Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

16 November 2024 - 8:30AM

Edgar (US Regulatory)

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)

| Description | |

No. of Shares | | |

Value | |

| EQUITY SECURITIES - 99.42% | |

| | | |

| | |

| CLOSED-END FUNDS - 10.00% | |

| | | |

| | |

| CONVERTIBLE SECURITY FUNDS - 0.05% | |

| | | |

| | |

| Bancroft Fund Ltd. | |

| 12,980 | | |

$ | 217,675 | |

| Calamos Convertible Opportunities and Income Fund | |

| 12,300 | | |

| 143,172 | |

| Gabelli Convertible & Income Securities Fund, Inc. | |

| 2,197 | | |

| 8,063 | |

| | |

| | | |

| 368,910 | |

| DIVERSIFIED EQUITY - 1.77% | |

| | | |

| | |

| Eaton Vance Tax-Advantaged Dividend Income Fund | |

| 122,755 | | |

| 3,030,821 | |

| General American Investors Company, Inc. | |

| 95,374 | | |

| 5,113,000 | |

| Liberty All-Star® Equity Fund | |

| 123,010 | | |

| 873,371 | |

| Liberty All-Star® Growth Fund, Inc. | |

| 704,762 | | |

| 3,953,715 | |

| Tri-Continental Corporation | |

| 29,262 | | |

| 966,816 | |

| | |

| | | |

| 13,937,723 | |

| GLOBAL - 1.87% | |

| | | |

| | |

| abrdn Global Dynamic Dividend Fund | |

| 29,902 | | |

| 317,559 | |

| Eaton Vance Tax-Advantaged Global Dividend Income Fund | |

| 537,711 | | |

| 10,453,103 | |

| Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund | |

| 120,923 | | |

| 3,209,296 | |

| GDL Fund (The) | |

| 84,674 | | |

| 690,093 | |

| | |

| | | |

| 14,670,051 | |

| INCOME & PREFERRED STOCK - 1.08% | |

| | | |

| | |

| Calamos Long/Short Equity & Dynamic Income Trust | |

| 33,275 | | |

| 522,085 | |

| Calamos Strategic Total Return Fund | |

| 458,067 | | |

| 7,947,462 | |

| | |

| | | |

| 8,469,547 | |

| LOAN PARTICIPATION - 0.06% | |

| | | |

| | |

| BlackRock Floating Rate Income Strategies Fund, Inc. | |

| 10,600 | | |

| 139,920 | |

| Invesco Senior Income Trust | |

| 44,200 | | |

| 179,894 | |

| Nuveen Credit Strategies Income Fund | |

| 26,400 | | |

| 152,856 | |

| | |

| | | |

| 472,670 | |

| OPTION ARBITRAGE/OPTIONS STRATEGIES - 4.44% | |

| | | |

| | |

| BlackRock Enhanced Capital & Income Fund, Inc. | |

| 198,800 | | |

| 3,914,372 | |

| BlackRock Enhanced Equity Dividend Trust | |

| 101,742 | | |

| 880,068 | |

| BlackRock Enhanced International Dividend Trust | |

| 32,897 | | |

| 190,803 | |

| Eaton Vance Enhanced Equity Income Fund | |

| 24,967 | | |

| 505,082 | |

| Eaton Vance Enhanced Equity Income Fund II | |

| 48,993 | | |

| 1,063,148 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| OPTION ARBITRAGE/OPTIONS STRATEGIES - 4.44% (Continued) | |

| | | |

| | |

| Eaton Vance Risk-Managed Diversified Equity Income Fund | |

| 305,389 | | |

$ | 2,812,633 | |

| Eaton Vance Tax-Managed Buy-Write Opportunities Fund | |

| 225,151 | | |

| 3,107,084 | |

| Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund | |

| 3,178 | | |

| 27,585 | |

| Eaton Vance Tax-Managed Global Diversified Equity Income Fund | |

| 71,032 | | |

| 619,399 | |

| Nuveen Dow 30SM Dynamic Overwrite Fund | |

| 355,959 | | |

| 5,285,991 | |

| Nuveen Nasdaq 100 Dynamic Overwrite Fund | |

| 453,984 | | |

| 11,404,078 | |

| Nuveen S&P 500 Buy-Write Income Fund | |

| 361,353 | | |

| 4,957,763 | |

| Nuveen S&P 500 Dynamic Overwrite Fund | |

| 5,379 | | |

| 90,260 | |

| | |

| | | |

| 34,858,266 | |

| SECTOR EQUITY - 0.54% | |

| | | |

| | |

| BlackRock Innovation and Growth Term Trust | |

| 130,309 | | |

| 983,833 | |

| John Hancock Financial Opportunities Fund | |

| 98,000 | | |

| 3,249,680 | |

| | |

| | | |

| 4,233,513 | |

| UTILITY - 0.19% | |

| | | |

| | |

| Allspring Utilities and High Income Fund | |

| 2,798 | | |

| 31,226 | |

| BlackRock Utilities, Infrastructure & Power Opportunities Trust | |

| 59,032 | | |

| 1,465,764 | |

| | |

| | | |

| 1,496,990 | |

| | |

| | | |

| | |

| TOTAL CLOSED-END FUNDS | |

| | | |

| 78,507,670 | |

| | |

| | | |

| | |

| COMMON STOCKS - 79.07% | |

| | | |

| | |

| COMMUNICATION SERVICES - 8.04% | |

| | | |

| | |

| Alphabet Inc. - Class C | |

| 167,200 | | |

| 27,954,168 | |

| AT&T Inc. | |

| 88,300 | | |

| 1,942,600 | |

| Comcast Corporation - Class A | |

| 53,700 | | |

| 2,243,049 | |

| Meta Platforms, Inc. - Class A | |

| 32,100 | | |

| 18,375,324 | |

| Netflix, Inc. * | |

| 8,600 | | |

| 6,099,722 | |

| T-Mobile US, Inc. | |

| 9,100 | | |

| 1,877,876 | |

| Verizon Communications Inc. | |

| 57,400 | | |

| 2,577,834 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| COMMUNICATION SERVICES - 8.04% (Continued) | |

| | | |

| | |

| Walt Disney Company (The) | |

| 21,700 | | |

$ | 2,087,323 | |

| | |

| | | |

| 63,157,896 | |

| CONSUMER DISCRETIONARY - 8.64% | |

| | | |

| | |

| Amazon.com, Inc. * | |

| 126,700 | | |

| 23,608,011 | |

| AutoZone, Inc. * | |

| 120 | | |

| 378,005 | |

| Booking Holdings Inc. | |

| 1,200 | | |

| 5,054,544 | |

| Chipotle Mexican Grill, Inc. * | |

| 20,800 | | |

| 1,198,496 | |

| D.R. Horton, Inc. | |

| 4,500 | | |

| 858,465 | |

| eBay Inc. | |

| 7,800 | | |

| 507,858 | |

| Ford Motor Company | |

| 59,600 | | |

| 629,376 | |

| General Motors Company | |

| 21,100 | | |

| 946,124 | |

| Hilton Worldwide Holdings Inc. | |

| 4,900 | | |

| 1,129,450 | |

| Home Depot, Inc. (The) | |

| 21,000 | | |

| 8,509,200 | |

| Lowe's Companies, Inc. | |

| 7,000 | | |

| 1,895,950 | |

| Marriott International, Inc. - Class A | |

| 4,600 | | |

| 1,143,560 | |

| McDonald's Corporation | |

| 9,600 | | |

| 2,923,296 | |

| NIKE, Inc. - Class B | |

| 13,700 | | |

| 1,211,080 | |

| O'Reilly Automotive, Inc. * | |

| 1,000 | | |

| 1,151,600 | |

| Ross Stores, Inc. | |

| 5,100 | | |

| 767,601 | |

| Starbucks Corporation | |

| 15,400 | | |

| 1,501,346 | |

| Tesla, Inc. * | |

| 47,500 | | |

| 12,427,425 | |

| TJX Companies, Inc. (The) | |

| 17,100 | | |

| 2,009,934 | |

| | |

| | | |

| 67,851,321 | |

| CONSUMER STAPLES - 5.74% | |

| | | |

| | |

| Altria Group, Inc. | |

| 30,400 | | |

| 1,551,616 | |

| Archer-Daniels-Midland Company | |

| 10,500 | | |

| 627,270 | |

| Coca-Cola Company (The) | |

| 76,400 | | |

| 5,490,104 | |

| Colgate-Palmolive Company | |

| 15,700 | | |

| 1,629,817 | |

| Constellation Brands, Inc. - Class A | |

| 2,800 | | |

| 721,532 | |

| Costco Wholesale Corporation | |

| 7,900 | | |

| 7,003,508 | |

| Dollar General Corporation | |

| 3,100 | | |

| 262,167 | |

| General Mills, Inc. | |

| 10,500 | | |

| 775,425 | |

| Hershey Company (The) | |

| 2,900 | | |

| 556,162 | |

| Keurig Dr Pepper Inc. | |

| 17,300 | | |

| 648,404 | |

| Kimberly-Clark Corporation | |

| 6,200 | | |

| 882,136 | |

| Kraft Heinz Company (The) | |

| 13,600 | | |

| 477,496 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| CONSUMER STAPLES - 5.74% (Continued) | |

| | | |

| | |

| Mondelēz International, Inc. - Class A | |

| 23,900 | | |

$ | 1,760,713 | |

| Monster Beverage Corporation * | |

| 13,100 | | |

| 683,427 | |

| PepsiCo, Inc. | |

| 18,900 | | |

| 3,213,945 | |

| Philip Morris International Inc. | |

| 26,700 | | |

| 3,241,380 | |

| Procter & Gamble Company (The) | |

| 47,100 | | |

| 8,157,720 | |

| Target Corporation | |

| 8,800 | | |

| 1,371,568 | |

| Walmart Inc. | |

| 74,800 | | |

| 6,040,100 | |

| | |

| | | |

| 45,094,490 | |

| ENERGY - 2.79% | |

| | | |

| | |

| Chevron Corporation | |

| 23,900 | | |

| 3,519,753 | |

| ConocoPhillips | |

| 23,300 | | |

| 2,453,024 | |

| Devon Energy Corporation | |

| 10,900 | | |

| 426,408 | |

| EOG Resources, Inc. | |

| 7,500 | | |

| 921,975 | |

| Exxon Mobil Corporation | |

| 76,064 | | |

| 8,916,222 | |

| Hess Corporation | |

| 5,800 | | |

| 787,640 | |

| Kinder Morgan, Inc. - Class P | |

| 16,884 | | |

| 372,968 | |

| Marathon Petroleum Corporation | |

| 3,700 | | |

| 602,767 | |

| Occidental Petroleum Corporation | |

| 8,000 | | |

| 412,320 | |

| Phillips 66 | |

| 7,200 | | |

| 946,440 | |

| Schlumberger Limited | |

| 19,200 | | |

| 805,440 | |

| Valero Energy Corporation | |

| 7,500 | | |

| 1,012,725 | |

| Williams Companies, Inc. (The) | |

| 16,600 | | |

| 757,790 | |

| | |

| | | |

| 21,935,472 | |

| FINANCIALS - 10.98% | |

| | | |

| | |

| Aflac Incorporated | |

| 8,600 | | |

| 961,480 | |

| American Express Company | |

| 8,300 | | |

| 2,250,960 | |

| American International Group, Inc. | |

| 10,700 | | |

| 783,561 | |

| Aon plc - Class A | |

| 2,900 | | |

| 1,003,371 | |

| Arthur J. Gallagher & Co. | |

| 3,000 | | |

| 844,110 | |

| Bank of America Corporation | |

| 133,300 | | |

| 5,289,344 | |

| Bank of New York Mellon Corporation (The) | |

| 9,600 | | |

| 689,856 | |

| Berkshire Hathaway Inc. - Class B * | |

| 24,300 | | |

| 11,184,318 | |

| BlackRock, Inc. | |

| 2,000 | | |

| 1,899,020 | |

| Capital One Financial Corporation | |

| 5,100 | | |

| 763,623 | |

| Charles Schwab Corporation (The) | |

| 23,100 | | |

| 1,497,111 | |

| Chubb Limited | |

| 7,400 | | |

| 2,134,086 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| FINANCIALS - 10.98% (Continued) | |

| | | |

| | |

| Citigroup Inc. | |

| 29,200 | | |

$ | 1,827,920 | |

| CME Group Inc. | |

| 5,800 | | |

| 1,279,770 | |

| Fiserv, Inc. * | |

| 9,400 | | |

| 1,688,710 | |

| Goldman Sachs Group, Inc. (The) | |

| 5,300 | | |

| 2,624,083 | |

| Intercontinental Exchange, Inc. | |

| 9,300 | | |

| 1,493,952 | |

| JPMorgan Chase & Co. | |

| 58,500 | | |

| 12,335,310 | |

| Marsh & McLennan Companies, Inc. | |

| 8,000 | | |

| 1,784,720 | |

| Mastercard Incorporated - Class A | |

| 14,400 | | |

| 7,110,720 | |

| MetLife, Inc. | |

| 9,900 | | |

| 816,552 | |

| Moody's Corporation | |

| 2,000 | | |

| 949,180 | |

| Morgan Stanley | |

| 23,900 | | |

| 2,491,336 | |

| MSCI Inc. | |

| 1,100 | | |

| 641,223 | |

| PayPal Holdings, Inc. * | |

| 17,000 | | |

| 1,326,510 | |

| PNC Financial Services Group, Inc. (The) | |

| 6,100 | | |

| 1,127,585 | |

| Progressive Corporation (The) | |

| 9,900 | | |

| 2,512,224 | |

| S&P Global Inc. | |

| 5,000 | | |

| 2,583,100 | |

| Travelers Companies, Inc. (The) | |

| 6,200 | | |

| 1,451,544 | |

| Truist Financial Corporation | |

| 20,600 | | |

| 881,062 | |

| U.S. Bancorp | |

| 24,400 | | |

| 1,115,812 | |

| Visa, Inc. - Class A | |

| 27,600 | | |

| 7,588,620 | |

| Wells Fargo & Company | |

| 59,100 | | |

| 3,338,559 | |

| | |

| | | |

| 86,269,332 | |

| HEALTH CARE - 9.19% | |

| | | |

| | |

| Abbott Laboratories | |

| 22,200 | | |

| 2,531,022 | |

| AbbVie Inc. | |

| 26,500 | | |

| 5,233,220 | |

| Amgen Inc. | |

| 7,200 | | |

| 2,319,912 | |

| Becton, Dickinson and Company | |

| 5,200 | | |

| 1,253,720 | |

| Boston Scientific Corporation * | |

| 20,336 | | |

| 1,704,157 | |

| Bristol-Myers Squibb Company | |

| 24,600 | | |

| 1,272,804 | |

| Centene Corporation * | |

| 10,200 | | |

| 767,856 | |

| Cigna Group (The) | |

| 4,400 | | |

| 1,524,336 | |

| CVS Health Corporation | |

| 14,400 | | |

| 905,472 | |

| Danaher Corporation | |

| 8,800 | | |

| 2,446,576 | |

| DexCom, Inc. * | |

| 12,900 | | |

| 864,816 | |

| Edwards Lifesciences Corporation * | |

| 7,300 | | |

| 481,727 | |

| Elevance Health, Inc. | |

| 3,200 | | |

| 1,664,000 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| HEALTH CARE - 9.19% (Continued) | |

| | | |

| | |

| Eli Lilly and Company | |

| 10,500 | | |

$ | 9,302,370 | |

| Gilead Sciences, Inc. | |

| 17,200 | | |

| 1,442,048 | |

| HCA Healthcare, Inc. | |

| 3,800 | | |

| 1,544,434 | |

| IDEXX Laboratories, Inc. * | |

| 700 | | |

| 353,654 | |

| Intuitive Surgical, Inc. * | |

| 5,800 | | |

| 2,849,366 | |

| Johnson & Johnson | |

| 39,802 | | |

| 6,450,312 | |

| McKesson Corporation | |

| 2,700 | | |

| 1,334,934 | |

| Medtronic plc | |

| 15,600 | | |

| 1,404,468 | |

| Merck & Co., Inc. | |

| 36,200 | | |

| 4,110,872 | |

| Moderna, Inc. * | |

| 1,800 | | |

| 120,294 | |

| Pfizer Inc. | |

| 77,300 | | |

| 2,237,062 | |

| Regeneron Pharmaceuticals, Inc. * | |

| 1,700 | | |

| 1,787,108 | |

| Stryker Corporation | |

| 4,000 | | |

| 1,445,040 | |

| Thermo Fisher Scientific Inc. | |

| 5,000 | | |

| 3,092,850 | |

| UnitedHealth Group Incorporated | |

| 15,403 | | |

| 9,005,826 | |

| Vertex Pharmaceuticals Incorporated * | |

| 3,300 | | |

| 1,534,764 | |

| Zoetis Inc. | |

| 6,000 | | |

| 1,172,280 | |

| | |

| | | |

| 72,157,300 | |

| INDUSTRIALS - 6.85% | |

| | | |

| | |

| 3M Company | |

| 10,000 | | |

| 1,367,000 | |

| Automatic Data Processing, Inc. | |

| 7,100 | | |

| 1,964,783 | |

| Boeing Company (The) * | |

| 10,200 | | |

| 1,550,808 | |

| Carrier Global Corporation | |

| 14,400 | | |

| 1,159,056 | |

| Caterpillar Inc. | |

| 10,100 | | |

| 3,950,312 | |

| Cintas Corporation | |

| 8,400 | | |

| 1,729,392 | |

| CSX Corporation | |

| 35,000 | | |

| 1,208,550 | |

| Cummins Inc. | |

| 2,900 | | |

| 938,991 | |

| Deere & Company | |

| 5,000 | | |

| 2,086,650 | |

| Eaton Corporation plc | |

| 7,600 | | |

| 2,518,944 | |

| Emerson Electric Co. | |

| 9,700 | | |

| 1,060,889 | |

| FedEx Corporation | |

| 3,500 | | |

| 957,880 | |

| GE Vernova Inc. * | |

| 5,275 | | |

| 1,345,020 | |

| General Dynamics Corporation | |

| 4,200 | | |

| 1,269,240 | |

| General Electric Company | |

| 19,200 | | |

| 3,620,736 | |

| Honeywell International Inc. | |

| 11,300 | | |

| 2,335,823 | |

| Illinois Tool Works Inc. | |

| 5,300 | | |

| 1,388,971 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| INDUSTRIALS - 6.85% (Continued) | |

| | | |

| | |

| Johnson Controls International plc | |

| 14,100 | | |

$ | 1,094,301 | |

| Lockheed Martin Corporation | |

| 4,300 | | |

| 2,513,608 | |

| Norfolk Southern Corporation | |

| 3,800 | | |

| 944,300 | |

| Northrop Grumman Corporation | |

| 2,500 | | |

| 1,320,175 | |

| Old Dominion Freight Line, Inc. | |

| 3,300 | | |

| 655,512 | |

| PACCAR Inc. | |

| 8,200 | | |

| 809,176 | |

| Parker-Hannifin Corporation | |

| 2,100 | | |

| 1,326,822 | |

| Paychex, Inc. | |

| 5,900 | | |

| 791,721 | |

| Republic Services, Inc. | |

| 3,600 | | |

| 723,024 | |

| RTX Corporation | |

| 24,100 | | |

| 2,919,956 | |

| Trane Technologies plc - Class A | |

| 3,900 | | |

| 1,516,047 | |

| TransDigm Group Incorporated | |

| 900 | | |

| 1,284,417 | |

| Uber Technologies, Inc. * | |

| 15,300 | | |

| 1,149,948 | |

| Union Pacific Corporation | |

| 10,500 | | |

| 2,588,040 | |

| United Parcel Service, Inc. - Class B | |

| 12,300 | | |

| 1,676,982 | |

| Veralto Corporation | |

| 5,233 | | |

| 585,363 | |

| Waste Management, Inc. | |

| 6,800 | | |

| 1,411,680 | |

| | |

| | | |

| 53,764,117 | |

| INFORMATION TECHNOLOGY - 23.30% | |

| | | |

| | |

| Accenture plc - Class A | |

| 9,000 | | |

| 3,181,320 | |

| Adobe Inc. * | |

| 5,900 | | |

| 3,054,902 | |

| Advanced Micro Devices, Inc. * | |

| 19,000 | | |

| 3,117,520 | |

| Amphenol Corporation - Class A | |

| 17,200 | | |

| 1,120,752 | |

| Analog Devices, Inc. | |

| 7,700 | | |

| 1,772,309 | |

| Apple Inc. | |

| 223,200 | | |

| 52,005,600 | |

| Applied Materials, Inc. | |

| 12,300 | | |

| 2,485,215 | |

| Arista Networks, Inc. * | |

| 4,000 | | |

| 1,535,280 | |

| Broadcom Inc. | |

| 57,200 | | |

| 9,867,000 | |

| Cisco Systems, Inc. | |

| 46,400 | | |

| 2,469,408 | |

| International Business Machines Corporation | |

| 14,300 | | |

| 3,161,444 | |

| Intuit Inc. | |

| 3,700 | | |

| 2,297,700 | |

| KLA Corporation | |

| 1,700 | | |

| 1,316,497 | |

| Lam Research Corporation | |

| 2,000 | | |

| 1,632,160 | |

| Micron Technology, Inc. | |

| 13,000 | | |

| 1,348,230 | |

| Microsoft Corporation | |

| 90,900 | | |

| 39,114,270 | |

| NVIDIA Corporation | |

| 288,100 | | |

| 34,986,863 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| INFORMATION TECHNOLOGY - 23.30% (Continued) | |

| | | |

| | |

| Oracle Corporation | |

| 27,600 | | |

$ | 4,703,040 | |

| Palo Alto Networks, Inc. * | |

| 4,500 | | |

| 1,538,100 | |

| QUALCOMM Incorporated | |

| 19,300 | | |

| 3,281,965 | |

| Salesforce, Inc. | |

| 12,500 | | |

| 3,421,375 | |

| ServiceNow, Inc. * | |

| 2,600 | | |

| 2,325,414 | |

| Synopsys, Inc. * | |

| 2,000 | | |

| 1,012,780 | |

| Texas Instruments Incorporated | |

| 10,700 | | |

| 2,210,299 | |

| | |

| | | |

| 182,959,443 | |

| MATERIALS - 0.53% | |

| | | |

| | |

| Air Products and Chemicals, Inc. | |

| 1,900 | | |

| 565,706 | |

| Albemarle Corporation | |

| 400 | | |

| 37,884 | |

| Corteva, Inc. | |

| 1,600 | | |

| 94,064 | |

| Ecolab Inc. | |

| 1,200 | | |

| 306,396 | |

| Freeport-McMoRan Inc. | |

| 2,300 | | |

| 114,816 | |

| Linde plc | |

| 4,100 | | |

| 1,955,126 | |

| Nucor Corporation | |

| 1,700 | | |

| 255,578 | |

| Sherwin-Williams Company (The) | |

| 2,100 | | |

| 801,507 | |

| | |

| | | |

| 4,131,077 | |

| REAL ESTATE - 0.92% | |

| | | |

| | |

| American Tower Corporation | |

| 3,500 | | |

| 813,960 | |

| CBRE Group, Inc. - Class A * | |

| 4,000 | | |

| 497,920 | |

| Crown Castle, Inc. | |

| 1,000 | | |

| 118,630 | |

| Equinix, Inc. | |

| 1,400 | | |

| 1,242,682 | |

| Extra Space Storage Inc. | |

| 500 | | |

| 90,095 | |

| Prologis, Inc. | |

| 8,000 | | |

| 1,010,240 | |

| Public Storage | |

| 7,600 | | |

| 2,765,412 | |

| Realty Income Corporation | |

| 8,900 | | |

| 564,438 | |

| SBA Communications Corporation - Class A | |

| 400 | | |

| 96,280 | |

| | |

| | | |

| 7,199,657 | |

| UTILITIES - 2.09% | |

| | | |

| | |

| American Electric Power Company, Inc. | |

| 9,300 | | |

| 954,180 | |

| American Water Works Company, Inc. | |

| 3,300 | | |

| 482,592 | |

| Consolidated Edison, Inc. | |

| 3,100 | | |

| 322,803 | |

| Constellation Energy Corporation | |

| 7,433 | | |

| 1,932,729 | |

| Dominion Energy, Inc. | |

| 15,000 | | |

| 866,850 | |

| Duke Energy Corporation | |

| 8,600 | | |

| 991,580 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Continued)

| Description | |

No. of Shares | | |

Value | |

| UTILITIES - 2.09% (Continued) | |

| | | |

| | |

| Edison International | |

| 6,800 | | |

$ | 592,212 | |

| Exelon Corporation | |

| 20,700 | | |

| 839,385 | |

| NextEra Energy, Inc. | |

| 54,200 | | |

| 4,581,526 | |

| PG&E Corporation | |

| 22,300 | | |

| 440,871 | |

| Public Service Enterprise Group Incorporated | |

| 9,000 | | |

| 802,890 | |

| Sempra | |

| 7,700 | | |

| 643,951 | |

| Southern Company (The) | |

| 18,700 | | |

| 1,686,366 | |

| WEC Energy Group, Inc. | |

| 6,600 | | |

| 634,788 | |

| Xcel Energy Inc. | |

| 9,900 | | |

| 646,470 | |

| | |

| | | |

| 16,419,193 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| 620,939,298 | |

| | |

| | | |

| | |

| EXCHANGE-TRADED FUNDS - 10.35% | |

| | | |

| | |

| Communication Services Select Sector SPDR® Fund (The) | |

| 12,300 | | |

| 1,111,920 | |

| Consumer Discretionary Select Sector SPDR® Fund (The) | |

| 18,000 | | |

| 3,606,660 | |

| Consumer Staples Select Sector SPDR® Fund (The) | |

| 94,400 | | |

| 7,835,200 | |

| Energy Select Sector SPDR® Fund (The) | |

| 17,900 | | |

| 1,571,620 | |

| Financial Select Sector SPDR® Fund (The) | |

| 37,400 | | |

| 1,694,968 | |

| Health Care Select Sector SPDR® Fund (The) | |

| 68,600 | | |

| 10,565,772 | |

| Industrial Select Sector SPDR® Fund (The) | |

| 52,000 | | |

| 7,042,880 | |

| iShares Core S&P 500 ETF | |

| 12,400 | | |

| 7,152,568 | |

| Materials Select Sector SPDR® Fund (The) | |

| 64,900 | | |

| 6,255,062 | |

| Real Estate Select Sector SPDR® Fund (The) | |

| 175,800 | | |

| 7,852,986 | |

| SPDR S&P 500® ETF Trust | |

| 11,500 | | |

| 6,598,240 | |

| Technology Select Sector SPDR® Fund (The) | |

| 83,100 | | |

| 18,760,656 | |

| Utilities Select Sector SPDR® Fund (The) | |

| 2,800 | | |

| 226,184 | |

| Vanguard Information Technology Index Fund | |

| 1,700 | | |

| 997,084 | |

| TOTAL EXCHANGE-TRADED FUNDS | |

| | | |

| 81,271,800 | |

| | |

| | | |

| | |

| TOTAL EQUITY SECURITIES (cost - $569,755,183) | |

| | | |

| 780,718,768 | |

CORNERSTONE TOTAL RETURN FUND, INC.

SCHEDULE OF INVESTMENTS - SEPTEMBER 30, 2024 (Unaudited)(Concluded)

| Description | |

No. of Shares | | |

Value | |

| SHORT-TERM INVESTMENT - 0.60% | |

| | | |

| | |

| MONEY MARKET FUND - 0.60% | |

| | | |

| | |

| Fidelity Institutional Money Market Government Portfolio - Class I, 4.83% ^ (cost - $4,741,308) | |

| 4,741,308 | | |

$ | 4,741,308 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS - 100.02% (cost - $574,496,491) | |

| | | |

| 785,460,076 | |

| | |

| | | |

| | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (0.02%) | |

| | | |

| (139,219 | ) |

| | |

| | | |

| | |

| NET ASSETS - 100.00% | |

| | | |

$ | 785,320,857 | |

|

| * |

Non-income producing security. |

| ^ |

The rate shown is the 7-day effective yield as of September 30, 2024. |

| plc |

Public Limited Company. |

Cornerstone Total Return (AMEX:CRF)

Historical Stock Chart

From Nov 2024 to Dec 2024

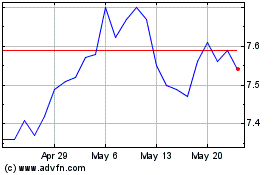

Cornerstone Total Return (AMEX:CRF)

Historical Stock Chart

From Dec 2023 to Dec 2024