Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

26 July 2023 - 7:15AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 11)

ALTA

EQUIPMENT GROUP INC.

(Name

of Issuer)

Common

stock, $0.0001 par value per share

(Title

of Class of Securities)

02128L106

(CUSIP

Number)

Bryant

R. Riley

B.

Riley Financial, Inc.

11100

Santa Monica Blvd., Suite 800

Los

Angeles, CA 90025

(818)

884-3737

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

July

21, 2023

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act.

| CUSIP

No. 02128L106 |

| 1 |

|

NAME

OF REPORTING PERSONS

B.

Riley Financial, Inc. |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

☐ (b) ☐ |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

AF |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

0 |

| |

8 |

|

SHARED

VOTING POWER

3,939,763 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

3,939,763 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,939,763 |

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.2%* |

| 14. |

|

TYPE

OF REPORTING PERSON

HC |

| * |

Based

on 32,368,112 shares of common stock, par value $0.0001 (the “Common Stock”), of Alta Equipment Group Inc. (the “Issuer”)

outstanding as of July 20, 2023 as reported by the Issuer on its Form 424B5 filed with the U.S. Securities and Exchange Commission

on July 20, 2023 (the “Prospectus Supplement”). |

| CUSIP

No. 02128L106 |

| 1 |

|

NAME

OF REPORTING PERSONS

B.

Riley Securities, Inc. |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

☐ (b) ☐ |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

0 |

| |

8 |

|

SHARED

VOTING POWER

1,160,134 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

1,160,134 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,160,134 |

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.6%* |

| 14. |

|

TYPE

OF REPORTING PERSON

BD |

| * |

Based

on 32,368,112 shares of Common Stock of the Issuer outstanding as of July 20, 2023 as reported by the Prospectus Supplement. |

| CUSIP

No. 02128L106 |

| 1 |

|

NAME

OF REPORTING PERSONS

BRF

Investments, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

☐ (b) ☐ |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

WC |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

0 |

| |

8 |

|

SHARED

VOTING POWER

2,779,629 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

2,779,629 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,779,629 |

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.6%* |

| 14. |

|

TYPE

OF REPORTING PERSON

OO |

| * |

Based

on 32,368,112 shares of Common Stock of the Issuer outstanding as of July 20, 2023 as reported by the Prospectus Supplement. |

| CUSIP

No. 02128L106 |

| 1 |

|

NAME

OF REPORTING PERSONS

Bryant

R. Riley |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

☐ (b) ☐ |

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS

PF,

AF |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

653,454 |

| |

8 |

|

SHARED

VOTING POWER

3,939,763 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

653,454 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

3,939,763 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,593,217 |

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.2%* |

| 14. |

|

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on 32,368,112 shares of Common Stock of the Issuer outstanding as of July 20, 2023 as reported by the Prospectus Supplement. |

This

Amendment No. 11 amends and supplements the Schedule 13D filed with the U.S. Securities and Exchange Commission (the “SEC”)

on April 15, 2019, as amended by Amendment No. 1 and Amendment No. 2 filed on February 24, 2020 and Amendment No. 3 filed on March 3,

2020 and Amendment No. 4 filed on March 17, 2020, Amendment No. 5 filed on March 11, 2021, and Amendment No. 6 filed on March 23, 2021,

and Amendment No. 7 filed on October 28, 2021, and Amendment No. 8 filed on February 8, 2022, and Amendment No. 9 filed on May 6, 2022,

and Amendment No. 10 filed on April 18, 2023 (as so amended, the “Schedule 13D”), relating to the Common Stock, par value

$0.0001 per share (the “Common Stock” or “Shares”), of Alta Equipment Group Inc., a Delaware corporation (the

“Issuer or “Company”). Except as set forth herein, the Schedule 13D is unmodified and remains in full force and effect.

Each capitalized term used but not defined herein has the meaning ascribed to such term in the Schedule 13D.

ITEM 4. PURPOSE OF THE TRANSACTION.

Item

4 of the Schedule 13D is hereby amended to add the following:

On July 20, 2023, the Company entered into an

Underwriting Agreement (the “Underwriting Agreement”) with D.A. Davidson & Co. and B. Riley Securities, Inc., as the representatives

of the underwriters (the “Representatives”), and BRF Investments, LLC (the “Selling Stockholder”), relating to

an underwritten secondary offering (the “Secondary Offering”) of 2,200,000 shares (the “Offered Shares”) of its

common stock, par value $0.0001 per share (the “Common Stock”). The Secondary Offering was made pursuant to the Company’s

resale shelf registration statement, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on March

25, 2020 and initially declared effective on April 3, 2020, as amended by Post-Effective Amendment No. 1, filed with the SEC on July 1,

2021 and declared effective on July 12, 2021. The Selling Stockholder also granted the Representatives a 30-day option to purchase up

to 330,000 additional shares of Common Stock. All of the shares of Common Stock were sold by the Selling Stockholder and the Company did

not issue any new shares of Common Stock in connection with the Secondary Offering. The price to the public in the Secondary Offering

is $16.25 per share and pursuant to the Underwriting Agreement, the Representatives have agreed to purchase the Shares from the Selling

Stockholder at a price of $15.4375 per share. The Selling Stockholder is an affiliate of B. Riley Securities, Inc.

On July 25, 2023, the Selling Stockholder completed the sale of the

Offered Shares. The Selling Stockholder received net proceeds of approximately $34.0 million, after deducting the estimated offering expenses

payable by the Company and the Representatives’ discounts and commissions.

ITEM 5. INTEREST OF SECURITIES OF THE ISSUER.

Item

5, Sections (a) and (b) of the Schedule 13D are hereby amended and restated as follows:

| |

1. |

As

of the date hereof, BRS beneficially owns directly 1,160,134 shares of Common Stock, representing 3.6% of the Issuer’s Common

Stock, and BRFI beneficially owns directly 2,779,629 shares of Common Stock, representing 8.6% of the Issuer’s Common Stock. |

| |

|

|

| |

2. |

BRF

is the parent company of BRS and BRFI. As a result, BRF may be deemed to indirectly beneficially own the Shares held by BRS and BRFI. |

| |

|

|

| |

3. |

Bryant

R. Riley may be deemed to indirectly beneficially own 653,454 shares of Common Stock representing 2.0% of the Issuer’s Common

Stock, of which (i) 624,596 shares are held jointly with his wife, Carleen Riley, and (ii) 24,610 shares are held as sole trustee

of the Robert Antin Children Irrevocable Trust, (iii) 1,062 shares are held as sole custodian for the benefit of Abigail Riley, (iv)

1,062 shares are held as sole custodian for the benefit of Charlie Riley, (v) 1,062 shares are held as sole custodian for the benefit

of Eloise Riley, and (vi) 1,062 shares are held as sole custodian for the benefit of Susan Riley. Bryant R. Riley may also be deemed

to indirectly beneficially own the 3,939,763 shares of Common Stock, representing 12.2% of the Issuer’s Common Stock outstanding

held directly by BRS and BRFI in the manner specified in paragraph (1) above. Bryant R. Riley disclaims beneficial ownership of the

shares held by BRS, BRFI, or the Robert Antin Children Irrevocable Trust in each case except to the extent of his pecuniary interest

therein. |

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS.

SIGNATURES

After

reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth

in this statement is true, complete and correct.

Dated:

July 25, 2023

| |

B.

RILEY FINANCIAL, INC. |

| |

|

| |

By: |

/s/

Bryant R. Riley |

| |

Name: |

Bryant

R. Riley |

| |

Title: |

Co-Chief

Executive Officer |

| |

|

| |

B.

RILEY SECURITIES, INC. |

| |

|

| |

By: |

/s/

Andrew Moore |

| |

Name: |

Andrew

Moore |

| |

Title: |

Chief

Executive Officer |

| |

|

| |

BRF

INVESTMENTS, LLC |

| |

|

| |

By: |

/s/

Phillip Ahn |

| |

Name: |

Phillip

Ahn |

| |

Title: |

Authorized

Signatory |

| |

|

|

| |

BRYANT

R. RILEY |

| |

|

| |

By: |

/s/

Bryant R. Riley |

SCHEDULE

A

Executive

Officers and Directors of B. Riley Financial, Inc.

| Name

and Position |

|

Present

Principal Occupation |

|

Business

Address |

|

Citizenship |

Bryant

R. Riley

Chairman of the Board of Directors and Co-Chief Executive Officer |

|

Chief

Executive Officer of B. Riley Capital Management, LLC; Co-Executive Chairman of B. Riley Securities, Inc.; and Chairman of the Board

of Directors and Co-Chief Executive Officer of B. Riley Financial, Inc. |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025 |

|

United

States |

Thomas

J. Kelleher[1]

Co-Chief Executive Officer and Director |

|

Co-Chief

Executive Officer and Director of B. Riley Financial, Inc.; Co-Executive Chairman of B. Riley Securities, Inc.; and President of

B. Riley Capital Management, LLC |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025 |

|

United

States |

Phillip

J. Ahn

Chief Financial Officer and Chief Operating Officer |

|

Chief

Financial Officer and Chief Operating Officer of B. Riley Financial, Inc. |

|

30870

Russell Ranch Rd

Suite

250

Westlake

Village, CA 91362 |

|

United

States |

Kenneth

Young

President |

|

President

of B. Riley Financial, Inc.; and Chief Executive Officer of B. Riley Principal Investments, LLC |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025 |

|

United

States |

Alan

N. Forman

Executive Vice President, General Counsel and Secretary |

|

Executive

Vice President, General Counsel and Secretary of B. Riley Financial, Inc. |

|

299

Park Avenue, 21st Floor

New York, NY 10171 |

|

United

States |

Howard

E. Weitzman

Senior Vice President and Chief Accounting Officer |

|

Senior

Vice President and Chief Accounting Officer of B. Riley Financial, Inc. |

|

30870

Russell Ranch Rd

Suite

250

Westlake

Village, CA 91362 |

|

United

States |

Robert

L. Antin[2]

Director |

|

Co-Founder

of VCA, Inc., an owner and operator of Veterinary care centers and hospitals |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025 |

|

United

States |

Tammy

Brandt

Director |

|

Senior

Member of the Legal team at Creative Artists Agency, a leading global entertainment and sports agency |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025 |

|

United

States |

Robert

D’Agostino

Director |

|

President

of Q-mation, Inc., a supplier of software solutions |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025 |

|

United

States |

Renée

E. LaBran

Director |

|

Founding

partner of Rustic Canyon Partners (RCP), a technology focused VC fund |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025

|

|

United

States |

Randall

E. Paulson

Director |

|

Special

Advisor to Odyssey Investment Partners, LLC, a private equity investment firm |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025

|

|

United

States |

Michael

J. Sheldon

Director |

|

Chairman

and Chief Executive Officer of Deutsch North America, a creative agency – Retired |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025

|

|

United

States |

Mimi

Walters

Director |

|

U.S.

Representative from California’s 45th Congressional District – Retired |

|

11100

Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025 |

|

United

States |

| 1 | As

of the date hereof, Thomas J. Kelleher directly owned 15,000 shares of Common Stock. The

aggregate purchase price of the 15,000 shares of Common Stock that were purchased by Thomas

J. Kelleher with personal funds is approximately $153,678. Thomas J. Kelleher has the sole

power to vote and dispose of such Common Stock and the right to receive, or the power to

direct the receipt of dividends from, or proceeds from the sale of, such Common Stock. |

| 2 | As

of the date hereof, Robert L. Antin directly owned 44,025 shares of Common Stock. The aggregate

purchase price of the 44,025 shares of Common Stock that were purchased by Robert L. Antin

with personal funds is approximately $307,741. Robert L. Antin has the sole power to vote

and dispose of such Common Stock and the right to receive, or the power to direct the receipt

of dividends from, or proceeds from the sale of, such Common Stock. |

ANNEX

I

Transactions

within the Past 60 Days

Trade Date | |

Transaction | |

Amount of Securities | | |

Price per Share of Common Stock | | |

Reporting Person |

| 7/21/2023 | |

Sale | |

| 2,200,000 | | |

$ | 16.25 | | |

BRF Investments, LLC |

9

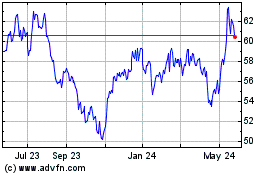

Amplify Video Game Tech ... (AMEX:GAMR)

Historical Stock Chart

From Nov 2024 to Dec 2024

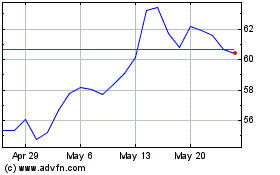

Amplify Video Game Tech ... (AMEX:GAMR)

Historical Stock Chart

From Dec 2023 to Dec 2024