0001555074false00015550742024-05-312024-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 31, 2024

ALTISOURCE ASSET MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| U.S. Virgin Islands | | 001-36063 | | 66-0783125 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive offices including zip code)

(704) 275-9113

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | AAMC | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On May 31, 2024, Altisource Asset Management Corporation (the “Company”) received a notification letter (the “Notice”) from the NYSE American LLC (the “NYSE American”) indicating that the Company is not in compliance with the NYSE American continued listing standards set forth in Sections 1003(a)(ii) and (iii) of the NYSE American Company Guide. Section 1003(a)(ii) of the NYSE American Company Guide requires a listed company’s stockholders’ equity be at least $4.0 million if it has reported losses from continuing operations and/or net losses in three of its four most recent fiscal years. Section 1003(a)(iii) of the NYSE American Company Guide requires a listed company’s stockholders’ equity be at least $6.0 million if it has reported losses from continuing operations and/or net losses in its five most recent fiscal years. The Notice noted that the Company reported stockholders’ equity of $3.3 million as of March 31, 2024, and losses from continuing operations and/or net losses in its five most recent fiscal years ended December 31, 2023. The Notice also noted that the Company is not currently eligible for any exemption set forth in Section 1003(a) of the NYSE American Company Guide.

In order to maintain the Company’s listing on the NYSE American, the NYSE American has requested that the Company submit a plan of compliance (the “Plan”) by June 30, 2024, addressing how the Company intends to regain compliance with Sections 1003(a)(ii) and (iii) of the NYSE American Company Guide by December 1, 2024.

The Company’s management has begun its analysis regarding submission of the Plan to the NYSE American by the June 30, 2024 deadline. If the NYSE American accepts the Company’s Plan, the Company will be able to continue its listing during the Plan period and will be subject to continued periodic review by the NYSE American staff. If the Plan is not submitted, or not accepted, or is accepted but the Company does not make progress consistent with the Plan during the Plan period, the Company will be subject to delisting procedures as set forth in the NYSE American Company Guide.

The Company is committed to considering available options to regain compliance with the NYSE American’s stockholders’ equity requirements. There can be no assurance that the Company will be able to achieve compliance with the NYSE American’s continued listing standards within the required time frame.

The notice has no immediate impact on the listing of the Company’s shares of common stock, which will continue to be listed and traded on the NYSE American during this period, subject to the Company’s compliance with the other listing requirements of the NYSE American. The common stock will continue to trade under the symbol “AAMC,” but will have an added designation of “.BC” to indicate the status of the common stock as “below compliance.” The notice does not affect the Company's ongoing business operations or its reporting requirements with the Securities and Exchange Commission.

If the Company’s common stock ultimately were to be delisted for any reason, it could negatively impact the Company by (i) reducing the liquidity and market price of the Company’s common stock; (ii) reducing the number of investors willing to hold or acquire the common stock, which could negatively impact the Company’s ability to raise equity financing; and (iii) limiting the Company’s ability to use a registration statement to offer and sell freely tradable securities, thereby preventing the Company from accessing the public capital markets; and (iv) impairing the Company’s ability to provide equity incentives to its employees.

Item 8.01 Other Events.

On June 6, 2024, in accordance with the NYSE American Company Guide, the Company issued a press release discussing the matters disclosed in Item 3.01 above. A copy of the press release is included herewith as Exhibit 99.1, which is incorporated by reference into this Item 8.01.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| | Press Release dated June 6, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | Altisource Asset Management Corporation |

June 6, 2024 | By: | /s/ Richard G. Rodick |

| | Richard G. Rodick Chief Financial Officer |

JUNE 6, 2024

ALTISOURCE ASSET MANAGEMENT CORPORATION REPORTS RECEIPT OF COMMUNICATIONS FROM NYSE

CHRISTIANSTED, U.S. Virgin Islands--(BUSINESS WIRE)—June 6, 2024. On May 31, 2024, Altisource Asset Management Corporation (the “Company”) received a notification letter (the “Notice”) from the NYSE American LLC (the “NYSE American”) advising that the Company is not in compliance with the NYSE American continued listing standards set forth in Sections 1003(a)(ii) and (iii) of the NYSE American Company Guide given the reported stockholders’ equity as of March 31, 2024, and losses from continuing operations and/or net losses in the Company’s five most recent fiscal years ended December 31, 2023. The Notice also advised that the Company is not currently eligible for any exemption set forth in Section 1003(a) of the NYSE American Company Guide.

In order to maintain the Company’s listing on the NYSE American, the NYSE American has requested that the Company submit a plan of compliance (the “Plan”) by June 30, 2024, addressing how the Company intends to regain compliance with Sections 1003(a)(ii) and (iii) of the NYSE American Company Guide by December 1, 2024.

The Company’s management has begun its analysis regarding submission of the Plan to the NYSE American by the June 30, 2024 deadline. If the NYSE American accepts the Company’s Plan, the Company will be able to continue its listing during the Plan period and will be subject to continued periodic review by the NYSE American staff. If the Plan is not submitted, or not accepted, or is accepted but the Company does not make progress consistent with the Plan during the Plan period, the Company will be subject to delisting procedures as set forth in the NYSE American Company Guide.

The Company is committed to considering available options to regain compliance with the NYSE American’s stockholders’ equity requirements. There can be no assurance that the Company will be able to achieve compliance with the NYSE American’s continued listing standards within the required time frame.

The notice has no immediate impact on the listing of the Company’s shares of common stock, which will continue to be listed and traded on the NYSE American during this period, subject to the Company’s compliance with the other listing requirements of the NYSE American. The common stock will continue to trade under the symbol “AAMC,” but will have an added designation of “.BC” to indicate the status of the common stock as “below compliance.” The notice does not affect the Company's ongoing business operations or its reporting requirements with the Securities and Exchange Commission.

About AAMC

AAMC is a private credit provider that originates alternative assets to provide liquidity and capital to under-served markets. AAMC works to employ capital light operating strategies that have historically been implemented across a variety of industry sectors. The Company currently also focuses on the development and licensing of a control system which increases the efficiency of electric vehicles. The Company acquired a non-exclusive license for a set of patents for a control system which seeks to optimize the efficiency of electric vehicles. Additional information is available at www.altisourceamc.com.

Forward-looking Statements

This press release and the attachments thereto contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “targets,” “predicts,” or “potential,” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. The forward-looking statements contained in this release reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual business, operations, results or financial condition to differ significantly from those expressed in any forward-looking statement.

Factors that may materially affect such forward-looking statements include, but are not limited to:

•Our ability to develop and implement new businesses or, to the extent such businesses are developed, our ability to make them successful or sustain the performance of any such businesses;

•Current inflationary economic and macro-economic and geopolitical events, and market conditions that can affect our businesses;

•Our ability to develop and implement a new business with respect to that certain non-exclusive patent and technology licensing agreement entered into on October 6, 2023 and that the Company will achieve its expectations with respect to the patents and other intellectual property associated therewith;

•Our ability to monetize our existing loan portfolio; and

•The failure of our information technology systems, a breach thereto, and our ability to integrate and improve those systems at a pace fast enough to keep up with competitors and security threats.

While forward-looking statements reflect our good faith beliefs, assumptions, and expectations, they are not guarantees of future performance. Such forward-looking statements speak only as of their respective dates, and we assume no obligation to update them to reflect changes in underlying assumptions, new information or otherwise. For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements contained herein, please refer to the section “Item 1A. Risk Factors” contained in the Company’s 2023 Annual Report on Form 10-K.

Media contact:

Charles Frischer

T: +1-813-474-9047

E: charles.frischer@altisourceamc.com

Source: Altisource Asset Management Corporation

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

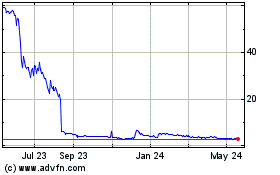

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Feb 2025 to Mar 2025

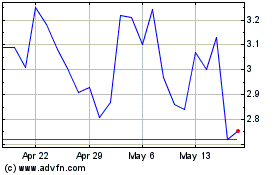

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Mar 2024 to Mar 2025