TIDMALBA

RNS Number : 0871U

Alba Mineral Resources PLC

24 March 2023

Alba Mineral Resources Plc / EPIC: ALBA / Market: AIM / Sector:

Mining

24 March 2023

Alba Mineral Resources Plc

("Alba" or the "Company")

GROC Update

2022 Full Year Results & Publication of Annual Report

Alba Mineral Resources Plc (AIM: ALBA) is pleased to note the

RNS today by its portfolio company, GreenRoc Mining Plc

("GreenRoc") (AIM: GROC), announcing its audited results for the

year ended 30 November 2022.

The GreenRoc announcement is set out below without material

changes.

GreenRoc Mining Plc / EPIC: GROC / Market: AIM / Sector:

Mining

24 March 2023

GreenRoc Mining plc

("GreenRoc" or the "Company")

2022 Full Year Results and Publication of Annual Report

GreenRoc Mining plc (AIM: GROC), a company focused on the

development of critical mineral projects in Greenland, today

announces its audited results for the year ended 30 November

2022.

The Financial Statements (including notes) and the statements of

the Chairman and CEO, set out below, have been extracted from

GreenRoc's Annual Report, which was approved by the Board on 23

March 2023 and will be sent to shareholders and made available on

the Company's website ( www.greenrocmining.com ).

Highlights:

-- Maiden Mineral Resource Estimate ("MRE") of 8.28Mt at 19.75%

graphitic carbon ("C(g)") declared for the Amitsoq Project in March

2022

-- Second phase drilling programme at Amitsoq Project completed in September 2022, with:

o 19 holes drilled for a total of 2,844m, every hole

intersecting significant graphite layers

o Drilling more than doubling the deposit footprint and

returning exceptionally high grades

-- MRE increased post period end to 23.05 Mt at a grade of

20.41% C(g) for 4.71 Mt contained graphite

o An increase of nearly three times the maiden MRE

-- Stefan Bernstein appointed as CEO in July 2022

Post year end highlights:

-- Raised GBP333k in December 2022 and GBP550k in March 2023 to

fund additional testing and work programmes arising from the highly

successful second phase drilling programme

-- European Raw Materials Alliance declared its official support

for the Amitsoq Project in February 2023

-- MoU signed with Norwegian mining and construction group LNS in March 2023

-- GreenRoc named "Greenland's Prospector and Developer of the

Year" at PDAC Toronto in March 2023

GreenRoc's Chairman, George Frangeskides, commented: " I am very

pleased to report that, due in no small measure to the skill and

dedication of the entire GreenRoc team, 2022 was a highly

successful and significant year for the Company. Enormous progress

has been made, in particular, at Amitsoq, where we have built up a

substantial graphite resource and have done so without any

sacrifice to grade, with Amitsoq now firmly established among a

very select grouping worldwide of graphite deposits with resource

grades averaging more than 20%. At the same time, we have greatly

advanced our metallurgical test work programme in order to

demonstrate the amenability of our graphite to the production of

high purity spherical graphite which is in such demand for electric

vehicles.

"These achievements mean that we can now focus our efforts for

the rest of this year on our ongoing development work and

furthering our discussions with potential strategic partners,

putting us in a very strong position as we seek to accelerate

Amitsoq along the path to production."

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

CHAIRMAN'S STATEMENT

I am very pleased to present the GreenRoc Mining Plc group

("GreenRoc" or "the Group") Annual Report for the year ended 30

November 2022.

This past year has seen us make a huge step forward at GreenRoc,

despite having had to navigate some decidedly choppy waters caused

by the persistent political and economic turmoil at home, combined

with the most serious conflict faced in Europe since the Second

World War.

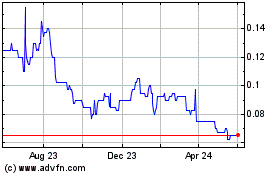

On 3 September 2021, the FTSE AIM All-Share Index, which charts

the stock prices of all companies traded on AIM, London's preferred

stock exchange for junior miners, technology and biotech companies,

hit a 20-year high. Later that same month, we completed the

spin-out of the Greenland assets of Alba Mineral Resources Plc, and

GreenRoc, the purchaser of those assets, was admitted to trading on

AIM.

Timing, as they say, is everything. So, while we were delighted

to have completed the spin-out and raised in excess of GBP5m, it

was clear some months into the IPO process that the market, and

investor appetite, had already begun to soften appreciably. Indeed,

since completing the IPO, the AIM All-Share Index began to fall and

has continued to do so, such that by the end of GreenRoc's first

full financial year, on 30 November 2022, the index had lost 35% of

its value since hitting that September 2021 high.

While not all exchanges have had quite such a tough time, it was

perhaps to be expected that AIM, which is home to a number of

pre-revenue technology and biotech companies, would suffer greater

headwinds than some other exchanges as investors sought safe havens

in a time of global economic turmoil. By way of comparison, the

FTSE 100 Index rose around 7% in the course of the same turbulent

year, having been buoyed by the strong performance of the major oil

and gas companies, which benefited from a steep rise in oil and gas

prices. It is no surprise that the FTSE 100 has bucked the general

trend when one considers that Shell's market capitalisation alone

dwarfs the size of the entire AIM market.

While this goes a long way to explaining the softening of

GreenRoc's share price post IPO, however, it is certainly not the

whole story. In my view, the market has at the same time simply

failed to recognise the inherent and significant value which we

have built up over the past 12 months at what it is now fair to

call our flagship asset, the Amitsoq Graphite Project ("Amitsoq")

in southern Greenland. We believe the market has also failed to

appreciate how the progress at this exceptional project positions

us to be able to capitalise on the demand for graphite, which is

forecast to rise substantially over the next two decades at

least.

Let us consider the advances made in the past 12 months at

Amitsoq. In March 2022 we announced a maiden Mineral Resource

Estimate at Amitsoq Island of 8.28Mt at 19.75% C(g), which put us

in a very exclusive top tier of super high-grade graphite projects

globally. In July 2022 we commenced our second phase drilling

programme at Amitsoq. The programme was highly successful, and by

the time we finished drilling in September we had completed 19

holes for a total of 2,844m, with every hole intersecting

significant graphite layers, more than doubling the deposit

footprint and returning exceptionally high grades of up to 24.52%

graphitic carbon (C(g)).

Following the year end, in January 2023, we announced a

significantly upgraded Mineral Resource Estimate for the Amitsoq

Island deposit comprising a total inferred, indicated and measured

JORC Resource of 23.05 million tonnes (Mt) at an average grade of

20.41% C(g), giving a total graphite content of 4.71 Mt

representing an almost three times increase from the 2022 maiden

Resource Estimate.

This upgraded Resource not only cements Amitsoq's position as

one of the very highest-grade graphite deposits globally, but the

substantial increase in tonnage greatly increases our confidence

that our forthcoming Scoping Study will confirm the economic

viability of the Amitsoq Island deposit.

It was not only in exploration drilling that great strides were

made this past year. Advanced test work conducted by our specialist

consultants in Germany confirmed that graphite concentrate from

Amitsoq is "very suitable" for micronisation and spheronisation,

those being the processes by which spherical graphite is produced

for the electric vehicle ("EV") sector. That spheronised material

was then subjected to purification test work, achieving a purity of

99.97%. This level of purity surpasses the minimum level required

to qualify as high purity spherical graphite ("HPSG") input

material in the manufacturing of anodes for EV batteries. These

results are among the most significant and critical achievements of

the past year.

At the corporate level, in July 2022 we announced the

appointment as CEO of Stefan Bernstein, a Danish geologist and

Greenland mining sector expert of many decades' standing. GreenRoc

is now under the stewardship of someone who has a real depth of

understanding of the country of Greenland and its mining industry,

combined with a steely determination and focus on getting Amitsoq

into commercial production. He is also someone who is held in high

regard in technical and political circles in Greenland, Denmark and

Europe, which is proving invaluable as we progress discussions at

the governmental, intergovernmental and industry levels.

We have spent a great deal of time this past year on

strengthening our links with government and industry participants

across the graphite, battery and OEM sectors, as we seek to develop

the future partnerships which will drive our push into commercial

production. On that front, two particular developments stand out

post year end: firstly, the declaration of official support from

the European Raw Materials Alliance ("ERMA"), whose role is to

secure raw materials for Europe, in which they state that in their

opinion Amitsoq is a resource of "global importance"; and secondly,

the MOU we signed recently with significant Norwegian construction

and mining group LNS, which provides us with a framework to explore

their potential appointment as the civil, mining and/or logistics

contractor during the construction and operational phases for the

Amitsoq mine.

Finally, it was wonderful to see Stefan stepping up to the

podium at the PDAC mining conference in Toronto a few weeks ago to

collect GreenRoc's award as Greenland's "Prospector and Developer

of the Year". That is testament to the excellence and dedication of

the GreenRoc technical team led by Stefan and fellow director Mark

Austin. Mark, for one, spent most of last year's drilling campaign

on site at Amitsoq in order to oversee both logistics and drilling

and ensure that any issues and challenges which arose could be

squared away and solutions found quickly.

GreenRoc's award is also testament to the solid foundations

which were laid before its time, by Alba's roll-out of a

comprehensive greenfield exploration campaign at Amitsoq over

several field seasons, including airborne electromagnetic and

magnetic surveys over Amitsoq Island, which highlighted a potential

graphite strike length running to several kilometres, the first

systematic exploration of the mainland portion of the Amitsoq

licence, which resulted in the discovery of the Kalaaq graphite

deposit, and the completion of the first ever drilling campaign at

Amitsoq.

A successful mining project involves a massive collective

effort, and we are fortunate at GreenRoc to be able to count on

such a committed, experienced and capable team.

In conclusion, while GreenRoc's first full financial year saw us

having to navigate some very strong geopolitical and financial

market crosswinds, I am very pleased to report to our Shareholders

that, due in no small measure to the skill, dedication and

determination of the GreenRoc team, 2022 was a highly successful

and significant year for the Company; successful in terms of the

enormous progress made at Amitsoq, in relation to Resource-building

and advanced HPSG test work; and significant, in that those

successes mean that we can now focus our efforts this year on our

ongoing development work as well as on furthering our discussions

with potential strategic partners, thereby putting us in the best

possible position as we seek to accelerate Amitsoq along the path

to production.

On behalf of the entire Board, I would like to thank GreenRoc's

shareholders for their continued support.

George Frangeskides

Chairman

CHIEF EXECUTIVE OFFICER'S STATEMENT

FIRST FULL YEAR IN OPERATION

The past year has seen a significant transition for GreenRoc,

with the Amitsoq graphite deposit proving itself to be of true

world class. A very successful second-phase drilling programme has

brought outstanding results both in terms of tonnage and grades and

with that, GreenRoc is positioning itself to transform from an

exploration company into a development company addressing the

fast-growing global graphite market. Located in sub-arctic South

Greenland, with a comparatively mild climate, our proposed future

mining operation at Amitsoq will be able to supply raw-material

hungry EV-battery factories both in Europe and in North

America.

PROJECTS

GreenRoc has three active projects in Greenland, namely Amitsoq

Graphite, Thule Black Sands Ilmenite, and Melville Bay Iron, of

which the latter two are situated in North Greenland. A fourth

project, Inglefield Multi-Element, has been relinquished since the

year end.

The Greenland Government decided to reduce exploration

obligations for 2022 by 50% in order to alleviate the pressure of

Covid-19 on the mining exploration industry. We regard this action

and the suspended obligations in 2020 and 2021 as expressions of a

solid welcoming hand to our industry from the Greenland

government.

Amitsoq Graphite Project ("Amitsoq")

The Amitsoq Graphite Project concerns the development of a rich

graphite ore deposit, outcropping at the southern tip of Amitsoq

Island (Fig. 1). As long as one hundred years ago the graphite ore

was already recognised to be of sufficient grade and quality to

support economic exploitation, resulting in the opening of the

original Amitsoq graphite mine in 1914. The mine operated until

1922, when it was shut down due to falling graphite prices after

the cessation of the First World War.

Almost exactly one hundred years later, in 2021, the deposit was

the subject of exploration diamond drilling for the first time when

eight holes were drilled for a total of 935 metres. As announced in

our 2021 annual report, this first phase drilling was a great

success in that thick ore bodies were encountered offset to the

west, and down dip from the surface outcrops, confirmed to be not

only of very high grade graphite but also of good consistency. A

further result of the 2021 drilling was the recognition of the

graphite being hosted in two main ore bodies, an Upper Graphite

Layer (UGL) and a Lower Graphite Layer (LGL), of which the LGL

attained the greatest thickness of 15.60m and also the highest

graphite grades (C(g) of 23.01%).

Based on this phase-one drilling, a maiden Mineral Resource

Estimate for Amitsoq was declared in March 2022, of 8.28Mt in the

inferred and indicated category at 19.75% graphite for 1.63Mt

graphite across the LGL and UGL ore bodies.

This past summer, we conducted a second-phase drilling

programme, directed at the westward projected extensions (down-dip)

of the UGL and LGL. After some busy months, with great support from

our local contractors 60N and Sermeq Helicopters, we closed our

drilling programme in September after completing 19 holes for a

total of 2,844m, with all holes reaching target depth. We believe

the results were outstanding - LGL shows mineable thicknesses

greater than 2.0m in all 19 holes, with true thicknesses varying

between 2.50m and a staggering 20.69m, while the UGL shows mineable

thicknesses greater than 2.0m in eight holes with true thicknesses

between 2.72m and 7.99m. In December 2022, we were excited to

announce the analytical results of these intersections, again

confirming the very high graphite grades for both UGL and LGL

orebodies. UGL returned graphite grades of 13.52 to 20.92 C(g) %,

while LGL returned grades of 17.80 C(g) % to 24.52 C(g) % (see

Table 1).

These drilling results, compiled with data obtained by drilling

in 2021 and surface sampling in former years, allowed for a new

Mineral Resource Estimate to be announced in January 2023. The new

JORC Resource is almost three times that of the estimate released

in March 2021 with 23.05 Mt grading 20.41 % graphite for 4.71 Mt of

graphite (Table 2), and again, the deposit remains open in several

directions. Importantly, an appreciable amount of the Resource has

now moved into the more certain categories of Measured and

Indicated, which together account for 7.38 Mt grading 21.21% C(g)

for 1.57 Mt graphite, cementing Amitsoq as a true world class

graphite deposit.

Further to this, we received a support letter issued by the

European Raw Materials Alliance (ERMA) in February 2023, expressing

that:

"GreenRoc's graphite resource is of global importance and...

will enable the European Union to achieve a certain level of

independence for the electrical vehicle supply chain. European Raw

Materials Alliance has approved the Amitsoq Graphite project and

will engage to support its development and financing to produce

these critical raw materials for the benefit of the European Union

goals ..

The support letter followed a submission of details of the

project, including project technicalities and market analyses as

well as risk analysis, and ended in a presentation to the ERMA

board supplemented by three industry experts in December 2022. Upon

the presentation and subsequent discussion, the ERMA evaluation

committee admitted the Amitsoq project for support. This is a major

achievement and endorsement for our project and an important

milestone on our road toward recognition of the quality and

importance of our Amitsoq graphite project.

Key to our development of Amitsoq towards production, is

conducting environmental and social impact assessment studies (EIA

and SIA, respectively). GreenRoc has signed contracts with BioApp

for the EIA and Niras for the SIA. These are both well respected

companies with considerable experience in Greenland mining

projects, and their respective studies are now well underway.

Figure 1. The Amitsoq Graphite Project in southern Greenland

(licence area in red; licence 2013-06), showing the Amitsoq Island

graphite deposit (site of the former graphite mine). Also shown in

yellow is new extended licence area, licence 2022-03, awarded to

GreenRoc in June 2022. See also Fig. 4.

Further testwork on graphite from Amitsoq was conducted by

ProGraphite GmbH, in Germany - a highly respected expert graphite

laboratory - which showed that Amitsoq graphite concentrate can be

processed into spherical graphite (the material used to manufacture

EV-battery anodes). In January, we received a report from

ProGraphite with the results of the purification, showing that

99.97% purity was achieved.

Another important piece of work conducted in 2022 was the

extraction of nearly 700kg bulk sample material of the LGL ore,

collected in the old mine adits. The sample arrived in Germany in

December 2022, and is presently being processed by UFR-FIA in

Freiberg, to constrain processing parameters and to produce a

graphite concentrate for further test work and for marketing.

Figure 2, Amitsoq drilling, showing Phase 1 collars (2021) in

blue with projection of drill holes in orange and Phase 2 collars

(2022) in red with projection of drill holes in green. Each collar

also has a vertical drill hole. Also traced are outcropping

graphite layers (in brown). There are 200m between the UTM

coordinate lines.

Further work undertaken in 2022 included developing an

understanding of the graphite market in general, and of the

EV-battery need for spherical graphite. Several contacts have been

made with graphite processing companies, EV-battery makers and

automobile manufacturers as well as larger engineering and mining

companies, thus widening our knowledge base and helping to position

GreenRoc in the future renewable energy industry landscape.

In November 2022, GreenRoc Mining and ProGraphite GmbH signed an

agreement, through which ProGraphite will act as adviser on

technical and marketing aspects of graphite.

Figure 3: View of 3D-model, from sea-level looking East, showing

Upper Graphite Layer (UGL) in orange and Lower Graphite Layer (LGL)

in red, based on interpolation of 2021 and 2022 drilling

intersections as well as surface expressions.

Table 1. Intersections of graphite layers from second phase

drilling at Amitsoq, calculated true thicknesses and

average graphite content across the indicated graphite

layer.

Measured 1.26 22.05 0.28

------ ------ -----

Indicated 6.12 21.04 1.29

---------------------------- ------ ------ -----

Total Measured + Indicated 7.38 21.21 1.57

---------------------------- ------ ------ -----

Inferred 15.67 20.04 3.14

---------------------------- ------ ------ -----

Total Resources 23.05 20.41 4.71

---------------------------- ------ ------ -----

Table 2. JORC resource estimate announced in January 2023

Graphite potential in South Greenland.

Realising the excellent quality and high grades of the graphite

ore from Amitsoq and the discovery of the Kalaaq deposit on the

eastern side of the fjord in 2017 (Fig 1), GreenRoc applied for and

was granted an additional exploration licence (2022-03) in ground

adjacent to Amitsoq (Figs. 1 and 4). This past summer our field

team conducted preliminary sampling of outcropping graphite bodies

and made significant discoveries further to the north of the

Amitsoq mine, the Amitsoq Valley Bed and in the south of Nanortalik

Island (Fig. 4) where grades well in excess of 20% C(g) were

achieved. Along with the Amitsoq mine, and the Kalaaq deposit,

these new discoveries suggest that GreenRoc is unravelling a world

class graphite district - and all within licences owned by

GreenRoc.

Amitsoq - outlook for 2023

We believe that the highly encouraging results of the Resource

update for Amitsoq, as well as recent spheronisation tests, justify

our view that we should start the process of moving towards

production. In 2023, we will be carrying out the EIA and SIA work,

bringing both to a near completion and to a stage where in 2024 we

can negotiate an Impact Benefit Agreement and start the application

process towards an exploitation permit.

We are presently looking at conducting a Scoping Study

(Preliminary Economic Assessment) for Amitsoq and possibly

geotechnical drilling to assess rock quality. We are also starting

the mine design work, which eventually will feed into the

Feasibility Study to be undertaken in 2024. Our plans for 2023 also

involve collecting a larger bulk sample to provide graphite

concentrate for spheronisation testwork and we will certainly

continue our discussions with potential partners, both technical,

offtakers and financial, to ensure fast-tracking Amitsoq towards

production in the shortest time span possible to meet the demand

for graphite from the EV-battery industry and in turn to provide

value to our investors.

Further to this, in March 2023 GreenRoc signed a non-binding MoU

with Norwegian construction and mining company LNS. This MoU is

important as it provides access to decades of experience in

construction and operation of mines under Arctic conditions. LNS

presently runs the Aapilattoq ruby mine in West Greenland. The

agreement could provide for LNS investment, either directly or

indirectly, in the Amitsoq graphite project as well as in the

testing and development in surrounding graphite deposits.

At the PDAC in Toronto, March 2023, GreenRoc received the

Prospectors and Developers Award from the Greenland Government.

This award is presented to a company, or an individual, who has

been active in advancing exploration projects, has shown initiative

and innovation and are operating according to best environmental

and social responsibility practices. On behalf of the company, I

received the award from Permanent Secretary Jørgen Hammeken-Holm,

Ministry of Minerals and Justice, and we regard this as another

sign of support from the Greenland Government, towards the mineral

industry and towards GreenRoc specifically.

Figure 4, giving location of other graphite deposits and

occurrences across GreenRoc's two licences 2013-06 (blue) and

2022-03 (yellow).

Thule Black Sands Ilmenite Project (TBS)

TBS comprises a long stretch of coast in northern Greenland with

heavy mineral sands. It is ca 80km South of Greenland's

northernmost town Qaanaaq and ca 60km NW of Thule Airbase.

GreenRoc's licence 2017-29 lies some 10km NW of BlueJay Mining's

Dundas licence and similarly contains a large amount of ilmenite

heavy mineral accumulations. Ilmenite is a primary source of

titanium, which, among other applications, is heavily used in the

paint industry for pigment (in the form of titanium oxide) and as

metal in the aerospace and defence industry. Titanium has been

designated a critical raw material by both the US Government and by

the EU.

Figure 5. Location of 2017-29 licence in blue.

Based on a dedicated shallow drilling campaign in 2018, a JORC

Inferred Resource of 19Mt at 8.9% ilmenite, was estimated across

the three main areas, Southern, Central and Northern Area (See Fig.

5). Drilling in 2018 was limited to the upper circa one metre

because of the presence of permafrost. In 2021, an advanced sonic

drill was employed to test the Southern Area with both greater

depth penetration (typically three metres, and locally up to six

metres) and considerably tighter drill hole spacing (Fig. 6). A

total of 249 holes were drilled and samples shipped to IHC Robbins

in Australia for the analytical work. IHC Robbins is an expert

laboratory on mineral sands deposits and part of the Royal IHC

Group. Due to a serious delay in the shipping of samples and a

mistake in the processing of the material at IHC, causing the

analytical data received from IHC in the autumn of 2022 to be

incomplete, the results of the drilling campaign are not yet

available at the time of this report. Together with IHC, GreenRoc

is presently working out how to resolve the analytical challenges,

and naturally, defining the 2023 work program for TBS will hinge on

the outcome of the analysis and resource update.

Another part of the work conducted at TBS in 2022 was extensive

fieldwork related to the environmental impact assessment for which

the bulk of the field work has now been completed. Additionally,

archaeologists from the Greenlandic National Museum visited TBS in

order to identify any site of cultural interest. This work is also

now complete.

Figure 6, showing locations of drill collars in the 2021

drilling programme at TBS. The 2021 drilling concerns the southern

part of the licence block (given by red lines).

Melville Bay Iron Project

This project concerns iron ore in the Melville Bay of North

Greenland. The geology here is dominated by Precambrian rocks

similar to those of the Committee Belt in Northern Canada, which on

Baffin Island host the Mary River iron mine (641Mt at 66% iron).

GreenRoc's licence 2017-41 comprises three blocks (Fig. 7), all

with outcropping banded iron ore. Former licence holders drilled

targets defined by geological mapping and geophysical anomalies

back in 2012 for a total of 27 holes and 3,520 metres of core.

Based on this drilling, GreenRoc received a resource estimate

calculated by SRK Consulting in 2021 providing a JORC inferred

resource of 63Mt at 31.4% iron at Havik East and Havik Northeast

(Fig. 8). SRK has derived a total Exploration Target for Havik East

of 100-200Mt at 29-33% Fe.

In 2022, GreenRoc requested a compilation of the geophysical

data along with the drilling results and geological mapping

conducted by former licence holders. The aim is to explore the

potential for a larger tonnage-deposit at Havik and design a work

programme to test such potential.

Figure 7. Location of three licence blocks, together

constituting licence 2017-41.

Figure 8. The two main iron ore bodies at Havik East and Havik

Northeast, drilled in 2012

Inglefield Multi-Element Project

Given the recent advances of the Amitsoq graphite project, and

after an assessment of the Company's licence portfolio, the Board

decided to relinquish this exploration licence (2018-25). This

licence was at a very early stage with a high degree of risk and

the Company wishes to concentrate efforts to advance the Amitsoq

project to production as fast as possible. Capitalised costs in

respect of this permit amounting to GBP0.2 million have been

impaired accordingly.

FINANCING

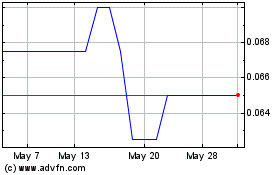

The Company recently completed two placings: in December 2022,

proceeds of GBP333k were raised at 4.5 pence; and in March 2023,

GBP550k was raised at 3.5 pence. These funds will be used to

complete the testwork and analysis from the 2022 field season, and

to finance further studies which will help define work plans for

the 2023 exploration programme. The Company's strategy is to design

work programmes around maximising the value of its projects,

building on the results of previous studies, for which it will

raise specific funding as required, and this will continue to be

the case in 2023.

OUTLOOK

In 2023, GreenRoc will continue to place maximum focus on the

Amitsoq graphite project in order to achieve the shortest route to

production, and thereby bringing in a positive cashflow. We are

watching the world market being heavily influenced by the

transition to renewable energy, with increasing national and

international concern over securing supply chains, while at the

same time exercising increasing focus on environmental and social

standards. With our world-class graphite at Amitsoq in Southern

Greenland, GreenRoc is well positioned to address many of these

challenges, while providing a sound business case for production.

In addition to the technical advances on our graphite deposit and

pursuing the regulatory requirements on the road to exploitation

permitting, we will approach the financial market, potential

technical and financial partners as well as governmental bodies to

help GreenRoc on our way to production of quality graphite for the

world market.

Stefan Bernstein

Chief Executive Officer

23 March 2023

CONSOLIDATED INCOME STATEMENT FOR THE YEARED 30 NOVEMBER

2022

Note Year ended 30 November 2022 Period 17 March to 30 November 2021

GBP'000 GBP'000

Revenue - -

Cost of sales - -

Gross profit - -

Administrative expenses 3 (1,030) (305)

Impairment 1 (199) -

--------------------------- -----------------------------------

Operating loss 3 (1,229) (305)

Finance expense (1) (1)

Loss for the period before tax (1,230) (306)

Taxation 5 - -

Loss for the period from continuing operations (1,230) (306)

=========================== ===================================

Attributable to:

Equity holders of the parent (1,230) (306)

--------------------------- -----------------------------------

(1,230) (306)

=========================== ===================================

Earnings per ordinary share attributable to

the ordinary equity holders of the parent

Basic and diluted 6 (1.10 pence) (1.11 pence)

--------------------------- -----------------------------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 30 NOVEMBER 2022

Year ended 30 November 2022 Period 17 March to 30 November 2021

GBP'000 GBP'000

Loss after tax (1,230) (306)

Total comprehensive income (1,230) (306)

=========================== ===================================

Total comprehensive income attributable to:

Equity holders of the parent (1,230) (306)

(1,230) (306)

=========================== ===================================

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AT 30 NOVEMBER

2022

Note 2022 2021

GBP'000 GBP'000

Non-current assets

Intangible fixed assets 7 10,151 8,259

------- -------

Total non-current assets 10,151 8,259

------- -------

Current assets

Trade and other receivables 8 13 64

Cash and cash equivalents 9 126 3,269

------- -------

Total current assets 139 3,333

------- -------

Current liabilities

Trade and other payables 10 (256) (482)

Payable to parent entity 10 (65) (52)

------- -------

Total current liabilities (321) (534)

------- -------

Net current (liabilities)/assets (182) 2,799

------- -------

Non-current liabilities

Deferred tax 1, 5 (1,004) (1,004)

------- -------

Total non-current liabilities (1,004) (1,004)

------- -------

Net assets 8,965 10,054

======= =======

Shareholders' equity

Share capital 11 161 161

Share premium 11 10,033 10,033

Share-based payment reserve 12 252 166

Retained earnings (1,481) (306)

Total equity 8,965 10,054

======= =======

These Financial Statements were approved and authorised for

issue by the Board of Directors on 23 March 2023.

Signed on behalf of the Board of Directors

Stefan Bernstein

Director

Company No 13273964

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30

NOVEMBER 2022

Share capital Share premium Share-based payment reserve Retained earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------- --------------------------- ----------------- -------

At 17 March 2021 (date of - - - - -

incorporation)

Loss for the period - - - (306) (306)

Total comprehensive income for

the period - - - (306) (306)

------------- ------------- --------------------------- ----------------- -------

Contributions by and

distributions to owners

Shares issued 161 10,915 - - 11,076

Cost of issuing equity - (800) - - (800)

Warrants issued at listing - (127) 127 - -

Bonus shares awarded - 45 - - 45

Fair value of share options

awarded - - 39 - 39

------------- ------------- --------------------------- ----------------- -------

At 30 November 2021 161 10,033 166 (306) 10,054

------------- ------------- --------------------------- ----------------- -------

Loss for the period - - - (1,230) (1,230)

------------- ------------- --------------------------- ----------------- -------

Total comprehensive income for

the period - - - (1,230) (1,230)

------------- ------------- --------------------------- ----------------- -------

Contributions by and

distributions to owners

Fair value of share options

awarded - - 141 - 141

Reversal of share options

cancelled - - (55) 55 -

------------- ------------- --------------------------- ----------------- -------

At 30 November 2022 161 10,033 252 (1,481) 8,965

------------- ------------- --------------------------- ----------------- -------

CONSOLIDATED CASH FLOW STATEMENT FOR THE YEARED 30 NOVEMBER

2022

Note 2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Operating loss (1,229) (305)

Adjustments for:

Share-based payment charge 141 39

Impairment 199 -

Bonuses settled in shares - 45

(Decrease)/increase in creditors (226) 202

Decrease/(increase) in trade and other receivables 51 (64)

Net cash used in operating activities (1,064) (83)

------- -------

Cash flows used in investing activities

Purchase of intangible assets 7 (2,091) (475)

Net cash used in investing activities (2,091) (475)

------- -------

Cash flows from financing activities

Proceeds from the issue of shares 11 - 5,076

Costs of issue 11 - (800)

Repayment of loan from parent - (448)

Receipts of borrowings from parent 13 -

Finance expense (1) (1)

Net cash generated from financing activities 12 3,827

------- -------

Net increase in cash and cash equivalents (3,143) 3,269

Cash and cash equivalents at beginning of period 3,269 -

Cash and cash equivalents at end of period 9 126 3,269

======= =======

Significant non-cash transactions in the period included

share-based payments and the impairment charge (see notes 1, 4, and

7.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. ACCOUNTING POLICIES AND BASIS OF PREPARATION

GreenRoc Mining Plc is a public limited company incorporated on

17 March 2021 and domiciled in England & Wales, whose shares

are publicly traded on the AIM market of the London Stock Exchange

Group Plc. The registered office address is 6th Floor 60

Gracechurch Street, London, United Kingdom, EC3V 0HR.

The Company's principal activities are the development of mining

and exploration interests in Greenland, where its subsidiaries hold

four separate exploration permits.

These consolidated Financial Statements have been prepared in

accordance with UK-adopted international accounting standards

("UK-adopted IAS") as they apply to the Group for the period ended

30 November 2022 and with the Companies Act 2006. Numbers have been

rounded to GBP'000.

The consolidated Financial Statements have been prepared on the

historical cost basis, save for the revaluation of certain

financial assets as a result of fair value accounting. The

principal accounting policies applied in the preparation of these

Financial Statements are set out below.

The Company's Ultimate Controlling Party during the year was

Alba Mineral Resources Plc, which held 54% of the ordinary share

capital of the Company (since reduced post year end to 44.7%) and

has the right to appoint two Directors to the Board. The next

largest shareholder, Kadupul Limited, currently holds 15.6% of the

Company's share capital.

Going concern

Based on financial projections prepared by the Directors, the

Group's current cash resources are insufficient to enable the Group

to meet its recurring outgoings and planned exploration expenditure

for the entirety of the next twelve months.

The Directors have prepared cash flow forecasts to 30 November

2024 which take into account planned exploration spend, costs and

external funding. In December 2022, the Company raised gross

proceeds of GBP333k through a share placing, followed by a further

placing of GBP550k in March 2023. At 21 March 2023, the Company had

GBP446k in cash. Nevertheless, the need for external funding is a

material uncertainty that may cast doubt on the Group's ability to

continue as a going concern.

As an explorer with assets in the exploration and development

stage, the Group does not generate revenue and is reliant on

external funding such as capital raisings to fund activities. The

Directors intend to raise funds in advance of fieldwork programmes

in Greenland, in order to advance its mineral projects. The precise

nature and cost of those programmes are determined based on the

results of previous studies.

These fundraisings are ad-hoc and as such the Group does not

carry a cash balance sufficient for 12 months of expenditure.

However, the Board has a reasonable expectation that the Group will

continue to be able to meet its commitments for the foreseeable

future by raising funds when required from the equity capital

markets, based on the following:

-- The Group has a track record in sourcing external funding,

having raised funds in 2021, 2022, and 2023

-- The Group has a supportive major shareholder (Alba Minerals

Resources Plc) which has a strong track record of raising funds for

exploration over a number of years

-- Results from the Group's graphite and ilmenite projects in

particular have been positive and support the case for further

investment

-- Forecasts contain a level of discretionary spend such that in

the event that cash flow becomes constrained action can be taken to

enable the Group to operate within available funding.

-- The Group and Company may also consider future joint venture

funding arrangements in order to share the costs of the development

of its exploration assets, or to consider divesting of certain of

its assets and realising cash proceeds in that way in order to

support the balance of its exploration and investment

portfolio.

For these reasons the Directors continue to adopt the going

concern basis of accounting in preparing the financial

Statements.

International Financial Reporting Standards

There are no significant changes within the International

Financial Reporting Standards (IFRS) framework which impact upon

the Company and its subsidiaries within the next financial

reporting year.

Standards issued but not yet effective are as follows:

-- Amendments to IAS 1: Presentation of Financial Statements:

Classification of Liabilities as Current or Non-current

-- Amendments to IAS 1: Classification of Liabilities as Current

or Noncurrent - Deferral of Effective Date

-- Amendments to IAS 1: Presentation of Financial Statements and

IFRS Practice Statement 2: Disclosure of Accounting Policies

-- Amendments to IAS 8: Accounting policies, Changes in

Accounting Estimates and Errors - Definition of Accounting

Estimates.

-- Amendment to IAS 12: Income Taxes - Deferred Tax related to

Assets and Liabilities arising from a Single Transaction.

-- Amendments to IFRS 17 Insurance contracts: Initial

Application of IFRS 17 and IFRS 9 - Comparative Information

-- Amendments to IFRS 16 Leases: Lease Liability in a Sale and Leaseback

Critical accounting estimates and judgements

The preparation of the Financial Statements requires management

to make estimates and assumptions that affect the reported amounts

of assets and liabilities as well as the disclosure of contingent

assets and liabilities at the reporting date and the reported

amounts of revenues and expenses during the reporting period.

Actual outcomes could differ from those estimates.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances. The areas of judgement that have the most

significant effect on the amounts recognised in the Financial

Statements are as follows:

i) JUDGEMENTS

Capitalisation of exploration and evaluation costs - GBP2.1

million (note 7)

The capitalisation of exploration costs relating to the

exploration and evaluation phase requires management to make

judgements as to the future events and circumstances of a project,

especially in relation to whether an economically viable extraction

operation can be established. In making such judgements, the

Directors take comfort from the findings from exploration

activities undertaken, the fact the Group intends to continue these

activities and that the Company expects to be able to raise

additional funding to enable it to continue the exploration

activities.

Impairment assessment of exploration and evaluation costs -

GBP10.2 million (note 7)

At each reporting date, management make a judgment as to whether

circumstances have changed following the initial capitalisation and

whether there are indicators of impairment. If there are such

indicators, an impairment review will be performed which could

result in the relevant capitalised amount being written off to the

income statement.

At 30 November 2022, all capitalised costs in respect of the

Inglefield project were impaired on the basis of the Company's

decision to discontinue activity at that permit. The impairment

charge arising as a result of this decision was GBP199k.

All of the other current exploration projects are being actively

progressed, the Company does not believe any circumstances have

arisen to indicate these assets require impairment.

Fair value of the Greenland subsidiaries upon acquisition in

2021 - GBP6.0 million

On 22 September 2021, GreenRoc Mining Plc acquired the entire

share capital in Obsidian Mining Ltd ("OML"), White Eagle Resources

Limited ("WER"), and White Fox Resources Limited ("WFR") from Alba

Mineral Resources Plc ("Alba"). The purpose of the transaction was

to establish a separate group from Alba which would be solely

focused on progressing the Greenland mining projects held by the

subsidiaries acquired. The consideration paid by GreenRoc for these

shares totalled GBP6.0 million, in the form of 59.5 million shares

in the Company at a value of 10 pence per share, the price at which

the shares were admitted to the AIM list of the London Stock

Exchange on 28 September 2021, and GBP50k in cash.

The Directors believe that 10 pence per share was the Fair Value

of the Company's shares on the basis that this was the price paid

by new investors who subscribed to the placing at the time of the

IPO. This gave an implicit value of the consolidated Group,

including the new subsidiaries, of GBP11.1 million, including

GBP5.1 million of new cash, which supports the view of the

Directors that the Fair Value of the underlying assets amounted to

GBP6.0 million. The excess of the Fair Value over the historic cost

of the underlying assets represents the increased value as

perceived by the open market as a result of the development work

undertaken by Alba in the periods leading up to the

transaction.

Company accounts Consolidated

accounts

GBP'000 GBP'000

Consideration paid - Fair value of shares

in GreenRoc 5,950 5,950

----------------- -------------

Assets acquired - historic cost

Investment in subsidiary 4,017 -

Intangible fixed asset - capitalised exploration

expenditure - 2,678

Stamp duty payable (20) (20)

Trade creditors - (255)

Accruals - (5)

Intragroup receivable (from new subsidiaries) 2,503 -

Loan due to parent organisation (Alba) (550) (550)

Intangible fixed asset - fair value uplift - 5,106

Deferred tax on fair value uplift - (1,004)

----------------- -------------

Net assets acquired 5,950 5,950

----------------- -------------

As the transaction took place between two legal entities with

common control, it was deemed to be outside the scope of IFRS3, and

the acquisition method of accounting was adopted as the most

appropriate treatment.

ii) ESTIMATES

Share-based payments - GBP141k

Share-based payments represent the fair value of shares issued

to employees of the Company, and warrants issued to third parties

in consideration for services provided. The cost of these

share-based payments is based on the number of options or warrants

awarded, the grant date and exercise price, the vesting period, and

calculated based on a Black-Scholes model whose input assumptions

are derived from market and other estimates. These estimates

include volatility rates (38% for 2022 awards, 82% for 2021

awards), the risk-free rate (calculated to be 2.1% for 2022 awards

and 0.6% for 2021 awards) and the expected term of the options. For

further details, see note 4.

ACCOUNTING POLICIES

Basis of consolidation

The consolidated Financial Statements incorporate the Financial

Statements of the Company and companies controlled by the Company,

namely the Subsidiary Companies, drawn up to 30 November each

year.

Control is recognised where the Company has the power to govern

the financial and operating policies of an investee entity to

obtain benefits from its activities. The results of subsidiaries

acquired or disposed of during the period are included in the

consolidated income statement from the effective date of

acquisition or up to the effective date of disposal, where

appropriate.

Where necessary, adjustments are made to the Financial

Statements of subsidiaries to bring the accounting policies used

into line with those used by the Group. All intra-group

transactions, balances, income and expenses

are eliminated on consolidation. Non-controlling interests in

the net assets of consolidated subsidiaries are identified

separately from the Group's equity therein.

Foreign currency

For the purposes of the consolidated Financial Statements, the

results and financial position of each Group entity are expressed

in pounds sterling, which is the presentation currency for the

consolidated Financial Statements, as well as the functional

currency for each of the entities within the Group.

In preparing the Financial Statements of the individual

entities, transactions in currencies other than the entity's

functional currency (foreign currencies) are recorded at the rates

of exchange prevailing at the dates of the transactions. At each

reporting date, monetary items denominated in foreign currencies

are retranslated at the rates prevailing at the reporting date.

Exchange differences arising are included in the profit or loss for

the period.

Share-based payments

Share-based compensation benefits are made on an ad-hoc basis on

the recommendations of the Remuneration Committee. The fair value

of warrants or options granted is recognised as an employee

benefits expense, with a corresponding increase in the share-based

payment reserve. The total amount to be expensed is determined by

reference to the fair value of the options granted:

-- including any market performance conditions (e.g., the entity's share price);

-- excluding the impact of any service and non-market

performance vesting conditions (e.g., profitability, sales growth

targets and remaining an employee of the entity over a specified

time period); and

-- including the impact of any non-vesting conditions (e.g., the

requirement for employees to save or hold shares for a specific

period of time).

The total expense is recognised over the vesting period, which

is the period over which all of the specified vesting conditions

are to be satisfied. At the end of each period, the entity revises

its estimates of the number of options that are expected to vest

based on the non-market vesting and service conditions. It

recognises the impact of the revision to original estimates, if

any, in profit or loss, with a corresponding adjustment to the

share-based payment reserve.

Warrants issued as part of the cost of an equity raise (for

example as part of advisers' fees) are recorded at fair value as a

cost of that financing within Share Premium and Share-based Payment

Reserve.

Intangible assets: capitalised exploration and evaluation

costs

Pre-licence costs are expensed in the period in which they are

incurred. Expenditure on licence renewals and new licence

applications covering an area previously under licence are

capitalised in accordance with the policy set out below.

Once the legal right to explore has been acquired, exploration

costs and evaluation costs arising are capitalised on a

project-by-project basis, pending determination of the technical

feasibility and commercial viability of the project. Costs include

appropriate technical and administrative expenses. If a project is

successful, the related expenditures will be reclassified as

development and production assets and amortised over the estimated

life of the commercial reserves. Prior to this, no amortisation is

recognised in respect of such costs. When all licences comprising a

project are relinquished, a project is abandoned or is considered

to be of no further commercial value to the Company, the related

costs will be written off to administrative expense within profit

or loss. Deferred exploration costs are carried at historical cost

less any impairment losses recognised.

Impairment reviews for capitalised exploration and evaluation

expenditure are carried out on a project-by-project basis, with

each project representing a potential single cash generating unit.

In accordance with the requirements of IFRS 6, an impairment review

is undertaken when indicators of impairment arise such as:

-- unexpected geological occurrences that render the resource uneconomic;

-- title to the asset is compromised;

-- variations in mineral prices that render the project uneconomic;

-- substantive expenditure on further exploration and evaluation

of mineral resources which is neither budgeted nor planned; and

-- the period for which the Group has the right to explore has

expired and is not expected to be renewed.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised in profit or loss for the

year.

Financial instruments

Financial assets and financial liabilities are recognised in the

statement of financial position when the Group becomes a party to

the contractual provisions of the instrument.

Financial assets are classified as either:

-- those to be measured subsequently at fair value (either

through other comprehensive income or through profit or loss);

or

-- those to be measured at amortised cost.

The classification is dependent on the business model adopted

for managing the financial assets and the contractual terms of the

cash flows expected to be derived from the assets.

For assets measured at fair value, gains and losses will either

be recorded in profit or loss or other comprehensive income. For

investments in equity instruments that are not held for trading,

this will depend on whether the Group has made an irrevocable

election at the time of initial recognition to account for the

equity investment at fair value through other comprehensive

income.

The Group's financial assets comprise equity instruments and

debt instruments as described below.

Impairment provisions for receivables and loans to related

parties are recognised based on a forward-looking expected credit

loss model. The methodology used to determine the amount of the

provision is based on whether there has been a significant increase

in credit risk since initial recognition of the financial asset.

For those where the credit risk has not increased significantly

since initial recognition of the financial asset, twelve month

expected credit losses along with gross interest income are

recognised. For those for which credit risk has increased

significantly, lifetime expected credit losses along with the gross

interest income are recognised. For those that are determined to be

credit impaired, lifetime expected credit losses along with

interest income on a net basis are recognised.

Investment in subsidiaries: Investment in subsidiaries,

comprising equity instruments and capital contributions, are

recognised initially at cost less any provision for impairment.

Loans to subsidiaries: Loans to subsidiaries, other than capital

contributions, are held for the collection of contractual cash

flows and are classified as being measured at amortised cost, net

of provision for impairment. Impairment is initially based on the

expected lifetime credit loss as applied to the portfolio of loans.

The loans are interest free and have no fixed repayment terms. As

such the loans are assessed as being credit impaired on inception

and lifetime expected credit losses are recognised with the amount

of provision being recognised in the profit or loss.

A loan is fully impaired when the relevant subsidiary recognises

an impairment of its deferred exploration expenditure, such that

the subsidiary is not expected to be able to repay the loan from

its existing assets.

Trade and other receivables: Trade and other receivables are

held for the collection of contractual cash flows and are

classified as being measured at amortised cost. They are recognised

initially at fair value and subsequently measured at amortised cost

using the effective interest method less provision for

impairment.

Cash and cash equivalents: Cash and cash equivalents include

cash on hand and deposits held at call with banks.

Trade and other payables: Trade and other payables are not

interest bearing and are recognised initially at fair value and

subsequently measured at amortised cost.

Financial liabilities:

-- Trade payables and other short-term monetary liabilities are

initially recognised at fair value and subsequently carried at

amortised cost using the effective interest method.

-- There are no financial liabilities classified as being at fair value through profit or loss.

-- Borrowings are initially recognised at fair value net of any

transaction costs directly attributable to the issue of the

instrument. Such interest-bearing liabilities are subsequently

measured at amortised cost using the effective interest rate

method. Interest expense includes initial transaction costs and any

premium payable on redemption, as well as any interest or coupon

payable while the liability is outstanding.

-- Liability components of convertible loan notes are measured as described further below.

Share capital: The Company's ordinary and deferred shares are

classified as equity.

Warrants: Warrants are stated at their value, which is estimated

using a Black Scholes model where they are not issued as part of a

cash transaction.

Taxation

The charge for taxation is based on the profit or loss for the

period and takes into account deferred tax. The Group's liability

for current tax is calculated using tax rates that have been

enacted or substantively enacted by the reporting date. Deferred

tax is the tax expected to be payable or recoverable on differences

between the carrying amounts of assets and liabilities in the

Financial Statements and the corresponding tax bases used in the

computation of taxable profit or loss, and is accounted for using

the liability method.

Deferred tax assets are only recognised to the extent that it is

probable that future taxable profit will be available in the

foreseeable future against which the temporary differences can be

utilised.

2. ANALYSIS OF SEGMENTAL INFORMATION

The Group currently only has one primary reporting business

segment, exploration and development. The Group exploration assets

and investments along with capital expenditures are presented on

this basis below:

2022 2021

GBP'000 GBP'000

------- -------

Total assets

Exploration and evaluation 10,151 8,259

Current assets 13 64

Cash 126 3,269

------- -------

10,290 11,592

======= =======

Capitalised exploration and evaluation expenditure

Exploration and evaluation - Greenland 2,091 475

2,091 475

======= =======

The Group's primary business activities are the exploration

projects in Greenland and its corporate head office in the UK. The

split of total assets and capitalised exploration and evaluation

expenditure between these locations is set out below:

2022 2021

GBP'000 GBP'000

------- -------

Total assets

Greenland 10,151 8,259

United Kingdom 139 3,333

------- -------

10,290 11,592

======= =======

The administrative expenditure in the income statement primarily

relates to central costs.

3. OPERATING LOSS

2022 2021

GBP'000 GBP'000

------- -------

This is stated after charging:

Share-based payments charge 141 39

Auditor's remuneration

- Group audit services 35 32

- Group taxation advice 9 6

======= =======

Administration expenses are made up as follows:

2022 2021

GBP'000 GBP'000

------- -------

Staff costs (including share-based payments) 534 166

Professional fees 162 70

Office, travel, and other 171 25

Fees for services - parent 163 44

------- -------

Total 1,030 305

======= =======

Prior period comparatives relate to the two-month period from 28

September to 30 November 2021, prior to which the Group was not

active.

4. DIRECTORS' EMOLUMENTS AND STAFF COSTS

During the period there were six permanent employees, being the

Directors (who are the key management personnel). There were no

temporary employees.

2022 2021

GBP'000 GBP'000

------- -------

Staff and Directors' Remuneration

Salaries 349 50

Listing bonus - shares - 45

Listing bonus - cash - 20

Share based payment charge 141 39

Pension contributions 10 1

------- -------

Total remuneration 500 155

Social security costs 34 11

Total cost 534 166

======= =======

Average number of employees 6 6

Remuneration of each Director is set out below for 2022. Prior

period comparatives relate to the two-month period from 28

September to 30 November 2021, prior to which the Group was not

active.

2022 2021

Salary Bonus Pension FV of options Total Salary Bonus Pension FV of options Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------- ------- ------- ------------- ------- ------- ------- ------- ------------- -------

Directors

Kirk Adams(1) 101 - - 38 139 19 20 1 16 56

Stefan

Bernstein(2) 41 - 9 2 52

Jim Wynn 38 - 1 18 57 7 5 - 4 16

George

Frangeskides 54 - - 69 123 9 20 - 16 45

Lars

Brünner 55 - - - 55 5 10 - - 15

Mark Austin 30 - - 14 44 5 - - 3 8

Mark Rachovides 30 - - - 30 5 10 - - 15

Total 349 - 10 141 500 50 65 1 39 155

======= ======= ======= ============= ======= ======= ======= ======= ============= =======

(1) Kirk Adams stood down from the Board on 5 May 2022

(2) Stefan Bernstein was appointed on 1 July 2022

No bonuses were paid during 2022. During 2021, upon listing,

Kirk Adams and George Frangeskides were awarded 200,000 bonus

shares at a value of 10 pence per share, while Jim Wynn was awarded

50,000 bonus shares at 10 pence a share. Lars Brünner and Mark

Rachovides were awarded cash bonuses of GBP10k each. These bonuses

were compensation for work undertaken relating to the fundraising

and admission process prior to 28 September 2021.

During the year, Kirk Adams was the highest-paid employee,

receiving remuneration totalling GBP139k (2021: GBP56k). There were

no employees other than Directors, whose remunerations is fully

disclosed in the above table.

During the period the Company granted share options to the

Directors as follows:

No options Date of grant Exercise price

Stefan Bernstein 1,000,000 8-Jul-22 GBP0.10

Total options granted in 2022 1,000,000

The above share options vest after the following periods have

elapsed since the date of grant: 1/3rd after 12 months; 1/3rd after

24 months; and 1/3rd after 36 months.

Total options held by Directors at year end were as follows:

No options Date of grant Exercise price

Stefan Bernstein 1,000,000 8-Jul-22 GBP0.10

Jim Wynn 400,000 28-Sep-21 GBP0.10

George Frangeskides 1,500,000 28-Sep-21 GBP0.10

Mark Austin 300,000 28-Sep-21 GBP0.10

Total options at 30 November 2022 2,200,000

The total estimated value of the share-based remuneration

provided to Directors was GBP141k, which will be expensed over the

vesting period of each tranche. These values were derived from a

Black Scholes model as described in note 1.

5. INCOME TAXES

a) Analysis of charge in the period

2022 2021

GBP'000 GBP'000

-------- --------

United Kingdom corporation tax at 19% (2021: 19%) - -

Deferred taxation - -

- -

======== ========

b) Factors affecting tax charge/(credit) for the period

The tax assessed on the loss for the period before tax differs

from the standard rate of corporation tax in the UK which is 19%.

The differences are explained below:

2022 2021

GBP'000 GBP'000

------- -------

Loss before tax (1,230) (306)

======= =======

Loss multiplied by standard rate of tax (19%) 234 58

Effects of:

Disallowed expenses (65) (7)

Deferred tax assets not recognised (169) (51)

- -

======= =======

A deferred tax asset has not been recognised in respect tax

losses and accelerated capital allowances, due to uncertainty that

the potential asset will be recovered.

In 2021, a deferred tax liability of GBP1.0 million was

recognised as part of the fair value accounting for the acquisition

of the Alba subsidiaries, representing the taxation impact of the

fair value uplift of the intangible assets acquired, which would

not be an allowable deduction from tax profits in future

periods.

6. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the loss

attributed to ordinary shareholders of GBP1.2 million (2021:

GBP306k) by the weighted average number of shares of 111,200,001

(2021: 27,531,396) in issue during the period. The diluted earnings

per share calculation is identical to that used for basic earnings

per share as warrants are not dilutive due to the losses

incurred.

7. INTANGIBLE FIXED ASSETS

Amitsoq Thule Black Sands Inglefield Melville Bay Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------- ----------------- ---------- ------------ -------

At incorporation - - - - -

Acquired through business combination (note 1) 3,096 3,715 199 774 7,784

Additions 179 296 - - 475

------- ----------------- ---------- ------------ -------

Net Book Value at 30 November 2021 3,275 4,011 199 774 8,259

======= ================= ========== ============ =======

Additions 1,717 374 - - 2,091

Impairment - - (199) - (199)

------- ----------------- ---------- ------------ -------

Net Book Value at 30 November 2022 4,992 4,385 - 774 10,151

======= ================= ========== ============ =======

No amortisation was recorded in respect of these assets.

8. TRADE AND OTHER RECEIVABLES

2022 2021

Current receivables GBP'000 GBP'000

------- -------

VAT receivable 13 64

13 64

======= =======

VAT receivable relates to input VAT on supplies during the

period. The Company registered for VAT during the year.

9. CASH AND CASH EQUIVALENTS

2022 2021

GBP'000 GBP'000

------- -------

Cash at bank and in hand 126 3,269

======= =======

The fair value of cash at bank is the same as its carrying

value.

10. TRADE AND OTHER PAYABLES

2022 2021

Current GBP'000 GBP'000

------- -------

Trade creditors 138 398

Accruals and deferred income 118 84

Loan due to parent entity 65 52

------- -------

321 534

======= =======

The fair value of trade and other payables approximates to their

book value.

11. CALLED UP SHARE CAPITAL

Number of Share capital Deferred shares Share premium Total

shares

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ----------- ------------- --------------- ------------- -------

Allotted, called up and fully paid

Ordinary shares of GBP0.001 pence 111,200,001 111 - 10,033 10,144

Deferred shares of GBP0.099 500,000 - 50 - 50

Total 111,700,001 111 50 10,033 10,194

==================================== =========== ============= =============== ============= =======

No shares were issued in the year ended 30 November 2022. The

movement in shares in issue, share capital, deferred share capital

and share premium during 2022 and 2021 was as follows:

Old Ord Shares Ordinary Deferred Share capital Deferred Share premium Total

Shares Shares shares

of GBP0.10 of GBP0.001 of GBP0.099 GBP'000 GBP'000 GBP'000 GBP'000

-------------- -------------- -------------- ------------- -------------- ------------- -------

Incorporation

17 March 2021 5,000,000 - - 50 - - 50

Share

restructure (5,000,000) 500,000 500,000 (50) 50 - -

Acquisition of

subsidiaries - 59,500,001 - 60 - 5,890 5,950

September 2021

IPO placing - 50,750,000 - 51 - 5,025 5,076

Listing costs - - - - - (800) (800)

Warrants - - - - - (127) (127)

Employee bonus

shares - 450,000 - 0 - 45 45

-------------- -------------- -------------- ------------- -------------- ------------- -------

At 30 November

2021 - 111,200,001 500,000 111 50 10,033 10,194

-------------- -------------- -------------- ------------- -------------- ------------- -------

Movement during - - - - - - -

year

-------------- -------------- -------------- ------------- -------------- ------------- -------

At 30 November

2022 - 111,200,001 500,000 111 50 10,033 10,194

-------------- -------------- -------------- ------------- -------------- ------------- -------

12. RESERVES

The following describes the nature and purpose of certain

reserves within owners' equity:

Share premium Amounts subscribed for share capital in excess of

nominal value less costs of issue.

Share-based payment Amounts charged each period in relation to share options

reserve and warrants.

---------------------------------------------------------

The share-based payment reserve movement of GBP86k (2021:

GBP166k) in the year consisted of GBP141k (2021: GBP39k) in respect

of the fair value of employee share options, offset by GBP55k in

respect of share options which were cancelled in the period (whose

accumulated fair value was reversed through the profit and loss

reserve). During 2021, the share-based payment reserve also

included movement of GBP127k relating to warrants issued as part of

the cost of listing in September 2021.

13. CAPITAL COMMITMENTS

As at 30 November 2022, the Company had commitments to spend

approximately GBP470k in calendar year 2023 on its Greenland

licences. However, historic expenditures in excess of minimum

obligations in previous years carried forward more than offset

these obligations at all of its permits with the exception of

Melville Bay, for which an obligation of approximately GBP130k

exists for 2023.

14. CONTINGENT LIABILITIES

The Company had no contingent liabilities at the end of the

period.

15. FINANCIAL INSTRUMENTS

The Group's financial instruments comprise investments, cash at

bank, and various items such as debtors, loans, and creditors. The

Group has not entered into derivative transactions, nor does it

trade financial instruments as a matter of policy.

Credit risk

The Group's credit risk arises primarily from cash at bank,

other debtors, and the risk the counterparty fails to discharge its

obligations.

The Company holds its cash with MetroBank Plc whose credit

rating is B+.

Funding risk

Funding risk is the possibility that the Group might not have

access to the financing it needs. The Group's continued future

operations depend on the ability to raise sufficient working

capital through the issue of equity share capital. The Directors

are confident that adequate funding will be forthcoming with which

to finance operations. The Directors have a strong track record of

raising funds as required both as GreenRoc as well as within Alba.

Controls over expenditure are carefully managed and activities

planned to ensure that the Group has sufficient funding.

Liquidity risk

Liquidity risk arises from the management of cash funds and

working capital. The risk is that the Group will fail to meet its

financial obligations as they fall due. The Group operates within

the constraints of available funds and cash flow projections are

produced and regularly reviewed by management.

Interest rate risk profile of financial assets

The only financial assets (other than short term debtors) are

cash at bank and in hand, which comprises money at call. The

interest earned in the period was negligible. The Directors believe

the fair value of the financial instruments is not materially

different to the book value.

Foreign currency risk

The Group incurs costs denominated in foreign currencies

(including Danish Krone and Euros) which gives rise to short term

exchange risk. The Group does not currently hedge against these

exposures as they are deemed immaterial and there is no material

exposure as at the period end.

Market risk

The underlying value of the Group's assets is exposed to the

spot price in the relevant commodities, notably graphite (Amitsoq),

ilmenite (TBS), and iron ore (Melville Bay).

Categories of financial instrument

2022 2021

GBP'000 GBP'000

------- -------

Financial assets

Held at amortised cost:

Trade and other receivables 13 64

13 64

======= =======

Financial liabilities

Loan due to parent entity 65 52

Trade creditors 138 398

203 450

======= =======

16. CAPITAL MANAGEMENT

The Group's objective when managing capital is to safeguard the

entity's ability to continue as a going concern and develop its

mining and exploration activities to provide returns for

shareholders. The Group's funding to date has been comprised of

equity. The Directors consider the Company's capital and reserves

to be capital. When considering the future capital requirements of

the Group and the potential to fund specific project development

via debt, the Directors consider the risk characteristics of all

the underlying assets in assessing the optimal capital

structure.

17. RELATED PARTY TRANSACTIONS

Alba Mineral Resources Plc, which owns 44.7% of the Company's

issued shares, charged fees for services in the period amounting to

GBP163k (2021: GBP44k). These fees were calculated in accordance