TIDMRKH

RNS Number : 3805X

Rockhopper Exploration plc

20 December 2023

The information contained within this Announcement is deemed by

Rockhopper Exploration plc to constitute inside information as

stipulated under the Market Abuse Regulation (EU) No. 596/2014 as

it forms part of UK law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR").

20 December 2023

Rockhopper Exploration plc

("Rockhopper" or the "Company")

Monetisation of Ombrina Mare Arbitration Award

Rockhopper Exploration plc (AIM: RKH), the oil and gas company

with key interests in the North Falkland Basin, announces its entry

into a funded participation agreement (the "Agreement") with a

regulated specialist fund with over $4bn in investments under

management that has experience in investing in legal assets (the

"Specialist Fund") to monetise its ICSID Award (the "Award"), in

relation to the arbitration against the Republic of Italy relating

to the Ombrina Mare oil field (the "Arbitration"). The Award was

previously announced on 24 August 2022.

Key terms of the Agreement

-- Rockhopper to retain legal and beneficial ownership of the Award

-- Under the terms of the Agreement, the Specialist Fund will

make cash payments to Rockhopper in up to three tranches:

Ø Tranche 1 - Rockhopper will retain approximately EUR15 million

of an upfront payment of EUR45million on completion. As previously

disclosed, Rockhopper entered into a litigation funding agreement

in 2017 under which all costs relating to the Arbitration from

commencement to the rendering of the Award were paid on its behalf

by a separate specialist arbitration funder (the "Original

Arbitration Funder"). That agreement entitles the Original

Arbitration Funder to a proportion of any proceeds from the Award

or any monetisation of the Award. Rockhopper has entered into an

agreement with the Original Arbitration Funder to pay EUR26 million

of the Tranche 1 proceeds to discharge all of its liabilities under

the agreement with the Original Arbitration Funder. In addition,

Rockhopper is due to pay certain success fees to its legal

representatives. After making these payments, Rockhopper will

retain approximately EUR15million of the Tranche 1 payment and 100

per cent of all Tranche 2 and 3 payments.

Ø Tranche 2 - Additional contingent payment of EUR65 million

upon a successful annulment outcome. Should the Award be partially

annulled and the quantum reduced as a result, then Tranche 2 will

be reduced such that the amounts under Tranche 1 and Tranche 2

shall be adjusted downward on a pro-rata basis. For example, if the

quantum of the Award is reduced by 20%, then the amounts under

Tranche 1 and Tranche 2 shall be reduced by 20%. For the avoidance

of doubt, the amounts under Tranche 1 and Tranche 2 shall not

reduce below EUR45m in any circumstance.

Ø Tranche 3 - Potential payment of 20% on recovery of amounts in

excess of 200% of the Specialist Fund's total investment including

costs.

-- Tax will also be payable on Rockhopper's share of the

proceeds from the monetisation of the Award. These calculations are

complex and are unlikely to be resolved for some months but

Rockhopper currently estimates that the approximate effective tax

rate of between 10-15% is likely.

The Specialist Fund will cover all costs related to the

Arbitration from the date of this announcement.

Benefits of the agreement

-- Materially strengthens Rockhopper's balance sheet with no dilution to shareholders

-- De-risks the Award process while maintaining potentially significant upside

-- Removes future costs associated with the Award

-- Accelerates monetisation when compared to Rockhopper

challenging the annulment itself and seeking to enforce against the

Republic of Italy, which could take several years

-- Allows Rockhopper to focus on its core opportunity in the Falkland Islands

Proceeds from the monetisation will be used by Rockhopper for

both working capital, general corporate purposes and towards

Rockhopper's equity funding requirements in relation to developing

the Sea Lion oil field

Under the terms of the previously announced arrangements with

the Falkland Islands Government, it remains the case that

Rockhopper is prevented from making distributions, including any

form of dividend or share buyback.

Precedent Conditions

Approval will be required from the Falkland Islands Government

to the transaction. A further announcement will be made on

completion. Should completion not occur by 30.6.24. either side has

the right to termination. In the case of non-completion Rockhopper

will use proceeds of the Award to provide compensation to the

Specialist Funder based on their legal fees incurred.

Samuel Moody, Chief Executive of Rockhopper, commented:

"We are delighted to be able to announce this transaction which

provides near-term certainty for Rockhopper and de-risks our

exposure to the annulment process, while maintaining potentially

significant upside exposure both to a successful annulment outcome

and eventual recovery.

In the meantime, work continues refining the phasing of the Sea

Lion development in the Falklands and we will make further updates

to the market as appropriate. We are hopeful that this new funding

will largely or entirely fulfil our equity requirements for Sea

Lion which will only become clear once the project and financing

have been finalised. "

Simon Thomson, Non-Executive Chairman, commented:

"We are aware of a number of international arbitration awards

against the Government of Italy where payment remains outstanding.

Given this background, and the circumstances of our own dispute, we

are therefore pleased to have entered into this agreement, allowing

us to secure material value now and remain exposed to future upside

in the hands of experienced professional litigators. We look

forward to redeploying this capital in Sea Lion which continues to

offer significant value for shareholders."

Background

As announced on 23 March 2017, Rockhopper commenced

international arbitration proceedings against the Republic

of Italy in relation to the Ombrina Mare project.

Following the decision in February 2016 by the Ministry of

Economic Development not to award the Company a Production

Concession covering the Ombrina Mare field, the Company, with its

legal advisers, has considered its options with regard to obtaining

damages and compensation from the Republic of Italy for breaching

the Energy Charter Treaty ("ECT").

By way of background, the ECT entered into legal force in April

1998 and is designed to provide a stable platform for energy sector

investments. The Republic of Italy, as a member of the European

Union, was a founding signatory to the ECT.

In addition, the Company announced it had secured non-recourse

funding for the Arbitration from the Specialist Arbitration Funder

that specialises in financing commercial litigation and arbitration

claims.

As announced on 24 August 2022, the arbitration panel

unanimously held that the Republic of Italy had breached its

obligations under the Energy Charter Treaty (the "Award") entitling

Rockhopper to compensation of EUR190 million plus interest at

EURIBOR + 4%, compounded annually from 29 January 2016 until time

of payment (except the four-month period immediately following the

date of the Award).

The third-party funding agreement with the Original Arbitration

Funder does not cover any costs arising past the date of the Award

(23 August 2022). The Company recorded $185,000 of legal expenses

attributable to the Arbitration in the audited accounts to 31

December 2022. The Award was considered a contingent asset as at 31

December 2022 and was merely disclosed in those same accounts and

had no carrying value.

On 20 October 2022, Italy submitted an application to the

International Centre for Settlement of Investment Disputes

("ICSID") seeking to annul the Award under Article 52 of the ICSID

Convention. The Republic of Italy also requested a provisional stay

of the enforcement of the Award pursuant to Article 52(5) of the

ICSID Convention. The provisional stay prevented Rockhopper from

taking legal action to enforce the Award in any jurisdiction.

Following a hearing on 6 March 2023, the ad hoc committee (the

"Committee") convened by ICSID to rule on the annulment issued the

following orders with regard to the provisional stay of

enforcement:

1: that Italy and Rockhopper (together the "Parties") shall

confer - in good faith and using their best efforts to cooperate

and find an effective arrangement - for the mitigation of the risk

of non-recoupment using a first-class international bank outside

the European Union (or as Italy and Rockhopper otherwise agree) to

be put into place in anticipation of the termination of the

provisional stay of enforcement of the Award. This is to mitigate

the perceived risk that, in the event the Award is annulled, Italy

may not be able to recover Italian assets seized or frozen by

Rockhopper (before the ad hoc Committee issues its decision on

annulment) in court enforcement proceedings.

2: that Rockhopper shall, within 30 days of the date of the

decision, apprise the Committee of arrangements agreed with Italy

for the mitigation of the risk of non-recoupment or that

negotiations have failed and, in the latter event, propose concrete

arrangements in accordance with the decision for the mitigation of

the risk of non-recoupment. Italy may then briefly comment on

Rockhopper's proposal within 10 days, constructively highlighting

any areas of disagreement between the Parties.

In line with preceding orders and following failure to agree

arrangements with the Republic of Italy, Rockhopper submitted its

proposed arrangements (the "Escrow Arrangements") to mitigate the

risk of non-recoupment on 24 May 2023. On 5 June 2023 Italy

submitted its comments on the Escrow Arrangements.

On 11 July 2023, and having received additional comments from

the Parties, the Committee issued the following orders with regard

to the provisional stay of enforcement:

1: That the provisional stay of enforcement shall terminate 5

business days following the provision by Rockhopper to Italy of

documentation that escrow arrangements in the form proposed have

been established, provided that Italy does not within those 5

business days submit a reasoned written objection in these

annulment proceedings that the escrow arrangements established are

not in accordance with the proposed arrangements.

2: Reserves its right to revisit its decision at any time;

and

3: Reserves its decision on costs

The Republic of Italy submitted no further comments on the

Escrow Arrangements and so the stay of enforcement is now

lifted.

The Republic of Italy has not responded to Rockhopper's

September 2022 request for payment of EUR247 million, or to

multiple subsequent attempts to engage in negotiating a

settlement.

The annulment hearing is currently scheduled to commence in

April 2024.

Enquiries:

Rockhopper Exploration plc

Sam Moody - Chief Executive Officer

Tel. +44 (0) 20 7390 0234 (via Vigo Consulting)

Canaccord Genuity Limited (NOMAD and Joint Broker)

Henry Fitzgerald-O'Connor/Ana Ercegovic

Tel. +44 (0) 20 7523 8000

Peel Hunt LLP (Joint Broker)

Richard Crichton/Georgia Langoulant

Tel. +44 (0) 20 7418 8900

Vigo Consulting

Patrick d'Ancona/Ben Simons/Fiona Hetherington

Tel. +44 (0) 20 7390 0234

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFIFFVLALIV

(END) Dow Jones Newswires

December 20, 2023 02:00 ET (07:00 GMT)

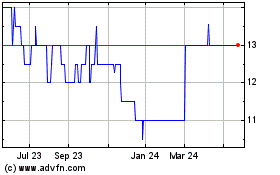

Rockhopper Exploration (AQSE:RKH.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

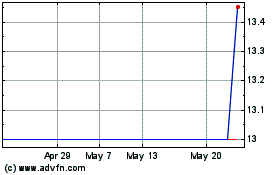

Rockhopper Exploration (AQSE:RKH.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024