2nd UPDATE: BlueScope Facing A$1 Billion Loss After Writedown

12 August 2011 - 5:25PM

Dow Jones News

Australia's largest steelmaker by output, BlueScope Steel Ltd.

(BSL.AU), said it will write off $900 million Australian dollars

(US$922 million) in assets and may cut its export capacity after

being squeezed by currency swings, high materials costs and low

product prices.

The news, which analysts say will likely bring about a A$1

billion full-year loss, is a further sign of the stresses being

placed on the country's economy by its once-in-a-generation mining

boom. A A$173.5 billion wave of resources investment due over the

next two years, plus the country's image as a safe-haven economy in

contrast to other struggling developed countries, has pushed the

Australian dollar to 28-year highs and driven up interest rates to

4.75%.

Manufacturers have been hit hard as a 24% strengthening in the

local currency against the U.S. dollar over the past two years has

made their exports uncompetitive and reduced the price of imports.

The country's largest beverage maker, Coca-Cola Amatil Ltd.

(CCL.AU), Tuesday blamed the high Australian dollar for its

decision to close a local food processing plant with the loss of

150 jobs.

In a statement to the Australian Securities Exchange, BlueScope

said the future of its export operations is in doubt. Exports

accounted for 59% of sales in the six months to the end of

December.

"The board is reviewing options to align BlueScope's domestic

steelmaking production capacity to Australian domestic market

demand. No decisions have been made," the Melbourne-based company

said.

Analysts have suggested the company abandon its export

operations and close one of the two blast furnaces at its Port

Kembla steel mill, located 60 miles south of Sydney. Such a move

would likely lead to significant job losses in the adjacent city of

Wollongong, where BlueScope is one of the largest employers.

"BlueScope has been a global anomaly in that it exports half of

its steel. There's a reason the Chinese only export about 5%, and

it's because you can't make money from it. Their exports are

bleeding money so they need to shut down one of the furnaces," said

Michael Slifirski, a Melbourne-based analyst at Credit Suisse.

BlueScope is the country's second-largest manufacturer by

revenues after packaging firm Amcor Ltd. (AMC.AU), but its current

unprofitability means its market value is just A$1.8

billion--barely half that of Lynas Corp. Ltd. (LYC.AU), a

rare-earths miner that has yet to make a trading profit.

The tribulations of BlueScope are emblematic of the changes that

have transformed the Australian economy over the past decade. Spun

out of BHP Billiton Ltd. (BHP)--now the world's largest mining

company--in 2002, it has been hit hard by the same rise in raw

materials prices that have buoyed both BHP's profits and the

Australian economy.

Each ton of steel requires around 1.5 tons of iron ore and 600

kilograms of coking coal. The prices of both have risen strongly in

recent years on the back of strong demand from Asian steelmakers,

especially in China.

Presenting BlueScope's half-year results in February, Chief

Executive Paul O'Malley said the cost of raw materials, which the

company largely buys from BHP, had risen to A$2.5 billion from

A$400 million in 2002. Profits would also improve by A$200 million

if the local currency fell back to the US$0.80 level it hovered

below for most of the past two decades, he said at the time. The

Australian dollar is currently trading at US$1.03 versus the

greenback.

Shares in the company slumped over the course of the day,

falling 7.7% to 91 Australian cents at the close of the market.

However, the company's peer OneSteel Ltd. (OST.AU), also spun out

of BHP in 2000, fell only 0.7% to A$1.38 and the broader

S&P/ASX 200 index closed up 0.8%. OneSteel owns iron ore and

coal mines, which partially insulate it from the economic stresses

faced by BlueScope.

Analysts expect BlueScope to make an underlying loss of A$102.2

million in the year to June 30, according to a Dow Jones Newswires

poll of six brokers. This would result in a A$1 billion reported

loss when the A$900 million writedown is included.

BlueScope said the writedown would come from reducing the

carrying values of its Australian coated and industrial products

division and its distribution business. Both units are being rolled

into the main steelmaking division and accounted for A$404 million

in goodwill between them, although the company did not offer

further details of how the writedown was calculated.

The revision was "accommodated within the company's financial

covenants with its lenders", BlueScope said. However, MF Global

analyst Andrew Gardner estimated the company only had enough

earnings to meet its interest payments twice over--an unusually

tight ratio.

BlueScope had net debt of A$912 million at 31 December 2010, and

drew down A$128 million of debt to pay interest, dividends, and

operating costs in the last six months of the year, according to

its half-year report. The company is due to report full-year

earnings August 22.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

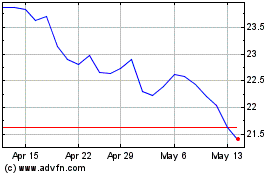

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

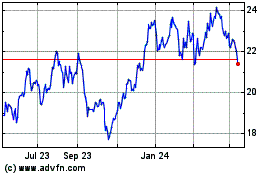

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Dec 2023 to Dec 2024