TIDMPGH

RNS Number : 0827O

Personal Group Holdings PLC

29 September 2023

29 September 2023

PERSONAL GROUP HOLDINGS PLC

("Personal Group", "Company" or "Group")

Interim Results & Interim Dividend for the six months ended

30 June 2023

Positive first half performance, driven by strong growth in

Insurance contribution

Personal Group Holdings Plc (AIM: PGH), the workforce benefits

and services provider, is pleased to announce its interim results

for the six months ended 30 June 2023.

Financial Highlights

-- Total revenue for the six months to 30 June 2023 increased 34% to GBP46.4m (H1 2022: GBP34.7m).

Whilst driven primarily by voucher resales through the benefits platform of GBP24.6m (H1 2022:

GBP13.8m), growth has also been seen across other key areas

-- Adjusted EBITDA* increased 75% to GBP2.7m (H1 2022: GBP1.5m), in line with management expectations

for H1, driven primarily by continued growth of the insurance book

-- Profit before tax increased to GBP1.6m (H1 2022: GBP0.5m) in line with adjusted EBITDA growth

-- Basic EPS increased to 4.5p (H1 2022: 1.7p)

-- Strong balance sheet and liquidity with cash and deposits at period end of GBP22.6m (Dec 2022:

GBP18.7m), and debt free

-- Interim dividend increased by 10% to 5.85p (H1 2022: 5.3p), reflecting the Board's continued

confidence in the Group's prospects

Operational Highlights

-- Strong growth in Affordable Insurance, driven by an increase in new sales and high retention

rates - new annualised insurance sales in the first six months rose by 34% to GBP5.8m (H1

2022: GBP4.3m)

-- Continued growth in recurring revenue streams providing increased visibility for H2 2023 and

2024:

o Annualised Premium Income (API) increased by 6% to GBP29.6m (31 Dec 22: GBP28.0m)

o Annualised Recurring Revenue (ARR) from our Benefits platform grew 10%, ending the period

with Hapi ARR of GBP2.2m and Sage Employee Benefits ARR of GBP3.3m respectively (31 Dec 2022:

GBP2.0m and GBP3.0m respectively)

o ARR from Innecto Digital products grew to GBP0.6m (31 Dec 22: GBP0.5m)

-- 52 new client wins (HY22: 52) with the award of a place on the Crown Commercial Services framework

serving as an endorsement of the Group's offering

-- Paula Constant assumed the role of Group CEO on 1 August 2023

Post-Period Trading and Outlook

-- Strong new insurance sales have continued at the start of H2 with retention rates remaining

robust

-- Next generation Hapi 2.0 successfully launched internally, enabling future roll out to customers

and partners

-- Trading remains in line to meet market's full year expectations

-- The Board is confident in the long-term outlook for the business

* Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation of intangible assets, goodwill

impairment, share-based payment expenses, corporate acquisition

costs and restructuring costs.

Paula Constant, Chief Executive of Personal Group, commented:

"Personal Group has enjoyed a positive start to the year, with a

particularly strong performance in our core Affordable Insurance

business alongside steady growth in our Benefits platform revenue.

Following the successful internal launch of Hapi 2.0, our enhanced

platform, we look forward to the subsequent roll out to our

customers and partners. It is clear to me that Personal Group is a

great business with a base of strong offerings on which to build

increased shareholder value and I am extremely excited about the

opportunity to develop a strategy to accelerate profitable growth

over the coming months."

-S-

Change of Nominated Adviser and Broker

The Company also announces that its Nominated Adviser and

Broker, Cenkos Securities plc, has now changed its name to

Cavendish Securities plc following completion of its own corporate

merger.

For more information please contact:

Personal Group Holdings Plc

Paula Constant / Sarah Mace +44 (0)1908 605 000

Cavendish Securities plc

Camilla Hume / Callum Davidson (Nominated

Adviser) +44 (0)20 7397 8900

Jasper Berry (Sales)

Alma

Caroline Forde / Joe Pederzolli / Kinvara +44 (0)20 3405 0205

Verdon personalgroup@almapr.co.uk

Notes to Editors

Personal Group Holdings Plc (AIM: PGH) is a workforce benefits

and services provider. The Group enables employers across the UK to

improve employee engagement and support their people's physical,

mental, social and financial wellbeing. Its vision is to create a

brighter future for the UK workforce.

Personal Group provides health insurance services and a broad

range of employee benefits, engagement, and wellbeing products. Its

offerings can also be delivered through its proprietary app,

Hapi.

The Group's growth strategy is centred around widening the

footprint of the business into the SME, talent-led & Public

Sectors, thereby expanding the addressable customer base. In

addition, it aims to grow in its existing industrial heartlands, to

re-invigorate growth in insurance policyholders and to drive the

use of its SaaS offerings.

Group Clients include: Airbus, B & Q, Barchester Healthcare,

British Transport Police, Merseyrail, Randstad, Royal Mail Group,

The Royal Mint, the Sandwell & Birmingham NHS Trust, Stagecoach

Group plc, and The University of York.

For further information on the Group please see

www.personalgroup.com

CEO STATEMENT

Having assumed the position of the Company's new CEO, post the

half year end, on 1 August 2023, I am delighted to be presenting

this set of interim results to shareholders. The team achieved a

positive first half of 2023, delivering year on year growth across

key metrics. I am particularly pleased to have seen the insurance

book continue to grow substantially - a result of strong new

insurance sales, operational effectiveness and efficiency as well

as continued high retention rates.

It is clear to me that the business is built on very solid

foundations. The strength of our face-to-face insurance sales

capability, we believe, is unmatched across the markets we serve.

Our Benefits platform, Hapi, will deliver enhanced capabilities

through the launch of Hapi 2.0. Furthermore, the strength of our

relationship with Sage has brought a growing new revenue stream for

the Group and opened up the wider SME market as a strategic

priority.

Since being appointed CEO in August I have commenced a

quantitative review of our operations in order to identify the

greatest available opportunities to improve profitability and drive

longer term growth in the business to increase shareholder value.

In the initial phase of this review we have commenced a detailed

customer segmentation analysis, prioritising our Insurance and

Benefits offerings, in order to identify optimal segments, price

points and specific offerings. Alongside this we are scrutinising

our lead generation effectiveness and the distribution of our

external marketing spend. We anticipate the introduction of more

granular KPIs across our sales processes and pipeline and we are

examining how to maximise the opportunity to visit lower penetrated

existing customer sites in the field. We are focussed on launching

Hapi 2.0 at scale and being able to onboard clients at pace. We

have employed external technology auditors to carry out a rigorous

technical review of Hapi 2.0 to stress test this ability before an

external rollout of the platform. We continue to penetrate the

existing, vast segment of Sage SME customers, with increased focus

at a senior level both of Sage and Personal Group on the

effectiveness of customer welcome calls whilst progressing

discussions with future partners.

My priorities in H2 are to conclude on this quantitative

evaluation of commercial, operations and technology to identify and

shape our strategic direction in terms of expanding our Insurance

offering, monetising our Hapi 2.0 platform, with a core focus on

the growth of partnerships, and streamlining the organisation

around the areas in which there are the greatest opportunities to

grow value for shareholders.

The Board and I would like to thank Deborah Frost, the Group's

previous CEO, for her leadership of Personal Group in recent years.

Her reinvigoration of the insurance offering and investment in the

Sage partnership have, I believe, placed the business in an

excellent position for further expansion.

Divisional H1 Segmental Analysis

Affordable Insurance

New annualised insurance sales in the first six months rose by

34% to GBP5.8m (H1 2022: GBP4.3m), a result of the growth in the

size of the field sales team alongside improved productivity and we

recorded new 'best' performances for 'day' and 'week' both

collectively and by individual. This, together with strong

retention levels, which remain above pre-pandemic averages, helped

to drive up the Annualised Premium Income value to GBP29.6m (31 Dec

2022: GBP28.0m) and led to a 14% increase in insurance revenue for

the period to GBP13.8m (H1 2022: GBP12.3m).

As anticipated, claims levels for the first half remained higher

than historic norms on Hospital Cash plans, as activity to address

NHS backlogs continued. These combined factors resulted in a 31%

increase in adjusted EBITDA contribution to GBP5.1m (H1 2022:

GBP3.9m).

Benefits platform

Revenue from digital platform subscriptions and commissions from

third party benefit suppliers which sit on the benefits platform

rose to GBP2.9m (H1 2022: GBP2.2m) with a resulting growth in

EBITDA of 35% to GBP1.8m (H1 2022: GBP1.3m).

Continued growth was seen in recurring subscription income,

across both Enterprise clients, taking Hapi, and Sage Employee

Benefits, which ended the half year with ARR of GBP2.2m and GBP3.3m

respectively (31 Dec 2022: GBP2.0m and GBP3.0m).

Income from voucher resales through the benefits platform rose

to GBP24.6m (H1 2022: GBP13.8m). Whilst the EBITDA contribution

from this remains minimal this significant growth in revenue

reinforces the relevance of our product to our clients, enabling

them to address cost of living issues with their employees, who

collectively saved over GBP1.3m through use of the discount

vouchers on the platform in the six months to June.

Alongside the growth of our existing customer base, we have been

developing the second generation of the Hapi platform, with

considerably enhanced capabilities. These include improved Reward

and Recognition functionality, simpler navigation and search

capability, modularisation for tiered and self-serve offers, and

slicker onboarding processes.

Our investment in the next generation of the platform, Hapi 2.0,

will provide us with opportunities to both enhance the quality of

our provision and to put us in a position to actively seek out and

continue discussions with additional external partners, to widen

our reach, and build further ARR streams.

Pay and Reward

The contribution from Pay & Reward, comprising Innecto and

Quintige Consulting Group, has remained steady with revenue of

GBP1.1m (H1 2022: GBP0.9m) and EBITDA of GBP0.2m (H1 2022:

GBP0.3m). This division has shown resilience despite the attention

of their normal audience of HR Directors being diverted to the

tactical focus of dealing with the cost-of-living crisis for their

employees and significant growth in the pipeline towards the end of

the period gives confidence for improved performance in H2.

Other Owned Benefits

(Let's Connect)

Contribution from Other Owned Benefits (Let's Connect) was in

line with management's expectations post cessation of the long-term

scheme with a major client in March 2023, as previously announced,

delivering revenue of GBP3.6m (H1 2022: GBP5.4) and an EBITDA loss

of (GBP0.3m) (H1 2022: 0.0m) . Contribution from this business

remains heavily second half weighted.

Interim Dividend

The Company is pleased to announce that an interim dividend for

2023 of 5.85p, representing a 10% increase on the previous year,

will be paid on 16 November 2023 to members on the register as at

13 October 2023 (the record date). Shares will be marked

ex-dividend on 12 October 2023. The Board has considered the level

of dividend in the context of the full year results and the level

reflects their continued confidence in the Group's business model

and prospects.

Current Trading and Outlook

Trading into Q3 has remained robust. The Group is trading in

line with management's expectations to date and this underpins the

Board's confidence in meeting market expectations for the full

year.

The market opportunity is, I believe, considerable and I look

forward to updating shareholders on strategic progress in the

coming months.

Paula Constant

Group Chief Executive

29 September 2023

Consolidated Income Statement

6 months

6 months ended

ended 30 June 2022

30 June 2023 Unaudited

Unaudited (*Restated)

Note GBP'000 GBP'000

Insurance revenue 13,848 12,301

Employee benefits and services 7,568 8,436

Voucher resale income 24,648 13,848

Other income 69 128

Investment income 295 29

(________) (________)

Revenue 46,428 34,742

(________) (________)

Insurance service expenses 4 (7,230) (6,890)

Net expenses from reinsurance

contracts held (57) (77)

Employee benefits and services

expenses (7,359) (8,268)

Voucher resale expenses (24,660) (13,872)

Other expenses (41) (38)

Group administration expenses (5,346) (4,679)

Share based payment expenses (110) (152)

Charitable donations (50) (50)

(________) (________)

Expenses (44,853) (34,026)

(________) (________)

Operating profit 1,575 716

Finance costs (22) (13)

Unrealised profit / (loss) on

equity investments 77 (244)

(________) (________)

Profit before tax 1,630 459

Tax 5 (221) 73

(________) (________)

Profit for the period after tax 1,409 532

(________) (________)

Total comprehensive income for

the period 1,409 532

(________) (________)

Earnings per share Pence Pence

Basic 4.5 1.7

Diluted 4.5 1.7

The total comprehensive income for the period is attributable to

equity holders of Personal Group Holdings Plc.

* With the transition to IFRS 17, certain comparative amounts

have been re-stated as if the standard had always been in effect.

See Note 11 for full details.

Consolidated Balance Sheet

At 30 June 2023 At 31 Dec 2022

Unaudited Audited

Note GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 7 2,684 2,684

Intangible assets 8 2,858 2,384

Property, plant and equipment 9 5,064 4,639

(_______) (_______)

10,606 9,707

(________) (________)

Current assets

Financial assets 10 3,137 3,031

Trade and other receivables 7,434 15,863

Reinsurance contracts held 55 95

Inventories 467 726

Cash and cash equivalents 20,827 16,958

Current tax assets 312 229

(________) (________)

32,232 36,902

(________) (________)

Total assets 42,838 46,609

(________) (________)

Consolidated Balance Sheet

At 30 June 2023 At 31 Dec 2022

Unaudited Audited

Note GBP'000 GBP'000

EQUITY

Equity attributable to equity

holders of Personal Group Holdings

plc

Share capital 1,562 1,562

Share premium 1,134 1,134

Capital redemption reserve 24 24

Other reserve (48) (55)

Share based payment reserve 477 367

Profit and loss reserve 27,694 27,946

(________) (________)

Total equity 30,843 30,978

(________) (________)

LIABILITIES

Non-current liabilities

Deferred tax liabilities 781 681

Trade and other payables 522 130

(________) (________)

1,303 811

(________) (________)

Current liabilities

Trade and other payables 7,725 11,346

Insurance contract liabilities 2,967 3,474

(________) (________)

10,692 14,820

(________) (________)

(________) (________)

Total liabilities 11,995 15,631

(________) (________)

(________) (________)

Total equity and liabilities 42,838 46,609

(________) (________)

Consolidated Statement of Changes in Equity for the six months

ended 30 June 2023

Share Share Capital Other Share Profit Total

capital Premium redemption reserve Based & loss equity

reserve Payment reserve

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 January

2023 1,562 1,134 24 (55) 367 27,946 30,978

(________) (________) (________) (________) (________) (________) (________)

Dividends - - - - - (1,656) (1,656)

Employee

share-based

compensation - - - - 110 - 110

Proceeds of

SIP*

share sales - - - - - 12 12

Cost of SIP

shares

sold - - - 17 - (17) -

Cost of SIP

shares

purchased - - - (10) - - (10)

(________) (________) (________) (________) (________) (________) (________)

Transactions

with owners - - - 7 110 (1,661) (1,544)

(________) (________) (________) (________) (________) (________) (________)

Profit for the

period - - - - - 1,409 1,409

(________) (________) (________) (________) (________) (________) (________)

Total

comprehensive

income for

the

period - - - - - 1,409 1,409

(________) (________) (_______) (_______) (_______) (_______) (_______)

Balance as at

30 June 2023 1,562 1,134 24 (48) 477 27,694 30,843

(________) (________) (________) (________) (________) (________) (________)

* PG Share Ownership Plan (SIP)

Consolidated Statement of Changes in Equity for the six months

ended 30 June 2022

Share Share Capital Other Share Profit Total

capital Premium redemption reserve Based & loss equity

reserve Payment reserve

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 January

2022 1,561 1,134 24 (32) 158 38,436 41,281

(________) (________) (________) (________) (________) (________) (________)

Dividends - - - - - (1,654) (1,654)

Employee

share-based

compensation - - - - 152 - 152

Proceeds of

SIP*

share sales - - - - - 11 11

Cost of SIP

shares

sold - - - 9 - (9) -

Cost of SIP

shares

purchased - - - (18) - - (18)

Purchase of

New

shares - - (20) - - (20)

Shares issued

in year -

LTIP

exercise 1 - - - (63) 63 1

(________) (________) (________) (________) (________) (________) (________)

Transactions

with owners 1 - - (29) 89 (1,589) (1,528)

(________) (________) (________) (________) (________) (________) (________)

Profit for the

period - - - - - 532 532

(________) (________) (________) (________) (________) (________) (________)

Total

comprehensive

income for

the

period - - - - - 532 532

(________) (________) (_______) (_______) (_______) (_______) (_______)

Balance as at

30 June 2022 1,562 1,134 24 (61) 247 37,379 40,285

(________) (________) (________) (________) (________) (________) (________)

* PG Share Ownership Plan (SIP)

Consolidated Statement of Cash Flows

6 months

6 months ended

ended 30 June 2022

30 June 2023 Unaudited

Unaudited

GBP'000 GBP'000

Net cash from operating activities (see

opposite) 6,442 3,023

(______) (______)

Investing activities

Additions to property, plant and equipment (99) (222)

Additions to intangible assets (872) (473)

Purchase of financial assets (29) (1,509)

Sale of financial assets - 871

Interest received 295 29

(______) (______)

Net cash from investing activities (705) (1,304)

(______) (______)

Financing activities

Proceeds from issue of shares - 1

Purchase of own shares by the SIP (6) (31)

Proceeds from disposal of own shares

by the SIP 12 6

Interest paid - (4)

Payment of lease liabilities (218) (226)

Dividends paid (1,656) (1,654)

(______) (______)

Net cash used in financing activities (1,868) (1,908)

(______) (______)

Net change in cash and cash equivalents 3,869 (189)

Cash and cash equivalents, beginning

of period 16,958 20,291

(_______) (_______)

Cash and cash equivalents, end of period 20,827 20,102

(________) (________)

Consolidated Statement of Cash Flows

6 months

6 months ended

ended 30 June 2022

30 June 2023 Unaudited

Unaudited

GBP'000 GBP'000

Operating activities

Profit after tax 1,409 532

Adjustment for:

Depreciation 506 493

Amortisation of intangible assets 398 364

Loss on disposal of property, plant and equipment 14 24

Interest received (295) (29)

Realised and unrealised investment losses (77) 244

Interest charge 22 13

Share-based payment expenses 117 152

Taxation expense recognised in income statement 221 (73)

Changes in working capital:

Trade and other receivables 8,469 5,675

Trade and other payables (4,385) (4,129)

Inventories 259 (161)

Taxes paid (209) (82)

(________) (________)

Net cash from operating activities 6,442 3,023

(________) (________)

Notes to the Consolidated Financial Statements

1 General information

The principal activities of Personal Group Holdings Plc ('the

Company') and subsidiaries (together 'the Group') include

transacting short-term accident and health insurance and providing

employee services in the UK.

The Company is a limited liability company incorporated and

domiciled in England. The address of its registered office is John

Ormond House, 899 Silbury Boulevard, Milton Keynes, MK9 3XL.

The Company is listed on the Alternative Investment Market of

the London Stock Exchange.

The condensed consolidated financial statements do not include

all the information required for full annual financial statements

and should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2022.

The financial information for the year ended 31 December 2022

set out in this interim report does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

statutory financial statements for the year ended 31 December 2022

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006.

These interim financial statements are unaudited and have not

been reviewed by the auditors under International Standard on

Review Engagements (UK and Ireland) 2410.

These consolidated interim financial statements have been

approved for issue by the board of directors on 29 September

2023.

2 Accounting policies

These June 2023 interim consolidated financial statements of

Personal Group Holdings Plc are for the six months ended 30 June

2023. These interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as endorsed for

use in the UK.

They do not include all the information required for a complete

set of IFRS financial statements. However, selected explanatory

notes are included to explain events and transactions that are

significant to an understanding of the changes in the Group's

financial position and performance since the last annual

consolidated financial statements as at and for the year ended 31

December 2022.

These financial statements have been prepared in accordance with

IFRS standards and IFRIC interpretations as adopted by the UK,

issued and effective as at 30 June 2023.

Changes in accounting policies and new standards

Personal Group has initially applied IFRS 17 including any

consequential amendments to other standards, from 1 January 2023.

There are no other new or amended IFRS standards, that have a

material effect, that have become effective during the period ended

30 June 2023.

IFRS 17 has had a significant impact on accounting for insurance

contracts. As a result, Personal Group has re-stated certain

comparative amounts particularly in the presentation of its Income

Statement. Personal Group's updated accounting policies for

reinsurance contracts are set out below. Disclosures relating to

the transition to IFRS 17 have been set out in note 12.

Insurance contracts

IFRS 17 sets out the classification, measurement and

presentation and disclosure requirements for insurance contracts.

It requires insurance contracts to be measured using current

estimates and assumptions that reflect the timing of cash flows and

recognition of profits as insurance services are delivered. The

standard provides two main measurement models which are the General

Measurement Model ("GMM") and the Premium Allocation Approach

("PAA").

The PAA simplifies the measurement of insurance contracts for

remaining coverage in comparison to the GMM. The PAA is very

similar to Personal Group's previous accounting policies under IFRS

4 for calculating revenue, however there are some presentation

changes.

The GMM is used for the measurement of the liability for

incurred claims.

Notes to the Consolidated Financial Statements

PAA eligibility

Under IFRS 17, Personal Group's insurance contracts issued and

are all eligible to be measured by applying the PAA, due to meeting

the following criteria:

-- Insurance contracts with coverage period of one year or less

are automatically eligible. This covers all hospital,

convalescence, and death benefit insurance contracts.

-- Modelling of contracts with a coverage period greater than

one year (employee default policies) produces a measurement for the

group of reinsurance contracts that does not differ materially from

that which would be produced applying the GMM.

Level of aggregation

Personal Group manages all insurance contracts as one portfolio

within the insurance operating segment as they are subject to

similar risks.

Onerous contracts

Under the PAA, it is assumed there are no contracts in the

portfolio that are onerous at initial recognition, unless there are

facts and circumstances that may indicate otherwise. Given the

short-tailed nature of policies issued be Personal Group,

management do not consider there to be any material circumstance

under which policies in issue would be onerous.

Modification and derecognition

Personal Group derecognises insurance contracts when the rights

and obligations relating to the contract are extinguished (meaning

discharged, cancelled, or expired) or the contract is modified such

that the modification results in a change in the measurement model

or the applicable standard for measuring the contract.

Contract boundaries

The measurement of insurance contracts includes all future cash

flows expected to arise within the boundary of each contract. Cash

flows are within the boundary of an insurance contract if they

arise from substantive rights and obligations that exist during the

reporting period in which Personal Group can compel the

policyholder to pay premiums or in which it has a substantive

obligation to provide the policyholder with services.

Personal Group assesses the contract boundary at initial

recognition and at each subsequent reporting date to include the

effects of changes in circumstances on the Group's substantive

rights and obligations. The assessment of the contract boundary,

which defines the future cash flows that are included in the

measurement of the contract, requires judgement and

consideration.

Personal Group primarily issues insurance contracts which

provide coverage to policyholders in the event of hospitalisation,

convalescence, or death. While the contracts are typically weekly

or monthly in their term length, the contract boundary is assessed

with consideration of the delayed timing around claims of this

nature and the timing of expected future claims payments with

reference to the covered loss event.

Measurement - Liability for remaining coverage

On initial recognition of insurance contract, the carrying

amount of the liability for remaining coverage is measured as the

premiums received on initial recognition, if any, minus any

reinsurance acquisition expense cash flows allocated to the

contracts and any amounts arising from the derecognition of the

prepaid reinsurance acquisition expense cash flows asset. Personal

Group has chosen not to expense insurance acquisition expense cash

flows as incurred on its contracts as they have coverage of less

than one year.

Subsequently, at the end of each reporting period, the liability

for remaining coverage is increased by any additional premiums

received in the period and decreased for the amounts of expected

premium cash flows recognised as reinsurance revenue for the

services provided in the period.

Personal Group has elected not to adjust the liability for

remaining coverage for the time value of money as its insurance

contracts do not contain a significant financing component.

Notes to the Consolidated Financial Statements

Measurement - Liability for incurred claims

The liability for incurred claims represents the estimated

ultimate cost of settling all insurance claims arising from events

that have occurred up to the end of the reporting period, including

the operating costs that are expected to be incurred in the course

of settling such claims. The liability for claims is derived from

the estimated fulfilment cash flows relating to expected claims.

The fulfilment cash flows incorporate, in an unbiased way, all

reasonable and supportable information available, without undue

cost of effort, about the amount, timing and uncertainty of those

future cash flows. They also include an explicit risk adjustment.

Estimates of future cash flows for incurred claims are not

discounted on initial recognition due to the immateriality of the

impact of the time value of money as discussed in Note 12.

3 Segment analysis

The segments used by management to review the operations of the

business are disclosed below.

1) Affordable Insurance

Personal Assurance Plc (PA), a subsidiary within the Group, is a

PRA regulated general insurance Company and is authorised to

transact accident and sickness insurance. It was established in

1984 and has been underwriting business since 1985. In 1997

Personal Group Holdings Plc (PGH) was created and became the

ultimate parent undertaking of the Group.

Personal Assurance (Guernsey) Limited (PAGL), a subsidiary

within the Group, is regulated by the Guernsey Financial Services

Commission and has been underwriting death benefit policies since

March 2015.

This operating segment derives the majority of its revenue from

the underwriting by PA and PAGL of insurance policies that have

been bought by employees of host companies via bespoke benefit

programmes. During 2020 PAGL began underwriting employee default

insurance for a proportion of LC customers.

2) Other Owned Benefits

This segment constitutes any goods or services in the benefits

platform supply chain which are owned by the Group. At present this

is made up of a technology salary sacrifice business trading as PG

Let's Connect, purchased by the Group in 2014.

3) Benefits Platform

Revenue in this segment relates to the annual subscription

income and other related income arising from the licensing of Hapi,

the Group's employee benefit platform. This includes sales to both

the large corporate and SME sectors.

4) Pay and Reward

Pay and Reward refers to the trade of the Group's pay and reward

consultancy Company Innecto, purchased in 2019, and QCG, purchased

in 2022. Revenue in this segment relates to consultancy, surveys,

and licence income derived from selling digital platform

subscriptions.

5) Other

The other operating segment includes revenue generated from the

resale of vouchers. This segment also consists of revenue generated

by Berkeley Morgan Group (BMG) and its subsidiary undertakings

along with any investment and rental income obtained by the

Group.

Notes to the Consolidated Financial Statements

The revenue and net result generated by each of the Group's

operating segments are summarised as follows,

6 months 6 months

ended ended

30 June 2023 30 June 2022

Unaudited Unaudited

GBP'000 GBP'000

Revenue by Segment

---------------------------------------- -------------- -------------

Affordable Insurance 13,848 12,301

Other Owned Benefits 3,563 5,387

Benefits Platform 4,356 3,574

Platform - Group Elimination (1,425) (1,425)

Pay & Reward 1,074 900

---------------------------------------- -------------- -------------

Other Income:

Voucher resale 24,648 13,848

Other 69 128

Investment income 295 29

---------------------------------------- -------------- -------------

Group Revenue 46,428 34,742

---------------------------------------- -------------- -------------

Adjusted EBITDA contribution by segment

---------------------------------------- -------------- -------------

Affordable Insurance 5,143 3,970

Other Owned Benefits (287) (32)

Benefits Platform 1,750 1,298

Pay & Reward 172 282

---------------------------------------- -------------- -------------

Other 387 (149)

Group admin and central costs (4,449) (3,798)

Charitable donations (50) (50)

---------------------------------------- -------------- -------------

Adjusted EBITDA 2,666 1,521

---------------------------------------- -------------- -------------

Depreciation (506) (493)

Amortisation (398) (364)

Interest (22) (13)

Share based payments expenses (110) (152)

Corporate acquisition costs - (40)

---------------------------------------- -------------- -------------

Profit before tax 1,630 459

---------------------------------------- -------------- -------------

All income was derived from customers that are based in the

UK.

4 Insurance service expenses

6 months ended 6 months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

Claims incurred 3,750 3,663

Insurance operating expenses 3,480 3,227

(________) (________)

7,230 6,890

(________) (________)

Notes to the Consolidated Financial Statements

5 Taxation

The tax expense recognised is based on the weighted average

annual tax rate expected for the full financial year multiplied by

management's best estimate of the taxable profit of the interim

reporting period.

The Group's consolidated effective tax rate in respect of

continuing operations for the six-month period ended 30 June 2023

was 13.6% (six-month period ended 30 June 2022: 15.9% credit). The

tax charge recognised in the period continues to benefit from the

application of the super-deduction capital allowances tax relief,

eligible until 31 March 2023.

6 Earnings per share and dividends

The weighted average numbers of outstanding shares used for

basic and diluted earnings per share are as follows:

6 months ended EPS 6 months ended EPS

30 June 2023 Pence 30 June 2022 Pence

Basic 31,230,807 4.5 31,210,686 1.7

-------------- ------ -------------- ------

Diluted 31,230,807 4.5 31,218,953 1.7

-------------- ------ -------------- ------

During the first six months of 2023 Personal Group Holdings Plc

paid dividends of GBP1,654,000 to its equity shareholders (2022:

GBP1,592,000). This represents a payment of 5.30p per share (2022:

5.10p).

6 months ended 6 months ended

30 June 2023 30 June 2022

GBP'000 GBP'000

Dividends paid or provided for

during the period 1,656 1,654

(_____) (_____)

7 Goodwill

PG Let's Innecto QCG Total

Connect

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2023 10,575 2,121 563 13,259

Additions in the year - - - -

(________) (________) (________)

_________ _______ _______ (________)

At 30 June 2023 10,575 2,121 563 13,259

(________) (________) (________)

_________ _________ _________ (________)

Amortisation and impairment

At 1 January 2023 10,575 - - 10,575

Impairment charge for year - - - -

(________) (________) (________) (________)

_________ _________ _________ _________

At 30 June 2023 10,575 - - 10,575

(________) (________) (________) (________)

Net book value at 30 June 2023 - 2,121 563 2,684

(________) (________) (________) (________)

Net book value at 31 December

2022 - 2,121 563 2,684

(________) (________) (________) (________)

Notes to the Consolidated Financial Statements

8 Intangible assets

Customer Computer Innecto Internally Work Total

Value software Technology Generated in Progress

and development Computer

Software

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2023 2,711 2,678 298 506 1,003 7,196

Transfers - - - - - -

Additions - 52 - - 820 872

Disposals - - - - - -

(________) (________) (________) (________) (________) (________)

At 30 June 2023 2,711 2,730 298 506 1,823 8,068

(________) (________) (________) (________) (________) (________)

Amortisation

At 1 January 2023 2,238 1,838 230 506 - 4,812

Amortisation charge

for the year 106 262 30 - - 398

Disposals in the - - - - - -

period

(________) (________) (________) (________) (________) (________)

At 30 June 2023 2,234 2,100 260 506 - 5,210

(________) (________) (________) (________) (________) (________)

Net book amount

at 30 June 2023 367 630 38 - 1,823 2,858

(________) (________) (________) (________) (________) (________)

Net book amount

at 31 December

2022 473 840 68 - 1,003 2,384

(________) (________) (________) (________) (________) (________)

9 Property, plant and equipment

Freehold Motor vehicles Computer Furniture Leasehold Right of Total

land and equipment fixtures improve- use Assets

properties & fittings ments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2023 5,037 157 1,443 2,318 38 1,139 10,132

Additions - - 69 30 - 845 944

Disposals - (104) - - - (210) (314)

(______) (______) (______) (______) (______) (______) (______)

At 30 June 2023 5,037 53 1,512 2,348 38 1,774 10,762

(______) (______) (______) (______) (______) (______) (______)

Depreciation

At 1 January 2023 1,916 134 1,058 1,474 38 873 5,493

Provided in the

period 43 5 127 105 - 226 506

Disposals - (104) - - - (197) (301)

(______) (______) (______) (______) (______) (______) (______)

At 30 June 2023 1,959 35 1,185 1,579 38 902 5,698

(______) (______) (______) (______) (______) (______) (______)

Net book amount

at

30 June 2023 3,078 18 327 769 - 872 5,064

(______) (______) (______) (______) (______) (______) (______)

Net book amount

at

31 December 2022 3,121 23 385 844 - 266 4,639

(______) (______) (______) (______) (______) (______) (______)

Notes to the Consolidated Financial Statements

10 Financial Investments

At 30 June At 31 December

2023 2022

Unaudited Audited

GBP'000 GBP'000

Bank deposits 1,771 1,742

Equity investments 1,366 1,289

(________) (________)

3,137 3,031

(_________) (_________)

IFRS 13 Fair Value Measurement establishes a fair value

hierarchy that categorises into three levels the inputs to

valuation techniques used to measure fair value. The fair value

hierarchy gives the highest priority to quoted prices (unadjusted)

in active markets for identical assets or liabilities (Level 1

inputs) and the lowest priority to unobservable inputs (Level 3

inputs)

-- Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities

-- Level 2: inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly (i.e., as prices) or indirectly (i.e., derived from

prices)

-- Level 3: inputs for the asset or liability that are not based

on observable market data (unobservable

input).

Bank deposits, held at amortised cost, are due within 6 months

and the amortised cost is a reasonable approximation of the fair

value. These would be included within Level 2 of the fair value

hierarchy.

Equity Investments are held at fair value and are considered

Level 1 financial assets.

11 Long Term Incentive Plan (LTIP)

During the period, the Remuneration Committee approved a third

tranche of share awards under the existing LTIP approved on 6 April

2021. Further details of the award can be found in the RNS

announcement from 21 June 2023.

Under the scheme share options of Personal Group Holdings Plc

are granted to senior executives with an Exercise Price of 5p

(nominal value of the shares). The share options have various

market and non-market performance conditions which are required to

be achieved for the options to vest. The options also contain

service conditions that require option holders to remain in

employment of the Group. The market and non-market performance

conditions are set out below.

Total Shareholder Return (Market condition)

42.5% of the awards vest under this condition. Subject to

Compound Annual Growth Rate (CAGR) of the Total Shareholder Return

(TSR) over the Performance Period.

EBITDA Targets (Non-market condition)

42.5% of the awards vest under this condition. Subject to

cumulative EBITDA over the Performance Period.

Environmental, social and governance targets ("ESG") Targets

(Non-market condition)

Up to 15% of the awards vest under this condition. The awards

shall vest upon the Remuneration Committee determining that all ESG

targets have been met.

The fair value of the of the share options is estimated at the

grant date using a Monte-Carlo binomial option pricing model for

the market conditions, and a Black-Scholes pricing model for

non-market conditions.

Notes to the Consolidated Financial Statements

However, the above performance condition is only considered in

determining the number of instruments that will ultimately

vest.

There are no cash settlements alternatives. The Group does not

have a past practice of cash settlement for these share options.

The Group accounts for the LTIP as an equity-settled plan.

In total, GBP118,000 of employee share-based compensation has

been included in the consolidated income statement to 30 June 2023

(2022: GBP142,000). The corresponding credit is taken to equity. No

liabilities were recognised from share-based transactions. The

remaining GBP10,000 (2022: GBP10,000) of share-based compensation

expense relates to the Company Share Option Plan (CSOP).

12 Transition to IFRS 17

IFRS 17, Insurance Contracts

IFRS 17 replaces IFRS 4 Insurance Contracts for annual periods

on or after 1 January 2023. In addition to the

updated accounting policies discussed in Note 2, some of the key

differences between IFRS 17 and the accounting policies previously

adopted by Personal Group under IFRS 4 are outlined below.

Changes to classification and measurement

The adoption of IFRS 17 did not change the classification of

Personal Group's insurance contracts issued. Under IFRS 17,

Personal Group's insurance contracts are all eligible to be

measured by applying the Premium Allocation Approach ("PAA").

The measurement principles of the PAA are very similar to

accounting policies previously applied under IFRS 4 but are

different in the following key areas:

-- Under IFRS 4 gross premiums written were recognised at the

top of the consolidated income statement with an adjustment for the

change in unearned premium liability and outward reinsurance

premiums. IFRS 17 defines insurance revenue as the expected premium

cash flows net of any deductions that are paid to reinsurance

providers, excluding any investment components. As such, the new

Income Statements consolidates those previous balances into one

insurance income figure for the period.

-- If contracts are assessed as being onerous, a loss component

is recognised. Previously these may have formed an unexpired risk

reserve provision determine through the liability adequacy test. No

onerous contracts have been identified and, as a result, there has

been no transition adjustment for this.

-- Under IFRS 4, contract specific acquisition cash flows were

deferred and amortised. Under IFRS 17, the recognition of insurance

acquisition expense cash flows includes an allocation of

acquisition-related operating expenses incurred in the period. The

deferral and amortisation of these expenses, under both IFRS 4 and

IFRS 17, is spread over the life of insurance contracts. As the

vast majority of Personal Group's insurance contracts are weekly or

monthly in length, there is no deferral and amortisation of

acquisition costs performed.

-- In the measurement of the insurance contract liability, under

IFRS 4, losses and loss adjustment expenses were required to be

undiscounted without an explicit need for an adjustment for

non-financial risk. Under IFRS 17, the liability for incurred

claims is typically determined on a discounted expected value basis

and includes an explicit risk adjustment for non-financial risk.

Personal Group has assessed the impact of discounting of expected

future insurance losses and, due to the majority of losses being

paid in the first 12 months following a loss event, this impact was

insignificant. In addition to this, Personal Group has always

included a risk adjustment into its chain-ladder method for

calculating its insurance contract liability. As a result, there

has been no change in calculation method on transition to IFRS

17.

Changes to presentation and disclosure

Under IFRS 4, separate assets and liabilities were recognised

for premium receivables, deferred acquisition costs, unearned

premiums, and loss and loss adjustment reserves. These assets and

liabilities were shown aggregated for all insurance contracts.

While IFRS 17 groups the insurance assets and liabilities by

portfolio, as defined by Personal Group's level of aggregation

accounting policy (see Note 2), all insurance contracts are treated

as one aggregate class so there has been no impact of the change on

transition.

The Group Income Statement has also changed in its presentation.

Previously, Personal Group reported items such as gross premiums

written, movement in unearned provisions and the reinsurer's share

of these. Under IFRS 17, the standard defines and requires distinct

presentation of insurance revenue and insurance service

expenses.

Transition to IFRS 17

Changes in accounting policies resulting from the adoption of

IFRS 17 have been applied using a full retrospective approach.

Under the full retrospective approach, as at 1 January 2022

Personal Group identified, recognised, and measured each group of

reinsurance contracts as if IFRS 17 had always applied.

Were they to have arisen, Personal Group would have derecognised

any existing balances that would not exist had IFRS 17 always

applied and recognised any resulting net difference in equity.

There were adjustments to the calculations on the balance sheet

recognised on the transition to IFRS 17.

13 Post balance sheet events

There have been no post balance sheet events.

14 Financial calendar for the year ending 31 December 2023

The Company announces the following dates in its financial

calendar for the year ending 31 December 2022:

-- Preliminary results for the year ending 31 December 2023 - March 2024

-- Publication of Report and Accounts for 2023 -

March 2024

-- AGM

- April/May 2024

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LPMMTMTBTTRJ

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

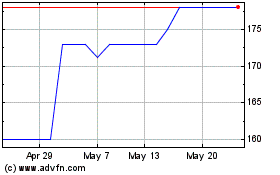

Personal (AQSE:PGH.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Personal (AQSE:PGH.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025