of Simwell Resources Limited ("Simwell

Resources") in January 2023 which provided valuable data and added

to Reabold's understanding of the Zechstein play, which is

fundamental to the Company's onshore assets of West Newton and

Crawberry Hill.

-- Commencement of a share buyback programme in April 2023 for a

maximum amount of GBP750,000 as part of the proposed GBP4.0 million

return to shareholders announced via RNS on 3 October 2022 [4]

.

-- Net cash of GBP2.6 million at 30 June 2023. Cash inflows

expected in Q4 2023 as part of the contingent consideration

receivable arising from the sale of Corallian to Shell. For further

details of the contingent consideration receivable, please see

Review of Operations - UK offshore, and Note 11.

Sachin Oza and Stephen Williams, Co-CEOs of Reabold,

commented:

"We are encouraged with progress made across the Reabold

portfolio in 2023. The prospects for LNEnergy have developed

rapidly since May 2023, when we re-invested part of the proceeds

from the disposal of the Victory asset in the Colle Santo project.

The post period end indicative approvals from both the regional and

national regulators are key steps to unlocking the material

potential of the Colle Santo gas field and to near-term production.

We also made good progress with UK onshore licence PEDL183 and

anticipate commencement of drilling at the well during H1 2024. The

identification of an existing discovery, Crawberry Hill, a lso on

PEDL183, confirms the significant prospectivity in the licence.

"

"The next 12 months will be exciting for Reabold with

anticipated newsflow on our key assets and the expected receipt of

the GBP9.5 million contingent payment from Shell (as the balance of

the consideration for the Victory project). We will continue with

our disciplined strategy to allocate capital to undervalued oil

& gas assets where their development benefits from being close

to existing infrastructure and there is a clear path to

monetisation."

Enquiries:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757

Stephen Williams 4980

Strand Hanson Limited - Nominated & Financial +44 (0) 20 7409

Adviser 3494

James Spinney

James Dance

Rob Patrick

Stifel Nicolaus Europe Limited - Joint Broker +44 (0) 20 7710

Callum Stewart 7600

Simon Mensley

Ashton Clanfield

finnCap Ltd - Joint Broker

Christopher Raggett +44 (0) 207 220

Barney Hayward 0500

Camarco

Billy Clegg +44 (0) 20 3757

Rebecca Waterworth 4980

reaboldenquiries@camarco.co.uk

Forward looking statements

This disclosure contains certain forward-looking statements with

respect to the business of Reabold and certain of the plans and

objectives of Reabold that involve substantial known and unknown

risks and uncertainties. By their nature, forward-looking

statements involve risk and uncertainty because they relate to

events and depend on circumstances that will or may occur in the

future and are outside the control of Reabold. Actual results or

outcomes, may differ materially from those expressed in such

statements, depending on a variety of factors, including: the

impact of general economic conditions where Reabold operates,

industry conditions, changes in consumer preferences and societal

expectations, the pace of development and adoption of alternative

energy solutions, changes in laws and regulations including the

adoption of new environmental laws and regulations and changes in

how they are interpreted and enforced, increased competition, the

timing of bringing new fields onstream, fluctuations in foreign

exchange or interest rates, stock market volatility, the success or

otherwise of partnering, Reabold's access to future credit

resources, and other risk factors discussed in Reabold's 2022

Annual Report. Accordingly, no assurances can be given that any of

the events anticipated by the forward looking statements will

transpire or occur, or if any of them do so, what benefits,

including the amount of proceeds, that Reabold will derive

therefrom.

Review of Operations

UK Onshore

Rathlin Energy (UK) Limited and West Newton - PEDL183

West Newton is an onshore hydrocarbon discovery located north of

Hull, England. To date, three wells have been drilled at West

Newton (A-1, A-2 and B-1Z) confirming a major discovery -

potentially one of the largest hydrocarbon fields discovered

onshore UK. Rathlin is the operator of the licence and holds a

66.67% interest. Reabold holds a 59.5% shareholding in Rathlin and

holds a direct 16.67% in the licence giving the Company an

aggregate c. 56% economic interest in West Newton.

In the first half of the year, the JV partnership, which

comprises Rathlin, Reabold and Union Jack Oil plc, agreed a

specific well path for the West Newton B-2 ("WN B-2") well. The JV

has continued to analyse the geophysical, petrophysical and test

data from the West Newton A and B wells in preparation for

drilling. The data analysis has already confirmed the likelihood of

intersecting good reservoir quality that, when taken in conjunction

with the optimised drilling and completion methods, is expected to

deliver good well productivity from a horizontal well from WN B-2

and, as such, the JV partnership has committed to the specific,

optimised well path for WN B-2. The WN B-2 well has been approved

by the East Riding of Yorkshire Council. Rathlin has received the

necessary permit variations from the Environmental Agency for the

use of oil-based fluids at the A and B sites. An invitation to

tender has been distributed to potential drilling rig providers. It

is envisaged that WN B-2 will be followed by a multi-well

development programme based on a 50 Mscf/d gas facility.

Rathlin, the operator of PEDL183 with a 66.67% licence interest,

is currently unfunded for its share of the WN B-2 well and is

currently assessing funding solutions including reducing its

working interest position by bringing in a partner to participate

in drilling on PEDL183. The drilling and testing of the WN B-2 well

is planned to be completed by June 2024, in-line with the time

limits set by the North Sea Transition Authority ("NSTA"). Reabold

may be in a position to provide additional funding to Rathlin

following receipt of the second tranche payment from Shell relating

to the sale of the Victory asset.

Alongside the drilling plans for the WN B-2 well, Reabold has

continued to appraise other opportunities within the PEDL183

licence. Reabold has undertaken a technical review of its Zechstein

play prospectivity in the UK, including the licences acquired

through the acquisition of Simwell Resources and PEDL183, combining

the significant quantity of seismic data, historical wells, core

analysis and other proprietary data and analysis assembled by the

Company.

Through this analysis, Reabold has identified on PEDL183 a

significant potential discovery, Crawberry Hill, which was drilled

by Rathlin in 2013 and which could add materially to the already

significant resource within PEDL183. The Crawberry Hill-1 well,

drilled in 2013, intersected 141m of Kirkham Abbey Formation with

good indications of gas shows and porosity. The well was originally

drilled to test a deeper target and does not have a full suite of

logs over the Kirkham Abbey interval.

ERC Equipoise Ltd ("ERCE") has undertaken a petrophysical

analysis of the conventional reservoir of the Kirkham Abbey

formation in the Crawberry Hill and Risby-1 wells and interprets

average porosities greater than 15% in the top 20m of the Kirkham

Abbey formation in Crawberry Hill-1.

Reabold believes the apparent discovery at Crawberry Hill to be

an exciting appraisal opportunity potentially significantly

enhancing the already strategic asset that is PEDL183.

UK Offshore

Victory contingent consideration receivable update

Further to the receipt of initial gross consideration of GBP10

million (c. GBP3.2 million net to Reabold) in November 2022, the

payment of the contingent consideration arising from the sale of

Corallian to Shell in 2022 will be staged as follows:

A single payment of GBP22.0 million (GBP9.5 million net to

Reabold) will be made, assuming the development and production

consent for the Victory gas field is secured from the North Sea

Transition Authority, on or before 1 December 2023. If consent has

not been granted by this date, then Shell will have the option to

either: i) pay GBP12.0 million (GBP5.1 million net to Reabold),

with the remaining GBP10.0 million (GBP4.4 million net to Reabold)

being paid at a later consent date; or ii) offer to transfer-back

the Victory licence to the current Corallian shareholders for GBP1

consideration.

The Company understands, from documents made available to the

public in August 2023 as part of the statutory public consultation,

that Shell intends to continue to pursue the development of the

Victory gas field. Shell conducted detailed surveys in 2023 to

allow, subject to the necessary consents and approvals, development

drilling and subsea installation activities to be undertaken from

Q2 2024 with first gas targeted from 2025.

Reabold is encouraged by the progress being made on Victory

field development and will provide a further update with regards to

the contingent consideration receivable on or around 1 December

2023 as and when appropriate.

P2478 (36%), P2504 and P2605 (both 100%) and P2486 (10%)

During the first half of the year, a high-grading exercise was

completed for Reabold's North Sea licences, which resulted in the

prioritisation of the highest potential return assets. As at the

start of October 2023, Reabold will have retained its interests in

four key licences in the North Sea - P2478 (36%), P2605, P2504

(both 100%) and P2486 (10%). This includes the key Dunrobin

prospect in licence P2478. In the first half of 2023, Reabold

relinquished interests in two North Sea licences (P2332 (30%) and

P2329 (10%)) and a further 2 licences (P2464 and P2493 (both 100%))

in July 2023). Reabold is due to relinquish its 10% interest in

licence P2427 at the end of September 2023.

Discussions to farm down these high-graded assets to help fund

the de-risking and value creation process continues.

P2478 (36%)

Licence P2478 is located in the Inner Moray Firth Basin. In

February 2023, Reabold released a CPR prepared by RPS on licence

P2478 effective 30 September 2022. The key points from the CPR are

set out below:

-- 201 mmboe(1) aggregate gross unrisked(2) Pmean Prospective Resources on licence P2478.

-- The Dunrobin West prospect ("Dunrobin West"), agreed by the

JV to be the proposed location of the first exploration well on the

licence, would target 119 mmboe aggregate gross unrisked Pmean

Prospective Resources(3) .

-- 34% Chance of Geologic Discovery (Pg) on Dunrobin West Jurassic primary target.

-- Secondary Triassic target at Dunrobin West, which along with

the Jurassic can be tested by a single vertical borehole, included

in formal resource assessment for the first time with a Pg of

12%.

-- Dunrobin West dry hole drilling costs to a total depth of 800

metres estimated by the JV to be GBP8.6 million gross.

-- The Company believes that Dunrobin West is geologically

analogous to the Beatrice field, which produced 164 mmboe.

-- Success at Dunrobin West would significantly de-risk Dunrobin

Central & East and Golspie analogous prospects.

(1) The CPR reports oil and gas Prospective Resources. The oil

equivalent value of the gas resources has been estimated by the

Company using a factor of 5.8bcf per mmboe.

(2) The unrisked aggregation was performed by the Company and

assumes that all prospects at all levels are successful.

(3) The unrisked aggregation of Dunrobin West was performed by

the Company. The volumes were presented for each reservoir in the

CPR and, at the Company request, were not aggregated

probabilistically.

In July 2023, the NSTA approved an extension of the licence

until July 2025, at which point a drilling decision will be made.

The extension was made via a Deed of Variation, which stipulates an

additional commitment to acquire a minimum of 30 square kilometres

of 3D seismic data. Reabold estimates the costs of its 36% share of

the 3D acquisition to be c.GBP0.7 million.

P2504 and P2605 (100%)

Licence P2504 is located in the East Shetland Basin and contains

the Oulton Discovery, Oulton West Jurassic Prospect and Oulton West

Eocene Prospect. The Oulton West Ecoene prospect exhibits seismic

amplitude anomalies analogous to the nearby Nuggets Fields. Per the

most recent CPR (effective 30 September 2022), the Oulton discovery

has contingent resources of 11mmbbls (2C) with an associated NPV10

of GBP59.0 million based on RPS's assumptions. Licence P2504 also

has unrisked Pmean prospective oil resources of 38mmbbl and

unrisked Pmean prospective gas resources of 26bcf(a) .

Licence P2605 is in the Faroe Shetland Basin, approximately 60

km northwest of Shetland, and contains the Laxford discovery and

Scourie prospect. Licence P2605 has unrisked Pmean Prospective gas

resources of 122bcf(a) .

(a) Pmean totals are by arithmetic summation (in-house)

P2486 (10%)

Reabold has retained its interest in licence P2486 in the

Southern North Sea following the acquisition of Simwell Resources

in January 2023. The operator is investigating farm out

opportunities prior to a drill or drop decision by July 2024. The

work undertaken on the Southern North Sea licences following the

Simwell Resources acquisition has provided the Company with

valuable data and added to its understanding of the Zechstein play,

which is fundamental to Reabold's West Newton and Crawberry Hill

assets onshore.

LNEnergy - Colle Santo gas field, Italy

In May 2023, Reabold acquired a 3.1% interest in LNEnergy for

cash consideration of GBP250,000 and received options to acquire,

at its sole discretion, further shares in LNEnergy. In June 2023,

Reabold exercised certain of these options to increase the

Company's stake in LNEnergy to 16.2% through a cash consideration

of GBP500,000 and the issuance of 810,810,811 new Ordinary Shares

as consideration for the increased investment. In September 2023,

Reabold increased its stake in LNEnergy to 17.6% for a further cash

consideration of GBP250,000. Reabold retains a final option

expiring 29 December 2023, to increase, at its sole discretion, its

investment in LNEnergy to 26.1% for a further consideration of

GBP1.8 million, which would be satisfied through either cash or new

Ordinary Shares, at the option of LNEnergy.

LNEnergy's primary asset is an exclusive option over a 90%

interest in the onshore Colle Santo gas field in Abruzzo, Italy.

With 65bcf of 2P reserves, as estimated by RPS as of 30 September

2022, this is a highly material undeveloped onshore gas resource.

Reabold believes this is the largest onshore proven undeveloped gas

field in mainland Western Europe. The field is development ready

subject to permits and approvals. Two wells have already been

drilled and are available for production, with no additional

drilling being required. The development will be a small-scale LNG

facility to produce initially at 10mmcf/d from the existing two

wells with over 20 years of ultimate production.

Post period end, in August 2023, Reabold announced that LNEnergy

had recently received a letter from the head of the Italian

National Bureau of Hydrocarbons and Georesources ("UNMIG"), the

minerals division of Italian Ministry of Environment and Energy

Security ("MASE"), giving permission to carry out well integrity

and well service testing on the two existing wells and to start

work on the installation and commissioning of the monitoring

network at the Colle Santo gas field. The letter is a positive

indication of support for the development of the Colle Santo gas

field and the next stage is to receive a formal decree from MASE to

conduct the work.

In September 2023, Reabold announced that the Abruzzo regional

government had confirmed its agreement with, and intention to

approve, by decree, the Early Production Programme for the Colle

Santo gas field, allowing early revenue generation from the Colle

Santo project. The Early Production Programme and associated

monitoring will facilitate completion of the work required by the

Visual and Environmental Impact Assessment Commission for the

granting of the full development concession for the Colle Santo gas

field.

The Early Production Programme includes the following:

-- Production of gas for a period of 24 months;

-- Conversion of gas to power for sale to the electricity grid; and

-- Renewal of the Abruzzo Region's earlier 24-month test approval permit.

The permissions from UNMIG and the Abruzzo regional government

significantly de-risk the full concession permit approval to allow

for over 20 years of production.

Colle Santo has the potential to generate an estimated EUR11-12m

of post-tax free cash flow per annum(1) . LNEnergy will seek to

secure EUR30m in debt financing to fund the exercise of the option

to purchase the Colle Santo gas field and development capex to

achieve first gas.

(1) LNEnergy Management estimate, at 9 mmcf/d sales gas and

EUR45/MWh

Daybreak Oil and Gas Inc - USA

Reabold has a 42% shareholding in Daybreak Oil and Gas Inc

("Daybreak"). Daybreak is an OTC traded oil and gas company engaged

in the exploration, development and production of onshore crude oil

and natural gas, primarily in California.

Danube Petroleum Limited - Parta and Iecea Mare licences,

Romania

Reabold has a 50.8% equity position in Danube Petroleum Limited

("Danube"), with ASX listed ADX Energy Ltd ("ADX") holding the

remaining 49.2%. Danube has a 100% interest in the Parta

exploration licence and a 100% interest in the Iecea Mare

production licence.

ADX has continued to engage with the Romanian authorities with

respect to preparation for a government decision in relation to the

Parta exploration licence extension. The Iecea Mare production

licence which has a validity (or term) of 20 years is not

affected.

Other Business and corporate

In February 2023, investors voted to support a capital reduction

and share buyback programme. The capital reduction was approved at

the High Court of Justice in March 2023 and a buyback programme of

up to GBP750,000 was announced in April 2023, as part of a proposed

GBP4.0 million return of excess cash to shareholders. For further

details on the progress of the buyback programme please see Note

8.

In April 2023, the board adopted the Reabold Resources plc 2023

Long Term Incentive Plan ("LTIP"). The maiden award has been made

to members of the Group's executive team and senior management. All

previous share option plans in the Company expired in March 2023.

Please see Note 10 for further details.

Financial Review

Group Income Statement

The Group's loss for the first half of 2023 was GBP3.65 million

(1H 2022: loss of GBP2.72 million).

The Group generated nil revenue and incurred nil cost of sales

in the first half of 2023 as a result of the completion of the

equity exchange agreement with Daybreak in May 2022 (1H 2022:

GBP560,000 and GBP834,000 respectively).

The Group incurred a loss of GBP895,000 on financial assets (1H

2022: gain of 1,165,000). The loss primarily arose from a decline

in the market value of Daybreak's shares.

Exploration expenses of GBP1.3 million were incurred in the

first half of 2023 (1H 2022: Nil). The charge in 2023 principally

relates to exploration expenditure written off as a result of the

relinquishment of several North Sea licences. See Note 5 for

further details.

Reabold's share of loss of associates was GBP263,000 (1H 2022:

GBP1.2 million). The decrease was largely due to the absence of

non-cash impairment charges which Corallian had incurred in 1H

2022. See Note 9 for a breakdown per associate.

The Group's administrative expenses for the period were GBP1.1

million (1H 2022: GBP0.7 million). The biggest driver being an

increase in legal fees as a result of the LNEnergy acquisition as

well as the impact of inflation across all suppliers. Foreign

exchange losses of GBP107,000 (1H 2021: gains of GBP695,000) arose

on US dollar denominated financial assets as sterling strengthened

compared to the US$ during 1H 2023.

Group Balance Sheet

Reabold retains a strong balance sheet with no borrowings,

limited decommissioning liabilities and cash inflows expected in Q4

2023 as part of the contingent consideration receivable arising

from the sale of Corallian to Shell. Receipt of the contingent

consideration will allow the Company to fund ongoing capital

investment programmes as well as seeking new acquisition and

investment opportunities. For further details of the contingent

consideration receivable please see Review of Operations - UK

offshore, and Note 11.

Exploration and evaluations assets increased from GBP6.8 million

at 31 December 2022 to GBP7.1 million at 30 June 2023. Additions at

West Newton as well as the acquisition of four North Sea licences

as part of the acquisition of Simwell Resources was largely offset

by several relinquishments within the North Sea portfolio. See Note

7 for further details.

Other non-current investments increased from GBP3.5 million at

year end to GBP4.6 million at 30 June 2023. The increase was driven

by the investment of GBP2.25 million into LNEnergy, offset by a

decline of GBP1.2 million in the market value of Reabold's

investment in Daybreak.

Group cash flow

The decrease in cash balances from GBP5.5 million at 31 December

2022 to GBP2.6 million at 30 June 2023 reflected cash used in

operations of GBP1.3 million and cash capital expenditure of GBP1.5

million.

Cash used in operations of GBP1.3 million for the half year

compared with GBP0.8 million for the same period last year,

consistent with the movements in administration expenses for the

periods as well as the introduction of exploration expenditure on

Reabold's North Sea licences.

Capital expenditure for the half year was GBP1.5 million

compared with GBP0.5 million in the same period in 2022 reflecting

the GBP0.75 million spend on the investment in LNEnergy and the

GBP0.5 million spend on the acquisition of Simwell Resources,

including transaction costs of GBP0.1 million. Capital expenditure

in 1H 2022 included GBP0.25 million on the acquisition of North Sea

licences from Corallian.

Future commitments

The Group has obligations to carry out defined work programmes

on its licences under the terms of the award of rights to these

licences.

Onshore PEDL183 - West Newton

Reabold and its partners have a commitment with the NSTA to

drill and test a new Kirkham Abbey deviated or horizontal appraisal

well by June 2024 as well as the recompletion or sidetrack and

testing of one of the WNA-1, WNA-2, or WNB-1Z wells in that same

timeframe. The Company estimates that its 16.67% share of the costs

to be c.GBP2.2 million.

Central North Sea - P2478

In July 2023, the Company was granted an extension until July

2025 for licence P2478. The extension was made via a Deed of

Variation to the licence by the NSTA, which stipulates an

additional commitment to acquire a minimum of 30 square kilometres

of 3D seismic data. Reabold estimates its 36% share of the 3D

acquisition costs to be c.GBP0.7 million.

Approved on behalf of the Board

Sachin Oza and Stephen Williams

Co-Chief Executive Officers

27 September 2023

Reabold Resources plc

Group Income Statement

For the period ended 30 June 2023

Six months Six months

ended 30 ended 30

June 2023 June 2022

GBP000 GBP000

Notes (Unaudited) (Unaudited)

--------------- --------------

Revenue - 560

Cost of sales - (834)

--------------- --------------

Gross profit - (274)

Net (loss) gain in financial assets measured

at fair value through profit or loss 11 (895) 1,165

Other income 24 26

Share of losses of associates 9 (263) (1,185)

Other expenses - (89)

Loss on sale of business - (2,345)

Exploration expense 5 (1,292) -

Administration expenses (1,111) (722)

Share based payments expense 10 (15) (17)

Foreign exchange (loss) gain (107) 695

--------------- --------------

Loss on ordinary activities (3,659) (2,746)

Finance costs - unwinding of discount on decommissioning

provisions (7) (9)

Finance income 16 39

Loss before tax for the period (3,650) (2,716)

Taxation - -

Loss for the period (3,650) (2,716)

Attributable to:

Reabold shareholders (3,650) (2,716)

(3,650) (2,716)

=============== ==============

Earnings per share

Basic and fully diluted loss per share (pence) (0.04) (0.03)

Reabold Resources plc

Group statement of comprehensive income

For the period ended 30 June 2023

Six months Six months

ended 30 ended 30

June 2023 June 2022

GBP000 GBP000

Notes (Unaudited) (Unaudited)

--------------- --------------

Loss for the period (3,650) (2,716)

--------------- --------------

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss

Currency translation differences - 77

Exchange (gains) on translation of foreign

operations reclassified

to loss on sale of business - (80)

--------------- --------------

Other comprehensive income/(loss) - (9)

--------------- --------------

Total comprehensive loss (3,650) (2,725)

--------------- --------------

Attributable to

--------------- --------------

Reabold Shareholders (3,650) (2,725)

--------------- --------------

Reabold Resources plc

Group balance sheet

As at 30 June 2023

30 June 31 Dec

2023 2022

GBP000 GBP000

Notes (Unaudited) (Audited)

------------- -----------

Non-current assets

Exploration & evaluation assets 7 7,100 6,815

Investments in associates 9 22,009 22,272

Other investments 11 4,559 3,484

------------- -----------

33,668 32,571

------------- -----------

Current assets

Prepayments 79 120

Trade and other receivables 94 181

Other investments 11 8,901 8,728

Restricted cash 25 25

Cash and cash equivalents 2,620 5,511

------------- -----------

11,719 14,565

------------- -----------

Total assets 45,387 47,136

------------- -----------

Current liabilities

Trade and other payables 58 198

Accruals 84 111

------------- -----------

142 309

------------- -----------

Non-current liabilities

Provision for decommissioning 374 367

------------- -----------

374 367

------------- -----------

Total liabilities 516 676

------------- -----------

Net assets 44,871 46,460

------------- -----------

EQUITY

Share capital 8 10,102 9,044

Share premium account 689 29,033

Capital redemption reserve 200 200

Treasury shares (122) -

Share based payment reserve 1,935 1,920

Retained earnings 32,067 6,263

------------- -----------

Total Equity 44,871 46,460

------------- -----------

Reabold Resources plc

Group statement of changes in equity

For the period ended 30 June 2023

Share Foreign

Share Capital based currency

Share premium Redemp-tion Treasury payments translat-ion Retained

capital account reserve Shares reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ---------- ---------- ------------- ---------- ---------- -------------- ---------- ---------

At 1 January

2022 9,044 29,033 200 - 1,898 9 6,308 46,492

Loss for the

year - - - - - - (2,716) (2,716)

Other

comprehensive

income - - - - - (9) - (9)

---------- ---------- ------------- ---------- ---------- -------------- ---------- ---------

Total

comprehensive

loss for the

period - - - - - (9) (2,716) (2,725)

Share based

payment - - - - 17 - - 17

At 30 June

2022 9,044 29,033 200 - 1,915 - 3,592 43,784

Profit for the

period - - - - - - 2,671 2,671

Other

comprehensive

income - - - - - - - -

Total

comprehensive

income for

the

period - - - - - - 2,671 2,671

Share based

payment - - - - 5 - - 5

At 31 December

2022

(audited) 9,044 29,033 200 - 1,920 - 6,263 46,460

Loss for the

period - - - - - - (3,650) (3,650)

Other

comprehensive

loss - - - - - - - -

Total

comprehensive

loss for the

period - - - - - - (3,650) (3,650)

Issue of

ordinary

share capital 1,058 1,110 - - - - - 2,168

Repurchase of

ordinary

share

capital - - - (122) - - - (122)

Reduction of

share

premium

account - (29,454) - - - - 29,454 -

Share based

payment - - - - 15 - - 15

---------- ---------- ------------- ---------- ---------- -------------- ---------- ---------

Balance 30

June

2023

(unaudited) 10,102 689 200 (122) 1,935 - 32,067 44,871

========== ========== ============= ========== ========== ============== ========== =========

Reabold Resources plc

Group cash flow statement

For the period ended 30 June 2023

Six months

Six months ended

ended 30 30 June

June 2023 2022

GBP000 GBP000

Note (Unaudited) (Unaudited)

-------------- --------------

Operating activities

Loss for the period (3,650) (2,716)

Adjustments to reconcile loss for the period

to net cash used in operating activities

Exploration expenditure written off 5 1,154 -

Depreciation - 318

Net loss (gain) on financial assts at fair value

through profit or loss 11 895 (1,165)

Net loss on sale of business - 2,345

Share of losses from associates 9 263 1,185

Net finance (income) costs (9) (30)

Share-based payments 10 15 17

Other non-cash movements - 89

Unrealised currency translation losses (gains) 107 (695)

Decrease (increase) in receivables 78 (220)

(Increase) in inventories - (22)

(Decrease) increase in payables (164) 50

Net cash used in operating activities (1,311) (844)

-------------- --------------

Investing activities

Expenditure on oil and gas assets - (8)

Expenditure on exploration & evaluation assets 7 (229) (193)

Acquisitions 3 (1,241) (250)

Investments in associates - -

-------------- --------------

Total cash capital expenditure (1,470) (451)

Interest received 16 1

Movements in restricted cash - (19)

Net cash disposed from sale of business - (16)

Net cash used in investment activities (1,454) (485)

Financing activities

Repurchase of shares 8 (122) -

Net cash used in financing activities (122) -

Currency translation differences relating to

cash and cash equivalents (4) -

(Decrease) in cash and cash equivalents (2,891) (1,329)

Cash and cash equivalents at the beginning of

the period 5,511 4,883

-------------- --------------

Cash and cash equivalents at the end of the period 2,620 3,554

============== ==============

Reabold Resources plc

Notes to the unaudited interim condensed consolidated financial

statements

1. Corporate information

The interim condensed consolidated financial statements of

Reabold Resources plc and its subsidiaries (collectively, the

"Group") for the six months ended 30 June 2023 were authorised for

issue in accordance with a resolution of the directors on 27

September 2023. Reabold Resources plc is a public limited company,

incorporated and domiciled in England & Wales, whose shares are

traded on AIM in London. The registered office is located at 20

Primrose Street, London, EC2A 2EW. The Group is principally engaged

in the investment in pre-cash flow upstream oil and gas

projects.

2. Basis of preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2023 have been prepared in accordance with

IAS 34 Interim Financial Reporting. The Group has prepared the

financial statements on the basis that it will continue to operate

as a going concern. The directors consider that there are no

material uncertainties that may cast significant doubt over this

assumption. They have formed a judgement that there is a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing the

financial statements.

The interim condensed consolidated financial statements do not

include all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the

Group's annual consolidated financial statements as at 31 December

2022.

There are no new or amended standards or interpretations adopted

from 1 January 2023 onwards that have a significant impact on the

financial information.

The financial information presented herein has been prepared in

accordance with the accounting policies expected to be used in

preparing Reabold's annual consolidated financial statements for

the year ended 31 December 2023 which are the same as those used in

preparing Reabold's annual consolidated financial statements for

the year ended 31 December 2022, with the exception of the changes

described in the 'Updates to significant accounting policies'

section below.

Significant accounting judgements and estimates

Reabold's significant accounting judgements and estimates were

disclosed in Reabold's Annual Report 2022. These have been

subsequently considered at the end of the period to determine if

any changes were required to those judgements and estimates. No

significant changes were identified.

Updates to significant accounting policies

Own equity instruments - treasury shares

Own equity instruments that are reacquired (treasury shares) are

recognised at cost and deducted from equity. Treasury shares

represent Ordinary Shares repurchased and available for specific

and limited purposes. No gain or loss is recognised in profit or

loss on the purchase, sale, issue or cancellation of the Group's

own equity instruments. Any difference between the carrying amount

and the consideration, if reissued, is also recognised in

equity.

Change in segmentation

During the first half of 2023, the Group's reportable segments

changed consistent with a change in the way that resources are

allocated and performance is assessed by the chief operating

decision maker, who for Reabold is the co-chief executive officers,

from that date. From the first half of 2023, the Group's reportable

segments are onshore UK, offshore UK, and international. At 31

December 2022, the Group's reportable segments were UK/Europe and

USA.

Onshore UK comprises the Group's investment in Rathlin and the

Group's 16.67% direct interest in PEDL183, which was previously

reported as part of the UK/Europe segment.

Offshore UK comprises the Group's interest in UK North Sea

licences, which was previously reported as part of the UK/Europe

segment.

International comprises the Group's investments in Danube

Petroleum Ltd, Daybreak Oil & Gas Inc., and LNEnergy Ltd.

Comparative information for 2022 has been restated in Note 4 to

reflect the changes in reportable segments.

3. Acquisitions

On 3 January 2023, Reabold acquired 100% of the issued share

capital of Simwell Resources. Total cash consideration for the

acquisition was GBP491,000, including transaction costs of

GBP118,000. In addition to the cash consideration, 247,775,359 new

Ordinary Shares were issued as part of the consideration for the

acquisition.

Between May and June 2023, Reabold acquired 16.2% of the

ordinary share capital of LNEnergy for a cash consideration of

GBP750,000 and the issuance of 810,810,811 new Ordinary Shares to

LNEnergy.

4. Segmental information(a)

The directors consider the Group to have three segments, being

onshore UK, offshore UK and international. Other business and

corporate comprises the Group's treasury functions and corporate

activities. The following tables present revenue and profit/(loss)

information for the Group's operating segments for the six months

ended 30 June 2023 and 2022, respectively.

Period ended Other business

30 June 2023 UK onshore UK offshore International & corporate Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue - - - - -

------------ ------------- --------------- ---------------- ---------

Segment loss (278) (1,133) (1,207) (1,032) (3,650)

------------ ------------- --------------- ---------------- ---------

Period ended Other business

30 June 2022 UK onshore UK offshore International & corporate Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue - - 560 - 560

------------ ------------- --------------- ---------------- ---------

Segment loss (383) (712) (1,408) (213) (2,716)

------------ ------------- --------------- ---------------- ---------

The following table presents assets and liabilities information

for the Group's operating segments as at 30 June 2023 and 31

December 2022, respectively:

Other business

UK onshore UK offshore International & corporate Total

GBP000 GBP000 GBP000 GBP000 GBP000

Assets

------------ ------------- --------------- ---------------- ---------

30 June 2023 24,050 9,400 9,177 2,760 45,387

------------ ------------- --------------- ---------------- ---------

31 December

2022 24,090 9,161 8,141 5,744 47,136

------------ ------------- --------------- ---------------- ---------

Other business

UK onshore UK offshore International & corporate Total

GBP000 GBP000 GBP000 GBP000 GBP000

Liabilities

------------ ------------- --------------- ---------------- ---------

30 June 2023 374 - - 142 516

------------ ------------- --------------- ---------------- ---------

31 December

2022 367 72 - 237 676

------------ ------------- --------------- ---------------- ---------

(a) Comparative information for 2022 has been restated to

reflect the changes in reportable segments. For more information

see Note 2 basis of preparation - Change in segmentation

5. Exploration expense

The following table represents amounts included within the Group

income statement relating to activity associated with the

exploration for and evaluation of oil and natural gas

resources.

GBP000 GBP000

------------------------------------- ------------ ------------

Six months Six months

ended 30 ended 30

June 2023 June 2022

------------ ------------

Exploration expenditure written off 1,154 -

Other exploration costs 138 -

------------------------------------- ------------ ------------

Total exploration expense 1,292 -

------------------------------------- ------------ ------------

Exploration expenditure written off relates to the following

North Sea Licences: P2332 - GBP633,000, P2329 - GBP382,000, P2427 -

GBP42,000, P2464 - GBP94,000, P2493 - GBP3,000.

6. Loss per share

Basic loss per ordinary share is calculated by dividing the loss

for the period attributable to ordinary shareholders by the

weighted average number of Ordinary Shares outstanding during the

period. As the Group is reporting a loss in each period, in

accordance with IAS 33, outstanding share options are not

considered to be dilutive because the exercise of the share options

would have the effect of reducing the loss per share.

Six months Six months

ended 30 ended 30

June 2023 June 2022

Results for the period (GBP000)

Loss for the period attributable to Reabold

shareholders (3,650) (2,716)

Number of shares (thousand) (a)

Basic weighted average number of shares outstanding 9,191,540 8,929,613

Basic loss per share (pence) (0.04) (0.03)

Diluted loss per share (pence) (0.04) (0.03)

(a) Excludes treasury shares

7. Exploration and Evaluation Assets

Total

GBP000

---------

Cost:

At 1 January 2022 9,123

Exchange adjustments 240

Acquisitions 343

Additions 572

Disposals (3,463)

---------

At 31 December 2022 6,815

---------

Acquisitions 1,210

Additions 229

Exploration expenditure written off (1,154)

---------

At 30 June 2023 7,100

---------

Acquisitions in 2023 relate to the acquisition of Simwell

Resources.

Exploration expenditure written off relates to the following

North Sea Licences: P2332 - GBP633,000, P2329 - GBP382,000, P2427 -

GBP42,000, P2464 - GBP94,000, P2493 - GBP3,000.

The disposal of GBP3.5 million in 2022 represents the

derecognition of E&E assets in California as a result of the

equity exchange agreement with Daybreak.

8. Called-up Share Capital

Allotted, called-up and fully paid share capital at 30 June

was as follows:

Number GBP000

Ordinary Shares of 0.1p each

----------------- ---------

At 1 January 2022 8,929,612,550 8,930

At 31 December 2022 8,929,612,550 8,930

----------------- ---------

Issue of new shares 1,058,586,170 1,058

----------------- ---------

At 30 June 2023 9,988,198,720 9,988

----------------- ---------

"A" Deferred shares 6,915,896 114

----------------- ---------

10,102

----------------- ---------

During the first half of 2023 the Company repurchased 83,281,490

Ordinary Shares for a total consideration of GBP121,830, including

transaction costs of GBP994. All shares purchased were retained in

treasury. At 30 June 2023, 83,281,490 Ordinary Shares of nominal

value GBP83,281 were held in treasury. These treasury shares are

not taken into consideration in relation to the payment of

dividends and voting at shareholder meetings.

At 30 June 2023, the issued share capital of the Company

comprised 9,904,917,230 Ordinary Shares (excluding treasury shares)

par value 0.1p per share, each with one vote; and 6,915,896 "A"

Deferred shares of 1.65p. The "A" deferred shares do not carry

voting rights. The total number of voting rights in the Company is

therefore 9,904,917,320.

A further 28,291,347 Ordinary Shares were repurchased between

the end of the reporting period and 25 September 2023, the latest

practicable date before the completion of these financial

statements, for a total cost of GBP35,770. The number of shares in

issue is reduced when shares are repurchased.

247,775,359 new Ordinary Shares were issued in January 2023 as

part of the consideration for the acquisition of Simwell Resources.

810,810,811 new Ordinary Shares were issued in June 2023 as part of

the investment into LNEnergy.

9. Investments in associates

The following tables provide aggregated summarised financial

information for the Group's associates as it relates to the amounts

recognised in the Group income statement and on the Group balance

sheet.

GBP000

Income Statement

Losses from associates

------------ -----------------------------

30 June 30 June 2022

2023

------------ --------- ------------------

Rathlin 223 394

Danube 40 29

Corallian - 762

------------- --------- ------------------

263 1,185

--------- ------------------

GBP000

Balance Sheet

Investments in associates

---------- -----------------------------

30 June 31 Dec 2022

2023

---------- ----------- ----------------

Rathlin 17,381 17,604

Danube 4,628 4,668

----------- ----------- ----------------

22,009 22,272

----------- ----------------

Details of the Company's associates as at 30 June 2023 are shown

below

Associates % Country of incorporation Principal activities

-------------------------- ------ -------------------------- ----------------------------

Rathlin Energy (UK) 59.5 England & Wales Exploration and Evaluation

Limited

Danube Petroleum Limited 50.8 England & Wales Exploration and Evaluation

-------------------------- ------ -------------------------- ----------------------------

10. Share-Based payments

On 27 April 2023, the Board adopted the Reabold Resources plc

2023 LTIP. On adoption of the LTIP, 390,000,000 share options were

granted to members of the Group's executive team and senior

management. All previous share option plans in the Company expired

on 19 March 2023.

The vesting criteria of the options is based on Total

Shareholder Return ("TSR") over a three-to-five-year period. For

the awards to vest in full, the TSR of a share must be at or more

than six times (6x) the market value of a share at the grant date

using a 30-trading day average. The first measurement date shall be

at the end of year three, the second measurement date at the end of

year four and the final measurement date at the end of year five.

If TSR is less than 2.5x market value, 0% of the award vests. If

TSR is at 2.5x market value, 30% of the award vests and if TSR is

at 4x market value, 60% of the award vests. Performance between TSR

thresholds shall be calculated on a straight-line basis. The fair

value at grant date is estimated using a Monte Carlo model, taking

into account the terms and conditions upon which the options were

granted. The fair value of options granted during the six months

ended 30 June 2023 was estimated on the date of grant using the

following inputs and assumptions:

Dividend yield 0.0%

Volatility 68%

Risk-free rate

(3 years) 3.82%

Risk-free rate

(4 years) 3.73%

Risk-free rate

(5 years) 3.67%

Share price GBP0.0018

Exercise price Nil

The fair value of the options at grant date was GBP0.00109. For

the 6 months ended 30 June 2023, the Group has recognised GBP15,000

of share-based payment expense in the income statement (30 June

2022: GBP17,000).

11. Other investments

30 June 2023 31 Dec 2022

GBP000 GBP000

------------------------ ------------------------

Current Non-Current Current Non-Current

Investment in Connaught Oil

& Gas Ltd - 15 - 15

Contingent consideration 8,901 8,728 -

Investment in Daybreak - 2,294 - 3,469

Investment in LNEnergy - 2,250 - -

8,901 4,559 8,728 3,484

The contingent consideration relates to amounts arising on the

disposal of Corallian in 2022 which are financial assets classified

as measured at fair value through profit or loss. The payment of

the contingent consideration from Shell will be staged as

follows:

A single payment of GBP22 million (GBP9.5 million net to

Reabold) will be made, assuming the development and production

consent for the Victory gas field is secured from the North Sea

Transition Authority, on or before 1 December 2023. If consent has

not been granted by this date, then Shell will have the option to

either: i) pay GBP12 million (GBP5.1 million net to Reabold), with

the remaining GBP10 million (GBP4.4 million net to Reabold) being

paid at a later consent date; or ii) offer to transfer-back the

Victory licence to the current Corallian shareholders for GBP1

consideration.

The table below summarises the change in fair value of other

investments as reported in the income statement.

Change in fair value

--------------------------- --------------------------

Six months Six months

ended 30 ended 30

June 2023 June 2022

GBP000 GBP000

--------------------------- ------------ ------------

Convertible loan notes - 10

Contingent consideration 173 -

Investment in Daybreak (1,068) 1,155

(895) 1,165

------------ ------------

12. Events after the reporting period

On 12 September 2023, Reabold increased its stake in LNEnergy

from 16.2% to 17.6% for cash consideration of GBP250,000. For

further details on LNEnergy and the Colle Santo gas project please

see Review of Operations - LNEnergy - Colle Santo gas field,

Italy.

13. Non-Statutory accounts

The financial information shown in this publication, which was

approved by the Board of Directors on 27 September 2023, is

unaudited and does not constitute statutory financial statements.

Audited financial information will be published in Reabold's 2023

Annual Report. Reabold's 2022 Annual Report has been filed with the

Registrar of Companies in England and Wales.

GLOSSARY

2C resources, 2C

Best estimate contingent resource, being quantities of

hydrocarbons which are estimated, on a given date, to be

potentially recoverable from known accumulations but which are not

currently considered to be commercially recoverable.

1U resources, 1U

Unrisked low estimate prospective resources.

2U resources, 2U

Unrisked best estimate prospective resource.

3U

Unrisked high estimate prospective resource.

Best estimate

With respect to resources categorisation, the most realistic

assessment of recoverable quantities if only a single result were

reported. If probabilistic methods are used, there should be at

least a 50% probability (P50) that the quantities actually

recovered will equal or exceed the best estimate.

bcf

Billion standard cubic feet.

boe

Barrels of oil equivalent.

Capital expenditure

Total cash capital expenditure as stated in the Group cash flow

statement.

CPR

Competent Persons Report.

High estimate

With respect to resources categorisation, this is considered to

be an optimistic estimate of the quantity that will actually be

recovered from the accumulation by a project. If probabilistic

methods are used, there should be at least a 10% probability (P10)

that the quantities actually recovered will equal or exceed the

high estimate.

IFRS

International Financial Reporting Standards.

Joint arrangement

An arrangement in which two or more parties have joint

control.

Joint control

Contractually agreed sharing of control over an arrangement,

which exists only when decisions about the relevant activities

require the unanimous consent of the parties sharing control.

Joint operation

A joint arrangement whereby the parties that have joint control

of the arrangement have rights to the assets, and obligations for

the liabilities, relating to the arrangement.

Low estimate

With respect to resources categorisation, this is a conservative

estimate of the quantity that will actually be recovered from the

accumulation by a project. If probabilistic methods are used, there

should be at least a 90% probability (P90) that the quantities

actually recovered will equal or exceed the low estimate.

mmboe

Million barrels of oil equivalent.

mmcf/d

Million cubic feet per day.

MWh

Megawatt hour.

NPV10

Net Present Value using a 10% discount factor.

NSTA

North Sea Transition Authority.

OTC

Over-the-counter.

Pmean

Reflects a mid-case volume estimate of resource derived using

probabilistic methodology. This is the mean of the probability

distribution for the resource estimates and may be skewed by

resource numbers with relatively low probabilities.

Prospective Resources

Quantities of hydrocarbons which are estimated, as of a given

date, to be potentially recoverable from undiscovered accumulations

by application of future development projects

[1] RPS estimate, September 2022

[2] The CPR reports oil and gas Prospective Resources. The oil

equivalent value of the gas resources has been estimated by the

company using a factor of 5.8bcf per mmboe.

[3] The unrisked aggregation was performed by the company and

assumes that all prospects at all levels are successful.

[4] For further details on the progress of the buyback programme

see note 8

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKOBPABKDKCB

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

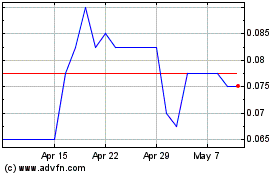

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Jan 2024 to Jan 2025